-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ Launches Review, Major Policy Levers Unchanged, Tweaks Guidance

EXECUTIVE SUMMARY

- BOJ'S NEW BOSS KEEPS ULTRA-LOW RATES, EMBARKS ON POLICY REVIEW (RTRS)

- EX-OFFLS: FED TO KEEP TIGHTENING BIAS AS CYCLE NEARS END (MNI)

- FED EMERGENCY LOANS RISE AGAIN AMID RENEWED FINANCIAL STRESS (BBG)

- MONEY MARKET ASSETS CLIMB TOWARD RECORD AHEAD OF FED MEETING (BBG)

- SAN FRANCISCO FED’S ROLE IN SVB COLLAPSE DRAWS US HOUSE INVESTIGATION (BBG)

- EU’S DEBT RULES MEAN JUST FOUR COUNTRIES CAN FINANCE GREEN GOALS (BBG)

- MELONI COALITION TO TRY AGAIN ON ITALY DEFICIT PLAN AFTER DEFEAT (BBG)

- CHINA RATCHETS UP PRESSURE ON FOREIGN COMPANIES (WSJ)

- CHINA MOVES TO CRACK DOWN ON DEFAMATION OF PRIVATE SECTOR ONLINE (BBG)

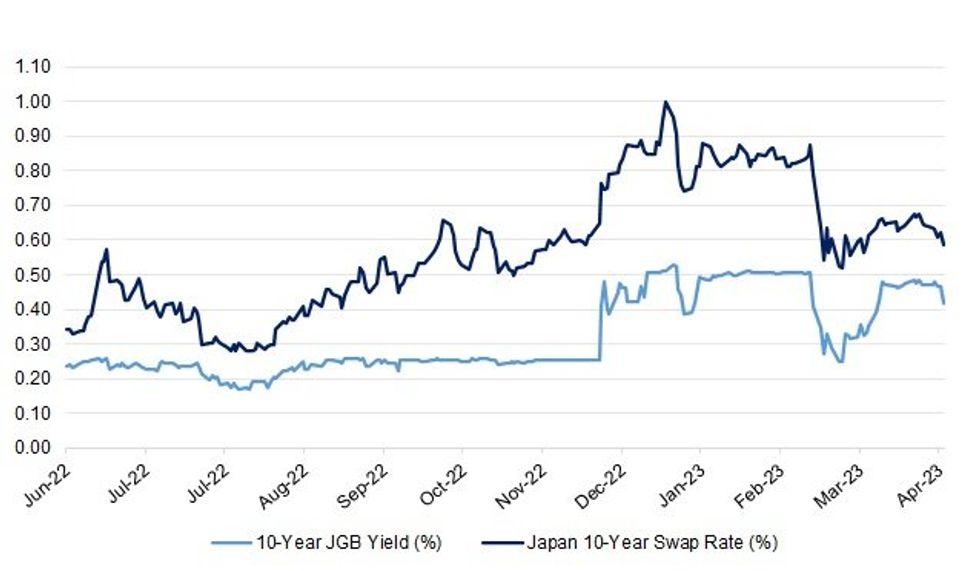

Fig. 1: 10-Year JGB Yields vs. Japan 10-Year Swap Rate

Source: MNI - Market News/Bloomberg

UK

BREXIT: The UK government is set to abandon its controversial plan to review or scrap all EU-era law by the end of 2023, in a move which has sparked fury among Tory Eurosceptics. (FT)

PENSIONS: The Bank of England warned insurers on Thursday not over extend themselves in grabbing more business from pension schemes eager to offload risks. (RTRS)

EUROPE

ECB: The European Central Bank will ease the pace of interest-rate hikes to a quarter-point next week as it weighs a pullback in bank lending against still-stubborn inflation and a surprisingly resilient economy, according to a Bloomberg survey of analysts. (BBG)

FISCAL: The European Union’s proposed overhaul of debt rules leaves a majority of member states without sufficient firepower to finance the climate transition, according to a new report. (BBG)

