-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: European Fiscal Matters & Fed Rhetoric From Monday Dominate Conversations

EXECUTIVE SUMMARY

- FED’S BRAINARD SEES RESTRICTIVE POLICY FOR SOME TIME (MNI)

- JAPAN FINMIN: U.S. HAS SHOWN UNDERSTANDING ON TOKYO'S FX INTERVENTION (RTRS)

- BERLIN HAS NO PLANS TO SUPPORT JOINT EU DEBT FOR LOANS (RTRS SOURCE)

- KWASI KWARTENG WARNED HE FACES £60BN BILL TO STABILISE UK FINANCES (FT)

- FUMIO KISHIDA BACKS BANK OF JAPAN’S ULTRA-LOOSE POLICY DESPITE YEN PLUNGE (FT)

- PEOPLE’S DAILY UNDERSCORES NEED FOR ZCS

- IRAQ CAN’T AFFORD OPEC-MANDATED OIL PRODUCTION CUT, SENIOR LEADER SAYS (WSJ)

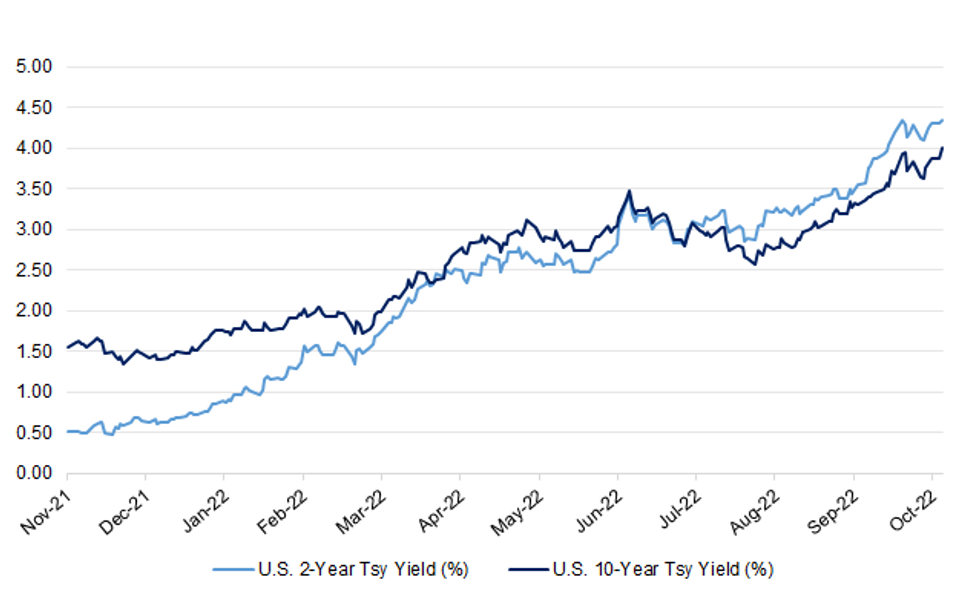

Fig. 1: U.S. 2- & 10-Year Tsy Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: British consumer spending grew last month at a rate that lagged behind inflation by a long way, according to surveys on Tuesday that underlined the risk of recession as the cost-of-living crisis rumbles on. (RTRS)

FISCAL: The Institute of Fiscal Studies warns that the Chancellor Kwasi Kwarteng will need to reveal fiscal tightening of more than £60bn if he wants to persuade investors he can stabilize the public finances. (FT)

POLITICS: Floating voters are now overwhelmingly prepared to give Sir Keir Starmer the benefit of the doubt and would prefer him to Liz Truss as prime minister, a focus group for Times Radio suggests. (The Times)

PENSIONS: Multi-asset funds are the latest casualty of the British pension industry’s dash for cash. (BBG)

PROPERTY: The boss of Santander UK says the bank is putting aside more money for potential defaults linked to the cost of living crisis after seeing a pickup in customers falling behind on mortgage and loan payments. (Guardian)

EUROPE

FISCAL/ENERGY: Germany has no plans to back a joint European Union debt issuance, a government source told Reuters on Monday, denying a media report saying Chancellor Olaf Scholz supported joint debt issuances to tackle the energy crisis. "Such plans are not known in the government," the source said. (RTRS)

FISCAL: Poland is on track to unblock billions of euros of EU recovery funds before the end of the year, its finance minister has said, insisting that negotiators had made significant progress in talks with Brussels in the past month. (FT)

