-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoE QT To Commence On Nov 1, Fiscal Headwinds Remain In Place

EXECUTIVE SUMMARY

- KASHKARI: HIKES PAST 4.5% NEXT YEAR IF CPI STUBBORN (MNI)

- BOE CONFIRMS GILT SALES TO COMMENCE NOV 1 (MNI)

- PRESS REPORTS POINT TO TRIPLE LOCK REMOVAL, CORPORATE PROFIT RAID AND DELAYED REFORMS AS UK C’LLR HUNT LOOKS TO FIX FINANCES

- DUTCH CENTRAL BANK URGES PENSION FUNDS TO GUARD AGAINST UK-STYLE CRISIS (FT)

- JAPAN AUTHORITIES KEEP UP WARNING AGAINST SHARP YEN DECLINE (RTRS)

- BIDEN OPEN TO NEW SPR SALES AS LAST PLANNED TRANCHE RELEASED (BBG)

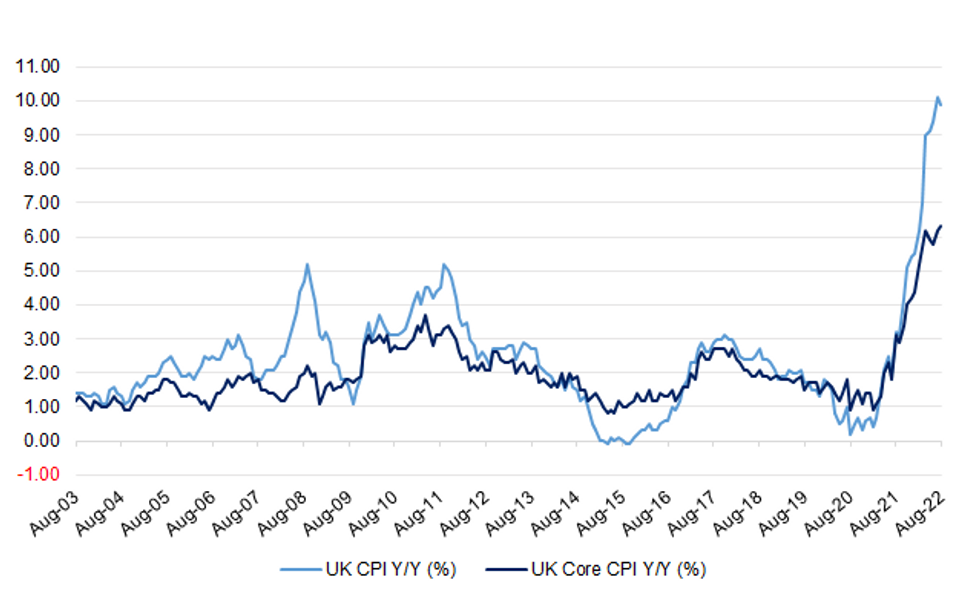

Fig. 1: UK CPI & Core CPI Y/Y

Source: MNI - Market News/Bloomberg

UK

BOE: An unwind of the Bank of England's pile of giits will begin in the week of Oct 31, it announced on Tuesday, confirming the first sale will be held on Nov 1. (MNI)

FISCAL: Chancellor Jeremy Hunt is preparing to raid the profits of banks and energy companies in an attempt to fill a £40bn fiscal hole through a mix of tax rises and public spending cuts. (FT)

FISCAL: Pensions could rise in line with earnings instead of inflation next year after Liz Truss reneged on her commitment to the triple lock. (Telegraph)

FISCAL: Jeremy Hunt is poised to delay Boris Johnson’s flagship social care reform and has been warned that his spending cuts may have to be tougher even than George Osborne’s era of austerity. (The Times)

FISCAL/POLITICS: Liz Truss has told right-wing Tory MPs her tax U-turns were "painful," as she continues to try and shore up her support within the party. (BBC)

FISCAL/POLITICS: Liz Truss is facing cabinet unrest over her plans for brutal public spending cuts across all departments after the disastrous mini-budget put major pledges at risk, including the pensions triple lock. (Guardian)

POLITICS: Rebel Tories have been asking Labour MPs to help them overthrow Liz Truss, The Telegraph has been told. (Telegraph)

