-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Asset Volatility In Focus

EXECUTIVE SUMMARY

- BOE’S RAMSDEN: “FEBRILE” MARKETS WANT CLARITY ON UK FISCAL POLICY (FT)

- RISHI SUNAK TO TAKE OVER AS UK PRIME MINISTER THIS MORNING

- U.S. SAYS GOT NO UPDATE FROM TOKYO ON FX INTERVENTION, JAPAN SAYS IT’S IN COMMUNICATION WITH U.S.

- JAPAN’S FINMIN SUZUKI: BOJ EASING AND GOVT FX INTERVENTION NOT CONTRADICTORY (RTRS)

- PBOC RAISES CROSS-BORDER FUNDING MACRO-PRUDENTIAL PARAMETER (BBG)

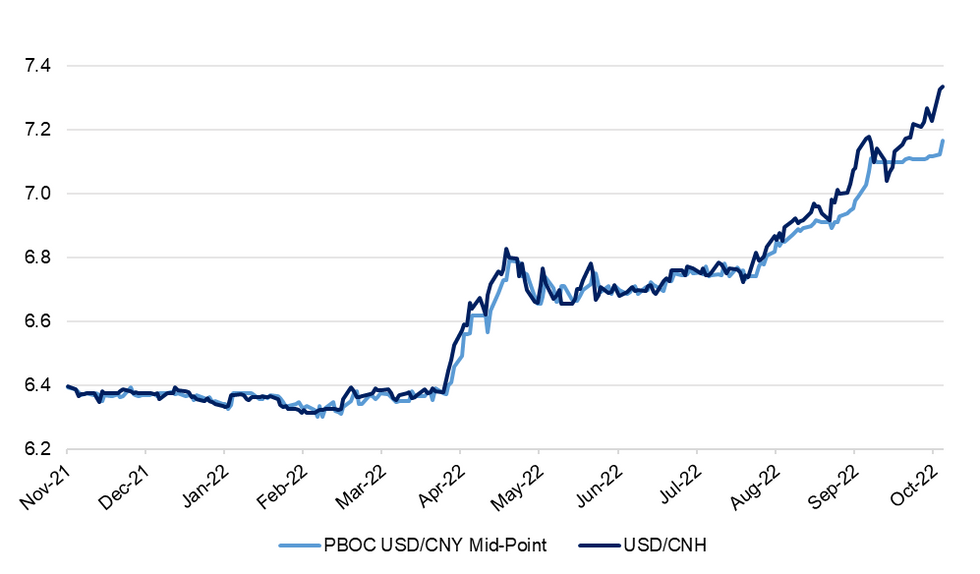

- PBOC SETS YUAN FIXING AT WEAKEST LEVEL SINCE 2008 (BBG)

- IEA: ASIA MAY SEE SIGNIFICANT RISE IN LNG PRICES NEXT YEAR (BBG)

Fig. 1: Mid-Point Of USD/CNY Permitted Trading Band vs. USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Markets remain “febrile” and the medium-term fiscal plan set for next Monday will be crucial for investor clarity over the UK’s fiscal policy and wider economic context, a senior Bank of England official warned on Monday. (FT)

POLITICS: Rishi Sunak will on Tuesday enter Downing Street as Britain’s youngest prime minister in modern times and its first non-white leader, with a vow to get to grips with the “profound economic challenge” facing the country. (FT)

POLITICS: The government has announced a timetable for Tuesday, where Rishi Sunak will travel to Buckingham Palace and meet King Charles. Sunak will meet the monarch after Liz Truss has chaired a final meeting of her cabinet at 9am, after which she will make a speech outside Downing Street. She will then go to Buckingham Palace for an audience with the King. (Guardian)

POLITICS: The Telegraph has been talking to insiders in Rishi Sunak’s campaign about the possible make-up of his Cabinet, a decision that could come as early as Tuesday. As one friend of Mr Sunak put it: “His primary driver will be competence. His second will be unity. His third will be rewards for allies. But if there is no room for rewards, so be it. He will want to be able to say of whoever is removed that they are superseded by someone who is demonstrably more capable, to make clear that the reshuffle is driven by merit.” (Telegraph)

