-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI EUROPEAN OPEN: China Tech Stocks Slump On Gaming Curbs

EXECUTIVE SUMMARY

- NIPPON’S BID FOR US STEEL DESERVES SERIOUS SCRUTINY: BRAINARD - BBG

- CHINA HOME SALE VOLUMES TO REBOUND, PRICES REMAIN WEAK - MNI

- CHINA’S 30YR YIELD HITS LOWEST SINCE ‘05 ON DEPOSIT RATE CUTS - BBG

- NEW GAMING CURBS SEND CHINESE TECH STOCKS LOWER - BBG

- JAPAN NOV CORE CPI RISES 2.5% VS. OCT’S 2.9% - MNI BRIEF

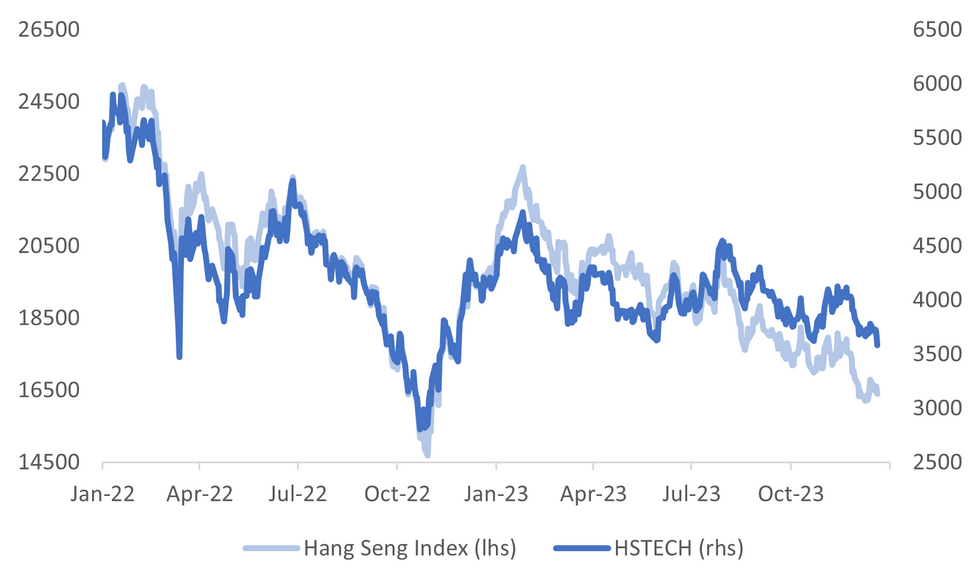

Fig. 1: Hong Kong Equity Indices

Source: MNI - Market News/Bloomberg

U.K.

CORPORATE (BBG): Shell Plc has begun cutting jobs beyond previously announced reductions in its low-carbon division as Chief Executive Officer Wael Sawan seeks to trim costs and be more competitive with US rivals, people familiar with the matter said.

EUROPE

CHINA/HUNGARY (FT): BYD is in final talks with the Hungarian government for a multibillion-euro investment into a new EV factory, Financial Times reports, citing three unidentified people familiar with the matter.

SWITZERLAND/UK (RTRS): Britain and Switzerland signed a wide-ranging financial services deal on Thursday granting reciprocal market access for their banks, insurers, asset managers and stock exchanges to boost trade and cut compliance costs.

U.S.

FED (BBG): Banks borrowed a record amount from the Federal Reserve’s newest backstop facility in the most recent week as increasing wagers on interest-rate cuts made it a more attractive choice.

CORPORATE (WSJ); The Biden administration's top economic adviser said Thursday the $14.1 billion deal to acquire U.S. Steel by Japan's Nippon Steel deserved "serious scrutiny" regarding its potential impact on national security and supply chains.

CORPORATE (BBG): Nike Inc. said it’s looking for as much as $2 billion in cost savings by dismissing workers and simplifying the sneaker company’s product assortment amid a weaker sales outlook.

US/CHINA (BBG): General Charles Brown, chairman of the US Joint Chiefs, spoke with his Chinese counterpart for the first time in a call that the Biden administration billed as a further sign that ties between the two countries’ militaries may be getting back to normal.

