-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Down 0.36% In Week of Dec 6

MNI: PBOC Net Injects CNY13.8 Bln via OMO Monday

MNI BRIEF: PBOC Increases Gold Reserves

MNI EUROPEAN OPEN: Dollar & Yields Consolidate Off Recent Highs

EXECUTIVE SUMMARY

- FED WELL-POSITIONED TO WAIT, GATHER DATA - MESTER - MNI BRIEF

- YELLEN ACKNOWLEDGES JAPAN, S.KOREA WORRIES OVER YEN, WON - BBG

- SLOW RATE HIKES EXPECTED - BoJ’s NOGUCHI - MNI BRIEF

- AUSSIE EMPLOYMENT FALLS, UNEMPLOYMENT AT 3.8% - MNI BRIEF

- CHINA AIMS TO DIGITALISE 70% Of FIRMS BY 2025 - MNI BRIEF

- CHINA EYES SIGNIFICANT SPECIAL TREASURY ISSUANCE - MNI INTERVIEW

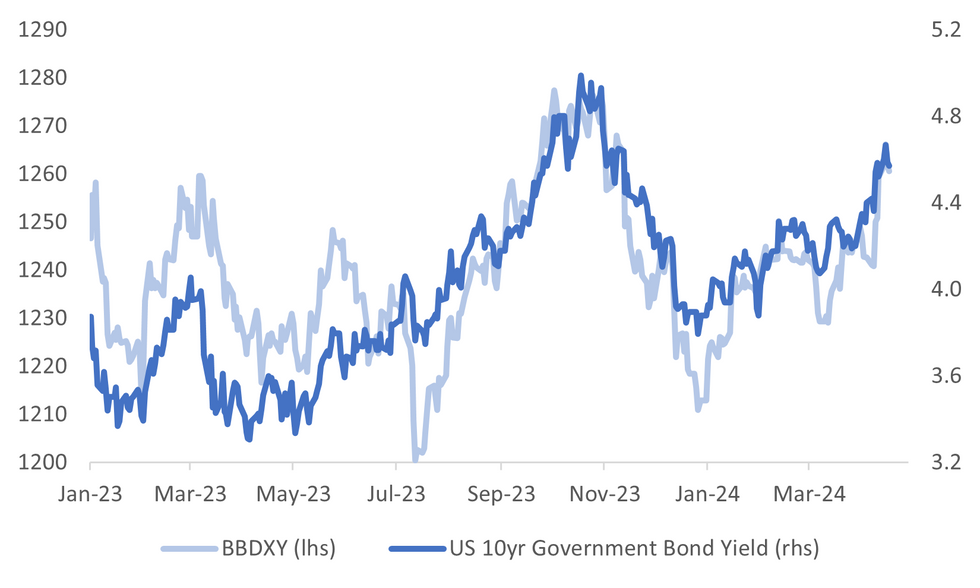

Fig. 1: BBDXY USD Index & US Tsy Nominal 10yr Yield

Source: MNI - Market News/Bloomberg

U.K.

TECH (BBG): The UK is considering new curbs on outward investment in emerging technologies such as artificial intelligence and semiconductors, citing the potential security risks of aiding hostile states such as Russia and China.

BOE (BBG): Bank of England Governor Andrew Bailey said the UK and the rest of Europe are facing less of an inflation threat than the US, opening the prospect of a rate cut for Britain before the Federal Reserve moves.

POLITICS (BBC): The government's showdown with the House of Lords over its Rwanda deportation bill continues. Peers have voted to demand changes to the bill, including an amendment which would ban sending people who have assisted the UK military to Rwanda. Earlier, MPs overturned a series of changes to the legislation which were made by the Lords on Monday.

ISRAEL (BBC): Benjamin Netanyahu has told UK Foreign Secretary Lord Cameron that Israel would "make its own decisions" over how to respond to an Iranian attack. He said his government would "do everything necessary to defend itself" during talks the British government had hoped would help prevent escalation.

EUROPE

SANCTIONS (RTRS): European Union leaders decided on Wednesday to step up sanctions against Iran after Tehran's missile and drone attack on Israel left world powers scrambling to prevent a wider conflict in the Middle East.

ECB (BBG): The European Central Bank should consider rethinking how it forecasts economic growth and inflation in the euro zone to improve communication and respond rapidly to shocks, Executive Board member Isabel Schnabel said.

