-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: ECB Continues To Point Towards More 50bp Hikes, While Fed Eyes Stepping Down To 25s

EXECUTIVE SUMMARY

- FED'S WALLER BACKS 25BPS, SEES CONTINUED TIGHTENING AHEAD (MNI)

- ECB’S KNOT WANTS AT LEAST TWO MORE HALF-POINT RATE HIKES (BBG)

- ECB’S REHN SEES GROUNDS FOR SIGNIFICANT RATE HIKES IN SPRING (BBG)

- ECB SHOULD STICK TO HALF-POINT HIKES FOR MONTHS, HOLZMANN SAYS (BBG)

- EU’S MICHEL PROPOSES NEW EUROPEAN BOND PROGRAM (HANDELSBLATT)

- GERMANY AND FRANCE PUSH FOR HUGE SPENDING TO COMPETE WITH U.S. (BBG)

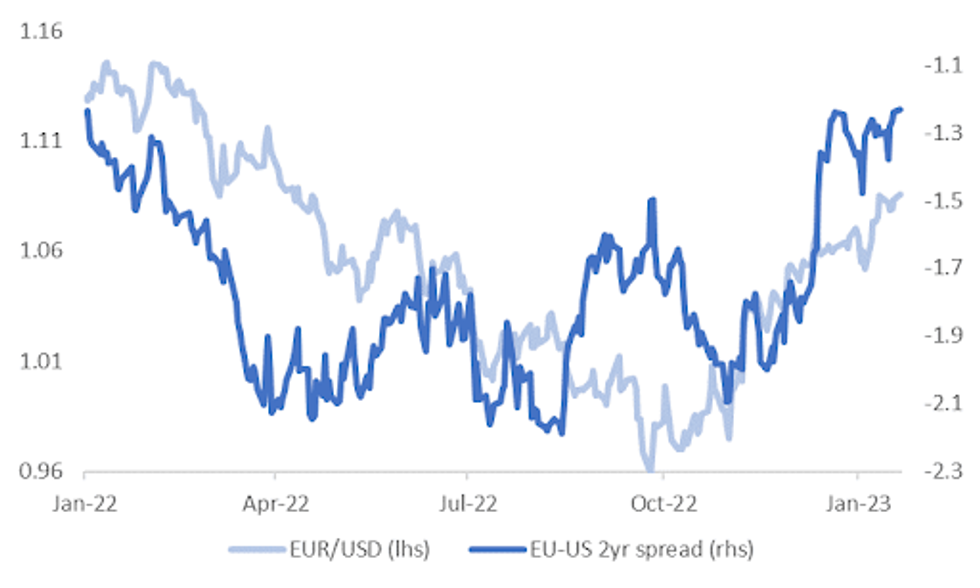

Fig. 1: EUR/USD Vs. EU/U.S. 2-Year Yield Spread

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Consumer confidence turned a corner at the end of last year after 15 consecutive months of decline, according to new analysis. (The Times)

FISCAL: Chancellor Jeremy Hunt is poised to sign off a support package for British Steel and Tata Steel UK worth over half a billion pounds in a move that will be tied to Britain’s two biggest steel manufacturers switching to green technology. (FT)

ENERGY: A scheme that offers discounts on bills for households who cut peak-time electricity use will be triggered on Monday as the UK's cold snap continues. (BBC)

ENERGY: The UK government urged energy suppliers to stop forcing financially vulnerable consumers to install prepayment meters, saying such meters should be used only as a last resort. (BBG)

BREXIT: Rishi Sunak is considering a compromise in Brexit talks with the EU in a move that would risk major conflict with Conservative MPs. (Telegraph)

BREXIT: Britain has started evaluating whether the EU’s offshore financial centres are fit to oversee the more than £2tn of UK investors’ cash held there, amid concern that Europe is not moving fast enough on appropriate safeguards. (FT)

