-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Kiwi Soars On RBNZ, Before Falling Back

- The NZD appreciated as the RBNZ raised its key policy rate by the expected 50bp and reaffirmed its hawkish credentials via another strong-worded statement. The tone of today's interim monetary policy review disappointed those who had expected the RBNZ to signal imminent slowdown in the pace of its rate hikes, after the RBA delivered a smaller-than-expected 25bp rate hike the day before.

- However, the lack of a decisive hawkish shift (just about) from the RBNZ and the downtick in e-minis capped gains for the NZD, eventually resulting in an unwind of most of the knee-jerk gains

- U.S. ADP employment change & trade balance data, as well as a suite of services PMI readings from across the globe will take focus after Asia hours. Fed's Bostic & Kashkari are set to speak.

US TSYS: Antipodean Influence Offset By Issuance

TYZ2 has stuck to a narrow 0-07+ range in Asia-Pac hours, last printing around the mid-point of that range, -0-03 at113-13.

- This leaves the major cash Tsy benchmarks at essentially unchanged levels across the curve.

- The cross-market impact of richer NZGBs & ACGBs post-RBNZ (where the expected 50bp hike was delivered and the Bank just about managed to stay away from a decisively hawkish shift) was cancelled out by the marketing of a US$ multi-tranche round of issuance from the Philippines (consisting of 5-, 10- & 25-Year paper).

- ADP employment data, the ISM services survey and Fedspeak from Kashkari & Bostic headline Wednesday’s NY docket.

- Elsewhere, the latest OPEC+ decision will cross on Wednesday, with various source reports prepping market participants for a sizable output cut (in headline quota terms, at a minimum), which supported crude oil over the first couple of sessions of the week (putting a bid into U.S. breakevens).

JGBS: Sideways Trade Continues

JGB futures oscillated either side of unchanged levels during Tokyo trade, dealing -3 into the bell, sticking to a tight range, while cash JGBs sit 1bp richer to 1bp cheaper across the curve. There hasn’t been much in the way of a meaningful domestic catalysts, leading to a lack of conviction in JGB trade.

- Offer/cover ratios nudged higher in the latest round of BoJ Rinban operations, perhaps as participants use the move away from recent cheaps in those maturities as a selling opportunity:

- 1- to 3-Year: 3.59x (prev. 2.74x)

- 3- to 5-Year: 2.50x (prev. 1.60x)

- Comments from PM Kishida underscored the BoJ’s independence when it comes to setting monetary policy, while he refrained from commenting on the outlook for the JPY.

- Weekly international security flow data and the latest liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs will be seen on Thursday.

AUSSIE BONDS: 10s Lead Auction/RBNZ-Inspired Bid, Off Best Levels Into The Bell

A solid enough round of ACGB supply and the trans-Tasman spill over from the latest RBNZ decision (universally expected and fully priced 50bp OCR hike delivered and a lack of a decisively hawkish shift, just about) supported ACGBs, allowing the space to add to the gains that came on the back of the overnight session uptick in futures.

- XM managed to show through its overnight peak, although YM didn’t, with both contracts pulling back from best levels alongside a similar move in U.S. Tsys. That leaves YM +3.0 & XM +8.0, with the major cash ACGB benchmarks running 2-8bp richer, as 10s lead the bid.

- Bills sit -4 to +4 through the reds, with a lack of net movement in RBA terminal rate pricing, with OIS still pricing a peak rate of ~3.60%.

- Looking ahead, monthly trade balance data headlines the domestic docket on Thursday.

NZGBS: NZGBs Richer Despite RBNZ Debating 75bp Hike

NZGBs finished 16-18bp richer on Wednesday, bull steepening at the margin.

- Yesterday’s dovish RBA surprise provided the catalyst for the bid in early Wednesday trade.

- Later in the day we saw NZGBs initially cheapen as the RBNZ delivered the universally expected and fully priced 50bp rate hike (as it became apparent that 50 & 75bp hikes were discussed, indeed, the 50bp decision was made “on balance”), although the lack of a decisive hawkish shift (there was a high bar for such a move) allowed a bid to come back in.

- The RBNZ reiterated the need for tightening to be conducted at pace, while the proximity to yesterday’s dovish RBA surprise likely had some readthrough when it came to initial price action.

- There hasn’t been meaningful, lasting movement in the market pricing of RBNZ tightening expectations, with the terminal rate now seen at 4.55%, after some contained gyrations post-MPR.

- There isn’t much of note on Thursday’s local docket.

FOREX: RBNZ's Hawkish Determination Boosts Kiwi But Risk Aversion Limits Gains

New Zealand dollar appreciated as the RBNZ raised its key policy rate by the expected 50bp and reaffirmed its hawkish credentials via another strong-worded statement. The tone of today's interim monetary policy review disappointed those who had expected the RBNZ to signal imminent slowdown in the pace of its rate hikes, after the RBA delivered a smaller-than-expected 25bp rate hike the day before.

