-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Related Equities Continue To Underperform

EXECUTIVE SUMMARY

- RBA HOLDS AT 4.35% ON LIGHT DATA - MNI BRIEF

- CHINA’S NOV SERVICES ACTIVITY ACCELERATES ON BOOST FROM NEW ORDERS - CAIXIN PMI - RTRS

- CHINA'S STATE BANKS SEEN SWAPPING AND SELLING DOLLARS FOR YUAN - SOURCES - RTRS

- PBOC TO OFFER MORE TARGETED TOOLS, EXPAND BALANCE SHEET - MNI

- OPEC+ CUTS CAN ‘ABSOLUTELY STAY PAST MARCH, SAUDI MINISTER SAYS - BBG

- JAPAN NOV TOKYO CORE CPI RISES 2.3% VS. OCT 2.7% - MNI BRIEF

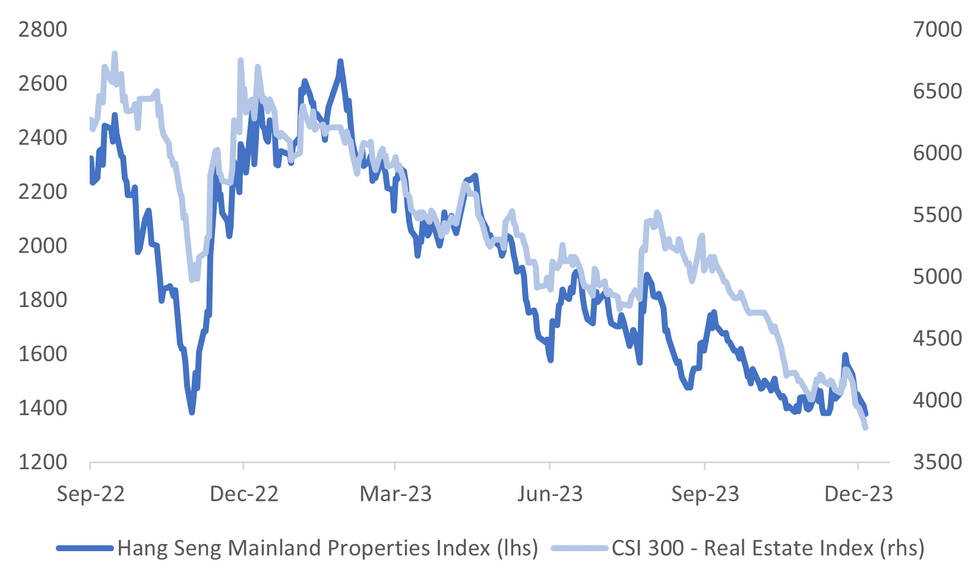

Fig. 1: China Real Estate Related Equities Continue To Weaken

Source: MNI - Market News/Bloomberg

U.K.

CORPORATE (BBG): Qatar’s wealth fund is offloading almost half of its shares in Barclays Plc, a surprise move that comes as the bank’s executives ready a strategic overhaul for early next year.

MIGRATION (RTRS): Britain announced plans to slash the number of migrants arriving by legal routes on Monday, raising the minimum salary they must earn in a skilled job by a third, amid pressure on Prime Minister Rishi Sunak to tackle record net migration figures.

EUROPE

FISCAL (MNI): Talks aimed at securing agreement on new European Union fiscal rules are getting tougher in the countdown to Friday’s crunch meeting of finance ministers, officials told MNI, with one saying the chances of a deal were just 50-50.

GERMANY (BBG): Chancellor Olaf Scholz said he expects rapid progress in coalition talks on how to plug the hole left in next year’s budget by a court ruling that threw Germany’s financial planning into disarray.

GERMANY (POLITICO): Germany's ruling coalition risks further crisis after the country's federal audit court warned on Monday evening that its supplementary budget for 2023 is "extremely problematic under constitutional law."

RUSSIA (BBG): Russian President Vladimir Putin will travel to the United Arab Emirates and Saudi Arabia, according to people familiar with the plans, a rare trip abroad for the leader since his invasion of Ukraine.

