-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Central Bank Speak Sets The Tone Into Weekend

EXECUTIVE SUMMARY

- BULLARD SEES ‘CONTINUED’ HIKES TO LOCK IN DISINFLATION (MNI)

- ECB’S STOURNARAS SAYS MARCH FORECASTS SHOULD DECIDE NEXT HIKES (BBG)

- BANK OF ENGLAND’S TOP ECONOMIST SIGNALS PACE OF RATE HIKES MAY SLOW (BBG)

- SUNAK IN BELFAST FOR NORTHERN IRELAND PROTOCOL TALKS WITH STORMONT LEADERS (BBC)

- BIDEN INTENDS TO SPEAK WITH XI TO DEFUSE TENSIONS OVER BALLOON (BBG)

- CHINA REGULATORS QUERYING BANKS ON MORTGAGE PREPAYMENT STRAIN (BBG)

- RBA'S LOWE SAYS RATE CUTS IN 2024 ARE 'PLAUSIBLE' (MNI)

- PBOC MAKES RECORD NET DAILY INJECTION VIA OMOS

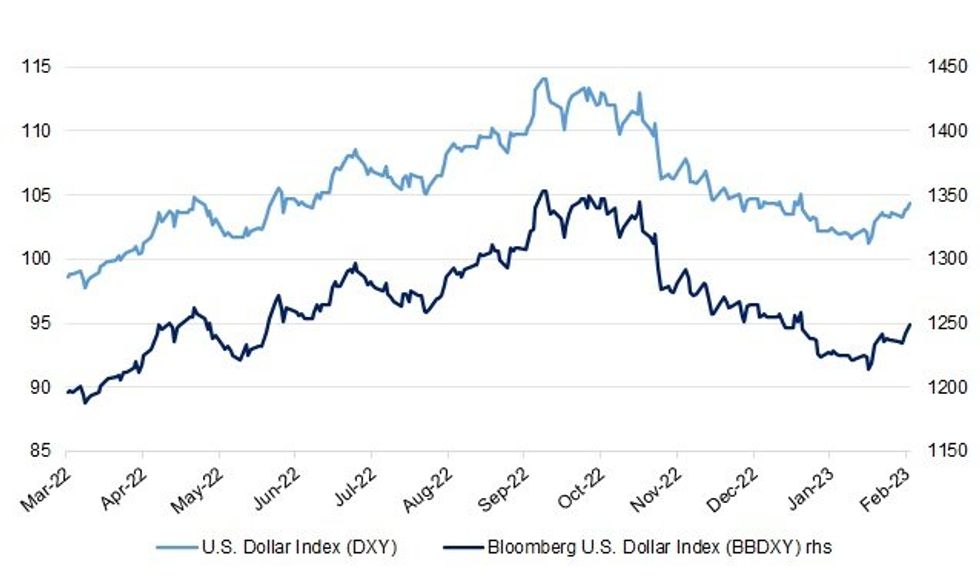

Fig. 1: U.S. Dollar Index (DXY) & Bloomberg U.S. Dollar Index (BBDXY)

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England Chief Economist Huw Pill signaled policy makers are ready to reduce the speed of their interest rate increases, saying there’s a risk of “overtightening” if the pace over the past few months is maintained. (BBG)

BREXIT: Prime Minister Rishi Sunak is in Belfast to meet local political parties amid speculation a deal on the Northern Ireland Protocol could soon be struck. Sources suggest a deal could be reached as early as next week on the region's post-Brexit trading arrangements. (BBC)

BREXIT: Northern Ireland's Democratic Unionist Party, whose support is seen as crucial for any deal between Britain and the European Union on the Northern Ireland protocol, has not yet seen details of any possible compromise, a senior member said on Thursday. (RTRS)

SCOTLAND: Candidates are expected to formerly enter the race to replace Nicola Sturgeon as leader of the SNP and first minister today - after the timeline for the contest was unveiled last night. (Sky)

