-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 2-8 December

MNI POLITICAL RISK - Trump Targets BRICS w/New Tariff Threat

MNI Gilt Week Ahead: Triple issuance week?

MNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI EUROPEAN OPEN: Core Equities Look Through Geopolitical Noise

EXECUTIVE SUMMARY

- BIDEN OFFICIALS OPEN TO DEBATE ON HOW $2TN INFRASTRUCTURE PLAN IS FUNDED (FT)

- CHINA ASKED BANKS TO REIN IN CREDIT ON BUBBLE FEARS (FT)

- FRANCE CUTS ECONOMIC GROWTH FORECAST TO 5% AMID LOCKDOWN (RTRS)

- SUEZ CANAL TRAFFIC JAM 'CLEARED' DAYS AFTER EVER GIVEN CARGO SHIP FREED (NBC)

- BIDEN ASSURES UKRAINE OF SUPPORT AS RUSSIA TENSIONS RISE (BBG)

- IRAN RULES OUT ANY TALKS WITH U.S. IN VIENNA UNLESS SANCTIONS GO (BBG)

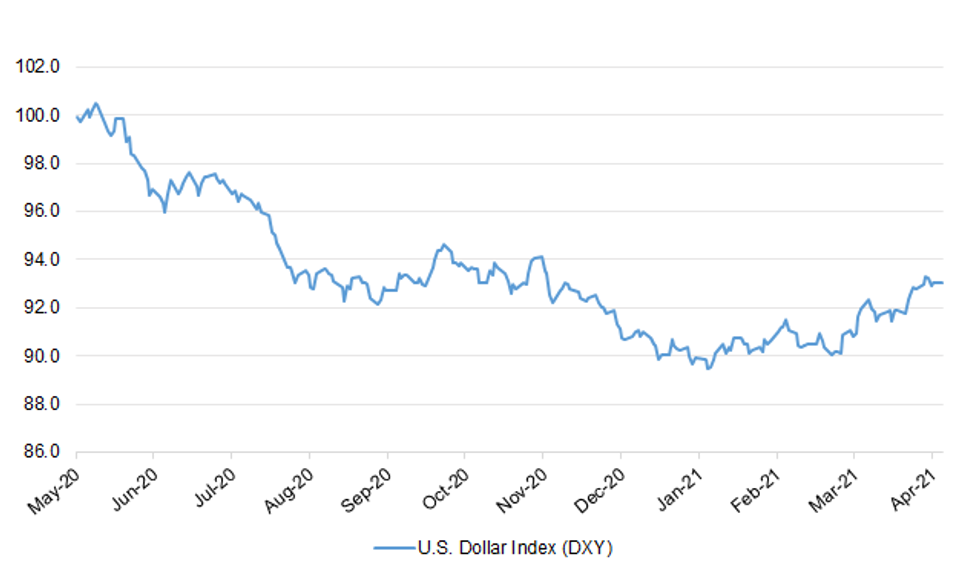

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Everyone in England is to be given access to two rapid coronavirus tests a week from Friday, under an extension of the government's testing programme. The lateral flow kits, which can provide results in around 30 minutes, will be available for free at testing sites, pharmacies and through the post. The tests are already offered to school children and their families plus those who have to leave home for work. The health secretary said it would help squash any outbreaks as lockdown eases. But critics of the programme say it risks becoming a "scandalous" waste of money. (BBC)

CORONAVIRUS: People should not socialise indoors with other households even if they are vaccinated, Boris Johnson has said. As the Easter Bank Holiday weekend began, the PM said "we're not yet at that stage" as coronavirus vaccines "are not giving 100% protection". (BBC)

CORONAVIRUS: Government plans for a Covid passport scheme will start to be trialled this month at a series of pilot events. Ministers are hoping passes will allow the safe return of sports matches, conferences and night clubs in England. They would show whether a person is vaccinated, had a recent negative test, or natural immunity determined by a positive test in the last six months. Downing Street also confirmed countries will be in a risk-based "traffic light" system when foreign holidays resume. (BBC)

CORONAVIRUS: Covid passports designed to return life to normal in Britain might not be ready until the autumn, The Telegraph can reveal. Boris Johnson, the Prime Minister, will on Monday confirm for the first time that a system is being developed that will allow people to return to sporting matches, theatres and other major public events, as well as travelling overseas for holidays. (Telegraph)

