-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Property Concerns Take Shine Off Data Beats

EXECUTIVE SUMMARY

- BIDEN’s MIDEAST MISSION UNRAVELLING AS ARAB LEADERS SHUN SUMMIT - BBG

- FED’S KASHKARI: INFLATION STILL TOO HIGH - RTRS

- ECB’S HOLZMANN SAYS NOT OUT OF THE WOODS YET ON INFLATION - BBG

- CHINA Q3 GDP BEATS EXPECTATION TO RISE 4.9%

- CHINA SHOULD NEGOTIATE WITH EU OVER POTENTIAL EV TARIFFS - MNI

- BOJ OFFERS EXTRAORDINARY JGB BUYING OPERATIONS - MNI BRIEF

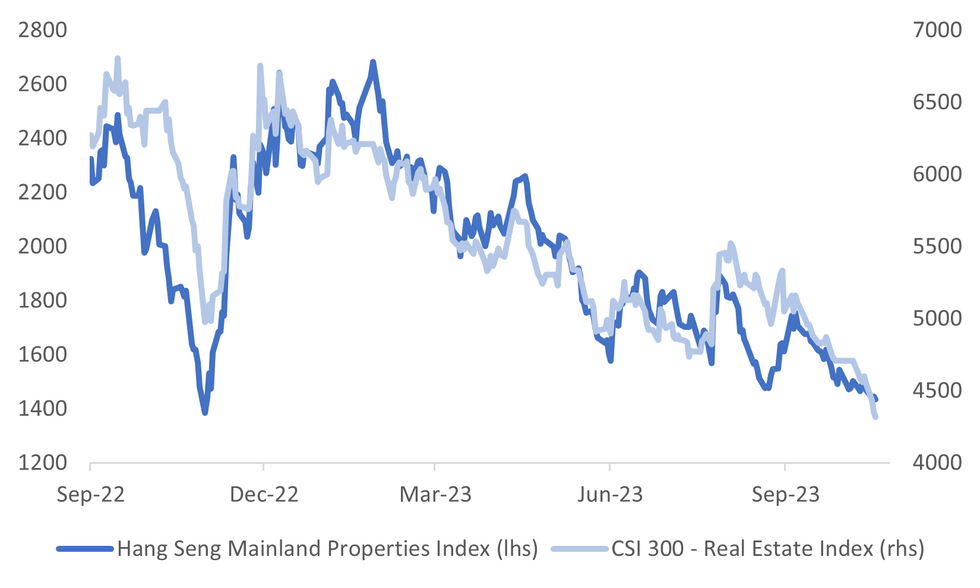

Fig. 1: China Real Estate Equity Indices Continue To Trend Lower

Source: MNI - Market News/Bloomberg

EUROPE

ECB (BBG): European Central Bank Governing Council member Robert Holzmann said inflation hasn’t been defeated yet and any additional price shocks could require further increases in borrowing costs.

ECB (FT): The Israel-Hamas war is creating new challenges for Europe’s economy, from energy market disruption to an influx of refugees, Greece’s central bank governor has warned. Yannis Stournaras told the Financial Times that the turmoil in the Middle East shifted the balance against any further tightening of monetary policy.

RUSSIA (RTRS): President Vladimir Putin on Wednesday praised Chinese President Xi Jinping for the Belt and Road Initiative (BRI) and invited global investment in the Northern Sea route which he said could deepen trade between east and west.

U.S.

MIDEAST (BBG): President Joe Biden’s dramatic war-time visit to Israel and Jordan began to unravel even before he left the ground, after an explosion at a Gaza hospital left hundreds dead and Arab leaders pulled out of a meeting planned for the trip.

FED (RTRS): Minneapolis Federal Reserve Bank President Neel Kashkari on Tuesday said it has taken much longer than expected for inflation to come down, and it is "still too high."

POLITICS (RTRS): Combative right-wing Republican Jim Jordan on Tuesday sought more time to build support for his bid for speaker of the U.S. House of Representatives after coming up short in a first vote, raising questions about his prospects for winning the job

GEOPOLITICS (BBG): President Joe Biden is considering a supplemental request of approximately $100 billion that would include defense assistance for Israel and Ukraine alongside border security funding and aid to nations in the Indo-Pacific, including Taiwan, according to people familiar with the matter.