NORTHERN IRELAND: In what could be his final act in office, Northern Ireland Secretary Chris Heaton-Harris announced he’s commissioning state-funded abortion services across the U.K. region – a step timed to show the Democratic Unionists what can happen when they sabotage local government. (POLITICO)

EUROPE

EU: European Union countries agreed on Monday to raise their target to curb greenhouse gas emissions under the Paris climate agreement next year, as the bloc attempts to rally ambition among major emitters ahead of this year's U.N. climate talks. (RTRS)

GERMANY: German President Frank-Walter Steinmeier arrived in Kyiv on Tuesday. It is Steinmeier's first trip to Ukraine since the Russian invasion on February 24. "My message to the Ukrainians is that we are not only standing by your side. We will continue to support Ukraine, economically, politically and also militarily," the president said after his arrival. (DW)

FRANCE: French President Emmanuel Macron’s centrist government survived two no-confidence votes Monday prompted by opposition lawmakers to protest the use of a special constitutional power to force the budget bill through the National Assembly without a vote. (France24)

HUNGARY: Hungary is ready to meet European Union conditions for unlocking aid even though it considers some of them to be “blackmail,” Prime Minister Viktor Orban said in an interview with German-language newspaper Budapester Zeitung published on Monday. (BBG)

UKRAINE: Germany and the EU will co-host a gathering Tuesday on how to rebuild Ukraine after Russia's aggression, but Kyiv shouldn't get its hopes up — the meeting is unlikely to deliver anything concrete. (POLITICO)

UKRAINE: Ukrainian President Volodymyr Zelensky on Monday criticized Israel and suggested that Russia will help Iran with its nuclear program in exchange for providing Moscow with drones and missiles for its war in Ukraine. (Axios)

UKRAINE: Defense Minister Benny Gantz spoke Monday with his Ukrainian counterpart Oleksii Reznikov in a call his office described as “positive,” despite tensions between the countries over Jerusalem’s refusal to provide Kyiv with defensive weaponry. (Times of Israel)

EQUITIES: Marlboro maker Philip Morris (PM.N) is set to gain EU antitrust approval for its $16 billion bid for Swedish Match after offering to sell the target's logistics business, people familiar with the matter said on Monday. (RTRS)

U.S.

POLITICS: President Joe Biden said on Monday he was optimistic about an eleventh-hour swing in Democrats’ favor, despite polls showing Republican candidates gaining momentum in a number of tight midterm races. (POLITICO)

POLITICS: A defiant Florida Gov. Ron DeSantis refused to commit to serving a full four-year term if reelected when pressed by his Democratic rival, Charlie Crist, at their only gubernatorial debate on Monday. (AP)

ECONOMY: The Biden administration is 'carefully monitoring financial risks' That was Treasury Secretary Janet Yellen, who warned Monday that the current economic backdrop is "dangerous and volatile," while stressing that the U.S. economy is "healthy" and the financial system "resilient" during a public appearance at a securities industry conference. (DJ)

EQUITIES: Reports that the United States was discussing launching a national security review of some of Elon Musk's ventures were "not true," said the White House on Monday. (RTRS)

OTHER

JAPAN: Japan's Finance Minister Shunichi Suzuki said on Tuesday there was no policy contradiction between the finance ministry's yen-buying to support the currency and the Bank of Japan printing money to sustain its ultra-loose monetary policy. (RTRS)

JAPAN: Treasury Secretary Janet Yellen declined to comment on reports that the Japanese government is again intervening in currency markets, saying the US government hadn’t received any notice from Tokyo about such a move. (BBG)

JAPAN: Japanese Prime Minister Fumio Kishida on Tuesday named former health minister Shigeyuki Goto as economic revitalization minister, replacing Daishiro Yamagiwa, who stepped down after facing a wave of criticism over his ties with the Unification Church. (Kyodo)

JAPAN: The resignation of Japanese economic revitalization minister Daishiro Yamagiwa on Monday raised concerns about a possible impact on the government's plans to put together a package of economic measures this week. (Jiji)

AUSTRALIA: Tuesday’s federal budget will show a $42 billion improvement to the bottom line over four years, but almost all of that saving will occur this financial year, before deficits start to blow out again as spending pressures grow. (AFR)