UKRAINE (POLITICO): NATO Secretary General Jens Stoltenberg on Wednesday called on allies to beef up Ukraine's air defense, amid intensifying Russian attacks. Stoltenberg spoke as Germany is making plans to encourage European countries operating Patriot missiles to give the systems to Ukraine. Over the weekend, Berlin announced it would send one Patriot air defense system.

UKRAINE (POLITICO): Zoran Milanović’s strong showing in a general election could give him an opening to chart a trajectory that would hurt Ukraine and play into Russia’s hands.

UKRAINE (ECONOMIST): On Thursday Ukrainian officials will pitch for more foreign investment at Ukraine’s Future Summit, a conference held in Brussels and supported by the European Union. Despite Ukraine’s resilience since Russia’s invasion in 2022, it may be a hard sell.

BUSINESS (BBC): TikTok has been given 24 hours to respond to the European Commission over a version of the app which pays users for viewing videos. TikTok Lite launched in France and Spain this week.

GERMANY (DER SPIEGEL): Reinsurer Munich Re’s CEO Wenning has called for politicans to have “courage” to make unpopular decisions. He also want people to work more.

U.S.

FED (MNI BRIEF): Cleveland Federal Reserve President Loretta Mester on Wednesday said she will be watchful and wait for more data to assess the economic outlook, noting that inflation this year has come in higher than expected.

ECONOMY (MNI BRIEF): Overall U.S. economic activity expanded "slightly" since late February, with 10 out of 12 Fed districts seeing either slight or modest growth, up from eight in the last report, and the Philadelphia and Chicago districts reporting no changes in activity, the Federal Reserve said Wednesday in its Beige Book report of interviews with local business and community contacts. Consumer spending was mixed and "barely increased overall," while employment rose slightly.

INFLATION (MNI BRIEF): The Bureau of Labor Statistics' New Tenant Rent Index fell further in the first quarter of the year to the smallest increase since 2010, and suggesting continued disinflation for the rent component of CPI later this year and next.

TRADE (BBC): US President Joe Biden has called for a tripling of tariffs on some steel and aluminium from China. It is the latest protectionist policy to be embraced by Mr Biden as he campaigns for re-election against Donald Trump, who was known for his tough trade stance against China.

UKRAINE (BBC): US President Joe Biden has said he "strongly supports" a new $61bn (£49bn) aid bill for Ukraine, arguing it will "send a message to the world". The long-stalled measure is one of four that the House of Representatives will vote on this Saturday. The legislation will also include funding for Israel as well as the Indo-Pacific.

FISCAL (RTRS): U.S. Republican presidential candidate Donald Trump has indicated to advisers he is keen on a new middle-class tax cut should he return to the White House, two people familiar with the discussions said, an initiative that could appeal to voters but could also worsen America's yawning budget deficit.

CORPORATE (BBG): Micron Technology Inc., the largest US maker of computer-memory chips, is poised to get more than $6 billion in grants from the Commerce Department to help pay for domestic factory projects, part of an effort to bring semiconductor production back to American soil.

OTHER

ISRAEL (RTRS): Israel will make its own decisions about how to defend itself, Prime Minister Benjamin Netanyahu said on Wednesday, as Western countries pleaded for restraint in responding to a volley of attacks from Iran.

FX (BBG): US Treasury Secretary Janet Yellen took note of worries between her Japanese and South Korean counterparts over sharp declines in their exchange rates, in a joint statement following a debut trilateral finance meeting.

OIL (RTRS): The Biden administration said it would not renew a license set to expire early on Thursday that had broadly eased Venezuela oil sanctions, moving to reimpose punitive measures in response to President Nicolas Maduro's failure to meet his election commitments.

JAPAN (MNI BRIEF): Bank of Japan board member Asahi Noguchi said on Thursday that the pace of raising the policy interest rate will be very slow as it takes considerable time for inflation to continue increasing as a trend.

JAPAN (BBG): Warren Buffett’s Berkshire Hathaway Inc. priced ¥263.3 billion ($1.71 billion) of bonds in the firm’s largest yen debt deal since its debut sale in the currency in 2019, raising bets it may boost holdings of Japanese stocks.

AUSTRALIA (MNI BRIEF): Australian unemployment rose to 3.8% in March, lower than the market’s 3.9% prediction, but up from the prior month’s 3.7%, while employment fell by 6,6000, data from the Australian Bureau of Statistics revealed Thursday.

