MNI EUROPEAN OPEN: China Lowers 14 Day Repo Rate, Supports Risk Appetite

EXECUTIVE SUMMARY

- US CONGRESS UNVEILS STOPGAP SPENDING DEAL TO AVERT SHUTDOWN - BBG

- SCHOLZ ESCAPES ANOTHER DEFEAT TO FAR RIGHT IN GERMAN STATE VOTE - DW

- PBOC CUTS 14-DAY REVERSE REPO RATE BY 10BP - MNI BRIEF

- FED’S BOWMAN CITES LINGERING INFLATION CONCERN IN DISSENT - MNI

- FED’S WALLER -50BP CUT REFLECTS RAPID INFLATION DROP - MNI BRIEF

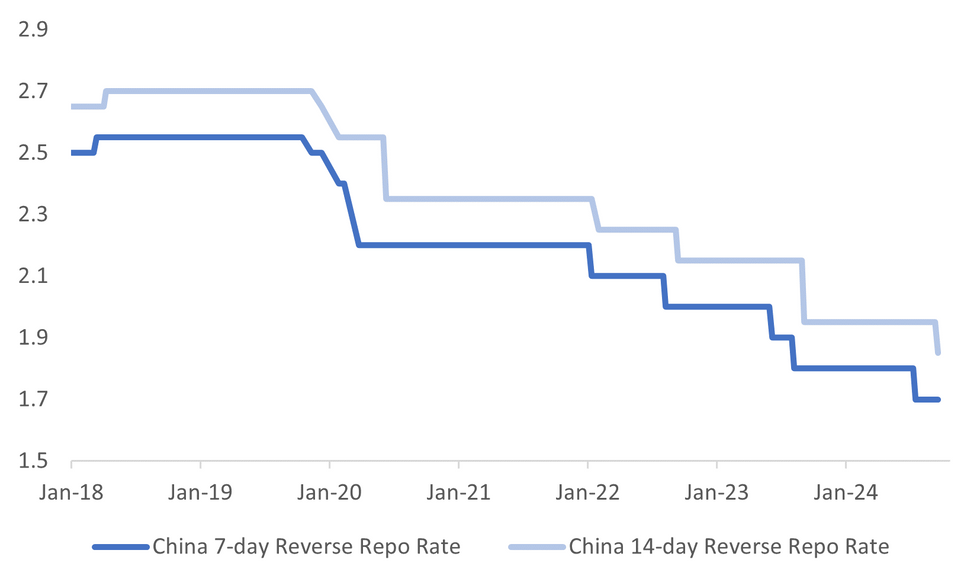

Fig. 1: China 7 and 14 day Reverse Repo Rates

Source: MNI - Market News/Bloomberg

UK

M&A (BBG): “ REA Group Ltd. increased its offer for Rightmove Plc to £6.1 billion ($8.1 billion), expressing frustration at the UK property portal’s refusal to even discuss a deal.”

FISCAL (BBG): “The UK’s new Labour government won’t return to the austerity cuts of its Conservative predecessors, Chancellor of the Exchequer Rachel Reeves will promise on Monday, as she pivots toward a more positive narrative after weeks of warning about the dire state of the public finances.”

FISCAL (BBC): “Rachel Reeves will pledge "a Budget to rebuild Britain" in her speech to the Labour Party conference in Liverpool on Monday. The chancellor is under pressure to provide some optimism after Labour's gloomy messaging on the state of the economy they inherited from the Conservatives.”

POLITICS (BBC): “Deputy Prime Minister Angela Rayner was cheered to the rafters when she restated Labour’s policy on workers’ rights in her speech to Labour's conference in Liverpool. She told the party faithful "Tory anti-worker" laws would be repealed and legislation offering a new deal for working people would be introduced within 100 days of taking power. She has one month left to deliver on that promise.”

EU

ECB (MNI BRIEF): The European Central Bank will stick to its 2% symmetric inflation target as part of its 2025 Strategy Review, President Christine Lagarde confirmed in a speech on Friday.

GERMANY (DW): “Initial results put the Social Democrats at 30.7%, ahead of the far-right AfD on 29.5%. ChancellorOlaf Scholz, a Social Democrat, told reporters in New York that the mood in his party was "good, of course," given the first projections from the Brandenburg state election. The state election is seen as a test of confidence for the government ahead of federal elections next year.”

