-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Israeli Officials Deny Draft Ceasefire Reports

MNI China Daily Summary: Monday, January 13

MNI BRIEF: China December Vehicle Sales Up 10.5%

MNI EUROPEAN OPEN: Dovish BoJ Remarks Hit Yen, Drive Equity Rebound

EXECUTIVE SUMMARY

- BOJ WILL NOT HIKE DURING UNSTABLE MARKETS - UCHIDA - MNI BRIEF

- HAMAS MAKES SINWAR POLITICAL CHIEF, UNDERCUTTING CEASE-FIRE HOPE - BBG

- US DELINQUENCY RATES REMAINED ELEVATED IN 2Q-NY FED-MNI BRIEF

- CHINA JULY EXPORTS SLOW UNEXPECTEDLY TO 7% Y/Y - MNI BRIEF

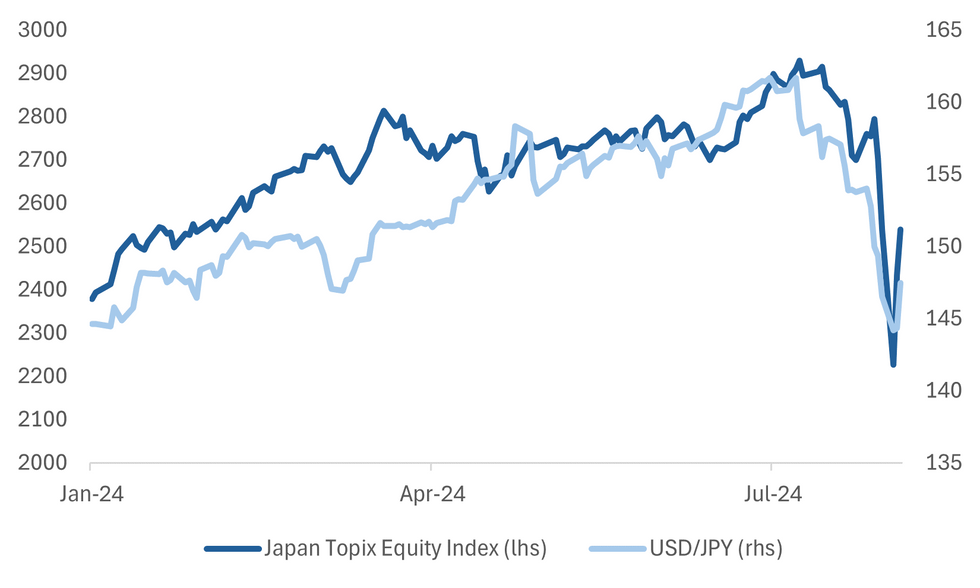

Fig. 1: Japan Equity & USD/JPY Continue To Rebound

Source: MNI - Market News/Bloomberg

UK

BOE (MNI BRIEF): The Bank of England key policy rate will follow a higher path than current market expectations, as inflation will exceed the Bank’s predictions the National Institute of Economic and Social Research’s quarterly release says.

POLITICS (BBC): “The government has started to undo Conservative-era rules limiting strike action by workers including teachers, firefighters and train workers. Labour ministers have told employers not to enforce legal minimum service levels whilst a new law to formally abolish them goes through Parliament.”

POLITICS (POLITICO):” Elon Musk could be summoned for a grilling by British MPs over X’s role in race riots that have rocked the U.K. over the last week, as well as his own incendiary comments about the violence.

EUROPE

BUSINESS (BBC): “Elon Musk's X/Twitter is suing a group of major companies, alleging that they unlawfully conspired to boycott the site. It accuses the food giants Unilever and Mars, private healthcare company CVS Health, and renewable energy firm Orsted of depriving it of "billions of dollars" in advertising revenue.”

US

ECONOMY (MNI BRIEF): U.S. delinquency transition rates for credit cards, auto loans and mortgages remained elevated and increased little in the second quarter, the New York Fed said in a report Tuesday.

