-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese Re-Opening Hope Drives Asia Trade

EXECUTIVE SUMMARY

- U.S. AUDIT INSPECTORS FINISH ON-SITE CHINA WORK AHEAD OF SCHEDULE (BBG)

- US, TAIWAN PLAN IN-PERSON TRADE TALKS AS CHINA TENSIONS SIMMER (BBG)

- ECB’S LAGARDE SAYS THERE’S STILL A WAY TO GO ON INTEREST RATES (BBG)

- ITALY'S MELONI TO GET WARM WELCOME IN BRUSSELS (MNI)

- BANK OF ENGLAND'S MANN SAYS INFLATION DRIVERS STILL STRONG (RTRS)

- UK CHANCELLOR HUNT CONSIDERS TAX HIT ON DIVIDENDS (FT)

- JEREMY HUNT SET TO LAUNCH CAPITAL GAINS TAX RAID (TELEGRAPH)

- G7 COALITION HAS AGREED TO SET FIXED PRICE FOR RUSSIAN OIL (RTRS)

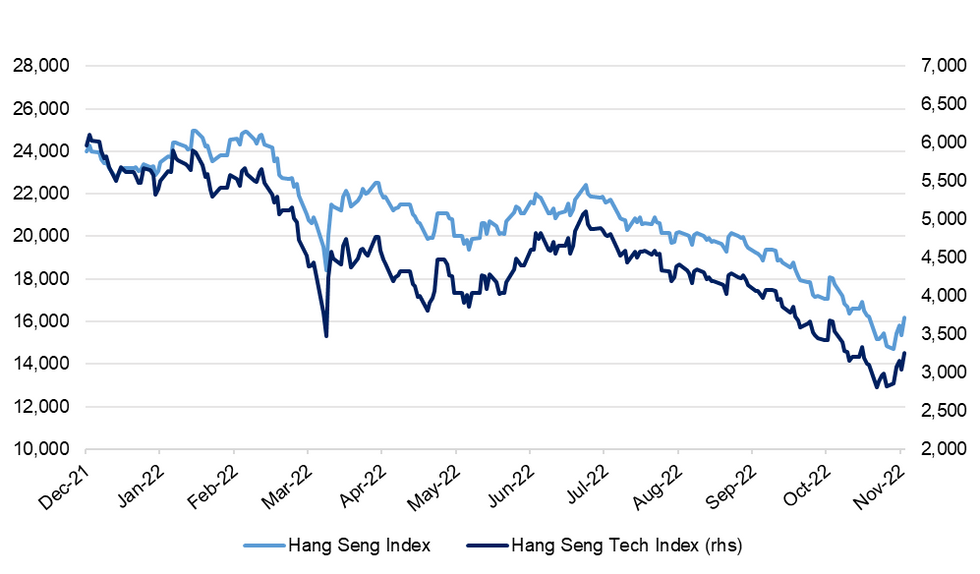

Fig. 1: Hang Seng Index & Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Britain is still facing strong domestic drivers of inflation on top of the impact of surging international energy prices and the after-effects of the coronavirus pandemic, Bank of England interest rate-setter Catherine Mann said on Thursday. (RTRS)

ECONOMY: Business organisations accepted the need for the Bank of England to raise the cost of borrowing but called on the government to prioritise fiscal sustainability and lifting trend growth. (The Times)

FISCAL: Jeremy Hunt is looking at increasing taxes on people who own shares, in a move that could help the UK chancellor raise a sum “in the low billions of pounds” to help plug a fiscal hole of about £50bn. (FT)

FISCAL: Jeremy Hunt is preparing a raid on entrepreneurs, savers and landlords to help plug the £50bn hole in Britain’s public finances, The Telegraph can reveal. (Telegraph)

FISCAL: Treasury officials are examining whether the autumn statement could include changes to non-dom status and moves to raise taxes on dividends by cutting tax-free allowances. No final decisions have been taken but Whitehall sources said options were being examined by the Treasury’s high net worth individuals policy team. (Guardian)

POLITICS/FISCAL: The Labour leader, Keir Starmer, is under pressure from campaigners, unions and his own MPs to set out plans for “wealth taxes” on the richest in society in order to support public services and help the poorest through the cost of living crisis. (Guardian)

