-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: A Still Growing Need To Go Higher

EXECUTIVE SUMMARY

- WALLER: JOB BOOM COULD MEAN TERMINAL FED RATE OVER 5.4% (MNI)

- FED’S BOSTIC SAYS RATES MIGHT NEED TO GO HIGHER (MNI)

- ECB’S WUNSCH SEES 4% RATES POSSIBLE IF INFLATION STAYS STRONG

- EU LEANING TOWARD MORE FISCAL LEEWAY FOR DEFENSE SPENDING (BBG)

- BOJ WATCHERS SEE HIGHER CHANCE OF JUNE SHIFT AFTER UEDA HEARINGS (BBG)

- CHINA'S CONSUMPTION REBOUND ON TRACK BUT RISKS REMAIN (MNI)

- PBOC'S YI SATISFIED WITH RATES, RRR CUTS EFFECTIVE

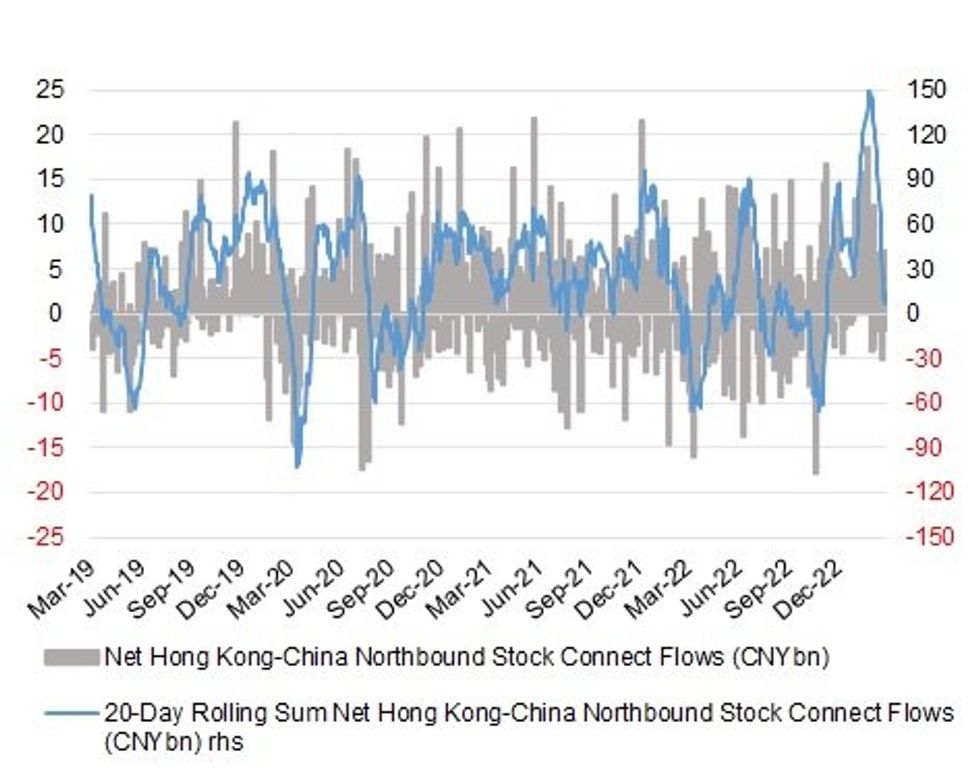

Fig. 1: Net Hong Kong-China Northbound Stock Connect Flows (CNYbn)

Source: MNI - Market News/Bloomberg

UK

BREXIT: The prime minister is willing to clarify any "misunderstandings" about how the new Brexit deal for Northern Ireland will work, Downing Street has said. (BBC)

EUROPE

ECB: European Central Bank Governing Council member Pierre Wunsch said market bets for interest rates to reach a 4% peak may prove accurate if underlying price pressures remain elevated. (BBG)

FISCAL: The European Union is leaning toward easing strict debt-limit rules imposed on national governments if extra spending is earmarked for defense. (BBG)

EU: The European Union is delaying crucial deliberations on phasing out combustion engine cars as it seeks more time to reach a compromise with Germany over e-fuels. (BBG)

FRANCE: The French government said it doesn’t plan to split electricity utility Electricite de France SA after its full nationalization. (BBG)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Austria (current rating: AA+; Outlook Negative) & the Czech Republic (current rating: AA+; Outlook Negative)

- Moody’s on Hungary (current rating: Baa2; Outlook Stable)

- S&P on Cyprus (current rating: BBB; Outlook Stable)

- DBRS Morningstar on the European Union (current rating: AAA, Stable Trend)

U.S.

