-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI EUROPEAN OPEN: China Stimulus Calls Continue, USD/CNH Breaches 7.2000

EXECUTIVE SUMMARY

- CHINA STATE MEDIA, GOVERNMENT ADVISERS CALL FOR ECONOMIC SUPPORT - BBG

- CHINA’S ECONOMY EXPECTED TO STABILIZE IN 2H ON STIMULUS - CSJ

- UPSIDE PRICE RISKS EXIST - BOJ’s ADACHI - MNI BRIEF

- JAPAN CPI UNLIKELY TO REMAIN ELEVATED - BoJ MINUTES- MNI BRIEF

- BIDEN CALLS PRESIDENT XI A DICTATOR - RTRS

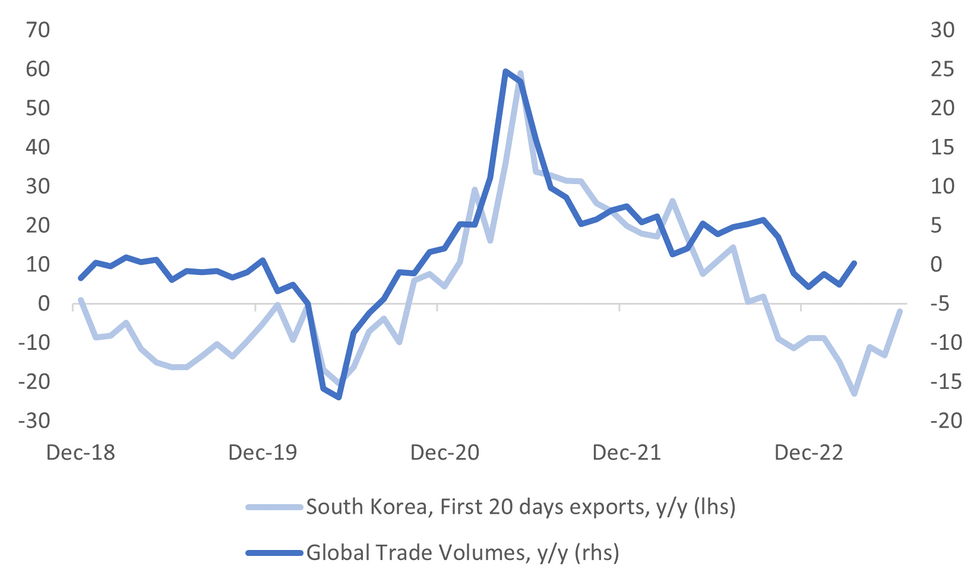

Fig. 1: South Korea Exports (first 20-days y/y) & Global Trade Volumes

Source: MNI - Market News/Bloomberg

EUROPE

EU/CHINA: A slowdown in both the Chinese and global economies is the biggest issue affecting European firms in China, beating political tensions with the United States and decoupling, according to the European Chamber of Commerce in China. (RTRS)

U.S.

TECH: The risks of artificial intelligence to national security and the economy need to be addressed, U.S. President Joe Biden said on Tuesday, adding he would seek expert advice. "My administration is committed to safeguarding Americans' rights and safety while protecting privacy, to addressing bias and misinformation, to making sure AI systems are safe before they are released," Biden said at an event in San Francisco. (RTRS)

US/CHINA: U.S. President Joe Biden on Tuesday called Chinese President Xi Jinping a dictator, adding that Xi was very embarrassed when a Chinese balloon was blown off course over the U.S. recently. Biden made the remarks at a fundraiser in California a day after Secretary of State Antony Blinken met Xi in a trip to China that was aimed at easing tensions between the two countries. (RTRS)

OTHER

JAPAN: Some Bank of Japan board members maintained a cautious price view and shared the view Japan’s inflation rate will not stay elevated as demand-driven price hikes remain weak, according to the April 27-28 meeting minutes released Wednesday. (MNI)

JAPAN: Bank of Japan board members agreed not to revise yield curve control conduct, while one board member noted global financial market turmoil warranted a wait-and-see approach in regards to any review, despite the programme's distortionary impact on bond markets, according to the recently released minutes of the April 27-28 meeting (MNI)

AUSTRALIA: Soon after deputy governor Michele Bullock delivered an insightful speech on full employment in Newcastle, local councillor Jenny Barrie asked her that question that is being muttered by close watchers of the Reserve Bank of Australia. Would Bullock want to be the first female governor of the RBA if Philip Lowe’s seven-year term is not extended by Treasurer Jim Chalmers beyond September? (AFR)

