-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Dollar & US Yields Extend Post FOMC Losses In Asia Pac

EXECUTIVE SUMMARY

- INTEREST RATE CUTS BEGIN TO COME INTO VIEW - MNI FED WATCH

- FED SIGNALS THREE 2024 RATE CUTS AS PAUSE EXTENDED - MNI

- JAPAN'S KISHIDA TO REHUFFLE CABINET IN BID TO STAY IN POWER - BBG

- AUSSIE UNEMPLOYMENT HIGHER AT 3.9% - MNI BRIEF

- NEW ZEALAND ECONOOMY UNEXPECTEDLY CONTRACTED IN THIRD QUARTER - BBG

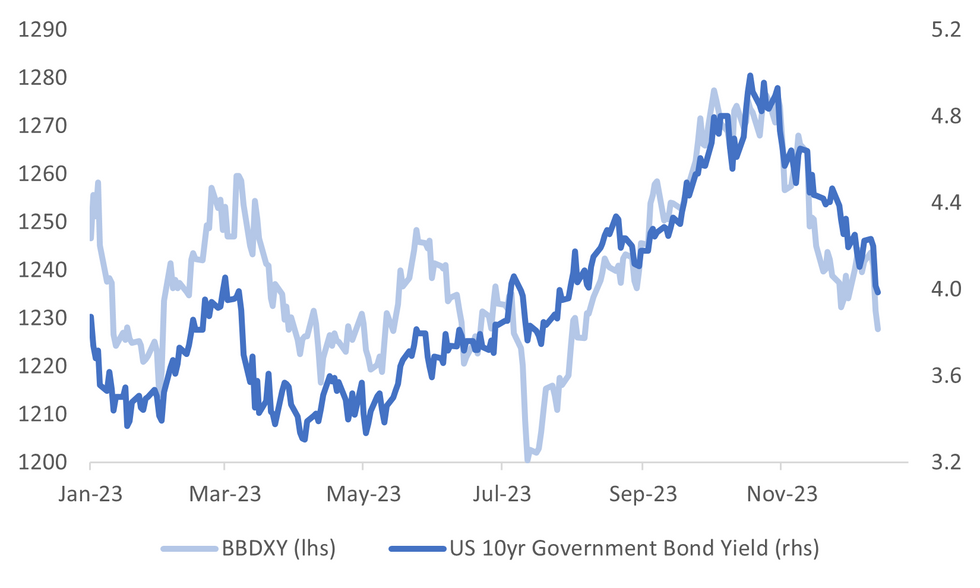

Fig. 1: USD BBDXY Index & US Tsy 10yr Nominal Yield

Source: MNI - Market News/Bloomberg

U.K.

BOE (BBG): Traders ramped up bets on interest-rate cuts by the Bank of England next year after soft GDP data reinforced the view that policymakers won’t be able to keep monetary policy tight for so long.

POLITICS (BBC): Talks between the government and Northern Ireland's largest political parties over a new financial package have been extended. The talks were due to end on Wednesday evening after a third day discussing a £2.5bn package. But the Northern Ireland secretary said they would now continue.

EUROPE

ECB (BBG): Stubborn underlying US inflation and stronger economic growth may mean that an interest-rate cut there will arrive after one in the euro zone, according to Jean-Claude Trichet. The former European Central Bank President, speaking on Bloomberg Television on Wednesday just before the Federal Reserve’s final decision of the year, doubted that officials in Washington can be so sure that consumer prices are fully tamed.

TECH (BBG): Apple Inc. faces a potentially hefty fine as well as a ban on App Store rules it allegedly used to thwart music-streaming rivals, in the European Union’s latest crackdown on Big Tech.

HUNGARY (BBG): The European Union decided to release more than €10 billion ($10.8 billion) of aid earmarked for Hungary, a major win for Prime Minister Viktor Orban ahead of a crucial summit on Ukraine that the nationalist leader is threatening to torpedo. The forint extended gains against the euro.

UKRAINE (BBC): If Ukraine is going to get anything out of an EU leaders' summit on Thursday, it will need the grudging backing of Hungary's Prime Minister, Viktor Orban. He has strongly resisted Kyiv's bid to join the EU and its pleas for aid. "We are the voice of common sense in Europe," he told the Hungarian parliament on the eve of the summit.