ITALY: Italian Prime Minister Giorgia Meloni’s government will make a second attempt to win authorization for extra deficit spending on Friday after its initial try suffered an embarrassing defeat in Parliament. (BBG)

BONDS: The European Union is preparing to approach index providers for its debt to be included in their government bond indexes, an EU official told Reuters, a move that would attract steady demand from a much bigger pool of global investors. Index inclusion "is something we are discussing with market participants at the moment, while we are also doing our internal analysis," the official said, looking at how the EU fulfills index providers' criteria. (RTRS)

RATINGS: Potential sovereign reviews of note scheduled for after hours on Friday include:

- Fitch on France (current rating: AA; Outlook Negative)

- Moody’s on Belgium (current rating: Aa3; Outlook Stable), the European Financial Stability Facility (current rating: Aaa; Outlook Stable) & the European Stability Mechanism (current rating: Aaa; Outlook Stable)

- S&P on Finland (current rating: AA+; Outlook Stable) & Sweden (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Italy (current rating: BBB (high), Stable Trend)

U.S.

FED: Federal Reserve officials will likely retain a tightening bias in their forward guidance even if next week's rate increase is their last, in a signal they're committed to holding interest rates high for some time barring a major financial crisis, former Fed officials told MNI. (MNI)

FED: Banks increased emergency borrowings from the Federal Reserve for the second week in a row, underscoring ongoing stress in the financial system following a string of bank collapses last month. (BBG)

MONEY MARKETS: The cash parked at money-market funds resumed its climb in the past week as prospects for higher rates spurred inflows ahead of the Federal Reserve’s next policy meeting. (BBG)

BANKS/FED: The US House’s top government watchdog committee has launched an investigation into the role the Federal Reserve Bank of San Francisco and other state and federal regulators played in the March failure of Silicon Valley Bank. (BBG)

BANKS: First Republic’s advisers are working on a private-sector solution they hope can overcome scepticism in Washington and keep the embattled California bank from being shut down by the Federal Deposit Insurance Corporation. (FT)

BANKS: U.S. officials are coordinating urgent talks to rescue First Republic Bank (FRC.N) as private-sector efforts led by the bank's advisers have yet to reach a deal, according to three sources familiar with the situation. (RTRS)

EQUITIES: Amazon.com Inc. warned that growth in its cloud computing division is continuing to cool, dashing hopes that the company’s most profitable division was weathering a lackluster environment for technology spending. (BBG)

OTHER

GLOBAL TRADE: TSMC reiterates its plans to mass-produce 2nm chips in 2025, Taipei-based Commercial Times reports, citing the chipmaker’s CEO C.C. Wei. (BBG)

U.S./CHINA: White House national security adviser Jake Sullivan said on Thursday the United States is not looking to decouple its economy from the Chinese economy, saying, "We're not cutting off trade." Speaking at the Brookings Institution, Sullivan said China should step up as a constructive force in assisting heavily indebted countries. He said Washington does not want China to use American technology against the United States but does not plan to end economic ties with Beijing. (RTRS)

U.S./CHINA/TAIWAN: A US Navy P-8A Poseidon transited the Taiwan Strait in international airspace Friday local time, according to a statement from the US 7th Fleet. (BBG)

CHINA/TAIWAN: China’s ambassador to Japan Wu Jianghao said the issue of Taiwan is a red line for Beijing and it’s dangerous to say a contingency in the strait is a contingency for Tokyo. (BBG)

EU/CHINA: China’s Commerce Minister Wang Wentao met Germany’s Vice Chancellor Robert Habeck on Thursday in Berlin and expressed concern about export restrictions, the Chinese commerce ministry says in a statement. (BBG)

GEOPOLITICS: The United States on Thursday imposed sanctions on Russia's domestic security service FSB and the intelligence unit of Iran's Revolutionary Guard Corps (IRGC) accusing them of being responsible or complicit in the wrongful detention of Americans overseas, senior administration officials said. (RTRS)