EUROPE

ECB: Updated economic projections due in March should determine the size of the European Central Bank’s interest-rate increase that month, according to Governing Council member Yannis Stournaras. (BBG)

FRANCE: French unions held another day of strikes and protests on Thursday in a fresh test of opposition to President Emmanuel Macron’s plan to raise the retirement age ahead of a two-week pause during the school holidays. (BBG)

ITALY: Italy’s government approved a streamlining of how it will spend billions of European Union funds, the first move by Premier Giorgia Meloni to seek more flexibility on how to use the pandemic recovery money. (BBG)

NORWAY: Norway's central bank governor on Thursday said the economy was "operating above potential" and that there should be no doubt that Norges Bank will bring down soaring consumer price inflation, which is running at its highest level in decades. (RTRS)

RATINGS: Sovereign credit rating reviews of note scheduled for after hours on Friday include:

- Fitch on Finland (current rating: AA+; Outlook Stable) & Slovakia (current rating: A; Outlook Negative)

- Moody’s on Switzerland (current rating: Aaa; Outlook Stable)

- S&P on Estonia (current rating: AA-; Outlook Negative) & Poland (current rating: A-; Outlook Stable)

- DBRs Morningstar On Spain (current rating: A, Stable Trend)

U.S.

FED: The Federal Reserve should keep raising interest rates to ensure the recent disinflationary trend continues and inflation expectations remain well anchored, St. Louis Fed President James Bullard said Thursday. (MNI)

FED: U.S. shelter inflation could jump by nearly as much as 6% in 2023, Boston Fed economists wrote in a paper published Thursday, adding that even under optimistic assumptions of low market-rent growth CPI shelter will raise inflation considerably in the year. (MNI)

POLITICS: Joe Biden’s doctor says he is “healthy” and “vigorous” following a routine physical Thursday that comes as the oldest ever US president eyes a widely expected 2024 reelection bid, where he will face scrutiny over his fitness. (BBG)

EQUITIES: Retail traders are pushing a record amount of cash into stocks, ignoring Wall Street’s alarms and helping to buoy a market that’s on edge. (BBG)

EQUITIES: Apple – which thus far avoided the mass layoffs that have claimed tens of thousands of workers at Amazon, Google, Meta and Microsoft – has quietly begun axing contractors, On The Money has learned. (New York Post)

OTHER

U.S./CHINA: The panel reviewing TikTok’s national security risks is facing heightened pressure to wrap up its investigation of the popular video-sharing app and impose strict restrictions on whether and how the company can continue to operate in the U.S. (CNBC)

U.S./CHINA: President Joe Biden sought to ease public concerns about a spate of aerial objects over the US in recent weeks, saying he intends to speak with President Xi Jinping of China to defuse tensions over the military downing of an alleged Chinese spy balloon. (BBG)

U.S./CHINA: China’s “unreliable entity list” targets very few illegal foreign entities and the scope of use won’t be expanded at will, China’s Commerce Ministry says in a statement after sanctions on two US companies. (BBG)

U.S./CHINA/TAIWAN:The Pentagon’s top China official is to visit Taiwan in the coming days, a rare trip to the island by a senior US defence policymaker that comes as relations between Washington and Beijing are mired in crisis over a suspected Chinese spy balloon shot down two weeks ago. (FT)

BOJ: Japan's government picked academic Kazuo Ueda as new central bank governor on expectations he can help keep inflation on target and sustain economic and wage growth, finance minister Shunichi Suzuki said on Friday. (RTRS)

BOJ: Bank of Japan watchers are quickly reassessing the path of monetary policy following Prime Minister Fumio Kishida’s surprise choice for the top job at the central bank, a Bloomberg survey shows. (BBG)

BOJ: The Bank of Japan said on Friday it will launch a pilot program of a central bank digital currency in April. (MNI)

RBA: Reserve Bank of Australia Governor Philip Lowe said it was "plausible" that rates could be cut in 2024 but that would require signs that inflation was on track to return to target, he told a House of Representatives economics committee on Friday. (MNI)