EUROPE

ECB: European Central Bank President Christine Lagarde said there’s “still a way to go” on raising interest rates to counter record inflation. (BBG)

ECB: The European Central Bank must raise interest rates much further, but it’s impossible to say how far because economic uncertainty is too high, according to Governing Council member Martins Kazaks. (BBG)

ITALY: Italy has reassured the European Union it is ready to play by the rules, and Brussels is prepared to take Prime Minister Giorgia Meloni at her word. Italian government officials, including Finance Minister Giancarlo Giorgetti, have shown a willingness to engage with EU partners and not flout regulations, according to people familiar with the matter. (BBG)

ITALY: Italy plans to set aside at least 15 billion euros ($14.6 billion) in its 2023 budget to soften the impact of sky-high energy costs on firms and families, two government sources told Reuters on Thursday. (RTRS)

ITALY: Italian Prime Minister Giorgia Meloni looks set for a warm welcome in Brussels today, where EU officials have been positively surprised by the new government’s willingness to engage on its 2023 budget plans. (MNI)

GREECE: Greece will impose supplementary tax bills on energy firms, its energy minister said on Thursday, after a regulator identified windfall profits stemming from elevated energy prices. (RTRS)

PORTUGAL: Government bond markets will start looking more at the economic “fundamentals” of each country, Portuguese Finance Minister Fernando Medina said. (BBG)

RATINGS: Potential sovereign rating reviews scheduled for after hours on Friday include:

- Fitch on France (current rating: AA; Outlook Negative)

- Moody’s on Ireland (current rating: A1; outlook poistive) & Norway (current rating: AAA; outlook stable)

U.S.

ECONOMY: U.S. service prices have months before falling to considerably lower levels while growth will continue to moderate through early next year, Institute for Supply Management services chair Anthony Nieves told MNI Thursday. (MNI)

ECONOMY: The White House remains confident that the US economy will not enter a recession, despite voter concerns about rising inflation driving next week’s midterm elections and recent announcements of job cuts and hiring freezes by major technology companies. (The Independent)

ECONOMY: Getting shoppers to spend this holiday season won’t be easy. The National Retail Federation said Thursday that it expects holiday sales during November and December to rise between 6% and 8% from last year — a decline when factoring in the effect of inflation. The sales forecast excludes spending at automobile dealers, gasoline stations and restaurants. (CNBC)

POLITICS: Former President Donald Trump is considering launching a third bid for the White House this month and is speed-dialing confidantes to hash out possible scenarios as he looks to benefit from expected Republican wins in Tuesday's midterms, three Trump advisers said. (RTRS)

POLITICS: As Donald Trump inches closer to launching another presidential run after the midterm election, Justice Department officials have discussed whether a Trump candidacy would create the need for a special counsel to oversee two sprawling federal investigations related to the former president, sources familiar with the matter tell CNN. (CNN)

EQUITIES/ECONOMY: Tech companies are once again tapping the brakes on hiring as they contend with sluggish consumer spending, higher interest rates and the impact of a strong dollar overseas. (BBG)

EQUITIES: Elon Musk has directed Twitter Inc's teams to find up to $1 billion in annual infrastructure cost savings, according to two sources familiar with the matter and an internal Slack message reviewed by Reuters, raising concerns that Twitter could go down during high-traffic events like the U.S. midterm elections. (RTRS)

OTHER

GLOBAL TRADE: Apple Inc.’s Taiwanese contract manufacturer Pegatron Corp. has begun assembling the company’s latest iPhone 14 model in India. (BBG)

U.S./CHINA: US audit officials completed their first on-site inspection round of Chinese companies ahead of schedule, according to people familiar with the matter, a sign of progress in the closely watched process to prevent the delisting of hundreds of stocks from Alibaba Group Holding Ltd. to Yum China Inc. (BBG)

U.S./CHINA: Secretary of Commerce Gina Raimondo had a sobering message for US makers of chipmaking equipment this week: you’ll need to wait as long as nine months before Washington can reach an accord with US allies over strict new rules aimed at restricting China’s access to certain technologies. (BBG)