GEOPOLITICS: Chinese and Philippine ships nearly collided in South China Sea days ago in yet another sign of continued tensions over contested waters, according to a report by the Southeast Asian nation. (BBG)

GEOPOLITICS: All border issues between India and China need to be resolved per existing bilateral agreements and commitments, Indian Defence Minister Rajnath Singh told his Chinese counterpart Li Shangfu on Thursday, amid simmering tensions over a border dispute in the Himalayas. (Nikkei)

BOJ: The Bank of Japan (BOJ) on Friday kept ultra-low interest rates but announced a broad review of its monetary policy, laying the groundwork for new Governor Kazuo Ueda to phase out his predecessor's massive stimulus programme. (RTRS)

JAPAN: The Japanese government said it will provide Honda Motor Co. and GS Yuasa Corp. with 159 billion yen ($1.2 billion) in subsidies to support their battery-making efforts as it tries to boost development of the industry. (BBG)

AUSTRALIA: The Australian Prudential Regulation Authority and the Australian Financial Complaints Authority have signed a memorandum of understanding, which is setting out the basis for engagement between the two regulators, according to a statement. (BBG)

AUSTRALIA/CHINA: Australia’s economic and diplomatic relations with China are in recovery mode, with tensions over issues ranging from foreign investment to security receding as Beijing tamps down its punitive efforts to bend one of its key commodity suppliers to its will. (BBG)

RBNZ: Weak employment figures next week would prompt the Reserve Bank of New Zealand to consider a pause or else signal an approaching peak in its monetary tightening after its May 24 meeting, amid fears a recession may already be underway as the lagged effect of previous hikes hits mortgage borrowers, former staffers told MNI. (MNI)

JAPAN/SOUTH KOREA: Japan’s trade ministry is preparing to restore South Korea’s preferred trading status, also known as the whitelist, Nikkei reports, without attribution. (BBG)

RBA: Australia's central bank will keep its interest rate unchanged at 3.6% on Tuesday for a second consecutive meeting to assess the impact of past hikes on inflation, according to a Reuters poll of economists who were split on where it would peak. (RTRS)

HONG KONG: Hong Kong is burning through a closely-watched component of its monetary base to ward off attacks on its dollar to little avail, with the lack of reaction in money markets likely to keep the pressure on the beleaguered currency. (BBG)

NORTH KOREA: South Korean President Yoon Suk Yeol told a joint meeting of the U.S. Congress on Thursday that it was necessary to speed up trilateral cooperation with Japan and the United State to counter increasing North Korean nuclear threats, and said the world must not "shy away" from its duty to promote freedom for the North. (RTRS)

BRAZIL: Ahead of Brazil’s next monetary policy decision, the Finance Minister expressed apprehension on Thursday about the economic impact of high interest rates, while the central bank’s chief continued to emphasize inflation concerns. Speaking at a Senate debate session on interest rates, inflation, and economic growth, Finance Minister Fernando Haddad warned that failure to integrate the country’s monetary and fiscal policies would create “a lot of difficulty” in achieving the Brazilian economy’s needs. (RTRS)

BRAZIL: Brazil's Treasury Secretary Rogerio Ceron said on Thursday the government is studying allowing the use of Treasury bonds held within its platform "Tesouro Direto" to be used as collateral for loans. Speaking at a press conference, Ceron said the initiative is expected to reduce the cost of credit. (RTRS)

BRAZIL: Shareholders of the state-owned oil company elected a new board of directors at an Ordinary General Meeting this Thursday, including three nominees from the by the Brazilian government previously rejected by Petrobras’ internal committees due to conflict of interest and recent political connections, in an opinion ratified by the company’s board. (BBG)

RUSSIA: Russia launched a new attack on Ukraine early Friday morning, with several explosions heard in the capital Kyiv. It’s the first strikes in the capital in more than a month. (BBG)

RUSSIA/OIL: Russia’s government is turning again to its oil industry for cash, exploring options from cutting fuel subsidies to a windfall tax as it seeks to boost budget revenue to fund its war in Ukraine, according to people familiar with the matter. (BBG)

