-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Cuts Key Interest Rates, UK's Johnson Under Fire Over "Partygate"

EXECUTIVE SUMMARY

- BORIS DRAWS UP SURVIVAL PLAN AS CALLS TO QUIT GROW LOUDER

- TORIES WILL OUST BORIS JOHNSON IF HE TRIES TO DODGE “PARTYGATE” BLAME (Guardian)

- CHINA’S ECONOMIC GROWTH SLOWS IN Q4 BUT STILL BEATS CONSENSUS

- PBOC SLASH 1-YEAR MLF & 7-DAY REVERSE REPO RATES BY 10BP EACH

- NORTH KOREA FIRES TWO APPARENT BALLISTIC MISSILES (Yonhap)

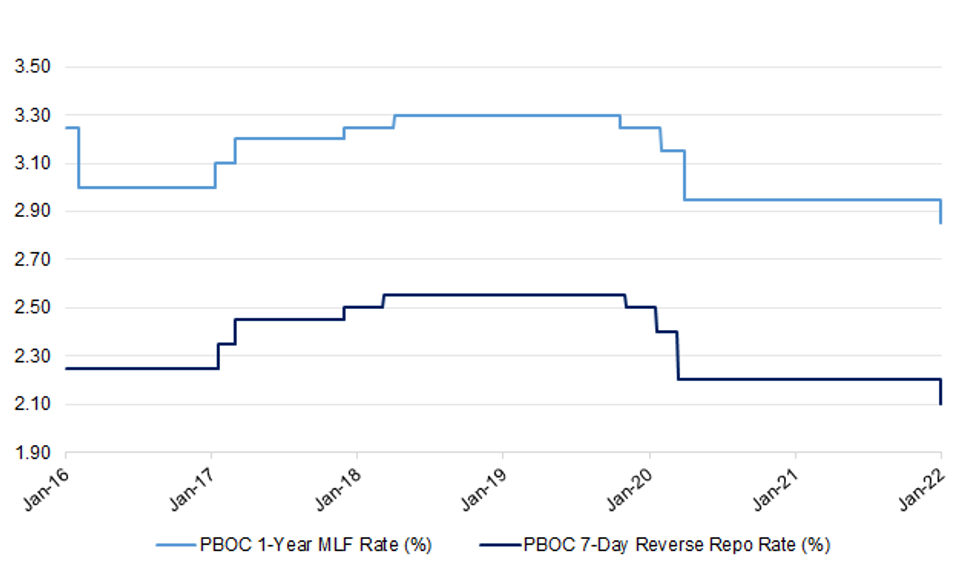

Fig. 1: PBOC 1-Year MLF Rate vs. 7-Day Reverse Repo Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson is planning a mass clearout of No 10 and a series of populist announcements to save his tottering premiership. Despite issuing a humiliating apology to MPs over the Downing Street parties on Wednesday, the prime minister is refusing to take responsibility for the crisis and in meetings last week questioned why his team had not protected him. A senior government source said: “He made it clear he thought they had let him down. Boris’s view is that he is not to blame. That everyone else is to blame.” Johnson’s view is supported by members of the cabinet. The effort to blame his staff has been named Operation Save Big Dog, while his plans to make policy announcements to woo disillusioned MPs and voters is being dubbed Operation Red Meat. (Times)

POLITICS: The chairman of the Conservative Party says he was "disgusted" at the revelations that two parties were held on the eve of Prince Philip's funeral and that a culture change is needed in Number 10. Oliver Dowden told Sky News' Trevor Phillips on Sunday programme that he had been "angered" by the reports of events that took place at a time when COVID restrictions were in force, but that "Boris Johnson should, of course, remain as prime minister". His comments come after Tim Loughton became the sixth Conservative MP to publicly call for Boris Johnson to quit amid the ongoing "partygate scandal". (Sky)