US/CHINA (BBG): Nvidia Corp. suffered its worst stock decline in more than two months after the Biden administration stepped up efforts to keep advanced chips out of China, a campaign that includes restricting the company’s sale of processors designed specifically for the Chinese market.

US/VENEZUELA (RTRS): Venezuela's government and its political opposition on Tuesday agreed to electoral guarantees for 2024 presidential elections, paving the way for possible U.S. sanctions relief, though the deal did not lift bans on opposition candidates barred from public office.

OTHER

JAPAN (MNI): The Bank of Japan on Wednesday conducted extraordinary bond buying operations to address the rise in Japanese government bond yields as the 10-year JGB yield rose to 0.815% for the highest level in 10 years and two months.

JAPAN (BBG): Struggling with his lowest approval ratings since taking office, Japanese Prime Minister Fumio Kishida is considering temporary tax reductions, the Nikkei newspaper reported, days ahead of two special elections.

HONG KONG (HKMA): The Chief Executive of the Hong Kong Monetary Authority (HKMA), Eddie Yue, said on Tuesday there is no plan to change the currency peg to the U.S. dollar in an article published on the HKMA website, calling it the cornerstone of Hong Kong’s monetary and financial stability. Yue said the linked exchange rate system (LERS) has helped Hong Kong weather a succession of shocks and crises, as well as many severe challenges since it was introduced in 1983.

AUSTRALIA (BBG): Australia’s central bank Governor Michele Bullock pointed to a series of obstacles to bringing inflation back to target that range from sticky services prices to repeated global shocks including the Israel-Hamas war.

NEW ZEALAND (BBG): New Zealand will begin publishing additional monthly price indexes to assist the central bank and economists to more accurately forecast quarterly headline inflation.

CHINA

GROWTH (MNI): The Chinese economy grew by 4.9% y/y in Q3, beating market expectations of 4.5%, as production and consumption rebounded more than expected, despite weakness in real estate continuing to drag down investment, data released by the National Bureau of Statistics on Wednesday showed.

GROWTH (MNI BRIEF): Chinese officials believe the country's economy can achieve the 5% GDP growth target, given the strong foundation established in the first three quarters of the year, according to Sheng Laiyun, spokesperson for the National Bureau of Statistics (NBS).

CHINA/EU (MNI): China should deepen cooperation with European countries on electric vehicles (EV) and negotiate should the E.U. escalate its investigation into cheaper Chinese EV imports and impose additional tariffs, policy advisors told MNI.

YUAN (MNI BRIEF): Continuous economic recovery fueled by the People’s Bank of China’s counter-cyclical measures and better leveraged aggregate and structural monetary tools will further support yuan stability, according to a commentary published on the PBOC-run newspaper Financial News on Wednesday.

BELT & ROAD (MNI BRIEF): China will further open up its domestic market, improve connection with its counterparts and pursue a win-win international cooperation in a process of building up a high-quality Belt and Road Initiative for the next decade, China's president Xi Jinping said in a keynote speech at the opening ceremony of the third Belt and Road Forum for International Cooperation on Wednesday in Beijing.

LPR (SECURITIES DAILY): The October Loan Prime Rate is set to remain unchanged, as the anchor rate of medium-term lending facility was kept steady this week. Quoting banks lacked motivation to reduce LPR quotation, as policymakers guided banks to reduce the financing cost of the real economy and lower the existing housing mortgage rates, which have put their net interest margins under pressure, said Wang Qing, analyst at Golden Credit Rating.

PROPERTY (BBG): Distressed Chinese builder Country Garden Holdings Co. has remained silent as a grace period is ending for dollar-bond interest that if unpaid would mark its first-ever public default.

CHINA MARKETS

MNI: PBOC Injects Net CNY3 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY105 billion via 7-day reverse repo on Wednesday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY3 billion after offsetting the maturity of CNY102 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8007% at 09:33 am local time from the close of 1.8776% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 49 on Tuesday, compared with the close of 41 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1795 Wednesday Vs 7.1796 Tuesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1795 on Wednesday, compared with 7.1796 set on Tuesday. The fixing was estimated at 7.3085 by Bloomberg survey today.

