-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI BRIEF: China Passenger Car Sales Up In November Y/Y

MNI EUROPEAN OPEN: China 5yr LPR Down By 25bps, But Risk Appetite Unmoved

EXECUTIVE SUMMARY

- HOUTHI STRIKES FORCE CREW TO ABANDON SHIP FOR FIRST TIME - BBG

- US PUSHES FOR UN TO SUPPORT TEMPORARY GAZA CEASEFIRE, OPPOSE RAFAH ASSAULT - RTRS

- CHINA'S FEB FIVE-YEAR LOAN PRIME RATE DOWN BY 25BPS - MNI BRIEF

- IRON ORE SLUMPS TO THREE-MONTH LOW AS CHINA CONCERNS ESCALATE - BBG

- RBA BOARD STRESSES FUTURE HIKE RISK - MINUTES - MNI BRIEF

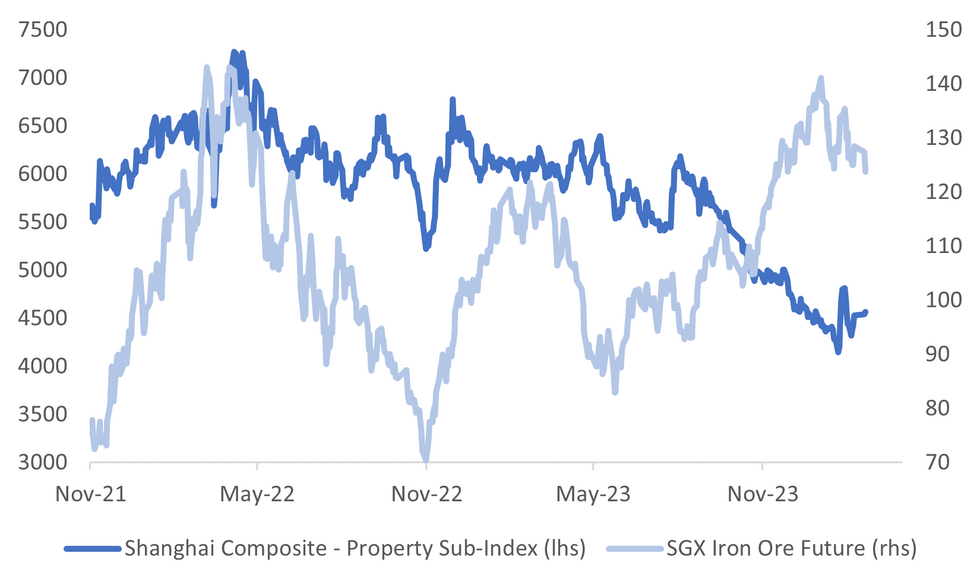

Fig. 1: Iron Ore Prices & Shanghai Composite Property Sub Index

Source: MNI - Market News/Bloomberg

EUROPE

FISCAL (MNI BRIEF): The EU’s new fiscal regime may prove credit negative, Scope Ratings says in a report out Monday, as it only partially meets the EU’s initial objective of creating a simple, flexible and credible framework better than the existing regime.

FRANCE (MNI): A draft paper prepared by European Union finance officials with support from countries including France proposes a joint eurozone retail bond or a similar market-based savings product as part of a package aimed at injecting new momentum into plans for Capital Markets Union, with other proposals including an overhaul of market supervision, easing obstacles to stock market consolidation and further convergence of listing requirements.

GERMANY (BBG): Bayer AG plans to slash its dividend by 95% in an effort to dig itself out of a hole created by the acquisition of Monsanto Co. that saddled the German company with massive debt and waves of litigation.

RUSSIA (ECONOMIST): As part of the 12th round, the bloc will implement stricter rules on Russian oil and petroleum products beginning Tuesday. Europe’s 13th wave of sanctions, which is expected to come ahead of the second anniversary of the war in Ukraine, reportedly proposes punishing some Indian and Chinese firms that have contributed to Russia's defence sector.

RUSSIA (POLITICO): The EU will impose new sanctions on Russia following the death of opposition leader Alexei Navalny, the EU’s High Representative Josep Borrell said Monday.

U.S.

CORPORATE (BBG): Capital One Financial Corp. agreed to buy credit-card lender Discover Financial Services in a $35 billion all-stock deal to create the largest US credit card company by loan volume.

FISCAL (BBG): President Joe Biden said he would be willing to meet House Speaker Mike Johnson to discuss an emergency funding package for Ukraine and Israel, after White House officials previously dismissed the utility of direct talks.

OTHER

MIDEAST (RTRS): The United States has proposed a rival draft United Nations Security Council resolution calling for a temporary ceasefire in the Israel-Hamas war and opposing a major ground offensive by its ally Israel in Rafah, according to the text seen by Reuters.