PERU: Peru’s Finance Minister Alex Contreras on Thursday said historic protests this year had had a “huge” impact on the economy, prompting the ministry to mark down growth forecasts for this year. (BBG)

ARGENTINA: Argentina’s central bank raised its benchmark interest rate by 1,000 basis points on Thursday as a renewed peso selloff in parallel markets adds to the sense of crisis in the South American nation. (BBG)

ARGENTINA: Argentine Vice President Cristina Fernandez de Kirchner blamed the country’s $44 billion agreement with the International Monetary Fund for a recent plunge in the value of the peso and wave of inflation pushing consumer price increases up over 100%. (BBG)

METALS: China steel mills face increasing challenges as domestic steel price continue to fall while iron ore prices remain elevated, according to People’s Day. In a quarterly press conference, officials from China Iron and Steel Association said the current inventory of major steel companies are higher than the same period last year, which has lead to a 71.49% y/y fall in profits in Q1 to CNY16 billion. Officials suggested the companies should adjust production according to the market demand and control inventory. (MNI)

OIL: Top oil exporter Saudi Arabia may cut the price for its flagship Arab Light crude to Asia in June despite an extra output cut from OPEC+, as refiners hit by sliding fuel prices consider reducing output and China and India snap up cheap Russian crude. (RTRS)

CHINA

POLICY: Chinese authorities have embarked on a campaign to bring foreign businesses to heel, just months after Beijing delivered an open-for-business message to global investors. (WSJ)

POLICY: Cyberspace Administration of China is starting a three-month operation to improve business environment and protect companies’ legitimate rights, according to a statement from the regulator. (BBG)

ECONOMY: The Labor Day holiday, April 29 to May 3, will push consumption to recover further and perform better in Q2, Shanghai Securities News reported. (MNI)

ECONOMY: Free from pandemic lockdowns, more people are expected to travel in China during the upcoming five-day May Day holiday than they did before the COVID-19 outbreak in a boost to the leisure and hospitality sectors. Bookings for domestic hotels and air travel from Saturday through Wednesday have exceeded 2019 levels, according to Trip.com Group, China's leading online travel agency, though it has not disclosed specific numbers. (Nikkei)

PROPERTY/BANKS: Chinese lenders recorded a surge of bad mortgages in 2022 as some developers failed to deliver new houses and the overall economy faced difficulties,(MNI)

PROPERTY/CREDIT: China Evergrande Group extended by three weeks a deadline for debtholders to receive compensation for backing the embattled developer’s restructuring plan, as the firm has yet to win enough support for the massive overhaul. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY77 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) conducted CNY165 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY77 billion after offsetting the maturity of CNY88 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at month end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2563% at 09:42 am local time from the close of 2.2494% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 46 on Thursday, compared with the close of 45 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9240 FRI VS 6.9207 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9240 on Friday, compared with 6.9207 set on Thursday.