FED: A persistently hot labor market could force the Federal Reserve to raise interest rates more than officials and investors currently expect, Governor Christopher Waller said Thursday. (MNI)

FED: The Federal Reserve could need to raise interest rates more than is currently priced in if inflation data remain persistently high and job numbers stronger than expected, Atlanta Fed President Raphael Bostic said Thursday. (MNI)

FED: US Senator Robert Menendez urged President Joe Biden to nominate a Latino to a vacancy on the Federal Reserve Board of Governors, according to an aide to the senator. (BBG)

HOUSING: The average rate on the 30-year fixed mortgage jumped back over 7% on Thursday, rising to 7.1%, according to Mortgage News Daily. (CNBC)

OTHER

GLOBAL TRADE: President Joe Biden’s trade chief said that she’s confident talks underway with the European Union will resolve the bloc’s concerns that a new law puts it at an unfair disadvantage. (BBG)

GLOBAL TRADE: Ukraine sees no need to limit wheat exports for the upcoming 2023/24 July-June season, as the winter harvest looks to be larger than expected, albeit smaller than in peacetime, a top agriculture ministry official said on Thursday. (RTRS)

GLOBAL TRADE: The Biden administration on Thursday added 37 companies to a trade blacklist, including units of Chinese genetics company BGI (300676.SZ) and Chinese cloud computing firm Inspur, in a move that promises to further ratchet up tensions with Beijing. (RTRS)

GEOPOLITICS: German Chancellor Olaf Scholz will hold confidential talks on Friday in Washington with U.S. President Joe Biden about Russia’s war in Ukraine, China and other matters amid signs of strains between the transatlantic partners. (RTRS)

GEOPOLITICS: US Secretary of State Antony Blinken on Friday said allowing Russia to do what it is doing in Ukraine will be a message to aggressors everywhere. (Business Standard)

BOJ: Almost two-thirds of Bank of Japan watchers now expect monetary policy change by June following the first extensive hearings of governor nominee Kazuo Ueda, according to the latest Bloomberg survey. (BBG)

BOJ: The Bank of Japan's decade of ultraloose monetary policy is raising fresh questions about its merits as architect Gov. Haruhiko Kuroda prepares to hand over the reins, with his predecessor calling it a "great monetary experiment" with "modest" effects. But despite the grumbling, a quick exit from easy money would have its own downside. Kazuo Ueda, the nominee to succeed Kuroda in April, will have to tread a fine line to strike the right balance between minimizing policy side effects and propelling growth. (Nikkei)

BOJ: Japanese Finance Minister Shunichi Suzuki says the Bank of Japan’s exchange-traded fund exit strategy should be left to the central bank, speaking to reporters in Tokyo. (BBG)

BOJ: Bank of Japan officials are alert to the risk that private consumption may lose momentum as low-income households are hit by high electricity and gas charges in addition to high food prices, MNI understands. (MNI)

JAPAN: Japanese Prime Minister Fumio Kishida has ordered the ruling party to draft additional measures to counter price hikes, Kyodo news agency reported on Friday. Koichi Hagiuda, the ruling Liberal Democratic Party's policy chief, told reporters that Kishida made the instruction given high inflation for items such as energy and food, Kyodo said. (RTRS)

RBA: The Reserve Bank of Australia will hike its interest rate again by 25 basis points to 3.60% on Tuesday, followed by one more lift next quarter, before pausing until next year, taking the peak rate higher than previously thought, a Reuters poll found. (RTRS)

