-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Equity Losses Continue, USD Pushes Higher

EXECUTIVE SUMMARY

- BIDEN SET TO SPEAK WITH CHINA’S TOP DIPLOMAT WANG YI ON FRIDAY, SOURCES SAY - RTRS

- FORD. UAW REACH TENTATIVE DEAL TO END STRIKE INCLUDING RECORD PAY RAISE - RTRS

- ECB’s LAGARDE SAYS FIGHT AGAINST INFLATION ISN’T OVER YET - BBG

- FORECASTS TO CHANGE, POLICY IMPACT UNCLEAR - RBA - MNI BRIEF

- JAPAN SEPT SERVICES PPI RISES 2.1% VS. AUG 2.1% - MNI BRIEF

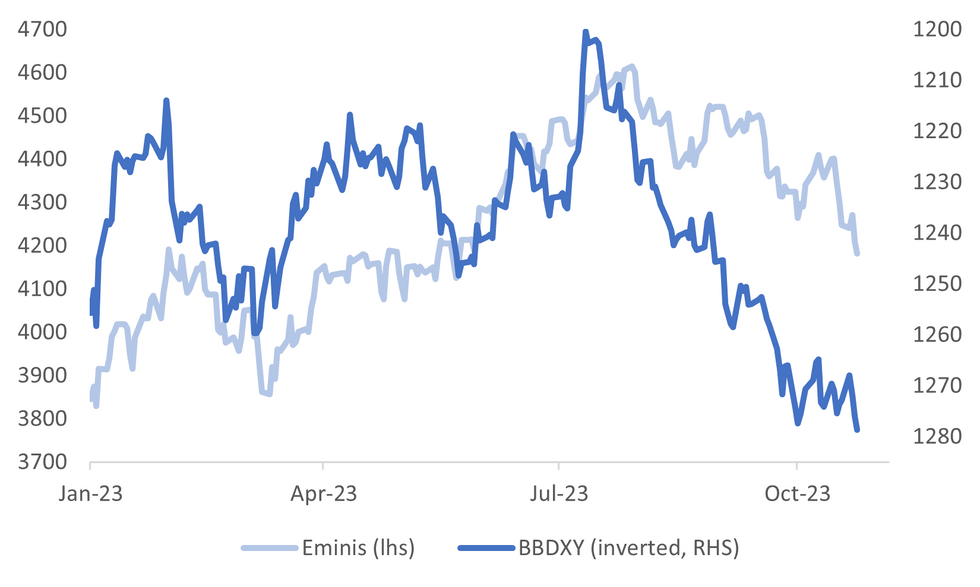

Fig. 1: US Eminis & BBDXY Dollar Index (Inverted)

Source: MNI - Market News/Bloomberg

EUROPE

ECB (BBG): European Central Bank President Christine Lagarde said the battle to tame consumer-price gains isn’t over, but she has confidence they can be returned to 2%.

EU/ISRAEL (BBC): EU leaders meet in Brussels on Thursday for a summit overshadowed by Hamas's war with Israel and the EU's failure to project a united front.

FRANCE (POLITCO): French President Emmanuel Macron said France is sending a navy ship to “support” hospitals in the Gaza Strip, which are struggling to function due to the lack of fuel and medical supplies.

EU/EGYPT (POLITICO): The European Commission is pushing a deal to provide aid to Egypt as concerns grow over the potential fallout from the Israel-Hamas war.

U.S.

WAGES (RTRS): Ford Motor (F.N) and United Auto Workers (UAW) union negotiators reached a tentative labor deal after a six-week strike, UAW President Shawn Fain and the automaker said on Wednesday, agreeing a 4-1/2-year contract with a record pay boost.

US/CHINA (RTRS): President Joe Biden is expected to speak with Wang Yi when China's top diplomat visits the White House this week, according to two U.S. officials familiar with planning for the visit.

CORPORATE (BBG): Meta Platforms Inc. dashed investors’ hopes for a long-term advertising recovery, saying it was at the whim of an uncertain economic environment, even as the company plans to spend heavily on newer businesses including virtual reality and artificial intelligence. Shares fell in extended trading.

OTHER

ISRAEL (AFP): Prime Minister Benjamin Netanyahu said Wednesday that Israel is readying a ground war in Gaza, pressing ahead with plans that have troubled allies and threaten to worsen an already cascading humanitarian crisis.

MIDEAST (RTRS): Russia and China on Wednesday vetoed a U.S. push for the United Nations Security Council to act on the Israel-Hamas conflict by calling for pauses in fighting to allow humanitarian aid access, the protection of civilians and a stop to arming Hamas and other militants in the Gaza Strip.JAPAN (MNI BRIEF): Japan's services producer price index rose 2.1% y/y in September, marking the 31st straight rise following August's 2.1% gain, showing that pass-through of cost increases continued, preliminary data released by the Bank of Japan on Monday showed.