U.S./CHINA/TAIWAN: The US and Taiwan will hold in-person trade talks in New York next week as they deepen ties despite opposition from China, which claims the island. (BBG)

EU/CHINA: Chinese President Xi Jinping touted the need for greater cooperation between China and Germany amid "times of change and turmoil" in his first meeting with German Chancellor Olaf Scholz, with talks expected to touch on Russia's war on Ukraine, climate change and developing economic ties. (RTRS)

JAPAN/CHINA: The Japanese and Chinese governments have started planning a meeting between Japan's Prime Minister Fumio Kishida and China's President Xi Jinping for mid-November, the Sankei newspaper reported on Friday. (RTRS)

NATO: Sweden and Finland have delivered on the demands Turkey has set for their accession to NATO and time has come to welcome them to the alliance, NATO's Secretary General Jens Stoltenberg said on Thursday. (RTRS)

NATO: Turkey's foreign minister said on Thursday that Sweden and Finland have not yet fulfilled all obligations under a deal clearing their bids to join NATO, and they must still take concrete steps. (RTRS)

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Friday authorities should be vigilant to any downside risks stemming from the U.S. Federal Reserve’s monetary policy tightening, which has pressured the yen to historic lows. (RTRS)

RBA: Australia’s central bank increased its forecasts for inflation and wages growth and highlighted the risk of a price-wage spiral emerging among key reasons it expects to raise interest rates further. (BBG)

SOUTH KOREA: South Korea plans to provide a wide array of support to local shippers and venture companies to add vitality to the weak investment sentiment amid the looming global recession, the finance minister said Friday. (Korea Herald)

SOUTH KOREA: Korea’s big brokerages will buy securities guaranteed by their smaller peers, as officials seek to ensure credit market stress doesn’t destabilize the financial sector. (BBG)

NORTH KOREA: Defense Secretary Lloyd Austin said during a meeting with his South Korean counterpart Thursday that any North Korean nuclear attack against the United States or others would “result in the end of the Kim regime.” The statement came hours after Pyongyang tested a new intercontinental ballistic missile, again raising tensions in the region. (POLITICO)

NORTH KOREA: The United States believes China and Russia have leverage they can use to persuade North Korea not to resume nuclear bomb testing, a senior U.S. administration official said on Thursday. (RTRS)

CANADA: Canadian Finance Minister Chrystia Freeland pared budget deficit projections Thursday as stronger growth and inflation boost government coffers for now, while largely holding the line on new spending as a global slowdown looms. (MNI)

CANADA/RATINGS: Moody's affirmed Canada at Aaa; outlook stable (MNI)

MEXICO: U.S. Trade Representative Katherine Tai discussed differences with Mexico over its energy sector and U.S. corn exports in a virtual meeting on Thursday with Mexican Economy Minister Raquel Buenrostro, the USTR said in a statement. (RTRS)

RUSSIA/G20: Ukrainian President Volodymyr Zelensky on Thursday said his country may not participate in next month’s Group of 20 (G-20) summit if Russian President Vladimir Putin attends. (The Hill)

SOUTH AFRICA: South Africa’s governing party has beefed up its campaign rules on disclosing funding ahead of its elective conference in December where its new leadership will be elected. (BBG)

IRAN: The United States on Thursday issued sanctions against an international oil smuggling network it said supports Hezbollah and Iran’s Quds Force, targeting dozens of people, companies and tankers as Washington sought to mount pressure on Tehran. (RTRS)

IRAN: Protests in Iran swelled with a fresh wave of demonstrations as traditional 40-day mourning ceremonies for people killed by security forces over the past month brought thousands of people into the streets, reigniting fury at the government. (BBG)

IRAN: President Joe Biden on Thursday told supporters “we're gonna free Iran” after audience members appeared to call on him to address the ongoing protests that have spread through that country in the aftermath of the death of a young woman in the custody of its security forces. (The Independent)

ISRAEL: Israel Prime Minister Yair Lapid on Thursday congratulated Benjamin Netanyahu on his election win as final results confirmed the former premier's triumphant comeback at the head of a solidly right-wing alliance. (RTRS)

COLOMBIA: Colombia's Congress on Thursday approved a tax reform bill that will raise an additional 20 trillion pesos ($4 billion) annually for the next four years, in part through increased duties on oil and coal. (RTRS)