RBNZ: New Zealand’s central bank would still target achieving maximum sustainable employment even without an express mandate to do so, Governor Adrian Orr said. (BBG)

NORTH KOREA: The US and South Korea plan to hold large-scale military drills in a move set anger Pyongyang, which has promised an unprecedented response to the exercises and threatened to turn the Pacific Ocean into its “firing range.” (BBG)

CANADA/CHINA: A Canadian parliamentary committee passed a motion on Thursday calling on the federal government to set up a public inquiry into allegations of foreign election interference, after listening to testimony from top intelligence officials. (RTRS)

BRAZIL: Central Bank President Roberto Campos Neto has to think about how to reduce country’s interest rate, President Luiz Inacio Lula da Silva said during an interview with BandNews radio this Thursday. (BBG)

BRAZIL: Brazilian Finance Minister Fernando Haddad said on Thursday the ministry plans to finish working on a new fiscal framework this week and present it to President Luiz Inacio Lula da Silva. (RTRS)

RUSSIA: The United States is not expecting further formal senior-level dialog with Russia in the near term, the State Department said on Thursday, following a face-to-face meeting between the top diplomats of the countries. "We're always going to remain open to dialog," State Department spokesperson Ned Price told a briefing. (RTRS)

RUSSIA: The United States is not providing Ukraine with intelligence for targets inside Russia, the Pentagon said on Thursday, calling the Russian accusations "nonsense." (RTRS)

RUSSIA: The United States will announce a new military aid package for Ukraine on Friday, worth roughly $400 million and comprised mainly of ammunition, two officials and a person familiar with the package said. (RTRS)

RUSSIA: The US has launched a renewed crackdown on countries and individuals helping the Kremlin evade western sanctions amid growing fears Russia is fuelling the war in Ukraine by funnelling imports through countries such as the United Arab Emirates and Turkey. (FT)

RUSSIA: The Russian budget system received more than 5 trillion rubles ($66.22 bln) of tax revenues in January-February 2023, which is more than last year, Finance Minister Anton Siluanov said on Thursday in an interview with RT. (TASS)

IRAN: The United States imposed sanctions on Thursday on firms it said had transported or sold Iranian petroleum or petrochemical products in violation of U.S. restrictions, including two companies based in China. (RTRS)

COLOMBIA: Colombia’s Council of State suspended a decree issued by President Gustavo Petro that would have allowed him, for three months, to take over the duties of the energy and gas commission, known as CREG, and the water and basic sanitation commission, known as CRA, according to a ruling published late Thursday. (BBG)

WORLD BANK: US President Joe Biden's nominee to lead the World Bank, ex-Mastercard Chief Executive Officer Ajay Banga, said he plans to meet with government officials in Europe, Asia, Africa and potentially Latin America to hear their views on challenges facing the bank. (RTRS)

EMERGING MARKETS: China's reopening is set to boost emerging market currencies against the U.S. dollar over the next six months, primarily for those that export commodities to the world's second-largest economy, a Reuters poll of foreign exchange analysts found. (RTRS)

CHINA

NPC/ECONOMY: High frequency data including measures of air traffic and subway riding indicate Chinese consumption has rebounded since the start of the year, but while this reduces the need for monetary stimulus, economists told MNI that this weekend’s National People’s Congress is still likely to see more fiscal spending and moves to boost the labour market. (MNI)

ECONOMY: More policies are needed to boost fertility and improve the workforce to ensure long term economic vitality, according to an editorial by Yicai.com. (MNI)

POLICY: Chinese internet moguls like Tencent’s Pony Ma have dropped from key lawmaking and advisory bodies, replaced by chip researchers and engineers in a sign of Beijing’s lingering distrust for private enterprise and focus on winning the tech race with the US. (BBG)

PBOC: People’s Bank of China Governor Yi Gang told a briefing on Friday that said he was satisfied with the current real interest rate and that a reduction in the reserve requirement ratio would be an effective way to inject liquidity, suggesting limited room for policy rate cuts and the possibility of a lower RRR depending on the economic outlook. (MNI)

