-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: EUR/USD Eyes 100-DMA Ahead Of ECB

EXECUTIVE SUMMARY

- RISHI SUNAK RECONSIDERS TAX RISES AS BUDGET DELAY SAVES GBP15BN (Telegraph)

- MACRON TO UNVEIL NEW ENERGY PRICE AID FOR COMPANIES FRIDAY (BBG)

- U.S. SPEEDS UP PLANS TO STORE UPGRADED NUKES IN EUROPE (POLITICO)

- BIDEN TEAM REWORKS PLAN FOR RUSSIA OIL-PRICE CAP AS MARKETS SOUR (BBG)

- IEA: RUSSIA CRISIS HERALDS TURNING POINT FOR GLOBAL ENERGY (BBG)

- E-MINIS ADVANCE DESPITE META’S POST-MARKET SLUMP, KOSPI FIRMS DESPITE WEAK PROFITS REPORT FROM SAMSUNG

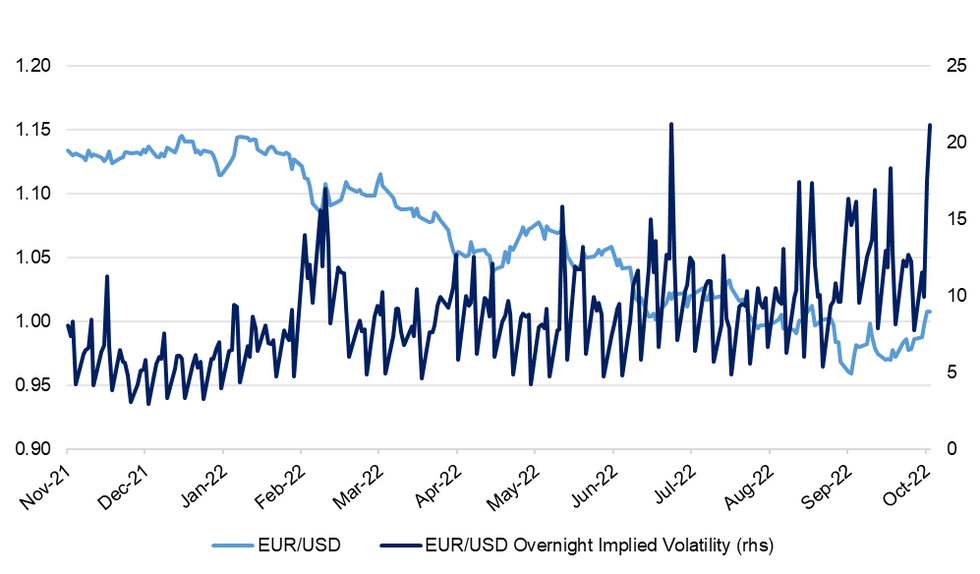

Fig. 1: EUR/USD vs. EUR/USD Overnight Implied Volatility

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: UK chancellor Jeremy Hunt has delayed the date for his long-awaited debt-cutting plan from October 31 to November 17, as calmer markets gave the government some economic breathing space. (FT)

FISCAL: Rishi Sunak is reconsidering tax rises and major public spending cuts after a dramatic improvement in the state of the nation’s finances. An analysis to be published on Thursday shows that the fortnight delay is expected to shrink the size of the black hole in the public finances by up to £15 billion. (Telegraph)

POLITICS: Rishi Sunak has dismantled what was left of Liz Truss’s legacy on his first full day as prime minister, abandoning fracking and refusing to guarantee the pensions triple lock or a defence spending rise. (Guardian)

POLITICS: Rishi Sunak’s decision to reappoint Suella Braverman six days after she was forced to resign for a security breach is facing fresh questions after a former Conservative minister claimed the home secretary was responsible for “multiple breaches of the ministerial code”. (Guardian)