POLITICS: Prime Minister Rishi Sunak is facing questions over the tax affairs of a senior figure in his ruling Conservative Party, a growing distraction for the UK government as ministers attempt to head off a new wave of public sector strikes over pay. (BBG)

POLITICS: Nadhmi Zahawi faced the first Tory calls to resign after admitting “errors” in his tax affairs had been deemed “careless” by HMRC. (Telegraph)

POLITICS: A “blue wall” offensive focusing on the NHS is being plotted by the Liberal Democrats this weekend, amid mounting evidence that the Conservative brand has been significantly damaged among crucial voters in traditional Tory seats. (Guardian)

EUROPE

ECB: The European Central Bank should continue with half-point interest-rate increases at the next two meetings and the time to slow the pace of hikes is “still far away,” according to Governing Council member Klaas Knot. (BBG)

ECB: European Central Bank Governing Council member Olli Rehn said “there are grounds for significant increases” in the key interest rate in the winter and early spring, reiterating comments he’d made earlier in the week. (BBG)

ECB: The European Central Bank should stick to a plan laid out by President Christine Lagarde and continue raising interest rates in half-point steps, according to Governing Council member Robert Holzmann. (BBG)

ECB: The European Central Bank will be more aggressive than previously thought in its tightening campaign, adding another 50 basis points to its deposit rate on Feb. 2, as it continues its battle against rampant inflation, a Reuters poll found. (RTRS)

FISCAL: Responding to massive state aid the US is providing for its green transition, European Council President Charles Michel is proposing steps to strengthen the bloc’s economies that would involve a new bond program to even out the different financial situations of EU member states. (BBG)

FISCAL: Germany and France warned that European businesses will need to unleash investments on a nearly unparalleled scale to keep from falling behind US and Chinese firms as countries revamp their economies to make them more climate friendly. (BBG)

FRANCE: The energy branch of France’s CGT union called for a 48-hour strike starting Jan. 26 as well as a 72-hour action from Feb. 6, in addition to the day of coordinated protests labor unions have agreed on for Jan. 31. (BBG)

FRANCE: French President Emmanuel Macron’s approval rating dropped by 2 points in a poll taken after his government released its plan to raise the retirement age. (BBG)

GREECE/BANKS: The European Central Bank wouldn’t object to a dividend payment if Greek banks prove they can fulfill all supervisory demands even under an adverse scenario, said Andrea Enria, head of the ECB’s Supervisory Board. (BBG)

SNB: Swiss inflation may have peaked, but it’s too soon to swear off new interest rate hikes, Swiss National Bank President Thomas Jordan told Schweiz am Wochenende in an interview published Saturday. (BBG)

RATINGS: Rating reviews of note from after hours on Friday include:

- Fitch affirmed Hungary at BBB; Outlook revised to Negative

- Fitch affirmed Ireland at AA-; Outlook Stable

- Fitch affirmed Norway at AAA; Outlook Stable

- DBRS Morningstar confirmed Austria at AAA, Stable Trend

- DBRS Morningstar confirmed Estonia at AA (low), Stable Trend

- DBRS Morningstar confirmed the European Financial Stability Facility at AAA, Stable Trend

- DBRS Morningstar confirmed the European Stability Mechanism at AAA, Stable Trend

- DBRS Morningstar confirmed Switzerland at AAA, Stable Trend

BANKS: Intesa Sanpaolo SpA is cutting risk-weighted assets by as much as €20 billion ($22 billion) after the European Central Bank faulted the lender’s calculations of how much risk it faces. (BBG)

U.S.