CORONAVIRUS: Vaccinated Britons would avoid Covid tests and quarantine under government plans to allow foreign summer holidays. (Telegraph)

CORONAVIRUS: Pubgoers will be able to enjoy a pint without having to show a vaccine passport under plans to lift lockdown that will be unveiled tomorrow. Boris Johnson will announce that a new NHS app confirming that the holder has had the jab, a recent negative test or Covid-19 in the previous six months will be needed to enter theatres, cinemas and sports and music events after June 21. (The Times)

CORONAVIRUS: COVID passports could be introduced as a way of ensuring people can get "back to doing the things they love", the culture secretary has said. Oliver Dowden made the comments as more than 70 MPs sent a warning shot to Prime Minister Boris Johnson by forming a major cross-party campaign against the use of such passports within the UK. (Sky)

CORONAVIRUS: MPs will be given a vote on plans for vaccine passports before they are introduced, risking a Government defeat in the Commons, The Telegraph has learnt. (Telegraph)

CORONAVIRUS: Matt Hancock has been ordered to the High Court on Tuesday to justify why he is allowing non-essential shops to open before pubs and restaurants. (Telegraph)

BREXIT: The majority of British firms have faced disruption with trade with the European Union since Brexit, with many expecting the problem to last for some time, according to a survey published on Saturday. A trade agreement between London and Brussels which came into force on Jan. 1 has meant some companies have had to deal with new bureaucracy and rules. The Survation survey for London First/EY, conducted in February, found 75% had experienced some disruption, even though 71% said they had felt prepared for the changes. (RTRS)

EUROPE

ECB: The uneven pace at which countries are vaccinating their populations against Covid-19 is the single greatest threat to a global economic recovery Italy's central bank governor said, ahead of the country hosting a G20 summit this week. Ignazio Visco, who will co-host the virtual G20 meeting of finance ministers and central bank governors on Wednesday with Daniele Franco, Italy's economy minister, warned that a patchy international vaccine rollout could result in sharply different recoveries for developed and developing nations. "The main instrument we have at the moment is neither monetary nor fiscal, it is vaccinations," he said in an interview with the Financial Times. "We need to maintain close international co-operation within the G20 to avoid that the different stages of the vaccination campaign in the various countries result in excessive divergences of the respective economies." (FT)

ECB: Environmental campaigners have criticised the European Central Bank's recent loosening of its collateral rules for disproportionately benefiting companies that are heavy emitters of carbon, such as airlines and carmakers. The ECB changed its collateral rules in response to the pandemic almost a year ago to start accepting securities issued by "fallen angel" companies — those that have had their credit rating downgraded below investment grade since the coronavirus crisis started. Greenpeace said the temporary change to the rules had mostly benefited heavy polluters, including Lufthansa, International Airlines Group and Renault, according to a report seen by the Financial Times. (FT)

CORONAVIRUS: Dutch Prime Minister Mark Rutte and the premier of the neighboring German state of North Rhine-Westphalia appealed to citizens to avoid non-essential travel and stay home over the Easter vacation. "We are in the third wave and must therefore exercise great caution," Rutte and NRW Premier Armin Laschet said in a statement. Staying at home will help avoid restrictions on border traffic, they said. (BBG)

FRANCE: The French economy will expand by 5% in 2021, Economy Minister Bruno Le Maire said in a newspaper interview, as a third lockdown to tackle the coronavirus pandemic has prompted a downward revision in the previous government forecast for 6% growth.The new forecast was prudent, Le Maire said in comments published on Sunday in Le Journal Du Dimanche (JDD)."Our fundamentals are sound; we will be able to bounce back," Le Maire said.French schools and non-essential stores such as clothing chains will now be shut for four weeks, after COVID-19 cases surged in recent weeks, edging up the number of patients in intensive care units. (RTRS)

FRANCE: France favors a Covid-19 tracing app rather than health passes for entry into restaurants, museums or other public places once lockdown restrictions are eased, Junior Tourism Minister Jean-Baptiste Lemoyne said Friday on France Info radio. (BBG)

