-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Pivot Pushback Continues Pre-Payrolls

EXECUTIVE SUMMARY

- WALLER SEES FED HIKES 'INTO EARLY NEXT YEAR' (MNI)

- COOK SAYS APPROPRIATE FOR FED TO SLOW HIKES AT SOME POINT (MNI)

- MESTER SAYS NO EVIDENCE TO SUPPORT SLOWING PACE OF FED RATE HIKES (BBG)

- FED'S EVANS: RATES HEADED TO 4.5%-4.75% BY SPRING OF 2023 (RTRS)

- BANK OF ENGLAND OFFICIAL CRITICISES GOVERNMENT'S MINI BUDGET ACTION (SKY)

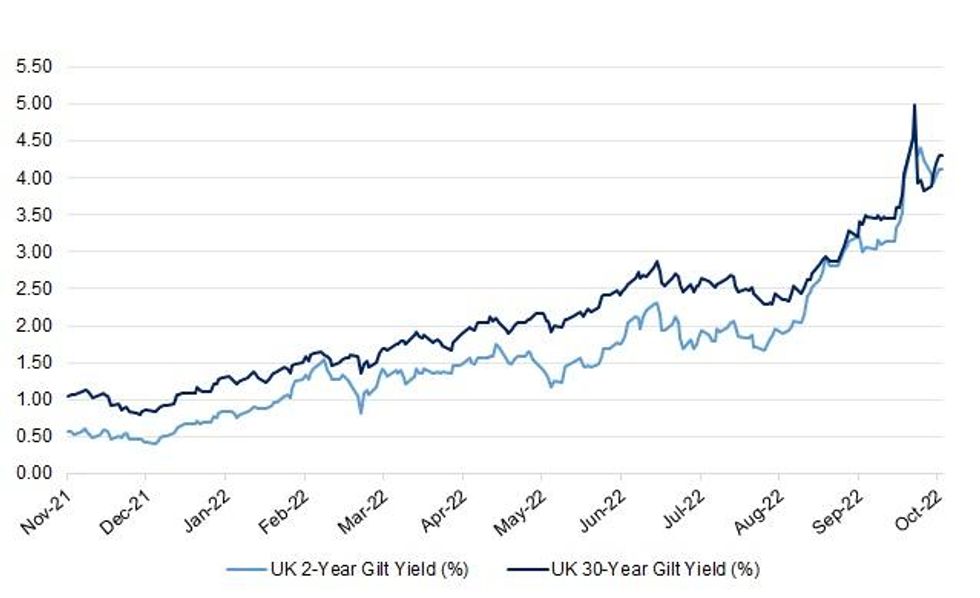

Fig. 1: UK 2-Year Gilt Yield V. UK 30-Year Gilt Yield

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Another Bank of England official has weighed in to criticise the government's mini-budget announcement - rebuking the absence of Office of Budget Responsibility (OBR) input, detailing how the UK bond market reaction was unique, and reiterating the Bank's resolve to return inflation to 2%. (Sky)

ECONOMY: British companies are the most downbeat about the outlook for their profits since the depths of the COVID-19 pandemic in late 2020 despite widespread plans to raise prices, a major survey showed on Thursday, adding to signs of gloom about the economy. (RTRS)

ECONOMY: British recruiters saw the weakest growth in hiring in more than a year and a half last month, as signs of an economic downturn made workers more wary about changing jobs and businesses more cautious about hiring, a survey showed on Friday. (RTRS)

ECONOMY: September saw the slowest retail sales growth since shops reopened post-COVID restrictions due to a combination of inflation, economic crisis and an uexpected bank holiday, figures show. (Sky)

BREXIT: UK Prime Minister Liz Truss ditched the antagonistic rhetoric that became a hallmark of post-Brexit relations with the European Union in a sign the two sides may be moving closer to putting their differences behind them. (BBG)

ECONOMY: Chancellor of the Exchequer Kwasi Kwarteng discussed ways to ease the cost-of-living crisis, including giving more time for energy and council tax payments, with the bosses of UK banks on Thursday. (BBG)

