-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A$ & Local Yields Down Post Retail Sales Miss

EXECUTIVE SUMMARY

- TREASURY RAISES Q2 BORROWING ESTIMATE BY USD41B- MNI BRIEF

- ECB’S GINDOS SAYS INFLATION OUTLOOK FACES ‘SUBSTANTIAL RISKS’ - BBG

- CHINA APR MFG. PMI MODERATES TO 50.4 - MNI BRIEF

- JAPANESE INDUSTRIAL OUTPUT RISES IN MARCH - MNI BRIEF

- JAPAN’S TOP FX DIPLOMAT SAYS READY TO DEAL WITH YEN AROUND THE CLOCK - RTRS

- AUSSIE RETAIL SALES FALL 0.4% M/M IN MARCH - MNI BRIEF

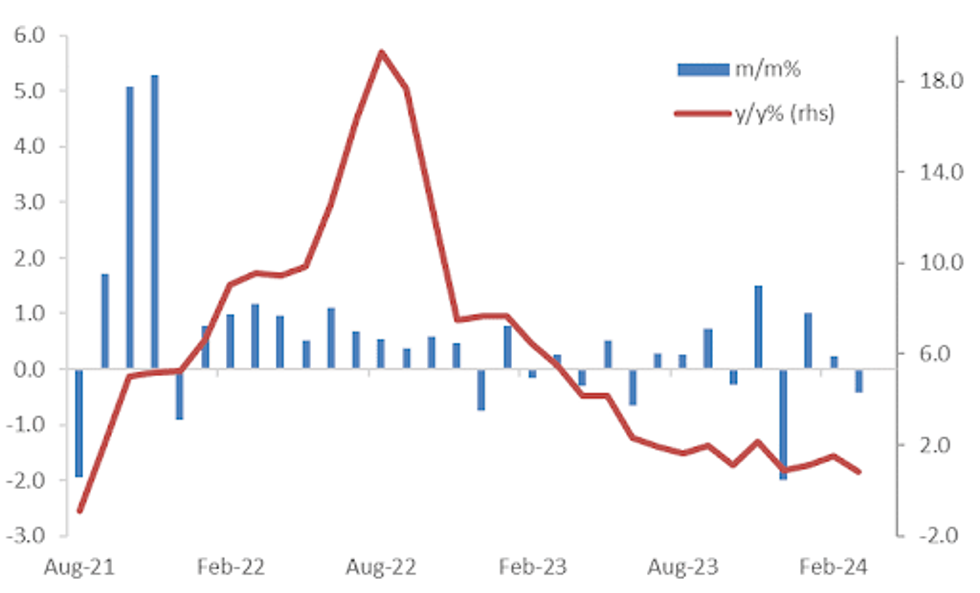

Fig. 1: Australian Retail Sales

Source: MNI - Market News/Bloomberg

U.K.

INFLATION (MNI): BRC-NielsenIQ Shop Price inflation slowed to +0.8% Y/Y in April (vs +1.3% Y/Y prior), whilst Shop Price Inflation fell on a monthly basis by 0.3% M/M (vs 0.4% M/M decline in March) for the second consecutive month.

EUROPE

ECB (BBG): The European Central Bank faces significant dangers to achieving its inflation goal, according to Vice President Luis de Guindos, who cited factors that could pull prices too far in either direction.

ECB (NIKKEI): The European Central Bank should proceed with caution after a probable first reduction in interest rates in June, with quarterly data on wages likely to be key in determining further moves, according to Governing Council member Klaas Knot.

FISCAL (MNI BRIEF): EU Budget Commissioner Johannes Hahn has mooted the possibility of suspending repayments of EU’s Next Generation programme in order to provide more funding leeway in the EU’s next multiannual budget.

