-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN OPEN: China LGFV Debt Relief & Property Market Support In Focus

EXECUTIVE SUMMARY

- PBOC TO SUPPORT LOCAL GOVT DEBT SALES, ADVISORS SAY - MNI

- CHINA TO SHIFT $139bn OF TROUBLED DEBT TO PROVINCES - BBG

- ECB TO PAUSE IN SEPTEMBER, SAY SLIM MAJORITY OF ECONOMISTS- RTRS

- SERVICES, PRODUCTIVITY, CHINA BIGGEST RISKS - LOWE - MNI BRIEF

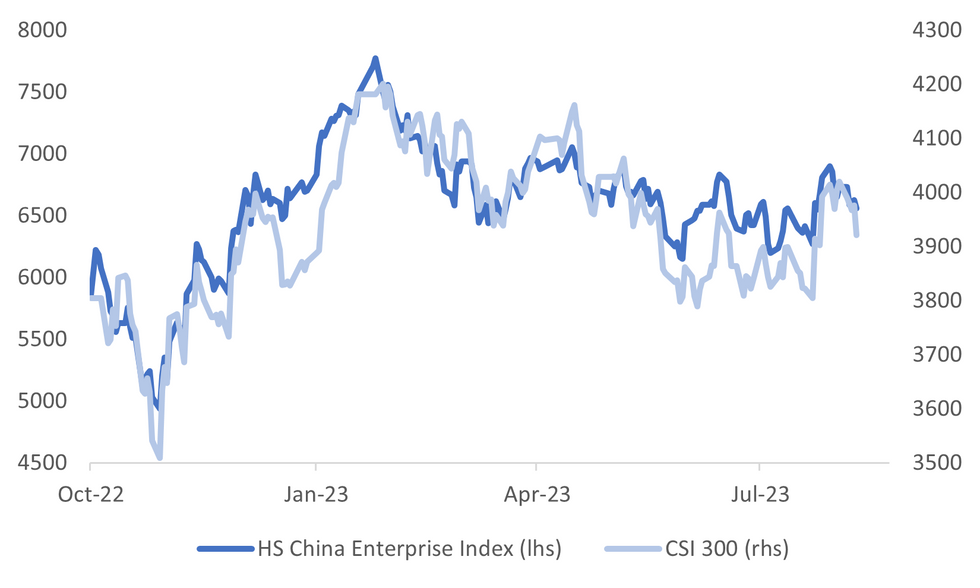

Fig. 1: China CSI 300 and Hang Seng China Enterprise Index

Source: MNI - Market News/Bloomberg

EUROPE.

ECB: The European Central Bank will pause a more than year-long rate-hiking campaign in September, according to a narrow majority of economists polled by Reuters, but a further rise by year-end is still on the cards with inflation running hot. (RTRS)

RUSSIA: Russia launched its first lunar lander in nearly 50 years on Friday in a journey to the moon’s south pole, joining a race with NASA and other space agencies to the region. The Soyuz rocket carrying the Luna-25 craft lifted off from the Vostochny Cosmodrome in Russia’s far east at 2:11 a.m. Moscow time and reached orbit about 10 minutes later. Luna-25 then separated from the upper-stage booster about one and a half hours into its flight. (BBG)

U.S.

POLITICS: U.S. prosecutors on Thursday asked a federal judge to begin former President Donald Trump's trial on charges of trying to overturn his 2020 election loss to Democrat Joe Biden on Jan. 2, 2024. That date would have the trial get under way just two weeks before the first votes are cast in the 2024 Republican presidential primary, a race in which Trump is the front-runner. (RTRS)

OTHER

AUSTRALIA: The Reserve Bank of Australia’s fight against inflation has shifted into the "next phase” which will feature slow unit labour cost growth, while sticky services inflation and the China slowdown represent the biggest risks to the economy, according to Governor Philp Lowe. (MNI BRIEF)

AUSTRALIA: Australia’s central bank chief Philip Lowe said monetary policy has now entered a “recalibration phase” under which the board will likely only need to make small adjustments in response to data. Speaking in his final semi-annual testimony as Reserve Bank governor at Parliament House in Canberra on Friday, Lowe said policymakers are keeping their options open on further tightening as they assess which way services prices and household consumption break. (BBG)

NEW ZEALAND: New Zealand posted its first monthly decline in food prices since early 2022, adding to signs that inflation pressures are continuing to ease. The food price index fell 0.5% in July from June, Statistics New Zealand said Friday in Wellington. That’s the first decline since February 2022. Annual food inflation slowed to 9.6% from 12.5%, and is the weakest since September. (BBG)