NORTHERN IRELAND: Northern Ireland’s secretary of state on Wednesday made a last-ditch effort to avert an assembly election before Christmas following months of political deadlock. (FT)

EUROPE

EU/UK: European Commission President Ursula von der Leyen said on Wednesday she spoke with new British Prime Minister Rishi Sunak and is looking forward to working on issues such as Russia’s war on Ukraine and climate change. (RTRS)

GERMANY/FRANCE: French president Emmanuel Macron and German chancellor Olaf Scholz sought to put tensions behind them during a three-hour meeting at which they discussed energy, defence and the geopolitical challenges raised by the war in Ukraine. (FT)

FRANCE: President Emmanuel Macron said his government would unveil measures to shield more companies from rising electricity prices on Friday. (BBG)

FRANCE: French President Emmanuel Macron vowed Wednesday to implement a pension reform that would eventually push up the retirement age by three years to 65, making younger generations work longer. (AP)

FRANCE: Emmanuel Macron called for a "Buy European Act" on Wednesday to protect carmakers on the Continent in the face of competition from China and in response to the United States' own controversial scheme to incentivize domestic production. (POLITICO)

UKRAINE: Ukrainian troops are holding out against repeated attacks by Russian forces in two eastern towns while those at the southern front are poised to battle for the strategic Kherson region, which Russia appears to be reinforcing. (RTRS)

U.S.

ECONOMY: The average interest rate on the most popular U.S. home loan rose to its highest level since 2001 as tightening financial conditions weigh on the housing sector, data from the Mortgage Bankers Association (MBA) showed on Wednesday. (RTRS)

EQUITIES: Elon Musk told Twitter Inc. employees on Wednesday that he doesn’t plan to cut 75% of the staff when he takes over the company, according to people familiar with the matter. (BBG)

EQUITIES: Meta reported a deepening slowdown and warned that fourth-quarter revenues could come in lower than expected, as Big Tech groups continue to face a reckoning from a brutal digital advertising slump and tough macroeconomic conditions. (FT)

EQUITIES: Seagate Technology Holdings said in a filing on Wednesday the U.S. government has warned the company that it may have violated export control laws by providing hard disk drives to a customer that a source familiar with the situation identified as Huawei Technologies. (RTRS)

OTHER

U.S./CHINA: President Xi Jinping said China is willing to work with the United States to find ways to get along to the benefit of both, state broadcaster CCTV reported on Thursday. (RTRS)

GEOPOLITICS: The United States has accelerated the fielding of a more accurate version of its mainstay nuclear bomb to NATO bases in Europe, according to a U.S. diplomatic cable and two people familiar with the issue. (POLITICO)

NATO: Sweden’s new prime minister, who’s trying to persuade Turkey to ratify the Nordic country’s accession to NATO, said he held a “constructive” phone call with President Recep Tayyip Erdogan. (BBG)

BOJ: MNI POLICY: BOJ Sees Yen's Direction Steered By Fed Outlook (MNI)

JAPAN: Policymakers are still in the decision making process for its latest economic stimulus package, Japanese Finance Minister Shunichi Suzuki told reporters on Thursday. (BBG)

RBNZ: There's rising tension globally between monetary policy aimed at low and stable inflation, and governments’ longer-term fiscal priorities, Reserve Bank (RBNZ) Governor Adrian Orr says. (interest.co.nz)

SOUTH KOREA: President Yoon Suk-yeol said Thursday that he wishes to give hope to the people by outlining policies to revive the economy and boost exports in a nationally televised government meeting set for later in the day. (Yonhap)

SOUTH KOREA: The Bank of Korea (BOK) said Thursday that it has decided to include bank debentures and debt issued by nine state-run companies on a list of collateral it accepts for making loans in the latest move to inject liquidity and ease jitters over a credit crunch. (Yonhap)

SOUTH KOREA: Samsung Electronics Co Ltd reported a 31% drop in third-quarter profit on Thursday and said geopolitical uncertainties are likely to dampen demand until early 2023, as the global economic downturn slashed appetite for electronic devices. (RTRS)