POLITICS (RTRS): “Democratic presidential nominee Kamala Harris and her newly selected vice presidential running mate, Minnesota Governor Tim Walz, campaigned for the first time together on Tuesday in Philadelphia, kicking off a multi-day tour of battleground states aimed at introducing Walz to the national stage.”

OTHER

JAPAN (MNI BRIEF):Bank of Japan Deputy Governor Shinichi Uchida said on Wednesday that the BOJ will not raise its policy interest rate while financial and capital markets are unstable.“In contrast to the process of policy interest rate hikes in Europe and the United States, Japan's economy is not in a situation where the BOJ may fall behind the curve if it does not raise the policy interest rate at a certain pace,” Uchida told business leaders in Hakodate City. “Therefore, the Bank will not raise its policy interest rate when financial and capital markets are unstable.”

JAPAN (MNI BRIEF): Japanese authorities conducted yen buying interventions on April 29 and May 1, purchasing JPY5.9 trillion and JPY3.9 trillion respectively when the yen fell to JPY160 for the lowest level in 34 years, data released by the Ministry of Finance showed on Wednesday.

JAPAN (RTRS): “A prime potential candidate for Japan's next prime minister endorsed the Bank of Japan's policy of gradually raising interest rates, saying its normalisation of monetary policy could push down prices and boost industrial competitiveness.”

MIDEAST (BBG): “Hamas named Yahya Sinwar, the alleged mastermind of the group’s Oct. 7 assault, as its new political leader, the latest blow to multilateral efforts to reach a cease-fire agreement in Gaza.”

NEW ZEALAND (BBG): "New Zealand’s jobless rate rose less than forecast in the second quarter as the economy unexpectedly added workers despite a weaker outlook."

CHINA

TRADE (MNI BRIEF): China's exports rose for the fourth consecutive month by 7.0% y/y in July, though missing the 9.9% market consensus and decelerating from June’s 8.6%, with expansion in the first seven months totalling 4.0%, data released by Customs on Wednesday showed.

TRADE (MNI BRIEF): China’s imports of iron-ore reached 103 million metric tonnes in July, up 5.3% m/m, according to customs statistics released on Wednesday. Beijing’s inbound shipments of iron-ore now total 713 million metric tonnes during the first seven months of the year, up 6.7% y/y, accelerating from 6.2% during the first six months.

YUAN (MNI): PBOC Seen Capping Yuan Fixing At 7.10 After Rally.

BONDS (YICAI): “Local governments will accelerate bond sales in August and September to around CNY2 trillion as authorities target investment and stabilising growth, Yicai.com reported. ”

OVERSEAS DEBT (SECURITIES DAILY): “Chinese enterprises issued a record USD17.05 billion of overseas convertible bonds so far this year, up 159% y/y, as firms expand financing channels with lower costs, the Securities Daily reported.”

CHINA MARKETS

MNI: PBOC Net Drains CNY251.67 Bln via OMO Wednesday

The People's Bank of China (PBOC) skipped open market operations on Wednesday, as the banking system's total liquidity was at a reasonable and ample level, the central bank said in a statement. This led to a net drain of CNY251.67 billion after offsetting the maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7033% at 09:40 am local time from the close of 1.6932% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Tuesday, compared with the close of 50 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1386 on Wednesday, compared with 7.1318 set on Tuesday. The fixing was estimated at 7.1479 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND Q2 EMPLOYMENT +0.4% Q/Q; EST. -0.2%; PRIOR -0.3%