MIDEAST (BBG): The crew of a commercial ship in the Red Sea abandoned the vessel following a Houthi attack — the first such evacuation since the militant group began menacing trade in the vital waterway late last year.

AUSTRALIA (MNI BRIEF): The Reserve Bank of Australia board aimed to stress the risk of further cash rate hikes due to high uncertainty over returning inflation to its 2-3% target band at the Feb 6 meeting, the published minutes showed Tuesday.

NEW ZEALAND (BBG): New Zealand’s economic slowdown continued into early 2024, the Treasury Dept. says in Fortnightly Economic Update published Tuesday in Wellington.

CHINA

POLICY (MNI BRIEF): China's five-year Loan Prime Rate fell by 25bp on Tuesday according to a People's Bank of China statement, following the central bank’s previous moves to reduce lenders’ funding cost.

TECH (BBG): China’s ruling Communist Party will play a bigger role in steering its vast technology industry, the latest sign that Beijing intends to exert more influence over swathes of the world’s No. 2 economy.

MARKETS (YICAI): The China Securities Regulatory Commission said it will strictly control IPO access, strengthen firm supervision and quality, and increase investment returns at a recent symposium. CSRC head Wu Qing held in-depth discussions with industry representatives regarding the promotion of high-quality development in the capital market, with a focus on promoting long-term funds and boosting investment value.

LAND REFORM (YICAI): China needs to reform its land management system to more efficiently connect with macro policy and regional development, according to President Xi. Chairing a meeting of the Central Committee for Comprehensive Deepening Reforms, Xi called for improvements to land allocation accuracy, utilisation efficiency, and orderly land development.

COMMODITIES (BBG): Iron ore slumped to a three-month low despite extra support for China’s housing market as investors fretted that steel demand wouldn’t stage a strong recovery after the Lunar New Year break.

CHINA MARKETS

MNI: PBOC Drains Net CNY298 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY41 billion via 7-day reverse repo and on Tuesday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net drain of CNY298 billion reverse repos after offsetting CNY339 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7853% at 09:58 am local time from the close of 1.7855% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 41 on Monday, the same as the close on the previous day. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1068 on Tuesday, compared with 7.1032 set on Monday. The fixing was estimated at 7.1979 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA FEB. CONSUMER CONFIDENCE RISES TO 101.9; PRIOR 101.6

SOUTH KOREA FEB. BOK CONSUMERS' 12-MTH MEDIAN INFLATION EXPECTATION AT 3.0%; PRIOR 3.0%

SOUTH KOREA 4Q HOUSEHOLD CREDIT RISES TO KRW1,886.4T; PRIOR KRW1,878.3T

TOKYO JAN. CONDOMINIUMS PUT UP FOR SALE RISE 56.6% Y/Y; PRIOR +3.8% Y/Y

MARKETS

US TSYS: Treasury Futures Erase Early Moves To Trade Unchanged

TYH4 is currently trading at 109-24, unchanged from New York closing levels.

Treasury futures have traded in a very tight range today, with little in the way of market headlines, as we await the US to come back from President's Day

- Mar'24 10Y futures have been trading in a tight range in Asia, with lows of 109-17, and highs of 109-24 where we currently trade heading into the Asia break.

- Cash yields opened with the curves 1-4bps higher this morning, and as the day as progress we have reversed most of that move to trade just 0-2bps higher in yield terms. The 2Y yield is unchanged today at 4.642%, the 10Y is +1.6bps higher at 4.395% while the 2y10y is +1.574 at -34.879

- Looking ahead later today, Philadelphia Fed Non-Manufacturing Activity & Leading Index Data is due out.

JGBS: Twist-Flattened After 20Y Supply Goes Well

JGB futures have weakened and are currently trading near the mid-range of today’s session, -4 from settlement levels. With a light domestic calendar, local participants were primarily focused in the morning session on a Reuters report suggesting the BoJ’s consideration to end negative interest rates in the upcoming months, despite the country's recession, as well as the resumption of trading for cash US tsys after yesterday’s holiday. In the afternoon session, attention shifted to the results of today’s 20-year supply.

- 20-year supply displayed strong demand metrics. The low price beat dealer expectations, the cover ratio increased to 3.852x from 3.126x at last month’s auction and the auction tail shortened materially.

- After the lunch break, JGB futures exhibited a notable uptick, reaching new session lows, and the 20-year JGB witnessed a 3bps richening in post-auction trading. Although JGB futures retraced some of their initial gains, the 20-year bond sustained its rally.

- Cash US tsys are dealing flat 2bps cheaper in today’s Asia-Pac session.