JAPAN (RTRS): The Bank of Japan will end its negative interest rate policy next year, according to nearly two-thirds of economists in a Reuters poll, with more now saying the central bank is inching closer to phasing out ultra-accommodative monetary policy.

AUSTRALIA (MNI BRIEF): The Reserve Bank of Australia will change its economic forecasts following recent elevated quarterly and monthly inflation prints, but it is unclear whether this will materially impact monetary policy, Governor Michele Bullock told a senate committee Thursday.

AUSTRALIA (RTRS): Economists at Westpac now expect Australian interest rates to rise further in November, the latest bank to change its steady outlook following surprisingly high inflation figures.

NEW ZEALAND (BBG): New Zealand banks might experience defaults on 16% of their lending to dairy farms if an unprecedented, two-year drought hit the rural economy, according to the results of a central bank stress test.

HONG KONG (Shanghai Securities News): Hong Kong will cut the stamp duty on stock transactions to 0.1% from 0.13%, Chief Executive John Lee Ka-chiu said in his annual policy address on Wednesday. A 10bp cut on stamp duty will help increase the spot market trading volume by about 10-12%, according to a research note by Goldman Sachs.

PHILIPPINES (STAR/BBG): The Philippines has informed Chinese Ambassador Huang Xilian that the government is withdrawing its request for China to finance the first phase of its Mindanao railway project worth 83b pesos, Philippine Star reports, citing a letter from the Department of Finance.

CHINA

PROPERTY (WSJ): With China's property bust threatening to sink the country's economic recovery, Xi Jinping is looking for someone to blame. After putting the billionaire founder of Evergrande, a heavily indebted property firm, under investigation for possible crimes, Beijing is expanding its probes to include bankers and financial institutions that facilitated developers' risky behavior, people familiar with the matter say.

EQUITIES (SECURITIES DAILY/BBG): Stock repurchases in the A-share market have reached 63 billion yuan ($8.6 billion) in total so far this year, signaling listed firms’ confidence in their growth outlook, Securities Daily says in a report Thursday.

COMMODITIES (BBG): Chinese coal prices are falling as winter nears, offering relief to power plants that buy the fuel and reducing the chances of another round of debilitating power crunches.

FISCAL ( 21st Century Business Herald): China’s 2024 budget deficit-to-GDP ratio may also break through the 3% red line, after the issuance of CNY1 trillion of China Government Bonds pushing this year’s deficit ratio to 3.8% from the 3% set in March. A 3-3.5% deficit ratio may be enough, if policymakers set the 2024 growth target about 5%, said Zhang Yu, chief macro analyst at Huachuang Securities.

INFRASTRUCTURE (YICAI): China will begin several major water conservancy projects in Q4, according to Chen Min, vice minister of water resources. At a press conference Chen said the Ministry of Water Resources will focus on post-disaster reconstruction and ensure 2023 investment in water conservancy exceeds 2022 levels. (Source: Yicai)

CHINA MARKETS

MNI: PBOC Injects Net CNY80 Bln Via OMO Thur; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY424 billion via 7-day reverse repo on Thursday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY80 billion after offsetting the maturity of CNY344 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9001% at 09:26 am local time from the close of 2.0602% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 39 on Wednesday, the same as the close on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1784 Thursday vs 7.1785 Wednesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1784 on Thursday, compared with 7.1785 set on Wednesday. The fixing was estimated at 7.3206 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA NOV BUSINESS SURVEY NON-MANUFACTURING 69; PRIOR 77

SOUTH KOREA NOV BUSINESS SURVEY MANUFACTURING 69; PRIOR 67

SOUTH KOREA Q3 GDP Q/Q 0.6%; MEDIAN 0.5%; PRIOR 0.6%

SOUTH KOREA Q3 GDP Y/Y 1.4%; MEDIAN 1.1%; PRIOR 0.9%

JAPAN SEP PPI SERVICES Y/Y 2.1%; MEDIAN 2.0%; PRIOR 2.1%

AUSTRALIA Q3 IMPORT PRICE INDEX 0.8%; MEDIAN 0.1%; PRIOR -0.8%

AUSTRALIA Q3 EXPORT PRICE INDEX -3.1%; MEDIAN -3.0%; PRIOR -8.5%

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 105-20+, -0-01, a 0-06 range has been observed on volume of ~105k. Technically TY trend condition is bearish, support comes in at 105-10+ the Oct 19 low and bear trigger.

- Cash tsys sit 1bp richer to 1bp cheaper across the major benchmarks, light twist steepening is apparent.

- Tsys have observed narrow ranges in Asia with little follow through on moves.

- A retreat from early session highs was seen as US Equity futures extended losses. TY saw support ahead of yesterday's lows and the early range persisted.