CHINA

ECONOMY (MNI BRIEF): Authorities will provide support to ensure 70% of manufacturing firms are digitalised and open several smart factories by 2025, according to Shan Zhongde, vice minister of the Ministry of Industry and Information Technology.

ISSUANCE (MNI INTERVIEW): China will likely issue a significant volume of ultra long-term special treasury bonds with tenors of 30 years or greater to support government investment over the next few years, while the central bank aims to strengthen credit support for related projects, a prominent policy advisor told MNI in an interview, adding that the boost to fiscal revenues from additional economic growth would pay for the extra debt.

TRAVEL (MNI BRIEF): China’s cross border activity saw 141 million people enter and exit the country over Q1, an increase of 117.8% y/y, according to the National Immigration Administration on Thursday.

ECONOMY (YICAI): China’s domestic demand remains insufficient with weak social expectations, according to Liu Sushe, deputy director of the NDRC. Speaking at a press conference, Liu acknowledged the economic foundation was not yet solid and still faced challenges.

SHIPPING (MOFCOM): China firmly opposes the Section 301 investigation launched by the U.S targeting China's maritime, logistics and shipbuilding industries, China's commerce ministry said late Wednesday on its website.

POLICY (ECONOMIC DAILY): China should use coordinated policy incentives, including proactive fiscal and prudent monetary policies along with sound employment and industrial support to bolster its economic recovery, according to a commentary published by the official Economic Daily.

TRADE (YICAI): Premier Li Qiang has met with foreign buyers during this year’s Canton Fair calling the event a platform to expand China operations and promote free trade and maintain global supply chain stability.

EQUITIES (SHANGHAI SECURITIES NEWS): A flock of A share listed firms have revised 2023 annual earning estimates, a move likely to avoid punitive delisting due to “beautification of financials”, the official Shanghai Securities News reported, citing data the paper compiled and analysts.

CHINA MARKETS

MNI: PBOC conducts CNY2 bln via Omo Thurs; liquidity unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Thursday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting the maturity of CNY2 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8223% at 10:08 am local time from the close of 1.8326% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Wednesday. the same as the close on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1020 on Thursday, compared with 7.1025 set on Wednesday. The fixing was estimated at 7.2299 by Bloomberg survey today.

MARKET DATA

AUSTRALIA MARCH EMPLOYMENT FALLS 6,585 M/M; EST. +10.0K; PRIOR +117.6K

AUSTRALIA MARCH FULL-TIME EMPLOYMENT RISES 27.9K M/M; PRIOR +79.4K

AUSTRALIA MARCH PART-TIME EMPLOYMENT FALLS 34.5K M/M; PRIOR +38.2K

AUSTRALIA MARCH JOBLESS RATE 3.8%; EST. 3.9%; PRIOR 3.7%

AUSTRALIA MARCH PARTICIPATION RATE 66.6%; EST. 66.7%; PRIOR 66.7%

AUSTRALIA 1Q NAB BUSINESS CONFIDENCE RISES TO -2; PRIOR -6

MARKETS

US TSYS: Treasury Futures Off Intraday Highs, Job Claims & Home Sales

- Jun'24 10Y futures broke above Wednesday's higher earlier making a high of 108-09+, we are just off those levels at 108-07+ up + 02+ from NY closing levels. Earlier there was a 2/5/30 Fly block trade, while a 2y/10y block flattener has traded.

- Cash Treasury yields have reversed earlier moves and now trade 1-2bps lower, the 2Y yield -0.8bps at 4.924%, 10Y -1.6bps to 4.571%, while the 2y10y is -0.822 at -35.519

- (MNI) Fed Well-Positioned To Wait, Gather Data - Mester (See Link)

- Earlier, Fed's Bowman acknowledges that progress on inflation has slowed, if not stalled, despite strong economic conditions and ongoing job growth, suggesting that current monetary policy may be restrictive, but its sufficiency remains uncertain. He notes that consumers may be adjusting spending habits, trading down to lower goods while also spending large amounts on experiences like travel.

- Projected rate cut pricing steady vs. late Tuesday levels: May 2024 steady at -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 steady at -16.2% w/ cumulative rate cut -4.7bp at 5.282%. July'24 cumulative at -12.6bp, Sep'24 cumulative -24.9bp.

- Looking ahead: Weekly Claims, Exist Home Sales, Fed Speak from NY Fed Williams, Atlanta Fed Bostic and Boston Fed Collins.