RBA: Reserve Bank of Australia Governor Philip Lowe responded to criticism of his closed-door meeting at investment bank Barrenjoey by pledging to avoid events at the firm “for quite some time.” (BBG)

NEW ZEALAND: The country should not expect many “lollies” in the 2023 Government Budget, Finance Minister Grant Robertson says. “This isn’t a Budget where people should expect to see huge sums of money thrown around,” he told the Auckland Business Chamber annual economic update lunch on Friday. (Stuff NZ)

RBNZ: New Zealand's central bank will scale down its tightening campaign only slightly with a half-point interest rate hike to 4.75% on Wednesday as inflation is still running at a near three-decade high, a Reuters poll of economists found. (RTRS)

SOUTH KOREA: South Korea’s financial regulator vowed to revamp schemes for bonuses and interest rates on loans at banks as well as to spur more competition in the industry. (BBG)

NORTH KOREA: North Korea threatened on Friday to take "unprecedentedly constant, strong responses" if South Korea and the United States press ahead with planned military drills, accusing the allies of raising tensions in the region. (RTRS)

BOC: Bank of Canada Governor Tiff Macklem, speaking for the first time since the report on January’s job blowout came out last week, said on Thursday that the economy remains overheated and continued to leave the door open to higher interest rates. (RTRS)

BOC: Bank of Canada Deputy Governor Paul Beaudry on Thursday said it will take time to pull inflation all the way back to the 2% target after the strongest interest-rate hikes in decades and warned about complacency around finishing the job. (MNI)

MEXICO: The Bank of Mexico's monetary tightening cycle is nearing its end and could see nominal interest rates top out between 11.25% and 11.75%, at which point rates would be kept steady to allow them to take effect, deputy bank governor Jonathan Heath said. (RTRS)

BRAZIL: Brazil's National Monetary Council (CMN), the country's top economic policy body, announced no new resolutions regarding its inflation targets at a monthly meeting on Thursday. (RTRS)

BRAZIL: President Luiz Inacio Lula da Silva toned down his criticism of Brazil’s central bank chief in an interview Thursday, in another sign that their frosty relationship is starting to thaw. (BBG)

RUSSIA: The European Commission has abandoned plans to sanction Russia's nuclear sector or its representatives in its next sanctions package, three diplomats told POLITICO on Thursday. (POLITICO)

RUSSIA: Germany plans to change its Energy Security Act to allow a quick sale of Russian energy group Rosneft's stake in the Schwedt refinery without the need for prior nationalisation, a draft law showed, as Berlin strives to stabilise a key energy supplier. (RTRS)

WORLD BANK: The World Bank, under pressure to do more to help poor countries grapple with climate change, is considering taking on more risk to free up $4 billion in additional lending capacity each year, World Bank President David Malpass told Reuters on Thursday. (RTRS)

MARKETS: Commodity Futures Trading Commission said it will postpone the weekly Commitments of Traders report that normally would have been published on Feb. 17. Intends to resume publishing the report as early as Feb. 24. (BBG)

METALS: Vale SA, the world’s No. 2 iron ore supplier, missed earnings estimates in the fourth quarter as higher costs added to a dip in revenue. Vale produced less of the steel-making ingredient than expected last quarter on rain disruptions and licensing delays in northern Brazil, but the impact was cushioned by an quarter-on-quarter up-tick in prices. On a net basis, profit fell less than expected. (BBG)

OIL: Russian oil companies expect to maintain the current volume of crude exports, despite the government’s plan to reduce production by 500,000 bpd in March, Vedomosti reports, citing three unidentified people familiar with plans. (BBG)

OIL: Saudi Energy Minister Prince Abdulaziz bin Salman said the current OPEC+ deal on oil output will continue until the end of the year, Ashrq TV reported on Thursday citing comments by the prince published on Energy Aspects' website. The minister also said the oil group can't increase output based on initial signals about demand only, the report added. (RTRS)

