-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - China Hits Back With New Tariffs on US Imports

MNI BRIEF: Riksbank Minutes Suggest May Have Cut Enough

MNI EUROPEAN OPEN: China Reopening Remains In Focus As Asia Digests U.S. Data

EXECUTIVE SUMMARY

- FED’S COOK SAYS INFLATION IS TOO HIGH, SOME SIGNS OF HOPE (MNI)

- FED'S MORE GRADUAL RATE HIKE PATH SHOULD LIMIT ECONOMIC HARM, BARKIN SAYS (RTRS)

- FED’S BOSTIC OPEN ON SIZE OF RATE HIKE AT NEXT MEETING (RTRS)

- ECB’S LANE SAYS PRICE PRESSURES WON’T VANISH IF ENERGY COSTS EASE (BBG)

- BOE’S MANN SAYS ENERGY PRICE CAPS MAY BE LIFTING OTHER INFLATION

- ‘NOT A GIVEN’ UK INFLATION WILL SLOW THIS YEAR, RISHI SUNAK SAYS (BBG)

- CHINA TIGHTENS LISTING GUIDELINES TO FUNNEL FUNDING TO STRATEGIC SECTORS (FT)

- CHINA WRAPS UP TWO-YEAR TECH CRACKDOWN, TOP OFFICIAL SAYS (CAIXIN)

- COLONIAL RESTARTS NEW YORK HARBOR-BOUND FUEL PIPE AFTER LEAK (BBG)

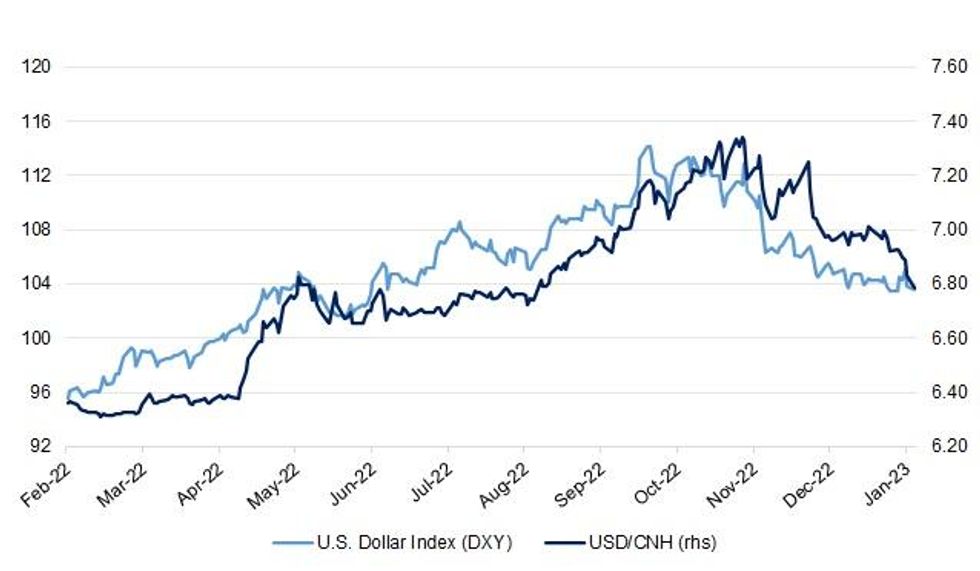

Fig. 1: U.S. Dollar Index Vs. USD/CNH

Source: MNI - Market News/Bloomberg

UK

BOE: Price caps on energy in response to a price surge following Russia’s invasion of Ukraine might be sparking inflation in other sectors by boosting consumer spending, Bank of England policy maker Catherine Mann said. (BBG)

INFLATION: UK Prime Minister Rishi Sunak said it’s “not a given” that inflation will slow this year and stressed the need for continued wage restraint in ongoing negotiations with striking sectors including the National Health Service and railways. (BBG)

ECONOMY: British households are only halfway through a two-year cost of living crisis, with average incomes likely to fall by more than £2,000, a leading thinktank has warned. (Guardian)

ECONOMY: Manufacturers have warned that high energy costs will force them to cut jobs and production this year, with some bosses saying political chaos is damaging UK competitiveness and making the country less attractive to foreign investors. (FT)

ECONOMY/POLITICS: Train drivers have been offered a 4% pay rise for two years in a row by the body which represents rail companies in a bid to end strike action. (BBC)