FED: Federal Reserve Governor Chris Waller Friday said he favors another downshift at the next meeting ending February 1 to a 25bp rate hike but anticipates continued tightening going forward. (MNI)

FED: Federal Reserve officials are preparing to slow interest-rate increases for the second straight meeting and debate how much higher to raise them after gaining more confidence inflation will ease further this year. They could begin deliberating at the Jan. 31-Feb. 1 gathering how much more softening in labor demand, spending and inflation they would need to see before pausing rate rises this spring. (WSJ)

FED: Minneapolis Fed economist Simon Mongey told MNI his research on job matching suggests that counter to the pessimism of some prominent economists, the high vacancy rate can still fall without a spike in unemployment, enhancing the chances of a soft landing. (MNI)

ECONOMY: A new survey of business economists suggests US job market conditions are beginning to soften, with firms indicating an easing of labor shortages and a pullback in hiring expectations. (BBG)

FISCAL: U.S. Treasury Secretary Janet Yellen said in an Associated Press interview Saturday she expects Congress will ultimately vote to raise America’s debt limit, but demands by House Republicans for spending cuts in return for backing an increase are “a very irresponsible thing to do” and risk creating a “self-imposed calamity” for the global economy. (AP)

FISCAL: President Joe Biden said he would discuss the debt limit with Republican House Speaker Kevin McCarthy and raise the issue in his State of the Union, saying it would be a financial “calamity” if the US defaults on its obligations. (BBG)

FISCAL: A bipartisan group of U.S. lawmakers is preparing a plan to defuse a looming crisis over the nation's debt ceiling by changing it from a fixed dollar amount a percentage of national economic output, the group's top Republican said on Sunday. (RTRS)

FISCAL: Treasury Secretary Janet Yellen said the Federal Reserve likely wouldn’t accept a $1 trillion platinum coin if the Biden administration tried to mint one to avoid breaching the debt limit, dismissing an idea that has been floated to circumvent Congress on the issue. (WSJ)

FISCAL: U.S. Treasury Secretary Janet Yellen on Sunday said rebuilding the Internal Revenue Service would be one of her top priorities in coming years, putting her squarely at odds with Republicans who have taken control of the House of Representatives. (RTRS)

POLITICS: The FBI found more classified documents at the Wilmington, Delaware, home of President Joe Biden during a consensual search Friday that lasted nearly 13 hours, his personal lawyer and a prosecutor said Saturday evening. (CNBC)

POLITICS: Jeff Zients will serve as President Joe Biden’s next chief of staff, according to media reports on Sunday. (CNBC)

BANKS: The Federal Reserve is investigating Goldman Sachs Group Inc.’s consumer business to determine whether the bank had appropriate safeguards in place as it ramped up lending, according to people familiar with the matter. (WSJ)

EQUITIES: AppleInsider has learned that Apple has started to lay off non-seasonal employees in its retail channel outside of Apple Stores. (Apple Insider)

OTHER

GLOBAL TRADE: Japanese non-life insurers will raise premiums for liquefied natural gas vessels on voyages in Russian waters by ~80%, Nikkei reports, without attribution. (BBG)

U.S./CHINA: US Treasury Secretary Janet Yellen again expressed cautious optimism that China will be willing to enter into a multilateral debt restructuring deal with Zambia. (BBG)

NATO: Sweden was working frantically on Sunday to keep its Nato bid on track after a furious reaction in Turkey to a provocateur being allowed to burn a copy of the Koran outside its embassy in Stockholm. (FT)

BOJ: Government officials who attended the Bank of Japan's December policy meeting were given a half-hour adjournment to contact their ministries, minutes showed, underscoring the significance of the central bank's decision to tweak its bond-market peg. (RTRS)

BOJ: Japanese Prime Minister Fumio Kishida said on Sunday he would nominate a new Bank of Japan governor next month, as markets test whether the central bank will change the ultra low-rate policy of the dovish Haruhiko Kuroda. (RTRS)

BOJ: A review of the joint statement between the Bank of Japan and the government is expected to deliver more monetary policy flexibility but will not lead to an immediate normalisation of policy, with the 2% inflation target and negative short-term policy rate expected to be maintained, MNI understands. (MNI)