PENSIONS/MARKETS: Pension funds are selling billions of pounds worth of assets to rebuild their cash buffers before the Bank of England removes critical market support next week that it introduced to prevent the collapse of the UK’s government bond market. (BBG)

PROPERTY: The UK's biggest mortgage lenders will urge the chancellor to extend a government home loans initiative which helps first-time buyers get onto the property ladder. (Sky)

ENERGY: Liz Truss has refused to rule out the prospect of widespread blackouts for up to three hours a day this winter if the country is unable to import enough energy. (Telegraph)

EUROPE

ECB: ECB Governing Council member Peter Kazimir tweeted the following on Thursday, “In our discussions in #Cyprus we focused on how to reach our price stability objective by ensuring that inflation returns to 2% in the medium term. We discussed the merits of the instruments in our toolbox, including interest rates and adjustments to our balance sheet.” (MNI)

SWEDEN: The slide in Swedish home prices deepened in September amid signs the housing market was drying up as interest rate hikes and concerns over surging energy costs dented demand, according to the latest broker data. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Austria (current rating: AA+; Outlook Stable) and Greece (current rating: BB; Outlook Positive)

- DBRS Morningstar on Cyprus (current rating: BBB; Stable Trend) and The Netherlands (current rating: AAA; Stable Trend)

U.S.

FED: Federal Reserve Governor Christopher Waller said Thursday he expects to raise interest rates "into early next year" to fight inflation and that market volatility, and liquidity strains won't sap the Fed's resolve to do so. (MNI)

FED: Federal Reserve Governor Lisa Cook in her first public speech Thursday endorsed the U.S. central bank's historically fast pace of interest rate increases but said it will become appropriate at some point to slow the tightening, adding that monetary policy may hit the real economy faster these days. (MNI)

FED: Federal Reserve Bank of Cleveland President Loretta Mester said the US central bank has more work to do to tame inflation and she has not seen the evidence needed to convince her that the officials should slow the pace of interest-rate increases. (BBG)

FED: Chicago Federal Reserve Bank President Charles Evans on Thursday said the U.S. central bank's policy rate is likely headed to 4.5%-4.75% by the spring of 2023 as the Fed increases borrowing costs to bring down too-high inflation. (RTRS)

FED: Market instability will not dissuade the Fed from pressing on with its aggressive interest rate hike campaign, but the central bank is likely to to pause its balance sheet runoff sooner than it has signalled as financial volatility heightens systemic risks, former White House economist Joseph LaVorgna told MNI. (MNI)

POLITICS: President Joe Biden stopped by Gov. Phil Murphy’s Middletown house Thursday for an intimate, high-dollar fundraiser as Democrats seek to retain control of Congress and several governorships in next month’s midterm elections. When he turned to the 2022 election, he acknowledged that “based on statistics, Democrats are running uphill,” but “so far it looks like the Senate we are not only going to hold but maybe pick up a couple of seats.” (NJ.com)

EQUITIES: A Delaware judge halted a court case against Elon Musk over his $44 billion purchase of Twitter Inc., giving the parties more time to complete the deal. Delaware Chancery Judge Kathaleen St. J. McCormick said if the transaction isn’t done by 5 p.m. on Oct. 28, she will set new trial dates in November, according to an order issued Thursday. (BBG)

OTHER

GEOPOLITICS: U.S. President Joe Biden said Russian President Vladimir Putin's threat to use nuclear weapons threatens to bring about the biggest such risk since the Cuban Missile Crisis, adding Washington was "trying to figure out" Putin's off-ramp. (RTRS)

JAPAN: Japanese Finance Minister Shunichi Suzuki declines to comment on the content of September’s currency intervention transactions. Drop in foreign reserves was most on record, Suzuki tells reporters in Tokyo. (BBG)