FRANCE: The French government and the European Commission have reached an agreement in principle on fresh financial support for Air France, which has been hurt by a drop in air travel since the start of the pandemic, Finance Minister Bruno Le Maire said on Sunday. "It's very good news for Air France, it's very good news for the whole French aviation sector," Le Maire said in an interview on LCI television. "It was a long and difficult negotiation, but I think we've reached a good agreement" with EU Competition Commissioner Margrethe Vestager. Air France-KLM's board is preparing to meet Monday to consider a recapitalization plan for its French arm, according to people familiar with the matter. (BBG)

NETHERLANDS: The Netherlands temporarily halted vaccinations of people younger than 60 with AstraZeneca's vaccine after reports of a handful of severe blood-clotting events associated with a low platelet count. The Dutch Health Ministry reported five cases in Dutch women between the ages of 25 to 65. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- S&P affirmed France at AA; Outlook Stable

U.S.

ECONOMY/FISCAL: President Joe Biden said the sweeping infrastructure proposal he unveiled this week would result in 19 million jobs created over the next decade as the U.S. seeks to emerge from the pandemic. "Independent analysis shows that if we pass this plan the economy will create 19 million jobs," Biden said in remarks at the White House Friday. "Good jobs, blue collar jobs, jobs that pay well." The remarks were the first time the White House offered a guess at the employment impact of the president's $2.25 trillion "American Jobs Plan," unveiled Wednesday, which aims to update the country's physical and technological infrastructure, and address longstanding economic inequities in the nation. (BBG)

FISCAL: Top Biden administration officials said they saw room for a deal on corporate taxes to pay for the president's $2tn infrastructure plan, as they pushed Congress to make progress on the package by the end of next month. "I think we're going to find a really good, strong deal space on this," Pete Buttigieg, the transportation secretary, told ABC on Sunday. "We know that this is entering a legislative process where we're going to be hearing from both sides of the aisle, and I think you'll find the president's got a very open mind." Last week on a visit to Pittsburgh, Joe Biden unveiled his next multitrillion-dollar economic proposal after securing passage of his $1.9tn fiscal stimulus package last month. (FT)

FISCAL: Republican Sen. Roy Blunt of Missouri on Sunday urged the Biden administration to cut its $2 trillion infrastructure plan to roughly $615 billion and focus on rebuilding physical infrastructure like roads and bridges. In an interview with Fox News Sunday, Blunt – the fourth-ranking Republican in the Senate – argued that only 30% of the president's proposal focuses on traditional infrastructure and said reducing the price would allow the White House to pass the bill through both chambers of Congress. "I think there's an easy win here for the White House if they would take that win, which is make this an infrastructure package, which is about 30% — even if you stretch the definition of infrastructure some — it's about 30% of the $2.25 trillion we are talking about spending," Blunt said. (CNBC)

FISCAL: New York Gov. Andrew Cuomo and state lawmakers are nearing a budget agreement that would increase corporate and income taxes by $4.3 billion a year and would make top earners in New York City pay the highest combined local tax rate in the country. Democratic leaders of the state Assembly and Senate briefed legislators on Saturday on the tax plan, which was one of the last pieces of a roughly $200 billion state budget, people familiar with the deal said. The additional tax revenue would be used to increase school aid and create new funds for undocumented immigrants, small businesses and tenants who are behind on their rent, the people said. (Dow Jones)

CORONAVIRUS: The Centers for Disease Control and Prevention said Friday that fully vaccinated Americans can resume domestic and overseas travel as long as they wear masks in public. The individuals do not need to get a Covid-19 test before or after traveling and do not need to self-quarantine afterward, as long as they follow public health measures. (POLITICO)

CORONAVIRUS: The B.1.1.7 virus version, which was first detected in the U.K., is now the dominant variant across an area comprising two-thirds of the U.S. population, according to the CDC. (BBG)

CORONAVIRUS: A fourth surge of infections in the U.S. is just gathering pace and is focused on younger people who've yet to be vaccinated, said epidemiologist Michael Osterholm, reflecting the race between more contagious variants and quickly getting shots into arms. (BBG)

CORONAVIRUS: California will allow indoor events such as conferences and performances to resume with limited capacity in most of its virus positivity-rate tiers starting April 15. The capacity limits, which differ based on tiers, can increase when all guests are tested or show proof of full vaccination. (BBG)

