-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ Gradually Seeing Progress To Price Goal

EXECUTIVE SUMMARY

- LAGARDE SAYS ECB WILL GET INFLATION DOWN TO 2% TARGET IN 2025 - BBG

- BOJ’S UEDA REITERATES GRADUAL PROGRESS TOWARDS PRICE GOAL SEEN - BBG

- PRESSURE ON ISRAEL OVER CIVILIANS STEPS UP AS CEASEFIRE CALLS REBUFFED - RTRS

- CHINA’S NEW FINANCE MINISTER REITERATES PROACTIVE FISCAL POLICY - BBG

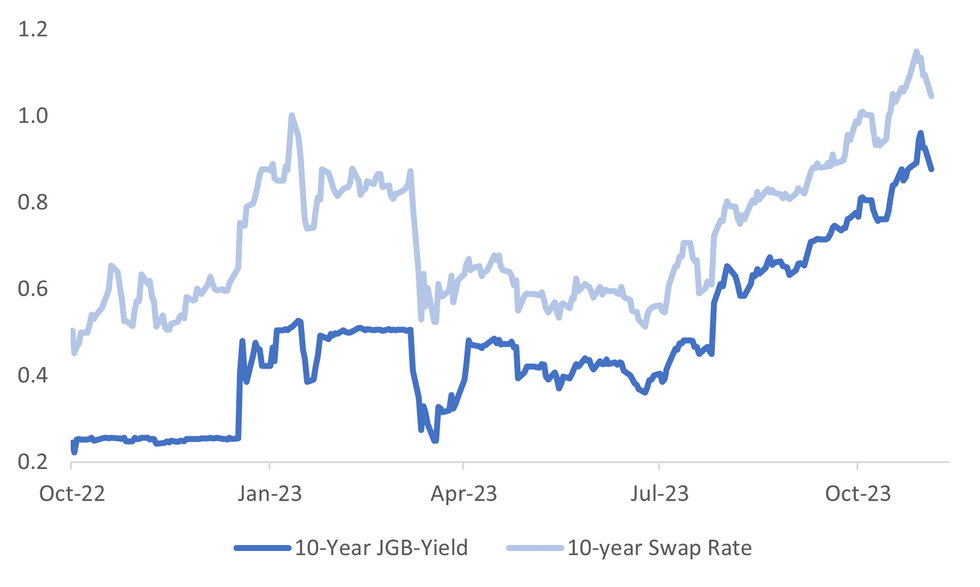

Fig. 1: JGB10yr Yield & 10yr Swap Rate

Source: MNI - Market News/Bloomberg

U.K.

BOE (MNI BRIEF): The rise in U*, the equilibrium, or non-inflationary, jobless rate means that the Bank of England's policy rate will have to stay high-for-longer, Monetary Policy Committee member Jonathan Haskel said at a King's College BOE Watchers conference Friday.

OIL& GAS (BBC): Licences for oil and gas projects in the North Sea are set to be awarded annually, under government plans. There is currently no fixed period between licensing rounds - but this would change under a bill to be announced in Tuesday's King's Speech. Ministers said projects would have to meet net zero targets and claimed the policy would guarantee energy security.

EUROPE

ECB (BBG): European Central Bank President Christine Lagarde said that slowing inflation is “certainly our forecast” and that the institution is determined to return prices to its target. “We are determined to bring inflation down to 2%,” Lagarde told the Greek newspaper Kathimerini in remarks posted Saturday on the ECB’s website. “According to our projections we will get there in 2025.”

ITALY (BBG): Telecom Italia SpA agreed on Sunday to sell its land-line network to KKR & Co., a blockbuster €22 billion ($23.6 billion) deal backed by Italy’s government.

GERMANY (BBG): The Far Right Is on the Rise in Germany and Scholz Is at a Loss. The AfD has seen a surge in support and is targeting a string of elections next year to cement its gains

RUSSIA (BBG): Russia is moving to expand its military presence in eastern Libya, a plan that could lead to a naval base, giving it a significant foothold on Europe’s southern doorstep.

TURKEY (ECONOMIST): Turkey’s main opposition party voted to remove its leader, Kemal Kilicdaroglu. Mr Kilicdaroglu was replaced by Ozgur Ozel, who promised to expand the CHP’s appeal before local elections in March. – The Economist

U.S.