POLITICS: Tory MPs will be ready in sufficient numbers to force Boris Johnson out of Downing Street within weeks if he tries to dodge responsibility for rule-breaking parties at No 10, the Observer has been told. While most Conservative MPs say they are waiting for a report into so-called “partygate” by the senior civil servant Sue Gray before deciding the prime minister’s fate, large numbers admit privately that their minds are effectively made up and that they are merely observing “due process”. (Guardian)

POLITICS: Boris Johnson has been accused of giving a speech at a leaving do for his defence adviser in December 2020 when Covid restrictions were in force. The prime minister has been embroiled in an ongoing scandal over a number of parties that were held at Downing Street while the public was being told to obey social distancing rules. According to The Mirror, Mr Johnson attended Captain Steve Higham’s leaving party “for a few minutes” in which he gave a speech “to thank him for his service”. The newspaper said a “small number of No 10 staff briefly said goodbye”. (Independent)

POLITICS: Boris Johnson has been questioned by Sue Gray over “partygate” allegations, Whitehall sources have told The Telegraph, as new signs of a Tory grassroots backlash emerged. The Prime Minister is understood to have shared what he knows with Ms Gray, the civil servant overseeing the investigation into alleged parties at Downing Street during lockdown, ahead of publication of the report as early as this week. (Telegraph)

POLITICS: Today’s Opinium poll for the Observer is grim reading for Boris Johnson and his party. Johnson’s personal approvals fall below the worst figures ever recorded by Theresa May; and his party sinks to its worst vote share since the general election, 10 points behind Labour. Majorities of practically every political and demographic group believe Johnson and his colleagues have broken the rules and lied about it, and say Johnson should resign. (Guardian)

POLITICS: Sir Keir Starmer has accused Boris Johnson of breaking Covid laws with parties held in Downing Street during lockdown. The Labour leader said the prime minister had "lied" about "industrial scale partying" in No 10. (BBC)

POLITICS: The Liberal Democrats have found cross-party support for a motion of no confidence in Boris Johnson and are calling for Conservative MPs to back it. The motion states that Parliament has no confidence in the PM as he has "broken the COVID lockdown laws his government introduced, misled both Parliament and the public about it, and disastrously undermined public confidence in the midst of a pandemic". The motion has been signed by 18 MPs from four parties, including all 13 Lib Dems, two Labour MPs, two from Plaid Cymru, and Stephen Garry from the Alliance Party. (Sky)

POLITICS: The Conservatives have said they will scrap the BBC licence fee at the next opportunity – if they are still in government. Unveiling a £2bn budget cut for the public broadcaster, culture secretary Nadine Dorries said that this year’s funding announcement “will be the last”. (Independent)

POLITICS: Boris Johnson will put the military in charge of stemming the number of boats crossing the Channel as part of an attempt to save his premiership. Plans are also being drawn up to send migrants to countries such as Ghana and Rwanda for processing and resettlement in a move to tackle the small boats crisis. The prime minister will give the Royal Navy “primacy” over all government vessels in the Channel this month in one of a series of populist announcements as he faces pressure to quit over Downing Street parties. A rear admiral will have the power to direct Border Force, coastguard, fisheries protection and customs and excise to carry out surveillance or intercept those crossing the Channel. (The Times)

CORONAVIRUS: The United Kingdom is drawing up plans under which people will not be legally bound to self-isolate after catching COVID-19, The Telegraph reported on Sunday. Prime Minister Boris Johnson wants to permanently revoke emergency coronavirus laws as Britain's COVID-19 cases continue to fall, the report said, adding official guidance would remain but would not result in fines or legal punishment if ignored. The plans will be worked up over the coming weeks, with an announcement expected as early as the spring, the report said. (RTRS)

EUROPE

EU: The EU’s €1.2 trillion war chest — also known as its long-term budget — has emerged as a possible workaround on how to finance the expensive fight against climate change despite carrying heavy debt from the pandemic. European Commission staffers and treasury officials are debating the idea in Brussels behind closed doors, according to five EU officials and a briefing document obtained by POLITICO. This push is continuing even though frugal-minded countries such as Austria, Germany, Finland and the Netherlands have already voiced skepticism over the concept. (Politico)

