-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI EUROPEAN OPEN: Equities Rally, Asia FX Steady, Rates Mixed

EXECUTIVE SUMMARY

- FRANCE AND ITALY WILL BE AMONG SEVEN COUNTRIES THAT WILL FACE A EUROPEAN UNION INFRINGEMENT PROCEDURE - BBG - BBG

- FED'S SUSAN COLLINS ON TUESDAY URGED PATIENCE - MNI - MNI

- FED'S KUGLER STRUCK AN OPTIMISTIC NOTE ON INFLATION TUESDAY - MNI - MNI

- JAPAN'S EXPORTS POSTED THEIR SIXTH STRAIGHT Y/Y RISE IN MAY - MNI - MNI

- THE CSRC WILL ENRICH POLICY TOOLS TO PREVENT ABNORMAL FLUCTUATIONS IN THE STOCK MARKET - MNI - MNI

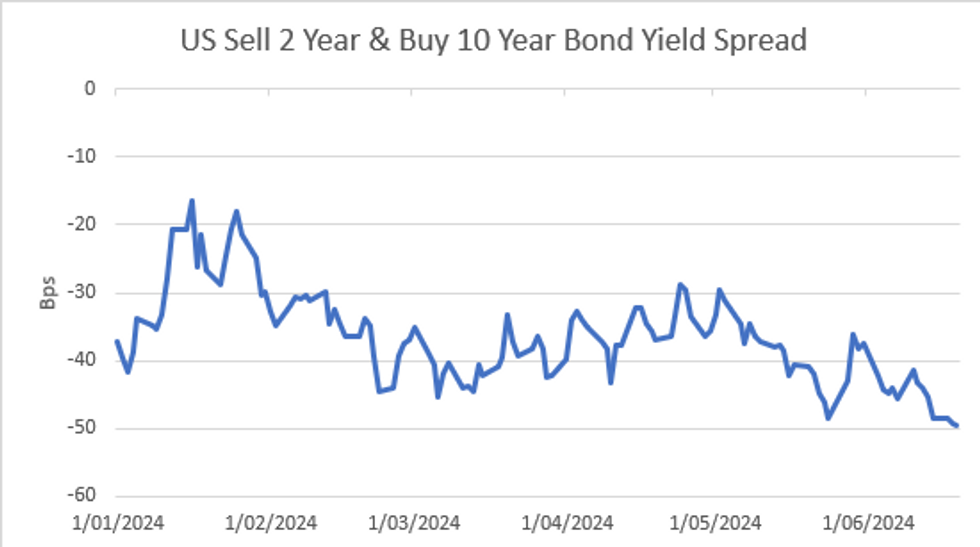

Fig. 1: US 2Y10Y Spread

Source: MNI - Market News/Bloomberg

UK

BOE (MNI): “Barring a huge surprise to June CPI on Wednesday, the MNI Markets team (and consensus) expects no change to Bank Rate, guidance or the vote split. We think this is due to a combination of the data and the election.”

ELECTION (BBC): “The SNP is set to launch its manifesto on Wednesday “with the spotlight on plans for a "major investment" in the NHS.”

EUROPE

EU (BBG): “France and Italy will be among seven countries that will face a European Union infringement procedure for their excessive deficits last year, French Central Bank Chief according to a person familiar with the matter. The EU’s executive arm — the European Commission — will on Wednesday announce the reprimands, said the person who declined to be identified because the plans are confidential.”

FRANCE (POLITICO): “French Finance Minister Bruno Le Maire warned on Tuesday that France could fall into a "debt crisis" and be placed under the supervision of the International Monetary Fund and the European Commission, should the far right or the left-wing alliance come to power in upcoming elections and enact their programs.”

FRANCE (EURONEWS): “The newly formed left-wing alliance New Popular Front reveals plans to support tax increases in order to fund more government spending. Support for the National Rally party has been growing among French business after the country's newly formed left-wing alliance the New Popular Front (NPF) indicated it was in favour of tax increases for businesses.”

NATO (POLITICO): “Outgoing Dutch PM Mark Rutte neared his goal of becoming NATO's next secretary-general with both Hungary and Slovakia indicating today they'd support his bid — leaving Romania as the final holdout. Getting their support involved making some promises.”