HUNGARY (BBG): Hungarian Prime Minister Viktor Orban warned the European Union against discussing the start of membership talks with Ukraine at a leaders summit in Brussels next week, putting new strain on allied support as Ukrainian forces continue to battle Russian troops.

SWEDEN (BBC): Swedish music-streaming giant Spotify has announced it is cutting 17% of its workforce, about 1,500 jobs, as the company seeks to clamp down on costs.

U.S.

US/CHINA (BBG): China criticized the US for seeing it as a threat after Commerce Secretary Gina Raimondo defended efforts to deprive the Asian nation of cutting-edge semiconductors, underscoring the fragility of recently stabilized ties.

FED (MNI BRIEF): The Federal Reserve's inflation fight is moving in the right direction as one measure of underlying trend price pressures decreased to the lowest level since January of 2021.

FED (MNI INTERVIEW): The Federal Reserve needs to do more to modernize the discount window and ensure banks' operational readiness in times of crisis, including mandating testing of the facility at regular intervals, an ex-Federal Reserve staffer and former head of the discount window told MNI.

OTHER

JAPAN (MNI BRIEF): The Tokyo core inflation rate decelerated to 2.3% y/y in November from October's 2.7%, the lowest level since July 2022, weighed down by lower energy and food prices, data from the Ministry of Internal Affairs and Communications showed on Tuesday.

AUSTRALIA (MNI BRIEF): The Reserve Bank of Australia board held the cash rate at 4.35% on Tuesday, following its last meeting of 2024, in line with market expectations. RBA Governor Michele Bullock noted in a statement the RBA had received little domestic economic data since its November decision, while the October monthly CPI result had shown inflation continued to moderate. She said, however, the figures did not provide an insight into services inflation, a key focus for the bank. “Overall, measures of inflation expectations remain consistent with the inflation target,” she said.

NEW ZEALAND (INTEREST.CO/BBG): Policymakers will be looking for continued subdued economic growth to be confident it has achieved its inflation targets, RBNZ Governor Adrian Orr comments on the Of Interest podcast produced by interest.co.nz.

NEW ZEALAND (BBG): RBNZ says it has made some key decisions as part of its liquidity policy review. One decision refers to whether to adopt international liquidity metrics, which may have meant some NZ assets may not have been continued to be counted as liquid assets. “We decided we will not adopt the international liquidity metrics as our existing metrics work well and there would be a high cost to change them”

OIL (BBG): The OPEC+ oil production cuts can “absolutely” continue past the first quarter if needed, Saudi Energy Minister Prince Abdulaziz bin Salman said, as he pledged the curbs would be delivered in full.

BRAZIL (POLITICO): Brazilian President Luiz Inácio Lula da Silva said Monday that he will invite Vladimir Putin to G20 and BRICS summits in Brazil next year, but added it would be up to the judiciary to decide whether the Russian president is arrested if he decides to show up.

CHINA

PBOC (MNI): The People’s Bank of China will expand its balance sheet in 2024 to offer more structural tools targeted at weak and risky sectors such as the property market which it deems crucial to achieve the 5% GDP growth target, policy advisors and economists told MNI.

RRR (SECURITIES TIMES/BBG): China’s central bank should consider lowering the RRR to deal with factors that may impact liquidity toward year-end, Securities Times said in a report.

YUAN (RTRS): China's major state-owned banks were seen swapping yuan for U.S. dollars in the onshore swap market and selling those dollars in the spot market to support the yuan on Tuesday, two sources with knowledge of the matter said.

SERVICES (RTRS): China's services activity expanded at a quicker pace in November, a private-sector survey showed on Tuesday, as the upturn in new businesses were the best seen for three months amid reports of firmer market conditions.

GDP (ECONOMICS COMMITTEE): China’s economic growth this year should print above 5%, according to Liu Shijin, deputy director at the Economic Committee of the 13th National Committee. Speaking at a recent conference, Liu said China had potential to increase per capita GDP from US$13,000 to US$40,000 by developing its service industry and upgrading manufacturing and agriculture.