MARKET DATA

AUSTRALIA SEP WESTPAC LEADING INDEX M/M 0.07%; PRIOR -0.04%

CHINA Q3 GDP Q/Q 1.3%; MEDIAN 0.9%; PRIOR 0.5%

CHINA Q3 GDP Y/Y 4.9%; MEDIAN 4.5%; PRIOR 6.3%

CHINA SEP IP Y/Y 4.5%; MEDIAN 4.4%; PRIOR 4.5%

CHINA SEP RETAIL SALES Y/Y 5.5%; MEDIAN 4.9%; PRIOR 4.6%

CHINA SEP FAI EX RURAL YTD Y/Y 3.1%; MEDIAN 3.2%; PRIOR 3.2%

CHINA SEP PROPERTY INVESTMENT YTD Y/Y -9.1%; MEDIAN -8.9%; PRIOR -8.8%

CHINA SEP RESIDENTIAL PROPERTY SALES YTD Y/Y -3.2%; PRIOR -1.5%

CHINA SEP JOBLESS RATE 5.0%; MEDIAN 5.2%; PRIOR 5.2%

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 106-10, +0-03, a 0-04+ range has been observed on volume of ~99k.

- Cash tsys sit 2bps richer to 1bp cheaper, the curve has twist steepened pivoting on 10s.

- Tsys have observed narrow ranges in Asia with little follow through on moves, light risk off flows as President Biden's meeting with Arab leaders was cancelled saw tsys tick away from session lows.

- There was little follow through and tsys remained in narrow ranges for the majority of the session. The space looked through a strong Chinese Q3 GDP print.

- In Europe today the September CPI print from the UK crosses. Further out we have House Starts, Fed Beige Books and a number of Fed speakers including Philadelphia Fed President Patrick Harker and New York Fed President John Williams.

JGBS: Futures Cheaper, BOJ Inflation Projection Fears & US Tsys Weigh

In Tokyo afternoon dealings, JGB futures remain weaker, -38 compared to settlement levels.

- With the local data calendar light today (Tokyo Condominiums for Sale data the only release), JGBs weakness over the past 24 hours has reflected the combination of BOJ-induced selling and fresh cycle highs for US tsys.

- JGB futures pushed lower in the overnight session as BBG sources reported that “the BOJ is likely to discuss raising its inflation projection for fiscal year 2023 and 2024 at its policy meeting later this month, extending the period in which it sees prices hitting or exceeding its 2% goal.”

- JGB futures weakness then extended overnight, with US tsys finishing the NY session 8-15bps cheaper after another batch of firm data. However, US tsys are flat to 2bps richer in today’s Asia-Pac session.

- The cash JGB curve has bear-steepened, with yields 0.4bps to 5.1bps higher. The benchmark 10-year yield is 2.6bps higher at 0.807% versus the cycle high of 0.82% set today.

- Mid-session unscheduled bond purchases by the BOJ of Y300bn of 5-to-10-year and Y100bn of 10-to-25-year notes at market yields appeared to, at least momentarily, arrest the push higher in yields.

- Swap rate movements are mixed and bounded by 0.9bp lower and 1.3bps higher. Swap spreads are tighter beyond the 2-year.

- Tomorrow the local calendar sees Trade Balance and International Investment data.

AUSSIE BONDS: Sharply Cheaper, Global Bonds Weigh, Employment Report Tomorrow

ACGBs (YM -11.0 & XM -11.0) are sharply lower and close to Sydney session lows. Today’s move brings the sell-off over the past 24 hours to around 15-20bps.

- The local calendar has been light today.

- Accordingly, today’s move has been a continuation of the firming of RBA tightening expectations following yesterday’s RBA Minutes.

- The push to cycle highs for US tsy and JGB yields have also impacted. So far in Asia-Pac trade today, cash US tsys are flat to 2bps richer.