EU (POLITICO): Speaking at the Maastricht Debate, organized by POLITICO and Studio Europa Maastricht, European Commission President von der Leyen indicated she would be open to a deal with the European Conservatives and Reformists (ECR) group after this summer’s EU-wide election. The ECR group’s MEPs are often staunchly Euroskeptic, standing further to the right than von der Leyen’s centrists, and its ranks in the European Parliament are expected to swell after the vote in June.

AUSTRIA (FRANCE24): Austria’s far-right Freedom Party has been leading the opinion polls for over a year, hovering near 30 percent ahead of June elections for the European Parliament. It’s a rise of some 10 points from the party’s showing in the 2019 European elections.

UKRAINE (BBC): Ukraine's President Volodymyr Zelensky says Russia is taking advantage of the slow delivery of Western weapons to go on the offensive. His comments come after the US agreed a $61bn (£49bn) package of mostly military aid for Ukraine.

CHINA (POLITICO): Commission President Ursula von der Leyen hinted that banning TikTok in the European Union is an option, during a debate this evening in Maastricht, featuring parties' lead candidates for the bloc's 2024 election.

CHINA (FRANCE24): Chinese President Xi Jinping is due to make a state visit to France on May 6 and 7, Paris announced on Monday, with wars in Ukraine and the Middle East expected to be high on the agenda.

RUSSIA (BBG): The Biden administration is considering banning imports of enriched Russian uranium using executive authority as congressional efforts to block the Kremlin’s shipments of the reactor fuel stall, people familiar with the matter said.

U.S.

FED (MNI FED PREVIEW): Analysts generally look for a more hawkish message from the FOMC in May compared with March, in light of strong inflation and economic activity data.

TREASURY (MNI BRIEF): The U.S. Treasury Department on Monday announced it expects to borrow USD243 billion in privately held net marketable debt in the second quarter, USD41 billion more than previously announced in January due to lower cash receipts. Officials expect to borrow USD847 billion in the third quarter.

OTHER

JAPAN (MNI BRIEF): Industrial output rose 3.8% m/m in March for the first rise in three months following February's 0.6% fall, driven by a rise in automobile and electronics production, data released by the Ministry of Economy, Trade and Industry showed on Tuesday.

JAPAN (RTRS): Japan's top currency diplomat Masato Kanda said on Tuesday authorities were ready to deal with foreign exchange matters around the clock but declined to comment on whether the finance ministry had intervened to prop up the yen a day earlier.

AUSTRALIA (MNI BRIEF): Australian retail sales fell 0.4% m/m in March, more than the market’s expected 0.2% drop, following February’s 0.2% rise, data from the Australian Bureau of Statistics showed Tuesday.

SOUTH KOREA (BBG): Samsung Electronics Co.’s earnings surged after the semiconductor business returned to profitability for the first time since 2022, boosted by broad spending on artificial intelligence development.

MEXICO (MNI INTERVIEW): Mexico's Central Bank is falling behind the curve because it should have started reducing its interest rates in the second half of 2023, former director of economic studies at Banxico, Alejandro Werner, told MNI, adding the monetary authority's decision not to depict the 25-basis-point cut in March as the start of a new easing cycle was unduly hawkish.

CHINA

MANUFACTURING (MNI BRIEF): China's manufacturing Purchasing Managers' Index moderated by 0.4 points to 50.4 in April, expanding above the breakeven 50 level for the second month, driven by improved external demand and rapid expansion in high-end manufacturing amid policy push, data from the National Bureau of Statistics showed Tuesday.

MANUFACTURING (MNI BRIEF):China's Caixin manufacturing PMI registered 51.4 in April, up 0.3 points from March, staying in the expansionary zone above the breakeven 50 mark for a sixth month and hitting the highest level since March 2023, as both external and domestic demand improved, the financial publisher said on Tuesday.

LIQUIDITY (CSJ): China’s central bank is expected to maintain precise liquidity management operations and stable funding conditions that’s supportive for the economy, China Securities Journal reports.