FED (MNI BRIEF): Federal Reserve Bank of Minneapolis President Neel Kashkari on Friday said the Fed can not yet call the end of its rate-hiking cycle, even though the Labor Department's report of 150,000 jobs added in October signals the job market is slowing as desired.

POLITICS (RTRS): Democratic President Joe Biden trails Republican frontrunner Donald Trump in five of the six most important battleground states exactly a year before the U.S. election as Americans express doubts about Biden's age and dissatisfaction toward his handling of the economy, polls released on Sunday showed.

OTHER

OIL (BBG): Saudi Arabia and Russia reaffirmed that they will stick with oil supply curbs of more than 1 million barrels a day until the end of the year, even as turmoil in the Middle East roils global markets.

ISRAEL (RTRS): Efforts to pressure Israel to spare civilians in Gaza were set to continue on Monday after Israel rebuffed calls for a ceasefire amid a U.S. diplomatic blitz to the region to help contain escalation of the conflict.

JAPAN (BBG): Governor Kazuo Ueda says the Bank of Japan can’t yet see its inflation target in sight with sufficient certainty, though chances of achieving the goal are rising gradually.

JAPAN (BBG): Support for Japanese Prime Minister Fumio Kishida’s government hit a fresh low in a major poll to fall below a level seen as a danger zone for premiers, with respondents indicating they did not back his latest economic stimulus package.

JAPAN (RTRS): Most Bank of Japan board members saw no need for additional tweaks to yield curve control and agreed to continued monetary easing to meet inflation and wage growth objectives, minutes of its September meeting showed on Monday.

AUSTRALIA (BBG): Prime Minister Anthony Albanese will be the first Australian leader to meet with President Xi Jinping in China in more than seven years on Monday, sealing a rapid recovery in diplomatic relations between the nations.

SOUTH KOREA (BBG): South Korean stocks surged after regulators reimposed a full ban on short-selling for about eight months, a controversial move that authorities said was needed to stop illegal use of a trading tactic deployed regularly by hedge funds and other investors around the world.

PHILIPPINES (BBG): Philippine Rate Will Likely Be on Hold This Month, Says Official. Philippine Finance Secretary Benjamin Diokno, who is also a member of Bangko Sentral ng Pilipinas’ monetary policy board, comments on local economy.

CHINA

TRADE (YICAI): China will actively pursue joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) as it seeks to promote economic globalisation with other countries, according to Premier Li Qiang.

FISCAL (XINHUA): The Ministry of Finance will accelerate the issuance and use of the additional CNY1 trillion government bonds as well as local government special bonds and maintain reasonable spending, Finance Minister Lan Fo'an has said.

FISCAL (SECURITIES TIMES): Government will increase its debt responsibilities and reduce local funding pressure, the Securities Times reports Monday, citing analysts. Central government’s deficit has more room to increase in 2024 as it accelerates efforts to address local debt situation, says Zhao Wei, chief economist at Guojin Securities.

ECONOMY (XINHUA/BBG): China is confident that efforts to stablize and stimulate industrial economic growth will continue to yield positive results in the fourth quarter, Jin Zhuanglong, minister of industry and information technology, said in an interview with Xinhua News Agency on Nov. 4.

CHINA MARKETS

MNI: PBOC Drains Net CNY640 Bln Via OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY18 billion via 7-day reverse repo on Monday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY640 billion after offsetting the maturity of CNY658 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7781% at 09:46 am local time from the close of 1.7564% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 39 on Friday, compared with the close of 33 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1780 Monday vs 7.1796 Friday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1780 on Monday, compared with 7.1796 set on Friday. The fixing was estimated at 7.2860 by Bloomberg survey today.

MARKET DATA

AUSTRALIA OCT MELBOURNE INSTITUTE INFLATION M/M -0.1%; PRIOR 0.0%

AUSTRALIA OCT MELBOURNE INSTITUTE INFLATION Y/Y 5.1%; PRIOR 5.7%

AUSTRALIA OCT ANZ-INDEED JOB ADS M/M -3.0%; PRIOR -0.5%

NEW ZEALAND OCT ANZ COMMODITY PRICE M/M 2.9%; PRIOR 1.4%.