- Following news that the BOJ may raise its inflation projections, the JGB curve has bear-steepened, with yields 0.9bps to 5.2bps higher.

- Cash ACGBs are 9-11bps cheaper, with the AU-US 10-year yield differential 3bps higher at -18bps.

- Swap rates are 10-11bps higher.

- The bills strip has bear-steepened, with pricing -4 to -13.

- RBA-dated OIS pricing is 4-13bps firmer for ’24 meetings.

- Tomorrow, the local calendar sees the Employment Report for September, along with the release of NAB Business Confidence.

- Bloomberg consensus has 20k new jobs with the unemployment rate stable at 3.7%.

- QTC has announced the launch of a new 5.25% 21 July 2036 bond. Initial price guidance is a range of 80-84bps over the 10-year futures contract. This transaction is expected to price tomorrow, subject to market conditions.

NZGBS: Cheaper But Off Worst Levels, Outperformance In $-Bloc Continued

NZGBs closed 1-5bps cheaper but near the best levels of the local session. With no significant domestic events until the release of trade balance data on Friday, it's probable that local participants have been closely following global bond market trends. This attention has been driven by the overnight uptick in US tsy yields to new cycle highs and the current surge in longer-dated JGBs to fresh cycle peaks.

- Nevertheless, NZGBs have managed to add to yesterday’s post-CPI-induced outperformance in the $-bloc. The NZ-US and NZ-AU 10-year yield differentials have narrowed another 4-6bps today, bringing the cumulative outperformance from pre-CPI levels to 8-9bps.

- Swap rates are flat to 3bps higher, with the 2s10s curve steeper and implied swap spreads tighter.

- RBNZ dated OIS pricing is flat to 3bps firmer across meetings, unwinding some of yesterday’s post-CPI softening. Nevertheless, pricing remains 5-7bps softer than pre-CPI levels. Terminal OCR expectations sit a 5.65% versus the pre-CPI level of 5.72%.

- Tomorrow, the NZ Treasury plans to sell NZ$200mn of the May-26 bond, NZ$200mn of the May-34 bond and NZ$100mn of the May-41 bond.

- Later today, the US calendar sees House Starts and the Fed’s Beige Book. There is also a number of Fed speakers.

EQUITIES: Tracking Weaker, US Futures Lower, Oil Prices Up On Middle East Tension

Regional equity markets are mostly tracking lower in the first part of Wednesday trade. For the most part losses are modest, but sentiment has struggled amid a further rise in oil prices and on-going China property market concerns. US futures are down, Eminis last off by 0.10%, with higher oil prices weighing as a Middle East summit meant to held in Jordan was cancelled. We are off session lows though, the active contract last near 4397 (against earlier lows of 4386).

- In China, the CSI 300 sits 0.57% weaker at the break. Northbound stock connect outflows continue. This comes despite a better Q3 GDP print and higher y/y retail sales for September. Still, IP and retail sales slowed in m/m terms for September, and property sales/investment remained weak.

- A potential dollar bond default from Country Garden is also weighing on broader property sentiment. The CSI 300 real estate index is off a further 0.83%. The index has fallen in 7 out of the last 8 sessions.

- The HSI is off by 0.10% at the break, which is comfortably above earlier session lows.

- In Taiwan, the Taiex is one of the weaker performers in the region, off by over 1%. Weakness in the semiconductor sector is the main drag. South Korean shares are doing better, holding close to flat at this stage. The ASX 200 sits slightly higher in Australia.

- In SEA, most markets are down, although Thailand is outperforming, up 0.50% at this stage.

FOREX: Greenback Reverses Gains After Chinese Data

The USD reversed an early uptick which was seen alongside higher Oil prices after China's Q3 GDP, September Industrial Production and Retail Sales were firmer than forecast. Ranges remain narrow in today's Asian session and there has been little follow through on moves. WTI has held it's early gains and is up ~2%. US Tsy Yields are little changed across the curve. E-minis have pared losses and sit ~0.2% lower.

- The AUD is the strongest performer in the G-10 space, early losses were reversed after the Chinese data and AUD/USD sits up ~0.2%. Technically AUD/USD is bearish, the pair is supported at $0.6286 low from Oct 3. Resistance is at $0.6445, high from Oct 11.