RUSSIA (BBC): “A fleet of Russian warships has left the port of Havana after a five-day visit to Cuba, following planned military drills. The vessels, which included a nuclear-powered submarine and a frigate, had been anchored at Havana Bay - some 90 miles (145km) from the US state of Florida.”

US

FED (MNI): “St. Louis Fed President Alberto Musalem in his first public remarks Tuesday questioned the degree of restrictiveness of the current stance of monetary policy and said it "could take months, and more likely quarters" before he's confident that a reduction in interest rates is appropriate.”

FED (MNI): “Federal Reserve Governor Adriana Kugler struck an optimistic note on inflation Tuesday, saying she’s hopeful that continued progress toward 2% will allow the central bank to begin cutting interest rates before the end of the year.”

FED (MNI): “Federal Reserve Bank of Boston President Susan Collins on Tuesday urged patience to see if the encouraging recent price data mean inflation is on a sustained path back to the Fed's 2% target.”

FINANCE (BBC): “Nvidia became the world’s most valuable company after its share price climbed to an all-time high on Tuesday. The stock ended the trading day at nearly $136, up 3.5%, making it more valuable than Microsoft. It overtook Apple earlier this month.”

OTHER

JAPAN (MNI): “Some Bank of Japan board members saw the possibility that developments of foreign exchange rates could warrant monetary policy action at the April 25-26 policy meeting, despite forex rates not subject to direct control by monetary policy, the meeting minutes showed on Wednesday.”

JAPAN (MNI): “Japan's exports posted their sixth straight y/y rise in May, up 13.5% driven by automobile and semiconductor manufacturing equipment shipments, data released by the Ministry of Finance showed on Wednesday.”

NEW ZEALAND (BBG): “New Zealand’s central bank expects inflation to continue to slow but said it needs more time to be certain. Good progress is being made in bringing inflation back to the Reserve Bank’s 1-3% target band, chief economist Paul Conway said in a speech Wednesday in Wellington.”

CHILE (BBG): “Chile’s central bank reduced its key interest rate by a quarter-point, slowing the pace of monetary easing for the third consecutive meeting as a pick-up in annual inflation gives reason for caution.”

CHINA

FINANCE (MNI): “The China Securities Regulatory Commission will enrich policy tools to prevent abnormal fluctuations in the stock market, according to an article published by the regulator's Market Supervision Department.”

FISCAL (SECURITIES DAILY): Authorities have launched a CNY443 million fund to address agricultural production disasters following recent droughts in seven provinces including Hebei and Jiangsu, the Ministry of Finance has announced.

TRADE (YICAI): Beijing’s decision to investigate EU pork dumping has aggravated bullish domestic sentiment, but any final tariffs imposed will have little market impact given China imports less than 5% of pork consumed, according to Xu Hongzhi, senior analyst at Brick Agricultural Big Data.

NATO (BBC): “The head of Nato has told the BBC that China should face consequences for supporting Russia's war in Ukraine, if it does not change its ways. Jens Stoltenberg said Beijing was "trying to get it both ways" by supporting Russia's war effort, while also trying to maintain relationships with European allies.”

PBOC (BBG): “The weakening of the US dollar appreciation momentum will be beneficial for the stability of the yuan and provide room for China’s monetary policy, PBOC Governor Pan Gongsheng says at the ongoing

Lujiazui Forum in Shanghai.”

PBOC (MNI WATCH): "The weak yuan, lender’s narrowed interest margin and the continued fall of long-term CGB yields will drive a steady reference lending rate in June and make the People’s Bank of China more cautious over any potential policy rate cut."

PBOC (BBG): “China’s central bank chief said it is studying how to implement government bond trading together with the finance ministry, while rejecting the idea the practice would equate to quantitative easing.

CHINA MARKETS

MNI: PBOC Net Injects CNY276 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY278 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY276 after offsetting the CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8123% at 09:24 am local time from the close of 1.8871% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Tuesday, compared with the close of 51 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1159 on Wednesday, compared with 7.1148 set on Tuesday. The fixing was estimated at 7.2451 by Bloomberg survey today.