FISCAL/POLITICS: Prime Minister Rishi Sunak is facing calls from senior Conservatives, including members of his own government, to get a grip of the crisis in Britain’s National Health Service and make a more generous pay offer to end strikes by nurses and ambulance drivers. (BBG)

FISCAL/POLITICS: Striking health workers could get a significant pay boost from April - if staff will accept radical reforms to improve productivity, Steve Barclay has suggested in an olive branch to the unions. (Telegraph)

POLITICS/FISCAL: Rishi Sunak has opened the door to a pay deal for striking nurses when ministers meet health unions for talks on Monday after signalling for the first time a willingness to address demands for more help with the cost of living. (Guardian)

BREXIT: British foreign minister James Cleverly will on Monday seek to inject fresh momentum into talks with the EU on resolving disputes over a post-Brexit trade relationship when he hosts the European Commission Vice-President Maros Sefcovic in London. (RTRS)

EUROPE

ECB: European Central Bank Chief Economist Philip Lane said price pressures in the euro area will remain elevated even if surging energy costs are starting to ease. (BBG)

GERMANY: Germany has enough gas to get through the current winter season without the risk of a supply emergency, the head of the country's network regulator told weekly Bild am Sonntag, adding the focus was now on the 2023/24 period. (RTRS)

FRANCE: French President Emmanuel Macron’s plan to increase the retirement age to preserve the financial balance of the national pension system may get the backing of the Republican opposition party, its leader Eric Ciotti said. (BBG)

FRANCE: France's power suppliers have agreed to offer small businesses struggling with price rises a guaranteed tariff of 280 euros ($298) on average per megawatt hour, Finance Minister Bruno Le Maire said. (RTRS)

IRELAND: Ireland risks bigger than expected revenue losses under a global overhaul of corporate tax rules kicking in next year, according to a new government estimate. (BBG)

U.S.

FED: U.S. inflation remains “far too high” for the Federal Reserve’s comfort despite recent dips in headline and core figures, Governor Lisa Cook said Friday, although there is some reason to hope for improvement. (MNI)

FED: The Federal Reserve's move to smaller interest rate hike increments will help limit damage to the economy as the U.S. central bank works to bring high inflation down, Richmond Fed President Thomas Barkin said on Friday. (RTRS)

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank still needs to keep raising interest rates despite cooler-than-expected wage data and indicated he’s open to a second straight half-point increase. (BBG)

FED: A long-serving Federal Reserve official set to retire from the central bank next week said he was hopeful milder inflation data would allow for the Fed to return to raising interest rates in more traditional quarter-percentage-point increments at its next meeting. Chicago Fed President Charles Evans said in an interview Thursday he penciled in the benchmark federal-funds rate peaking this year at a level between 5% and 5.25% in projections at last month's meeting of Fed officials. (WSJ)

FED: The Federal Reserve faces an "extremely tight labor market" and needs to bring supply and demand into balance to lower inflation this year, Kansas City Fed president Esther George said Friday. (MNI)

ECONOMY: The U.S. economy appears headed for a soft landing, with recent economic data pointing to an ongoing recovery, not a recession, White House economist Heather Boushey told Reuters on Friday. (RTRS)

ECONOMY: U.S. Treasury Secretary Yellen tweeted the following on Friday: "Today’s jobs report is further evidence of a strong labor market with broad-based employment gains, increased labor force participation, and the lowest unemployment rate in over a half-century." (MNI)

ECONOMY: A surprising contraction in U.S. services in December probably won't lead to a further decline next month, Institute for Supply Management chair Anthony Nieves told MNI Friday. (MNI)

FISCAL: The White House on Sunday said it wasn't planning to circumvent Congress in order to raise the U.S. debt ceiling, a regular flashpoint in times of divided government. (RTRS)

FISCAL: A conservative Republican at the center of the tortured effort to elect House Speaker Kevin McCarthy says he’d welcome a hard-fought battle over the US debt ceiling, but said both parties should start negotiating terms for the increase now so it doesn’t go down to the wire. (BBG)

POLITICS: Republican Kevin McCarthy was elected speaker of the U.S. House of Representatives early on Saturday, after making extensive concessions to right-wing hardliners that raised questions about the party's ability to govern. (RTRS)