NEW ZEALAND Q2 EMPLOYMENT +0.6% Y/Y; EST. 0%; PRIOR +1.3%

NEW ZEALAND Q2 UNEMPLOYMENT RATE 4.6%; EST. 4.7%; PRIOR 4.4%

NEW ZEALAND Q2 PARTICIPATION RATE 71.7%; EST. 71.3%; PRIOR 71.6%

NEW ZEALAND Q2 AVERAGE HOURLY EARNINGS +1.1% Q/Q; PRIOR +0.3%

NEW ZEALAND Q2 PRIVATE ORDINARY TIME WAGES RISE 0.9% Q/Q; EST. +0.8%; PRIOR +0.8%

NEW ZEALAND Q2 PRIVATE WAGES INCLUDING OVERTIME +0.9% Q/Q; EST. +0.8%; PRIOR +0.8%

CHINA JULY EXPORTS IN USD +7.0% Y/Y; EST. +9.5%; PRIOR +8.6%

CHINA JULY IMPORTS IN USD +7.2% Y/Y; EST. +3.2%; PRIOR -2.3%

CHINA JULY TRADE SURPLUS +$84.65B; EST. +$98.35B; PRIOR +$99.05B

SOUTH KOREA JUNE GOODS TRADE SURPLUS $11.469B; PRIOR $8.7515B

SOUTH KOREA JUNE CURRENT ACCOUNT SURPLUS $12.259B; PRIOR $8.9225B

MARKETS

US TSYS: Tsys Futures Edges Lower, Curve Flattens

- Tsys futures opened the session slightly higher today before turning lower on headlines out of Japan around FX intervention and Ruling party heavyweight Ishiba saying the BoJ is on right track to align with world interest rates and followed up by dovish comments from BoJ Deputy Governor Uchida.

- TUU4 is - 02+ at 103-08⅞, while TYU4 is - 06 at 113-07, we trade at session lows and have jsut broken through the lows made overnight.

- The cash treasury curve has bear-flattened, with yields 1-5bps higher. The 2y is back above 4% after trading +4.7bps to 4.022%, while the 10y is +2.5bps at 3.916%.

- Fed fund futures for September meeting has softened 3-5bps into year-end with 42bps of cuts priced for Sept, and 102bps by December.

- Today, we have MBA Mortgage Apps and Consumer Credit, Boston Fed Collins speak, but is not expected to speak about policy, US Tsy $42B 10Y Note auction.

JGBS: Cash Curve Twist-Steepener After Dovish Comments From BoJ

JGB futures are stronger and near session highs, +36 compared to the settlement levels, after dovish comments from BoJ Deputy Governor Uchida.

- (MNI) BoJ Deputy Governor Shinichi Uchida said “In contrast to the process of policy interest rate hikes in Europe and the United States, Japan's economy is not in a situation where the BoJ may fall behind the curve if it does not raise the policy interest rate at a certain pace. Therefore, the Bank will not raise its policy interest rate when financial and capital markets are unstable.”

- Cash US tsys are 2-5bps cheaper in today’s Asia-Pac session. Today, the US calendar will see MBA Mortgage Apps and Consumer Credit data. Fed Collins is set to speak but is not expected to discuss policy. There is also a $42bn US tsy 10-year note auction.

- The cash JGB curve twist-steepened, pivoting at the 30s, with yields ranging from 5bps lower to 3bps higher. The benchmark 10-year yield has decreased by 4.1bps to 0.860%, positioning it in the lower half of its 0.74-1.10% range from the past week.

- Swap rates are 1-4bps lower out to the 10-year and 1-4bps higher beyond.

- Leading and Coincident Indices are due shortly.

- Tomorrow, the local calendar will see International Investment Flow, Trade Balance, Bank Lending and Tokyo Office Vacancies data. There is also 30-year supply.

AUSSIE BONDS: Holds Post-RBA Sell-Off Ahead Of Tomorrow’s RBA Gov Speech

ACGBs (YM -7.0 & XM -6.5) are cheaper and trading near Sydney session lows, having moved within relatively narrow ranges. With a light domestic calendar, the local market has focused on the 2-5bp cheapening in US tsys during today’s Asia-Pacific session, following yesterday’s sharp sell-off.

- After RBA Governor Bullock's press conference yesterday, the appearances of RBA staffers Hunter and Cassidy before the Senate Select Committee on the Cost of Living did not impact the market.

- Cash ACGBs are 6bps cheaper on the day and 9-14bps cheaper than pre-RBA decision levels. The AU-US 10-year yield differential is flat at +17bps.

- Today’s auction demonstrated solid pricing for ACGBs, with the weighted average yield coming in below prevailing mid-yields and the cover ratio increasing to 3.3813x.

- Swap rates are 5-7bps higher.

- The bills strip has bear-steepened, with pricing -2 to -10.