RUSSIA (POLITICO): The EU's latest package of sanctions against Russia is in limbo over internal checks from Austria, five European diplomats told POLITICO.

U.S.

FED (MNI FED WATCH): The Federal Reserve's pandemic era interest-rate hiking cycle has likely crested without tipping the U.S. economy into recession and policymakers are prepared to debate when to start cutting, Chair Jerome Powell said Wednesday. The Federal Open Market Committee acknowledged after a two-day meeting that no more hikes are likely needed to keep inflation moving toward their 2% goal next year, and all but two out of 19 officials saw the Fed's benchmark overnight rates falling next year.

FED (MNI): Federal Reserve officials held interest rates steady Wednesday at their highest level in 22 years while signaling they expect to cut them three times next year as inflation falls more than previously expected. The Summary of Economic Projections showed policymakers penciling in a median 4.6% rate of interest for the end of 2024 -- - down from 5.1% in the September projection -- and core PCE inflation ending next year at 2.4%, lower than the 2.6% September projection.

FED (MNI BRIEF): Federal Reserve Chair Jerome Powell said policymakers are aware of the risk that they could unduly hurt the economy by waiting too long to cut interest rates, after the FOMC said it expects three rate reductions next year. "We're aware of the risk that we would hang on too long. We know that that's a risk, and we're very focused on not making that mistake," he said.

POLITICS (RTRS): The U.S. House of Representatives voted on Wednesday to formally authorize its ongoing impeachment inquiry into President Joe Biden, as Republicans unite behind the effort even though they have yet to find evidence of wrongdoing by the Democrat.

POLITICS (BBG): A federal judge granted Donald Trump’s request to pause the 2020 election obstruction case scheduled for trial in March while he presses a claim for sweeping immunity against criminal charges.

OTHER

AUSTRALIA (MNI BRIEF): Australia’s unemployment rate rose 0.1 percentage point to 3.9% in November, while employment grew 61,500 up from October’s 55,000, according to data released today by the Australian Bureau of Statistics. “We have continued to see employment growth keeping pace with high population growth through 2023,” said Bjorn Jarvis, head of labour statistics at the ABS.

NEW ZEALAND (BBG): New Zealand’s economy unexpectedly contracted in the third quarter, fueling bets that the central bank will start cutting interest rates next year. Gross domestic product declined 0.3% in the three months through September after increasing 0.5% in the previous quarter, Statistics New Zealand said Thursday in Wellington. Economists expected 0.2% growth. From a year earlier, the economy shrank 0.6% — its weakest performance since a pandemic-led contraction in 2021.

JAPAN (BBG): Japanese Prime Minister Fumio Kishida is set to reshuffle his cabinet Thursday in a bid to contain a funding scandal that threatens the future of his struggling government.

BRAZIL (BBG): Brazil’s central bank cut its key interest rate by half a percentage point and cued more reductions of the same size into 2024 as inflation eases toward target while the global economic outlook improves. Policymakers led by Roberto Campos Neto lowered the Selic to 11.75% late on Wednesday as expected by all analysts in a Bloomberg survey. Board members have now reduced borrowing costs by 2 percentage points since August.

ARGENTINA (RTRS): Argentina's December inflation rate will "clearly be substantially higher than in November," Economy Minister Luis Caputo said in a televised interview on Wednesday, as Javier Milei's newly elected government grapples with an economy in crisis.

CHINA

CONSUMPTION (SECURITIES DAILY): Authorities should enhance the virtuous cycle of consumption and investment, according to Fu Yifu, senior researcher at Xingtu Financial Research Institute. Fu said household spending has recovered slowly, meaning consumption has not driven investment demand which remains imbalanced towards the industrial sector.

FINANCE (21st CENTURY BUSINESS HERALD): Chinese financial regulators will focus on revitalising inefficient financial resources, as 80% of all loans in China need to be recycled and reinvested every year, said Lu Lei, deputy director at the State Administration of Foreign Exchange. The balance of yuan loans reached CNY236.42 trillion by end-November, according to data from the central bank.