OIL: A US Treasury official pushed back against speculation that Russia — confronted by a set of price caps and sanctions that seek to limit its oil revenue — could be quietly earning more than reported data suggest. (BBG)

CHINA

PBOC: China’s loan prime rate is expected to remain unchanged this month as credit continues to expand amid a robust economic rebound, though the key reference rates could be lowered if the recovery falters, economists and advisers said. (MNI)

POLICY: China is poised to name regulatory veterans known for their strict campaigns against financial wrongdoing as new chiefs of the country’s banking and securities watchdogs, according to a person familiar with the matter. (BBG)

BANKS/PROPERTY: Banks are encouraged to adjust down payment ratios, interest rates, and their tolerance of non-performing loans to support the logistics industry during the economic recovery, according to a circular posted on the PBOC website. (MNI)

BANKS/PROPERTY: China’s regulators are checking on how the nation’s major lenders are coping with the pressure from a wave of mortgage prepayments as homeowners take advantage of falling interest rates to reduce debt. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY632 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) conducted CNY835 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY632 billion after offsetting the maturity of CNY203 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1140% at 9:24 am local time from the close of 2.1285% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 63 on Thursday, compared with the close of 44 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8659 FRI VS 6.8519 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8659 on Friday, compared with 6.8519 set on Thursday.

MARKETS

US TSYS: Cheaper In Asia As Thursday's Forces Spill Over

TYH3 deals at 111-17+, -0-11, a touch off the base of its 0-08 range on volume of 128K.

- Cash Tsys sit ~2-3bps richer across the major benchmarks.

- Tsys were cheaper in early Asian dealing as local participants yesterday’s stronger than expected PPI data and Fedspeak.

- Sell side calls from Goldman Sachs and Bank of America, with both now looking for a terminal Fed Funds target range of 5.25-5.50%, also weighed on the space.

- The weakness extended a touch with 5-10 year zone printing fresh year to date peaks in yield terms.

- Highlight flow-wise was TY block sellers (-3K & -2.25K) with a TU block seller also noted (-1.6K).

- The USD erased its 2023 losses, aided by the move in Tsy yields, BBDXY is ~0.4% firmer.

- In Europe today we have PPI from Germany and French CPI. Further out US terms of trade and Fedspeak from Richmond Fed President Barkin and Fed Gov Bowman will cross.

JGBS: Off Cheaps As We Wind Into The Weekend

Weakness in core global FI markets biased JGB futures a touch cheaper ahead of the weekend, although the contract stuck to a contained range and recovered from session lows, sitting -9 ahead of the closing bell.

- Yesterday’s after-hours tweak to BoJ fees for borrowing three on-the-run 10-Year JGBs (making shorting those lines more expensive) probably provided some counter t the cheapening (albeit not as forceful as some believed may be seen).

- Cash JGBs run 1.5bp cheaper to 1.5bp richer, with a lack of uniform direction noted.

- Swap rates are 0.5-1.5bp higher, meaning swap spreads are biased a little wider on the day.

- Local headline flow remains limited, with focus squarely on the BoJ leadership plans and related knock-on impact on monetary policy.

- BoJ speculation continues to dominate after the recent Bank leadership nominations from the government, with the latest BBG survey seeing 70% of the respondents looking for a tightening move by the end of July (up from the 54% in last month’s survey).

- We also saw Finance Minister Suzuki reaffirm the government perception re: Ueda’s suitability to head up the Bank, with his communication skills once again highlighted.

- The latest batch of BoJ Rinban operations headline on Monday.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y5.12514tn 3-Month Bills:

- Average Yield -0.1526% (prev. -0.1649%)

- Average Price 100.0410 (prev. 100.0443)

- High Yield: -0.1358% (prev. -0.1545%)

- Low Price 100.0365 (prev. 100.0415)

- % Allotted At High Yield: 58.4803% (prev. 0.5526%)

- Bid/Cover: 3.225x (prev. 3.007x)

AUSSIE BONDS: Weakness Develops In Afternoon

Weakness developed in the afternoon after a contained two-way start, with YM -4.0 and XM -6.0 at the close. Weaker Asian trading for U.S. Tsys was the dominant driver, with RBA Governor Lowe’s testimony generally viewed as having covered familiar ground. Lowe did however conclude the Q&A session by suggesting it was plausible that rate cuts could be in play in ’24, although noted that a lot “has to go right” for that to be realised.