CORONAVIRUS: Mississippi Governor Tate Reeves is the latest Republican governor opposing so-called "vaccine passports" that would document that an individual has received the Covid-19 vaccines to gain entry into businesses. (BBG)

CORONAVIRUS: Florida Gov. Ron DeSantis issued an executive order Friday prohibiting businesses from requiring customers to show proof they have received COVID vaccines and preventing the state government from issuing so-called "vaccine passports." (Axios)

CORONAVIRUS: Colorado Governor Jared Polis extended the state's Covid-19 mask mandate for another 30 days while relaxing requirements for counties with low infection rates. Masks will continue to be required in schools across the state, Polis said. (BBG)

CORONAVIRUS: Johnson & Johnson, with help from the Biden administration, is taking over a Baltimore vaccine production facility that was the site of a major manufacturing error last month -- and moving production of material for a second company's shot to minimize risk of another mistake. J&J announced Saturday that it was "assuming full responsibility regarding the manufacturing of drug substance" at the Emergent BioSolutions Inc. plant. To facilitate that, the Department of Health and Human Services worked with AstraZeneca to move its production out of that plant so it can focus only on J&J, according to an HHS official familiar with the measure, who spoke on condition of anonymity. (BBG)

AIRLINES: Delta Air Lines Inc. said it's canceled about 100 flights due to a staffing shortage, and as a result will allow travelers to book middle seats on some planes a month ahead of plan. "Delta teams have been working through various factors, including staffing, large numbers of employee vaccinations, and pilots returning to active status," a spokeswoman said in a statement on Sunday. "We apologize to our customers for the inconvenience and the majority have been rebooked for the same travel day." (BBG)

OTHER

GLOBAL TRADE: The maritime traffic jam created when a giant container ship blocked the Suez Canal has now been cleared, Egyptian authorities said Saturday. Some 422 ships, which were visible from space, have now cleared the vital artery, with the final 61 vessels passing through the waterway on Saturday, the Suez Canal Authority said. (NBC)

GLOBAL TRADE: The UK is in a global race to secure the rare-earth elements that are crucial for fighter jets, wind turbines and electric cars amid fears that China could weaponise its monopoly of them. Security agencies are concerned that there will be increased competition for scarce natural resources and that Beijing's control of supplies could be used as leverage in any disputes. (The Times)

GLOBAL TRADE: An influx of imports from Asia to the U.S. has created a bottleneck at West Coast ports, with backed up cargo ships contributing to a worldwide shortage of containers and soaring shipping rates. The volume of containers handled at the California ports of Los Angeles and Long Beach, which serve as gateways for goods from Asia, grew 45% in February compared with a year earlier, climbing for an eighth consecutive month. In March, container volume at the port of Los Angeles apparently surged by more than 80%. (Nikkei)

CORONAVIRUS: Australian authorities say they are working with the European Union and the U.K. to investigate the first local case of an unusual clotting in a patient after receiving the AstraZeneca vaccine, as global concern over the safety of the shot continues to grow. The case, first reported on April 2, is currently being investigated by the country's Therapeutic Goods Administration. (BBG)

JAPAN: Japan's government will consider allowing a broader array of medical professionals, such as dentists, to inject Covid-19 vaccines as it looks to ramp up its shots in the coming weeks, the Nikkei newspaper reported, without saying where it obtained the information. Economy Minister Yasutoshi Nishimura, in an appearance on national public broadcaster NHK, asked people to refrain from trips to the Osaka region. The government placed new virus restrictions on the region in recent days to battle a fresh surge. (BBG)

AUSTRALIA: The first phase of Australia's coronavirus vaccine program could finish up to two months late, according to federal Health Department documents, as the Morrison government scrambles to hire more providers to deliver jabs across the country. The Sunday Age can reveal the federal government has advertised for further assistance – in every state and territory across the country – to roll out the vaccine to residential aged care staff and other people in the phase 1a cohort of 700,000 people. (The Age)

SOUTH KOREA: South Korea is on the brink of a fourth wave of the coronavirus, health minister Kwon Deok-cheol said in a statement. There is an increasing trend, Kwon said, as the daily number of positive cases exceeded 500 on average last week and may top 1,000 in a short period. Kwon urged people not to gather and to get vaccinated. (BBG)