MARKET DATA

UK MAR-MAY BRIGHTMINE MEDIAN PAY AWARDS +4.6%

NEW ZEALAND CURRENT ACCOUNT DEFICIT Q1 YTD 6.8% OF GDP; EST. -6.8%; PRIOR -6.9%

NEW ZEALAND Q1 CURRENT ACCOUNT DEFICIT NZ$4.359B; EST. -NZ$4.650B; PRIOR -NZ$7.975B

JAPAN MAY ADJUSTED TRADE DEFICIT 618.23B YEN; EST. -625.2B YEN; PRIOR -581.3B YEN

JAPAN MAY EXPORTS +13.5% Y/Y; EST. +12.7%; PRIOR +8.3%

JAPAN MAY IMPORTS +9.5% Y/Y; EST. +9.5%; PRIOR +8.3%

JAPAN MAY TRADE BALANCE -1.22T YEN; EST. -1.28T YEN; PRIOR -0.47T YEN

MARKETS

TSYS: Tsys Futures Edge Lower Ahead Of US Holiday, 2Y10Y at YTD Lows

- Treasury futures are a touch lower today ahead of the public holiday in the US later with cash trading closed for the day. TUU4 is -0-01 at 102-07⅛ vs a high of 102-07⅝, while TYU4 is - 03 at 110-22+ vs a high of 110-24.

- The 2y10y hit new ytd lows overnight, now trading at -49.569.

- Volumes are on the low side today; TU 13k, FV 20k, TY 39k

- APAC markets: ACGB curve has bear-flattened, yields are 1-5bps higher, NZGB curve bull-flattened, yields are 2-5bps lower. JGB curve has bear-steepened yield are +/- 2bps, BOJ’s April minutes showed board members discussed a futures reduction in the central bank’s bond purchases

- China has has increased their US Treasury holdings in April, ending a three month decrease, while Japan decreased their holdings.

- Projected rate cut pricing regaining momentum (but still off Friday highs). Post-Retail Sales vs. pre-data: July'24 steady at -8% w/ cumulative at -2bp at 5.307%, Sep'24 cumulative -18.1bp (-16.1bp), Nov'24 cumulative -27.8bp (-25.3bp), Dec'24 -48.3bp (-44.5bp).

- Looking ahead, MBA Mortgage Applications

NZGBS: Richer, Closed Near Best Levels, NZ-AU 10Y Spread Narrows

NZGBs closed just off session bests with benchmarks 2-5bps richer and the 2/10 curve flatter.

- A better-than-expected Current Balance likely helped at the margin, but the outperformance relative to its antipodean counterpart appeared more driven by a post-RBA cheapening in ACGBs. The NZ-AU 10-year yield differential is 7bps tighter on the day.

- The RBA Governor’s press conference remark that a rate cut was not considered, but a hike was, caught the market by surprise. This seems inconsistent with the previous statement that the RBA was "not ruling anything in or out."

- The RBNZ's Conway expects inflation to continue to slow but said it needs more time to be certain. “These processes could occur more quickly or slowly than currently projected,” he said. “Overall, a period of restrictive policy is necessary to give us confidence that inflation will return to target over a reasonable timeframe.” (See BBG link)

- Swap rates closed 4-5bps lower.

- RBNZ dated OIS pricing closed 5bps softer for 2025 meetings. A cumulative 32bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Q1 GDP.

- Tomorrow, the NZ Treasury plans to sell NZ$250mn of the 1.5% May-31 bond, NZ$200mn of the 4.25% May-34 bond and NZ$50mn of the 5.0% May-54 bond.

ACGBS: Post-RBA Sell-Off Continues

ACGBs (YM -5.0 & XM -2.0) are at session cheaps and holding a bear-flattening in a data light session. With cash US tsys closed for the Juneteenth holiday, today’s weakness has been driven by further post-RBA selling.

- The market was surprised by the realisation that the RBA considered a hike but not a cut given that it was inconsistent with previous statements that the RBA was "not ruling anything in or out."

- Earlier, today’s auction of Jun-35 bonds showed relatively tepid demand with the cover ratio being a modest 2.2125x versus 2.925x in May and 2.8438x in March.

- As highlighted in our preview, today's auction bid may have been affected by a relatively low outright yield and the flattest 3/10 cash curve since September last year. The AOFM plans to sell A$700mn of the 1.50% 21 June 2031 bond on Friday.

- Cash ACGBs are flat to 2-4bps cheaper, with the 3/10 curve flatter.

- Swap rates are flat to 3bps higher, with EFPs tighter.