NEW ZEALAND: New Zealand's manufacturing PMI fell to 46.3 in July from revised 47.4 in June, according to Bank of New Zealand. Lowest level since gauge slumped to 39.0 in August 2021 during the Covid-19 pandemic Long-term average is 52.9. Production sub-index was lowest since August 2021, while employment measure was weakest since May 2020. (BBG)

SINGAPORE: Singapore slightly cut its economic outlook for 2023 on Friday after it narrowly averted a recession in the second quarter, with weak global demand a key drag on its trade-reliant economy. Goss domestic product (GDP) expanded a seasonally-adjusted 0.1% quarter-on-quarter in April to June, slower than 0.3% growth seen in the government's advance estimate. The first quarter contracted 0.4%. (RTRS)

MEXICO: Banxico’s Governor Victoria Rodriguez said that the bank would need to maintain its current rate “for a period that’s sufficiently long to see that the inflation panorama has advanced,” she said in a radio interview with Enfoque Noticias. She did not specify for how long the bank could hold its current rate The circumstances require “time for the disinflation process” to continue. (BBG)

CHINA

STIMULUS: The People’s Bank of China will boost liquidity by measures including possibly cutting reserve requirement ratios or policy rates in order to facilitate increased local government debt issuance while additional stimulus to boost a flagging economy is likely to be announced after this month’s key government meeting at Beidaihe, policy advisors told MNI. (MNI)

DEBT: Beijing is making one of its biggest top-down efforts in years to tackle the debts racked up by local governments in a sign of authorities’ mounting concern over the risk to financial stability as the economy falters. China’s state council, the country’s cabinet, is sending teams of officials to more than 10 of the country’s financially weakest provinces to scrutinise their books — including the liabilities of opaque off-balance sheet entities — and find ways to cut their debts. (FT)

PROPERTY: China will allow provincial-level governments to raise about 1 trillion yuan ($139 billion) via bond sales to repay the debt of local-government financing vehicles and other off-balance sheet issuers, a small step toward addressing one of the biggest threats to the nation’s economy and financial stability. (BBG)

PROPERTY: Country Garden is preparing to restructure its debt soon, Yicai understands. The developer has hired China International Capital Corporation to assist the restructure and recently released a statement saying it will maintain communication with creditors and take various debt management measures to ensure the long-term development. Insiders believe Country Garden can overcome current difficulties given its low leverage. (Yicai)

PROPERTY: Country Garden Holdings Co., formerly China’s largest developer by sales, has become a Hong Kong penny stock amid increasing scrutiny of its operations and mounting liquidity concerns. (BBG)

GROWTH: China will need 4.5% y/y growth in the H2 to achieve its 5% y/y growth target, which depends on whether policies can boost real estate while offsetting export decline, said Luo Zhiheng, chief economist at Yuekai Securities. Though the y/y growth in Q2 accelerated to 6.3% from Q1’s 4.5%, the two-year average growth excluding the base effect decelerated to 3.3% from Q1’s 4.6%, indicating a slower recovery. H2's two-year average growth will need to reach 3.95% to meet the target. (Century Business Herald)

YUAN: The dollar’s share of global reserves is expected to fall by five percentage points over the next decade, though remaining above 50%, while the remimbi portion is seen doubling to 6%, according to a survey by OMFIF of 75 central banks. (BBG)

PRIVATE SECTOR: China should guide more financial resources to private firms in order to stabilize their expectations and confidence, the Economic Daily says in a front-page commentary. Big state banks should step up lending for private firms and support their bond issuance. (Economic Daily).

COMMODITIES: China’s inbound shipments of fuel oil fell from a record set in June as a local bottleneck eased and refiners received a fresh import quota, pressuring regional processors’ cracks for making high-sulfur fuel oil. Imports declined to 330,000 barrels a day in July, down from June’s peak of 432,000 barrels a day, according to data intelligence firm Kpler. Initial flows this month showed a further drop-off in the pace to 239,000 barrels a day. (BBG)

CHINA MARKETS

PBOC Injects CNY2 Bln Via OMOs Fri; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Friday with the rate unchanged at 1.90%. The operation has led no change to the liquidity after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8000% at 09:41 am local time from the close of 1.7309% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 50 on Thursday, compared with the close of 43 on Wednesday.

PBOC Yuan Parity At 7.1587 Friday Vs 7.1576 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1587 on Friday, compared with 7.1576 set on Thursday. The fixing was estimated at 7.2078 by BBG survey today.