- Kiwi was also pressured before reversing losses and NZD/USD now sits above the $0.59 handle.

- Yen is a touch firmer however there has been little follow through on moves. Resistance in USD/JPY remains at ¥150.16, Oct 3 high and bull trigger. Support is at the 20-Day EMA (¥148.74).

- Elsewhere in G-10 EUR and GBP are little changed from opening levels. BBDXY is marginally softer.

- CPI data from the UK provides the highlight in Europe today.

OIL: Crude Stronger On Better China Data And Heightened Middle East Risks

Oil prices are higher today driven by increased uncertainty in the Middle East after the Jordan leg of US President Biden’s trip was cancelled due to an explosion at a Gaza hospital. Stronger domestic data in China also supported prices but they are now off the high reached directly after the data was released. The USD index is flat.

- Brent is currently 1.8% higher during APAC trading at $91.54/bbl. Earlier it broke through $92 briefly following China data, which showed apparent oil demand up 17% last month. WTI is up 2.1% to $88.45 and reached a high of $89.09.

- Uncertainties in the Middle East continue to cause jitters in energy markets. There are concerns that the conflict will spread particularly to Iran, who also controls the strategic Strait of Hormuz, at a time of tight supplies. On a more positive note, Venezuela’s government and opposition have agreed on terms for a fair election, which would result in an easing of oil sanctions.

- Bloomberg reported that US crude inventories fell a more-than-expected 4.38mn barrels after rising 12.9mn in the previous week according to API data. Later official EIA data print and a drawdown of just over 1mn barrels is expected.

- Later there are numerous Fed speakers including Waller, Williams, Bowman, Barkin, Harker and Cook plus the release of the Beige Book. In terms of data, there are US housing starts/permits and UK CPI. ECB’s Lagarde is also scheduled to speak.

GOLD: Highest in Four Weeks As Hopes Of A Diplomatic Resolution To Middle East Conflict Fade

Gold is 0.7% higher in the Asia-Pac session, the highest level in four weeks, as the intensifying conflict in the Middle East bolstered haven demand. Hopes for a diplomatic resolution deteriorated after a deadly explosion at Gaza hospital left hundreds dead and Arab leaders pulled out of a meeting planned with US President Joe Biden on his scheduled visit to Israel and Jordan.

- Bullion closed +0.2% at $1924.06 on Tuesday as geopolitical concerns and a softer USD offset a strong push higher in Treasury yields.

- US Treasury yields were pushed to or close to cycle highs after another batch of hot data. Retail sales were strong, with the ex-auto and gas measure rising by 0.6% m/m in September, above the 0.1% expected. The strength of domestic data was later reinforced by an upward revision to the Atlanta Fed’s GDPNow to 5.4% annualised for Q3.

- By the NY session close, US Treasury yields had lifted chunky 8-15bps, with the belly underperforming. The 5-year yield printed a high of 4.89%, its highest level since 2007

- According to MNI’s technical team, the high of $1931.58 came close to a key resistance at $1932.9 (Oct 13 high).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/10/2023 | 0030/1130 | *** |  | AU | RBA board meeting minutes |

| 17/10/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 17/10/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 17/10/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 17/10/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/10/2023 | 1200/0800 |  | US | New York Fed's John Williams | |

| 17/10/2023 | - |  | EU | ECB's de Guindos attends Luxembourg Ecofin meeting | |

| 17/10/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/10/2023 | 1230/0830 | *** |  | CA | CPI |

| 17/10/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 17/10/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 17/10/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 17/10/2023 | 1320/0920 |  | US | Fed Governor Michelle Bowman | |

| 17/10/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/10/2023 | 1400/1000 | * |  | US | Business Inventories |

| 17/10/2023 | 1445/1045 |  | US | Richmond Fed's Tom Barkin | |

| 17/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 17/10/2023 | 1700/1900 |  | EU | ECB's De Guindos Speech at Conference | |

| 17/10/2023 | 2000/1600 | ** |  | US | TICS |

| 17/10/2023 | 2100/1700 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.