ENERGY: German Economy Minister Robert Habeck is optimistic on the cost of gas in the coming year, even as benchmark futures suggest prices may stay elevated. (BBG)

OIL: The Group of Seven rich nations and Australia have agreed to set a fixed price when they finalize a price cap on Russian oil later this month, rather than adopting a floating rate, sources said on Thursday. (RTRS)

OIL: Deliveries of U.S. crude oil to Asia are set to touch a record 1.8 million barrels per day this month, Kpler shipping data showed, as demand climbed on a widening discount to global oil. (RTRS)

CHINA

INFLATION: China’s inflation is expected to have eased in October, with the CPI likely to slow to between 2.2% and 2.5% year-on-year from September’s 2.8%, Securities Daily reported citing analysts. (MNI)

CORONAVIRUS: Local governments have begun to charge and reduce the frequency of nucleic acid testing amid increasing fiscal pressure, Caixin reported. (MNI)

EQUITIES: Longtime China investor Tiger Global Management has hit pause on investing in Chinese equities, said people familiar with the matter, as the firm reassesses its exposure to the world’s second-largest economy after President Xi Jinping cemented his control over the country. (WSJ)

WEALTH: Wealth growth among high-net-worth individuals (HNWI) has slowed, with the growth in the number of private banking customers and the average asset size decelerating, The Economic Observer reported, citing the Q3 reports of China Merchants Bank and Ping An Bank, leaders in retail banking. (MNI)

CHINA MARKETS

PBOC SETS YUAN CENTRAL PARITY AT 7.2555 FRI VS 7.2472 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a sixth day at 7.2555 on Friday, compared with 7.2472 set on Thursday.

PBOC NET DRAINS CNY87 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) on Friday injected CNY3 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY87 billion after offsetting the maturity of CNY90 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8160% at 9:42 am local time from the close of 1.6006% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 52 on Thursday vs 41 on Wednesday.

OVERNIGHT DATA

JAPAN OCT, F JIBUN BANK SERVICES PMI 53.2; PRELIM 53.0

JAPAN OCT, F JIBUN BANK COMPOSITE PMI 51.8; PRELIM 51.7

Activity and jobs in Japan's service sector expanded at stronger rates in October. The roll-out of the Nationwide Travel Discount Programme alongside the recent lifting of remaining travel restrictions reportedly strengthened demand conditions and supported growth in activity levels. Japanese service providers were hopeful that these current demand trends would continue into the future and registered a level of confidence that was among the highest on record. More negatively, price pressures worsened with a near-record pace of input cost inflation. Meanwhile, selling price inflation was among the highest on record as firms reportedly continued to partly share increasing cost burdens with their clients. (S&P Global)

AUSTRALIA Q3 RETAIL SALES EX-INFLATION +0.2% Q/Q; MEDIAN +0.4%; Q2 +1.0%

MARKETS

SNAPSHOT: Chinese Re-Opening Hope Drives Asia Trade

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 485.28 points at 27178.11

- ASX 200 up 34.62 points at 6892.5

- Shanghai Comp. up 83.521 points at 3081.327

- JGB 10-Yr future down 45 ticks at 148.35, yield down 0.3bp at 0.251%

- Aussie 10-Yr future up 6.5 ticks at 96.135, yield down 7bp at 3.85%

- U.S. 10-Yr future down 0-02 at 109-21, yield down 0.74bp at 4.1395%

- WTI crude up $1.63 at $89.80, Gold up $16.54 at $1645.94

- USD/JPY down 34 pips at Y147.92

- U.S. AUDIT INSPECTORS FINISH ON-SITE CHINA WORK AHEAD OF SCHEDULE (BBG)

- US, TAIWAN PLAN IN-PERSON TRADE TALKS AS CHINA TENSIONS SIMMER (BBG)

- ECB’S LAGARDE SAYS THERE’S STILL A WAY TO GO ON INTEREST RATES (BBG)

- ITALY'S MELONI TO GET WARM WELCOME IN BRUSSELS (MNI)

- BANK OF ENGLAND'S MANN SAYS INFLATION DRIVERS STILL STRONG (RTRS)

- UK CHANCELLOR HUNT CONSIDERS TAX HIT ON DIVIDENDS (FT)

- JEREMY HUNT SET TO LAUNCH CAPITAL GAINS TAX RAID (TELEGRAPH)

- G7 COALITION HAS AGREED TO SET FIXED PRICE FOR RUSSIAN OIL (RTRS)

US TSYS: Light Twist Steepening, With China Matters Dominating Pre-NFP

Tsys remain underpinned into London as Chinese & Hong Kong equities rally and the broader USD weakens.