GERMANY: Germany’s Finance Minister Christian Lindner wants to implement a planned global minimum tax of 15% for multinationals as early as January 2023, WirtschaftsWoche reports, citing the ministry. According to the German business news magazine, tax officials from the federal and state governments held initial talks this month, with the aim of drafting a law. Germany will then wait for a corresponding European Union directive. (BBG)

FRANCE: President Emmanuel Macron will on Monday tout 21 new foreign investment projects in France and a booming economy as proof his economic reforms have been bearing fruit less than three months before a presidential election in which he is expected to run. During a visit to Alsace in the east, Macron will announce a 300-million-euro ($342 million) industrial project by German chemical giant BASF, one of 21 new projects worth 4 billion euros and 10,000 jobs as part of a drive to attract foreign investors, his office said. (RTRS)

FRANCE: France's stronger than expected economic recovery last year means the public sector budget deficit should come in better than planned, the budget minister said in an interview published on Sunday. The government had built its budget planning on expectations for the economy to grow 6.25% last year, but the most recent indications are that the figure was probably around 6.7%. "The strength of our growth translates into more tax revenue than expected and we spent less because companies drew less on emergency support," Public Accounts Minister Oliver Dussopt told weekend newspaper Le Journal du Dimanche. (RTRS)

FRANCE: A new controversial vaccine pass law is set to be introduced in France in the coming days after being approved in the country's parliament on Sunday. The law will require people to have a certificate of vaccination in order to enter public places such as restaurants, cafes and cinemas. The pass will also be required for people travelling on long-distance trains, and replaces the previous need for unvaccinated people to show a recent negative test. (Sky)

NORWAY: Jens Stoltenberg’s candidacy for the role of Norway’s next central bank governor has stoked rising opposition from MPs, who have raised concerns about the independence of monetary policy and trust in public figures. The Nato secretary-general, who is a former Norwegian prime minister, has been seen as the favourite for the position, which includes oversight of the country’s $1.4tn oil fund — the world’s largest sovereign wealth fund — ever since his application was made public last month. But parties with a majority in Norway’s parliament are now opposed to his candidature after a series of revelations about dinners involving Stoltenberg, current prime minister Jonas Gahr Store and oil fund boss Nicolai Tangen, as well as the well-connected banker son of former prime minister Gro Harlem Brundtland. (FT)

UKRAINE: Former Ukrainian president Petro Poroshenko said on Sunday he planned to return to Ukraine on Monday despite the threat of arrest in a treason case he says was trumped up by allies of current President Volodymyr Zelenskiy. Poroshenko's return sets up a showdown with Zelenskiy's government in what critics say is an ill-judged distraction at a time when Ukraine is bracing for a possible Russian military offensive and appealing to Western allies for support. (RTRS)

U.S.

POLITICS: On one level, the story of President Biden's first year is a simple one: Americans feel worse about the pandemic and economy than they did earlier in his term, and his ratings have suffered for it. On another level, it's a little more nuanced: they do not exclusively blame his policies, but they do demand more attention to inflation just the same; there are many reasons the pandemic is seen as bad, but confusing information stands out as a factor that is hurting views of his handling of it. "Focus" is a running theme in this story. Majorities say he isn't paying enough attention to either the economy or inflation — together, their top issues — not just that he isn't handling them well. Few think Mr. Biden and his fellow Democrats are focused on the right things overall, either. Even within his own party, it's inflation where his fellow Democrats give him their lowest marks, compared to other issues. His overall approval at the one-year mark is 44%, and it's been in the 40s since this fall. That is, however, despite the fact that only 26% of Americans think things in the country are going well. Mr. Biden saw his approval drop months ago without a subsequent recovery. At the start of his term, his rating was up in the 60s, buoyed by optimism about getting the pandemic under control. The honeymoon had faded by summer. Approval fell after the Afghanistan withdrawal, sagged as inflation and COVID cases rose and has not rebounded. (NBS)