NORTH KOREA: China and South Korea will strengthen cooperation to achieve denuclearization on the Korean Peninsula, the two countries' foreign ministers agreed on Saturday, with plans for senior-level security talks in the first half of the year. The two countries share the goal of the denuclearization of the peninsula, both governments said in releases, and the two sides aim for the first talks between their foreign affairs and defense vice ministers. The agreement came during newly appointed South Korean Foreign Minister Chung Eui-yong's visit to Xiamen, China, to meet Foreign Minister Wang Yi. (Nikkei)

TURKEY: Turkish President Recep Tayyip Erdogan summoned his cabinet and top officials for an unscheduled meeting on Monday, after a group of retired navy admirals criticized the government's stance on a key international convention in a move that was seen as a direct challenge to the Erdogan's authority. Erdogan's communications director Fahrettin Altun on Sunday accused the former admirals of insinuating that the government should be overthrown and said that a public prosecutor was starting a probe into the incident. The cabinet will convene at 3 p.m. local time, followed by a meeting with the ruling AK Parti's central executive committee at 6 p.m. (BBG)

TURKEY: Turkish Defense Minister Hulusi Akar reiterated on Saturday his country's view that islands could not have a continental shelf, adding that Greeks "continue their provocative actions" and "increase tension" in the region despite Ankara's "constructive, peaceful stance." Akar, who was speaking to media during a visit to south-eastern Turkey, said Greece uses "threatening language" in order to achieve some goals and violate international law. "Every time we emphasize that these moves are pointless, no threat has any impact on our country," he said. (Kathimerini)

BRAZIL: Brazil's Central Bank Chief Roberto Campos Neto said policy makers will not take borrowing costs to a neutral level at this moment because economy still needs stimulus, according to O Estado de S. Paulo newspaper, citing an interview with him. Unless there is an extraordinary change in conditions, interest rates will rise by another 75 basis points in May, he said. Campos Neto also repeated that the Central Bank does not make monetary policy based on the exchange rate and is most concerned with inflation, according to Estado. (BBG)

RUSSIA: U.S. President Joseph Biden pledged to stand with Ukraine against Russian "aggression" in his first official phone call with his counterpart, Volodymyr Zelenskiy, who raised concerns of troop movement near the border. (BBG)

RUSSIA: Russia's death toll linked to Covid-19 grew to 24,369 in February, nearly double initial reports, illustrating the price the country is paying for opting against locking down during the pandemic's second wave. Data released by the Federal Statistics Service on Friday includes people who were infected with the virus though it was not regarded as the cause of death. The revision increases Russia's death toll 225,572 since the pandemic began. (BBG)

IRAN: U.S. State Department spokesman Ned Price said on Friday that the United States has agreed to talks with European, Russian and Chinese partners to identify issues involved in returning to compliance with the 2015 nuclear agreement with Iran. "These remain early days and we don't anticipate an immediate breakthrough as there will be difficult discussions ahead. But we believe this is a healthy step forward," Price said in a statement. Diplomats had said earlier on Friday that officials from Tehran and Washington would travel to Vienna next week as part of efforts to revive the 2015 accord. (RTRS)

IRAN: Iran said it will hold no direct or indirect talks with the U.S. when the two countries and other world powers gather in Vienna on Tuesday for planned talks on the possible resurrection of the 2015 nuclear deal. (BBG)

MIDDLE EAST: The Saudi-led coalition fighting in Yemen foiled an imminent Houthi attack on Saturday, destroying an explosive-laden boat in a southern part of the Red Sea, Saudi state TV reported. It also quoted the coalition as saying that the Iran-aligned Houthis "continue to threaten maritime shipping lines and global trade". (RTRS)

OIL: Saudi Arabia raised prices for oil shipments to customers in its main market of Asia, signaling the kingdom's confidence in the region's economic recovery. The decision comes after the OPEC+ cartel, led by the Saudis and Russia, agreed to boost daily crude production by more than 2 million barrels between May and July. Aramco, the Saudi state energy firm, will increase its grades for Asia in May by between 20 and 50 cents a barrel, according to a statement. It will raise the key Arab Light grade for the region by 40 cents from April to $1.80 per barrel above the benchmark. The company had been expected to hike the grade by 30 cents, according to a Bloomberg survey of eight traders and refiners. (BBG)