TSYS: The Federal Reserve will be the backstop of the Treasury market this year to alleviate dysfunction resulting from its increasing size and the retreat of regular buyers. That’s the view of Credit Suisse Group AG analyst Zoltan Pozsar, who in a note to clients Friday predicted the Fed will restart asset purchases during the summer of 2023. (BBG)

EQUITIES: Hundreds of Tesla owners gathered at the automaker's showrooms and distribution centres in China over the weekend, demanding rebates and credit after sudden price cuts they said meant they had overpaid for electric cars they bought earlier. (RTRS)

BANKS: Goldman Sachs Group Inc. is embarking on one of its biggest round of job cuts ever as it locks in on a plan to eliminate about 3,200 positions this week, with the bank’s leadership going deeper than rivals to shed jobs. (BBG)

OTHER

CHINA/TAIWAN: China's military said it had carried out combat drills around Taiwan on Sunday, the second such exercises in less than a month, with the island's defence ministry reporting it detected 57 Chinese aircraft. (RTRS)

EU/CHINA/TAIWAN: A delegation led by Marie-Agnes Strack-Zimmermann, chair of the Bundestag’s defense committee, and Johannes Vogel, deputy chairman of the Free Democratic Party, will visit Taiwan from Jan. 9 to 12, according to a statement from the Foreign Ministry in Taipei. (BBG)

GEOPOLITICS: The US and Japanese armed forces are rapidly integrating their command structure and scaling up combined operations as Washington and its Asian allies prepare for a possible conflict with China such as a war over Taiwan, according to the top Marine Corps general in Japan. (FT)

GEOPOLITICS: Japanese defense officials are weighing a plan to build dozens of ammunition and weapons depots on far-flung southwestern islands in preparation for a potential Taiwan crisis, Nikkei has learned. (Nikkei)

GEOPOLITICS: The US and Japan will issue a joint statement on security following Prime Minister Fumio Kishida’s summit with President Joe Biden in Washington this week, the Yomiuri newspaper said. (BBG)

NATO: Sweden has said Turkey is demanding concessions that Stockholm cannot give to approve its application to join Nato as the prime minister insisted the country had done all it could to meet Ankara’s concerns. (FT)

CORONAVIRUS: Countries from around the world are stepping up measures to shield their populations from the Covid-19 outbreak in China that comes as a more transmissible variant of the virus boosts infections globally. (BBG)

JAPAN: Japanese Prime Minister Fumio Kishida said careful explanation and communication with markets would be part of consideration on monetary policy, when asked about possible future changes in the Bank of Japan’s ultra-loose policy. (BBG)

AUSTRALIA: Labor want a more ‘sustainable footing’ for its second budget, with a fresh approach towards defence, debt, the NDIS and aged care being prioritised. (The Australian)

USMCA: Prime Minister Justin Trudeau and U.S. President Joe Biden are set to meet just before the start of a summit of North American leaders next week in Mexico City. (CBC)

USMCA: Canada and the United States are going to argue at a North American leaders' summit next week that resolving a dispute over measures that favor Mexican energy companies would help draw more foreign investment to Mexico, Prime Minister Justin Trudeau said on Friday. (RTRS)

BRAZIL: Police regained control of Brazil’s main government complex on Sunday evening after thousands of supporters of rightwing former president Jair Bolsonaro stormed the Congress, supreme court and presidential palace. (FT)

BRAZIL: Former Brazilian president and conservative firebrand Jair Bolsonaro spoke out against supporters who invaded and vandalized the government’s top institutions on Sunday. (BBG)

BRAZIL: Petroleo Brasileiro SA stepped up security at its refineries, in a cautionary measure after threats against assets including Brazil's biggest such fuel plant, two company officials said, speaking on condition of anonymity. (RTRS)

BRAZIL: Brazil’s state-controlled oil giant Petrobras should abandon planned divestments in refining and natural gas and expand in those areas instead, according to a detailed report from President Luiz Inacio Lula da Silva’s transition team. (BBG)

RUSSIA: President Volodymyr Zelenskiy said Ukraine is sending reinforcements to defend two front-line towns in the Donetsk region that he called among the bloodiest in the fight against Russia’s invasion. Earlier Sunday, Kyiv rejected as “nonsense” a Russian government claim that Kremlin troops killed 600 Ukrainian soldiers in an overnight strike. (BBG)