- RBA-dated OIS pricing is 3-9bps firmer across meetings beyond September today, with mid-2025 leading. Today’s move leaves pricing 6-21bps firmer across meetings than pre-RBA levels. A cumulative 19bps of easing is priced by year-end versus 30bps before the RBA decision.

- Tomorrow, the local calendar will see a speech by RBA Governor Bullock and Foreign Reserves data.

NZGBS: Closed Sharply Cheaper After Stronger-Than-Expected Labour Market Data

NZGBs closed 9-14bps cheaper on the day across benchmarks and 8-12bps cheaper than pre-jobs data levels.

- The NZ labour market continued to ease but not by as much as consensus expected for Q2. The unemployment rate rose 0.3pp to 4.6%, its highest since Q1 2021 but in line with the RBNZ’s May expectation.

- Employment growth and the participation rate were stronger than expected as were private sector wages. Public sector agreements boosted overall earnings.

- With the labour market developing broadly as the RBNZ expects and some domestic inflation still strong, it will likely want to see Q3 CPI on October 16 before cutting rates.

- Swap rates closed 9-13bps higher on the day, with the 2s10s curve flatter.

- RBNZ-dated OIS pricing closed 10-17bps firmer across meetings. The market now prices a 43% chance of a rate cut in August, down from 78% before the data release. Additionally, a cumulative 82bps of easing is anticipated by year-end, compared to 97bps previously.

- Tomorrow, the local calendar will see RBNZ Inflation Expectations data alongside the NZ Treasury's planned sale of NZ$275mn of the 1.5% May-31 bond, NZ$175mn of the 4.5% May-35 bond and NZ$50mn of the 1.75% May-41 bond.

FOREX: Yen Slumps 2% On Dovish BoJ Comments, Broader Risk Recovers Further

Recent safe haven FX gains have continued to be unwound today. Yen losses are over 2%, as the dovish rhetoric from the BoJ Deputy Governor weighed heavily on yen. These comments also helped fuel broader risk gains. Regional equities and US futures are continuing to recover from recent lows. Japan equities have been the strongest gainers.

- USD/JPY is close to 147.7 in recent dealings, very close to session highs. We stared the session around 144.35. Upside focus may rest on pre NFP highs, which came in around 149.10 last Friday.

- BoJ Deputy Governor Uchida stated, that rates won't be raised if the market is unstable and the rate path will shift if market moves affect the economic outlook (per BBG). This offset earlier comments that rates would continue to rise if projections unfolded as expected.

- It also follows yesterday meeting between the BoJ/FinMin and the FSA, where recent volatility in Japan financial markets was clearly a focus.

- High beta FX has outperformed, led by the NZD following the earlier Q2 jobs beat. This has seen RBNZ easing expectations for next week's meeting slashed to 43% from 78% prior.

- NZD/USD is up 1% to 0.6015, AUD/USD at 0.6560/65 is 0.65% higher, so lagging NZD. The AUD/NZD cross is at 1.0910/15, near recent lows. NZD/JPY has rebounded +3%, last near 88.90.

- Looking ahead, the data calendar is fairly light for the offshore session, with just second tier releases out.

JAPAN STOCKS: Japanese Equities Continue Bounce, Lead By Financials

BOJ Deputy Gov Uchida stated that the central bank will maintain its current policy interest rate and not raise it amid market instability to ensure monetary easing. His comments led to the yen has slipped to 147.75 vs the USD, which has helped local equities, with banks the top performing sector.

- The TOPIX Bank Index is currently trading 9.36% higher today, with Mitsubishi UFJ Financial (+10.89%), Sumitomo (+10.63%) & Mizuho (+10.13%) and after falling over 30% after a profit miss and market sell-off Daiwa has recovered 17.5%.

- The TOPIX Bank Index is currently underperforming the wider TOPIX by 9.72% since August 1.

- The broader TOPIX is 3.75% higher today, while the Nikkei 225 is 2.65% higher.