OVERNIGHT DATA

NEW ZEALAND BUSINESSNZ MANUFACTURING PMI 46.3; PRIOR 47.4

NEW ZEALAND FOOD PRICES M/M -0.5%; PRIOR 1.6%

SOUTH KOREA AUGUST 1-10 DAY EXPORTS Y/Y -15.3%; PRIOR -14.8%

SOUTH KOREA AUGUST 1-10 DAY IMPORTS Y/Y -30.5%; PRIOR -26.9%

SOUTH KOREA AUGUST 1-10 DAY TRADE DEFICIT Y/Y -$3bn; PRIOR -$2.28bn

SOUTH KOREA JUNE MONEY SUPPLY M2 SA M/M 0.5%; PRIOR -0.3%

MARKETS

US TSYS: Weaker, Narrow Range, No Cash Trading

TYU3 is trading at 110-23+, -04 from NY closing levels. With no headlines of significance and no cash tsy trading due to Japan’s observance of the Mountain Day public holiday, TYU3 dealings have been contained in a narrow range in the Asia-Pac session.

AUSSIE BONDS: Trading On A Weak Note, Wage Price Index On Tuesday

ACGBs (YM -6.0 & XM -7.5) are sitting at session lows. While the local session had RBA Governor Lowe’s appearance before Parliament, the market's direction appears more linked to the direction in US tsys, which are testing overnight lows in Asia-Pac trade.

- In his testimony, Governor Lowe highlighted household consumption and services inflation as the risks that will determine the policy path. These are familiar themes. Lowe added that the RBA is in watch-and-wait mode.

- Cash ACGBs are 5-7bp cheaper with the AU-US 10-year yield differential -2bp at +1bp.

- Swap rates are 4-6bp higher.

- The bills strip twist steepens with pricing flat to -6.

- RBA-dated OIS pricing is 1-3bp firmer across meetings.

- (AFR) Outgoing RBA governor Philip Lowe has urged policymakers not to succumb to the allure of quick fixes for the housing crisis, warning rent controls would make the shortage of homes even worse over the long term. (See link)

- Next week, the local calendar is uneventful on Monday. On Tuesday, attention turns to the CBA Household Spending data, setting the stage for the highly significant Wage Price Index scheduled for release on Wednesday and the Employment report on Thursday.

- The AOFM has announced plans to sell A$500mn of 2.75% 21 May 2041 bond on Wednesday.

NZGBS: Weaker, But Off Cheaps, Outperforms $-Bloc

NZGBs closed with a twist steepening of the 2/10 curve. Benchmarks were 1bp richer to 3bp cheaper. The short-end's move away from early session cheaps was aided by a soft Manufacturing PMI report that showed the index falling to 46.3 in July from a revised 47.4 in June. This was the lowest level since the gauge slumped to 39.0 in August 2021 during the Covid-19 pandemic. The long-term average is 52.9.

- The intraday short-end strengthening stood in stark contrast to the observed cheapening in US tsys and ACGBs, notably. Consequently, the yield differentials for the NZ-US and NZ-AU 10-year yield differentials contracted by 4bp.

- The swap curve also twist steepened with rates 2bp lower to 5bp higher.

- RBNZ dated OIS pricing closed 1-3bp softer across meetings.

- Food prices fell 0.5% m/m in July, with fruit and vegetable prices -4.1% m/m.

- Next week, the domestic calendar sees the Performance Services Index and Net Migration data on Monday, followed by REINZ House Prices on Tuesday. These precede the RBNZ Policy Decision on Wednesday. Bloomberg consensus is unanimous in expecting the OCR to be kept at 5.50%. The OIS market currently attaches an 8% chance of a 25bp hike.

EQUITIES: Japan Stocks Outperform Again, China Markets Down Despite LGFV Debt Relief

Regional equity indices are mixed as we approach the end of the week. Outside of Japan, most regional markets are again weaker. The early positive impetus to US equity futures also wasn't sustained. Eminis last track at 4484, down slightly for the session. Earlier highs were just above 4496.25. Nasdaq futures are still slightly higher, but well off intra-day highs.

- The focus for China and Hong Kong markets remains property market sentiment and local government debt. The HSI is down 0.62% at the break, which is up from lows, but only marginally. The HSTECH index is down by close to 1.90%.

- Not long before the break we had Bloomberg headlines cross that China's Ministry of Finance will help shift $139bn of debt (or around 1 trillion yuan) from LGFV to provinces. Provincial level governments will raise these funds through debt sales to repay debt of LGFVs. The initial market reaction was positive, but not large. Bloomberg notes this is a smaller than a similar scheme, which was launched in 2015, while it is also well below total LGFV debt estimates compiled by the IMF.