- Cash JGBs have twist-flattened, pivoting at the 7s, with yields 0.6bp higher to 3.4bps lower (20-year). The 20-year yield is currently 1.482% versus this morning’s high of 1.528%.

- The swaps curve has bull-flattened.

- Tomorrow, the local calendar sees Trade Balance and Machine Tool Orders data, along with BoJ Rinban operations covering 1-10-year JGBs.

AUSSIE BONDS: Slightly Mixed, RBA Minutes Have Minimal Impact, Wages Data Tomorrow

ACGBs (YM +1.0 & XM -1.0) are mixed after the release of the RBA Minutes for the February meeting.

- The RBA Board discussed leaving rates at 4.35% and a 25bp increase but decided on the former as it best balanced its objectives of price stability and full employment.

- However, the tightening bias was retained given that inflation was still high and it would take time for it to feel confident inflation was returning to target.

- The Board is prepared to respond to the data, risks and changes in the outlook but the minutes suggest that for now, it is on hold.

- US tsys are dealing flat to 2bps cheaper in today’s Asia-PAC session.

- Cash ACGB movements are bounded by +/- 1bp, with the curve steeper.

- Swap rates are -1bp lower to 1bp higher.

- Bills strip pricing is flat to +2.

- RBA-dated OIS pricing is little changed across meetings.

- Tomorrow, the local calendar sees the Wage Price Index (WPI). The Q4 WPI is expected to rise 0.9% q/q with the annual rate rising to 4.1% y/y from 4.0% in Q3. The RBA said in its February meeting statement that the WPI “remains consistent with the inflation target” assuming productivity growth improves.

- Tomorrow, the AOFM plans to sell A$800mn of 3.75% Apr-37 bond.

NZGBS: Closed Strongly, PPI Data Tomorrow

NZGBs closed 1-2bps richer after trading in relatively narrow ranges in today’s session. With the domestic calendar empty, local participants appear to have been content to sit on the sidelines as cash US tsys resumed dealings after yesterday’s holiday. US tsys are dealing flat to 2bps cheaper in today’s Asia-PAC session, with a steepening bias in place.

- Swap rates closed 1-4bps richer, with the 2s10s curve flatter.

- Long-dated implied swap spreads are tighter, possibly aided by the NZDM's announcement of the launch of a new May 2054 bond. The scheduled February 22 bond auction has been cancelled. The NZDM expects to issue at least NZ$2bn of the new bond via syndication, with a cap of NZ$4bn. Pricing will be on February 21, with guidance at -1 to +6 over May 2051 yield.

- RBNZ dated OIS pricing closed 1-3bps firmer across meetings. A cumulative 39bps of easing is priced by year-end.

- NZ’s economic slowdown continued into early 2024, the NZ Treasury said in Fortnightly Economic Update. “In an economy buffeted by big opposing forces, the downdraft from high-interest rates appears to be dominating the updrafts coming from net migration and still-strong employment and wage growth”

- Tomorrow, the local calendar will see PPI data.

FOREX: USD Firms, But Off Best Levels

The USD index sits close to 1245 in recent dealings, up around 0.1% for the session so far, but down slightly from session highs (1245.60).

- Initial support for the USD was evident as US cash Tsys resumed trading after the long weekend. Yields opened higher, particularly at the back end. Still, we are away from highs in yield terms, with the 10yr last near 4.29%. This has like tempered US demand at the margins.

- US equity futures sit lower, off by around 0.30%, another potential USD support point. Regional equities have mostly tracked lower in Asia, although are away from lows. The larger than expected cut in China's 5yr LPR (-25bps to 3.95%) hasn't materially impacted sentiment.

- The RBA minutes stated the central bank considered a hike, but this only saw a modest recovery in AUD sentiment. AUD/USD sits near 0.6530 in latest dealings, -0.15% for the session. Iron ore prices have continued to correct lower.

- NZD/USD is off by a similar amount, last near 0.6140. The AUD/NZD cross is up from earlier lows at 1.0625, last near 1.0635.

- USD/JPY has firmed a touch, last near 150.30/35, but overall moves have been modest.

- Looking ahead, the BoE’s Bailey appears. There are also January Canadian CPI data and US Philly Fed non-manufacturing and leading indices.

CHINA/HONG KONG EQUITIES: Hong Kong and China Equities Lower As Market Concerns Persist

Hong Kong and China equities are lower today as we head in the lunch break, earlier Chinese banks cut the 5-year loan prime rate by 25bps to 3.95%, marking the most substantial reduction on record and surpassing expectations. However, concerns persist among investors that recent policy announcements and market headlines may not be sufficient to halt the sell-off in Chinese and Hong Kong equities that has occurred over the past few months.