POLITICS: Sky News can reveal Chancellor Jeremy Hunt has met with Sir Graham Brady, chairman of the 1922 Committee this afternoon, prompting further questions about the prime minister's future, says Sky's deputy political editor, Sam Coates. (Sky)

POLITICS: Michael Gove on Tuesday said it was a matter of when not if Liz Truss will be toppled and joked she had lived up to her “human hand grenade” nickname. (Telegraph)

ECONOMY: Confidence among British businesses has dropped precipitously, damaged by a toxic combination of rising costs and economic turmoil, surveys showed on Wednesday. The Federation of Small Businesses (FSB), a trade body, said its latest small business confidence index fell to -35.9 from -24.7, the worst reading outside of COVID-19 lockdowns. The survey ran from Sept. 20 to Oct. 4, covering much of the period since Prime Minister Liz Truss’s economic plans published on Sept. 23 triggered a historic sell-off in British assets. A separate report from the Recruitment and Employment Confederation, covering July through to late September, also showed businesses’ sentiment towards the economy and hiring and investment fell sharply. (RTRS)

ECONOMY: The rate at which prices rose in September is due to be revealed as a survey for the BBC uncovers growing concern about the squeeze on finances. Some 85% of those asked are now worried about the rising cost of living, up from 69% in a similar poll in January. As a result, nine in 10 people are trying to save money by delaying putting the heating on. (BBC)

EUROPE

ECB: The European Central Bank will go for another jumbo 75 basis point increase to its deposit and refinancing rates when it meets on Oct. 27 as it tries to contain inflation running at five times its target, a Reuters poll found. (RTRS)

ECB: The European Central Bank should soon allow its almost 5 trillion-euro ($4.9 trillion) bond portfolio to start shrinking as the securities come due, augmenting existing efforts to combat inflation, according to Governing Council member Joachim Nagel. (BBG)

ECB/SPAIN: The European Central Bank is set to warn of the adverse impact on Spanish banks' solvency of a proposed tax on the sector and of a higher cost of credit in an upcoming non-binding opinion, two sources with direct knowledge of the matter said. (RTRS)

NETHERLANDS: The Dutch central bank is calling on the country’s pension funds to consider boosting holdings of cash and other liquid assets to ensure that they can avoid the turmoil that has hit the UK. (FT)

IRELAND: The Central Bank is set to say on Wednesday that it will ease its mortgage rules marginally to allow households to borrow up to four times their income in taking on a home loan, according to sources. (Irish Times)

U.S.

FED: Minneapolis Federal Reserve President Neel Kashkari said Tuesday he would back raising interest rates beyond his base case for going to about 4.5% early next year if core inflation remains stubborn. (MNI)

FED: The U.S. labor market is still in the middle of adjusting to new wage and occupation trends that grew out of the pandemic as large firms raise wages and draw workers away from jobs that pay less, Atlanta Fed president Raphael Bostic said on Tuesday. (RTRS)

FED: The board of directors of the Federal Reserve banks of New York and San Francisco last month voted in favor of a smaller 50 basis point hike in the discount rate charged to banks for emergency loans, according to the latest discount rate meeting minutes published Tuesday. (MNI)

ECONOMY: Amazon’s Bezos tweeted the following on Tuesday: “Yep, the probabilities in this economy tell you to batten down the hatches.” (MNI)

EQUITIES: Apple Inc is cutting production of iPhone 14 Plus within weeks of starting shipments as it re-evaluates demand for the mid-range model, the Information reported on Tuesday, citing two people involved in the company's supply chain. (RTRS)

EQUITIES: Netflix shares skyrocketed more than 14% after the bell Tuesday as the company posted better-than-expected results on the top and bottom lines. The streamer also reported the addition of 2.41 million net global subscribers, more than doubling the adds the company had projected a quarter ago. (CNBC)

OTHER

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Wednesday that he was checking currency rates "meticulously" and with more frequency, Jiji News reported, as the yen continues to weaken against the dollar and markets watch for signs of intervention. Suzuki also said the government would "properly respond" in the foreign exchange market based on existing policy, according to Jiji. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Wednesday that the rapid and one-sided downward moves in the yen were a negative for Japan's economy as it increased uncertainties and made it difficult for business planning. (MNI)