HOUSING (YICAI): The central government should establish a fund to guarantee the delivery of housing projects, given the lack of funds in local governments and developers as well as relatively low motivation of banks to provide funds, Yicai reported citing Lu Ting, chief economist of Nomura China.

HOUSING (YICAI): Real-estate stocks rose on Monday with more than 20 companies including Vanke hitting their daily limit on the A-share market, driven by rumors about “directional changes in housing policy”, Yicai.com reported.

EQUITIES (SHANGHAI SECURITIES NEWS): Cash dividend payouts by listed companies in China’s A-share market for the fiscal year of 2023 are set to hit a record high, Shanghai Securities News reported.

CHINA/PHILIPPINES (RTRS): China's coast guard said on Tuesday it "expelled" a Philippine coast guard ship and another vessel from waters adjacent to the Scarborough Shoal, Chinese state media reported. The coast guard did not provide additional information in a statement, but the incident was the latest to occur between the two countries at the disputed atoll in the South China Sea.

CHINA MARKETS

MNI: PBOC Net Injects CNY438 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY440 billion via 7-day reverse repo before May Day holiday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY438 billion after offsetting the maturity of CNY2 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1014% at 09:41 am local time from the close of 2.1024% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 41 on Monday, compared with the close of 44 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1063 on Tuesday, compared with 7.1066 set on Monday. The fixing was estimated at 7.2432 by Bloomberg survey today.

MARKET DATA

UK APRIL BRC SHOP PRICE INDEX +0.8% Y/Y; PRIOR +1.3% Y/Y

NEW ZEALAND 1Q JOB ADS FALL 5.4% Q/Q, PRIOR -5.5%

NEW ZEALAND APRIL ANZ BUSINESS ACTIVITY OUTLOOK INDEX FALLS TO 14.3; PRIOR 22.5

NEW ZEALAND APRIL ANZ BUSINESS CONFIDENCE INDEX FALLS TO 14.9; PRIOR 22.9

AUSTRALIA MARCH RETAIL SALES FALL 0.4% M/M; EST. +0.2%; PRIOR +0.2%

AUSTRALIA MARCH CREDIT TO BUSINESS, CONSUMERS RISES 0.3% M/M; EST. +0.4%; PRIOR +0.5%

AUSTRALIA MARCH CREDIT TO BUSINESS, CONSUMERS RISES 5.1% Y/Y; PRIOR 5.0%

CHINA APRIL MANUFACTURING PMI 50.4; EST. 50.3; PRIOR 50.4

CHINA APRIL NON-MANUFACTURING PMI 51.2; EST. 52.3; PRIOR 53.0

CHINA APRIL COMPOSITE PMI 51.7; PRIOR 52.7

CHINA APRIL CAIXIN MANUFACTURING PMI 51.4; EST. 51.0; PRIOR 51.1

JAPAN MARCH JOBLESS RATE 2.6%; EST 2.5%; PRIOR 2.6%

JAPAN MARCH JOB-TO-APPLICANT RATIO IS 1.28; EST. 1.26; PRIOR 1.26

JAPAN MARCH INDUSTRIAL OUTPUT RISES 3.8% M/M; EST. 3.3%; PRIOR -0.6%

JAPAN MARCH INDUSTRIAL OUTPUT -6.7% Y/Y; EST. -6.3%; PRIOR -3.9%

JAPAN’S METI SEES APRIL OUTPUT TO RISE 4.1% M/M

JAPAN’S METI SEES MAY OUTPUT TO RISE 4.4% M/M

JAPAN MARCH RETAIL SALES -1.2% M/M; EST. -0.2%; PRIOR +1.7%

JAPAN MARCH RETAIL SALES RISE 1.2% Y/Y; EST. 2.4%; PRIOR +4.7%

SOUTH KOREA MARCH INDUSTRIAL OUTPUT FALLS 3.2% M/M; EST. +0.5%; PRIOR +2.9%

SOUTH KOREA MARCH INDUSTRIAL OUTPUT RISES 0.7% Y/Y; EST. +4.6%; PRIOR +4.6%

SOUTH KOREA MARCH CYCLICAL LEADING INDEX FALLS 0.2 PT M/M; PRIOR +0.2

MARKETS

US TSYS: Treasury Futures Steady, MNI Chicago PMI and Consumer Confidence Later

- Treasury futures have been uneventful today, the 10Y briefly traded above Monday highs to 108-00 however we now trade back at 107-31+ while the 2Y is unchanged for the day at 101-15