OVERNIGHT DATA

JAPAN APR TOKYO CPI 3.5% Y/Y; MEDIAN +3.3%; MAR +3.3%

JAPAN APR TOKYO CPI EXCLDUING FRESH FOOD +3.5% Y/Y; MEDIAN +3.2%; MAR +3.2%

JAPAN APR TOKYO CPI EXCLDUING FRESH FOOD & ENERGY +3.8% Y/Y; MEDIAN +3.5%; MAR +3.4%

JAPAN MAR, P INDUSTRIAL PRODUCTION +0.8% M/M; MEDIAN +0.4%; FEB +4.6%

JAPAN MAR, P INDUSTRIAL PRODUCTION -0.7% Y/Y; MEDIAN -1.2%; FEB -0.5%

JAPAN MAR RETAIL SALES +0.6% M/M; MEDIAN +0.3%; FEB +2.1%

JAPAN MAR RETAIL SALES +7.2% Y/Y; MEDIAN +6.5%; FEB +7.3%

JAPAN MAR JOBLESS RATE 2.8%; MEDIAN 2.5%; FEB 2.6%

JAPAN MAR JOB-TO-APPLICANT RATIO IS 1.32; MEDIAN 1.34; FEB 1.34

AUSTRALIA Q1 PPI +5.2% Y/Y; Q4 +5.8%

AUSTRALIA Q1 PPI +1.0% Q/Q; Q4 +0.7%

AUSTRALIA MAR PRIVATE SECTOR CREDIT +0.3% M/M; MEDIAN +0.3%; FEB +0.3%

AUSTRALIA MAR PRIVATE SECTOR CREDIT +6.8% Y/Y; FEB +7.6%

NEW ZEALAND APR ANZ CONSUMER CONFIDENCE INDEX 79.3; MAR 77.7

The ANZ-Roy Morgan Consumer Confidence Index lifted 1 point in April, remaining very subdued. (ANZ)

SOUTH KOREA MAR INDUSTRIAL OUTPUT +5.1% M/M; MEDIAN +0.4%; FEB -2.7%

SOUTH KOREA MAR INDUSTRIAL OUTPUT -7.6% Y/Y; MEDIAN -10.2%; FEB -8.0%

SOUTH KOREA MAR CYCLICAL LEADING INDEX -0.3 M/M; FEB -0.3

UK APR LLOYDS BUSINESS BAROMETER 33; MAR 32

MARKETS

US TSYS: Marginally Richer, BoJ Matters Dominate

TYM3 deals at 114-26+, +0-03, with a 0-11+ range observed on volume of ~133k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- After a muted start tsys were briefly pressured after Nikkei reports surfaced noting the potential for policy change at today's meeting, however losses were pared as further headlines clarified that the change was in relation to the governments covid classification. TYM3 showed below Thursdays lows.

- Spillover from JGBs, as the BoJ left policy setting unchanged and announced a review of monetary policy which will take 1-1.5 years, saw tsys firm.

- FOMC dated OIS price ~22bp hike for next week's meeting with a terminal rate of 5.1% in June. There are ~60bps of cuts priced in 2023.

- In Europe today we have Eurozone, French and German GDP and Regional and National German CPI. Further out we have a slew of US data including PCE Deflator, MNI Chicago PMI and UofMich Consumer Sentiment.

JGBS: Futures Spike To Highest Level Since Late March After BoJ Decision

Following the BoJ’s monetary policy decision, JGB futures experienced a sudden surge, erasing the prior downtrend and climbing to +36 versus settlement levels. The JBM3 reached a peak of 148.49, marking the highest point since late March.

- The BoJ announced today that it would maintain its target yield for the 10-year bond at approximately 0% and keep the policy balance rate at -0.1%. As widely anticipated, the bank removed references to COVID-19 from its forward guidance. Furthermore, the BoJ called for a comprehensive review of its longer-term policies.

- Despite the significant increase in inflation forecasts for FY23 and FY24, the BoJ saw the price risks skewed to the downside for FY25, given the high levels of economic uncertainty. The bank expects the pace of growth to slow down towards the end of the projection period, and as such, it will patiently continue with monetary easing.

- Cash JGBs have richened across the curve after the BoJ decision with yields flat to 5.4bp lower with the 20-year zone and beyond the strongest performers. The benchmark 10-year yield is 3.9bp lower at 0.427%, well below the BoJ's YCC limit of 0.50%.

- The swaps curve bull flattened after the BoJ decision with swap spreads wider beyond the 3-year zone.

- BoJ Governor Ueda is scheduled to hold a news conference after the policy meeting at 0730 BST.

AUSSIE BONDS: Weaker, Supported By JGBs, Eyes US PCE Deflator

ACGBs sit weaker (YM -4.0 & XM -3.0) but well off session cheaps after JGBs rallied on the BoJ policy decision. US Tsys richened around 2bp after the BoJ decision versus +4-5bp for ACGBs. Before the post-BoJ spike the local market had appeared troubled by a firm Q1 PPI print. Private sector credit printed in line with expectations.

- Cash ACGBs are 2-3bp cheaper with the AU-US 10-year yield differential -3bp at -12bp.