US/SAUDI ARABIA (NYT): Some lawmakers are likely to oppose the move, but officials said the Biden administration has noted the kingdom’s de facto cease-fire with the Houthi militia in Yemen. The Biden administration is preparing to relax restrictions on some weapons sales to Saudi Arabia, U.S. officials said on Thursday, crediting the kingdom’s peace talks with a militia in Yemen for hastening an easing of the constraints.

OTHER

JAPAN (MNI BRIEF): Japan's annual core consumer inflation rate decelerated to 2.5% y/y in November from October's 2.9%, the first slowdown in two months but remaining above the Bank of Japan's 2% target for the 20th straight month, data released by the Ministry of Internal Affairs and Communications showed on Friday.

JAPAN (BBG): Japan’s Government Pension Investment Fund is open to increasing its active allocation in stocks and tapping more fund managers for that purpose, according to Chief Investment Officer Eiji Ueda.

CANADA (BBG): The Canadian government approved Royal Bank of Canada’s landmark deal to acquire HSBC Holdings Plc’s Canadian operations, handing a major regulatory win to one of North America’s largest financial institutions.

AUSTRALIA (BBG): Australia's credit to business, consumers rose as much as economists expected in November. Credit to business, consumers rose 0.4% m/m (estimate +0.4%) in November versus +0.3% in October, according to the Reserve Bank of Australia.

CHINA

PROPERTY (MNI): Beijing and Shanghai’s latest round of house-market relaxations may help boost volumes and revive the ailing property sector over the next few months, but price weakness will likely persist as over-leveraged developers offer discounts to boost sales, policy advisors told MNI.

TECH (BBG): Chinese technology companies tumble in Hong Kong after China says online games should not contain inducive rewards to get users to log on daily.

BOND YIELDS (BBG): A fresh round of large banks’ deposit rate cuts turbocharged Chinese government bonds, driving some ultra-long yields to the lowest in nearly two decades, as the move may steer investment toward the debt market.

DEPOSIT RATES (SECURITIES TIMES/BBG): There exists room for Chinese banks to continue lowering deposit rates next year, as they are faced with heightened net interest margin pressures, Securities Times reports, citing analysts.

SUPPLY CHAINS (ECON DAILY/BBG): China needs to strengthen its supply chains in order to cope with rising geopolitical tensions and trade protectionism, as well as to keep up with developments in industry, the Economic Daily said in a commentary on Friday.

CONSUMPTION (BBG): China must continue to enhance national strength and global competitiveness to boost national security, said Zheng Shanjie, chairman of the National Development and Reform Commission, in a signed article published on Friday in Study Times.

CHINA MARKETS

MNI: PBOC Injects Net CNY281 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY40 billion via 7-day reverse repo and CNY291 billion via 14-day on Friday, with the rates unchanged at 1.80% and 1.95%, respectively. The reverse repo operation has led to a net injection of CNY281 billion reverse repos after offsetting CNY50 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7833% at 09:34 am local time from the close of 1.8050% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Thursday, compared with the close of 46 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.0953 Friday vs 7.1012 on Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0953 on Friday, compared with 7.1012 set on Thursday. The fixing was estimated at 7.1306 by Bloomberg survey today.

MARKET DATA

JAPAN NOV NATIONAL CPI Y/Y 2.8%; MEDIAN 2.8%; PRIOR 3.3%

JAPAN NOV NATIONAL CPI EX FRESH FOOD Y/Y 2.5%; MEDIAN 2.5%; PRIOR 2.9%

JAPAN NOV NATIONAL CPI EX FRESH FOOD, ENERGY Y/Y 3.8%; MEDIAN 3.8%; PRIOR 4.0%

AUSTRALIA NOV PRIVATE SECTOR CREDIT M/M 0.4%; MEDIAN 0.4%; PRIOR 0.3%

AUSTRALIA NOV PRIVATE SECTOR CREDIT Y/Y 4.7%; PRIOR 4.7%

MARKETS

US TSYS: Muted Asian Session, Busy Docket To Round Off Week.

TYH4 deals at 112-20, -0-01+, a 0-06+ range has been observed on volume of ~38k.

- Cash tsys sit ~1bps cheaper across the major benchmarks.

- Tsys have observed a narrow range, with little follow through on moves in today's Asian session. A downtick from session highs was observed alongside a marginal bid in the USD and pressure on equities however the move lower didn't follow through and Tsys observed narrow ranges for the most part.