- The cash treasury curve tighter with the 2Y yield -0.8bp to 4.968%, 10Y -0.8bp to 4.605%, while the 2y10y unchanged at -36.524

- Across local rates markets: NZGB yields are 5-6.5bps lower & ACGBs 7-8bps lower after weaker than expected Retail Sales numbers, while the JGBs curve has bull-steepened with yields 2bps lower to 1bp higher.

- MNI Fed Preview - May 2024: Analyst Outlook - (See Link)

- MNI BRIEF: Treasury Raises Q2 Borrowing Estimate By USD41B - (See Link)

- Looking ahead: Employment Cost Index, FHFA House Price Index, MNI Chicago PMI & Conf. Board Consumer Confidence later today, while major focus will turn to FOMC on Wednesday

JGBS: Futures Richer & Near Highs, Light Local Calendar Tomorrow

JGB futures are sharply and near session highs, +59 compared to the settlement levels on Friday, after yesterday’s public holiday.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined labour market, retail sales and IP data.

- (Bloomberg Opinion, John Authers) Authorities won’t confirm intervening on behalf of the yen because they know what really matters is being decided by the Fed. (See link)

- Cash US tsys are ~1bp richer across benchmarks, continuing the rally since Thursday’s Q1 PCE Deflator-induced low. The FOMC Policy Decision is scheduled for Wednesday, with policymakers expected to reiterate their commitment to maintaining higher interest rates for an extended period.

- Cash JGBs are richer across the curve, with yields 0.3-3bps lower. The benchmark 10-year yield is 2.2bps lower at 0.869% versus the YTD high of 0.930%.

- The swaps curve has bull-flattened, with rates 1-2bps lower. Swap spreads are wider out to the 10-year and tighter beyond.

- Tomorrow, the local calendar will see Jibun Bank PMI Mfg (F) data ahead of BoJ Minutes of March Meeting.

AUSSIE BONDS: Strong Session Instigated By Weaker Than Expected Retail Sales

ACGBs (YM +8.0 & XM +7.5) are 5bps richer after today’s softer-than-expected domestic data drop.

- Retail sales were weaker than expected in March falling 0.4% m/m after rising 0.2% with the decline broad-based. Turnover is now up only 0.8% y/y, the lowest since August 2021.

- The series is nominal and so impacted by inflation trends. Q1 volumes are published on May 7. This data aligns with the RBA’s assessment that “consumption growth is weak” but given sticky inflation and the robust labour market are unlikely to drive a change in stance.

- Private Sector Credit also surprised on the downside printing at +0.3% m/m versus +0.4% est and +0.5% prior.

- Cash US tsys are ~1bp richer across benchmarks, continuing the rally since Thursday’s Q1 PCE Deflator-induced low.

- Cash ACGBs are 8-9bps richer on the day, with the AU-US 10-year yield differential 4bp lower at -19bps.

- Swap rates are 8-9bps lower.

- The bills strip has bull-flattened, with pricing +3 to +10.

- RBA-dated OIS pricing is 9-10bps softer on the day for early 2025 meetings. The expected terminal rate falls to 4.40% (Sep-24) from 4.47% before the data.

- The local calendar will see CoreLogic House Prices and the Judo Bank PMI Mfg tomorrow.

- Tomorrow, the AOFM plans to sell A$800mn of the 3.75% May-34 bond.