PROPERTY (YICAI): China’s property sector demand should adjust to reflect changes in population, according to Dong Jianguo, deputy minister at the Ministry of Housing. Speaking at the China Economic Annual Conference, Dong said authorities will address real estate risks by continuing to meet the reasonable financing needs of real-estate enterprises without ownership discrimination to help with short-term cash flow issues.

PROPERTY (BBG): Chinese developer Country Garden Holdings Co. took steps to alleviate concerns after a dollar bond default in October, paying off a yuan note ahead of schedule and selling a stake in a mall operator to help restructure offshore debt.

CHINA MARKETS

MNI: PBOC Drains Net CNY101 Bln Thurs; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY262 billion via 7-day reverse repo on Thursday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY101 billion after offsetting the maturity of CNY363 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7360% at 09:34 am local time from the close of 1.8293% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Wednesday, compared with the close of 42 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity lower at 7.1090 Thursday vs 7.1126 Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1090 on Thursday, compared with 7.1126 set on Wednesday. The fixing was estimated at 7.1462 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND Q3 GDP Q/Q -0.3%; MEDIAN 0.2%; PRIOR 0.5%

NEW ZEALAND Q3 GDP Y/Y -0.6%; MEDIAN 0.5%; PRIOR 1.5%

JAPAN OCT CORE MACHINE ORDERS M/M 0.7%; MEDIAN -0.4%; PRIOR 1.4%

JAPAN OCT CORE MACHINE ORDERS Y/Y -2.2%; MEDIAN -5.6%; PRIOR -2.2%

JAPAN OCT F IP M/M 1.3%; PRIOR 1.0%

JAPAN OCT F IP Y/Y 1.1%; PRIOR 0.9%

AUSTRALIA DEC CONSUMER INFLATION EXPECTATION 4.5%; PRIOR 4.9%

AUSTRALIA NOV EMPLOYMENT M/M 61.5k; MEDIAN 11.5k; PRIOR 42.7k

AUSTRALIA NOV FULL-TIME EMPLOYMENT M/M 57k; PRIOR 10.7k

AUSTRALIA NOV PART-TIME EMPLOYMENT M/M 57k; PRIOR 10.7k

AUSTRALIA NOV UNEMPLOYMENT RATE 3.9%; MEDIAN 3.8%; PRIOR 3.8%

AUSTRALIA NOV PARTICIPATION RATE 67.2%; MEDIAN 66.9%; PRIOR 67.0%

MARKETS

US TSYS: The Massive Post-FOMC Rally Extends Into Asia-Pac Dealings

TYH4 is trading at 112-10+, +0-14 from NY closing levels.

- Cash tsys are 2-6bps richer, with the curve steeper, in today’s Asia-Pac session as local participants digest the clearest signal yet that the Fed has finished its aggressive monetary-tightening campaign, by forecasting a series of rate cuts next year.

- The yield on 10-year has fallen below 4% for the first time since August.

JGBS: Bull-Flattening Unwound After Poor 20Y Auction

JGB futures are +15 position compared to settlement levels in afternoon dealings, having scaled back their post-FOMC gains after a disappointing 20-year auction. The outcome revealed a low-price print that fell short of dealer expectations, a reduced cover ratio compared to last month’s auction, and a considerably extended tail.

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined weekly international investment flows and core machine orders. The recently released final read of IP for October showed +1.3% y/y versus 1.0% prior.

- The pronounced decline in JGB performance during the afternoon session occurred despite the extension of yesterday’s post-FOMC rally in cash US tsys into today’s Asia-Pac session. At the time of writing, cash tsys were dealing off session highs but 3-5bps richer, with the curve steeper. Local participants are likely digesting the clearest signal yet that the Fed has finished its aggressive monetary-tightening campaign, by forecasting a series of rate cuts next year. The yield on 10-year has fallen below 4% for the first time since August.

- Cash JGBs are dealing mixed, with yield movements bounded by +/-2bps. The benchmark 10-year yield is 0.8bp lower at 0.686%. The 20-year is 0.2bp lower on the day but 7bps above the session’s low.

- Tomorrow, the local calendar sees Flash Jibun Bank Japan PMI and Tertiary Industry Index data.