FRANCE (BBC): “French President Emmanuel Macron has unveiled his new government almost three months after a snap general election delivered a hung parliament.”

FRANCE (FRANCE24): “French Prime Minister Michel Barnier's new government is already feeling the pressure from opposition politicians on both sides amid growing threats of a no-confidence vote in parliament. Barnier's first main task is to submit a 2025 budget plan that addresses what he called France's "very serious" financial situation.”

FRANCE (BBG): “French Prime Minister Michel Barnier said his new government could increase taxes for big business and the wealthiest as it seeks to repair runaway budget deficits and keep the faith of bond markets.”

ITALY (BBG): “Italy is considering asking banks for a symbolic contribution calculated from earnings posted in the last two years, Corriere della Sera reported on Sunday.”

UKRAINE (FRANCE24): “As Biden continues to oppose Ukraine's use of NATO weapons on targets inside Russian territory, Zelensky arrived in the United States on Sunday to present his war plan to US President Joe Biden, as well as presidential candidates Donald Trump and Kamala Harris.”

SWITZERLAND (DW): “Switzerland on Sunday held a popular vote on two national issues. The first was to compel authorities to do more for biodiversity preservation, and the second called for a government-backed reform on pension financing. According to projected results, voters voted no on both issues.”

US

POLITICS (RTRS): “U.S. Vice President Kamala Harris leads Republican rival Donald Trump by 5 percentage points in an NBC News poll released on Sunday that found that respondents have come to see her more favorably since she emerged as the Democratic candidate for president.”

POLITICS (RTRS): “U.S. Vice President Kamala Harris plans to roll out a new set of economic policies this week that aim to help Americans build wealth and set economic incentives for businesses to aid that goal, three sources with knowledge of the matter said.”

POLITICS (RTRS): “- Republican Donald Trump said that he will not make a fourth consecutive run for the U.S. presidency if he loses the Nov. 5 election, saying "that will be it" in an interview released on Sunday.”

FISCAL (BBG): “Congressional leaders unveiled a stopgap funding bill Sunday to temporarily keep the US government’s doors open through Dec. 20, as negotiators aim to avert an Oct. 1 shutdown and set the stage for a funding showdown shortly before Christmas.”

FED (MNI): Federal Reserve Governor Michelle Bowman said Friday she preferred a smaller interest rate cut this week to start the Fed's easing cycle because inflation remains a concern.

FED (MNI BRIEF): Federal Reserve Governor Christopher Waller said Friday the central bank's 50 basis point rate cut this week was justified by inflation falling faster than policymakers had foreseen, and said policymakers would not hesitate to keep cutting aggressively if the economy weakens.

FED( MNI): The Federal Reserve will announce the details of its upcoming review of the central bank's monetary policy framework "in coming months," the Fed said Friday.

ECONOMY (MNI): The U.S. economy has been in a soft landing since early 2022 and that could well continue, according to a paper co-authored by Federal Reserve Governor Chris Waller published Friday.

OTHER

ISRAEL (BBG): “The exchange of fire - and of rhetoric - between Israel and Hezbollah intensified on Sunday as the Lebanon-based group launched about 115 rockets, missiles and drones toward vast areas of Israel’s north.”

MIDDLE EAST (WSJ/BBG): “Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. have discussed building major new factories in the United Arab Emirates in coming years to help satisfy soaring demand for artificial intelligence computing, the Wall Street Journal reported.”

SOUTH KOREA (YONHAP): “National Security Adviser Shin Won-sik said Monday that North Korea remains ready to carry out its seventh nuclear test at any time and that includes around the U.S. presidential election in November.”

NEW ZEALAND (MNI): External Risks To Accelerate RBNZ Easing Cycle - Ex Econs

AUSTRALIA (BBC): “The Australian Competition and Consumer Commission (ACCC) claims Coles and Woolworths broke consumer law by temporarily raising prices before lowering them to a value either the same as or higher than the original cost.”

GLOBAL (DW): “The international community adopted a plan to reform the United Nations, called the "Pact for the Future," despite Russian efforts to derail it.”

CHINA

POLICY (MNI BRIEF): The People’s Bank of China eased the 14-day reverse repo rate by 10bps to 1.85% on Monday, the first reduction since January 2023, following the 7-day reverse repo rate cut in July, according to a statement on the PBOC’s website

DEBT (MNI BRIEF): China's rising debt-to-GDP ratio will not increase financial risks, as rising liabilities are accompanied by an increase in asset size, said Li Yang, chairman at the National Institution for Finance & Development, in Beijing on Saturday.