NZGBS: Closed Sharply Richer After Bus. Conf. Falls, Q1 Employment Tomorrow

NZGBs closed on a strong note, with benchmark yields 5-6bps lower, after Business Confidence fell to its lowest level since September last year.

- ANZ’s Business Confidence measure for April fell to 14.9 from 22.9 and the activity outlook to 14.3 from 22.5. Cost and wage pressures remained elevated with some easing only in the latter. Weak demand will make it difficult to pass on higher costs. The RBNZ needs activity to ease to return to inflation to target but this may be a slow journey.

- Swap rates closed 8-9bps lower.

- RBNZ dated OIS pricing closed 4-6bps softer for meetings beyond August. A cumulative 32bps of easing is priced by year-end.

- Tomorrow, the local calendar will see the Q1 Employment Report. The labour market is widely expected to have eased further with slower growth resulting in less hiring and migration increasing the labour supply and thus reducing pressure on wages.

- Bloomberg consensus has a 0.3pp increase in the unemployment rate to 4.3%, the highest in over 5 years, and forecasts employment growth to moderate to 0.3% q/q and 1.6% y/y from 0.4/2.4% in Q4. Unemployment expectations are between 4.1% and 4.5%.

- Private wages including overtime are projected to rise by between 0.6% and 0.9% q/q in Q1.

FOREX: USD Recovers Some Ground, A$ Weighed By Retail Sales Miss

The USD has recovered some ground today, mainly against AUD and NZD, with yen also weaker. The BBDXY USD index sits up around 0.20%, last near 1260.70.

- AUD/USD is down 0.5% to 0.6530/35 during today’s APAC trading as weaker Aussie retail sales and China services PMI weigh on the currency, which is unwinding the 0.5% gain from Monday. We are just below 0.6441 support.

- Australian retail sales were weaker than expected in March falling 0.4% m/m after rising 0.2% with the decline broad based. They are now up only 0.8% y/y.

- Regional equities are mostly stronger, although China markets are lagging modestly. US Tsy yields are down around 1bps.

- NZD/USD has been dragged lower, with AUD, off 0.50% to just under 0.5950. We did have weaker NZ survey results, but only off recent highs.

- USD/JPY has climbed, but couldn't reclaim the 157.00 level. We were last near 156.75/80, around 0.30% weaker in yen terms. The market is testing the waters post yesterday's strong rebound amid intervention speculation. Earlier comments from Chief FX Diplomat Kanda stated the authorities are ready to deal with FX at any time of the day, but declined to confirm whether they intervened yesterday. Mixed Japan data outcomes didn't shift FX sentiment.

- Later US Q1 ECI, February house prices, April MNI Chicago PMI and consumer confidence print. The ECB’s Buch speaks and euro area preliminary April HICP, and German, Italian & French Q1 GDP are released.

ASIA EQUITIES: China And HK Equities Mixed, China PMIs Higher For 2nd Month

Hong Kong and China equities are mixed today, with Hong Kong equities continuing their outperformance, after China announced measures to support the HK market. China equities have displayed a subdued response to the consecutive increase in factory activity for the second month, suggesting that the country's economic recovery could still have legs. The HSI has outperformed the CSI300 over the past month by 3.89% and 6.26% since the announcement. Positive property markets headlines out over the weekend saw property indices surge on Monday with many now entering bull markets. Earlier China PMI data was out with a positive print in manufacturing PMI, the gauge now in the second month of expansion although services slowed from the previous month and came in below expectations.

- Hong Kong equities are slightly higher today with the HSTech Index little changed after breaking back above the 200-day EMA and is now up 14.5% from lows on the Apr 19th. The Mainland Property Index surged higher on Monday after positive headlines over the weekend, finishing the day up 3.35%, we a touch lower today down 0.35% while the wider the HSI is up just 0.10%. China Mainland equities have again underperformed today , with the CSI300 down 0.35%, although the index was able to closed above the 200-day EMA for the first time since August 2023, small-cap indices are performing the lower today with the CSI1000 and CSI2000 both down about 0 .90%, while the ChiNext is giving back some of Mondays gains, down 1.25%

- China Northbound had another double digit inflow of 11b yuan on Monday. The past 5-days saw just a single day of outflows, with a total inflow of 35b yuan. The 5-day average at 7.05billion, while the 20-day average sits at 0.48billion yuan.