FDI: China will further reduce its negative list for foreign investment and relax restrictions on investment access for overseas firms as it seeks to improve conditions for foreign direct investment, Wang Wentao, Minister of Commerce said. (MNI)

PROPERTY: China property buyers are back on the hunt, but not quite ready to invest, underscoring the tenuous state of the country’s real estate market. (BBG)

EQUITIES: China’s listed A-share companies are engaged in nearly 500 M&A deals so far this year, compared with less than 300 in the same period last year, Securities Daily reported. (BBG)

PROPERTY: Some Chinese cities recently issued policies to support home purchases by families with more than one child or people with advanced degrees, the Securities Times reported, citing local governments documents. (BBG)

REITS: Chinese regulators expanded their pilot program of real estate investment trusts (REITs) to new energy and is expected to include water conservancy and new infrastructure projects soon, Securities Times reported on Friday. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY452 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) conducted CNY18 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY452 billion after offsetting the maturity of CNY470 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9379% at 09:57 am local time from the close of 1.9972% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 46 on Thursday, compared with the close of 44 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9117 FRI VS 6.8808 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9117 on Friday, compared with 6.8808 set on Thursday.

OVERNIGHT DATA

CHINA FEB CAIXIN SERVICES PMI 55.0; MEDIAN 54.5; JAN 52.9

CHINA FEB CAIXIN COMPOSITE PMI 54.2; JAN 51.1

There was still a lot of optimism in the services sector in February as business owners continued to express great confidence in an economic recovery upon the easing of Covid controls. The reading for expectations for future activity slipped from the previous month, but remained at a high level. (Caixin)

JAPAN FEB TOKYO CPI +3.4% Y/Y; MEDIAN +3.3%; JAN +4.4%

JAPAN FEB TOKYO CPI EXCLUDING FRESH FOOD +3.3% Y/Y; MEDIAN +3.3%; JAN +4.3%

JAPAN FEB TOKYO CPI EXCLUDING FRESH FOOD & ENERGY +3.2% Y/Y; MEDIAN +3.1%; JAN +3.0%

JAPAN JAN UNEMPLOYMENT RATE 2.4%; MEDIAN 2.5%; DEC 2.5%

JAPAN JAN JOB-TO-APPLICANT RATIO 1.35; MEDIAN 1.36; DEC 1.36

JAPAN FEB, F JIBUN BANK SERVICES PMI 54.0; PRELIM 53.6; JAN 52.3

JAPAN FEB, F JIBUN BANK COMPOSITE PMI 51.1; PRELIM 50.7; JAN 50.7

The Japanese services economy signalled that demand conditions had improved at a stronger rate during February. Latest PMI data indicated quicker expansions in both new business and business activity that were the strongest since the summer of 2022. (S&P Global)

AUSTRALIA JAN HOME LOANS -5.3% M/M; MEDIAN -3.0%; DEC -4.3%

AUSTRALIA JAN OWNER-OCCUPIER HOME LOANS -4.9 % M/M; DEC -4.3%

AUSTRALIA JAN INVESTOR HOME LOANS -6.0% M/M; DEC -4.3%

AUSTRALIA FEB, F JUDO BANK SERVICES PMI 50.7; PRELIM 49.2; JAN 48.6

AUSTRALIA FEB, F JUDO BANK COMPOSITE PMI 50.6; PRELIM 49.2; JAN 48.5

Service sector activity improved further in February and is now back in expansionary territory. The activity index, which rose 2.1 points to an index level of 50.7, is the highest it has been since July 2022. This is a clear indication that the slowdown in economic activity over the second half of 2022 has run its course. (Judo Bank)

NEW ZEALAND FEB ANZ CONSUMER CONFIDENCE 79.8; JAN 83.4

The ANZ-Roy Morgan Consumer Confidence Index eased 3 points in February,to a level that is by any definition very subdued. While confidence is rising in our Business Outlook survey, consumer confidence could better be described as bouncing round the bottom. (ANZ)

MARKETS

US TSYS: Marginally Richer In Asia

TYM3 deals at 110-19+, +0-03+, a touch off the top of the contained 0-05 range on volume of ~89k.