ECONOMY (21ST CENTURY BUSINESS HERALD): “Authorities should implement at least CNY10 trillion of economic stimulus within one to two years by mainly issuing ultra-long-term special treasury bonds, said Liu Shijin, deputy director at the Economic Affairs Committee of the Chinese People's Political Consultative Conference.”

CONSUMER (CASS): “The government needs to boost consumer demand to ensure China’s economy meets its potential growth rate, said Cai Fang, chief expert at the National Think Tank of the Chinese Academy of Social Sciences, at a recent forum.”

HOUSING (YICAI): “ Officials should eliminate banks’ concerns regarding whitelisted housing project lending by relaxing due diligence, said Wang Yiming, vice chairman at the China Center for International Economic Exchanges.”

CHINA MARKETS

MNI: PBOC Net Injects CNY95.9 Bln via OMO Monday

The People's Bank of China (PBOC) conducted CNY160.1 billion and CNY74.5 billion via 7-day and 14-day reverse repos, with the rate at 1.70% and 1.85%, respectively. The operation led to a net injection of CNY95.9 billion after offsetting CNY138.7 billion maturities, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7988% at 09:52 am local time from the close of 1.9569% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Friday, compared with the close of 46 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0531 on Monday, compared with 7.0644 set on Friday. The fixing was estimated at 7.0535 by Bloomberg survey today.

MARKET DATA

AUSTRALIA JUDO BANK SEPT FLASH MFG PMI 46.7; PRIOR 48.5

AUSTRALIA JUDO BANK SEPT FLASH SERVICES PMI 50.6; PRIOR 52.5

AUSTRALIA JUDO BANK SEPT FLASH COMPOSITE PMI 49.8; PRIOR 51.7

NEW ZEALAND AUGUST TRADE BALANCE –NZ$2.20B; PRIOR –NZ$1.02B

NEW ZEALAND AUGUST YTD TRADE BALANCE –NZ$9.29B; PRIOR –NZ$9.35B

SOUTH KOREA SEPT EXPORTS 20 DAYS -1.1%Y/Y; PRIOR +18.5%

SOUTH KOREA SEPT IMPORTS 20 DAYS -4.5% Y/Y; PRIOR +10.1%

MARKETS

US TSYS: Futures Weaker, No Cash Trading Due To Japan Holiday

TYZ4 is trading at 114-20, -0-07 from NY closing levels.

- There has been no cash trading for US tsys in today's Asia-Pac session due to a holiday in Japan.

- Newsflow has also been light so far today, leaving Asia-Pac market participants to digest Friday’s conflicting Fedspeak.

- Fed Governor Bowman (voter) issued a statement on Friday explaining why she dissented against the FOMC’s decision to cut the Fed Funds target range by 50bps last Wednesday. Her comments were in contrast to Governor Waller’s remarks in a CNBC interview, which were concerned with risks of inflation undershooting.

- Projected rate cuts into early 2025 bounced off early session lows on Friday, with the latest vs. late Thursday levels (*) as follows: Nov'24 cumulative -37.8bp (-35.9bp), Dec'24 -75.0bp (-72.4bp), Jan'25 -108.5bp (-106.5bp).

- Looking ahead to today’s US calendar, we will see more Fedspeak from Bostic, Goolsbee and Kashkari, alongside data including flash PMI data from S&P Global.

AUSSIE BONDS: Subdued Start To A Busy Week, RBA Tomorrow, CPI On Wednesday

ACGBs (YM -4.0 & XM -5.0) are weaker after dealing in narrow ranges in today’s Sydney session. Without cash US tsy dealing in today's Asia-Pac session due to a holiday in Japan, the local market has traded without conviction.

- TYZ4 currently deals at 114-20+, -0-06+ from Friday’s closing levels.

- The RBA's Policy Decision is due tomorrow, with Bloomberg consensus unanimous in expecting a no-change outcome.

- Following the decision and statement at 1430 AEST, RBA Governor Bullock will hold a press conference at 1530 AEST. She last spoke on September 5 and since then survey data have been soft but labour market and lending data strong. So, we don’t expect that the Board has changed its view that it is too soon to discuss rate cuts.

- August CPI is released on Wednesday with the headline forecast to moderate to 2.7% from 3.5% driven by federal government electricity subsidies. The trimmed mean will be the focus (3.8% in July).