AUSSIE BONDS: Holding The Post-FOMC Rally Despite Jobs Data Beat

ACGBs (YM +22.0 & XM +18.2) remain sharply richer but little changed after a comfortable headline job beat of +61.5k versus +11.5k forecast. Most of the jobs created were full-time as well. The u/e rate ticked up to 3.9%, (3.8% forecast) but this reflected a bounce in the participation rate to 67.2% (66.9% forecast).

- Meanwhile, Melbourne Institute consumer inflation expectations eased to 4.5% in December from 4.9%, the lowest since January 2022.

- Cash US tsys are dealing 3-8bps richer in today's Asia-Pac session after yesterday's strong post-FOMC rally. Local participants are likely digesting the clearest signal yet that the Fed has finished its aggressive monetary-tightening campaign, by forecasting a series of rate cuts next year.

- Cash ACGBs are 18-21bps richer, with the AU-US 10-year yield differential 4bps wider at 13bps.

- Swap rates are 18-21bps lower, with the 3s10s curve steeper.

- The bills strip has bull-flattened, with pricing +12 to +28.

- RBA-dated OIS pricing is 9-29bps softer on the day across meetings beyond Feb’24. There has been little net movement since the data release. 63bps of easing is priced by Feb’25.

- Tomorrow, the local calendar sees Flash Judo Bank PMI data.

- ICYMI, based on MYEFO forecasts, the issuance of Treasury Bonds has been reduced to around A$50bn ($23.6bn has been completed): AOFM.

NZGBS: FOMC Decision & GDP Miss Sparks A Ferocious Rally

NZGBs closed 22-29bps richer across benchmarks, with the 5-year leading, after Q3 GDP surprised on the downside printing -0.3% q/q (-0.6% y/y) versus expectations of +0.2% (+0.5%). Q2 was revised down 0.4pp to 0.5% q/q and 0.3pp to 1.5% y/y.

- The expenditure measure of GDP was weak falling 0.7% q/q but this was after a strong +0.9%. All of the main components fell with private consumption down 0.6% q/q, government spending -1.8%, GFCF -3.4% and the net export contribution -0.5pp.

- While the RBNZ predicted +0.3% q/q in its November update, it did have -0.3% in August. This outcome is likely to mean that the risk of another hike, which the RBNZ threatened at its last meeting, is highly unlikely as demand is moving more in line with supply.

- NZGBs were 13-20bps richer in post-GDP dealings.

- Swap rates closed 21-29bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing shunted 6-40bps softer across meetings, with Nov’24 leading. The market now prices 103bps of easing by Nov’24.

- Tomorrow, the local calendar sees BusinessNZ Manufacturing PMI.

FOREX: Post FOMC Dollar Losses Extend In Asia Pac Trade

The BBDXY is off a further 0.35% in Thursday Asia Pac trade, as continuing US yield losses weigh on dollar sentiment. The index got to a low of 1225.35, fresh lows back to the first half of August, but we sit slightly higher now, just near 1227.

- Following Wednesday's US yield plunge post the FOMC, weakness has extended in Asia Pac trade, with a further -2.5 to -6.5bps in yield losses, against dominated by the front end.

- USD/JPY got sub 141.00 (lows 140.97) fresh lows back to end July before stabilizing. The pair last near 141.60, still 0.90% stronger in yen terms.

- NZD/USD is up by around the same amount, largely shrugging off a much weaker than expected Q3 GDP print. From 0.6170 we got close to 0.6250 (last near 0.6230/35).

- The A$ was buoyed by stronger jobs data. AUD/USD got near 0.6730, but we now sit back at 0.6710/15, still above the technical bull trigger (near 0.6690).

- EUR/USD is back above 1.0900, while GBP has lagged somewhat, last near 1.2640.

- Looking ahead, the BoE and ECB meet and both are expected to leave rates unchanged. The SNB and Norges Bank also meet. Later, there US November retail sales will be watched closely. There are US jobless claims and trade prices.

EQUITIES: Broad Based Gains (Ex Japan), China Markets Lagging

Asia Pac equities are mostly higher, although Japan weakness is a notable exception, while China markets have generally lagged firmer gains elsewhere. US futures have tracked higher, posting solid further gains. We sit down a touch below session highs, with Eminis last near 4779, +0.38%, while Nasdaq futures are around 0.54% higher.