JAPAN: Japanese Prime Minister Fumio Kishida said on Friday recent sharp, one-sided yen declines were undesirable, repeating the government's warning to investors against pushing down the currency too much. (RTRS)

BOJ: The Bank of Japan is more likely to adjust policy after failing to achieve its inflation goal rather than in response to the current cost-push inflation, according to a former executive director in charge of monetary policy. (BBG)

RBA: Australia’s financial stability risks have increased over recent months and some households and businesses are already facing “more challenging conditions” as interest rates rise and inflation accelerates, the Reserve Bank said. (BBG)

BOK: South Korea's central bank governor Rhee Chang-yong on Friday said country's headline inflation is likely to stay around 5% through the first half of next year, which would warrant further increases in interest rates. (RTRS)

BOK: South Korea's central bank will opt to go big again and hike rates by another half-point next week, pushing borrowing costs higher than earlier predicted to support a weakening won and dull its effect on inflation, a Reuters poll showed. (RTRS)

SOUTH KOREA: South Korea's finance ministry said on Friday it would prepare to have tools ready for the authorities to supply foreign exchange liquidity to financial institutions if needed. (RTRS)

SOUTH KOREA: South Korean President Yoon Suk-yeol said on Friday the government would take steps to spur capital inflows and ease dollar supply-demand imbalance, adding that uncertainty has expanded on foreign exchange and other markets. (RTRS)

NORTH KOREA: South Korea and the United States began joint maritime exercises with a U.S. aircraft carrier on Friday, South Korea's military said, a day after it scrambled fighter jets in reaction to an apparent North Korean bombing drill. (RTRS)

BOC: Bank of Canada Governor Tiff Macklem said Thursday it's too soon to shift from forceful interest-rate hikes to a more balanced approach because there's little evidence trend inflation is slowing and a weaker currency is adding to broadening price pressures. (MNI)

CANADA: Alberta conservatives elected a sovereignty advocate who railed against vaccine mandates to lead Canada’s biggest oil-producing province. (BBG)

TURKEY: President Recep Tayyip Erdogan on Thursday said Greece should take his warnings seriously about Turkey’s response to any threats, resorting to the menacing rhetoric he’s used in recent months that’s prompted the US to urge the two NATO allies to negotiate and focus on the Russia threat. (BBG)

BRAZIL: Those who want to know [Lula’s] cabinet composition will have to wait for the election’s result, the presidential candidate Luiz Inácio Lula da Silva at a press conference this Thursday in Sao Paulo. (BBG)

BRAZIL: Brazil's government believes in a fast accession to the Organization for Economic Co-operation and Development (OECD), Economy Minister Paulo Guedes said on Thursday. (RTRS)

BRAZIL: Brazilian Treasury official Esteves Colnago has been tapped for a position on the executive board of Petrobras, two sources told Reuters on Thursday, as part of a broad shakeup at the state-run oil company under its new chief executive. (RTRS)

RUSSIA: The Kremlin on Thursday denounced comments by Ukrainian President Volodymyr Zelenskiy in which he suggested NATO should launch preventive strikes to rule out any Russian use of nuclear weapons, RIA news agency said. (RTRS)

IRAN: The US sanctioned seven Iranian officials it said played a role in an internet cutoff and crackdown on protests that have wracked the country, part of the Biden administration’s move to take a more forceful stand against the regime’s response. (BBG)

PERU: Peru raised interest rates for a 15th straight month in a bid to get inflation back under control and limit the risk of capital flight as the US Federal Reserve withdraws stimulus. (BBG)

MIDDLE EAST: US forces killed two top ISIS leaders in an airstrike in northern Syria on Thursday, according to two defense officials, one day after a US raid killed an ISIS smuggler. (CNN)

EQUITIES: Samsung Electronics Co Ltd flagged a worse-than-expected 32% drop in quarterly operating earnings on Friday, as demand for electronic devices and the memory chips that power them shrank due to an economic downturn. (RTRS)