- Property Indices surged on Monday after broader market rally, and as expectations of further easing of home purchase restrictions grow following a major city’s relaxation, with headlines such as "CHINA'S CHENGDU WILL NO LONGER REVIEW HOME BUYING QUALIFICATION" & "CHINA'S CHENGDU RELAXES HOME-BUYING RULES IN BOOST TO MARKET" - BBG helping push markets higher. While CIFI has reached an agreement with creditors to restructure its debt, potentially reducing principal by up to 85%. The proposal involves swapping existing debt for new notes and saw CIFI's shares surge 28% in Hong Kong trading. The Mainland Property Index was up as much as 5.8% at one stage on Monday finishing the session up 3.35%

- Dividend payouts by China's A-share listed companies for 2023 are poised to reach a record high, with 3,800 out of 5,160 companies having currently released annual reports and have planned to distribute 2.2 trillion yuan ($304 billion). The banking, telecommunications, and oil and coal sectors are among those with the largest dividend plans.

- Earlier, Composite PMI was 51.7, down from 52.7 in March, Manufacturing PMI was 50.4 vs 50.3 est, while Caixin China PMI Mfg was 51.4 vs 51.0 est and up from 51.1 in March.

- Looking forward, Hong Kong GDP on Thursday

ASIA PAC EQUITIES: Equities Higher, Samsung's Strong Earnings, Busy Data Day

Asian markets are higher today, it has been a busy session on the data front. Japan has returned from a break on Monday with indices up close to 2%, the yen stabilized following wild swings in the previous session with what looked to be intervention from the MoF on Monday, while earlier we Had Japan Job Data, Retail Sales & Industrial Production with Housing starts data to come. Elsewhere South Korean equities are higher, driven largely by strong earnings from Samsung Electronics, while earlier Industrial Production missed estimates by quiet some margin. Australia Retail Sales missed estimates, ACGB yields moved lower and New Zealand's Business confidence fell. Looking ahead we have Taiwan GDP and Thailand BoP Current Account Balance a bit later.

- Japanese equities are higher today, playing a bit of catch up after being closed on Monday, focus has been largely on the Yen after yesterday briefly trading above 160, before what looks like MoF intervention saw the currency rally 3% at one stage to now trade at 156.82, although it should be noted we are now trading back at levels from Friday. Earlier this morning we had Jobless rate coming in at 2.6% vs 2.5% for March, but in line with Feb, and Job-To-Applicant Ratio of 1.28 vs 1.26, while Retail Sales showed a dropped from Feb 4.6% to 1.2% vs 2.4% est and finally Industrial Production picked up in March coming in at 3.8% vs 3.3% est. The Topix is up 1.81% and has broken back above the 20-day EMA, while the Nikkei 225 is up 1.07% and is testing both the 20 & 20-day EMAs.

- South Korean equities are higher today, led by strong earnings results from Samsung Electronics after reporting a more than tenfold surge in its first-quarter operating profit compared to the previous year which marked the first time in five quarters that its chip business turned profitable. Earlier this morning, Industrial Production was 0.7% vs 4.6% y/y est, falling from 4.6% in Feb. The Kospi is 0.65% higher, now up 5.88% from recent lows and trading back above all major moving averages while the 14-day RSI have ticked back above 50.

- Taiwan equities opened lower but have been able to edge slightly higher as the day progresses, later we have GDP data due out with consensus at 6% up from 4.93% last quarter. The Taiex is up 0.20%, and has been one of the top performers in the region since the Israel/Iran conflict up 6.45% with technical indicators showing buyers are well and truly in control.