RBNZ: The era of low-to-negative "helpful" imported inflation may be coming to an end, Reserve Bank chief economist Paul Conway says. (interest.co.nz)

NEW ZEALAND: New Zealand’s Labour government has a record of raising the minimum wage each year, but has made no decisions yet on the 2023 adjustment, Deputy Prime Minister Grant Robertson told a news conference. (BBG)

SOUTH KOREA: President Yoon Suk-yeol called Tuesday for bipartisan cooperation to cope with threats from North Korea and economic difficulties as he explained his administration's first budget proposal in a parliamentary speech boycotted by the opposition party. (Yonhap)

BRAZIL: Brazil's leftist presidential candidate Luiz Inacio Lula da Silva has increased his lead slightly over his far-right adversary President Jair Bolsonaro ahead of Sunday's runoff election. (RTRS)

RUSSIA: A group of 30 House liberals is urging President Biden to dramatically shift his strategy on the Ukraine war and pursue direct negotiations with Russia, the first time prominent members of his own party have pushed him to change his approach to Ukraine. (Washington Post)

RUSSIA: Russian Foreign Minister Sergei Lavrov said on Monday that accusing Moscow of planning an attack with a radioactive "dirty bomb", as Ukrainian President Volodymyr Zelenskiy did on Sunday, was "not a serious conversation", the Interfax news agency reported. (RTRS)

RUSSIA: Russia’s defence ministry has “readied forces and capabilities” to deal with radioactive contamination following Moscow’s unsubstantiated and disputed claims that Ukraine is developing a “dirty bomb”. (FT)

RUSSIA: Western countries accused Russia on Monday of plotting to use a threat of a "dirty bomb" laced with nuclear material as a pretext for escalation in Ukraine, as Moscow evacuated civilians from a southern city in anticipation of a major battle. (RTRS)

RUSSIA: SAP will miss its deadline to exit Russia before the end of the year as the German software group has failed to find a buyer for the unit, five sources told Reuters, underscoring the difficulties some companies are facing to leave the country. (RTRS)

TURKEY: Turkey’s finance minister has defended Ankara’s economic ties with Russia as “good neighbourly relations” even as western governments raise concerns that the country is serving as a backdoor for Moscow to evade sanctions. (FT)

IRAN: Iran will not remain indifferent if it is proven that its drones are being used by Russia in the Ukraine war, the Iranian foreign minister said on Monday, amid allegations the Islamic Republic has supplied drones to Moscow to attack Ukraine. (RTRS)

GAS: Asia LNG prices might increase significantly next year amid growing demand in Europe, a potential rebound in China’s economy and limited additional supply, Fatih Birol, the executive director of the International Energy Agency, said in Singapore on Tuesday. (BBG)

GAS: A number of European Union nations are pushing for a price cap on natural gas used to generate power, but the bloc’s executive arm is warning that any such step would need to avoid boosting demand or subsidizing electricity to foreign consumers. (BBG)

GAS: European natural gas prices have dropped below €100 per megawatt hour for the first time since Russia slashed supplies this summer, with warm weather and close-to-full gas storage easing concerns over winter shortages. (FT)

CHINA

PBOC: China’s central bank adjusted rules to allow companies to borrow more from overseas, enabling more foreign capital inflows at a time when the currency is plunging to fresh 2008 lows against the dollar. (BBG)

ECONOMY: Both the central and local governments should seize the moment to further stabilise the economy, work together to achieve reasonable growth and strive for better results, Xinhua News Agency reported citing a State Council meeting chaired by Premier Li Keqiang. China should thoroughly implement pro-growth measures, focus on stabilising employment and prices, and ensure smooth transportation and logistics and stable energy supply, the meeting said. (MNI)

ECONOMY: China’s richest tycoons lost more than $35 billion in the market selloff that followed Xi Jinping’s tightening grip on the government. (BBG)