- The bills strip has cheapened, with pricing -2 to -4.

- RBA-dated OIS pricing is 3-9bps firmer than pre-RBA levels. A cumulative 8bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

JGBS: Cash Bonds Dealing Mixed, MoF Considering Shorter Maturity Issuance

JGB futures are lower at 143.86, -9 compared to the settlement levels.

- According to MNI’s technicals team, key resistance for JBU4 remains at 145.95, the Mar 28 high. A break would signal the scope for a climb towards the bull trigger at 147.74, the mid-January high. The bounce off late May lows has called into question the sustainability of the bear trend this year, despite the contract recently trading through key support at 143.44, the Nov 1 low. This exposes 141.65, a Fibonacci projection.

- Outside of the previously outlined April BoJ Meeting Minutes and Trade data, there hasn't been much in the way of domestic drivers to flag.

- (Bloomberg) Japan’s Ministry of Finance is weighing a plan to shift more of its bond issuance to shorter maturities. (See link)

- US markets are shut today for the Juneteenth holiday.

- Cash JGBs are dealing mixed, with futures linked 7-year the underperformer. The range of yield movements are bounded by 2bps lower (30-year) to 1bp higher (7-year). The benchmark 10-year yield is 0.7bp higher at 0.949% versus the cycle high of 1.101%.

- The swaps curve has bear-steepened, with rates flat to 2bps higher. Swap spreads are mostly wider.

- Tomorrow, the local calendar will see weekly Internation Investment Flow data alongside 5-year supply.

STIR: RBA Dated OIS Pricing Firmer Following The RBA Policy Decision

RBA-dated OIS pricing is 3-8bps firmer than pre-RBA levels.

- Going into Tuesday’s meeting, the market was pricing approximately 15bps of easing by year-end from an anticipated terminal rate of 4.33%.

- As it currently stands, the market attaches a 20% chance of a 25bp hike in August, with an expected terminal rate of 4.37%.

- The expected official rate at year-end is 4.28% versus 4.21% ahead of Tuesday’s meeting.

- For context, the market was pricing no easing by year-end from an anticipated terminal rate of 4.42% in the run-up to the RBA’s May Policy meeting.

Figure 1: RBA-Dated OIS – Today Vs. Yesterday

Source: Bloomberg / MNI - Market News

GOLD: Boosted By Weaker Retail Sales

Gold is little changed in the Asia-Pac session, after closing 0.4% higher at $2329.46 on Tuesday.

- Bullion was supported yesterday by lower US treasury yields following weaker than expected Retail Sales data. US treasuries finished with yields 5-7bps lower across benchmarks.

- Tuesday’s rally in US treasuries came despite some Fed speakers pushing back on dovish expectations: Boston Fed Collins: "shouldn't overreact to a month or two of good inflation data" and St Louis Fed Musalem "could be 'quarters' before the first rate cut".

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, spot gold remains rangebound. That said, the yellow metal has traded through the 50-day EMA, at $2,315.3, signalling the scope for a deeper correction to $2,277.4, the May 3 low. Initial firm resistance remains at $2,387.8, the Jun 7 high.

OIL: Crude Holds Onto Gains, Approaching Overbought

Oil prices have range traded today holding onto the week’s gains. There has been little new news and the US is closed for a holiday. WTI is slightly higher at $80.74/bbl after moving in a range of $80.67 - $80.88. Brent is also little changed at $85.35/bbl after a high of $85.47 and low of $85.28. The benchmark broke key resistance at $84.72 and if sustained undermines the recent bearish theme. The USD index is also unchanged.

- Oil prices have been supported this week by positive risk appetite and equities are generally rallying again across APAC today and so the market has looked through data showing a US crude stock build.

- Benchmarks are approaching levels that would result in a shift from a bearish theme to bullish, but Bloomberg is reporting that Brent’s 9-day relative strength index is above 70 and getting close to signalling that it is overbought.

- Asian demand has been an area of concern for oil markets and the fall in China’s refining output in May added to this. One reason for that weakness has been seasonal maintenance but the strength of demand when that is finished remains unclear.

- Bloomberg reported that US crude inventories rose 2.26mn barrels last week, according to people familiar with the API data. But gasoline stocks fell 1.08mn while distillate rose 538k. Prices have looked through the data. The official EIA data is delayed one day due to today’s US holiday and will be released on Thursday.