JAPAN OCT F JIBUN BANK SERVICES PMI 51.6; PRIOR 51.1

JAPAN OCT F JIBUN BANK COMPOSITE PMI 50.5; PRIOR 49.0

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 108-05+, -0-06, a 0-04 range has been observed on volume of ~98k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Narrow ranges were observed in Asia for the most part, there was little follow through on moves and little meaningful macro news flow crossed.

- Tsys ticked marginally lower in early dealing, firmer Oil weighed at the margins and Friday's richening perhaps gave participants the opportunity to close long positions/add fresh shorts.

- FOMC dated OIS now price a terminal rate of 5.35% in January, there are ~75bps of cuts priced by Sep 24.

- The calendar is thin in Europe today, further out we have Fedspeak from Governor Cook.

JGBS: Futures Spike Higher, Ueda States Gradual Progress Towards Price Goal Evident

JGB futures sit below session highs. We were last at 144.46, +0.38. Session highs came around near the lunch time break, at 144.55. These levels are a touch above highs from earlier last week, but broadly we remain within recent ranges. These moves have outperformed a slightly softer tone to US Tsy futures, although we are up from session lows (last near 108-07).

- Much of the focus today in Japan has been comments from BoJ Governor Ueda. The Governor reiterating that it is unlikely 10yr yields will spending much time above 1.0%. Ueda stated the country is getting gradually closer to its price goal, but it is not within sight yet, nor could Ueda state when that was likely to be. Next year's spring wage negotiations will be very important to the outlook (BBG).

- The Governor stressed large scale bond buying/continued easing would be maintained until the inflation target is in sight. BOJ operations totaled 1.825trln in bonds purchases earlier, from the 1yr to +25yr tenor.

- The BoJ minutes were also released for the Sep meeting but didn't shift sentiment greatly. Note tomorrow on the data front Sep cash earnings in real and nominal terms, along with household spending data.

- in the cash JGB space, the 10yr yield sits near 0.87%, but hasn't seen a great deal of fresh downside after opening sharply lower in yield terms. The 7yr and 20yr are down slightly more in yield terms (-6bps). Front end yields are off by -2-3.5bps. It is a similar story in the swap space (the 10yr down 5bps to just under 1.05%).

AUSSIE BONDS: Marginally Firmer On Monday

ACGBs sits ~1bp richer across the major benchmarks, the early support seen after Friday's US Tsys rally was unwound through session however ranges remained narrow and Aussie Bonds held marginally richer.

- XM and YM sit very lightly firmer from opening levels, narrow ranges have been observed for the most part.

- With tomorrow's RBA meeting firmly in view, the Bloomberg Survey looks for a 25bp increase in the cash rate to 4.35%. RBA dated OIS have ~15bps of hikes priced in with a terminal rate of ~4.47% in June 24.

- PM Albanese is in China meeting with President Xi Jinping today, the first meeting between an Australian PM and the Chinese President in 7 years.

- The Melbourne Institute inflation gauge for October moderated to 5.1% Y/Y from 5.7%, its lowest since September 2022. It remains elevated but is off the 6.4% peak seen in January.

NZGBs: Richer On Monday

NZGBs have finished dealing 3-7bps richer across the major benchmarks, the early support from Friday's move in US Tsys in lieu of the October NFP print extended through the session. The curve bull flattened.

- Rate differentials, observed via 10-Year Swaps, narrowed a touch on Monday and sit at +58bps.

- RBNZ dated OIS remain stable, a terminal rate of 5.55% is seen in Feb 24, there are ~35bps of cuts by Oct 24.

- In the latest NZ election news the NZ Nationals need two partners to govern, negotiations are continuing. PM-elect Luxon told Radio NZ (BBG), that he would like to detail spending plans in a mini budget before Christmas.

- The ANZ Commodity Price Index rose 2.9% M/M in October as a lower NZD and recovering demand for dairy products added support.

- The local docket is relatively light this week with just Q4 2-Year Inflation Expectations, Oct Card Spending and Oct BusinessNZ Mfg PMI due.

EQUITIES: Asia Pac Equities Surge, Led By South Korea

Asia Pac equities are once again a sea of green, as markets start the week off on a positive footing. The stand out performer has been the South Korean Kospi, with broader macro trends helping, along with an announced ban on short selling. US futures have been relatively quiet. Eminis have largely tracked sideways, last near 4379, while Nasdaq future sit near 15189 in recent dealings.