CHINA

CORONAVIRUS: China is ramping up its Covid-19 vaccination push, aiming to be twice as fast as the U.S. by pressuring Communist Party members, bank workers and college staff to get shots, as the lagging rollout threatens to undermine the advantage it secured by effectively wiping out the virus. The inoculation effort has been stepped up markedly in recent weeks, with China now administering an average of 5 million doses a day from less than a million at the start of the year. While a significant increase, that translates to 5 doses for every 100 people, compared to 25 in the U.S. and 56 in Israel, according to Bloomberg's Vaccine Tracker. (BBG)

CORONAVIRUS: China is receiving foreign dignitaries outside of Beijing, in a break from pre-pandemic custom, as the country tries to advance its diplomatic agenda while maintaining strict coronavirus measures in the capital. (Nikkei)

PBOC: China's central bank has asked lenders to rein in credit supply, as the surge of lending that sustained the country's debt-fuelled coronavirus recovery renewed concerns about asset bubbles and financial stability. New loan growth hit 16 per cent in the first two months of the year. The People's Bank of China responded in February by instructing domestic and foreign lenders operating in the country to keep new loans in the first quarter of the year at roughly the same level as last year, if not lower, according to people with knowledge of the situation. The directive could translate into a considerable drop in bank lending, the largest source of financing for the world's second-largest economy. (FT)

EQUITIES: A record number of companies are abandoning attempts to list on China's answer to the Nasdaq, as regulators increase scrutiny of technology businesses after scuppering Ant Group's $37bn initial public offering.A Financial Times analysis of figures released by Shanghai's Star Market, which was launched to fanfare in July 2019, shows a record 76 companies suspended their IPO applications in March, or more than double the previous month.The flurry of cancellations pushes the total number of aborted attempts to list on Star to more than 180. In November, the month that Beijing pulled Ant's listing due to concerns over its lending business, the total number of cancelled IPOs stood at just 12. (FT)

OVERNIGHT DATA

JAPAN MAR, F JIBUN BANK SERVICES PMI 48.3; PRELIM 46.5

JAPAN MAR, F JIBUN BANK COMPOSITE PMI 49.9; PRELIM 48.3

The Japanese services economy signalled a renewed move towards more stable business conditions in March. Latest PMI data indicated softer reductions in both business activity and new orders, with the former falling at the softest pace in 14 months. Some panel members highlighted that the slight easing of restrictions had led to a slow recovery in demand. Positively, Japanese service providers increased staffing levels for the second successive month, in anticipation of a recovery in demand. Firms were also increasingly optimistic that activity would increase over the coming 12 months. Overall private sector activity broadly stabilised in March, led by a solid expansion in Japanese manufacturing output. Although the larger service sector recorded a further decline, the downturn was the weakest since the onset of COVID-19. As a result, private sector businesses in Japan reported the strongest degree of positive sentiment in nearly eight years in March. Firms cited hopes that the impact of the pandemic would dissipate amid a successful vaccination program, providing a boost to domestic and external demand ahead of the Tokyo Olympics — currently expected to be going ahead with domestic spectators only. IHS Markit expects the Japanese economy to grow 2.6% in 2021. (IHS Markit)

AUSTRALIA MAR MELBOURNE INSTITUTE INFLATION +1.8 Y/Y; FEB +1.6%

AUSTRALIA MAR MELBOURNE INSTITUTE INFLATION +0.4% M/M; FEB +0.1%

SOUTH KOREA MAR FOREIGN RESERVES $446.13BN; FEB $447.56BN

CHINA MARKETS

Chinese markets were closed for the observance of a national holiday on Monday.