RUSSIA: The Biden administration is sending a $2.85 billion package of military hardware to Ukraine, supplying the sort of powerful weapons that it had previously withheld as the country looks to press a counteroffensive against Russia. (BBG)

SOUTH AFRICA: South Africa’s governing African National Congress is intent on turning itself around and addressing voter disillusionment over poor government services and high levels of crime, poverty and unemployment, President Cyril Ramaphosa said. (BBG)

WORLD BANK: The World Bank is concerned that “further adverse shocks” could push the global economy into recession in 2023, with small states especially vulnerable. (BBG)

ENERGY: Iran cut gas exports to Turkey by 70% due to a fault ahead of peak winter demand, Turkey’s state-owned grid operator said. (BBG)

OIL: The Biden administration is delaying the replenishment of the nation’s emergency oil reserve after deciding the offers it received were either too expensive or didn’t meet the required specifications, according to people familiar with the matter. (BBG)

OIL: Colonial Pipeline Co. resumed service to a vital conduit that supplies fuel to the US Northeast, fixing a leak from last week that the company took more than a day longer than expected to repair. (BBG)

OIL: Monthly wage growth in the US shale patch slowed to less than 1% in November as explorers pulled back activity in an effort to manage record costs in the oilfield. (BBG)

CHINA

CORONAVIRUS: The State Council joint prevention and control mechanism against COVID-19 issued the 10th edition of the COVID-19 prevention and control protocol on Saturday in accordance to the decision of downgrading the epidemic management from Class A to Class B, highlighting the monitoring of mutated variants and early warning as well as protection of key groups by preventing severe cases. (Global Times)

CORONAVIRUS: China’s long-awaited border reopening — the final step in its dismantling of Covid Zero — is set to spark a homecoming rush for many diaspora, though a full rebound in travel is likely to take longer. (BBG)

CORONAVIRUS: The likelihood of a second or third wave of Covid infections during the Lunar New Year holidays this month is small because outbreaks in many provinces have peaked, Liang Wannian, a senior health official overseeing China’s epidemic response, said in an interview with state broadcaster CCTV. (BBG)

CORONAVIRUS: The rate of Covid-19 cases in big cities has peaked, with the rate of people requiring emergency care showing signs of decline, and those needing intensive care plateauing, according to Jiao Yahui, Director of the Department of Medical Administration of the National Health Commission. (MNI)

CORONAVIRUS: China's Health Security Administration said on Sunday that talks to include Pfizer's Paxlovid in the latest drug list for basic state health insurance did not succeed. (RTRS)

ECONOMY: Six Chinese cities have announced GDP growth targets for next year, with most between 5.5% and 7%, on confidence that changes to Covid policies will lead to economic recovery, Securities Daily reported. (BBG)

PBOC: China’s economic growth will return to its “normal” path as Beijing provides more financial support to households and private companies to help them recover after the nation ended its Covid Zero policy. (BBG)

PBOC: The People’s Bank of China will ensure ample liquidity and guide down borrowing costs early in 2023 as the economy continues to struggle after a likely slowdown in fourth quarter GDP amid a nationwide surge in Covid infections, economists and analysts said. (MNI)

YUAN: Overseas capital flows will continue to rebound and the yuan will continue to strengthen in 2023, according to Guo Shuqing, Secretary of the Party Committee of the People's Bank of China (the PBOC) and Chairman of the Banking and Insurance Regulatory Commission. (MNI)

YUAN: China’s foreign exchange reserves will remain stable in 2023 despite weakening in the world economy and volatile international financial markets, according to Guan Tao, a former official at the State Administration of Foreign Exchange. (MNI)

POLICY/EQUITIES: China’s more than two-year clampdown on its sprawling internet sector is coming to an end, according to a top central bank official. (Caixin)

POLICY/EQUITIES: China’s stock regulator is set to stop allowing local companies in certain sectors to list on the country’s main stock exchanges as Beijing works to channel funding into strategic industries, according to two capital markets bankers familiar with the matter. (FT)

POLICY/EQUITIES: Chinese billionaire Jack Ma is to relinquish control of Ant Group, the fintech company revealed on Saturday, as its founder continues his withdrawal from his online businesses following Beijing’s tech crackdown. (FT)

CHINA MARKETS

PBOC NET DRAINS CNY41 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) on Monday conducted CNY2 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY41 billion after offsetting the maturity of CNY43 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8400% at 9:43 am local time from the close of 1.4736% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 48 on Friday, flat from the index close on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8265 MON VS 6.8912 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8265 on Monday, compared with 6.8912 set on Friday.