ACTIVITY (SECURITIES DAILY): Consumption may have accelerated and investment growth picked up in November, Securities Daily reported citing economists. November retail sales may increase significantly to double digits from October’s 7.6% y/y, due to the lower comparison base for the same period last year and improved spending expectation, said Ming Ming, chief economist at CITIC Securities.

POLICY (ECONOMIC INFORMATION DAILY/BBG): Chinese authorities will step up support to businesses next year with tax, land and other policies to improve conditions for development, according to a report in the Economic Information Daily which doesn’t offer further details on the policies.

TECH (PEOPLE’S DAILY/BBG): China needs to speed up building an integrated computing service system to meet the demand from the fast growing artificial intelligence and big data sectors, according to a commentary in the People’s Daily, the flagship newspaper of China’s Communist Party.

CHINA MARKETS

MNI: PBOC Drains Net CNY205 Bln Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY210 billion via 7-day reverse repo on Tuesday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY205 billion after offsetting the maturity of CNY415 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8029% at 09:29 am local time from the close of 1.7855% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 42 on Monday, compared with the close of 50 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Higher At 7.1127 Tuesday vs 7.1011 Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1127 on Tuesday, compared with 7.1011 set on Monday. The fixing was estimated at 7.1438 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA NOV FX RESERVES $417.08BN; PRIOR $412.87BN

SOUTH KOREA Q3 P GDP Y/Y 1.4%; MEDIAN 1.4%; PRIOR 1.4%

SOUTH KOREA Q3 P GDP Q/Q 0.6%; MEDIAN 0.6%; PRIOR 0.6%

SOUTH KOREA NOV CPI M/M -0.6%; MEDIAN -0.3%; PRIOR 0.3%

SOUTH KOREA NOV CPI Y/Y 3.3%; MEDIAN 3.5%; PRIOR 3.8%

SOUTH KOREA NOV CORE CPI Y/Y 3.0%; MEDIAN 3.1%; PRIOR 3.2%

NEW ZEALAND Q3 VOLUME OF ALL BUILDINGS Q/Q -2.4%; MEDIAN -0.5%; PRIOR 1.9%

NEW ZEALAND NOV ANZ COMMODITY PRICES M/M -1.3%; PRIOR 2.8%

AUSTRALIA NOV F JUDO BANK AUSTRALIA PMI SERVICES 46.0; PRIOR 46.3

AUSTRALIA NOV F JUDO BANK AUSTRALIA PMI COMPOSITE 46.2; PRIOR 46.4

AUSTRALIA Q3 NET EXPORTS -0.6%; MEDIAN -0.2%; PRIOR 0.8%

AUSTRALIA Q3 BOP CURRENT ACCOUNT BALANCE -A$0.2BN; MEDIAN A$3.2BN; PRIOR A$7.8BN

AUSTRALIA RBA CASH RATE TARGET 4.35%; MEDIAN 4.35%; PRIOR 4.35%

CHINA CAIXIN NOV SERVICES PMI 51.5; MEDIAN 50.5; PRIOR 50.4

CHINA CAIXIN NOV COMPOSITE PMI 51.6; PRIOR 50.0

MARKETS

US TSYS: Firm From Session Lows Alongside ACGBs, Ranges Narrow

TYH4 deals at 110-15+, +0-09+, a 0-07 range has been observed on volume of ~61k.

- Cash tsys sit 1-2bps richer across the major benchmarks, light bull flattening is apparent.

- Tsys firmed from session lows as a bid in ACGBs, in lieu of the RBA holding the cash rate steady at 4.35% and the statement noting that inflation is continuing to moderate.

- Earlier in the session Tsys were muted dealing in a narrow range for the most part.

- ECB CPI Expectations and Eurozone PPI are due in Europe, further out we have ISM Services and JOLTS Job Openings.