- Cash Tsys sit flat to 1bp richer across the major benchmarks, with some light bull flattening apparent.

- Modest pressure from February's Tokyo CPI data, the headline and core-core measures print a touch above expectations, saw Tsys weaken in early dealing.

- The pressure reversed as a bid in JGBs facilitated a recovery from early session lows.

- Tsys looked through the firmer than expected Caixin Services PMI print out of China, and the light richening held.

- Narrow ranges were observed for the remainder of the session with little follow through.

- Early in the Asian session Fed Gov Waller noted that a strong labour market could force the Fed to raise rates further than officials currently expect. Elsehwere, Minneapolis Fed President Kashkari ('23 voter) reiterated that inflation is very high, with demand exceeding supply.

- In Europe today Eurozone PPI data and ECB-speak from de Guindos headline. Further out the ISM Services survey provides the highlight ahead of the weekend.

JGBS: Curve Twist Steepens, Futures Outperform, YCC Band Breached

JGB futures extended on their early bid into the bell and close just shy of best levels, +26. Cash JGBs are 3bp richer to 3bp cheaper, twist steepening, with a pivot around 10s (which operate in a narrow range between 0.50-0.51%, just through the peak of the BoJ’s YCC band). 7s outperform on the bid in futures. Weakness in the long end was at least partially linked to payside swap flows, but the move in JGBs in now more notable, with twist steepening also observed on the swap curve.

- Tokyo participants have looked to the latest Bloomberg sources piece and survey covering the BoJ (both of which were released between yesterday’s local close and today’s open), which played down the likelihood of a hawkish policy tweak from the BoJ next week.

- Local data saw downticks in the headline and core Tokyo CPI readings in the month of February (driven by government subsidies surrounding energy), with the prints near enough meeting expectations, while there was a slightly larger than expected uptick in the excluding fresh food and energy metric. This comes after recent rhetoric from BoJ Governor-in-waiting Ueda flagged the likelihood of a slowing inflationary impulse in the months ahead. Meanwhile, the latest labour market report saw a modest downtick in the unemployment rate.

- The offer to cover ratios covering today’s BoJ Rinban operations were subdued to average (1.95-2.25x).

- Elsewhere, PM Kishida instructed the LDP to compile a package of additional measures to further curb the burden of the recent run of inflation.

- The aforementioned BoJ monetary policy meeting headlines next week’s local docket, with confirmation votes for BoJ Governor-in-waiting Ueda also slated.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y5.06889tn 3-Month Bills:

- Average Yield -0.1846% (prev. -0.1418%)

- Average Price 100.0496 (prev. 100.0381)

- High Yield: -0.1842% (prev. -0.1303%)

- Low Price 100.0495 (prev. 100.0350)

- % Allotted At High Yield: 79.7218% (prev. 58.8551%)

- Bid/Cover: 3.687x (prev. 3.578x)

AUSSIE BONDS: A Heavy Global Calendar Next Week With RBA Decision The Local Highlight

ACGBs move away from overnight lows to close near session highs (YM -3.0 & XM -4.0) with U.S Tsys lightly richening in Asia-Pac trade. The AU/U.S. 10-Year yield differential treads water at -16bp.

- Bills strip twist steepens with the whites out to Sep-23 +2bp and up to 6bp of cheapening seen beyond there.

- Ahead of the RBA’s rates decision on Tuesday, RBA-dated OIS is pricing a 92% chance of a 25bp hike. More broadly, strip pricing was mixed with meetings through October flat to -2bp, but November and December respectively +1 and +3bp firmer, as the market prices out any chance of an easing this year.

- The RBA rates decision (Tues) and RBA Governor Lowe’s AFR Summit speech (Wed) are the local highlights next week with the market keen for an update after last month’s hawkish shift. In the February decision statement, the RBA signalled multiple hikes by removing the ‘not on a pre-set course’. With Q4 WPI and January monthly CPI both surprising on the downside since then, the market will be watching to see if the RBA stays on the pre-set course of “further increases in interest rates will be needed”.