JAPAN: Japanese Prime Minister Fumio Kishida said he’d press ahead with labor market reforms to create an environment for sustainable pay rises in a policy-setting address to a new parliament session, which is clouded by inflation hitting its highest level since 1981. (BBG)

JAPAN: Japan's finances are becoming increasingly precarious, Finance Minister Shunichi Suzuki warned on Monday, just as markets test whether the central bank can keep interest rates ultra-low, allowing the government to service its debt. (RTRS)

JAPAN: Japan intends to scrap a key restriction on overseas investments by domestic venture funds dedicated to backing startups, a move intended to attract more foreign investors into the sector. (Nikkei)

RBA: Australian central bank chief Philip Lowe’s prospects for an extension of his role are far from clear-cut, according to economists, with some highlighting political hurdles to his reappointment. (BBG)

NEW ZEALAND: Incoming New Zealand Prime Minister Chris Hipkins will prioritize the economy as a recession looms and may jettison some of Jacinda Ardern’s policies as he seeks to win back the political middle ground ahead of an October election. (BBG)

HONG KONG/CHINA: Hong Kong is looking to drop the requirement that travelers to and from mainland China get a PCR test and seeking to remove the cap on people crossing the border, according to the city government’s No. 2 official. (BBG)

BOC: The Bank of Canada will hike one more time Wednesday and take a pause to assess how much inflation moderates, and a cut late this year can't be ruled out amid public pressure if output plunges, says Canadian Chamber of Commerce chief economist and former government researcher Stephen Tapp. (MNI)

MEXICO: It’s clear we face a slowdown in economic activity,” central banker Jonathan Heath said on Twitter citing estimates from the nation’s statistics agency. (BBG)

BRAZIL: Brazil's president, Luiz Inácio Lula da Silva, has sacked the country's army chief, two weeks after rioting in the capital. (BBC)

BRAZIL: Brazilian Senator Jean Paul Prates, nominated by President Luiz Inacio Lula da Silva to head state-run oil company Petrobras, has been meeting with members of his Workers Party to confirm decisions about the new senior management for the company, four sources familiar with the matter said. (RTRS)

BRAZIL/ARGENTINA: Brazil and Argentina aim for greater economic integration, including the development of a common currency, Brazilian President Luiz Inacio Lula da Silva and Argentine leader Alberto Fernandez said in a joint article they penned. (RTRS)

RUSSIA: Western allies on Friday dampened Ukraine's hopes for a rapid shipment of battle tanks to boost its firepower for a spring offensive against Russian forces, with the United States urging Kyiv to hold off from mounting such an operation. (RTRS)

RUSSIA: Germany's foreign minister said on Sunday her government would not stand in the way if Poland wants to send its Leopard 2 tanks to Ukraine, in a possible breakthrough for Kyiv which wants the tanks for its fight against Russia's invasion. (RTRS)

RUSSIA: Ukraine's defence minister has said he had a "frank discussion" with his German counterpart about German Leopard 2 tanks, which Kyiv is urgently requesting to confront Russian armour. (BBC)

RUSSIA: The director of America’s top spy agency described Russia’s war in Ukraine as a “grinding conflict” that will require the West to continue to provide security assistance packages in order for Kyiv to prevail. (CNBC)

RUSSIA: The head of the Russian private military contractor Wagner published on Saturday a short letter to the White House asking what crime his company was accused of, after Washington announced new sanctions on the group. (RTRS)

RUSSIA: The European Council president has urged capitals to push forward with talks on using $300bn-worth of confiscated Russian central bank assets for the reconstruction of Ukraine, as the scale of the destruction mounts in the war-torn country. (FT)

RUSSIA: Russia’s biggest companies, even those that haven’t been directly targeted by recent sanctions, are bypassing Wall Street to repay their outstanding debt after the crackdown broadly disrupted the financial plumbing needed to service bonds. (BBG)

OIL: Russian government will soon publish a decree detailing the ban on Russian companies to sell oil to clients adhering to the price ceiling introduced by Western countries, Kommersant reports, citing unidentified sources. (BBG)