METALS: The London Metal Exchange opened the door to a potential ban on new Russian metal by issuing a discussion paper to solicit members’ views on how to handle the country’s supplies. (BBG)

ENERGY: The U.S. Interior Department took initial steps on Thursday toward holding oil and gas drilling auctions in New Mexico, Wyoming and the Gulf of Mexico in the coming months. (RTRS)

OIL: The White House said nothing was off the table a day after Opec+ angered Washington with sharp cuts to world oil supply, as it considered responses — including new releases from the US Strategic Petroleum Reserve to contain energy prices. (FT)

OIL: Top U.S. senators from both parties on Thursday gave momentum to a bill pressuring OPEC+ after the group this week announced a deep cut in oil production despite lobbying by President Joe Biden's administration to keep the taps open. (RTRS)

OIL: The OPEC+ decision to cut oil production by 2 million barrels per day came as result of a production surplus, Iraq oil minister Ihsan Abdul Jabbar told Kuwait news agency (KUNA) on Thursday. (RTRS)

OIL: Treasury Secretary Janet Yellen touted efforts by the U.S. and Europe to implement a price cap on Russian oil and choke off a massive amount of revenue for Moscow, despite retaliatory production cuts from OPEC+ this week. (Fox)

OIL: The European Union on Thursday gave a final approval to its eighth batch of sanctions against Russia for its invasion of Ukraine, but said implementing a price cap on Russian seaborne oil included in the package required more work. (RTRS)

OIL: Russian crude exports fell to a 12-month low in September, according to tanker tracking data, as European buyers continued to wind down their purchases of Moscow's oil ahead of looming sanctions despite surging flows into Turkey, which has become the third largest buyer of Russia's oil behind China and India. (S&P Global)

OVERNIGHT DATA

CHINA SEP FOREIGN RESERVES $3,028.9BN; MEDIAN $2,997.50BN; AUG $3,054.88BN

JAPAN AUG HOUSEHOLD SPENDING +5.1% Y/Y; MEDIAN +6.7%; JUL +3.4%

JAPAN AUG LABOUR CASH EARNINGS +1.7% Y/Y; MEDIAN +1.4%; JUL +1.3%

JAPAN AUG REAL CASH EARNINGS -1.7% Y/Y; MEDIAN -1.8%; JUL -1.8%

JAPAN AUG, P LEADING INDEX CI 100.9; MEDIAN 100.3; JUL 98.9

JAPAN AUG, P COINCIDENT INDEX 101.7; MEDIAN 101.7; JUL 100.1

SOUTH KOREA AUG BOP CURRENT ACCOUNT BALANCE -$3,049.1MN; JUL +$791.1MN

SOUTH KOREA AUG BOP GOODS BALANCE -$4,449.3MN; JUL -$1,434.5MN

MARKETS

SNAPSHOT: Fed Pivot Pushback Continues Pre-Payrolls

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 168.24 points at 27142.11

- ASX 200 down 36.222 points at 6781.3

- Shanghai Comp. down 16.815 points at 3024.39

- JGB 10-Yr future down 29 ticks at 148.57, JGB 10-Yr yield down 0.3bp at 0.251%

- Aussie 10-Yr future down 7.5 ticks at 96.13, Aussie 10-Yr yield up 7.5bp at 3.85%

- US 10-Yr future -0-01 at 111-29, 10-Yr yield down 0.41bp at 3.8195%

- WTI crude down $0.12 at $88.33, Gold down $2.19 at $1710.35

- USDJPY down 15 pips at 144.99

- WALLER SEES FED HIKES 'INTO EARLY NEXT YEAR' (MNI)

- COOK SAYS APPROPRIATE FOR FED TO SLOW HIKES AT SOME POINT (MNI)

- MESTER SAYS NO EVIDENCE TO SUPPORT SLOWING PACE OF FED RATE HIKES (BBG)

- FED'S EVANS: RATES HEADED TO 4.5%-4.75% BY SPRING OF 2023 (RTRS)

- BANK OF ENGLAND OFFICIAL CRITICISES GOVERNMENT'S MINI BUDGET ACTION (SKY)

US TSYS: Block Sales Offsets Downtick In Equities Ahead Of Payrolls

Cash Tsys are virtually unchanged across the curve into London hours, with the latest round of hawkish Fedspeak (via Waller & Mester) and block sales in the FV & TY futures contracts cancelling out any bullish impetus from weaker equities during overnight trade.