- Australian equities are slightly higher today, Gains in Miners have been offset by loses in Industrials and Energy names. The ASX200 is up 0.20% after recently bouncing off the 100-day EMA and now trades just below both the 20 & 50-day EMAs at about 7685.

- Elsewhere in SEA, New Zealand Equities are up 0.2%, earlier 1Q Job ads fell 5.4% q/q and ANZ Business Confidence dropped to 14.9 from 22.9 in March. Indonesian Equities are up 1.20%, Singapore equities are up 0.38% ahead of Unemployment data later, while Malaysian equities are down 0.20%

OIL: Crude In Narrow Ranges As Waits For Gaza Deal & Fed Announcement

Oil prices have range traded during today’s APAC session as markets wait the FOMC decision tomorrow (see MNI Fed Preview) and news on a Gaza ceasefire agreement. The Fed will be monitored closely as any further indication that the first rate cut will be delayed further is likely to weigh on oil prices as the market fears soft demand. A ceasefire is likely to see the geopolitical premium decline further. The USD index is up 0.2%.

- Oil prices fell over a percent yesterday on prospects of a truce deal for Gaza and today those losses have been held. WTI is down 0.2% to $82.50/bbl off the intraday low of $82.43. Brent is also 0.2% lower at $87.07 after finding support at $87.00.

- US crude inventories fell sharply the week before last. Today API data for last week will be released with the official EIA numbers on Wednesday.

- Later US Q1 ECI, February house prices, April MNI Chicago PMI and consumer confidence print. The ECB’s Buch speaks and euro area preliminary April HICP, and German, Italian & French Q1 GDP are released.

GOLD: Rangebound Ahead Of FOMC Decision On Wednesday

Gold is 0.3% lower in the Asia-Pacific session, after closing 0.1% lower at $2335.66 on Monday.

- The yellow metal remains rangebound ahead of Wednesday’s FOMC decision, where policymakers are anticipated to reiterate their commitment to maintaining higher interest rates for an extended period.

- Historically, gold tends to react negatively to higher interest rates due to its lack of yield-bearing characteristics.

- Nonetheless, bullion is on track for a third straight month of gains due to strong central bank and haven demand.

- According to MNI’s technicals team, gold remains in consolidation mode. Having last week pierced the 20-day EMA, a continuation lower would signal scope for an extension towards $2238.8, the 50-day EMA. Key resistance and the bull trigger is at $2431.5, the recent Apr 12 high.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/04/2024 | 0530/0730 | *** |  | FR | GDP (p) |

| 30/04/2024 | 0530/0730 | ** |  | FR | Consumer Spending |

| 30/04/2024 | 0600/0800 | ** |  | DE | Retail Sales |

| 30/04/2024 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 30/04/2024 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/04/2024 | 0645/0845 | ** |  | FR | PPI |

| 30/04/2024 | 0700/0900 | *** |  | ES | GDP (p) |

| 30/04/2024 | 0700/0900 | ** |  | CH | KOF Economic Barometer |

| 30/04/2024 | 0755/0955 | ** |  | DE | Unemployment |

| 30/04/2024 | 0800/1000 | *** |  | IT | GDP (p) |

| 30/04/2024 | 0800/1000 | *** |  | DE | GDP (p) |

| 30/04/2024 | 0830/0930 | ** |  | UK | BOE M4 |

| 30/04/2024 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/04/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/04/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 30/04/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 30/04/2024 | 0900/1100 | *** |  | IT | HICP (p) |

| 30/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 30/04/2024 | 1100/1200 |  | UK | Asset Purchase Facility Quarterly Report 2024 Q1 | |

| 30/04/2024 | 1230/0830 | *** |  | US | Employment Cost Index |

| 30/04/2024 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 30/04/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/04/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/04/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/04/2024 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 30/04/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/04/2024 | 1400/1000 | ** |  | US | housing vacancies |

| 30/04/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 30/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 01/05/2024 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

| 01/05/2024 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.