- The RBNZ echoed most of it rhetoric from the August statement when it comes to the main policy objectives, while for the first time making an explicit mention of a debate on raising interest rates by 75bp. Comments on FX dynamics intimated greater sense of concern with the weakening exchange rate and its impact on imported inflation.

- Renewed risk aversion prompted NZD/USD to gradually erase its post-RBNZ gains but the kiwi dollar outperformed on other crosses. AUD/NZD probed the water below NZ$1.1300 before settling just above that level amid a limited round trip in AU/NZ 2-year swap spread.

- Cautious mood supported safe-haven currencies at the expense of most G10 high-betas as e-mini futures faltered after a two-day rally in U.S. equity benchmarks.

- Sterling resumed losses after cable recovered to its pre-mini budget levels, as jitters resurfaced ahead of PM Truss' address to the Tory party conference today.

- Financial markets in mainland China and India were closed for local public holidays.

- U.S. ADP employment change, trade balance, as well as a suite of Services PMI readings from across the globe will take focus after Asia hours. Fed's Bostic & Kashkari are set to speak.

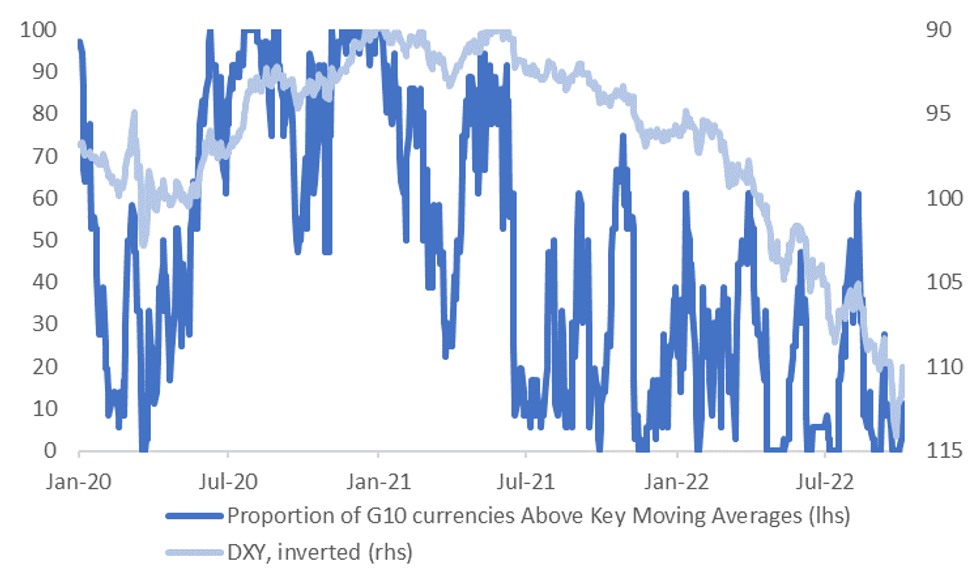

MARKET INSIGHT: USD Momentum Only Slightly Away From Recent Extremes

The DXY move off its recent highs is now close to 4% (using the late September intra-day high). This is in line with pullbacks in May and July/August, although the recent correction has happened over a much shorter time frame. The index is now sub its 20-day MA (110.914) versus last 110.10/15. We are still some distance away from the 50-day MA (108.88) though, having spent very little time below this level since the USD bull run commenced earlier this year.

- For the G10, momentum has shifted only modestly against the USD. Only 4 currencies, the EUR, GBP, JPY (albeit just at the time of writing) and SEK are above their respective 20 day MAs against the USD.

- This leaves our G10 FX MA momentum gauge barely off recent lows, see the first chart below. This measure looks at the proportion of G10 currencies which are above their respective 20, 50,100 or 200 day MA against the USD. Currently we sit just 4 out of possible 36, or just 11.1%.

- Typically, this measure gets closer to 50% or higher before topping out, at least if the 2022 experience is to be repeated.