SOUTH AFRICA: President Cyril Ramaphosa has appealed to the board of South Africa’s cash-strapped power utility to suspend its biggest electricity-price increase in more than a decade as the nation faces two more years of rolling blackouts. (BBG)

PERU: Peruvian police arrested over 200 people accused of illegally entering the campus of a major Lima university, while authorities in Cusco shut the Incan citadel of Machu Picchu and the Inca trail as deadly anti-government protests spread nationwide. (RTRS)

MACRO: In a week marked by fresh recession angst from Wall Street to Davos, JPMorgan Chase & Co. finds the odds of an economic downturn priced into financial markets have actually fallen sharply from their 2022 highs. (BBG)

WORLD BANK: The head of the World Bank said Sunday he’s worried that a slowdown in the global economy this year could be “long-lasting.” (BBG)

WORLD BANK: U.S. Treasury Secretary Janet Yellen on Sunday said the United States wanted to see quicker progress on the World Bank's plans for expanding its lending capacity to address climate change and other global crises. (RTRS)

METALS: Glencore's Antapaccay copper mine in Peru suspended operations on Friday after protesters attacked the premises for the third time this month, the global commodity giant said, as social unrest in the South American nation continued. (RTRS)

OIL: Group of Seven officials have agreed to review the level of the price cap on exports of Russian oil in March, later than originally planned in order to give time to assess the market after more caps are placed on oil products from Russia, the U.S. Treasury said on Friday. (RTRS)

OIL: Western countries are working to structure price caps on Russian refined petroleum products to ensure continued flow of Russian diesel, but the markets are complicated and there is a chance things do not go to plan, Treasury Secretary Janet Yellen said. (RTRS)

OIL: Russian government will soon publish a decree detailing the ban on Russian companies to sell oil to clients adhering to the price ceiling introduced by Western countries, Kommersant reports, citing unidentified sources. (BBG)

CHINA

CORONAVIRUS: The possibility of a big Covid-19 rebound in China over the next two or three months is remote as 80% of people have been infected, a prominent government scientist said on Saturday. (CNBC)

OVERNIGHT DATA

SOUTH KOREA JAN 1-20 TRADE BALANCE -US$10.263BN

SOUTH KOREA JAN 1-20 EXPORTS +9.3% Y/Y

SOUTH KOREA JAN 1-20 IMPORTS -2.7% Y/Y

MARKET

US TSYS: Early Richening Holds In Asia

TYH3 deals at 115-05, +0-03+, off the top of its 0-06+ range on volume of ~45K.

- Cash Tsys 1-2 bps richer across the major benchmarks, with the belly leading the bid.

- Tsys were marginally cheaper to start before reversing to deal richer as a bid in JGB futures and a rally in the intermediate zone of the JGB curve spilled over.

- The richening held through the session, a thin data calendar and limited liquidity due to Lunar NY holiday saw early ranges respected.

- Note that WSJ Fed watcher Timiraos' latest piece (released after the start of the Fed blackout period) noted that "Federal Reserve officials are preparing to slow interest-rate increases for the second straight meeting and debate how much higher to raise them after gaining more confidence inflation will ease further this year."

- ECB speak from Lagarde and the U.S. leading index headlines an otherwise thin docket today. Further out, PCE, Jan Preliminary PMIs and Q4 GDP provide the U.S. highlights this week.

JGBS: Futures Push Higher Again, Leaning On BoJ Collateral Operations

JGB futures extend higher into the Tokyo close after breaching last week’s high, with the contract now erasing the bulk of the cheapening observed since the BoJ’s surprise YCC tweak. Futures are also through their 6 Dec base, and now look to the Nov 16 high as the next area of meaningful resistance, +67 on the day.

- The major cash benchmarks are mixed, with the 3- to 10-Year zone running 1-6bp richer, led by 7s. While the super-long end struggled all day, with 30+-Year paper failing to get anywhere near unchanged, sitting 1.5-3.5bp cheaper into the bell.