OTHER

GEOPOLITICS: The U.S. is working to determine who carried out a cyberattack on Ukrainian government websites and it wouldn’t be surprising if Russia was behind it, President Joe Biden’s national security adviser Jake Sullivan said. Ukrainian officials say “all evidence” points to Russia, while Russia denies it was behind the hacks. It’s the latest source of tension after President Vladimir Putin massed 100,000 troops on the Ukrainian border for what the U.S. says is a possible invasion. “We’re working hard on attribution,” Sullivan said on CBS’s “Face the Nation” on Sunday. “This is part of the Russian playbook, so it would not surprise me one bit if it ended being attributed to Russia.” (BBG)

RUSSIA/UKRAINE: The US has information that indicates Russia has prepositioned a group of operatives to conduct a false-flag operation in eastern Ukraine, a US official told CNN on Friday, in an attempt to create a pretext for an invasion. The official said the US has evidence that the operatives are trained in urban warfare and in using explosives to carry out acts of sabotage against Russia's own proxy forces. (CNN)

RUSSIA/UKRAINE: Russia excludes any possibility of deploying its offensive weapons in Ukraine but doesn’t rule out that the United States and NATO can do it, Russian presidential press secretary Dmitry Peskov said on Sunday. "We cannot rule out that our partners (the United States and NATO) can deploy offensive weapons on Ukraine’s territory. On our part, we exclude the deployment of offensive weapons there. That is why we insist on legally binding guarantees," he said in an interview with the Ekho Moskvy radio station cited on the Telegram channel of the radio station’s editor-in-chief Alexey Venediktov. (TASS)

RUSSIA/UKRAINE: Ukraine said it had evidence that a cyber attack against government websites on Friday was likely to have been carried out by Russia, amid fears that Moscow may be planning military action against the country after security talks with the US and Nato failed. “At the moment we can say that all evidence points to Russia being behind the attack,” Ukraine’s digital transformation ministry said in a statement on Sunday. “Moscow continues to wage hybrid war and is actively growing its information and cyber space capabilities.” But Kyiv said the investigation was still ongoing and had yet to formally attribute the attack to Russia. Stopping short of blaming Moscow on Sunday, Jake Sullivan, national security adviser to US president Joe Biden, said: “It would not surprise me one bit if it ends up being attributed to Russia.” (FT)

BOJ: Governor Haruhiko Kuroda starts his last full year at the helm of Bank of Japan amid hints of public discontent over rising prices that could shape the direction of the central bank after he leaves or even as soon as coming months. While Japan’s inflation remains weak compared with the United States and other major economies, it appears to have picked up enough speed to trigger a change in optics. At a two-day meeting starting Monday, the central bank is likely to discuss dropping its insistence that downward risks to prices outweigh upward factors for the first time in over seven years, according to people familiar with the matter. (BBG)

JAPAN: Japan will bring forward COVID-19 vaccination booster shots by as much as two months, Prime Minister Fumio Kishida said on Monday, as the highly transmissible Omicron variant sends infections soaring nationwide. In a policy speech to parliament, Kishida also said Japan would fortify defence capabilities around its southwestern islands near Taiwan, and that the marked improvement of North Korea's missile technology should not be condoned. (RTRS)

JAPAN: Japan’s government is deliberating placing stricter coronavirus measures, known as a “quasi” state of emergency, on Tokyo and surrounding prefectures within the week, broadcaster FNN reported, citing several unidentified government officials. The Tokyo Metropolitan Government said Sunday 19.3% of its hospital beds were filled, approaching the 20% threshold that would compel it to consider asking the central government to implement stricter restrictions. While FNN didn’t elaborate on measures that would be taken, previous restrictions have included shorter hours at retailers and dining establishments as well as caps on participant numbers at events. (BBG)

JAPAN: U.S. President Joe Biden will meet virtually on Friday with Japanese Prime Minister Fumio Kishida discuss the two nations' economies, security matters, climate change and other bilateral issues, the White House announced on Sunday. "The meeting will highlight the strength of the U.S.-Japan alliance, which is the cornerstone of peace, security, and stability in the Indo-Pacific and around the world," the White House said in a statement. (RTRS)