- The US is closed today. UK May PPI/CPI and euro area Q1 current account print.

LNG: Gas Prices Stronger Due To Outage & Warmer Weather

European gas prices were higher on Tuesday rising 1.3% to EUR 34.70 after a high of EUR 35.10. It is up just over 1% in June to date. The region remains highly sensitive to outages and the pick up in prices was due to an unplanned disruption in Norway. A date for the resumption of normal output is yet to be set. Warmer weather is also expected around the end of the month.

- US natural gas rose 4.3% to $2.91 after falling at the start of the week as weather forecasts shifted higher for around the turn of the month. It is now over 12% higher this month.

- There is a tropical storm warning for the Texas coast which could result in some gas production being halted but is also likely to reduce air conditioner demand.

- North Asian prices also increased rising 0.5% to be up 3.6% in June as heatwaves across the region have driven stronger demand. China’s gas imports rose 3.4% y/y in May according to China customs. The country is the world’s largest LNG importer.

ASIA STOCKS: Flows Into Asian Equities Dominated By Tech Names

- South Korean equities were higher on Tuesday (Kospi up 0.72%, Kosdaq unchanged). Flows were above average with just a decent $466m inflow more than covering the $100m outflow on Monday. The past 5 session have now netted a total inflow of $3.14b. The 5-day average is $628m, above both the 20 day average of $18m and the longer-term 100-day average at $155m.

- Taiwan equities were higher on Tuesday with a strong inflow of $530m. The Taiex continues to make new all time highs. The past 5 session's seeing a total inflow of $1.5b with the 5-day average now $304m, above both the 20-day average at $20m, while the 100-day average is $45m.

- Thailand equities were slightly higher on Tuesday. Foreign investors continue to sell equities as we now have marked the 19 straight session of selling for a total outflow of $999m with $245m of that coming in the past 5 sessions. The 5-day average is now -$49m, below both the 20-day average at -$49m and the 100-day average at -$24.5m.

- Philippines equities were lower on Tuesday, and now trades at YTD lows. Foreign investors have been better sellers of equities recently, the past 5 sessions have seen a net outflow of $26.5m. The 5-day average is now -$5.3m, slightly above the 20-day average at -$10.45m, but inline with the long term average at -$5.62m

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 466 | 2227 | 16365 |

| Taiwan (USDmn) | 531 | 3143 | 4600 |

| India (USDmn)** | 387 | 1150 | -2999 |

| Indonesia (USDmn)** | -44 | -44 | -423 |

| Thailand (USDmn) | -47 | -245 | -2823 |

| Malaysia (USDmn) ** | -12 | 43 | -3 |

| Philippines (USDmn) | -4 | -26.4 | -485 |

| Total | 1275 | 6247 | 14232 |

| ** Up to 14th June |

ASIA STOCKS: Equities Higher As AI Stocks Continue Rally

Asian equities continued their upward momentum for a second day, buoyed by Wall Street's record close and strong performance in chip and AI-related shares. The MSCI Asia Pacific Index advanced about 1%, with notable gains in technology stocks. The Kospi index hit its highest level since January 2022, driven by Nvidia's historic milestone. Taiwan and Japan also saw significant gains. Earlier, Japan trade deficit widened as exports increased on the lower yen.

- Japanese equities opened higher, buoyed by gains in export-related stocks such as automobile and electrical machinery companies. Earlier, Japan Trade Balance was -¥1221.3b vs -¥1280.5b est, with the deficit widening from -¥465.6b in April, with exports rising to 13.5% from 8.3%. The Nikkei 225 rose 0.24% while the Topix Index increased by 0.44%, driven by expectations of US interest rate cuts. Toyota Motor Corp. contributed significantly to the gains. Semiconductor-related stocks also advanced following Nvidia's performance in the US market.

- South Korean stocks opened higher with tech stocks leading the gains, Samsung Electronics up 1.6% and SK Hynix climbing 1.3%, following Nvidia's surge. Auto stocks like Hyundai Motor also performed well. However, some transport and energy stocks, such as Korean Air and Korea Gas saw declines. Foreign investors have been buyers of local stocks so far this morning, with majority of the flows heading into tech names. The Kospi is 0.96% higher, while the Kosdaq is unchanged.