- The latest monetary policy decision from the ECB provides the highlight in the European session today. Further out we have US wholesale inventories, GDP, US durable goods, initial jobless claims and pending home sales. We also have the latest 7-Year Supply.

JGBS: Futures At Session Lows, Fresh Cycle High For 10YY

In the Tokyo afternoon session, JGB futures are weaker and at session lows, -47 compared to settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined PPI services and international investment flow data. Later, the docket shows Machine Tool Orders (final) for September.

- Bloomberg reported that Daiwa Securities believed the BOJ needed to review its “exceptional” policy of buying corporate bonds at the first opportunity. It is problematic that the bond purchase program, which started in response to the 2008 global financial crisis, hasn’t been discussed much, said Toshiyasu Ohashi, chief credit analyst at Daiwa, one of the top arrangers of corporate bonds in Japan. (See link)

- Cash JGBs are cheaper out to the 20-year, with the belly of the curve underperforming. The benchmark 10-year yield is 3.2bps higher at 0.891%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also a fresh cycle high.

- The swaps curve has twist-steepened, pivoting at the 2s, with rates 0.1bp lower to 2.3bps higher. Swap spreads are tighter out the 10-year and wider beyond.

- Tomorrow, the local calendar sees Tokyo CPI and BOJ Rinban operations covering 3- to 25-year+ JGBs.

AUSSIE BONDS: Holding Cheaper, Near Session Lows, Q3 PPI & Sep-26 Supply Tomorrow

ACGBs (YM -7.0 & XM -14.0) are sharply weaker and near Sydney session lows. With the data calendar being relatively light today, the focus was on RBA Governor Bullock’s appearance before the Senate Economics Committee. Unfortunately, for a market that was looking for clues on the outlook for policy following yesterday’s higher-than-expected CPI data, Bullock didn’t give anything away regarding the likely outcome of the November 7 meeting. She said the bank’s forecasts will be altered in November but it’s too early to say whether there will be a “material” change in the inflation outlook and thus the return to target.

- Cash US tsys' twist-steepening in today’s Asia-Pac session, pivoting at the 10s, also likely weighed on longer-dated ACGBs.

- Cash ACGBs are 6-14bps cheaper on the day, with the AU-US 10-year yield differential 6bps higher at -10bps.

- The swaps curve has bear-steepened, with rates 5-13bps higher.

- The bills strip has twist-steepened, with pricing +2 to -7.

- RBA-dated OIS pricing is flat to 4bps softer across meetings, but remains 6-12bps firmer from pre-CPI levels.

- Tomorrow, the local calendar shows Q3 PPI data.

- Tomorrow, the AOFM plans to sell A$800mn of the 0.50% 21 September 2026 bond.

- Fitch Ratings has affirmed the 'AAA' Ratings for NSW and TCorp. The Outlook is Stable.

NZGBS: Bear Steepening, Tracking Tsys, ECB Expected To Hold Policy Steady

NZGBs closed 1-8bps cheaper, with the 2/10 curve steeper. NZGBs traded in relatively narrow ranges during the local session after gapping cheaper at the open following US tsys' weak lead-in.

- In the realm of weekly supply, demand metrics were rather lacklustre, with cover ratios for the various lines falling in the range of 2.6 to 2.9 times.

- With the local data calendar light again today, local participants have likely taken their directional cues from US tsy dealings in the Asia-Pac session. Cash US tsys have twist-steepened, pivoting at the 10s, with yield movement bounded by +/-1.5bps.

- Swap rates closed 6-11bps higher, with the 2s10s curve steeper and implied swaps spreads wider.

- RBNZ dated OIS pricing closed slightly firmer across meetings, with terminal OCR expectations at 5.61%.

- Tomorrow, the local calendar sees ANZ Consumer Confidence.

- Later today, the ECB is widely expected to hold policy steady at 4%. Even though the Eurozone economy is at risk of a potential recession and facing a downside skew in terms of risks, the ECB is unlikely to waver and will likely reiterate the necessity of maintaining restrictive measures.

- Further out, we have US wholesale inventories, GDP, durable goods, initial jobless claims and pending home sales. There is also 7-year supply.

FOREX: AUD Breaks Bear Trigger

AUD/USD has been pressured in today's Asian session, the pair has broken $0.6286, low from Oct 3/13 and bear trigger. AUD was pressured after RBA Gov Bullock's senate testimony, extending losses as US Equity futures ticked lower through the session.

- AUD/USD sits at $0.6275/80 down ~0.5% today. The next support level is $0.6215, 2.236 proj of Jun 16-Jun 29-Jul 13 price swing.

- Kiwi is also pressured, NZD/USD printed a fresh 2023 low today before marginally paring losses in recent trade. NZD/USD is down ~0.4% and last prints at $0.5775/80.