JGBS: Futures Stronger Despite A Poor 10Y Auction

JGB futures are higher, +5 compared to settlement levels, after holding a small loss at the lunch break. This shift into positive territory surprisingly coincided with news that today’s 10-year supply saw lacklustre demand metrics. The low price failed to meet wider expectations, the tail lengthened, and the cover ratio declined to the lowest level seen at a 10-year auction since 2021.

- Demand seems to have faced a setback due to an outright yield that was approximately 20bps lower, along with a 2/10 yield curve that was 13bps flatter compared to the levels seen in early November. Despite the prevailing bullish sentiment towards long-end global bonds and the relative affordability of 10-year JGBs compared to futures with a 7-year maturity, these factors were not enough to bolster the bid during today's auction.

- There wasn't much in the way of domestic data to flag, outside of the previously outlined Tokyo CPI, which surprised on the downside.

- Cash JGBs remain mixed, with yield movements bounded by +/-1bp. The benchmark 10-year yield is 0.8bp lower at 0.691% versus a pre-auction high of 0.704%.

- Swaps are also dealing mixed, with swap spreads tighter.

- (Reuters ICYMI) Japan plans to issue Y1.6tn of climate transition bonds with five- and 10-year tenors in February, three people with direct knowledge of the matter said.

- Tomorrow, the local calendar is empty.

AUSSIE BONDS: Richer After RBA Policy Decision, RBA Noted Monthly CPI Suggests CPI Moderating

ACGBs (YM +4.0 & XM +4.5) sit 5-6bps richer after the RBA Policy Decision. As widely expected, the cash rate was left unchanged at 4.35%, following last month’s increase. In the statement, the RBA noted that:

- “While the economy has been experiencing a period of below-trend growth”, inflation and housing prices have exceeded projections.

- The Board believed “the risk of prolonged high inflation has risen, justifying the earlier rate hike”.

- Nevertheless, the RBA noted that “the monthly CPI indicator for October suggested that inflation is continuing to moderate”.

- While the impact of recent rate increases is ongoing, uncertainties persist, including global economic trends, the Chinese economic outlook, and domestic factors affecting household consumption.

- The Board emphasised its commitment to returning inflation to target. “Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks.”

- Cash ACGBs are 4-6bps richer following the decision, with the 3/10 curve slightly steeper and the AU-US 10-year yield differential 5bps tighter at +15bps.

- The swaps curve is 4-6bps richer after the decision, with rates 3-4bps lower on the day.

- The bills strip is now richer on the day, with pricing +2 to +5. Late whites/early reds leading.

- RBA-dated OIS pricing is 2-8bps softer across meetings, with Sep’24 leading.

NZGBS: Subdued Session But Closed On A Positive Note

NZGBs closed on a strong note, with the benchmarks flat to 2bps richer on the day. The 2/10 curve finished flatter. The session was however subdued, with ranges narrow, after today’s domestic newsflow failed to provide a market-moving event.

- In addition to the previously outlined softer-than-expected 3Q Construction Work Done, the NZ Treasury published financial statements for the three months ended Oct. 31. These showed an operating deficit of NZ$3.85bn. The deficit was NZ$91m wider than projected in the pre-election fiscal update. (See Bloomberg link)

- Also potentially keeping local participants on the sidelines was the fact that the RBA Policy Decision coincided with the local market closing. The post-decision rally in ACGBs will therefore be reflected at tomorrow’s local market open.

- The swaps curve twist-flattened, with rates 2bps lower to 3bps higher.

- RBNZ dated OIS pricing is little changed.

- Tomorrow, the local calendar is empty.

- Later today, the US calendar sees ISM Services and JOLTS Job Openings.

EQUITIES: Regional Markets Lower, No Let Up For China Related Equity Weakness

Regional equities are mostly lower in Tuesday Asia Pac trade. Weakness in China/HK markets remains a focus point. Only Indian markets are tracking higher at this stage. Weakness follows a negative US lead from Monday's session, after a recovery in US yields. US equity futures are weaker in the first part of trade today, Eminis last 4567 (-0.20%), while Nasdaq futures are down 0.24%. A tick down in nominal US yields in Tuesday trade hasn't aided sentiment much.