GERMANY: Germany on Monday said it plans to urgently implement a 96 billion euro ($93 billion) plan to ease pressure on consumers from surging gas prices as it was warned that the supply situation heading into winter remained tense even with full reserves. (RTRS)

FRANCE: France’s drivers face more fuel shortages as unions plan to prolong strikes at the country’s biggest refineries that have left almost a third of its gas stations with supply shortfalls. (BBG)

FRANCE: French Energy Minister Agnes Pannier-Runacher said on Monday the possibility of fuel requisitions could be discussed during a meeting scheduled later in the evening with Prime Minister Elisabeth Borne to deal with the shortage at the country's petrol pumps due to refinery strikes. (RTRS)

ITALY: Banca Monte dei Paschi di Siena SpA is set to proceed with a planned €2.5 billion ($2.4 billion) share sale as banks arranging the deal are close to an agreement with the Italian lender, a person familiar with the matter said. (BBG)

U.S.

FED: The Federal Reserve's aggressive interest rate increases are gradually working their way through the economy but additional tightening is needed to make sure price pressures are brought under control, and policy will need to be tight for a while, Fed Vice Chair Lael Brainard said Monday. (MNI)

FED: The Federal Reserve is leading a worldwide rush of central bank rate rises that risks tipping the world into a recession, the EU’s top diplomat said, as he warned the union is not fighting its corner in the world. (FT)

ECONOMY: JPMorgan Chase CEO Jamie Dimon on Monday warned that a “very, very serious” mix of headwinds was likely to tip both the U.S. and global economy into recession by the middle of next year. (CNBC)

ECONOMY: The nation's third-largest freight rail workers union rejected a temporary agreement brokered by the Biden administration to avert a potentially crippling nationwide railroad strike, raising the possibility the one could occur next month. (NBC)

OTHER

BOJ: Fumio Kishida has signalled his support for the Bank of Japan’s ultra-loose monetary policy despite the yen’s plunge to its lowest level in real terms since the 1970s. (FT)

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Tuesday the United States has shown “a certain extent” of understanding about the currency market intervention Tokyo conducted last month. Suzuki also told reporters he would explain Japan’s recent intervention to financial leaders from the Group of 20 major economies when they gather this week in Washington. Japan’s top currency diplomat, Masato Kanda, later said authorities were always ready to take necessary steps against excess currency volatility, broadcaster TBS reported. (RTRS)

AUSTRALIA: Australia is expected to avoid recession due to strong domestic conditions that will help shield its economy from mounting international risks, Treasurer Jim Chalmers said. (BBG)

RBNZ: Governor Adrian Orr says Te Pūtea Matua has remained focused on supporting New Zealand’s economic recovery through the COVID-19 pandemic. (Stuff NZ)

NORTH KOREA: President Yoon Suk-yeol said Tuesday that North Korea has nothing to gain from nuclear weapons, a day after the North said it carried out exercises on mobilizing "tactical nukes" and rejected any chances of negotiations. (Yonhap)

MEXICO: Mexico’s central bank needs to keep up its tight monetary stance for the coming months as inflation expectations have continued to rise recently, deputy Governor Irene Espinosa said at a panel in Washington on Monday. (BBG)

BRAZIL: Brazilian presidential candidate Luiz Inacio Lula da Silva slightly broadened his lead over incumbent President Jair Bolsonaro ahead of the Oct. 30 runoff vote, according to a survey by pollster IPEC published on Monday. (RTRS)

RUSSIA: U.S. President Joe Biden pledged to Ukraine President Volodomyr Zelenskiy on Monday that the United States will provide Ukraine with advanced air systems after a devastating missile barrage from Russia. (RTRS)

RUSSIA: Russia is open for diplomacy, but Washington's encouragement of Ukraine's "bellicose mood" complicates diplomatic efforts to solve the conflict, Foreign Ministry spokeswoman Maria Zakharova said on Monday. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskyy will address an emergency meeting of G-7 leaders on Tuesday after Russian missile strikes rocked Ukrainian cities. (CNBC)

RUSSIA: Some of the nation's largest airports have been targeted for cyberattacks Monday by an attacker within the Russian Federation, a senior official briefed on the situation confirmed to ABC News. (ABC)

RUSSIA: The UAE’s president is to meet Vladimir Putin in Moscow as the Russian leader steps up his attacks on Ukraine with a series of missile strikes. (FT)

IRAN: Iran is rapidly expanding its ability to enrich uranium with advanced centrifuges at its underground plant at Natanz and now intends to go further than previously planned, a confidential U.N. nuclear watchdog report seen by Reuters showed on Monday. (RTRS)