ASIA STOCKS: China & Hong Kong Equities Edge Higher, China Trade Surplus Narrows

Hong Kong and China markets showed gains, helped by a regional rally after the BoJ announced it wouldn’t raise interest rates amidst financial instability. The Hang Seng China Enterprises Index climbed as much as 1.6%, breaking a four-day losing streak. Stocks related to China's electricity grid technology surged on plans to enhance renewable energy infrastructure, while China's trade surplus narrowed a touch after exports came in below estimates while imports were well above estimates.

- Major benchmarks are higher across the board, with Hong Kong's HSI up 1.25% & China's CSI 300 up 0.20%. Looking at sectors, the HSTech Index is up 1.15%, HS Finance Index is 0.90% higher, Property Indices are about 0.25% higher.

- China's battery makers face challenges of overcapacity, weakening demand, and falling prices in 2024, with smaller producers at risk as top players dominate the market; fierce competition and squeezed profit margins are expected to continue until a demand-supply rebalance occurs, the Global X China EV & Battery ETF is off 6.50% from recent highs made in July.

- China's imports surged 7.2% in July, the highest in three months, while export growth slowed to 7%, resulting in a $84.65b trade surplus, narrowing from $99.05b. The rise in imports indicates some domestic demand strength, but the decelerating exports suggest cooling global demand, potentially exacerbated by US and European trade tensions. The overall economic outlook remains mixed, with weak domestic demand and a prolonged housing slump offsetting export growth.

- Looking ahead focus will now turn to PPI & CPI on Friday

OIL: Crude Up Marginally As Risk Recovers, US EIA Stock Data Due Later

Oil prices were little changed on Tuesday after rising moderately on Monday and are up around 0.4% today, despite soft China oil imports. The recovery in risk appetite has also helped. The USD index is up 0.2%. The market remains nervous about attacks on Israel by Iran and Hezbollah but this is only likely to worry oil markets if there is an impact on output and exports from the region.

- WTI is up 0.4% today to $73.51/bbl, close to the intraday high of $73.59. It fell to a low of $72.58 early in the session. A bear threat remains in place with initial support at $71.67. Resistance is at $74.59.

- Brent is 0.4% higher at $76.77/bbl after a peak of $76.84 which followed a low of $75.96. The benchmark remains in a bear cycle but is trading above initial support at $74.96. Key support is at $73.31. It does appear oversold though and initial resistance is at $77.95.

- China’s oil imports remain weak with volumes in July down 3.1% y/y and refined products -27.8% y/y. In levels, crude was at 42.34mn tonnes, the lowest in almost two years. China is the world’s largest importer of oil and the market has been concern about its economic strength for some time. The EIA reduced its 2025 oil demand expectations due to a softer China.

- Bloomberg reported that US crude inventories rose a less-than-expected 0.176mn barrels, according to people familiar with the API data. Gasoline rose 3.31mn and distillate 1.22mn. The official EIA data is out today and last week recorded its fifth consecutive drawdown.

- Later the Fed’s Collins and ECB’s McCaul appear. US June consumer credit, German June IP & trade and Canadian July PMI are released as well as BoC’s summary of deliberations.

GOLD: Pullback Continues

Gold is 0.2% lower in today’s Asia-Pac session, after closing 0.8% lower at $2390.82 on Tuesday.

- This leaves the yellow metal ~3.5% down from last Friday’s high.

- Commerzbank says that along with overblown expectations of Fed rate cuts, selling to compensate for losses in other assets may have also been behind gold’s recent weakness.

- Nevertheless, bullion remains ~15% higher this year after hitting an all-time high in July, mainly supported by bets the US Federal Reserve will pivot to monetary easing. Lower borrowing costs are positive for bullion as it doesn’t pay interest.

- According to MNI’s technicals team, this recent weakness appears to be a correction, for now. However, a clear break of support at the 50-day EMA at $2,375.4 would signal scope for a deeper retracement towards $2277.4, the May 3 low.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/08/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 07/08/2024 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/08/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/08/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/08/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/08/2024 | - | *** |  | CN | Trade |

| 07/08/2024 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/08/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/08/2024 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 07/08/2024 | 1730/1330 |  | CA | BOC Minutes (Summary of Deliberations) | |

| 07/08/2024 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.