BOJ: Bank of Japan board member Seiji Adachi said on Wednesday that any delay in achieving the bank's price target or any policy response to address short-term forex moves would increase uncertainty around the outlook for monetary policy and would not be desirable for Japan’s economy. (MNI)

SOUTH KOREA: South Korea's central bank expects exports to weaken at a faster pace going forward and the current account to remain highly volatile for some time, it said in a report published on Wednesday (RTRS)

NORTH KOREA: North Korea fired artillery shells in waters near South Korea late Tuesday, South Korea's Chief of Staff said in a statement on Wednesday. (Deutsche Welle)

HONG KONG: Hong Kong is cutting property taxes and easing visa rules for non-permanent residents to attract global talent and revive the city as an international financial hub. (BBG)

MEXICO: Mexican President Andres Manuel Lopez Obrador said on Tuesday that he met with Judith McKenna, the head of Walmart Inc's international division, about "doing everything possible" to lower inflation on food products. (RTRS)

RUSSIA: The new commander of Russian forces in Ukraine, Sergei Surovikin, acknowledged on Tuesday that the military situation in Ukraine was "tense", especially around the occupied southern city of Kherson. (RTRS)

RUSSIA/IRAN: The United States, Britain and France plan to raise the issue of Iranian weapons transfers to Russia during a closed-door U.N. Security Council meeting on Wednesday, diplomats said without providing details. (RTRS)

IRAN: The United States will continue to take "practical, aggressive" steps to make it harder for Iran to sell drones and missiles to Russia, State Department deputy spokesperson Vedant Patel said on Tuesday, adding that Washington had a number of tools to hold both Moscow and Tehran accountable. (RTRS)

METALS: BHP Group said on Wednesday its quarterly iron ore output rose, aided by better performance from its Western Australian assets and a continued ramp-up at its South Flank project. (RTRS)

OIL: The Biden administration plans to release 15 million barrels from US emergency reserves, and may consider significantly more this winter, in an effort to ease high gasoline prices that have become a liability for Democrats in next month’s midterm elections. (BBG)

OIL: Mexico has an oil hedge program for 2023 that protects the country’s revenue if prices for its decline below $68.70 per barrel, Deputy Finance Minister Gabriel Yorio told lawmakers on Tuesday. (BBG)

CHINA

POLITICS: China’s bespectacled, studious ideology tsar Wang Huning could rise further after the Communist Party’s five-yearly leadership reshuffle, sources say. (SCMP)

POLICY: China is expected to loosen its credit control further in the fourth quarter by ramping up lending to infrastructure and equipment upgrade projects as part of efforts to shore up economic growth, Shanghai Securities News reports, citing analysts. (BBG)

ECONOMY/BANKS: Six major state-owned banks will continue to be the main source of credit issuance in Q4, with lending to infrastructure, manufacturing and real estate expected to drive growth in credit and total social financing and stabilize economic growth, the 21st Century Business Herald reported. (MNI)

FISCAL: Both central and local governments are increasing policy support to stabilise manufacturing investment and promote the high-quality development of industry, said China Securities Journal in a front-page report. (MNI)

INFLATION: China’s central government will sell more pork from reserves and guide local governments to release their inventories too because of a continuing increase in prices, the National Development and Reform Commission said in a statement on its official WeChat account Wednesday. (BBG)

PROPERTY: The recovery in China's second-hand housing market is accelerating, with the growth of transactions outpacing new home sales, Caixin reported. (MNI)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.5785% at 10:02 am local time from the close of 1.4796% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 52 on Tuesday vs 50 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1105 WED VS 7.1086

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1105 on Wednesday, compared with 7.1086 set on Tuesday.