- Swap rates are 1-2bp higher with EFPs 2bp tighter.

- Bills strip pricing is -3 to -7 with late whites the weakest.

- RBA dated OIS pricing is 1-7bp firmer with late ‘23/early ’24 leading.

- Q1 PPI data printed an increase of 1.0% Q/Q and +5.2% Y/Y versus 0.7% and +5.8% in Q4. According to the ABS, electricity and gas supply (+13.3% Q/Q) was the key upside driver, with fuel refining and manufacturing (-7.2% Q/Q) and furniture and other manufacturing (-5.8% Q/Q), as the weakest components.

- The local calendar highlight next week is the RBA policy decision on Tuesday.

- Until then, all eyes will be on the release late today of the March PCE Deflator.

- The AOFM announced today that it plans to sell A$800mn of the 4.50% 21 April 2033 on Wednesday May 3.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 3 May it plans to sell A$800mn of the 4.50% 21 April 2033 Bond.

- On Thursday 4 May it plans to sell A$1.0bn of the 21 July 2023 Note & A$500mn of the 22 September 2023 Note.

NZGBS: Cheaper, Boosted By JGBs, Awaits US PCE Deflator

NZGBs closed cheaper with the 2-year and 10-year benchmark yields 6bp and 3bp higher. With domestic data and headlines light, the local market had been content to track US Tsys ahead of US PCE Deflator data later today. The local market however received a boost from JGBs late in the session following the BoJ policy decision.

- Swap rates are 5-9bp higher with implied swap spreads slightly wider.

- RBNZ dated OIS closed 2-10bp firmer across meetings with early ’24 leading. May meeting closed 2bp firmer with 22bp of tightening priced.

- While ANZ Consumer Confidence unexpectedly increased by 2.1% M/M in April, the overall level of confidence remains low, reflecting the impact of rising costs and worsening household balance sheets.

- Next week’s local calendar highlight is the release of the March Quarter Labour Market Report on Wednesday. BBG consensus expects some cooling in tight labour market conditions with the unemployment rate forecast to increase to 3.6% from 3.4% in Q4. Slowing demand for labour and increasing supply, due to an inflow of migrant workers, should dampen wage pressures and core inflation, in time.

- Ahead of that data, the RBA will hand down its policy decision on Tuesday.

- Until then, all eyes will be on the release late today of the March PCE Deflator after yesterday’s stagflation-like Q1 GDP report.

EQUITES: Japan Stocks Gain Post BoJ, China/HK Bourses Gain

Regional equities are mostly tracking higher, following firm gains for US stocks through Thursday trade. US futures have drifted lower through the course of the session, but losses are modest, last around 0.10% for eminis, -0.20% for Nasdaq futures.

- Japan stocks have firmed, the Topix around +0.70%, aided by an unchanged BoJ, with arguably some dovish rhetoric in terms of the review stance. USD/JPY got close to 135.00 but is now lower. Not surprisingly, Japan bank stocks have suffered post the BoJ, the Topix bank index off 2.4% at one stage.

- China and HK shares are higher, the HSI by nearly 0.90%m while the CSI 300 up around 0.75%. The Golden Dragon index firmed in US trade for the second session. Reports of potential efforts to lower US-China tensions may be helping at the margins. The Cyberspace regulators is also launching a 3 month campaign to protect Internet companies legal interests.

- South Korean shares are underperforming, the Kospi down 0.20%, the Kosdaq off 1.10%. The FSS is meeting with heads of local brokerages to increase oversight of retail investors.

- In SEA, markets are more mixed, with Indonesian stocks down slightly, unwinding a touch of Wed/Thur gains. Philippines stocks are doing better, +0.70% of talk of rate pauses and RRR cuts by mid year.

- The ASX 200 is close to flat.

GOLD: Slips But Still Within Recent Ranges

Gold is tracking lower, albeit with recent ranges. We currently sit close to mid-point of the last week's range, currently around $1987.00. The last part of trading has seen the precious metal slip, as the USD has seen support post the BoJ decision (led by yen weakness). We remain above session lows of $1985 though.