PROPERTY: China’s housing market has shown a weak recovery as the year-on-year decline in home sales from January to September narrowed, the 21st Century Business Herald reported. Transaction volumes are expected to increase month-on-month in Q4 as local governments keep loosening policy and developers continue with sales promotions, the newspaper said citing Chen Wenjing, head of market research at China Index Academy. Reducing the down-payment ratio, supporting the purchase of second homes, and relaxing restrictions on home purchase limits are required to support a further recovery, the newspaper said citing analysts. (MNI)

YUAN: The yuan may continue to fall until the end of the year as the U.S. Dollar Index is unlikely to retreat soon amid geopolitical turmoil, Yicai.com reported citing analysts. The People’s Bank of China is seeking to stabilise the currency by setting the central parity rate stronger, with traders saying the rate set by PBOC is over 1,000 points stronger than predicted by their models, Yicai said. Apart from the U.S. dollar, China’s exports are a key factor affecting the yuan. High-frequency data suggests exports may continue to slow in Q4, with container throughput at major ports falling by 9% in the first 10 days of October, the newspaper said citing Chang Jian, chief economist at Barclays China. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY228BN VIA OMOS TUESDAY

The People’s Bank of China (PBOC) on Tuesday injected CNY230 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY228 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to offset the impact of tax season and government bond issuance, and keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8229% at 9:27 am local time from the close of 1.7077% on Monday.

- The CFETS-NEX money-market sentiment index closed at 66 on Monday vs 50 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1668 TUES VS 7.1230

The People’s Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1668 on Tuesday, compared with 7.1230 set on Monday.

OVERNIGHT DATA

SOUTH KOREA OCT CONSUMER CONFIDENCE 88.8; SEP 91.4

MARKETS

SNAPSHOT: China Asset Volatility In Focus

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 305.06 points at 27280.25

- ASX 200 up 19.24 points at 6798.6

- Shanghai Comp. up 11.371 points at 2988.847

- JGB 10-Yr future up 15 ticks at 148, yield up 0.1bp at 0.256%

- Aussie 10-Yr future up 6.5 ticks at 95.89, yield down 6.3bp at 4.085%

- U.S. 10-Yr future +0-05+ at 109-29, yield down 3.77bp at 4.205%

- WTI crude up $0.11 at $84.69, Gold down $0.96 at $1648.66

- USD/JPY up 2 pips at Y148.93

- BOE’S RAMSDEN: “FEBRILE” MARKETS WANT CLARITY ON UK FISCAL POLICY (FT)

- RISHI SUNAK TO TAKE OVER AS UK PRIME MINISTER THIS MORNING

- U.S. SAYS GOT NO UPDATE FROM TOKYO ON FX INTERVENTION, JAPAN SAYS IT’S IN COMMUNICATION WITH U.S.

- JAPAN’S FINMIN SUZUKI: BOJ EASING AND GOVT FX INTERVENTION NOT CONTRADICTORY (RTRS)

- PBOC RAISES CROSS-BORDER FUNDING MACRO-PRUDENTIAL PARAMETER (BBG)

- PBOC SETS YUAN FIXING AT WEAKEST LEVEL SINCE 2008 (BBG)

- IEA: ASIA MAY SEE SIGNIFICANT RISE IN LNG PRICES NEXT YEAR (BBG)

US TSYS: Futures Halt Gains Amid Rebound In Chinese Equities

Initial topside impetus moderated as T-Notes topped out at 109-29+ and stabilised just shy of that level. E-mini futures oscillated between gains and losses amid heightened volatility in China's equity markets, staging an about-face after a spell of early-doors weakness. The ongoing debate on Fed terminal rate level may have factored into the price action, although swaps market pricing was little changed.

- There was little in the way of FI-specific headline flow in Asia-Pac hours, but regional players digested Monday's surge in gilts, stemming from the promise of stabilisation in UK political landscape.

- When this is being typed, T-Notes trade +0-04 at 109-27+, while Eurodollars trade -0.5 to +1.5 tick through the reds.

- Cash curve sits lower and runs flatter, with yields last seen 0.6-3.3bp as 10s outperform. The marginal tightening in 5-Year/30-Year Tsy yield spread brought it close to the breakeven level.

- Local data highlights today include Conf. Board Consumer Confidence & Richmond Fed M'fing Index, while Fed's Waller will speak at a conference in Las Vegas. Also coming up is an auction of 2-Year Tsys.