OVERNIGHT DATA

CHINA DEC FOREIGN RESERVES US$3.12769TN; MEDIAN US$3.15000TN; NOV $3.11749TN

AUSTRALIA NOV BUILDING APPROVALS -9.0 M/M; MEDIAN 0.0%; OCT -5.6%

AUSTRALIA DEC FOREIGN RESERVES A$85.4BN; NOV A$86.8BN

MARKETS

US TSYS: Narrow Ranges As Cash Closed; CPI, Powell Headline Week

TYH3 deals at 114-07+, +0-00+, in the middle of its 0-05+ range on volume of ~76k.

- Cash tsys are closed until the London session today due to a Japanese holiday.

- Tsys were pressured in early dealing as U.S. Equity futures started the week firmer and the USD weaker as local participants digested Friday's U.S. data, headlined by a weaker than expected US ISM services survey and wages data, although the unemployment rate did tick lower.

- Early session lows were marginally extended on as optimism from China's re-opening saw an uptick in Hong Kong and mainland Chinese equities.

- With limited macro headline flow and general liquidity impacted by the aforementioned Japanese holiday Tsys have remained in a tight range.

- On the flow side, a 5.3K lift of the FVH3 110/112 call spread (delta hedged at 109-02, 23% delta) headlined.

- In Europe today we have Eurozone unemployment. In the week ahead, Thursday's December CPI print provides the domestic data highlight.

- Atlanta Fed President Bostic and SF Fed President Daly are on the wires today, although participants are looking ahead to Chair Powell's Tuesday remarks when it comes to Fedspeak.

AUSSIE BONDS: Bull Steepening Holds In Wake Of U.S. Data, Finish Off Best Levels

ACGBs held on to a relatively large chunk of the gains that were inspired by Friday’s U.S. data release, but still finished comfortably shy of best levels come the end of the first Sydney session of the week. This came alongside regional focus on the continued reopening drive in China and perhaps longs trimming exposure after a swift round of profit in early ’23 allowed the space to pullback from best levels. Major bond futures contracts failed to force a meaningful break through their respective overnight peaks.

- There was also a lack of meaningful, fresh cues from the wider core global FI space, with Japan out on holiday, leaving cash Tsys closed until London hours.

- That left YM +14.0 at the bell, while XM was +10.0. The major cash ACGB benchmarks were 5-14bp richer, with 3s outperforming all day against a bull steepening backdrop.

- RBA dated OIS came in a little, with 19bp of tightening priced for Feb’ 23, alongside a terminal cash rate of a little over 3.90%.

- When it came to local headline flow there was little to note, with the APRA confirming the as planned A$0 balance of the CLF as of the turn of the year, while Australia Treasurer Chalmers noted that he would aim to “put the budget on a more sustainable footing.”

- Much softer than expected domestic building approvals data failed to impact the space.

- Tomorrow’s local docket is empty.

NZGBS: Off Best Levels As China Reopening Hope Takes Edge Off Soft U.S. Data

NZGBs unwound some of the early richening on Monday, with Antipodean rates seemingly looking to Chinese reopening hopes (in the form of an uptick in HK & Chinese equities), given the lack of fresh core global FI cures owing to a Tokyo holiday and related closure for U.S. cash Tsys until London hours.

- Local news flow remains subdued to start ’23, with Synlait marking down its dairy price forecast for the current year providing the only point of note today.

- There may have also been a degree of rates moving too far, too fast in the early rounds of ’23 trade, facilitating a move away from intraday richest levels which came as NZ market participants adjusted to Friday’s soft U.S. wage data & ISM services survey.

- That left the major benchmarks 7.0-8.5bp richer at the close, with light bull steepening in play.

- Swap rates also pulled back from session highs, leaving the major benchmarks on that curve running 6.0-7.5bp lower on the day, as swap spreads ran flat to a touch wider.

- RBNZ dated OIS generally operated close to late Friday levels, with a slight softening bias, leaving 67bp of tightening priced for next month’s meeting, alongside a terminal OCR of just under 5.00%.

- Looking ahead, REINZ house price data, the monthly ANZ commodity price index and building permits data headline this week’s limited domestic docket.