JAPAN: Japan's southern prefecture of Okinawa reported record daily numbers of COVID-19 cases on Saturday, fueled by the spread of the highly transmissible Omicron variant. Okinawa, which hosts 70% of U.S. military facilities in Japan, said it recorded 1,829 new coronavirus cases on Saturday. The governor of the prefecture, Denny Tamaki, previously said he was "furious" about what he called inadequate infection controls at U.S. bases that allowed the variant to spread to the public. (RTRS)

AUSTRALIA: China has requested the establishment of a World Trade Organization panel to hear claims regarding Australia’s anti-dumping and countervailing measures on stainless steel sinks, railway wheels and wind towers, Australian Trade Minister Dan Tehan said in a statement. (BBG)

NEW ZEALAND: New Zealand is bracing for the arrival of omicron, with the highly infectious Covid-19 variant expected to breach the nation’s closed border at any time. “We know that with omicron it is a case of when, not if,” Prime Minister Jacinda Ardern told a news conference Monday in Auckland. “We’re doing what we can, but I think it would be wrong for us to assume that those border measures will be sufficient. At some point, we will see omicron in the community.” The government has delayed a phased reopening of the border to keep omicron out while it rushes to administer booster vaccination shots and begin inoculating children. (BBG)

NEW ZEALAND: New Zealand’s government is reviewing new banking regulations after evidence that lenders are applying the rules so rigorously that many people are being shut out of the housing market. The government has asked the Council of Financial Regulators to bring forward an investigation into whether lenders are implementing the new rules as intended, Commerce Minister David Clark said. (BBG)

SOUTH KOREA: South Korean President Moon Jae-in put on a display of both hard and soft power in the Middle East, closing a $3.5 billion missile deal and hosting a K-Pop concert for United Arab Emirates leaders. South Korea agreed to sell the UAE Cheongung II midrange surface-to-air missiles during Moon’s visit to the Persian Gulf nation, Defense Acquisition Program Administration chief Kang Eun-ho told reporters Sunday in Abu Dhabi. The two sides committed to expand ties between their defense industries after the contract, which will involve LIG Nex1 Co., Hanwha Systems Co. and Hanwha Defense Systems Corp. The deal was valued at an estimated 4 trillion won ($3.5 billion), according to a person familiar with the discussions. (BBG)

NORTH KOREA: North Korea fired two suspected short-range ballistic missiles eastward from an airfield in Pyongyang on Monday, South Korea's military said, in the recalcitrant regime's fourth show of force this year. The Joint Chiefs of Staff (JCS) said it detected the projectiles fired from the Sunan airport at 8:50 a.m. and 8:54 a.m., respectively, and that they flew about 380 kilometers at an altitude of 42 km. "For more specific information, the intelligence authorities of South Korea and the United States are conducting a detailed analysis," the JCS said in a text message sent to reporters without further elaboration. (Yonhap)

NORTH KOREA: Chinese brokers said they expect the resumption of regular trade with North Korea as soon as Monday, after a North Korean train pulled into a Chinese border town on Sunday in the first such crossing since anti-coronavirus border lockdowns began in 2020. (RTRS)

PHILIPPINES: Philippine central bank Governor Benjamin Diokno said the country can meet its inflation forecasts for this year and next unless crude oil prices rise above $95 a barrel and settle around that level. Oil prices should face less pressure this year after the Organization of Petroleum Exporting Countries pledged to increase output and as the pandemic continues to limit travel, Diokno said in a mobile-phone statement to reporters on Saturday. “Other things constant, our inflation forecasts for 2022 and 2023 would hold unless world crude prices settle above $95 per barrel from January 2022 until December 2023,” Diokno said. “Inflation could settle above the target range if crude oil prices average higher than $95 per barrel for 2022 and 2023.” (BBG)