- In South Korea, the Kospi is up 4%, the Kosdaq 6%. The short selling ban will be in place until June of this year (see this BBG link for more details). Broader trends of tech outperformance amid the recent sharp pull back in US yields has also helped. Offshore investors have added $538.8mn to local shares so far today.

- Japan markets have returned from Friday's holiday. At this stage, the Topix is up 1.80%, the Nikkei 225 ~2.4%. The cyclical sensitive electrical appliances sector is leading the Topix higher. in Taiwan, the Taiex is +1.1% higher.

- In Hong Kong, the HSI is up +1.70%, while at the break, the CSI 300 is +1.34%. China related property developers have tracked higher after reports that China Vanke will meet "financial institutions Monday to discuss matters regarding its operating conditions"(see this BBG link).

- In SEA gains are more muted, with the major indices tracking up less than 1% at this stage.

FOREX: Narrow Ranges In Asia On Monday

There have been narrow ranges across the G-10 FX in early dealing on Monday. The greenback is marginally lower however there has been little follow through on moves thus far. US Tsys Yields are a touch higher at the short end of the curve as Fridays losses are marginally pared. Regional equities are firmer, the Hang Seng is up ~1.5%, and E-minis are a touch higher.

- AUD/USD is up ~0.1%, and is consolidating above the $0.65 handle. Technically the 50-Day EMA has been breached, re-enforcing the bull cycle. Resistance is at $0.6522, Aug 30 high, and $0.6562 10-DMA envelope.

- Yen is a touch lower as the uptick in US Tsy Yields weighs. USD/JPY prints at ¥149.50/60. The bullish conditions for the pair remain intact. Resistance comes in at ¥151.72, high from Oct 31.

- NZD/USD is marginally lower however the pair has dealt in a narrow range below the $0.60 handle. The $0.60 presents immediate upside resistance and a $0.5985/95 range has been observed for the most part.

- Elsewhere in G-10 the Scandies are firmer however liquidity is generally poor in Asia.

- The docket is thin on Monday, the next major macro event is tomorrow's RBA monetary policy decision.

OIL: Crude Stabilises As OPEC+ Output Cuts Remain

Oil prices are moderately higher during the APAC session today after falling almost 2% on Friday. The reaffirmation of Saudi and Russian output cuts to year end has provided support plus a weaker dollar has helped (USD index is down 0.1%). WTI is up 0.5% to $80.94/bbl after a high of $81.20 and Brent +0.4% to $85.24 following $85.55 earlier.

- Last week the current containment of the Middle East conflict removed crude’s war premium and demand concerns, especially from China, weighed on prices and so they were down around 5% on the week.

- Saudi Aramco cut prices to Europe where demand has fallen and left them unchanged to North America. Two of the five grades shipped to Asia were unchanged while the other three saw price rises, according to Bloomberg.

- Later the Fed’s Cook speaks on financial stability. On the data front there are October European composite/services PMIs.

GOLD: Unwinds Friday's Gain, Resistance Still Evident Above $2000

Gold has tracked modestly lower in the first part of Monday dealing. We were last around $1985, off by 0.40%, which unwinds Friday's gain. Lows for the session rest near $1982, highs came in above $1993.

- More broadly, Friday highs came in close to $2005, but we couldn't sustain these gains, which has been the case in recent weeks. Whilst gold remains above all key EMAs (20 day at ~$1960 is the closest), we have largely tracked sideways in recent weeks.

- A generally softer USD backdrop is supportive, although today has been similar to Friday's Asia Pac session, where USD weakness has been more evident against Asia FX than the majors. The BBDYX is still down ~0.15$.

- The offset is coming from improved risk appetite, particularly in the equity space, which is likely reducing demand for the safe haven asset.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/11/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/11/2023 | 0815/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 06/11/2023 | 0845/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 06/11/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 06/11/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 06/11/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 06/11/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/11/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/11/2023 | 1530/1030 |  | CA | BOC releases quarterly market participants survey | |

| 06/11/2023 | 1600/1100 |  | US | Fed Governor Lisa Cook | |

| 06/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 06/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 06/11/2023 | 1700/1700 |  | UK | BOE's Pill MPR Virtual Q&A |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.