- Hong Kong equities opened higher but swiftly erased gains, pushed lower by tech names with the HS Tech Index is down 1.20%, while the HSI is down 0.30%. Meanwhile, the Mainland Property Index, which initially opened 2% higher, now trades down 0.43%.

- Chinese equities face similar challenges, with the 5-year loan prime rate reduction offering limited support. CSI300 is down 0.18%, ChiNext is down 0.60%, and the CSI1000 is down 0.70%.

- China margin debt bounced by 1.1% on Monday as traders return from LNY, marking the biggest increase since Sept.

- China's Communist Party aims to have a bigger role in the technology sector, planning a refined mechanism for top decision-makers on the Central Committee to steer technological work. This move signals Beijing's intent to exert more control, particularly in critical areas like semiconductors and artificial intelligence, amid a technological race with the US, causing concern among investors and experts about the potential impact on innovation.

ASIA PAC EQUITIES: Asia Equities Mixed Ahead of US Reopening

Asian Equities have a largely uneventful day, with most regions trading lower.- Japan Equities are lower today, as the Nikkei 225 comes ever so close to making new all-time highs down 0.22% today, while the Topix trades 0.34% lower. There has been little in the way of market news for Japan today, other than Tokyo Condominiums for sale data coming in at 56.6% from 3.8% prior.

- Taiwan equities are the outperformer in the region today, led by the semiconductor sector as TSMC contributed most of the gains up 1.18%. Currently the Taiex is 0.52% higher. While Monday saw the highest net selling of Taiwan Equities by foreign investors for a month with -$477m of outflows.

- South Korea is the worst performer in the region today as foreign buying of SK stocks lose momentum, the 5-day moving average of net foreign inflows decreased to $133.8m, falling below the 20-day average of $297.7m with -$58m of outflows occuring today. Currently the Kospi is down 1.23%.

- Australian Equities are lower today, as weakness in the mining and energy space weigh on the market. In other news ANZ were able to overturn the block to buy Suncorp, pathing the way for the purchase to go ahead, Suncorp equity up 5.79%, while ANZ stock trades 2.4% lower. The ASX 200 currently trades 0.10% lower for the day.

- Elsewhere in SEA, Indonesian, Philippines & Malaysian equities are up 0.50-0.70%, while New Zealand Equities are 0.70% lower.

OIL: Crude Little Changed, Talk Of Further Sanctions On Russia

Oil prices are currently little changed during today’s APAC session but are off their intraday lows. Weak supply-demand fundamentals continue to be offset by geopolitical tensions and threats to Red Sea shipping. Brent is down 0.1% to $83.46/bbl after falling to $83.23 early in trading and WTI is also 0.1% lower at $78.36 rising from $78.02. The USD index is 0.1% higher.

- OPEC quota compliance has been lax and Iraq has said that it will try and improve after it has done a review of its estimated output. OPEC+ meets in early March to decide if it will extend production cuts into Q2.

- Sanctions on Russia are in focus again and stricter measures are expected from the EU on its oil and gas, including against Indian and Chinese firms that have contributed to Russia’s defence industry. The US is also looking at improving enforcement. The death on the weekend of opposition leader Navalny and Ukraine’s loss of Avdiivka have put pressure on NATO countries to increase sanctions.

- G7 transport ministers are going to hold an online meeting to discuss the situation in the Red Sea.

- US inventory data has been volatile since a cold snap disrupted oil output and refining. Data for the latest week is released by API later today.

- Later the BoE’s Bailey appears. There are also January Canadian CPI data and US Philly Fed non-manufacturing and leading indices.

GOLD: Slightly Higher On Light Volumes

Gold is unchanged in the Asia-Pac session, after closing 0.2% higher at $2017.21 on Monday.

- Bullion’s nudge higher extended the recovery above the $2,000/oz mark and further ate into the US CPI-inspired decline on February 13.

- With the US out for the Presidents Day holiday, volumes were relatively subdued despite a boost from China’s reopening following a week-long break.

- The market’s focus is now likely tuned to the release of the Federal Reserve minutes of its recent meeting midweek.

- A handful of Fed speakers are also scheduled to speak this week. Among them, Minneapolis Fed chief Neel Kashkari will address economic trends and the outlook on Thursday.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/02/2024 | 0900/1000 | ** |  | EU | Current Account |

| 20/02/2024 | 1000/1100 | ** |  | EU | Construction Production |

| 20/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/02/2024 | 1015/1015 |  | UK | BOE's Bailey et al at TSC to discuss MPR | |

| 20/02/2024 | 1330/0830 | *** |  | CA | CPI |

| 20/02/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/02/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/02/2024 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.