AUSTRALIA: Australians support a resumption of dialogue with Beijing and are shifting back toward viewing China as more of an economic partner than a security threat, a new survey showed, after relations collapsed in 2020. Some 56% of respondents reckon renewed ministerial contacts with China is very or somewhat positive for Australia’s national interest, a Lowy Institute poll showed. Those seeing China as a danger fell 11 points to 52%, while those who see it as an economic partner rose by the same amount to 44%. (BBG)

NZ: New Zealand is tweaking its immigration settings further to help attract the skilled workers it needs to meet labor shortages. The changes to the Skilled Migrant Category visa will mean there will be clearer criteria and a faster pathway to residence for highly skilled people, Immigration Minister Michael Wood said Wednesday in Wellington. They include removing an existing cap on applications and making the threshold for residence simpler to understand, he said. (BBG)

NZ: New Zealand’s central bank has determined that households’ view of future inflation is more informative than the expectations of businesses and economists when it comes to predicting headline inflation. (BBG)

CHINA

POLICY: China is likely to cut reserve requirement ratio for banks and interest rates further this year as part of efforts to shore up the world’s second-largest economy, according to the country’s top three securities newspapers, citing analysts. China Securities Journal, Shanghai Securities News and Securities Times all ran similar front-page reports Wednesday, citing analysts as forecasting further monetary easing this year. (CSJ)

POLICY: Chinese policymakers are facing growing calls for economic stimulus, this time from several prominent state media and top government advisers. The country’s three main state-run securities newspapers ran front-page articles Wednesday saying the central bank is likely to ease monetary policy further, citing well-known economists. Separately, Xinhua News Agency reported that Wang Huning, the No. 4 official in China’s ruling Communist Party, held a meeting Tuesday with representatives of other Chinese political parties to discuss policy suggestions on reviving consumption. Liu Yuanchun, a prominent economist who’s previously consulted with top officials including President Xi Jinping, also called for interest rate cuts and other support measures in an interview with local media earlier this week. (BBG)

ECONOMY: China’s economy is expected to stabilize in the second half of the year, supported by policy stimulus, according to a China Securities Journal report Wednesday, citing analysts.(BBG)

CARS: China unveiled on Wednesday a 520 billion yuan ($72.3 billion) package to boost sales of electric vehicles (EVs) and other green cars over the next four years to prop up softening auto demand, sending shares of automakers sharply higher. (RTRS)

FISCAL: China is unlikely to increase the quota of special treasury bonds this year, as structural monetary policy and various measures to promote consumption and investment will have a positive impact on the economy, according to Ming Ming, chief economist at CITIC Securities. Ming said China's policy toolbox remained adequate and therefore the urgency to increase special bonds was not strong. For H2, policy makers will likely make further cuts to the reserve requirement ratio and reduce taxes, he said. (21st Century Herald)

BONDS: Regulators will strengthen bond-issuance rules in China’s interbank-bond market, according to a notice issued by the Association of Interbank Market Dealers. The association said China’s market suffered from market agents underwriting at low prices to gain market share and not following competitive dynamics. The association said issuers should adhere to market principles and must not interfere with pricing or illegally specifying issuance interest rates. Authorities will ensure underwriting institutions remain separate from investment trading to prevent conflicts of interest and will encourage more liquidity in the secondary market of bonds. (MNI)

CONSUMPTION: China must embrace policies aimed at restoring and expanding consumption, according to Wang Huning, member of the Standing Committee of the CPC Political Bureau. Speaking at a recent symposium, Wang said China’s society must understand consumption was key to modernisation and achieving high-quality development and the Government should carefully study how to increase consumption. At the symposium, leaders from The All China Federation of Industry and Commerce suggested boosting the role of private enterprises was key to restoring and expanding consumption (Xinhua).

CHINA MARKETS

PBOC Injects Net CNY143 Bln Via OMOs Wednesday

The People's Bank of China (PBOC) conducted CNY145 billion via 7-day reverse repos on Wednesday, with the rates at 1.90%. The operation has led to a net injection of CNY143 billion after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9264% at 09:25 am local time from the close of 2.0607% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 47 on Tuesday, compared with the close of 49 on Monday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1795 WED VS 7.1596 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1795 on Wednesday, compared with 7.1596 set on Tuesday.