- TYZ2 made a brief and very limited showing below its Thursday base in the wake of the TY block sales. The contract last deals -0-01+ at 111-28+, sticking to a narrow 0-04+ range, on volume of ~52K.

- A lack of meaningful headline flow, proximity to the impending NFP release and thinner liquidity on the back of the ongoing Chinese holiday left many sidelined.

- A downtick in e-minis and Chinese equities has failed to generate a bid.

- The NFP print provides the highlight of the wider global docket on Friday (see our full preview of that event here), with Williams, Kashkari and Bostic set to round off Fedspeak for the week.

- A reminder that cash Tsys will be closed on Monday owing to the Columbus Day holiday, although there will be no alteration to CME futures trading hours.

JGBS: Futures Hold Cheaper Ahead Of Long Weekend

JGB futures pushed lower in early Tokyo trade, breaching their overnight session base, although bears failed to force a meaningful extension with equities trading on the defensive. The contract is -28 ahead of the bell, just off worst levels, while wider cash JGB trade sees the major benchmarks running little changed to 2.5bp cheaper, with weakness led by 40s after Thursday’s cheapening in wider core global FI markets.

- Local data saw softer than exp. household spending data, while wage growth provided a modest beat vs. expectations (albeit with real wage growth residing comfortably in negative territory in Y/Y terms).

- Japanese Finance Minister Suzuki & Prime Minister Kishida failed to offer much colour on the FX intervention front, as you would expect, with a lack of domestic headline flow observed outside of their run-of-the-mill comments re: FX.

- Japanese markets are closed on Monday as the country observes a national holiday.

JGBS AUCTION: Japanese MOF sells Y4.86457tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.86457tn 3-Month Bills:

- Average Yield: -0.1899% (prev. -0.2327%)

- Average Price: 100.0505 (prev. 100.0638)

- High Yield: -0.1598% (prev. -0.2061%)

- Low Price: 100.0425 (prev. 100.0565)

- % Allotted At High Yield: 5.6319% (prev. 98.8823%)

- Bid/Cover: 2.460x (prev. 3.173x)

AUSSIE BONDS: Holding Cheaper In Narrow Pre-NFP Trade

Aussie bond futures operate off of worst levels into the bell, with weakness in wider equity markets limiting downside impetus during Sydney hours leaving overnight session losses intact. The proximity to the latest U.S. NFP print also limited price action.

- YM & XM both trade -7.0, off of worst levels, after the former had a look through its overnight base.

- Wider cash ACGB trade sees the major benchmarks running 5-7bp cheaper, with the 5- to 10-Year zone leading the weakness.

- TCV mandated banks to issue a new Sep-36 bond, which will launch and price “in the near future,” with hedging flows in XM futures expected around pricing, as the line will be of benchmark size.

- Bills run 3-8bp cheaper through the reds, with RBA terminal rate price nudging higher on the day, with dated OIS showing a peak of 3.85%.

- The latest RBA FSR came and went without too much to note, with the same holding true for a vanilla weekly AOFM issuance slate.

- There is nothing in the way of major economic releases on Monday’s domestic docket.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 11 Oct it plans to sell A$100mn of the 1.25% 21 August 2040 Indexed Bond.

- On Wednesday 12 Oct it plans to sell A$800mn of the 1.75% 21 November 2032 Bond.

- On Thursday 13 Oct it plans to sell A$500mn of the 27 January 2023 Note, A$1.0bn of the 10 February 2023 Note, and A$500mn of the 24 March 2023 Note.