- China re-opening speculation, signs of the potential for deepening of Sino-German economic ties and BBG source reports noting that “U.S. audit officials completed their first on-site inspection round of Chinese companies ahead of schedule” have all factored into price action.

- This came after weakness in the longer end of the Japanese curve and a bid for short dated Aussie bonds provided a light twist steepening impulse early in Asia trade.

- Cash Tsys run 2bp richer to 1bp cheaper across the curve, pivoting around 20s, with the 2-/10-Year spread hovering above the deepest levels of inversion registered during the current cycle (printed on Thursday). TYZ2 deals -0-00+ at 110-00+, a little off the peak of its 0-09 range on solid enough volume of ~95K.

- Flow was headlined by a couple of TY block sales (-1.4K & -1.9K), although these had no tangible impact on broader price action.

- Friday’s NY docket is headlined by the latest labour market report (see our full preview of that event here), meanwhile, post-FOMC blackout Fedspeak gets underway with addresses from Collins & Barkin.

JGBS: Steeper On Tokyo’s Post-FOMC Catch Up

JGB were subjected to post-FOMC catch up pressure after Thursday’s Japanese holiday, which saw the space on the defensive for most of Friday’s trade, before the wider core FI complex firmed (as we have outlined elsewhere), which allowed the space to edge away from cheapest levels of the day.

- Cash JGBs are little changed to ~5.5bp cheaper, with the super-long end leading the weakness. 10s remain capped by the upper limit of the BoJ’s YCC mechanism. JGB futures are -40, ~15 ticks off lows and ~100 ticks away from key technical support.

- Local news flow saw familiar rhetoric from Finance Minister Suzuki re: the JPY and the need for sound finances.

- Meanwhile, the Japanese cabinet OK’d the release of some the country’s reserve funds to pay for grain imports.

- Late in the session saw a couple of source reports do the rounds, pointing to requirements of ~Y22.8tn of bond issuance to finance the Japanese supplementary budget, providing a bit of a limit to the tick away from session cheaps for the space. The same reports indicated a record Japanese tax take in the current FY.

- 10-Year JGBi supply headlines the domestic docket on Monday.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.87590tn 3-Month Bills:

- Average Yield -0.1176% (prev. -0.1381%)

- Average Price 100.0316 (prev. 100.0371)

- High Yield: -0.1079% (prev. -0.1265%)

- Low Price 100.0290 (prev. 100.0340)

- % Allotted At High Yield: 63.9927% (prev. 53.2362%)

- Bid/Cover: 3.095x (prev. 2.576x)

AUSSIE BONDS: Firmer, Front End Leads The Bid

Aussie bonds firmed on Friday. A weaker USD surrounding Chinese re-opening hopes was a primary driver for a bid in U.S. Tsys which supported ACGBs during the latter rounds of Sydney dealing.

- EFPs were narrower all day, with receiver side flows in swaps lending a helping hand to ACGBs during early trade. This saw EFPS edge a little further away from cycle wides after the recent surge wider.

- YM was +11.0 at the bell, with XM +7.0, building on the overnight bounce from post-Sydney lows, while wider cash ACGB trade saw 7.5-11bp of richening as the curve bull steepened.

- The space looked through the latest round of economic projections provided in the RBA’s SoMP (with the major releases already flagged in Bank’s post-meeting statement earlier in the week, as is the norm).

- Elsewhere, slightly softer than expected Q3 real retail sales data was accompanied by negative revisions to the Q2 print,

- Bills were 6-16bp richer through the reds, with the backend of the whites and front end of the reds outperforming. RBA dated OIS has come in a touch more, pointing to a terminal cash rate of just over 4.00%.