MARKETS

SNAPSHOT: Core Equities Look Through Geopolitical Noise

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 238.94 points at 30092.72

- ASX 200 is closed

- Shanghai Comp. is closed

- JGB 10-Yr future up 6 ticks at 151.07, JGB 10-Yr yield down 0.6bp at 0.12%

- Aussie bonds are closed

- U.S. 10-Yr future up 0-01 at 130-31+, yield down 0.37bp at 1.7179%

- WTI crude down $0.53 at $60.92, Gold down $4.08 at $1724.80

- USD/JPY down 5 pips at Y110.64

- BIDEN OFFICIALS OPEN TO DEBATE ON HOW $2TN INFRASTRUCTURE PLAN IS FUNDED (FT)

- CHINA ASKED BANKS TO REIN IN CREDIT ON BUBBLE FEARS (FT)

- FRANCE CUTS ECONOMIC GROWTH FORECAST TO 5% AMID LOCKDOWN (RTRS)

- SUEZ CANAL TRAFFIC JAM 'CLEARED' DAYS AFTER EVER GIVEN CARGO SHIP FREED (NBC)

- BIDEN ASSURES UKRAINE OF SUPPORT AS RUSSIA TENSIONS RISE (BBG)

- IRAN RULES OUT ANY TALKS WITH U.S. IN VIENNA UNLESS SANCTIONS GO (BBG)

BOND SUMMARY: Core FI Mixed Amid Thinner Markets

The Tsy complex has unwound most of its early Asia bid (and more in some instances), in what was a holiday thinned Asia-Pac session, with thinner liquidity also set to be evident during Monday's European session. Participants pointed to various sources of geopolitical tension, an FT source report suggesting that the PBoC is leaning on lenders to restrain credit growth and continued GOP pushback vs. the size of U.S. President Biden's fiscal scheme as potential sources of support in early trade. Still, the moves were relatively shallow, with T-Notes last +0-01 at 130-31+, with the cash curve twist steepening (30s now print ~2bp cheaper on the day) as resolute equity markets and follow through from Friday's NFP print added some pressure to the longer end after the early richening.

- JGB futures have unwound their overnight losses, last printing +5 on the day, with cash JGBs experiencing very marginal richening (participants likely had one eye on tomorrow's 30-Year supply, which would have limited the firming). BoJ Rinban operations, which covered 1- to 5-Year JGBs, saw marginal upticks in the offer to cover ratios, even with the purchase offers increasing in size, as the Bank started to enact its tweaked purchase schedule. Elsewhere, a Chinese aircraft carrier has been spotted in waters near Okinawa, although this had little in the way of tangible impact on the space.

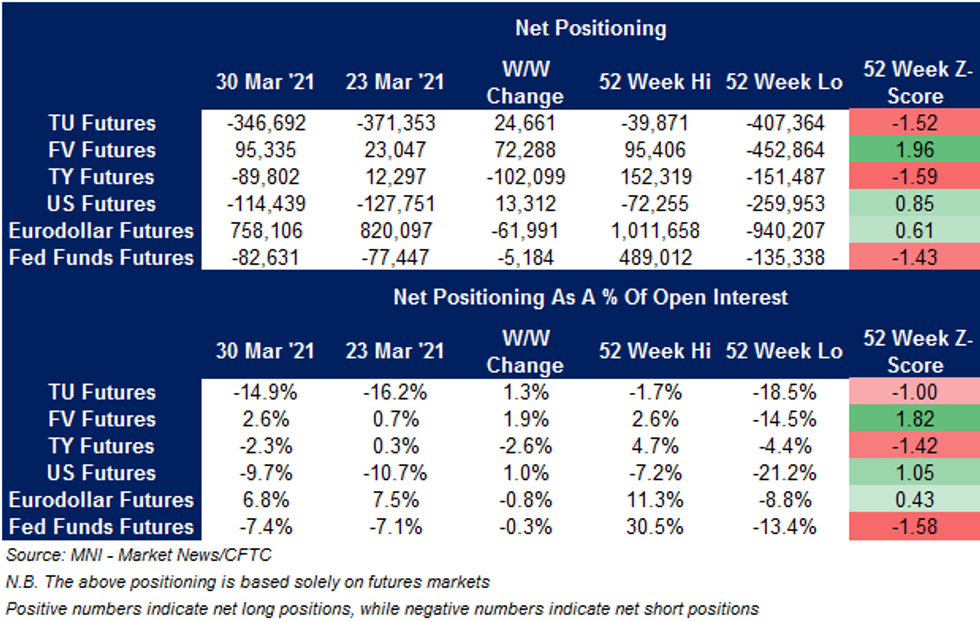

US TSY FUTURES: Mixed Moves In CFTC CoT Positioning

TU, FV and US futures saw net long positioning build/net short positioning trimmed in the latest CFTC CoT report, but the standout positioning move came in TY futures, with positioning moving net short, bucking the broader trend.