JGBS: Long-End Cash JGBs Regain Poise, 10-Year Yield Stays Near BoJ's 0.25% Cap

The outperformance of the super-long sector drove flattening in cash JGB yield curve, with 30s leading gains at typing. This represents a reversal of early price action, which saw the 20/30/40-Year sector lag shorter-dated bonds. Long-end purchases coincided with the publication of the results of a liquidity enhancement auction covering off-the-run JGBs with 15.5-39 years until maturity, which saw spreads widen, spread tail tighten a little and the cover ratio slip, relative to the previous auction. A spillover from other core FI markets may have facilitated the re-flattening of JGB curve.

- JGB futures had a strong start to the session, running to 148.05 in the initial upswing. The contract eased off into the Tokyo lunch break, which was out of sync with gains in T-Notes and Aussie bond futures, while coinciding with the latest round of comments from FinMin Suzuki. The contract found poise after lunch, albeit fell short of re-testing session highs, and last deals +15 ticks at 148.00.

- The latest speech from FinMin Suzuki reconstructed a familiar logic surrounding the division of labour between the MoF and BoJ, while reaffirming existing views on FX developments. The minister vowed to respect the central bank's independence as it's trying to achieve sustainable, wage-driven inflation. He noted that the MoF is in daily communication with the U.S. over market developments, despite earlier remarks from Tsy Sec Yellen, who said Japan did not notify the U.S. about any new FX interventions. Suzuki reiterated that officials are focusing on excessive volatility, while the exchange rate should be determined by the market, despite earlier conceding that the pass-through from currency depreciation to domestic price pressures is increasing.

- 10-Year JGBs operated in the vicinity of the 0.25% yield ceiling set by the BoJ as part of its Yield Curve Control programme. A scheduled round of 3-25+ Year Rinban operations tomorrow will be watched for any signs of escalation in YCC enforcement ahead of the BoJ's monetary policy meeting this Friday.

JGBS AUCTION: Japanese MOF sells Y498.8bn of 15.5-39 Year JGBs in a liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.8bn of 15.5-39 Year JGBs in a liquidity enhancement auction:

- Average Spread: +0.060% (prev. +0.029%)

- High Spread: +0.067% (prev. +0.034%)

- % Allotted At High Spread: 19.8770% (prev. 46.2311%)

- Bid/Cover: 2.897x (prev. 2.403x)

AUSSIE BONDS: Bull Flattening Takes Hold Ahead Of Budget Speech

Bull flattening in ACGB yield curve was evident, with U.S. Tsy curve undergoing a similar (albeit less pronounced) transformation. At typing, ACGB yields sit 1.7-8.3bp lower, as we await tonight's budget speech. The gap between 3-Year/10-Year yields narrowed at the margin and last sits at 48.75bp.

- Futures contracts traded with a bullish bias, while flattening impetus took hold; YM last +1.0 & XM +5.5, stabilising near session highs after the initial rally. A rebound in Chinese/HK equities likely contributed to the moderation in demand for core FI assets.

- Bills run unch. to +6 ticks through the reds.

- Treasurer Chalmers said that accelerating inflation was the "primary influence" on the spending plan, as he prepares to deliver his budget speech at 19:30 AEDT/09:30 BST (see our preview here).

EQUITIES: Dip Buyers Emerge For HK/China Equities, Offshore Flows Return

Hong Kong and China markets have remained in focus today. Both markets opened weaker, but are now back in positive territory, with large trading ranges for the session so far. Trading has been more muted elsewhere. US futures are range bound, ahead of important earning results later this week. Eminis just sitting in positive territory for the session, last around 3810.

- The range today on HSI has been over 3%. After opening lower (after yesterday's 6.36% fall) loss, dip buyers emerged, and we are now back to +0.5% the session. Ranges for the HSI tech sub index have been near 10%, with this index now around +2.7% for the session.

- Onshore equities are higher, albeit with reduced volatility. The CSI 300 last around +0.90% for the session, while the composite index is up 0.75%.