NORTH KOREA: More than three quarters of North Korea's missile tests conducted since 1984 were deemed to be successful, data showed Thursday, in an apparent sign of progress in Pyongyang's relentless push for advanced weapons systems. (Yonhap)

SINGAPORE: Singapore is headed for a troubling year in which economic growth will slow while inflation will remain elevated, in part because wage increases are expected to continue. (Straits Times)

CANADA: Secretary of State Antony Blinken will land in Ottawa Thursday for a two-day visit ahead of next week’s G-7 foreign ministers meeting in Germany. (POLITICO)

BRAZIL: Brazil’s presidential race is still tightening according to a new opinion poll that takes into account voters most likely to show up on election day. (BBG)

BRAZIL: Brazil’s central bank held its key interest rate steady for the second straight meeting, warning inflation is still running high and that the global outlook remains volatile. (BBG)

RUSSIA: Vladimir Putin on Wednesday oversaw Russia’s first nuclear exercises since the beginning of the war as he endorsed the baseless claim that Ukraine is preparing a “dirty bomb”. (Telegraph)

IRAN: The US has soured on the possibility of resuming fruitful talks with Iran over reviving the 2015 nuclear deal, and is disappointed and angry at Tehran over its approach to the moribund negotiations, a senior Israeli official said on Wednesday. (Times of Israel)

ENERGY: Russia’s invasion of Ukraine heralds a tipping point for global energy markets that will shrink Moscow’s influence and hasten the transition to renewables, the International Energy Agency said. (BBG)

OIL: US officials have been forced to scale back a plan to impose a cap on Russian oil prices, following skepticism by investors and growing risk in financial markets brought on by crude volatility and central bank efforts to tame inflation. (BBG)

CHINA

ECONOMY: China should focus on returning economic growth back to pre-pandemic levels in the next five years and keep growth within a reasonable range to avoid economic and financial risks, China Newsweek reported citing Yang Weimin, deputy director of the Economic Committee of the National Committee of the Chinese People's Political Consultative Conference. China’s GDP grew at an average annual rate of 6.6% from 2013 to 2021, while the average growth in the past two years was 5.1%, nearly 1 percentage point lower than the pre-pandemic level, Yang was cited as saying. Yang noted that a growth rate matching the country’s potential growth rate of around 5.5% is a reasonable growth. (MNI)

PROPERTY: Some private property developers are expected to receive a second round of credit enhancement to support continued debt issuance, the China Securities Journal reported. Some non-leading private developers are working with China Bond Insurance Co Ltd, indicating that regulatory authorities are expanding the scope of financing support, the newspaper said citing Liu Shui, a research head at the China Index Academy. A peak in debt repayments is coming with the maturing of bonds issued by 200 core developers reaching CNY181.2 billion in Q4, among which overseas debt accounts for about CNY61.7 billion, the newspaper said citing data from China Real Estate Information Corporation. (MNI)

YUAN: The sharp rise in the yuan against the U.S. dollar retraced some of the currency's excessive depreciation this week, helped by a fall in the U.S. Dollar Index, the 21st Century Business Herald reported after both the onshore and offshore yuan strengthened over 1,000 points on Wednesday. Many asset management institutions view the yuan as undervalued against the dollar, which had rallied on expectations the Federal Reserve would continue to hike rates but which have now been questioned by weak U.S. economic data, the newspaper said. The yuan will continue to fluctuate in a wide range amid changing expectations, the newspaper said citing analysts. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY238BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) on Thursday injected CNY240 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY238 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0195% at 9:30 am local time from the close of 2.0226% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 48 on Wednesday vs 49 on Tuesday

PBOC SETS YUAN CENTRAL PARITY AT 7.1570 THURS VS 7.1638

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1570 on Thursday, compared with 7.1638 set on Wednesday