- On Friday 14 Oct it plans to sell A$700mn of the 4.75% 21 April 2027 Bond.

AUSSIE BONDS: The AOFM sells A$700mn of the 0.25% 21 November 2025 Bond, issue #TB161:

The Australian Office of Financial Management (AOFM) sells A$700mn of the 0.25% 21 November 2025 Bond, issue #TB161:

- Average Yield: 3.4303% (prev. 3.3210%)

- High Yield: 3.4325% (prev. 3.3225%)

- Bid/Cover: 3.0357x (prev. 3.7000x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 35.5% (prev. 94.3%)

- Bidders 36 (prev. 35), successful 19 (prev. 12), allocated in full 12 (prev. 5)

NZGBS: NZGBs Cheaper Ahead Of The Weekend

The major NZGB benchmarks finished Friday’s pre-NFP session 9-10bp cheaper.

- The early weakness saw a mild extension as global core FI markets struggled to catch a bid, with participants zeroed in on the aforementioned U.S labour market report.

- Swap rates pressed higher, with 2-Year swaps now ~10bp off their cycle high.

- RBNZ terminal rate pricing nudged 5-10bp higher on the day, with RBNZ dated OIS sitting around 4.80% late in the local session, within the recently observed range.

- Local headline flow was non-existent.

- Next week’s domestic data releases include card spending data, REINZ house sales readings, food prices and the manufacturing PMI.

EQUITIES: Lower In Asia; Tech Stocks Slip As AMD Disappoints

Asia-Pac equity indices are mostly lower at typing, tracking a negative lead from Wall St. Semiconductor stocks across the region struggled, sliding after AMD reported disappointing preliminary financials after the bell, adding to bearish pressure as optimism re: a Fed pivot from earlier in the week has faded.

- The TAIEX (-1.2%) is accordingly one of the worst performers region-wide, dragged lower by the semiconductor sub-gauge (-2.3%), with index heavyweight TSMC (-2.6%) leading the way lower.

- The Hang Seng deals 1.1% softer at typing, with China-based tech (HSTECH: -2.7%) and property (Hang Seng Mainland Properties Index: -4.4%) contributing the most to losses.

- Chinese EV stocks were notable underperformers, with the likes of Li Auto (-16.0%) and XPeng (-7.1%) experiencing sharp declines amidst jitters over the outlook for EV sales.

- The ASX200 trades 0.5% lower at typing, with the benchmark still on track to close ~4.8% firmer on the week after its strong post-RBA rally.

- E-minis sit 0.1% softer apiece at writing, sticking to the bottom end of their respective ranges on Thursday, having struggled to make meaningful headway above neutral levels throughout Asia-Pac dealing.

OIL: On Track For Higher Weekly Close; U.S. Response To OPEC+ Cuts Eyed

WTI and Brent are little changed, operating just shy of the respective best levels observed on Thursday. Both benchmarks are on track for their largest weekly gain in months, with WTI sitting >10% firmer for the week at typing.

- Participants will be watching for the U.S. response to the OPEC+ output quota cut, with some of the measures possibly involving a further release of crude from the SPR, or restrictions on U.S. energy exports.

- Meanwhile, U.S. Senate Majority Leader Schumer stated that the “NOPEC” bill (allowing the U.S. to file antitrust lawsuits against members of OPEC) remains on the table, although BBG sources reported that there are no plans to bring the measure to the floor at present.

- Elsewhere, Norway announced that it expects crude production capacity at the Johan Sverdrup oilfield to rise by ~220K bpd in ‘23.

- Looking ahead, leaders from >40 nations will meet at the inaugural summit of the European Political Community later on Friday, with energy-related issues likely to rank highly on the agenda amidst a mix of multilateral and bilateral meetings.

GOLD: Holding Above $1,700/oz Ahead Of NFPs

Gold deals ~$3/oz softer to print ~$1,709/oz at writing, extending a move away from three-week highs established on Tuesday as the USD (DXY) and U.S. real yields have simultaneously unwound some of their recent declines.