IRAN/OIL: Fresh violence erupted in a Kurdish city in western Iran and reports emerged of oil workers joining nationwide protests that have spread since the death of a 22-year-old woman last month in the custody of the nation’s so-called “morality police.” (BBG)

ENERGY: The Ukrainian energy ministry said it will halt exports of electricity to the European Union following Russian missile strikes on energy infrastructure on Monday. (RTRS)

OIL: U.S. Treasury officials plan to press ahead at this week’s IMF meetings with a cap on the price of Russian oil, despite Wednesday’s decision by OPEC+ to cut oil production that’s already driven gas prices higher. (CNBC)

OIL: Iraq can’t afford to reduce its oil production as part of a move by OPEC+ to slash output, according to the top candidate for the Iraqi prime minister’s post, who said the country needs the money to bolster its floundering economy. (WSJ)

OIL: Hungary has said it will help build a pipeline to transport Russian crude to Serbia in an effort to ensure continued oil supply to Belgrade despite EU sanctions. (FT)

CHINA

PBOC: Chinese market liquidity should remain reasonably ample in 4Q, with the possibility of further cuts to bank reserve ratios, Securities Daily reported, citing analysts. (BBG)

YUAN: The yuan is likely to hover between 7 and 7.3 against the U.S. dollar over the rest of 2022 as expectations for higher U.S interest rates pressure the currency, the CPPCC Daily reported citing Sheng Songcheng, previously head of the statistics and analysis department at the People's Bank of China. (MNI)

INFLATION: China’s consumer price index in September will rise close to the government's targeted 3% y/y ceiling compared to August’s 2.5% print as a low comparison base last year, coupled with significant gains in pork and vegetable prices due to holiday demand, offset declining fuel costs, the Securities Daily reported citing Golden Credit Rating chief analyst Wang Qing. (MNI)

CORONAVIRUS: China’s dynamic “zero-Covid” policy is sustainable and must persist as the epidemic is still spreading nationwide, with 31 provinces reporting 434 infections on Oct 9, according to a commentary by the Party-run People’s Daily. (MNI)

CORONAVIRUS: Shanghai is rolling out mandatory mass testing again -- with residents needing to be tested at least twice weekly through early November. Anyone traveling to the city will need a negative Covid result within 24 hours of arriving and have to do three tests in three days. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY60 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) on Tuesday injected CNY2 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY60 billion after offsetting the maturity of CNY62 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7973% at 09:40 am local time from the close of 1.4066% on Monday.

- The CFETS-NEX money-market sentiment index closed at 56 on Monday vs 45 on Sunday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1075 TUES VS 7.0992 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1075 on Tuesday, compared with 7.0992 set on Monday. (MNI)

OVERNIGHT DATA

JAPAN AUG CURRENT ACCOUNT BALANCE +Y58.9BN; MEDIAN -Y56.7BN; JUL +Y229.0BN

JAPAN AUG ADJUSTED CURRENT ACCOUNT BALANCE -Y530.5BN; MEDIAN -Y550.0BN; JUL -Y629.0BN

JAPAN AUG BOP TRADE BALANCE -Y2.4906TN; MEDIAN -2.4283TN; JUL -Y1.2122TN

JAPAN SEP ECO WATCHERS SURVEY CURRENT 48.4; MEDIAN 47.7; AUG 45.5

JAPAN SEP ECO WATCHERS SURVEY OUTLOOK 49.2; MEDIAN 50.8; 49.4

AUSTRALIA SEP NAB BUSINESS CONFIDENCE 5; AUG 10

AUSTRALIA SEP NAB BUSINESS CONDITIONS 25; AUG 22

Business conditions strengthened further in September on the back of very high trading conditions and are now above their pre-COVID peak. Both the employment and profitability indexes also remain elevated. Conditions remain strong across industries and states - with wholesale and retail rising notably in the month. (NAB)

AUSTRALIA OCT WESTPAC CONSUMER CONFIDENCE INDEX 83.7; SEP 84.4

The Index remains in deeply pessimistic territory at a level comparable to the lows briefly reached during the pandemic and the extended weakness experienced during the Global Financial Crisis. The key drags on confidence continue to come from a surge in the cost of living, rising interest rates, and concerns about the near- term outlook for the economy. (Westpac)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 84.6; PREV 85.5

Consumer confidence dropped by 1.1% last week, despite the smaller than expected 25bp rate hike by the RBA. (ANZ)