- Taiwan equities are higher today, there has been very little in the way of local headlines. The market is being led higher by semiconductor stocks, TSMC in particular which is up 1.91%. The Taiex is up 0.166%.

- Australian equities are lower today, with financial stocks leading the decline. Commonwealth Bank of Australia and Helia Group Ltd. contributed significantly to the losses. Headlines have been limited in the region today while the data calendar is empty for the remainder of the week. The ASX200 is down 0.22%

- Elsewhere, New Zealand equities are 0.66% lower, Philippines equities are 0.05% higher, Singapore equities are up 0.40%, Indonesia returned from a holiday with the JCI up 0.60%, Indian equities are little changed, while Malaysian equities are 0.20% lower.

ASIA STOCKS: China & HK Equities Mixed As Tech Rallies, Regulatory Developments

Hong Kong and China equities had a mixed performance today, influenced by positive momentum from Wall Street and regulatory developments in China, while concerns over delistings and economic indicators weighed on sentiment. Overall, tech and semiconductor stocks provided a boost, but regulatory pressures and mixed economic data continued to cast a shadow over the broader market sentiment.

- Hong Kong equities, with the HSI up 1.95%, driven by positive sentiment from Wall Street and hopes for US interest rate cuts. The HSTech Index is 1.96%, the Mainland Property Index increased by 2.03%, and the HS Property Index was up by 2.13%.

- China Onshore equities are mostly lower today with small-cap indices the CSI 1000 down by 0.94% and the CSI 2000 down by 0.30%, while the broader CSI 300 Index fell by 0.42%, and the CSI 300 Real Estate Index decreased by 1.00%.

- China has tightened oversight of listed companies, setting higher standards and stricter delisting rules to enhance market quality and protect investor rights. A nine-point guideline aims to improve corporate governance and transparency. Additionally, China launched a $47.5 billion semiconductor investment fund to bolster its domestic chip industry and counteract US-led export controls.

- US lawmakers are proposing a bipartisan bill to prevent companies that receive federal chipmaking funds from using Chinese-made equipment at government-backed factories. This bill aims to limit Beijing’s influence on domestic chip production and would apply only to US facilities funded by the 2022 Chips and Science Act, not to overseas operations.

- Looking ahead, focus will turn to China's 1yr & 5yr LPR and Hong Kong Unemployment Rate on Thursday

FOREX: G10 In Narrow Ranges, IDR Stronger Ahead Of BI Meeting

G10 currencies have generally been in narrow ranges during APAC trading today with the USD BBDXY unchanged as there have been few drivers. The largest mover has been kiwi with NZD down 0.2% to 0.6132, close to the intraday low.

- AUDUSD is off its intraday high of 0.6669 but is still 0.1% higher at 0.6662 supported by generally positive equity sentiment in the region. AUDNZD has continued to climb and is up 0.3% to 1.0864.

- USDJPY is flat at 157.85 after trading between 157.73/157.92. Tuesday’s BoJ comments that a July rate hike is possible have been unable to strengthen the yen.

- EURUSD and GBPUSD are slightly lower at 1.0736 and 1.2706 respectively.

- CNY fixing was 69pips tighter than yesterday and the lowest in around two weeks. USDCNH is off its intraday low of 7.2698 to be slightly higher at 7.2748 after the PBoC’s Pan said that the stronger greenback gave China more monetary policy flexibility.

- USDIDR is down 0.2% to 16370 after holidays. The move lower is important as Bank Indonesia meets on Thursday and if rupiah depreciates into the meeting, there would be a material risk of another rate hike (see MNI BI Preview).

- USDTHB is down 0.3% to 36.72 despite PM Srettha saying that the FY25 deficit is necessary to boost the economy and that fiscal and monetary policy should be aligned.

- The US is closed today. UK May PPI/CPI and euro area Q1 current account print.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/06/2024 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/06/2024 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/06/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 19/06/2024 | 0800/1000 | ** |  | EU | Current Account |

| 19/06/2024 | 0900/1100 | ** |  | EU | Construction Production |

| 19/06/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/06/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 19/06/2024 | 1730/1330 |  | CA | BOC Minutes (Summary of Deliberations) | |

| 20/06/2024 | 2245/1045 | *** |  | NZ | GDP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.