- A further pull back in US yields (rough -3-7bps lower across the curve) has weighed on the USD and boosted broader risk appetite, aiding equity markets in the region, as the market focuses in on potential Fed cuts next year.

- Japan markets are clear outliers though. The Topix off 1.65% at this stage, the Nikkei 225 down nearly 1%. Export names have struggled amidst a firmer yen backdrop. USD/JPY falling sub 141.00 at one stage before stabilizing.

- China markets have also struggled to post strong gains. At the break the CSI 300 is up 0.25%, but still comfortably sub 3400 in index terms. Earlier gains were as much as 0.9%. An ex Development Bank Vice President was arrested on bribery charges (BBG). Yesterday's weaker than expected aggregate financing data may be another headwind.

- Hong Kong markets are faring better, the HSI up 1.1% at the break.

- The Kospi has rallied 1.3%, while the Taiex is up 0.8%. The ASX 200 is up over 1.5%.

- In SEA, the pick of the markets is the Philippines, up over 2%. Indonesia and Thailand markets have also post +1% gains.

OIL: Prices Hold Onto Wednesday’s Gains, IEA Monthly Report Coming Up

While oil prices are up moderately on the day after rising almost 2% on Wednesday, they are off their early session highs despite a dovish Fed and continued dollar weakness (USD index -0.4%). Brent is up 0.4% to $74.56/bbl but down from the intraday high of $74.95. WTI is 0.3% higher at $69.69/bbl but it rose to just above $70 early in trading.

- Pessimism re the demand outlook, scepticism that OPEC members will comply with their new quotas and expected robust supply growth, especially from non-OPEC producers, aren’t far from the market’s mind and the move off today’s highs demonstrates that. But there may be a floor under the market if US inventories stay low.

- The IEA monthly report is published later today and it will be interesting to compare its demand projections with the more optimistic OPEC ones released yesterday. OPEC still expects a deficit in Q1 2024, while other indicators point to a surplus due to robust supply flows.

- Later the BoE and ECB meet and both are expected to leave rates unchanged. Also US November retail sales will be watched closely. There are US jobless claims and trade prices.

GOLD: Strong Post-FOMC Rally

Gold is 0.1% higher in the Asia-Pac session, after closing 2.4% higher at $2027.74 on Wednesday.

- Yesterday’s move came after the Federal Reserve gave the clearest signal yet that it had finished its aggressive monetary-tightening campaign, by forecasting a series of rate cuts next year. The Dot Plot pointed to a 2024 median of 75bp of rate cuts, a sharper pace than indicated in September’s projections, with reductions expected by 17 of 19 members.

- While the Fed held the funds rate steady, as expected, Fed Chair Powell delivered little to no pushback to market expectations of significant rate cuts next year.

- His commentary and tone seemed at odds with his final speech before the FOMC blackout: "It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease."

- Bullion’s rally on Wednesday unwound the slide seen since US payrolls on Friday. It also punched through resistance at $2003.9 (20-day EMA) to open $2041.3 (Dec 5 high), according to MNI’s technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/12/2023 | 0700/0800 | *** |  | SE | Inflation Report |

| 14/12/2023 | 0745/0845 | * |  | FR | Retail Sales |

| 14/12/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/12/2023 | 0830/0930 | *** |  | CH | SNB PolicyRate |

| 14/12/2023 | 0830/0930 | *** |  | CH | SNB Interest Rate Decision |

| 14/12/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 14/12/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 14/12/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 14/12/2023 | 1230/1230 |  | UK | MPR Press Conference MPR Press Conference | |

| 14/12/2023 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 14/12/2023 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 14/12/2023 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 14/12/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 14/12/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/12/2023 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/12/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 14/12/2023 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 14/12/2023 | 1345/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 14/12/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 14/12/2023 | 1500/1000 | * |  | US | Business Inventories |

| 14/12/2023 | 1515/1615 |  | EU | ECB Lagarde participates in MP Podcast | |

| 14/12/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 14/12/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 14/12/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/12/2023 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 15/12/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.