OVERNIGHT DATA

AUSTRALIA SEP WESTPAC LEADING INDEX -0.04% M/M; AUG -0.16%

The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, fell to –1.15% in September, down from –0.33% in August. (Westpac)

MARKETS

SNAPSHOT: BoE QT To Commence On Nov 1, Fiscal Headwinds Remain In Place

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 121.91 points at 27278.05

- ASX 200 up 20.885 points at 6800.1

- Shanghai Comp. down 21.476 points at 3059.482

- JGB 10-Yr future down 8 ticks at 148.19, yield down 0.5bp at 0.251%

- Aussie 10-Yr future down 3 ticks at 96.03, yield up 2.6bp at 3.945%

- U.S. 10-Yr future down 0-06 at 110-23, yield up 1.89bp at 4.0255%

- WTI crude up $0.82 at $83.64, Gold down $5.84 at $1646.4

- USD/JPY up 3 pips at Y149.29

- KASHKARI: HIKES PAST 4.5% NEXT YEAR IF CPI STUBBORN (MNI)

- BOE CONFIRMS GILT SALES TO COMMENCE NOV 1 (MNI)

- PRESS REPORTS POINT TO TRIPLE LOCK REMOVAL, CORPORATE PROFIT RAID AND DELAYED REFORMS AS UK C’LLR HUNT LOOKS TO FIX FINANCES

- DUTCH CENTRAL BANK URGES PENSION FUNDS TO GUARD AGAINST UK-STYLE CRISIS (FT)

- JAPAN AUTHORITIES KEEP UP WARNING AGAINST SHARP YEN DECLINE (RTRS)

- BIDEN OPEN TO NEW SPR SALES AS LAST PLANNED TRANCHE RELEASED (BBG)

US TSYS: Block Sales Apply Light Pressure In Asia

Tsys have cheapened at the margin overnight, with the now familiar TY block sales (-1.7K & -2.0K) once again evident in Asia-Pac hours, helping the space lower.

- TYZ2 deals -0-06 at 110-23, 0-01 off the base of a tight 0-07 range, on limited volume of ~54K.

- Meanwhile, cash Tsys run 1-2bp cheaper across the curve, bear flattening.

- Minneapolis Fed President Kashkari (’23 voter) underscored the need for continued tightening during the NY-Asia crossover, as he suggested that there would be no pause in tightening until there is compelling evidence that core inflation has peaked.

- The first notable risk event of Wednesday trade comes in the form of UK CPI data.

- Further out, housing starts and building permits data headline the NY data docket, with Fedspeak from Bullard, Evans & Kashkari, as well as the release of the Fed’s Beige Book, also due. On the supply side, we will see the latest 20-Year Tsy auction.

JGBS: Bear Steepening Flips To Bear Flattening

JGBs came under some cheapening pressure as the Tokyo morning session wore on, with the curve steepening. 40-Year yields registered a fresh cycle high, with 20- & 30-Year yields printing a touch shy of their respective cycle peaks, with the recent run of pressure maintained.

- That was before a pull away from cheapest levels of the session in the super-long end, with the respective outright levels and steepness vs. 10s (which are capped by the BoJ’s YCC mechanism) perhaps luring domestic life insurers and pension funds in.

- Cash JGBs run little changed to ~1.5bp cheaper, with the front end now leading the cheapening, as the curve bear flattens.

- JGB futures last -7, sticking to a very narrow range.

- Local headline flow has been focused on FX matters, once again, with Finance Minister Suzuki highlighting the increased frequency of the monitoring of FX markets.

- BoJ board member Adachi stuck to the BoJ’s central script, playing down any suggestions that the Bank should tighten monetary policy, while providing familiar overtures re: the JPY. Elsewhere, BoJ Governor Kuroda failed to provide fresh, meaningful information.

- Looking ahead, the monthly trade balance reading and weekly international security flow data from the Japanese MoF headline the domestic docket on Thursday.

JGBS AUCTION: 1-Year Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.94826tn 1-Year Bills:

- Average Yield: -0.1098% (prev. -0.1437%)

- Average Price: 100.110 (prev. 100.144)

- High Yield: -0.1018% (prev. -0.1338%)

- Low Price: 100.102 (prev. 100.134)

- % Allotted At High Yield: 29.3793% (prev. 17.4028%)

- Bid/Cover: 2.612x (prev. 3.491x)

AUSSIE BONDS: Cheaper On Global Moves, Labour Market Report Eyed

Spill over from the wider core global FI space (a downtick in U.S. Tsys and a heavier move in NZGBs) applied modest pressure to the ACGB space on Wednesday, although Sydney trade was relatively narrow, with the major bond futures contracts sticking within their respective overnight ranges.