JGBS: Futures Richer & At Session Highs, National CPI For March Tomorrow

JGB futures are holding stronger and at the top of today’s range, +23 compared to the settlement levels.

- Tertiary Industry Index for February printed +1.5% m/m versus +0.5% est and -0.5% (revised) prior. Today, the local calendar also sees later Tokyo Condominiums for Sale and Machine Tool Orders.

- (MNI ICYMI) BoJ board member Asahi Noguchi said on Thursday that the pace of raising the policy interest rate will be very slow as it takes considerable time for inflation to continue increasing as a trend.

- The BoJ must maintain accommodative monetary policy not only to keep favourable labour market conditions but also to achieve its inflation target, he added.

- Noguchi was against ending the negative interest rate and yield curve control policy simultaneously at the March meeting, he told business leaders in Saga City.

- The cash JGB curve has slightly bull-flattened, with yields flat to 2bps lower. The benchmark 10-year yield is 0.2bp lower at 0.881% versus the YTD high of 0.891% set yesterday.

- Swap rates are ~1bp lower across maturities. Swap spreads are tighter out to the 10-year and wider beyond.

- Tomorrow, the local calendar will see National CPI data for March.

AUSSIE BONDS: Richer After Jobs Report, Next Key Release Is Wednesday’s Q1 CPI

ACGBs (YM +5.0 & XM +8.0) are 2-4bps richer after the release of the Employment Report for March. Employment fell 6,585 m/m (estimate +10.0k) in March versus a revised +117.6k in February. The Jobless rate rose to 3.8% (3.9% est) from 3.7% in February.

- Employment growth slowed to 2.7% y/y in Q1 from 3.0% in Q4 – the RBA is forecasting 2.0% for Q2. Job creation rose in Q1 with 122.3k new positions after Q4’s 52.9k but below Q1 2023’s 157k.

- Hours worked posted their second straight increase in March to be marginally higher on the quarter and up 1.7% y/y with the strength again concentrated in FT. Underemployment fell 0.1pp as a result.

- Overall, today's data showed that the labour market remained tight, so the RBA’s stance is unlikely to change.

- Cash ACGBs are 6-8bps richer, with the AU-US 10-year yield differential 1bp higher at -27bps.

- Swap rates are 5-8bps lower, with the 3s10s curve flatter.

- The bills strip has bull-flattened, with pricing +1to +7.

- RBA-dated OIS pricing is 3-5bps softer for meetings beyond September. A cumulative 17bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty. The next key release is Wednesday’s Q1 CPI.

NZGBS: Closed On A Positive Note, Tracking US Tsys With The Local Calendar Empty

NZGBs ended the day on a positive note, with benchmark yields down by 6-7bps. This outcome is notable considering the mixed demand metrics observed during today's weekly supply. Cover ratios varied from 2.02x for the May-51 bond to 3.42x for the May-32 bond.

- With the domestic market devoid of data today, the strengthening in today’s session mirrored the robust performance seen in US tsys overnight, which has extended into today's Asia-Pacific session. Cash US tsys have gained approximately 2bps across benchmarks.

- Furthermore, there is likely some positive spill-over effect from ACGBs, which have strengthened by 4-5bps following the release of the March Employment Report.

- Swap rates closed 5-6bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed is 3bps softer for meetings beyond August. A cumulative 52bps of easing is priced by year-end.

- The local calendar is empty again tomorrow. The next major release is Trade Balance data for March on Wednesday.

- Today’s US calendar will see Weekly Claims, Existing Home Sales and Fed Speak including Bostic and Collins.

FOREX: Dollar Weakness Continues Amid Lower Yields, A$ Aided By Higher Equities/Iron Ore Surge

The BBDXY sits a touch above session lows, the index last near 1260.20 (still off -0.15% for the session). US yields sit lower across the board, with 2 to 10yr benchmark yields down a little over 2bps. This reversed earlier momentum where yields tried to go higher post some hawkish Fed speak.

- These moves have weighed on USD sentiment, with 10yr Tsy futures above Wednesday highs.

- USD/JPY got sub 154.00, aided by headlines from currency chief Kanda that the G7 is in agreement that excessive FX moves are harmful for economies.

- We have since rebounded though back to 154.25/30. A better regional equity tone has likely weighed on yen performance versus crosses. We had dovish remarks from BoJ board member Noguchi earlier, but they didn't shift the sentiment needle.