- Cash ACGBs are 4bps cheaper.

- Swap rates are 4bps higher.

- The bills strip has bear-steepened, with pricing -4 to -6.

- RBA-dated OIS pricing is 2-5bps firmer across 2025 meetings. A cumulative 15bps of easing is priced by year-end.

NZGBS: Closed Cheaper, Subdued Session, Light Local Calendar

NZGBs closed 1-4bps cheaper after a relatively subdued session. There has been no cash trading for US tsys in today's Asia-Pac session due to a holiday in Japan. TYZ4 currently deals at 114-20+, -0-06+ from Friday’s closing levels.

- Outside of the previously outlined Job Ads data, there hasn't been much by way of domestic drivers to flag. It is a reasonably quiet week for NZ, with Friday’s ANZ Consumer Confidence data as the highlight.

- Across the ditch, the RBA Policy Decision is due tomorrow, with Bloomberg consensus unanimous in expecting a no-change outcome.

- Swap rates closed flat to 4bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed little changed. A cumulative 83bps of easing is priced by year-end.

- On Thursday, the NZ Treasury plans to sell NZ$250mn of the 3.00% Apr-29 bond, NZ$225mn of the 4.50% May-35 bond and NZ$25mn of the 2.75% Apr-37 bond.

FOREX: Safe Havens Down, A$ Firms On Regional Equity Gains Post China Repo Cut

Safe havens have lost ground in the first part of Monday trade, while the AUD has outperformed. The BBDXY and DXY USD indices sit little changed. Yen is off around 0.25%, while CHF is down by a little over 0.10%.

- The backdrop from a regional equity market standpoint has been positive, with most major markets higher at this stage. China related sentiment has been supported by a 10bps cut to 14 day repo rate. This is not a widely used benchmark but may signal further policy easing is coming. A press conference will be held tomorrow, where the PBoC Governor will be in attendance.

- US equity futures are also firmer higher, up 0.30% for Eminis and nearly 0.60% for Nasdaq futures.

- This has likely helped AUD/USD, which is the outperformer in the G10 space, up 0.35% to 0.6835. Recent highs at 0.6839 are very close by. Late December 2023 levels rested just above 0.6870.

- We had earlier preliminary PMI data in Australia, for September, but sentiment wasn't shifted. NZ's trade deficit widened in August, but didn't impact NZD much. NZD/USD was last a touch higher at 0.6240/45. The AUD/NZD cross is close to recent highs, last near 1.0940/45.

- USD/JPY got close to Friday highs (144.49) but ran out of steam at 144.46, the pair last near 144.25, still 0.25% weaker in yen terms. Japan markets have been out today, so no cash Tsy trading has taken place. US 10yr futures have edged down but remain within Friday's ranges.

- Commodities have been mixed, with oil up on the China news and continued geopolitical tensions. Iron ore is softer but hasn't impacted AUD.

- Looking ahead on the data front, we have EU and US September preliminary PMIs are released. The Fed’s Bostic, Goolsbee and Kashkari also speak.

CHINA STOCKS: Strong Start to the Week Ahead of Next Week’s Holidays

- China and Hong equity markets are starting the week on a positive note following on from last week’s shortened week.

- The Shanghai Composite finished the week +1.21% higher with only three days of trading.

- This morning the Shanghai composite is up 0.43% in early trade.

- The PBOC announced the reduction in the interest rate for the 14-day repo rate ahead of next week’s holidays.

- Whilst not as widely used, the reduction in the 14-day is seen as a timely reminder of authorities’ willingness to alter policy to support the economy and the Monday’ rally in part is due to expectations that today’s policy changes are potentially a sign of more to come.

- The other focus point remains on domestic calls for further economic stimulus. See our onshore China press briefing for more details.

- Across in Hong Kong, the Hang Seng too had a strong week last week, up 5.12% as investors digested the HKMA’s first cut in rates in four years.

- The Hang Seng too is opening strong Monday, up 0.41% in morning trade as investors take a positive view on last week’s monetary policy decisions ahead of National Day Holidays next week.

ASIA STOCKS: Signs of Strength, with South East Asia Lagging.

- Asian stocks started the week strongly after the PBOC reduced the interest rate on a lesser used liquidity tool.

- The 14-day repo rate is in place to support the daily used 7-day repo rate in the event of holidays.

- With the upcoming National Day Holidays, the 14-day rate was reduced following July’s cut of the 7-day rate.