- For the past week, dips towards $1975 have been support, while moves above $2000 have ultimately drawn selling interest. For the week, gold is tracking modestly higher +0.20%.

- US yield/USD moves will likely continue to dominate as we progress into next week.

- Gold ETF holdings are holding near recent highs.

OIL: Recovers Further On China Demand Outlook, But Still Tracking Lower For THe Week

Brent crude has firmed through the Asia Pac session today, up another 0.90%, to be back above the $79/bbl handle. This follows Thursday's 0.88% gain as well. Sentiment has been buoyed today after China's top fuel producer, Sinopec, stated demand growth should be more than 10% in 2023. Demand growth was 6.7% in Q1 and is expected to be stronger in Q2. Note we also get China PMIs on Sunday which will provide a further economic update.

- Still these gains need to be seen in the context of broader trends. Brent is still tracking 3.20% lower for the week and is down modestly for April as a whole.

- In terms of levels recent lows towards $77/bbl have been supported. On the topside we are comfortably off resistance at $83.06/$85.15 (Apr 25/19 highs).

FOREX: Yen Pressured After BOJ Meeting

Yen is the weakest performer in the G-10 space at the margins on Friday after the latest BoJ Monetary Policy decision. The BoJ removed reference to Covid in its forward guidance. It also removed reference to rates in terms of the guidance (expecting rates to remain at low or present levels was left out), but the Bank left in that is prepared to take further easing measures if necessary. The BOJ will also conduct a review, which is expected to take 1 to 1.5 yrs.

- USD/JPY prints at ¥134.65/75, the pair is ~0.5% firmer, gains have been marginally pared after printing a post BOJ high at ¥134.94. Bulls target the high from Apr 19 at ¥135.13, break through here opens ¥135.96 76.4% retracement of the Mar 8-24 bear leg.

- AUD/USD is ~0.2% as spillover from the USD/JPY has helped the USD firm, support is seen at $0.6591 low Apr 26. Westpac noted that it expects the RBA to pause again at its May meeting and that 3.6% is the likely cash rate peak.

- Kiwi is a touch softer, however a narrow $0.6140/60 range has prevailed thus far today.

- Elsewhere in G-10, GBP and EUR are both ~0.1% softer.

- Cross asset wise; e-minis are ~0.1% softer and BBDXY is ~0.2% firmer. US Treasury Yields are ~1bp lower across the curve.

- In Europe today we have Eurozone, French and German GDP and Regional and National German CPI. Further out we have a slew of US data including PCE Deflator, MNI Chicago PMI and UofMich Consumer Sentiment.

FX OPTIONS: Expiries for Apr28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0950-70(E711mln), $1.1000(E2.9bln), $1.1040-50(E1.2bln)

- USD/JPY: Y130.00-20($1.4bln), Y134.00($537mln)

- AUD/USD: $0.6600(A$1.2bln), $0.6900(A$2.1bln)

- GBP/USD: $1.2600(Gbp615mln)

- USD/CAD: C$1.3600($747mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/04/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/04/2023 | 0630/0830 | ** |  | CH | retail sales |

| 28/04/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 28/04/2023 | 0645/0845 | ** |  | FR | PPI |

| 28/04/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 28/04/2023 | 0700/0900 | *** |  | ES | GDP (p) |

| 28/04/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/04/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 28/04/2023 | 0800/1000 | *** |  | IT | GDP (p) |

| 28/04/2023 | 0800/1000 | *** |  | DE | GDP (p) |

| 28/04/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/04/2023 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 28/04/2023 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 28/04/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/04/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/04/2023 | - |  | EU | ECB Lagarde at Post-Eurogroup Meeting Press Conference | |

| 28/04/2023 | - |  | EU | ECB Lagarde, Panetta, de Guindos at Eurogroup / ECOFIN Meeting | |

| 28/04/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/04/2023 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/04/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/04/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 28/04/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/04/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.