- On the mainland, the CSI 300 sits -1.38% lower at the break, with real estate sub-index at -0.43%, which is up from session lows, but still down for the week.

- Japan stocks are outperforming, the Topix and Nikkei 225 both up by 0.80-0.90%. Weaker yen levels and carry over from China recommencing tours to the country remain positives.

- The Kospi and Taiex are close to flat. In SEA Singapore shares are down over 1%. Weaker than expected Q2 GDP revisions have not helping sentiment.

FOREX: USD Can't Sustain Early Gains, NZD Underperforms

The BBDXY tracked higher in initial trade, as markets extended the USD's gains that came post the CPI print in Thursday NY trade. However, the BBDXY couldn't sustain a move above 1233.40, the index last around 1232.90, little changed for the session. Japan onshore markets have been closed today, which has meant no cash US Tsy trading. US bond futures have been range bound, unable to test late Thursday session lows. Equity futures opened higher, but are now back close to flat.

- USD/JPY attempted an early move towards 145.00 but this ran out of steam quickly, an option expiry later today in NY with a 145.00 strike may have been a factor. USD/JPY, last tracked around 144.65/70, slightly below Thursday closing levels in NY.

- NZD has underperformed at the margins. We had softer data on the manufacturing PMI front, which dipped further into contractionary territory (46.3), while food prices fell 0.5% m/m (the first fall since Feb 2022). The pair last tracked near 0.6010, but support appears evident ahead of the 0.6000 figure level, which is close to multi-month lows.

- AUD/USD was softer in early trade, but didn't test sub 0.6500. The pair was last 0.6520/25. RBA Governor Lowe testified before parliament, reiterating many previous well documented points. Household consumption, services inflation and the China slowdown are RBA watch points. AUD/NZD has tracked higher today, last near 1.0850.

- EUR/USD has been steady, unable to move back above the 1.1000 level.

- Looking ahead, we get UK Q2 GDP printing, while in the US the July PPI and August U.of Mich sentiment readings are on tap.

OIL: Little Changed In Asia-Pac After Giving Early Gains On Thursday

Oil is little changed in Asia-Pac trade after closing 1.8% lower on Thursday.

- After briefly pushing on to fresh YTD highs in London trading on Thursday, crude oil steadily moved lower both before and after US CPI and OPEC's MOMR, with Treasury sell-off and resumption of USD strength in the second half of the NY session adding a further headwind.

- Oil is on track to end the week little changed ahead of a report from the International Energy Agency that will provide a snapshot of a crude market that’s tightening due to supply curbs. Global markets are heading for a sharp supply deficit of more than 2 million barrels a day this quarter as Saudi Arabia slashes output, according to a monthly report from OPEC on Thursday. (See link)

- China’s inbound shipments of fuel oil fell from a record set in June as a local bottleneck eased and refiners received a fresh import quota. Imports declined to 330,000 barrels a day in July, down from June’s peak of 432,000 barrels a day. (See link)

GOLD: Little Changed After Less Dovish Fedspeak

Gold is slightly stronger in the Asia-Pac session, after closing marginally weaker at $1912.48 on Thursday. Bullion had initially spiked to $1930 after US CPI printed in line with expectations and initial jobless claims increased. However, that move proved to be short-lived as Fedspeak dampened optimism that easing inflation signalled the end of monetary tightening.

- Fed’s Daly (’24 voter) noted that the Fed still has more work to do and that the CPI data was largely as expected and that it doesn’t say ‘victory is ours’ on inflation. Daly added the Fed is yet to determine whether to raise and how long to hold rates, with Daly being data dependent and it premature to decide on another hike. There is a lot more info coming in before the September meeting and before year-end.

- Still, the Fed is looking increasingly likely to leave interest rates unchanged at its next meeting, with market participants having significantly pared bets on a September hike over recent weeks. The market currently attaches a 10% chance of a 25bp hike at the 20 September FOMC meeting.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/08/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 11/08/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 11/08/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 11/08/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 11/08/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 11/08/2023 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 11/08/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 11/08/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 11/08/2023 | - | *** |  | CN | Money Supply |

| 11/08/2023 | - | *** |  | CN | New Loans |

| 11/08/2023 | - | *** |  | CN | Social Financing |

| 11/08/2023 | 1230/0830 | *** |  | US | PPI |

| 11/08/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 11/08/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.