- At the break, the HSI is off 1.76%, the index near 16354, which is fresh lows back to Nov last year. The HSTECH index is off by slightly more, down 2% at this stage.

- The better Caixin services PMI print in China has done little to improve sentiment. The CSI 300 index is off 0.80% at the break, with the real estate sub index down a further 1.62%, tracking lower for the 8th straight session.

- WuXi Biologics weak guidance has continued a run of generally softer earnings outcomes, which has weighed on broader sentiment, amid concerns of a still tepid China economic recovery.

- Comments from the regulator after yesterday's close stated that it will ensure the stable operation of capital markets.

- Other NEA markets are lower, the Nikkei 225 off over 1%, South Korea's Kospi -0.35%, the Taiex -0.70%, following some tech equity underperformance on Monday.

- SEA markets are weaker, although losses are under 0.50% at this stage for most markets.

- India remains an outperformer, with the Nifty +0.40% in early Tuesday trade.

FOREX: AUD Pressured After RBA Holds Cash Rate Steady

The Aussie is the weakest performer in the G-10 space at the margins. AUD/USD was pressured in early trade as regional equities ticked lower before extending losses as the RBA held rates steady and noted that inflation is continuing to moderate.

- AUD/USD is down ~0.6% and has breached the $0.66 handle to last print at $0.6580/85. Support is at the 20-Day EMA ($0.6539).

- Kiwi has been pressured on spillover from the weakness in the AUD however losses have been pared and NZD/USD is down ~0.2%. AUD/NZD is pressured and sits a touch above the $1.07 handle.

- Yen is firmer but only marginally so, USD/JPY has observed a ¥147.00/40 range for the most part with little follow through on moves. Support comes in at ¥146.23, the low from Dec 4. Resistance is at ¥148.51, high from Nov 30.

- Elsewhere in G-10 moves have been muted, CAD is a touch softer but well within recent ranges.

- Cross asset wise; US Tsys are little changed as is BBDXY. US Equity futures are marginally lower, and the Hang Seng is down ~1.8%.

OIL: Crude Steadies, Putin To Travel To Saudi Arabia

Oil prices have been trading in a narrow range during the APAC session holding onto the losses from the previous three days. WTI is flat at $73.07/bbl, close to the intraday low and off the high of $73.45. Brent is hovering around $78. The USD index is flat.

- Comments from the Saudi energy minister that cuts can easily be extended beyond Q1 2024 seem to have provided a floor to the market. Markets have questioned the compliance with the new quotas given the internal divisions in the lead up to the announcement. It is also focussed on rising non-OPEC supply, especially in the US.

- Russian President Putin is apparently scheduled to travel to the UAE and Saudi Arabia this week, according to Bloomberg.

- Futures contracts are in a bearish pattern signalling a looser market.

- Later US API inventory data is released and also US services PMI/ISM for November print as well as October JOLTS job openings. There are also European PMIs.

GOLD: Slightly Higher Today After A Spike Reversal From An All-Time High Yesterday

Gold is 0.4% higher in the Asia-Pac session, after closing -2.1% at $2029.42 on Monday following a sharp pullback from an all-time high of $2135.4. The decline came alongside USD strength and higher US Treasury yields.

- The jump to an all-time high was triggered by comments from Fed Chair Powell on Friday that traders interpreted as signalling a pivot to rate cuts was nearing. However, those bets were deemed overdone, with gold falling as US Treasury yields and the dollar rose.

- US Treasuries finished with yields 2-10bps higher and the curve flatter. The markets now await a slew of US labour market data this week, including Friday’s Non-Farm Payrolls.

- The pullback has already breached support at $2052.03 (Nov 29 high) to open $2001.5 (20-day EMA), according to MNI’s technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/12/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 05/12/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 05/12/2023 | 0815/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/12/2023 | 0845/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/12/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/12/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/12/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/12/2023 | 0900/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 05/12/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/12/2023 | 1000/1100 | ** |  | EU | PPI |

| 05/12/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 05/12/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/12/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/12/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 05/12/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/12/2023 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 05/12/2023 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 05/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.