- YM prints -4.0 ahead of the bell, with XM -2.5, while wider cash ACGB trade sees 2-6bp of cheapening, as the curve bear flattens

- EFPs are a little wider on the day, with the 3-/10-Year box steepening.

- Bills sit 7-10bp cheaper through the reds, with RBA dated OIS pointing to a terminal rate of just under ~4.10%, 10bp or so higher on the day, but comfortably within the recently observed range.

- ACGB Apr-29 supply was easily digested, while SAFA conducted a A$750mn tap of its May-30 select line.

- It is worth remembering that 21 October represents the joint largest round of ACGB coupon payments of the year (A$4.87bn), with eyes on the potential for coupon cash deployments over the next few sessions of a result.

- Looking ahead, Thursday’s domestic docket is headlined by the release of the monthly labour market report.

AUSSIE BONDS: ACGB Apr-29 Auction Results

The Australian Office of Financial Management (AOFM) sells A$800mn of the 3.25% 21 April 2029 Bond, issue #TB138

- Average Yield: 3.7426% (prev. 3.4492%)

- High Yield: 3.7450% (prev. 3.4550%)

- Bid/Cover: 2.8062x (prev. 2.9286x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 84.1% (prev. 2.0%)

- Bidders 47 (prev. 57), successful 14 (prev. 20), allocated in full 8 (prev. 17)

NZGBS: Continued Hedging For A More Hawkish RBNZ Weighs

NZGBs extended on Tuesday’s cheapening, with continued payside swap flow noted in the wake of Tuesday’s CPI reading, as hedging for a more hawkish RBNZ dragged swap spreads wider. Fresh cycle highs were registered in both swap rates and NZGB yields across the term structure as a result.

- NZGBs finished the session 8-12bp cheaper, bear flattening.

- RBNZ dated OIS now prices a peak OCR of just over 5.40%, with ~78bp of tightening priced in for next month’s meeting (some are pointing to the 3-month RBNZ meeting hiatus that follows that meeting as another source of uncertainty re: monetary policy, given the firmer than expected inflation prints).

- Looking ahead, Thursday’s domestic docket is headlined by the weekly round of NZGB issuance, with May-28, Apr-33 and May-51 paper set to come to market.

EQUITIES: Positive Property News Can't Curb Broader Losses For HK/China Shares

China and Hong Kong stock indices are lower, bucking the positive trend seen for most other Asia Pac equities. US futures are higher, buoyed by late earnings new from the US session, notably from Netflix. We are away from best levels though, Eminis peaked close to 3775, but we are now back under 3765. Nasdaq futures have outperformed.

- The HSI is still around 1% lower, as HK Chief Executive Lee speaks during the policy address. Stamp duty for foreigners will be refunded after they stay for 7-yrs. It will also start a scheme to attract high salary earners and top graduates, with visas of 2yrs. The HKEX will also revise listing rules next year to help fund raising for advanced tech companies and SMEs.

- The HSI tech index is still down around 2.5%, but the property sub-index is up nearly 0.9%.

- China stocks are lower, with the CSI 300 off by close to 0.90%, the Shanghai composite is -0.50%, although the property sub-index is close to flat. A number of China property developers are planning to raise funds through state back bond sales, which has helped sentiment at the margin.

- The Nikkei 225 is up around 0.60% at this stage, in in with US tech futures' gains. The Taeix has struggled, down by close to -0.50%, as TSMC has dipped around 2%., The Kospi is in positive territory but only just (last at +0.1%).

- The rest region is positive, although gains are generally below 0.50%.

OIL: Supply Worries Put A Floor Under Prices

Oil markets were up moderately today after falling overnight. WTI rose around 1% to $83.74 but remains below its key moving averages. Brent has stayed above $90 and is up 0.6%.

- Global growth concerns continue to weigh on oil prices but markets were also focused on supply issues, which have currently put a floor in the market.

- There was concern that the European Union’s latest sanctions against Russia would tighten the market despite the US’ expected release of up to $15mn barrels from the Strategic Petroleum Reserve (SPR). An announcement on this is expected in the US today. There could be further supplies from the SPR going forward for the winter.

- There has also been a delay to the full reopening of the Kashagan oil field in Kazakhstan. They are one of the largest alternatives to Russia for Europeans.