- Looking ahead, next week’s domestic highlights include an address from RBA Deputy Governor Bullock (Wednesday), CBA household consumption data, NAB business and Westpac consumer confidence surveys (all due Tuesday) & inflation expectations (Thursday). We will also get the syndication of the new ACGB May-34.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- It confirmed that “a new 21 May 2034 Treasury Bond is planned to be issued via syndication in the week beginning 7 November 2022 (subject to market conditions). The Joint Lead Managers for the issue are Australia and New Zealand Banking Group; J.P. Morgan Securities Australia Limited; UBS AG, Australia Branch; and Westpac Banking Corporation.”

- On Tuesday 8 November it plans to sell A$150mn of the 0.25% 21 November 2032 Indexed Bond.

- On Thursday 10 November it plans to sell A$1.0bn of the 24 February 2023 Note, A$500mn of the 24 March 2023 Note & A$500mn of the 12 May 2023 Note.

NZGBs: Curve Twist Steepens On Global Impulses, Swap Spreads Narrow Again

Wider core global FI moves likely allowed the NZGB space to correct from cheapest levels on Friday, with a lack of domestic headline flow evident.

- The bid in the shorter end of the ACGB curve/EFP narrowing provided some trans-Tasman impetus, while light twist steepening in U.S. Tsys and post-holiday catch up weakness in the longer end of the JGB curve were also also observed.

- The major NZGB benchmarks finished 2bp richer to 2bp cheaper on Friday, twist steepening, pivoting around 7s.

- Meanwhile, swap rates were lower across the curve, resulting in swap spread tightening. This extended the recent narrowing of swap spreads witnessed since NZGBs were formally included in the FTSERussell WGBI (after some widening into that event), while the receiver side flows observed in Australian swaps may have also helped (although that dynamic faded a little as Sydney trade wore on).

- RBNZ dated OIS ticked incrementally lower on the day, with ~68bp of tightening now priced for this month’s meeting and a terminal OCR of just below 5.25% observed.

- Next week’s local docket is headlined by the release of the latest batch of quarterly inflation expectations data, monthly card spending data and the RBNZ’s Review and Assessment of the Formulation and Implementation of Monetary Policy.

EQUITIES: HSI TECH +9%, As China/HK Stocks Rebound

China/HK related equities have again been the focus point. Strong gains have been recorded across all the major indices, particularly Hong Kong tech shares. This has helped lift US futures out of negative territory, although gains are modest at this stage, with only Nasdaq futures at +0.25/0.30%. Some regional markets are still in the red as well, so spill over from China/HK has not been uniform.

- Catalysts for the surge higher in HSI, ~+6% currently, are not clear from a headline standpoint. Once again, underlying sentiment has been governed by the tech space. The HSI tech sub index is up close to 9% at the moment. Some have pointed to the joint venture between large state-owned telco companies Tencent and Unicom as a potential catalyst.

- Otherwise, re-opening speculation is a likely factor, although we haven't seen any fresh developments on this front. The US audit inspectors have also finished on-site inspection work for China companies listed on US exchanges. Delisting risk has been a weight on market sentiment, albeit over a long period of time.

- The CSI 300 is up 2.7%, the composite index just over 2%.

- It has been more mixed elsewhere the Nikkei 225 is off just over 2%. This is more in line with US weakness from overnight, as tech related plays faltered. The Kospi has performed better, a trend evident for much of this week (up 0.47% today). The Taiex is off -0.30%.

- The ASX 200 is +0.40%, aided in part by higher resource names, as firmer commodity prices have been evident during today's session.

OIL: Rebounds In Line With Broader Risk Appetite

Brent crude has spent much of the session on the front foot, up +0.77% so far. This is line with a firmer tone to broader risk appetite, led by China related equities. This puts us back above $95.30/bbl, with highs near $95.50/bbl for the session. Broadly, dips remain supported in Brent, although we can't break out of the 50-day ($92.79) to 100-day ($98.22) MA ranges for now. WTI is back above $88.80, +0.75% for the session.

- Earlier, Reuters reported that the G7 had agreed to a fixed price (rather than floating) when they finalize a price cap for Russia later this month. The UK Treasury stated it won't allow insurance services for oil shipped from Russia unless the price is at or below the cap (when it comes into effect in December).