- Swaps rates were lower as that curve flattened, shedding 1-2bp across the major benchmarks.

- The presence of the BoJ’s initial 5-Year offering through its Funds-Supplying Operations was the catalyst for the bid in the belly to intermediate area of space, There was good demand at the operations, with over Y3tn of bids tendered and ~Y1tn allotted (as prescribed in the announcement of the ops).

- The weekend saw Japanese PM Kishida note that he will nominate a new BoJ Governor next month, while he stressed that it is too early to discuss a potential revision to the government-BoJ accord.

- The minutes of the Dec BoJ meeting, which saw the surprise YCC tweak, revealed that there was a 30 to 40-minute recess of the meeting, at the request of a government official (unusual, but not unprecedented).

- Flash PMI data and a liquidity enhancement auction for off-the-run 1- to 5-Year JGBs headline tomorrow’s domestic calendar.

AUSSIE BONDS: Futures Hold Overnight Losses, ACGBs Look Through Uptick In JGBs

Aussie bonds futures were happy to trade around levels seen late in the final overnight session of last week, looking through some richening in JGBs & U.S. Tsys after outperforming vs. their U.S. equivalents after Friday’s Sydney close (the Asia rally in Tsys chipped away at that outperformance).

- That left YM -4.0 & XM -5.5 at the bell. Meanwhile, wider cash ACGBs were 4-6bp cheaper, with some light bear steepening observed.

- EFPs dealt either side of unchanged through the session, finishing little changed.

- Bills finished 3-4bp cheaper through the reds, in a parallel shift, once again lacking anything in the way of real traction during Sydney hours.

- RBA dated OIS is still showing ~20bp of tightening for next month’s meeting, while terminal cash rate pricing shows just above 3.55% mark, a touch firmer on the day.

- A reminder that the LNY holiday period will thin out broader liquidity during Asia-Pac hours to varying degrees throughout the week.

- Wednesday’s Q4 CPI data headlines this week’s domestic docket, and will be supplemented by PPI, terms of trade, the monthly NAB business survey, Westpac leading index and Judo Bank flash PMIs.

- It is also worth noting that Australian markets will be closed on Thursday for the Australia Day holiday.

NZGBS: Early Cheapening Holds, CPI Eyed

There was little to move the needle for the NZ rates space during Monday’s session, leaving participants to adjust to Friday’s moves in wider core global FI markets.

- That presented a cheapening bias in early trade, with those moves essentially maintained across the curve as the major benchmarks finished the session 9.5-11.0bp cheaper, holding a light steepening bias.

- Swap rates displayed a similar steepening bias, although the moves there were more muted, as the major benchmarks finished 4-6bp higher.

- Liquidity was thinned by a regional holiday in Wellington.

- The key short-term RBNZ dated OIS measures are flat to incrementally higher to start the week, showing 65bp of tightening for next month’s gathering, alongside a terminal OCR of just over 5.45%.

- The Labour party’s Chris Hipkins was chosen to replace outgoing PM Ardern. He is due to be sworn in as PM on Wednesday. Hipkins, Police and Education Minister, was the only one to stand for the position. He has already pointed to a focus on the economy given the well-documented challenges, lining up the potential scrapping of some of Ardern’s policies.

- Looking ahead, Q4 CPI data (Wednesday) provides the highlight of the domestic economic calendar this week, with the latest PSI survey, credit card spending data, trade balance and the monthly ANZ business survey set to supplement the headline release throughout the week.

EQUITIES: Firmer Bias Amid LNY Impacted Markets

For those markets that are open in the region, the trend has mostly been a positive one today. This follows a firmer end to the week for US/EU markets on Friday. US futures are lower, but not far from -0.10% at this stage.

- A lot of major markets remain closed tomorrow for LNY, including China, Hong Kong and Singapore.