- Cash ACGB yields were 5-9bp higher across the curve, steepening. The AU-US 10-year cash bond yield differential narrowed to -6bp.

- Swaps generally tracked bonds with rates 6-8bp higher.

- Morning resilience in Bills gave way to weakness with the strip 3-5bp weaker, led by the reds.

- March meeting RBA-dated OIS continues to show an 88% chance of a 25bp hike. Terminal rate expectations firmed by 5bp to ~4.17%.

- The AOFM successfully sold A$500mn of the 4.25% April 2026 ACGB with a cover ratio over 4.00x and very firm pricing, while outlining a two ACGB auction schedule for next week, covering the familiar A$1.5bn in issuance.

- Looking ahead, the highlights for next week’s calendar will be Wednesday’s release of Q4 WPI, with the latest RBNZ decision due on the same day.

AUSSIE BONDS: ACGB Apr-26 Auction Results

The Australian Office of Financial Management (AOFM) sells A$500mn of the 4.25% 21 April 2026 Bond, issue #TB142:

- Average Yield: 3.4550% (prev. 2.0959%)

- High Yield: 3.4600% (prev. 2.1000%)

- Bid/Cover: 4.2200x (prev. 2.6000x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 6.6% (prev. 7.2%)

- Bidders 35 (prev. 34), successful 11 (prev. 16), allocated in full 6 (prev. 9)

- The time elapsed since the previous auction (which took place in Mar ’22) means that the previous metrics do not provide much comparable use.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 22 February it plans to sell A$900mn of the 3.75% 21 May 2034 Bond.

- On Thursday 23 February it plans to sell A$1.0bn of the 26 May 2023 Note, A$1.0bn of the 21 July 2023 Note & A$500mn of the 11 August 2023 Note.

- On Friday 24 February it plans to sell A$600mn of the 2.75% 21 November 2029 Bond.

EQUITIES: Weaker As Cross Asset Headwinds Weigh

Regional equities are on the back foot to end the week. Cross asset headwinds are evident, with a firmer UST cash Tsy yield backdrop (1.9-2.7bps higher across the curve), boosting the USD and weighing on broader risk appetite in the equity space. US futures are also tracking lower (-0.48% for Eminis, -0.65% for the Nasdaq).

- The HSI is off by 0.75% at this stage, with the underlying tech index down 2%, unwinding all of yesterday's bounce. Both indices are tracking lower for the week, the third straight week of losses, albeit down from the prior two weeks.

- China equities are also lower, the CSI 300 off by 0.50% at this stage. Some other China related assets (such as iron ore) have firmed post a large liquidity injection today, amid hopes of further efforts to boost the growth backdrop. This hasn't materially boosted the equity space though. US-China relations are also likely to remain a focus point.

- The Nikkei 225 is off by 0.75%, the Kospi -1.00% and Taiex -0.50%, as tech related sentiment suffers amidst the push higher in core yields.

- Other SEA markets are mostly lower, with only the Singapore index managing to post a gain at this stage.

GOLD: Fresh Lows Back To Early January Amid Continued USD Rebound

Gold continues to trend lower. The precious metal is back to early Jan lows, last around $1826.25. This is off a further 0.55% so far today, while for the week we are tracking 2.1% lower. To date in February we have lost around 5.25%. Gold hasn't enjoyed the USD/yield resurgence.

- From a technical standpoint, the 100-day EMA sits near $1818, while further below is the 200-day close to $1802.

- The inverse correlation with the USD index remains, although visually gold losses are still tracking ahead of USD gains at this stage.

- Gold ETF holdings continue to drift lower.