AUSTRALIA SEP CBA HOUSEHOLD SPENDING -0.5% M/M; AUG +0.9%

AUSTRALIA SEP CBA HOUSEHOLD SPENDING +14.1% Y/Y; AUG +15.1%

For September 2022 the CommBank Household Spending Intentions (HSI) Index declined by -0.5%/mth in September 2022. The fall in September was the first monthly decline since April this year and is clearly beginning to show the effects on the household sector of the RBA’s aggressive interest rate hiking cycle –with further impact expected in the months ahead. (CBA)

NEW ZEALAND SEP RETAIL CARD SPENDING +1.4% M/M; AUG +1.0%

NEW ZEALAND SEP CARD SPENDING + 2.5% M/M; AUG +0.8%

NEW ZEALAND SEP ANZ HEAVY TRUCKOMETER -3.3% M/M; AUG +8.9%

The Heavy and Light Traffic Indexes went in different directions in the month of September. Like just about every other type of data, traffic data has been very volatile in recent times as COVID impacts and supply-side disruptions and shortages mean observed activity is not all about the level of demand. (ANZ)

SOUTH KOREA OCT 1-10 TRADE BALANCE -$3.83BN

SOUTH KOREA OCT 1-10 EXPORTS -20.2% Y/Y

SOUTH KOREA OCT 1-10 IMPORTS -11.3% Y/Y

UK SEP BRC SALES LIKE-FOR-LIKE +1.8% Y/Y; AUG +0.5%

MARKETS

SNAPSHOT: European Fiscal Matters & Fed Rhetoric From Monday Dominate Conversations

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 707.13 points at 26408.98

- ASX 200 down 13.753 points at 6654

- Shanghai Comp. up 11.969 points at 2986.115

- JGB 10-Yr future down 35 ticks at 148.27, yield down 0.1bp at 0.251%

- Aussie 10-Yr future down 15.5 ticks at 95.955, yield up 15.5bp at 4.023%

- U.S. 10-Yr future down 0-10 at 110-22+, yield up 11.87bp at 4.0001%

- WTI crude down $0.54 at $90.59, Gold down $5.49 at $1663.12

- USD/JPY up 5 pips at Y145.77

- FED’S BRAINARD SEES RESTRICTIVE POLICY FOR SOME TIME (MNI)

- JAPAN FINMIN: U.S. HAS SHOWN UNDERSTANDING ON TOKYO'S FX INTERVENTION (RTRS)

- BERLIN HAS NO PLANS TO SUPPORT JOINT EU DEBT FOR LOANS (RTRS SOURCE)

- KWASI KWARTENG WARNED HE FACES £60BN BILL TO STABILISE UK FINANCES (FT)

- FUMIO KISHIDA BACKS BANK OF JAPAN’S ULTRA-LOOSE POLICY DESPITE YEN PLUNGE (FT)

- PEOPLE’S DAILY UNDERSCORES NEED FOR ZCS

- IRAQ CAN’T AFFORD OPEC-MANDATED OIL PRODUCTION CUT, SENIOR LEADER SAYS (WSJ)

US TSYS: Block Sales Help To Keep Pressure On

TYZ2 hovers just above the base of its 0-13+ range into London hours, last -0-09+ at 110-23, on solid volume of ~120K, operating just above technical support at the contract’s cycle low (110-19). Cash Tsys run 3.5-11.5bp cheaper across the curve, with 10s leading the way lower as that benchmark hovers just below 4.00%, with the round number protecting the triple top resistance area drawn off the ’09, ’10 & YtD highs.

- Spill over from Monday’s cheapening was aided by several rounds of block sales in TY & FV futures, alongside a USD bid, with Tsys extending on yesterday’s weakness as cash trade opened after the elongated Columbus Day weekend.

- There wasn’t much in the way of meaningful headline flow to drive the move, with the space shrugging off the latest round of risk-negative COVID headlines out of China, after the state-backed People’s Daily reiterated the need for the country’s ZCS, while a fresh mass testing scheme was unveiled in the city of Shanghai.

- Looking ahead, Tuesday’s NY docket will see the release of the NFIB small business optimism index, Fedspeak from Mester and 3-Year Tsy supply.

JGBS: Curve Steepens On Wider Weakness In Core Global FI Markets

JGB futures operate just above worst levels into the bell, -33 vs. Friday’s settlement, after Tokyo returned from an elongated weekend and reacted to the weakness witnessed in wider core global FI markets.

- Cash JGBs are flat to 7bp cheaper across the curve, with the super-long end leading the way lower owing to the relative lack of BoJ control in that area of the curve.