- Japan equities are higher, with the Nikkei 225 up 1.3%, as tech shares continue to outperform, amid expectations of a slower pace of Fed hikes.

- The ASX200 is slightly higher, +0.10% at this stage.

- Indian markets are higher, last around 0.70/0.75% higher. Better earnings in the financial sector have buoyed momentum.

- Philippines stocks are bucking the firmer trend, with the main bourse off -0.65% at this stage.

GOLD: Can't Break To Fresh Highs, ETF Positioning Remains Stagnant

Gold threatened fresh highs in the early part of trade as the USD was on the back foot. The precious metal breached $1935, but is now back sub $1930, as USD sentiment has stabilized somewhat. We are still higher for the session, but only modestly at +0.15%.

- The technical backdrop still looks supportive, even if the rate of gains have slowed. Moves back to $1900 should still generate some support, while the rising 20-day EMA sits back at $1873.

- CFTC net non-commercial longs rose further but at a more modest pace compared to the first half of January (+2.7k).

- Gold ETF positions also remain stagnant.

OIL: Prices Ease On Thin Trading, Attention On Russian Supply

Crude has been supported by increased purchases by China and the expected end of outsized Fed hikes. Both Brent and WTI are above their 50- and 100-day moving averages. Oil prices have eased today by around 0.3% to $81.37/bbl for WTI and $87.33 for Brent but have remained in a tight range of less than a dollar on thin trading due to Lunar New Year holidays. DXY has eased 0.2%.

- Brent traded at a high of $87.82 during today’s session, testing key short-term resistance of $87.85, the January 18 high. WTI also approached its resistance at $82.38. On the downside attention is on $77.75, the 20-day EMA.

- There is attention on Russian fuel exports as the February 5 deadline approaches for the implementation of the G7 & EU price cap. Russia has said that oil companies will need to monitor the rules surrounding the cap. International sanctions are expected to weigh on Russian drilling this year. In addition, US Treasury Secretary Yellen said that she believes it’s possible for restrictions to be extended to Russian refined products, although it would be more complicated.

FOREX: USD Off Lows, JPY Remains A Laggard

The USD has started the week off on the back foot, but dollar indices are up from session lows. The BBDXY last around 1222.90 (-0.15%), versus a low of 1221.10. US cash Tsy yields were firmer at the open but have reversed course through the session, now -1-2bps weaker across the curve. Regional equities, for those markets that are open, are mostly higher, but US futures are slightly down (-0.10%).

- USD/JPY remains somewhat volatile, with dips in the pair supported. We got close to 129.00, but now sit higher at 129.75/80. There was interest in the BoJ 5-yr loan operation, although it looks as though the rate remained positive. The Dec BoJ minutes didn't cause sentiment to shift. US-JP 10yr swap spreads remain skewed in favor of higher USD/JPY levels.

- Yield momentum remains in favor of EUR/USD tough. The pair broke above 1.0900 and sits just below this level currently. This is highs back to April last year. GBP/USD has also firmed, last around 1.2425, also multi-month highs.

- AUD/USD is back within sight of 0.7000, last around 0.6985/90. Metal commodities are higher, but no doubt liquidity is impacted by LNY holidays for China and other markets like Singapore.

- NZD/USD outperformed early but is now back at 0.6475/80, highs for the session were at 0.6500.

- Coming up, there is some ECB speak, including Lagarde, while on the data front its second tier released.

FX OPTIONS: Expiries for Jan23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-25(E1.3bln), $1.0800-25(E1.0bln), $1.0900-25(E1.3bln)

- USD/JPY: Y135.65($526mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/01/2023 | 1430/1530 |  | EU | ECB Panetta Into at ECON Hearing | |

| 23/01/2023 | 1500/1000 | ** |  | US | leading indicators |

| 23/01/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/01/2023 | 1745/1845 |  | EU | ECB Lagarde Speech at Deutsche Boerse |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.