- AUD/USD is up +0.25%, tracking just above 0.6450. The pair shrugged off the jobs miss (although other detail was mixed), with the better equity tone and higher iron ore prices providing support.

- NZD/USD is also higher, lagging AUD a touch, the pair last near 0.5925. EUR/USD was last near 1.0680.

- Looking ahead, US jobless claims, Philly Fed manufacturing and existing home sales are all scheduled. Further Fed speak is also due.

ASIA EQUITIES: HK & China Equities Erase Earlier Losses, Small-Cap Bounce

Hong Kong and China equity are higher today, with Hong Kong equities outperforming. It has been a quiet day for markets in terms of news and data flow. Moody's has downgraded China Oversea Land to Baa2, the UK is looking at imposing new restrictions on AI technology on countries like Russian and China. Some Chinese companies have revised down earnings due to tighter regulations, Taiwan Semiconductor Manufacturing Co will released earnings later today.

- Hong Kong equities have recovered from their opening levels with the Mainland Property Index now now up 1.30% after opening 0.80% lower, the HSTech Index has erased earlier losses to now trade up 1.14%, tech stocks throughout the region have bounce off earlier lows and the market eagerly awaits TSMC earnings, while the wider HSI is now up 1.23%. In China, equities are lagging the move higher by HK equities with the CSI300 up just 0.57%, while smaller-cap indices including are outperforming large-cap with the CSI2000 up 1.10% and the CSI1000 up 1.00%

- China Northbound saw an outflow of 0.23b on Wednesday, with the 5-day average at -0.05billion, while the 20-day average sits at -0.11billion yuan.

- In the property space, Moody's downgraded China Overseas Land's long-term rating to Baa2 from Baa1, with the outlook revised to stable from negative. The downgrade reflects concerns that COLI's credit metrics may not recover amid the extended downturn in China's property market. However, the outlook indicates expectations that COLI will maintain strong contracted sales performance and stabilize its credit metrics with robust liquidity over the next 6-12 months.

- The UK is considering imposing new restrictions on outward investments in emerging technologies like artificial intelligence and semiconductors, aiming to mitigate security risks associated with aiding adversarial states like Russia and China. Deputy Prime Minister Oliver Dowden plans to collaborate with G7 nations to assess these risks and explore the possibility of additional regulations, particularly in sectors crucial for national security.

- A group of A-share listed companies in China have adjusted their 2023 annual earnings estimates, a step likely taken to prevent potential delisting penalties for falsifying financial records, reports the official Shanghai Securities News. According to exchange filings, 35 companies have revised their initial earnings projections, with 31 of them lowering their estimates, including three shifting from profits to losses, with analysts attributing these adjustments to recent stricter regulations, particularly concerning accounting fraud.

- Looking ahead, Hong Kong has Unemployment data later today, while China's 1 & 5 yr LPR on Monday is the next focus

ASIA PAC EQUITIES: Asian Equities Head Higher, Buffets Yen Bond, TSMC Earnings Shortly

Regional Asian equities are higher today, after initially opening lower. Japanese equities have been boosted by Berkshire Hathaway pricing a ¥263.3 billion ($1.71 billion) of bond, the firms largest yen deal its debut sale in the currency in 2019, raising bets it may boost holdings of Japanese equities. Asian chipmakers such as TSMC which reports earnings later. The FX market has been quiet today, although most Asian currencies are a touch lower vs the USD, while global yields are edged lower. On the data front, focus was on Australian employment Report for March, with employment falling 6,585 m/m (estimate +10.0k) in March versus a revised +117.6k in February. The Jobless rate rose to 3.8% (3.9% est) from 3.7% in February.

- Japanese stocks initially opened lower this morning the focus has remained around the yen with the currency edging higher after a joint statement from Japan, South Korea and the US fueled speculation that the latter would tolerate any Japanese attempt to support its currency. Equities got a boost earlier when it was announced Berkshire Hathaway pricing a ¥263.3 billion ($1.71 billion) of bond, leading to speculation that that money would be put to work in the equity market after recent comments from Warren Buffett around his attraction to Japanese equities, especially Banks and Financials. The Nikkei 225 is now up 0.50%, while the Topix is up 0.90%, the Topix Bank Index is up 1.80%.