ISRAEL: Former Israeli prime minister Benjamin Netanyahu is negotiating a plea bargain to end his corruption trial, a source briefed on the matter said on Sunday, but talks have snagged over a condition that would remove him from politics. The source said Netanyahu, 72, was discussing a deal with Attorney-General Avichai Mandelblit under which he would plead guilty to reduced charges and have any resulting jail term commuted to community service. But the talks have hit a bump over Netanyahu's demand to be spared a conviction carrying a "moral turpitude" clause, which under Israeli law would force him to quit politics for years, said the source, speaking to Reuters on condition of anonymity. (RTRS)

ASIA-PACIFIC: An underwater volcano in the South Pacific erupted violently on Saturday, causing tsunamis to hit Hawaii, Japan, and Tonga's largest island, Tongatapu -- sending waves flooding into the capital. The Hunga-Tonga-Hunga-Ha'apai volcano, about 30 kilometers (18.6 miles) southeast of Tonga's Fonuafo'ou island, first erupted on Friday and a second time on Saturday around 5:26 p.m. local time, according to CNN affiliate Radio New Zealand (RNZ). (CNN)

CHINA

CORONAVIRUS: Beijing will require travellers to get a COVID-19 test within 72 hours of arrival in the Chinese capital, state media announced on Sunday, a day after the city reported its first Omicron case and as it readies to stage the Winter Olympics next month. On Saturday, the city reported the first local infection of the highly transmissible Omicron variant, involving a person who had visited multiple malls and restaurants in the previous 14 days. The person had not left the city since the start of this year. The new rule, effective from Jan. 22 to end-March, is aimed to help with early detection of Omicron, which is surging globally, and the control of epidemic risks, Beijing Daily, a government newspaper, said on its official social media account. (RTRS)

ECONOMY: China must seek breakthroughs in core technology and accelerate the building of new infrastructure as a part of its strategy to develop the digital economy, President Xi Jinping wrote in the official journal Qiushi, carried on the front pages of major state newspapers. There have been “unhealthy and disorderly signs and trends” in the digital economy’s development that threaten the nation’s economy and financial safety, which must be corrected and managed, Xi wrote. China should also actively participate in global cooperation to help strengthen its “national competitive advantage,”, as its digital economy lacks strength and excellence, said Xi. (MNI)

ECONOMY: Mainland China's birth rate dropped to a record low of 7.52 per 1,000 people in 2021, National Bureau of Statistics data showed on Monday, accelerating a downward trend that led Beijing last year to begin allowing couples to have up to three children. The birth rate was the lowest since 1949, when the statistics bureau began collating the data. The natural growth rate of China's population, which excludes migration, was only 0.034% for 2021, the lowest since 1960, according to the data. (RTRS)

PROPERTY: Housing markets in China’s largest cities may rebound after Q1 as regulators ease restrictive policies and allow easier funding to the industry, the China Securities Journal said citing researchers including Li Yujia of Guangdong Housing Policy Research Center. Signs that the market has bottomed out include rising prices of pre-owned homes in December from November and that more cities reported gains in prices of new homes, the newspaper said. However, the housing market may remain sluggish unless the central bank further cuts lending costs, it said. (MNI)

YUAN: The launch of a 25-year cooperation pact with Iran is a breakthrough in China advancing the internationalization of the yuan, the Global Times said in an editorial, after State Councillor Wang Yi met Iran’s FM Hossein Amir-Abdollahian in China’s Wuxi city last week. While the details of the agreement, spanning energy, infrastructure and technology, were not disclosed, the deal will benefit Iran’s much-needed economy under U.S. sanctions, the newspaper said. The yuan is an alternative to the U.S. dollar in trade settlement, listed by Iran’s central bank as a main forex currency, said the Times. As the U.S. debt and inflation woes led to diminished confidence in the dollar, the yuan’s status has risen in the global arena, it said. (MNI)