OVERNIGHT DATA

SOUTH KOREA MAY PPI Y/Y 0.6%; PRIOR 1.6%

SOUTH KOREA JUN EXPORTS 20 DAYS Y/Y 5.3%; PRIOR -16.1%

SOUTH KOREA JUN IMPORTS 20 DAYS Y/Y -11.2%; PRIOR 15.3%

AU MAY WESTPAC LEADING INDEX M/M -0.27%; -0.03%

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 113-07, -0-03, a touch off the bottom of the observed 0-06 range on volume of ~43k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Asia-Pac participants faded yesterday's richening, perhaps focusing on Tuesday US housing data in early dealing.

- A brief bid in the USD saw Tsys marginally extended losses however there was little follow through on the moves and narrow ranges persisted for the remainder of the session.

- Little meaningful macro news flow crossed.

- The UK's CPI report headlines in Europe today. Further out we have Mortgage Applications and Fed Chair Powell's semi-annual testimony to the House Services Panel. Also due to cross is Fedspeak from Chicago Fed President Goolsbee, and we have the latest 20-Year supply.

JGBS: Futures Stronger, Narrow Range, 5-Year Supply & BoJ Speak Tomorrow

JGB futures are holding richer at 148.64, +11 versus settlement levels, after trading in a narrow range in the Tokyo session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined BoJ Minutes for the April Meeting and a speech from BoJ Board Member Seiji Adachi.

- According to the MNI technicals team, JGBs continue to operate above support at 147.34, the May 26 low. The contract pierced 148.41, the May 12 high, on Friday. A clear break would strengthen a bullish case and signal scope for a climb towards the next key resistance at 149.21/53, this year's highs from May and March. Clearance of these levels would highlight an important break. To the downside, a breach of 147.34 would signal a stronger reversal and open 146.11, the Feb 22 low.

- The cash JGBs curve twist flattens with the 10-year zone (-1.2bp lower) leading. The benchmark 10-year yield is at 0.381%, below the BoJ's YCC limit of 0.50%.

- Swap spreads are generally narrower out to the 20-year zone and wider beyond.

- The local calendar tomorrow sees Weekly Investment Flow data (June 16) ahead of 5-year supply. BoJ Board Member Noguchi is also scheduled to give a speech in Okinawa.

AUSSIE BONDS: Richer, Narrow Range, Focus On Chair Powell's Testimony

ACGBs sit richer (YM +6.0 & XM +6.5) but at session cheaps as overnight strength in US tsys is faded ahead of Fed Chairman Powell's semi-annual testimony to House Services Panel later today. Chair Powell is not expected to deviate from last week's policy messaging.

- US tsys are holding cheaper through the Asia-Pac session, but ranges are narrow given the lack of meaningful news flow.

- Cash ACGBs are 5-6bp richer on the day with the AU/US 10-year yield differential +1bp at +23bp, the highest level since September of last year. The 10-year differential had traded within a range of -30bp to +20bp since November. The recent shift in the 10-year yield differential can be attributed to the divergent expected rate paths of the US Fed and the RBA. (See link)

- Swap rates are 5-6bp lower with EFPs slightly wider.

- The bills strip bull steepens with pricing +2 to +4.

- RBA-dated OIS pricing is 2-5bp softer across meetings with Feb’24 leading.

- The local calendar is light tomorrow.

- TCV has priced an A$2.75 billion increase to the 2.25% 20 November 2034 benchmark bond via syndication, taking outstanding volume to A$8.708bn. The bond priced with a re-offer spread of +95 basis points over the 10-year futures contract, equivalent to +90.5 basis points over the ACGB 3.5% 21 December 2034.

NZGBS: Closed Cheaper, US Tsys Weaken Ahead Of Chair Powell's Address

NZGBs closed 2bp cheaper, but well off session bests set in early local session trading. The limited local calendar activity suggests that the upward movement from yield lows can largely be attributed to softer US tsy yields in Asia-Pac trading. However, the range for cash tsys has been relatively narrow given the absence of significant macroeconomic news flow.

- The NZ/US 10-year yield differential has widened by 8bp, currently standing at +74bp. In addition, NZGBs have shown weaker performance compared to ACGBs, with the NZ/AU 10-year yield differential increasing by 7bp to +50bp, after reaching a five-week low yesterday.

- The 2s10s swap curve twist flattened with rates +3bp to flat.

- RBNZ dated OIS pricing closed 1-3bp firmer across meetings with terminal OCR expectations at 5.60%.

- The local calendar is slated to release May trade balance data tomorrow. The underlying balance is slowly improving as imports soften.

- Before then, the focus turns to Fed Chairman Powell's semi-annual testimony to the House Services Panel later today, though it's unlikely Chair Powell will deviate from last week's policy messaging.