- For many regional equity investors this was a sign of things to come that the PBOC is willing to support the ailing Chinese economy and that the potential for further stimulus remains.

- In India, data shows that net foreign purchases this quarter are the strongest they have been since 2023, unsurprisingly given the outlook for GDP growth.

- Last week saw investors in India starting to look forward to interest rate cuts from the RBI, buying interest rate sensitive stocks like banks and real estate. Whilst it may be some time off before the RBI cuts rates (given the seasonality expected in September data), the October 9 meeting could put rate cuts in play for the following meeting.

- The Nifty 50 firmed 2.03% last week.

- Trade data out this morning in Korea continues to show that the semi-conductor boom is continuing rising by 26.2% in the first part of September.

- The push pull between the Central Bank and Politicians in the desire to cut rates will be a driving factor for Korea in the coming months.

- Having risen 0.70% last week, the KOSPI is up 0.33%. The relative underperformance of the KOSPI is possibly a reflection of the disparity of views between the BOK and politicians.

- Elsewhere in the region, Malaysia is bucking the trend off -0.25% ahead of its upcoming CPI number and the Jakarta composite is following this trend down 0.36%

OIL: Crude Rallies On China Rate Cut And Rising Geopolitical Tensions

Oil prices are higher today after range trading on Friday driven by escalating geopolitical tensions in the Middle East and China’s 10bp reduction in the 14-day repo rate. WTI rose 0.9% to $71.61/bbl, close to the intraday high, and Brent is up 0.8% to $75.06. The USD index is little changed.

- Oil markets have been concerned about the outlook for China’s economy for some time, as the country is the world’s largest oil importer. Today’s rate cut has buoyed the market though as it signals that the authorities may be prepared to stimulate demand. The Fed’s 50bp rate cut last week may also open the door.

- Israel targeted rocket launchers in southern Lebanon over the weekend after striking Hezbollah leadership in Beirut. Hezbollah fired around 150 rockets and missiles into Israel. The UN has counselled both sides to step back from the brink. Iran supports Hezbollah and there could be risks to oil markets if it were to become more involved in the conflict.

- Later the Fed’s Bostic, Goolsbee and Kashkari speak and preliminary September US/European PMIs are released.

GOLD: Fresh All-Time High After Fed Waller’s Dovish Remarks

Gold is 0.3% higher at a new all-time high of $2631.13 in today’s Asia-Pac session, after closing 1.4% higher on Friday.

- Friday’s move was aided by dovish comments from the Fed’s Waller. Governor Waller expressed concern with inflation undershooting, not overshooting, noting firms' limited pricing power and wage inflation coming down, and that inflation is potentially on a lower path than had previously been expected.

- However, Fed Governor Bowman (voter) issued a statement explaining why she dissented against the FOMC’s decision to cut the Fed Funds target range by 50bps last Wednesday.

- Projected rate cuts into early 2025 bounced off early session lows, latest vs. late Thursday levels (*) as follows: Nov'24 cumulative -37.8bp (-35.9bp), Dec'24 -75.0bp (-72.4bp), Jan'25 -108.5bp (-106.5bp).

- Looking ahead to today’s US calendar we see more Fed speak from Bostic, Goolsbee and Kashkari, alongside data including flash PMI data from S&P Global.

- From a technical perspective, having pierced initial resistance at $2,613.3 on Friday, the next resistance is seen at $2,642.7, the 2.236 projection of the Jul 25 - Aug 2 - Aug 5 price swing.

- Analysts at Quantix Commodities say that although a near-term pull-back in prices is possible, given extreme positioning, the beginning of a Fed easing cycle will undoubtedly be bullish for gold.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/09/2024 | 0645/0845 |  | EU | ECB's Elderson at Real Estate summit | |

| 23/09/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/09/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/09/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/09/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/09/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/09/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/09/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/09/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/09/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/09/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/09/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 23/09/2024 | 1200/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/09/2024 | 1300/1500 |  | EU | ECB's Cipollone statement on digital euro at Hearing | |

| 23/09/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (Flash) |

| 23/09/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/09/2024 | 1415/1015 |  | US | Chicago Fed's Austan Goolsbee | |

| 23/09/2024 | 1530/1730 |  | EU | ECB's Cipollone in panel discussion at House of the euros | |

| 23/09/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/09/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/09/2024 | - |  | SE | Riksbank Meeting |