- 7s underperform surrounding paper owing to the weakness in futures, while 10s are little changed as they operate just shy of the BoJ’s yield cap.

- An FT interview with PM Kishida showed the leader’s support for the BoJ’s ultra-loose policy settings, even as the JPY tumbles, while Kishida indicated that he intends to allow Governor Kuroda to serve his full term atop the BoJ (which expires in April ’23).

- A steady to lower round of offer/cover ratios in the BoJ Rinban operations covering 1- to 25-Year JGBs, coupled with the FT story, seemed to facilitate a very modest bid during the early rounds of Tokyo afternoon dealing before fresh weakness set in.

- Elsewhere, Japanese policymakers reiterated well-trodden verses surrounding the FX market, alongside suggestions that the U.S. has shown “a certain extent” of understanding re: Tokyo’s FX intervention in September.

- Looking ahead, 30-Year JGB supply headlines the domestic docket on Wednesday, with lower tier economic data also due.

AUSSIE BONDS: Dragged Lower By Broader Weakness And Semi-Issuance Pricing

The wider weakness observed in core global FI futures allowed the major Aussie bond futures to extend through their respective overnight bases during Tuesday’s Sydney session, with hedging around the pricing of TCV’s new Sep-36 benchmark bond also applying some pressure late in the day.

- That leaves YM -9.0 and XM -15.0 into the bell, operating just above worst levels, as U.S. Tsys nudge away from session cheaps.

- Wider cash ACGB trade has seen the major benchmarks cheapen by 9-16bp, with the curve bear steepening as super-long paper leads the way lower.

- Bills sit flat to 10bp cheaper on the day, with RBA dated OIS now pricing a terminal rate of just under 4.0%, ~7bp or so higher on the day.

- Local data saw a firming of NAB business conditions, a moderation in business confidence (to around long-run average levels), a modest downtick in Westpac consumer confidence (albeit with very split directions in the reading, intra-month) and a sight slowing of CBA household spending in Y/Y terms (with a negative M/M print seen).

- An address from RBA Assistant Governor (Economic) Ellis on “The Neutral Rate: The Pole-star Casts Faint Light,” headlines the domestic docket on Wednesday. Elsewhere, A$800mn of ACGB Nov-32 supply is due.

AUSSIE BONDS: Aug-40 I/L Auction Results

The Australian Office of Financial Management (AOFM) sells A$100mn of the 1.25% 21 August 2040 Indexed Bond, issue #CAIN413

- Average Yield: 1.9689% (prev. 1.2380%)

- High Yield: 1.9825% (prev. 1.2500%)

- Bid/Cover: 2.9600x (prev. 3.7000x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 27.3% (prev. 100.0%)

- Bidders 52 (prev. 38), successful 27 (prev. 3), allocated in full 25 (prev. 3)

NZGBS: NZGBs Cheaper On The Global Drumbeat

The broader weakness observed in core global FI markets since Monday’s local close dragged NZGBs lower in early Tuesday trade, before fresh pressure for global core FI markets resulted in additional cheapening, with the major benchmarks running 12-13bp cheaper across the curve at the close, bear steepening.

- In the RBNZ's annual report Governor Adrian Orr reiterated the idea that "there is more work to do. Increasing the OCR is the most effective way we can reduce inflation and support maximum sustainable employment over the coming years, consistent with our monetary policy Remit. That is one of our key roles as a central bank and the best thing we can do for the long term economic wellbeing of all New Zealanders."

- RBNZ dated OIS indicated terminal rate pricing of just over 4.90%, advancing ~10bp on the day, with the move higher in global yields pushing that metric upwards as we moved through the session.

- Lower tier local data failed to impact the space in a meaningful manner, although firmer card spending data in September would have aided the cheapening in the background.

- Looking ahead, REINZ house sales and net migration data is due Tuesday.

EQUITIES: Tech Sensitive Markets Lead Declines

Asia Pac equities remain under pressure for the most part. Some smaller markets are outperforming, while Australian equities are close to flat. However, the bigger centers are seeing larger losses, part of this reflects catch up from closed markets yesterday.

- US futures are down close to -0.50%. Focus will be on whether we test below 3600 again for the SPX. Note lows at the start of the month were close to 3570. Overnight comments from Fed Vice Chair Brainard that the Fed needs to be cautious in terms of the outlook, have provided no lasting positive sentiment.

- China markets are also weaker, but mainland bourses are defying broader sell-off pressures. The Shanghai Composite down -0.35% so far in the session. The property sub-index is unwinding all of yesterday's gains, down 1.73%.