- Elsewhere, the global calendar is busy with the highlights: Fed Chair Powell’s semi-annual Monetary Policy Reports to Congress (Tue & Wed), BoC's decision (Wed), China’s CPI (Thu) and U.S. Payrolls (Fri).

NZGBS: Weaker Ahead of Heavy Global Calendar

NZGBs close near cheaps as the market looks to U.S Tsys for guidance heading into a next week’s heavy global calendar.

- Comments from RBNZ Governor Orr before market hours saw a marginally less hawkish message of “early signs of price pressures easing”, but U.S. Tsys were the driver today.

- Cash benchmarks close 7-9bp weaker across the curve, underperforming U.S Tsys. After narrowing from +26bp last Friday to an intraday low of flat yesterday, the NZ/US cash 2-year yield differential closes the week +10bp wider on the day at +15bp. The 10-year differential mapped out a similar path, closing in the middle of the week’s +54-74bp range.

- 2s10s swap curve bear steepens with rates +5-8bp higher, implying a 1-2bp tightening in swap spreads.

- RBNZ-dated OIS was subdued with pricing flat to 2bp firmer across meetings, leaving April meeting pricing at 40bp of tightening and terminal OCR pricing at the RBNZ’s projected OCR peak of 5.50%.

- A busy calendar of Antipodean and global data and events is seen next week. In Australia, all eyes will be on the RBA decision (Tue) and Governor Lowe’s speech at the AFR Business Summit (Wed). On the global calendar, the highlights will be Fed Chair Powell’s semi-annual Monetary Policy Reports to Congress (Tue & Wed), BoC’s decision (Wed), China’s CPI (Thu) and U.S. Payrolls (Fri).

EQUITIES: Positive Ending To The Week, Japan & India The Standouts

Regional markets are tracking higher, following the positive lead from Wall St on Thursday, but gains haven't been uniform. China markets have struggled to maintain a positive bias, while in SEA a number of markets are weaker. US futures are softer as well, albeit away from session lows. Eminis last near 3980 (-0.11%), while Nasdaq futures are off slightly more -0.18% (near 12040).

- The HSI opened higher, but couldn't hold firm gains. Last we sat still +0.70% higher for the session. The PBoC held a press conference, which appeared to push back against any imminent easing signals in monetary policy. This weighed at the margins.

- The CSI 300 is close to flat, while the Shanghai composite is +0.25%. The focus on the weekend if the NPC. Market expectations for this year's growth target are in the 5-5.5% range. Anything higher (say closer to 6%) could support risk appetite in the early part of next week.

- The Nikkei 225 is outperforming, up +1.66% at this stage. Better services PMI numbers helped at the margin, while prospects of a weaker yen may also aid the export sector. Today's Tokyo CPI data was a touch firmer than expected, but the economic consensus has pushed out its expectation around the timing of further BoJ action (to June).

- The Kospi and Taiex have lagged, up only modestly. Cautious guidance from Micron (around margins and pricing) may have weighed at the margins.

- Indian shares are up firmly, over 1.2%. Reports that offshore investor GQG Partners bought shares in four Adani group firms, is aiding sentiment. GQG is reported to have bought ~$1.9bn worth of shares in four of the Adani companies.

- SEA markets are a touch weaker, with Malaysia, Thia and Indonesia shares down at this stage.

GOLD: Set To Post A Weekly Gain

Gold tracks just below the $1840 level, which is just shy of highs for the week. We are up 0.15% for the session so far, and tracking +1.5% higher for the week, the first since the second week of Feb. This looks outsized relative to the ~0.3% pullback int he DXY this week, although gold sold off more than implied by USD trends in Feb, so this may reflect some pay back.

- In terms of levels, the 20 and 50-day EMAs sit around the $1845/46 level, while the 100-day EMA sits on the downside around $1821.

- Gold ETF holdings have drifted lower, after blipping higher at the end of Feb. Note China's FX reserves data prints next Tuesday, which will give an update on the country's gold holdings from an official standpoint.