- The NZ Treasury announced that they plan to sell NZ$200mn of the 4.50% 15 May 2030 bond, NZ$150mn of the 3.50% 14 April 2033 bond and NZ$50mn of the 2.75% 15 April 2037 bond tomorrow.

FOREX: Muted Asian Session On Wednesday

Its been a muted Asian session for G-10 FX, moves have been limited with little follow through and ranges have been narrow.

- AUD/USD is ~0.1% dealing in a narrow range below the $0.68 handle. The May Westpac Leading Index printed at -0.27%, the prior read was -0.03%.

- Kiwi is a touch firmer however NZD/USD has observed a 15 pip range for the most part of todays Asian session.

- Yen is marginally pressured, USD/JPY is up ~0.1% however the pair remains well within recent ranges.

- Elsewhere in G-10 EUR and GBP are a touch lower than Tuesday's closing levels.

- Cross asset wise; BBDXY is ~0.1% firmer and US Treasury Yields are ~2bps firmer across the curve. E-minis are little changed.

- The May CPI report from the UK headlines todays data docket. Headline CPI is expected to tick lower to 0.5% M/M from 1.2% M/M in April.

EQUITIES: HSI Threatening Move Back Sub 200-day MA

Regional equities are mostly weaker so far in the Wednesday session. Weakness is evident in HK and China equities, as recent gains on stimulus hopes are unwound further. Other bourses are tracking higher though, most notably Japan, but gains are modest at this stage. Following US/EU equity losses from Tuesday, futures for both markets are tracking a touch higher at this stage, although more so for the EU.

- The HSI is slightly above session lows at the break, down 1.90%, which puts the index just below its 200-day MA (19263.35). Tech index losses are weighing, the sub-index down a further 2.2%, the third straight session of losses. The Golden Dragon index fell nearly 5% in US trade on Tuesday.

- China's CSI 300 is back sub 3900, off 0.62% at the break. Calls for further stimulus continues from various China officials, including some linked closely to President Xi Jinping (see this link for more details). Per Reuters reports, US President Biden referred to China President Xi Jinping as a dictator, at a campaign rally in California.

- The Kospi and Taiex are tracking lower, more so the Kospi (-0.70%) as recent tech gains in global indices unwind gains. Reasonable offshore selling is also evident for Korean shares (-$303.2mn at this stage).

- Japan stocks are doing better, the Nikkei 225, +0.55% firmer.

- In SEA Thai stocks are off by 0.70%, but Singapore and Malaysian stocks are higher, while Indian stocks have started positively.

OIL: Crude Moves Higher Ahead Of Fed Chair Powell’s Appearance

Oil prices are up slightly during APAC trading ahead of Fed Chair Powell’s appearance later but are still down around 0.6% on the week. WTI is 0.4% higher to $71.49/bbl, close to the intraday high of $71.58. Brent is up 0.3% to $76.16, also near the high of $76.29. The USD index is slightly higher.

- China’s recent measures to support the economy appear to have helped provide a floor to oil prices today, but the market remains sensitive to demand indicators and is likely to look through stimulus if the data continue to disappoint. China National Petroleum Corp reduced its 2023 oil demand growth expectations to +3.5% from +5.1%.

- Later Fed Chairman Powell appears before the House Financial Services Panel, which should help frame the rate outlook, and Fed’s Goolsbee will also speak. On the data front UK May CPI and US mortgage applications are published.

GOLD: Lowest Close Since March

Gold is slightly higher in the Asia-Pac session, after closing 0.7% lower at 1936.42 on Tuesday, its lowest close since late-March.

- Firmer than expected US housing market data, coupled with the related move in the broader USD and US Tsys, saw spot gold shed ~$15/oz in fairly short order, with a fresh NY session low registered during the process.

- According to MNI's technicals team, the bear cycle in gold remains intact. The yellow metal is trading below trendline support drawn from Nov 3 2022 low - the trendline intersects at $1971.2. The break of this line reinforces bearish conditions and marks a resumption of the downtrend. The focus is on $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Initial firm resistance is $1985.3, the May 24 high. Clearance of this resistance would signal a short-term reversal instead.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/06/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/06/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 21/06/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 21/06/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 21/06/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 21/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/06/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/06/2023 | 1345/1545 |  | EU | ECB Schnabel Panels Discussion at Landesvertretung Hessen | |

| 21/06/2023 | 1400/1000 |  | US | Senate Hearing on Fed Nominees | |

| 21/06/2023 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 21/06/2023 | 1625/1225 |  | US | Chicago Fed's Austan Goolsbee | |

| 21/06/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 21/06/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.