BOJ: 1-5 Year Rinban Conducted

The BoJ offers to buy a total of Y925bn of JGB's from the market, sizes adjusted from the previous operations to reflect the purchase plan laid out for the month of April.

- Y475bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

EQUITIES: Mixed Amid Market Closures

A mixed session, with several markets still closed for holidays. Japanese markets are in the green, Softbank are the biggest gainer on talk it will lead the investment round for home fitness provider Tempo. South Korean markets spent the session moving between minor positive and minor negative territory, there is some coronavirus concern in the country with new cases still elevated and government talk of a potential fourth wave. Markets in mainland China and Hong Kong were closed.

- US equity futures are higher, supported by Friday's job report, the indices could make fresh record highs if they post gains today.

GOLD: Confined

Gold remains confined, with holiday thinned markets limiting participation. Spot last deals at $1,725/oz, with a familiar technical backdrop in play.

OIL: Holding Most Post-OPEC+ Gains

After being closed on Friday, crude futures are slightly lower to start the week but still holding the majority of the post-OPEC+ gain. WTI & Brent sit ~$0.50 shy of their respective settlement levels.

- At the meeting on April 1 the OPEC+ group decided to bring back 350k bpd in May, 350 k bpd in June, and 441k bpd in July. Additionally, Saudi Arabia said it will unwind its voluntary 1m bpd in extra cuts by 250k bpd in May, 350k bpd in June and 400k bpd in July. Despite the increase in supply, oil rose after the announcement with market participants showing faith in the demand recovery.

FOREX: Antipodean Divergence

Widespread holidays in Europe and Asia kept liquidity thin throughout the session in Asia, with little in the way of news flow to drive price action. The greenback softened slightly, giving back some of its post-NFP gains; the US economy gained 916k jobs in March, the most in seven months, and came alongside an upward revision to the February data.

- AUD was the outperformer, around 13 pips higher at 0.7621 ahead of the RBA meeting this week. NZD is bottom of the G10 pile so far, dropping after holding its ground on Friday.

- The yen has gained a handful of pips in Asia, USD/JPY last down 15 pips at 110.55. Japan Jibun Bank March Final Services PMI, the figure came in at 48.3 from 46.5 previously. Combined with the manufacturing PMI of 52.7 released last week, this brings the composite PMI to 49.9

- The yuan is slightly weaker, but broadly unchanged from Friday, USD/CNH last up 5 pips at 6.5775. There were reports over the weekend that the PBOC has asked lenders to reduce credit supply in order to cool the property boom amid concerns over asset bubbles. Chinese markets are closed for a holiday.

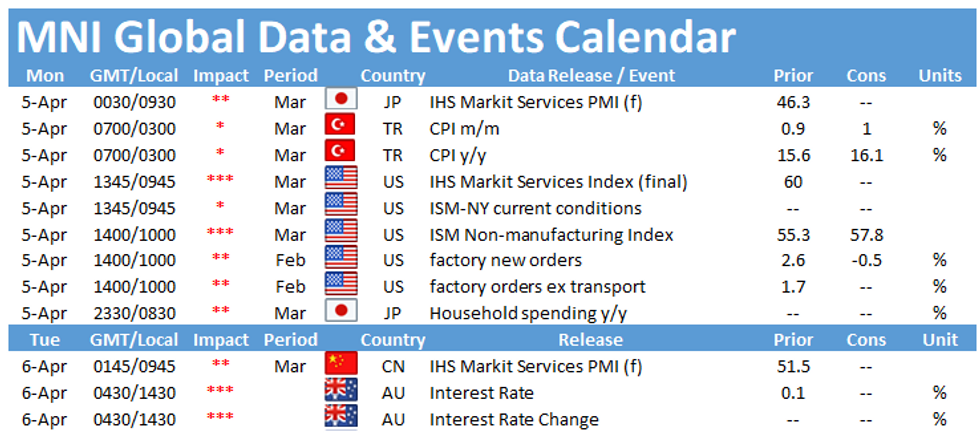

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.