OVERNIGHT DATA

CHINA Q4 GDP +4.0% Y/Y; MEDIAN +3.3%; Q3 +4.9%

CHINA Q4 GDP +1.6% Q/Q; MEDIAN +1.2%; Q3 +0.2%

CHINA Q4 GDP YTD +8.1% Y/Y; MEDIAN +8.0%; Q3 +9.8%

CHINA DEC INDUSTRIAL PRODUCTION +4.3% Y/Y; MEDIAN +3.7%; NOV +3.8%

CHINA DEC INDUSTRIAL PRODUCTION YTD +9.6% Y/Y; MEDIAN +9.7%; NOV +10.1%

CHINA DEC RETAIL SALES +1.7% Y/Y; MEDIAN +3.8%; NOV +3.9%

CHINA DEC RETAIL SALES YTD +12.5% Y/Y; MEDIAN +12.7%; NOV +13.7%

CHINA DEC PROPERTY INVESTMENT YTD +4.4% Y/Y; MEDIAN +5.2% NOV +6.0%

CHINA FIXED ASSETS EX RURAL YTD +4.9%; MEDIAN +4.8%; NOV +5.2%

CHINA DEC UNEMPLOYMENT 5.1%; MEDIAN 5.0%; NOV 5.0%

JAPAN NOV CORE MACHINE ORDERS +11.6% Y/Y; MEDIAN +6.7%; OCT +2.9%

JAPAN NOV CORE MACHINE ORDERS +3.4% M/M; MEDIAN +1.2%; OCT +3.8%

JAPAN NOV TERTIARY INDUSTRY INDEX +0.4% M/M; MEDIAN +1.0%; OCT +1.9%

UK JAN RIGHTMOVE HOUSE PRICES +7.6% Y/Y; DEC +6.3%

UK JAN RIGHTMOVE HOUSE PRICES +0.3% M/M; DEC -0.7%

CHINA MARKETS

PBOC NET INJECTS CNY290BN VIA OMOS MON; RATES DOWN

The People's Bank of China (PBOC) injected CNY700 billion via a 1-year medium-term lending facility and CNY100 billion via 7-day reverse repos with the rate lowering to 2.85% and 2.10%, respectively, on Monday. The operation has led to a net injected of CNY290 billion after offsetting the maturity of CNY500 billion MLF and CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2589% at 09:44 am local time from the close of 2.2068% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday, compared with the close of 42 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3599 MON VS 6.3677

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3599 on Monday, compared with 6.3677 set on Friday.

MARKETS

SNAPSHOT: China Cuts Key Interest Rates, UK's Johnson Under Fire Over "Partygate"

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 214.45 points at 28338.02

- ASX 200 up 23.442 points at 7417.3

- Shanghai Comp. up 21.081 points at 3542.323

- JGB 10-Yr future down 1 tick at 150.79, yield up 0.3bp at 0.146%

- Aussie 10-Yr future down 6.5 ticks at 98.055, yield up 6.8bp at 1.919%

- U.S. 10-Yr future -0-13 at 127-25, cash Tsys are closed

- WTI crude up $0.32 at $84.15, Gold up $1.5 at $1819.46

- USD/JPY up 30 pips at Y114.49

- BORIS DRAWS UP SURVIVAL PLAN AS CALLS TO QUIT GROW LOUDER

- TORIES WILL OUST BORIS JOHNSON IF HE TRIES TO DODGE “PARTYGATE” BLAME (Guardian)

- CHINA’S ECONOMIC GROWTH SLOWS IN Q4 BUT STILL BEATS CONSENSUS

- PBOC SLASH 1-YEAR MLF & 7-DAY REVERSE REPO RATES BY 10BP EACH

- NORTH KOREA FIRES TWO APPARENT BALLISTIC MISSILES (Yonhap)

BOND SUMMARY: U.S. Tsys & ACGBs Go Offered, JGBs Wobbly Ahead Of BoJ Meeting

Friday's upswing in U.S. Tsy yields spilled over into Asia in early trade, before the spotlight shifted to China, whose central bank cut the interest rates applied to 1-year MLF and 7-day reverse repo operations in a bid to stimulate economic growth. While speculation of imminent policy easing had been doing the rounds, the consensus view had been that the PBOC would leave these parameters unchanged today. Their moves came shortly before the release of China's Q4 GDP & December economic activity data, with the slowdown in growth proving less severe than forecast. The impact of Chinese goings-on may have helped prevent a recovery in U.S. Tsys & ACGBs after their initial spell of weakness.