GOLD: Range Bound, Awaiting Fresh Catalysts

Gold is down from earlier session highs, although ranges remain tight overall. The precious metal last sat just above $1650, versus earlier highs close to $1655.

- We are still respecting ranges from the overnight session, with gold waiting for a fresh catalyst to dictate new direction.

- As we noted yesterday, the technical set up still looks to be a bearish one, but we haven't made fresh lows this week, with moves towards $1645 still supported at this stage.

- Cross asset signals are mixed today. Higher beta FX is a touch stronger, but not breaking out of recent ranges. The majors though have been very quiet.

- US yields are slightly higher across the curve, 1-2bps. However, US real yields remained quite steady in the 10yr overnight (closing at 1.60%).

FOREX: Further Hawkish RBNZ Repricing Aids Kiwi, Japanese FinMin Vows To Boost Market Monitoring

Gains for U.S. e-mini futures and a firmer commodity complex buoyed high-beta currencies in the Asia-Pac session, with the Antipodeans pacing gains. Hawkish RBNZ repricing continued after the release of New Zealand's strong consumer inflation data on Tuesday, with little in the way of fresh headline catalysts trickling through today. Meeting-dated OIS price ~82bp worth of OCR hikes for the final meeting of 2022, with the 12bp upswing from the opening levels doubling the total post-CPI advance.

- AUD/NZD traded on a heavier footing but struggled to test yesterday's lows, as a move higher in the BBG Commodity Index lent support to the Aussie dollar. Relative interest rate dynamics remained skewed in favour of the kiwi, as Australia/New Zealand 2-year swap spread refreshed multi-month lows.

- Yen watchers were on alert for signs of an FX intervention by Japanese officials, after a sudden bout of purchases resulted in a sudden 110-pips downswing in USD/JPY on Tuesday, inspiring speculation on potential stealth action. Officials resumed jawboning, with FinMin Suzuki pledging to increase the frequency of detailed checks on market moves.

- The Asia-Pac section of G10 FX basket generally outperformed European peers, albeit sterling traded on a firmer footing. The BBDXY index ground higher alongside cash U.S. Tsy yields.

- Inflation data from the UK, Eurozone and Canada take focus from here, alongside U.S. housing starts and building permits. There is plenty of central bank speak coming up from Fed, ECB, BoE and Riksbank officials.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/10/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/10/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/10/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 19/10/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/10/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/10/2022 | 1230/0830 | *** |  | CA | CPI |

| 19/10/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/10/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 19/10/2022 | 1500/1600 |  | UK | BOE Mann Panels Webinar on ERM Crisis | |

| 19/10/2022 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 19/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 19/10/2022 | 1800/1400 |  | US | Fed Beige Book | |

| 19/10/2022 | 2230/1830 |  | US | St. Louis Fed's James Bullard | |

| 19/10/2022 | 2230/1830 |  | US | Chicago Fed's Charles Evans | |

| 20/10/2022 | 0030/1130 | *** |  | AU | Labor force survey |

| 20/10/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/10/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/10/2022 | 0720/0320 |  | ID | Bank of Indonesia Rate Decision | |

| 20/10/2022 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/10/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 20/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/10/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/10/2022 | 1600/1200 |  | US | Philadelphia Fed's Patrick Harker | |

| 20/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 20/10/2022 | 1730/1330 |  | US | Fed Governor Philip Jefferson | |

| 20/10/2022 | 1745/1345 |  | US | Fed Governor Lisa Cook | |

| 20/10/2022 | 1805/1405 |  | US | Fed Governor Michelle Bowman | |

| 21/10/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/10/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/10/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/10/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 21/10/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/10/2022 | 1310/0910 |  | US | New York Fed's John Williams | |

| 21/10/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/10/2022 | 1600/1200 | ** |  | US | Treasury Budget |

| 22/10/2022 | 0900/1100 |  | EU | ECB Panetta at Festa dell'ottimismo | |

| 23/10/2022 | - |  | SL | Slovenia Presidential Election | |

| 24/10/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 24/10/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/10/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 25/10/2022 | 0600/0800 | ** |  | SE | PPI |

| 25/10/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/10/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 25/10/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/10/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/10/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/10/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.