Fig 1: G10 MA Momentum & DXY Trends

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

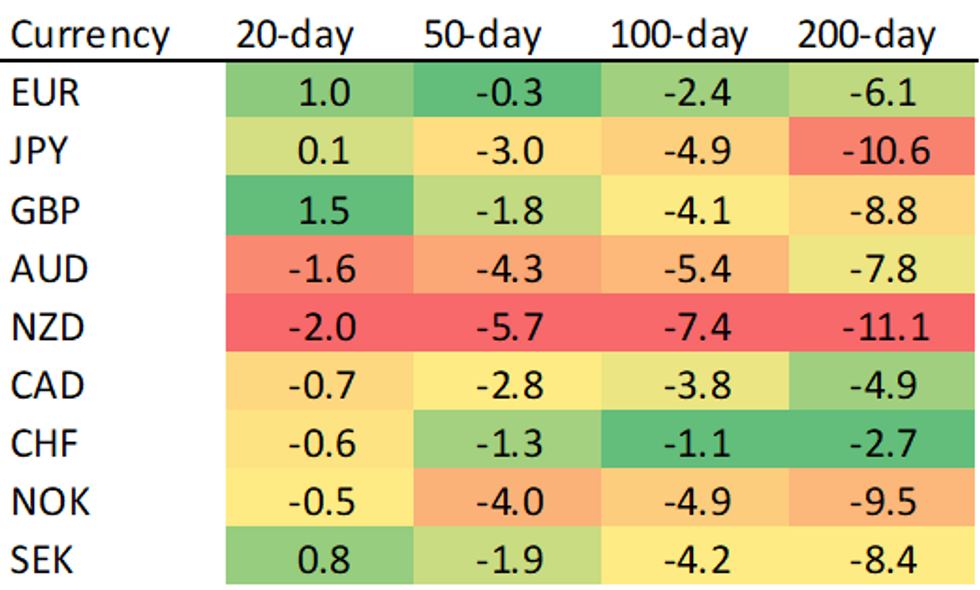

- The table below presents the deviation for each currency pair, in terms of current spot levels relative to each of these MA levels.

- AUD and NZD are the furthest (in percentage terms) from their respective 20 day MA levels.

- A lot may depend on how EUR/USD trends unfold, given it is within striking distance of its 50-day MA (1.0016), versus current spot of 0.9975.

Table 1: G10 Spot Deviation From MA Levels (Percentage Terms, %)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

AUD: Correlations With Yield Spreads Rebound, AU-US 2yr Spread Around Multi-Decade Lows

A$ correlations, on a short term basis, with yield differentials have rebounded. The table below presents the correlations for the past week and month (in levels terms) for AUD/USD against traditional macro drivers.

- Our last update had short term correlations with yield differentials in negative territory. As is usually the case though, the correlations have picked back up during RBA week.

- Yesterday's dovish RBA hike has also likely increased focus on the yield differential outlook from an AUD standpoint. The AU-US 2yr spread is threatening to break sub -100bps. We have spent little time below this level from an historical standpoint, see the second chart below.

- AUD/USD correlations with commodities and equities are generally lower compared to late September. We remain in positive territory for the most part though.

- The most notable pullback is for iron ore, although China onshore markets are closed this week.

Table 1: AUD/USD Correlations (Levels)

| 1wk | 1mth | |

| 2yr yield differential | 0.55 | 0.62 |

| 5yr yield differential | 0.52 | 0.58 |

| 10yr yield differential | 0.57 | 0.48 |

| Global commodity prices | 0.47 | 0.89 |

| Base metals | 0.13 | 0.81 |

| Iron ore | -0.55 | 0.78 |

| Global equities | 0.59 | 0.97 |

| US VIX index | -0.53 | -0.95 |

Source: MNI - Market News/Bloomberg

Fig 1: AU-US 2yr Government Bond Yield Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Oct5 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800(E2.0bln), $0.9930-36(E1.2bln)

- USD/JPY: Y143.85-05($798mln)

- EUR/JPY: Y142.20(E809mln)

- AUD/USD: $0.6650(A$629mln)

- USD/CAD: C$1.3800($585mln)

ASIA FX: Gains More Mixed, As Equity Rebound Pauses

Holidays have still disrupted markets in Asia Pac today (China and India out today). Sentiment has been mixed in the FX space, although there has been some outperformance compared to the majors, where the USD has looked firmer. Overall ranges in USD/Asia pairs have been modest though. Tomorrow the focus will be on South Korean FX reserves, along with Indian PMI prints. Still to come today is Singapore retail sales.

- USD/CNH started the day around the lows, but we have rebounded somewhat, pushing back into the 7.05/7.06 region, in line with softer EUR, GBP levels etc. Note the 20 day MA comes in at 7.0536, so this may act as a near term pivot point.

- USD/KRW has drifted back above 1420 in terms of the 1 month NDF, around +0.40% on NY closing levels. The Kospi rebound ran out of steam on foreign selling (-$198.3mn). The September CPI print was mixed, but is unlikely to deter a 50bps hike next week from the BoK next week.

- TWD has fared better. The 1 month USD/TWD NDF is back sub 31.50. Onshore equites are holding up well, +1.8% for the session.