OIL: Tracking Lower For The Week, But Respecting Recent Ranges

Brent crude has remained on the back foot through the session, in line with a firmer USD backdrop and risk aversion in the equity space. We last tracked around the $84.25/30bbl level, down close to 1% for the session so far. At this stage we are tracking 2.37% lower for the week. Overall, though Brent remains within well established ranges. WTI is last under $78/bbl, off by a similar amount to Brent today.

- The combination of the more hawkish Fed backdrop and rising inventory levels in the US have helped soften the oil backdrop in the past week. Headlines also crossed earlier that Russia will keep March export volumes.

- Still, optimism remains around the China outlook, with other commodities such as iron ore and copper looking better through the tail end of this week. Prompt spreads are also not too far off recent highs, suggesting some degree of tightness in terms of supply.

- Looking ahead, next week is fairly quiet in terms of oil specific event risks, other than the usual weekly inventory reports.

FOREX: Greenback Erases 2023 Losses, As Softer Equities Hurt Risk Appetite

Softer US equity futures and regional equities have pressured risk appetite in Asia. BBDXY is firmer and has erased its 2023 year to date losses.

- AUD/USD is ~0.5% lower, last printing $0.6840/45. The pair has tested short term resistance at $0.6840, yesterday's low, bears next target is $0.6781 38.2% retracement of Oct-Feb downleg. A lack of fresh hawkish surprises from Gov Lowe at a parliamentary committee weighed at the margins. AUD has looked through stronger Iron Ore futures which are up ~0.7% as PBoC pumps record amounts of cash into the economy sparking optimism over the recovery. Other China assets are less positive though, with equities tracking lower (CSI 300 off 0.50%).

- NZD/USD is down ~0.5%, last printing at $0.6220/25. Finance Minister Robertson spoke, noting that there may be initial inflationary pressure from cyclone Gabrielle however the rebuilding may boost H2 GDP. He also said that there is evidence inflation has peaked.

- Yen continues to weaken, USD/JPY is up ~0.6%. US yield momentum continues to point to further upside in the pair. USD/JPY last printed at ¥134.70/80, and is currently testing its 100-Day EMA (¥134.77).

- Broad based USD strength has weighed on CHF, EUR and GBP, which are down ~0.4%.

- Cross asset wise; S&P500 futures are ~0.4% lower and the Hang Seng is down ~0.6%. BBDXY is up ~0.4% and 10 Year US Treasury Yields are ~2bps firmer.

- In Europe today we have PPI from Germany and French CPI. Further out US terms of trade and Fedspeak from Richmond Fed President Barkin and Fed Gov Bowman will cross.

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Feb17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E1.4bln), $1.0665-80(E2.0bln), $1.0695-00(E623mln), $1.0710-20(E542mln), $1.0795-05(E1.1bln), $1.0850-55(E1.4bln)

- USD/JPY: Y133.50($1.9bln), Y134.30-40($1.2bln), Y135.00($3.5bln)

- EUR/JPY: Y142.25(951mln), Y147.00(E1.1bln)

- GBP/USD: $1.2000-20(Gbp692mln), $1.2110-25(Gbp571mln)$1.2400-15(Gbp1.4bln)

- AUD/USD: $0.6800(A$784mln), $0.6870-75($625mln), $0.7000(A$1.2bln), $0.7100(A1.2bln)

- USD/CAD: C$1.3500($651mln)

- USD/CNY: Cny6.7400($1.7bln), Cny6.7590($1.4bln), Cny6.8500($1.1bln), Cny6.8670($1.3bln), Cny7.0000($2.0bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/02/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 17/02/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 17/02/2023 | 0700/0800 | ** |  | DE | PPI |

| 17/02/2023 | 0745/0845 | *** |  | FR | HICP (f) |

| 17/02/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 17/02/2023 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/02/2023 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 17/02/2023 | 1330/0830 |  | US | Richmond Fed's Tom Barkin | |

| 17/02/2023 | 1445/0945 |  | US | Fed Governor Michelle Bowman | |

| 17/02/2023 | 1500/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.