- To recap, gold closed ~$4 lower on Thursday, having consolidated an earlier move lower despite weekly jobless claims printing above expectations, succumbing to an uptick in the DXY and U.S. real yields.

- Thursday’s deluge of Fedspeak was uniformly hawkish, with several speakers reiterating the Fed’s commitment to the inflation fight, and pushing back against the idea of a Fed pivot.

- Nov FOMC dated OIS now price in ~72bp of tightening at that meeting, operating at their highest levels for the week.

- Total known ETF holdings of gold are on track to decline for a 17th straight week, pointing to no let-up in weaker sentiment towards the yellow metal.

- From a technical perspective, gold has established a short-term bull cycle. Initial resistance is seen at ~$1,729.5 (Oct 4 high), with further resistance located at $1,735.1 (Sep 12 high and key resistance), while initial support is seen at $1,695.2 (former trendline resistance).

FOREX: Greenback Tad Softer With Market On NFP Watch

Thursday's rally in the greenback lost steam in Asia and the currency lagged all its G10 peers. Headline flow failed to offer much in the way of notable catalysts, keeping most major FX pairs in tight ranges, with all eyes on much-awaited U.S. jobs data today.

- The BBDXY snapped a two-day winning streak, even as Fed Governor Waller despite reinforcing the Fed’s commitment to fighting inflation during the NY-Asia crossover. The official noted that the Fed does "not face a tradeoff between our employment objective and our inflation objective, so monetary policy can and must be used aggressively to bring down inflation."

- Spot USD/JPY ground lower, returning under the Y145.00 mark, seen as an informal threshold of heightened intervention risk. The pair last sits just shy of there at Y144.96. PM Kishida told parliament that rapid, one-sided JPY moves are not desirable, but was generally laconic on the matter. FinMin Suzuki admitted that the recent FX intervention contributed to the record slump in Japanese foreign reserves last month.

- The Aussie dollar outperformed at the margin, with AUD/NZD extending yesterday's advance as a result.

- Financial markets in mainland China remained shut due to a public holiday, but will re-open on Monday. Offshore yuan has gained ~0.6% versus the greenback this week, which reduces pressure on the PBOC amid its efforts to manage the redback's decline.

- The U.S. NFP report provides the single focal point on Friday, after initial jobless claims rose more than forecast in the week through Oct 1.

- German industrial output and Canadian unemployment will also cross the wires today, while Fed's Williams, Kashkari & Bostic will speak, as will BoE's Ramsden.

FX OPTIONS: Expiries for Oct07 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9730-38(E1.1bln), $0.9750(E695mln), $0.9775(E506mln), $0.9800(E1.6bln), $0.9845-55(E1.8bln), $0.9900-02(E1.8bln), $0.9915-25(E1.8bln), $0.9941-55(E1.2bln), $1.0100(E2.0bln)

- GBP/USD: $1.0923(Gbp668mln), $1.1300(Gbp544mln), $1.1400(Gbp572mln)

- EUR/GBP: Gbp0.8690-00(E1.1bln)

- USD/CAD: C$1.3885-00($1.1bln)

- USD/CNY: Cny6.80($2.4bln), Cny7.09($600mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/10/2022 | 0545/0745 | ** |  | CH | Unemployment |

| 07/10/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/10/2022 | 0600/0800 | ** |  | DE | Retail Sales |

| 07/10/2022 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 07/10/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 07/10/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 07/10/2022 | 0645/0845 | * |  | FR | Current Account |

| 07/10/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/10/2022 | 0800/1000 |  | EU | ECB Consumer Expectations Survey Results - August | |

| 07/10/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 07/10/2022 | 1025/1125 |  | UK | BOE Ramsden Speech at Securities Industry Conference | |

| 07/10/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 07/10/2022 | 1230/0830 | *** |  | US | Employment Report |

| 07/10/2022 | 1400/1000 |  | US | New York Fed's John Williams | |

| 07/10/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 07/10/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.