- FOMC dated OIS are stable pricing ~130bps of cuts by November 2024.

- In Europe today UK Retail Sales and GDP provides the highlight, further out we have US personal income and spending, new home sales, durable goods and UofMich consumer sentiment.

- A reminder that there are no Fed speakers currently scheduled on Friday.

JGBS: Offered, But Up From Session Lows

The post lunch break tone to JGB futures has been skewed lower, although we are up from session lows. JBH4 was last 146.46, -.29, session lows coming in at 146.36.

- There has been spill over from weaker US Tsys, TYH4 close to Thursday lows at the time of writing.

- Lower bid to cover ratios at the 3m bill sale and the enhanced liquidity auction may have also contributed to the offered tone post the break.

- As noted earlier, we had Nov National CPI on expectations, but the detail showed some underlying pressures. The MUFG CEO also stated earlier that there's a "fair chance" the BoJ ends negative rates in Jan (Asahi, see this link).

- In the cash JGB space, the 10yr yield sits near 0.63% slightly below session highs. Yield gains remain firmer in the 20-40yr tenors. The 10yr swap rate is above 0.83% in latest dealings.

- A reminder that BoJ Governor Ueda speaks on Christmas day (next Monday) at the Keidanren meeting in Tokyo (no time is given for the speech at this stage).

AUSSIE BONDS: Muted Pre-Christmas Session; Closed Monday, Tuesday

ACGBs sit 1bp richer to 2bps cheaper across the major benchmarks, the curve has twist steepened pivoting on 10s. The space observed a muted pre-Christmas session with ranges narrow and activity limited.

- Futures are little changed from opening levels, XM sits at 95.95 (-0.02) and YM at 96.37 (+0.01).

- November Private Sector Credit was in line with expectations and there was little reaction in the space.

- RBA dated futures have been steady in recent trade, there are ~60bps of cuts priced by Dec 24.

- A reminder that Australian markets are closed Monday and Tuesday and will reopen on Wednesday.

NZGBS: Narrow Ranges In Muted Pre-Christmas Dealing

NZGBs observed narrow ranges on Friday in muted pre-Christmas dealing, finishing 1bp richer to 3bps cheaper across the major benchmarks as the curve twist steepened. The space ticked away from early session lows, however the recovery did not follow through.

- 10-Year NZ US Swaps are stable and sit at +56bps. RBNZ dated OIS remain stable, there are ~80bps of cuts priced by Nov 24.

- Domestic newsflow has been light on Friday, and a reminder that there was no local data today.

- Looking ahead, markets in New Zealand are closed on Monday and Tuesday and will re-open on Wednesday.

HONG KONG EQUITIES: Weakness Extends On Large Tech Losses, Post Gaming Curbs

Hong Kong equities continue to track lower post the lunch break. The aggregate HSI is off over 1%, while the tech sub index has slumped 3.3%, although this is up from session lows (-4.5%).

- This is close to YTD lows for the index. This follows headlines that the China regulator will aim to curb online gaming use (see this BBG link). NetEase dropped by a record 28%, while Tencent was down 16% at one stage, the most since 2008.

- After the break, mainland shares are paring earlier gains.

- The spill over to CNH has proven to be fairly limited at this stage. The pair got above 7.1600, but we now back at 7.1580.

EQUITIES: Hong Kong Markets Falter On China Gaming Curbs

Regional equity markets are mostly positive, although gains are below US moves seen in cash trade on Thursday. Hong Kong markets faltered into the break on headlines around China gaming restrictions. US futures have given back some of Thursday's gains, but are up from session lows. Eminis were last near 4790.50 (-0.13%), while Nasdaq futures are off 0.25% at this stage.

- At the break, the HSI sits down 0.43% and well off earlier highs. The tech sub index is down 1.52%.

- This follows headlines that the China regulator will aim to curb online gaming use (see this BBG link). Tencent and NetEase have dropped sharply.

- There has been less fallout for mainland indices at this stage. The CSI 300 is up 0.74%, while the Shanghai Composite Index is +0.50%, with both indices close to session highs at the break.

- Elsewhere, Japan indices have recovered some ground. The Topix +0.45%, the Nikkei 225 up 0.20%. GPIF's CIO has stated that the fund is open to raising its allocation to stocks (see this BBG link).