OIL: Maintaining Positive Bias Ahead Of China's NPC

Brent crude has been range bound so far today, currently sitting close to the $84.50/bbl level. WTI has traced a similar trajectory last just shy of the $78/bbl handle. Both benchmarks are tracing higher for the week. For Brent, we sit just north of the 20 and 50-day EMAs but the 100-day remains higher, closer to $86.50/bbl. We tested above this resistance point in Jan, but couldn't sustain the break.

- Prompt spreads also continue to track higher, back to 0.65 for Brent. This is highs back to Nov last year.

- The weekend focus will rest on China's NPC and growth targets for 2023. A rebound in China oil demand is seen as a key input underpinning higher oil forecasts for this year. It also comes after Saudi Aramco comments from earlier in the week that described China consumption as 'very strong'.

- Looking into next week, on Tuesday we get China trade figures, which will include oil import trends. Also out on that day will be the US EIA short term monthly outlook. Note Fed Chair Powell also testifies to the US Senate on Tuesday as well.

FOREX: USD Softer In Asia, Regional Equities Firm

The greenback is marginally pressured in Asia today. Firmer regional equities have boosted risk sentiment weighing on the USD, however ranges do remain modest with little follow through on moves in G10 FX.

- AUD/USD is ~0.2% firmer, last printing at $0.6740/45 the next upside target is $0.6812 the low from 17 Feb. The final read of Judo Banks Feb Composite and Services PMI was on the wires this morning, the measures are a touch above 50 in expansionary territory. Jan Home Loans fell -5.3%, the RBAs tightening continues to be felt in the housing market.

- Kiwi is also firmed, NZD/USD is up ~0.1%. The pair firmed as the Hang Seng opened up over 1% before paring gains to sit marginally higher as regional equities retreated from best levels. ANZ Consumer Confidence fell in February. The Index printed 79.8, down -4.3%, as continued RBNZ tightening and the impact of Cyclone Gabrielle are felt.

- USD/JPY prints at ¥136.65/75, marginally below yesterday's closing level. The pair initially softened post Tokyo CPI prints, headline and core-core measure were a touch firmer than expectations. Support was seen ahead of ¥136.50 with the level tested several times through the session.

- EUR and GBP are both marginally firmer, benefiting from the pressure on the USD.

- Cross asset flows are mixed; Hang Seng is up ~0.8% and e-minis are ~0.2% lower. BBDXY sits ~0.1% lower, 10 Year US Treasury Yields are ~1bp softer.

- In Europe today Eurozone PPI data and ECB-speak from de Guindos headline. Further out the ISM Services survey provides the highlight ahead of the weekend. We also have a number of Fed speakers scheduled to cross.

FX OPTIONS: Expiries for Mar03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.8bln), $1.0550(E577mln), $1.0595-00(E2.2bln), $1.0625-35(E893mln), $1.0675(E969mln), $1.0700-05(E1.8bln)

- USD/JPY: Y135.00($795mln), Y136.00($718mln)

- GBP/USD: $1.2060(Gbp645mln)

- AUD/USD: $0.6800(A$951mln)

- NZD/USD: $0.6100(N$1.0bln)

- USD/CAD: C$1.3500-15($591mln), C$1.3600($702mln)

- USD/CNY: Cny6.9000($1.3bln), Cny7.0000($800mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/03/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 03/03/2023 | 0700/0800 | * |  | NO | Norway Unemployment Rate |

| 03/03/2023 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/03/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 03/03/2023 | 0815/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 03/03/2023 | 0830/0930 |  | EU | ECB de Guindos Q&A at CUNEF University | |

| 03/03/2023 | 0845/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 03/03/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/03/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/03/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/03/2023 | 0900/1000 | *** |  | IT | GDP (f) |

| 03/03/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/03/2023 | 1000/1100 | ** |  | EU | PPI |

| 03/03/2023 | 1330/0830 | * |  | CA | Building Permits |

| 03/03/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/03/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/03/2023 | 1600/1100 |  | US | Dallas Fed's Lorie Logan | |

| 03/03/2023 | 1700/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 03/03/2023 | 2000/1500 |  | US | Fed Governor Michelle Bowman | |

| 03/03/2023 | 2115/1615 |  | US | Richmond Fed Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.