- USD/JPY has ticked higher and breached ¥150.40, 2.618 projection of the Jan16-Mar 8-Mar 24 price swing. The next target for bulls is ¥151.09, 2.764 projection of the Jan16-Mar 8-Mar 24 price swing.

- Elsewhere in G-10 EUR and GBP are reflecting the broader USD move and are down ~0.2%. The Scandies are pressured however liquidity is generally poor in Asia./

- Cross asset wise; BBDXY is up ~0.2% and e-minis are ~0.6% lower. US Tsy Yields are little changed across the curve.

- The latest monetary policy decision from the ECB provides the highlight in the European session today.

EQUITIES: Broad Based Weakness As Tech Earning Fear/Higher US Yields Weigh

Regional equity sentiment has faltered sharply in Thursday trade to date. This follows sharp US losses in Wednesday trade, particularly in the tech space. These trends have continued today, with US Nasdaq futures down sharply, off over 1%. Eminis are also weaker, down 0.65% at this stage. Weakness in Meta, which highlighted an uncertain economic backdrop and its impact on the AI sector, has weighed (see this BBG link). Elevated US yields remains the other headwind.

- Not surprisingly, tech sensitive bourses have seen the largest percentage losses. The South Korean Kospi is off 2.23%. Offshore investors have sold local shares, although institutional and retail investors have been buyers.

- The Topix is off nearly 1.40%, with Toyota losses dragging the index down. The Taiex is down by 1.5%, following a sharp loss for the SOX in Wednesday US trade.

- Losses are more modest for Hong Kong and mainland China shares. At the break the HSI is down by around 0.55%, with the CSI 300 off by the same amount. For the HSI this offsets yesterday's gain, which was aided in part by Hong Kong Executive efforts to aid the property market and boost stock trading.

- In SEA all markets are weaker, with Indonesia's JCI the worst performer, down 1.6%. Thailand and Philippine stocks are also off by a little over 1%.

OIL: Crude Range Trading While Watching And Waiting

Crude has held onto most of Wednesday’s gains during today’s APAC session. After rising around 2% prices are down around 0.3% today. Brent is down to $89.87/bbl, close to the intraday low of $89.78 after rising to $90.33 early in the session. WTI is at $85.22, close to the low of $85.08, after a high of $85.59. The stronger dollar has weighed on prices with the USD index +0.2%.

- The market remains nervous re events in the Middle East after Israeli PM Netanyahu said there would still be a Gaza ground offensive. Such a move could see the conflict spread outside of Israel/Gaza and world leaders are trying to change Netanyahu’s mind.

- Events in the Middle East have added a “war premium” to crude but Bloomberg is reporting that physical prices are easing as refiners reduce gasoline production ahead of the northern hemisphere winter.

- Later Fed’s Waller gives opening remarks and in terms of data there is Q3 GDP which is expected to be strong, September durable orders and jobless claims. The ECB meets and is expected to leave rates unchanged (see MNI ECB Preview). The decision will be followed by President Lagarde’s press conference.

GOLD: Extends Wednesday’s Gain In Asia-Pac Dealings

Gold is +0.2% in the Asia-Pac session, after closing +0.4% at $1979.72 on Wednesday following headlines that Israeli PM Benjamin Netanyahu suggested that a ground invasion will be conducted and a report that the US was deploying missiles in the region.

- Wednesday’s move in bullion came despite gains in the USD and Treasury yields.

- The rise in the USD and yields were fueled by unexpectedly robust data on new home sales, which added to concerns that the ongoing strength of the US economy will keep a Fed rate hike on the agenda later in the year or early 2024. It has also added to expectations of a significant increase in Q3 GDP later today.

- Weakness in US Treasuries was also driven by expectations of next week's announcements regarding larger auction sizes, coupled with lacklustre demand metrics witnessed at the US$52bn 5-year note auction.

- Higher yields are typically negative for non-interest-bearing gold.

- According to MNI’s technicals team, yesterday’s gain maintains the yellow metal’s bullish outlook. It was also a step closer to resistance at $1997.2 (Oct 20 high).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/10/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 26/10/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 26/10/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 26/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/10/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 26/10/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/10/2023 | 1230/0830 | *** |  | US | GDP |

| 26/10/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/10/2023 | 1245/1445 |  | EU | Press conference post- governing council meeting of ECB | |

| 26/10/2023 | 1300/0900 |  | US | Fed Governor Christopher Waller | |

| 26/10/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 26/10/2023 | 1415/1615 |  | EU | ECB's Lagarde presents monetary policy decisions via Podcast | |

| 26/10/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 26/10/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 26/10/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/10/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/10/2023 | 1645/1745 |  | UK | BoE's Cunliffe Speaks at Fed Conference | |

| 26/10/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.