- Hong Kong shares are lower as well, the HSI down 1.5%, with tech again driving weakness.

- The Nikkei 225 is off by over 2.6%, the Taiex 4.10%, and Kospi 2.45%. Tech names like TSMC and Smasung have seen sharp losses, no doubt reflecting some catch up from yesterday's holiday.

- Chip/PC demand concerns from US markets late last week continue to weigh on the sector.

OIL: Demand Concerns Cap Rebound

Oil is slightly below NY closing levels at present. Brent was last around $96/bbl, around -0.2% for the session so far, while WTI is back under $91/bbl, off by slightly more. This follows losses of more than 1.6% through yesterday's session.

- For Brent dips towards $95.50/bbl were supported yesterday, so this level could be watched on the downside. Beyond that, note the 50-day MA comes in just under $94/bbl.

- Oil could consolidate further after last week's very strong rally (+11.3% for Brent), with the OPEC+ supply meeting now out of the way.

- Concerns this week likely rest on the demand outlook, amid global recession fears. Also, the trend move higher in Covid case numbers in China can also impact sentiment.

- Note we don't get the API inventory report tonight in the US, as this has been delayed by a day due to the Columbus day holiday at the start of this week.

- Tomorrow will deliver OPEC's monthly oil report, along with the EIA short term energy outlook, and the weekly API inventory data.

GOLD: Could See More Downside On Higher USD Levels

The backdrop for gold still looks to be a bearish one. The precious metal has dropped over 2.5% in the past 2 sessions, as the USD and yields continue to recovery. We are relatively steady so far today in trading. Gold was last just above $1666, only slightly down on NY closing levels.

- Given the DXY is back above 113.00, a simple visual relationship suggests that gold should be testing sub $1650.

- Added to this is the generally hawkish core yield backdrop. The 10yr US real yield is back to 1.62%, only slightly down on cyclical highs.

- The weaker equity market back drop is likely helping at the margin, although the dollar and real yield move tend to be more important drivers over a multi-day/week horizon.

FOREX: Risk Aversion Evident, Iron Ore Dip Weighs On AUD, JPY Intervention Talk Returns

Participants rushed to safety as U.S. e-mini futures erased their initial uptick, while U.S. Tsy yield curve bear steepened as cash trading re-opened. The BBDXY index gained for the fifth consecutive day as its 1-month implied volatility was closing on its cyclical highs. There was little in the way of fresh risk-off headline flow, but familiar concerns continued to linger, affecting Japanese, South Korean and Taiwanese players as they returned from holidays.

- Spot USD/JPY traded within touching distance from a cyclical high (Y145.90) last printed on Sep 22, when Japanese officials intervened to prop up the yen. Renewed jawboning may have lent additional support to the yen, as officials vowed readiness to act decisively if needed. Japan's FX czar Kanda said he could order an intervention while en route to the G20 summit in Washington D.C.

- Risk aversion and intervention talk kept a lid on USD/JPY, allowing it to look past widening U.S./Japan yield spreads, with JGB yields anchored by confidence in the BoJ's commitment to its ultra-loose policy. PM Kishida reiterated his support for the central bank's current policy stance.

- A drop in Iron ore prices sapped strength from the Aussie dollar, which paced losses in G10 FX space for the second consecutive day. AUD/USD refreshed cycle lows, while AUD/NZD fell below the NZ$1.1300 figure.

- Spot USD/CNH advanced but the CNH7.2 mark proved resilient, with domestic COVID-19 case counts likely weighing on the redback.

- Major data releases going forward are limited to the UK labour market report. Speeches are due from Fed's Mester, ECB's Lane & Villeroy, BoE's Bailey & Cunliffe.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/10/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 11/10/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 11/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 11/10/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/10/2022 | - |  | EU | ECB Panetta IMF/World Bank Annual Meetings | |

| 11/10/2022 | 1245/1445 |  | EU | ECB Lane Keynote Speech | |

| 11/10/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 11/10/2022 | 1530/1130 |  | US | Philadelphia Fed's Patrick Harker | |

| 11/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/10/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 11/10/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/10/2022 | 1800/1900 |  | UK | BOE Cunliffe Panels IIF Annual Meeting | |

| 11/10/2022 | 1800/2000 |  | EU | ECB Lane NY Fed Fireside Chat | |

| 11/10/2022 | 1835/1935 |  | UK | BOE Bailey in Conversation w. Tim Adams at IIF Meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.