- In South Korea the Kospi is +0.35%, while the Taiex is up a more modest 0.20%. In Australia, the ASX 200 is close to flat.

- In SEA, Thailand and Malaysia stocks are down modestly, while elsewhere we are seeing mostly positive gains.

FOREX: Greenback Nudges Higher In Asia

The greenback has nudged higher in Asia, trimming some of yesterday's losses. BBDXY is up ~0.1%, the move higher has been seen alongside an uptick in US Tsys Yields and US Equities paring Thursday's gains.

- AUD is the weakest performer in the G-10 space at the margins, AUD/USD is down ~0.3%. Technically bullish trend conditions persist, resistance is at $0.6821 High Jul 27 and $0.6847 High Jul 20. Support comes in at $0.6655 Low Dec 14.

- Kiwi is ~0.2% lower however a ~20 pip range has persisted for the most part in NZD/USD. AUD/NZD has fallen below the $1.08 handle however the cross remains well within recent ranges.

- Yen is softer as the marginally firmer US Tsy Yields weigh, USD/JPY sits at ¥142.45/50. National CPI for November was on the wires this morning and was in line with estimates. Support in the pair comes in at ¥140.97/71 Low Dec 14 / 76.4% of the Jul 14 - Nov 13 bull run. Resistance is at ¥144.96/145.26 High Dec 19 / 76.4% of the Dec 11 - 14 sell-off.

- Elsewhere in G-10 EUR is down ~0.1% and the Scandies are both ~0.2% lower however liquidity is generally poor in Asia.

- In Europe today the docket is highlighted by the UK Retail Sales and GDP prints.

OIL: Pushing Higher, Up Strongly For the Past Week

Oil prices have probed higher through the first part of Friday trade. Brent was last just above $80/bbl, comfortably above intra-session lows from Thursday (just under $78/bbl). Highs for the session rest at $80.30/bbl, while earlier in the week we got $80.60/bbl. At this stage, Brent is comfortably higher for the week, +4.6%. WTI is near $74.50/bbl in recent dealings, +4.4% firmer for the week.

- Focus for oil markets largely remains on developments in the Red Sea, where disruptions risk a key supply route.

- Tankers carrying crude oil and fuel entering the Bab al-Mandab strait fell to around 30 this week, down by over 40% from the daily average seen in the previous three weeks as more shipping companies pause routes in the Red Sea according to Bloomberg ship tracking.

- Working the other way is a potential more positive supply backdrop. Angola will exit OPEC, stated-owned Jornal de Angola reported. This is not expected to boost supply in the near term, but is symptomatic of tensions within the group.

- Elsewhere, US total oil and gas rig counts fell by 3 to 620, according to Baker Hughes Dec. 21.

- This has helped temper US supply optimism and has added positive sentiment in the space at the margin.

GOLD: Holding Close To $2050, Comfortably Higher For The Week

Gold has maintained a positive tone through the first part of Friday trade, despite a modest recovery in USD sentiment. The precious metal was last near $2049.6, slightly above Thursday closing levels. At this stage we are tracking +1.50% higher for the week.

- This is line with broader USD losses over this period (despite today's stabilization).

- The technical picture looks positive, with recent highs resting at $2055, which is above the 50% retracement of the Dec 4-13 bear leg. The 61.8% retracement rests near $2073.4.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/12/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 22/12/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 22/12/2023 | 0700/0800 | ** |  | SE | PPI |

| 22/12/2023 | 0700/0700 | *** |  | UK | GDP Second Estimate |

| 22/12/2023 | 0700/0700 | * |  | UK | Quarterly current account balance |

| 22/12/2023 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 22/12/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 22/12/2023 | 0745/0845 | ** |  | FR | PPI |

| 22/12/2023 | 0800/0900 | *** |  | ES | GDP (f) |

| 22/12/2023 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 22/12/2023 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 22/12/2023 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 22/12/2023 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 22/12/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 22/12/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/12/2023 | 1500/1000 | *** |  | US | New Home Sales |

| 22/12/2023 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 22/12/2023 | 1530/1530 |  | UK | Publication of the Treasury Bill Calendar for January - March 2024 | |

| 22/12/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.