EQUITIES: Regional Markets On Positive Footing, As Eminis Through Friday's Peak

All major equity indices are firmer today. This follows the strong positive lead from offshore markets through Friday's session, while US equity futures have firmed further today.

- Encouragingly, S&P 500 e-minis are through Friday’s peak. The contract printed a high of 3,931, before selling interest emerged. The next meaningful technical resistance zone located at the Dec 15/13 highs (4,043.00/4,180.00), with the latter representing the bull trigger. Carry over from Friday's session (buoyed by lower US yields/softer US data outcomes) has continued in Asia Pac trading.

- China headlines have remained positive in terms of PBoC officials talking up the growth outlook, while a number of cities set 2023 GDP growth targets at least of 5.5%. Elsewhere health officials have also talked down the likelihood of fresh covid waves during the LNY period.

- The FT reported though the authorities will stop allowing companies in certain sectors to list as the authorities target strategic industries.

- The HSI is tracking 1.65% firmer, the CSI around 0.65% at this stage.

- The Kospi is the best performer +2.60%, while the Taiex is +2.2%. This followed tech outperformance on Friday. Offshore investors have added further to Korean shares today (+$311.6mn).

GOLD: Bullish Run Continues

The bullish run for gold continues. The precious metal has added a further 0.64% so far today, which comes after last week's 2.28% gain. We were last close to $1878, fresh highs going back to mid last year. The $1900 level, last seen in May of 2022 seems like the next logical upside target. The 20-day EMA is back at $1818.9 in terms of downside support levels.

- Gold continues to benefit from USD weakness, while the related sharp pull back in US yields through Friday's NY session, was also a clear positive.

- The metal has outperformed US real yields by a decent margin in recent months, but underlying demand still appears firm. China's FX reserves for December showed a further accumulation of gold (30 tons in Dec, versus 32 in November). Q3 saw record gold purchases from central banks according to the World Gold Council.

OIL: Firmer, But Lagging Other Commodities

Brent has firmed through the first part of the session, last tracking near $79.50/bbl. This is 1.10% for the session but follows a lackluster end to last week, where Brent finished down slightly despite a broad based USD sell-off/risk on move in other major asset classes. Support appears firm sub the $78/bbl level for now, while a move above the 50-day EMA at $84.71 might be required to generate a more positive medium term outlook. WTI was last at $74.70.

- Optimism around the demand outlook, particularly from China, with general positive news flow over the weekend, should keep oil dips supported, even as forward curves suggest few near term supply constraints.

- Elsewhere, the US delayed purchases to restock reserves, as price/sale conditions were reportedly unsatisfactory. Colonial also restarted a NY fuel pipe after a leak from last week was repaired.

FOREX: USD Weakness Persists, AUD & NZD Outperform

USD weakness has continued through today's Asia Pac session, a carryover from sharp weakness through Friday's session. The BBDXY is down a further 0.40%, with the index now sub 1240, its lowest level since early June last year. AUD and NZD have led the gains amid positive risk on signals from the equity space, as US eminis moved through Friday's peak.

- AUD/USD is through 0.6930, now targeting a move back to the 0.7000 handle. Markets have shrugged off weaker iron ore prices (with the authorities warning against speculative behavior), while Nov building approvals were much weaker than expected (-9.0%m/m, versus a flat forecast), but this didn't impact sentiment either.

- NZD/USD has followed closely behind, last near 0.6400, +0.80% higher for the session. A sustained move above this level has been hard to come by in recent months, so will be watched from a technical standpoint.

- USD/JPY is lower, has underperformed broader USD moves. The pair was last at 131.75/80, -0.25% lower for the session. Japan markets were closed today, so this may have impacted liquidity, although yen weakness on crosses is in line with the better equity market tone.

- Looking ahead, upcoming data releases are mostly second tier, so may not shift sentiment much. The Fed's Bostic is due to speak, along with Daly in the US session.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/01/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 09/01/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 09/01/2023 | 0745/0845 | * |  | FR | Foreign Trade |

| 09/01/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 09/01/2023 | - |  | UK | House of Commons Returns | |

| 09/01/2023 | 1330/0830 | * |  | CA | Building Permits |

| 09/01/2023 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 09/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 09/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 09/01/2023 | 1730/1230 |  | US | Atlanta Fed's Raphael Bostic | |

| 09/01/2023 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.