- T-Notes extended their Friday rout before finding support at 127-20+ and stabilising in the Tokyo afternoon. TYH2 last changes hands -0-14 at 127-24. Eurodollar futures run 0.25-3.00 ticks lower through the reds. Cash Tsy markets won't re-open until Tuesday, as the U.S. observes a national holiday today.

- Cash ACGB yields sit 5.5-6.7bp higher across the curve, with bear steepening evident, albeit less pronounced than earlier in the session. Aussie bond futures have ticked away from lows but remain at depressed levels, YM -5.5 & XM -6.5. Bills trade 1-8 ticks lower through the reds. The Australian headline flow failed to offer much in the way of market catalysts, with initial price action seemingly driven by impetus from Friday's after-hours moves in U.S. Tsys.

- The Tokyo session saw somewhat erratic price action of JGBs, with participants preparing for the upcoming monetary policy decision from the BoJ. Policymakers will make their announcement on Tuesday and are expected to raise the FY2022 CPI forecast a tad, with potential for hawkish (by BoJ standards) tweaks in the language surrounding risks to the price outlook. Benchmark JGB futures rose after the re-open, topped out at 150.86 and retreated from there, extending their pullback after the lunch break. The contract sits at 150.79, 1 tick shy of previous settlement and off the session low of 150.73 printed in the wake of the aforementioned pullback. Cash JGB yields are mixed across the curve, with 10s outperforming. Another missile test conducted by North Korea, reports flagging potential for tighter Covid curbs in several Japanese prefectures and the proximity of a key policy speech from PM Kishida helped complicate the underlying risk environment.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y1.375tn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

- Y50bn worth of JGBs with 25+ Years until maturity

FOREX: Yen Lags Major Peers On Eve Of BoJ Policy Announcement

The yen went offered on the eve of the BoJ's monetary policy decision announcement, despite speculation that it might see policymakers tone down their dovish rhetoric. The BoJ are widely expected to deliver a modest upgrade to their FY2022 CPI forecast on Tuesday. Meanwhile, source reports have suggested that policymakers may discuss tweaks to the language around risks to the price outlook, which might involve dropping the long-held view that they are skewed to the downside. Nonetheless, the yen landed at the bottom of the G10 pile as T-Notes extended their rout (cash Tsys did not trade), with the touted tweaks to the BoJ's rhetoric seemingly priced in.

- Spot USD/CNH crept higher but took a dive into negative territory when a slew of Chinese data hit the wires. The economic growth slowed in 4Q2021 but was better than expected and topped the government's official target. Elsewhere, December retail sales growth undershot median forecast, yet industrial output rose faster than anticipated.

- By the time China's data hit the wires, the PBOC cut the interest rates applied to their 1-year MLF (for the first time since Apr 2020) & 7-day reverse repo operations by 10bp each. Only a handful of economists expected the People's Bank to trim rates today, while even this minority group was generally surprised by the magnitude of the cuts and the size of the liquidity injection. Offshore yuan held steady despite China's growing policy divergence with the U.S.

- The global data calendar offers little of note during the remainder of the day, with U.S. markets shut in observance of a public holiday. The dearth of catalysts outside China translated into muted price action across G10 FX space overnight.

FOREX OPTIONS: Expiries for Jan17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1505-15(E657mln)

- USD/JPY: Y114.10-20($1.4bln), Y115.00($1.7bln), Y116.50($680mln)

- EUR/GBP: Gbp0.8410(E605mln)

- AUD/USD: $0.7285(A$577mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/01/2022 | - |  | EU | ECB Lagarde & Panetta Eurogroup Meeting | |

| 17/01/2022 | 1330/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/01/2022 | 1400/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 18/01/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 18/01/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/01/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/01/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/01/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 18/01/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 18/01/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 18/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/01/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 18/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 18/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 18/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 18/01/2022 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.