- South Korea’s equities are higher today with the Kospi up 1.80% erasing losses made on Wednesday. Food stocks have been the largest contributors to the move higher today, as food exports from the nation are expected to grow and helped by foreign investors who turn buyers of local equities as the won halts its drop against the dollar. The Kospi tapped the 200-day EMA on Wednesday as the 14-day RSI hit 30 before this mornings bounce.

- Taiwan equities have opened down 0.40%, although have completely reversed those moves to now trade up 0.40%, TSMC will be releasing earning later with the market eagerly waiting, it should be noted that TSMC has been responsible for about 60% of the Taiex yearly gains.

- Australian equities are higher today, miners have contributed the most to the moves as commodity prices head higher with Iron ore jumping as much as 6% on Wednesday as optimism that more Chinese steel mills would restart as demand picks up. Employment data was released earlier showing a loss of 6.6k jobs vs estimates of a 10k gain, while the employment rate fell to 3.8% in March from 3.9% in Feb. The ASX200 is up 0.46% today.

- Elsewhere in SEA, New Zealand Equities are down 0.60% after earlier testing the 100-day EMA at 11,750, Philippines equities are up 1.30%, Indonesian equities are up 0.30%, while India has returned from its break to trade up 0.20%

OIL: Crude Stabilises As Sanctions On Card For Iran & Venezuela

Oil has stabilised after falling around 3% on Wednesday on a better risk tone and weaker greenback (USD index -0.1%). Brent is up 0.3% to $87.57/bbl off the intraday low of $87.21 early in the APAC session. WTI is 0.2% higher at $82.88 after falling to $82.55.

- On the one hand US inventories rose strongly last week, but on the other the US will reinstate sanctions on Venezuelan oil unless there it changes its attitude to registering opposition candidates for the upcoming election by the end of today when the reprieve expires. New sanctions on Iranian oil are also to be tabled as part of the US foreign aid package currently struggling to pass through the House.

- There is significant uncertainty over the details of Israel’s response to Iran’s attack on the weekend. For now the situation has gone quiet but markets are wary. All of the above mean that significant risks to the energy outlook remain.

- Later the Fed’s Bowman, Williams, Bostic and Collins, ECB’s de Guindos and Schnabel, and BoE’s Greene appear. IMF meetings continue and the Eurogroup meets. US jobless claims and April Philly Fed print.

GOLD: Higher Today After Yesterday’s Drop

Gold is 0.6% higher in the Asia-Pacific session, after closing 0.9% lower at $2361.02 on Wednesday. This leaves the yellow metal 2.4% off its recent record high.

- Despite the prevailing risk-off sentiment in the markets yesterday, characterised by lower US Treasury yields, wider credit spreads, weaker US equities, and softer oil prices, bullion made a notable downward move.

- Technical buying, bargain hunting and an especially well-received 20-year auction also helped US Treasuries move away from YTD yield highs.

- Gold's decline yesterday likely stemmed from Federal Reserve Chair Jerome Powell's recent remarks, which indicated a potential postponement of the eagerly awaited policy shift following a string of unexpectedly high inflation readings.

- Newsflow was minimal yesterday. Today’s US calendar will see Weekly Claims, Existing Home Sales and Fed Speak.

- According to MNI’s technicals team, sights remain on $2452.5 next, a Fibonacci projection. Initial firm support is at $2286.3, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/04/2024 | 2315/1915 |  | US | Fed Governor Michelle Bowman | |

| 18/04/2024 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 18/04/2024 | 0715/0915 |  | EU | ECB's De Guindos ECB Report Presentation | |

| 18/04/2024 | 0800/1000 | ** |  | EU | Current Account |

| 18/04/2024 | 0900/1100 | ** |  | EU | Construction Production |

| 18/04/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 18/04/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 18/04/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/04/2024 | 1305/0905 |  | US | Fed Governor Michelle Bowman | |

| 18/04/2024 | 1315/0915 |  | US | New York Fed's John Williams | |

| 18/04/2024 | 1315/0915 |  | US | Fed's Miki Bowman | |

| 18/04/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/04/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 18/04/2024 | 1500/1100 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/04/2024 | 1500/1600 |  | UK | BOE's Greene with Atlantic Council GeoEconomics Center | |

| 18/04/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/04/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/04/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 18/04/2024 | 1730/1930 |  | EU | ECB's Schnabel Speaks At 2024 EU-US Symposium | |

| 18/04/2024 | 2145/1745 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.