- There didn't appear to be fundamental catalyst for the turnaround in HK or China equity indices. Offshore investors have turned net buyers of China shares (+4.2bn yuan, after yesterday's record 17.9bn yuan outflow). Some technical support was also cited for the HSI, while the PBoC also announced measures which make it easier for domestic companies to raise funds offshore, although this looks to be more targeted at relieving yuan depreciation pressures.

- Elsewhere, the Topix is up 1.3%, amid broad based gains. The Kospi is edging higher, last +0.40%, but the Taiex is lagging -0.90%.

OIL: Late Recovery As USD Down And Hang Seng Rises

Oil prices traded lower during the day before they turned up again as the Hang Seng and Shanghai stock indices bounced and the USD moderated, making commodities cheaper for foreigners.

- The WTI is trading at $84.92 +0.4%, just below 20-day MA, and Brent is around $93.50 +0.3%. Oil prices seem range bound as concerns over supply issues counteract expectations of a slowdown in global demand.

- API weekly crude oil stocks in the US are published tonight for the week of October 21. The previous week saw a drawdown of 1.27mn barrels. A repeat of this would likely bring supply worries to the forefront driving prices higher again.

- There are signs that Europe’s sanctions on Russian oil are already having an impact before they’re implemented next month. Russian shipments by sea hit a 5-week low in the 7 days to October 21. (ANZ)

GOLD: Taking Cues From USD Sentiment

Gold has stuck to ranges from late NY trading during today’s Asia Pac session. We last sat around $1652, slightly up on NY closing levels (+0.15%). This is in line with modest pull back in broader USD sentiment today (BBDXY off -0.16%).

- The high from earlier in the session, near $1655, along with today's low $1647.30 remain within yesterday's ranges though.

- Gold appears comfortable to follow broader USD sentiment for now, lacking a fresh catalyst for a major shift in direction.

- Overnight US real yields edged down 3bps to 1.66%. Nominal yields fell, but more so outside of the US.

FOREX: USD Lower, Higher China Equities Help A$ & NZD Outperform

The USD is down slightly through today's session, the BBDXY off by -0.10% to 1339, but dips in the index were supported back to overnight lows. We have seen some commodity currency outperformance, although this is more reflective of more positive sentiment in HK/China equities rather than a rebound in commodity prices.

- AUD/USD dips towards 0.6310 have been supported, last around 0.6330, with highs above 0.6340 capping the pair. Iron ore futures in Singapore are sub $90/tonne, while copper is also down slightly. Oil has held up better. Dip buyers in HK/China equities have offset and helped the A$ push higher and remain above NY closing levels.

- NZD/USD has slightly outperformed, last around 0.5715, +0.35% for the session. Earlier RBNZ Chief Economist Conway stated the central is hopeful inflation has peaked, while Deputy Prime Minister Robertson stated no decision has been made on a minimum wage rise for 2023.

- USD/JPY has traded tight ranges, last just above 148.80. A host of official comments didn't appear to shed any fresh light on the intervention issue.

- EUR/USD is just above 0.9880, unable to break above 0.9900, while GBP/USD is trying to hold above 1.1300.

- Still to come is the Australian budget speech (7:30pm AEST), followed by tomorrow's Q3 CPI print. In the US tonight, local data highlights today include Conf. Board Consumer Confidence & Richmond Fed M'fing Index, while Fed's Waller will speak at a conference in Las Vegas.

FX OPTIONS: Expiries for Oct25 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9745-50(E1.2bln), $0.9775-90(E1.3bln), $0.9800-05(E927mln)

- USD/JPY: Y145.00($2.4bln), Y145.65($1.45bln), Y150.00($1.2bln)

- GBP/USD: $1.1435(Gbp1.0bln)

- AUD/USD: $0.6600(A$759mln)

- USD/CAD: C$1.3500($550mln), C$1.3900($500mln)

- USD/CNY: Cny7.2000($830mln), Cny7.2500($1.0bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/10/2022 | 0600/0800 | ** |  | SE | PPI |

| 25/10/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/10/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/10/2022 | 0855/0955 |  | UK | BOE Pill at ONS ‘Understanding the cost of living through statistics’ | |

| 25/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 25/10/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/10/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/10/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/10/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/10/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/10/2022 | 1755/1355 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.