- Spot USD/IDR has faltered and last deals -41 figs at 15,204, with bears looking for a deeper sell-off towards the 100-DMA, which kicks in at IDR14,862. USD/IDR 1-month NDF last +29 figs at IDR15,215, suggesting that the overhang pressure from after hours Tuesday has petered out. Indonesia's Health Min Sadikin said the government was starting discussion with the WHO about declaring an end to the COVID-19 pandemic and lifting all remaining restrictions.

- Spot USD/PHP trades +0.05 at 58.72, down from earlier highs, but operating in the vicinity of record highs located near 59.000. Headline inflation in the Philippines quickened to +6.9% Y/Y in September from +6.3%, in line with the median estimate in a Bloomberg survey, reaching the fastest pace since Oct 2018. The BSP said it "is prepared to take further policy actions" to bring inflation towards the +2.0%-4.0% Y/Y target range over the medium term.

- USD/THB has continued to retrace. The pair was last at 37.44, around 0.30% below yesterday's closing levels. September CPI was a little weaker than expected. It printed at 6.41% y/y (6.58% was expected), while core came in at 3.1% y/y, against a 3.20% forecast.

EQUITIES: Bid Extends In Asia; Hang Seng Plays Catch Up

Most Asia-Pac equity indices are in the green at writing, tracking a positive lead from Wall St. on lingering speculation of a slowdown in Fed tightening amidst softer economic data.

- The Hang Seng (+5.3%) outperformed, playing catch up to regional equities on its first day back from a holiday. The HSTECH (+7.4%) contributed the most to gains, adding to strength in China-based stocks (Hang Seng China Enterprises Index: +5.7%).

- The ASX200 deals 1.7% firmer, building on Tuesday’s ~3.8% higher close, rising to fresh two-week highs amidst the repricing of expectations around the RBA’s terminal rate. Rate-sensitive tech leads the bid, with the ASX All Tech Index sitting 3.7% better off at typing.

- The Nikkei 225 is 0.4% better off at writing, on track to close higher for a third straight session, extending a move off of 15-week lows observed on Monday. Large caps such as Softbank (+2.0%) and Fast Retailing (+1.1%) lead the way higher, offsetting weakness in consumer staples.

- E-minis sit 0.4-0.5% weaker at writing, paring a little of their recent gains after a two-day rally (+5.5-5.9% apiece) saw the contracts record fresh two-week highs on Tuesday.

GOLD: Consolidating Below Three-Week Highs

Gold deals ~$6/oz softer to print ~$1,720/oz, backing away from three-week highs made on Tuesday (at ~$1,729.5/oz), but holding on to the bulk of that session’s gains at typing.

- To recap, the precious metal closed ~$26/oz firmer on Tuesday, drawing support from the miss in JOLTS job opening figures (pointing to softening labour demand), with the DXY hitting fresh two-week lows after.

- The improvement in sentiment likely reflects optimism from some quarters re: a slowdown in Fed tightening amidst soft U.S. economic data prints.

- Consensus re: a slower pace of Fed hiking remains far from certain however, with Nov FOMC dated OIS now pricing in ~70bp of tightening at that meeting, operating at its highest level in a week.

- Looking ahead, participants will be on the lookout for more employment data due later this week, capped by NFPs on Friday.

- From a technical perspective, gold has established a short-term bull cycle, having broken above its 20-Day EMA and trendline resistance. Initial resistance is seen at ~$1,735.1 (Sep 12 high and key resistance), while support is seen at $1,659.7 (Oct 3 low).

OIL: Holding Recent Gains As OPEC+ Output Cuts Eyed; U.S Inventory Data Due

WTI and Brent are ~$0.30 softer apiece, operating within ~$1 of their respective multi-week highs made on Tuesday, with participants on watch for the size of potential output cuts arising from the OPEC+ meeting later on Wednesday.

- To elaborate on the latter, OPEC+ will meet in Vienna amidst elevated uncertainty over the size of a possible cut in collective output targets, as various source reports in recent days have pointed to quota reductions ranging from 0.5-2mn bpd.

- Some will also be on the lookout for extra, unilateral output cuts from Saudi Arabia, a measure the kingdom has taken before in the past.

- Note that RTRS source reports previously highlighted that OPEC+ missed output targets by just under 3mn bpd for Jul, while Argus sources placed quota shortfalls at ~3.4mn for Aug.

- U.S. API data on Tuesday saw reports point to a large, surprise drawdown in crude inventories, with a decline in gasoline and distillate stocks and a build in Cushing hub stockpiles reported as well.

- Looking ahead, weekly U.S. EIA data is due, with BBG median estimates calling for a build in crude inventories.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/10/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 05/10/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/10/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/10/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/10/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/10/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/10/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/10/2022 | 1230/0830 | * |  | CA | Building Permits |

| 05/10/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 05/10/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/10/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 05/10/2022 | 2000/1600 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.