- President Biden also reiterated earlier calls for oil/energy companies to invest more in the US or risk paying higher taxes.

- Elsewhere, Saudi Arabia announced it was lowering a key oil benchmark price for Asia customers for December delivery. The Arab Light grade will be set at $5.45/bbl above the regional benchmark, a 40 cents reduction. A softer demand backdrop for the region is being cited as the driver of this result. oil

GOLD: Key Support Level Holds Despite Higher US Real Yields

Gold is +0.60% above NY closing levels, last just under $1640. This follows a weaker USD tone against the majors, with better China/HK equity sentiment seeing lower USD demand from a broader risk appetite standpoint.

- This comes after the overnight test sub $1620, where support held once again. This is the third time since late September this support zone has held.

- This came despite a surge in UST real yields overnight. We got to 1.74% for the 10yr.

- We are close to yesterday's highs, just above $1640, but beyond that is the $1660/$1670 region, which we haven't been able to trade above in a meaningful way since the first half of October.

FOREX: Sentiment Improves On Lead From China/HK Equity Space, USD Struggles Pre-NFP

The greenback sold off as the focus turned from the Fed's most recent monetary policy decision to the U.S. labour market data which will cross the wires after hours. The BBDXY fell 0.5% from Thursday's close, virtually erasing gains registered that day, with short-end U.S. Tsy yields sitting slightly lower.

- Risk sentiment turned positive, with a decent showing from Chinese/HK stocks lending support to the broader equity space. E-minis recouped their initial losses and now operate in the green. There were no obvious catalysts behind that move, outside of continued unverified re-opening speculation.

- Spot USD/CNH tumbled, outpacing losses in the BBDXY index. There was nothing unusual in the PBOC fix to boost the redback, with USD/CNY reference rate set at a new cyclical high and 593 pips below the sell-side estimate.

- G10 crosses traded in a typical risk-on pattern, with high-betas appreciating at the expense of traditional safe havens. The Aussie dollar outperformed on better iron ore prices and firmer commodity complex, leaving its Antipodean cousin NZD behind, out of sync with the move in Australia/New Zealand 2-year swap differential.

- Sterling firmed after cable found a base at $1.1150 and proceeded to chew into the prior trading day's losses. The pound came under pressure Thursday as the BoE delivered a 75bp hike while playing down terminal rate pricing and pointing to a bleak economic outlook.

- Outside of the U.S. NFP report, focus turns to Canadian jobs data, German factory orders, as well as comments from ECB's Lagarde, Nagel & de Guindos, BoE's Pill & Fed's Collins.

FX OPTIONS: Expiries for Nov04 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750(E615mln), $0.9790-00(E1.5bln), $0.9825(E650mln), $0.9900(E1.5bln), $1.0000(E2.3bln), $1.0100(E1.2bln)

- USD/JPY: Y146.00($607mln), Y147.00($973mln), Y148.00($580mln), Y149.00($553mln)

- GBP/USD: $1.1500(Gbp591mln)

- USD/CAD: C$1.3695-00($739mln), C$1.3800($689mln)

- USD/CNY: Cny7.2000($874mln), Cny7.3000($530mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/11/2022 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 04/11/2022 | 0745/0845 | * |  | FR | Industrial Production |

| 04/11/2022 | 0800/0900 | ** |  | ES | Industrial Production |

| 04/11/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 04/11/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 04/11/2022 | 0845/0945 |  | EU | ECB de Guindos Speech at Naturgy Foundation/IESE School | |

| 04/11/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/11/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/11/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/11/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/11/2022 | 0930/1030 |  | EU | ECB Lagarde Open Lecture | |

| 04/11/2022 | 1000/1100 | ** |  | EU | PPI |

| 04/11/2022 | - |  | DE | G7 Foreign Ministers summit in Germany | |

| 04/11/2022 | 1215/1215 |  | UK | BOE Pill & Shortall MonPol Report National Agency briefing | |

| 04/11/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 04/11/2022 | 1230/0830 | *** |  | US | Employment Report |

| 04/11/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 04/11/2022 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 04/11/2022 | 2000/1600 |  | US | Fed's Financial Stability Report |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.