OVERNIGHT DATA

CHINA SEP INDUSTRIAL PROFITS YTD -2.3% Y/Y; AUG -2.1%

AUSTRALIA Q3 EXPORT PRICE INDEX -3.6% Q/Q; MEDIAN -7.0%; Q2 +10.1%

AUSTRALIA Q3 IMPORT PRICE INDEX +3.0% Q/Q; MEDIAN +0.9%; Q2 +4.3%

SOUTH KOREA Q3, A GDP +3.1% Y/Y; MEDIAN +3.0%; Q2 +2.9%

SOUTH KOREA Q3, A GDP +0.3% Q/Q; MEDIAN +0.3%; Q2 +0.7%

MARKETS

SNAPSHOT: EUR/USD Eyes 100-DMA Ahead Of ECB

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 65.93 points at 27366.76

- ASX 200 up 34.233 points at 6845.1

- Shanghai Comp. down 16.407 points at 2983.097

- JGB 10-Yr future up 31 ticks at 148.63, yield up 0.3bp at 0.256%

- Aussie 10-Yr future up 7 ticks at 96.135, yield down 8.3bp at 3.835%

- U.S. 10-Yr future -0-01+ at 111-01+, yield up 0.65bp at 4.009%

- WTI crude up $0.17 at $88.08, Gold up $2.25 at $1666.82

- USD/JPY down 102 pips at Y145.34

- RISHI SUNAK RECONSIDERS TAX RISES AS BUDGET DELAY SAVES GBP15BN (Telegraph)

- MACRON TO UNVEIL NEW ENERGY PRICE AID FOR COMPANIES FRIDAY (BBG)

- U.S. SPEEDS UP PLANS TO STORE UPGRADED NUKES IN EUROPE (POLITICO)

- BIDEN TEAM REWORKS PLAN FOR RUSSIA OIL-PRICE CAP AS MARKETS SOUR (BBG)

- IEA: RUSSIA CRISIS HERALDS TURNING POINT FOR GLOBAL ENERGY (BBG)

- E-MINIS ADVANCE DESPITE META’S POST-MARKET SLUMP, KOSPI FIRMS DESPITE WEAK PROFITS REPORT FROM SAMSUNG

US TSYS: T-Notes Slip Amid Bid In E-Minis, Fed Musings Take Centre Stage

The debate on Fed tightening outlook dominated, after a surprise downshift in the BoC's rate-hike pace fuelled speculation that U.S. policymakers could follow suit sooner than had been expected. A slew of weak earnings reports from big U.S. tech names and unimpressive data outturns earlier this week helped this narrative gain some more traction. Another 75bp rate rise at the next FOMC meeting remains fully priced in, but hawkish bets for the subsequent meetings have moderated over the past week.

- A positive showing from U.S. e-minis kept a lid on core FI. Continued rally in the Hang Seng and resilience in South Korean stock indices lent further support to sentiment, even as equity indices in Japan and mainland China traded narrowly in the red.

- T-Notes ground higher but struggled to penetrate 111-05 on several attempts and eased off into negative territory. The contract last deals -0-02+ at 111-00+. Eurodollars trade 1.0-2.0 ticks lower through the reds.

- Cash Tsy curve runs marginally steeper at typing, with yields last seen 1.1-2.1bp cheaper. The spread on 5-Year/30-Year Tsys remained in inversion territory, despite moving towards the breakeven level through the session.

- Advance Q3 GDP data will provide another key input to the ongoing debate on Fed tightening trajectory. Other data highlights include durable goods and initial jobless claims. The Treasury will auction $35bnworth of 7-Year notes.

JGBS: Confidence In BoJ Dovish Resolve Supports JGBs, But Spillover From Offshore Bites Into Gains

Benchmark JGB futures went bid from the off after Wednesday's boost to the sizes of BoJ bond-purchase operations across the 10-25 & 25+ Year baskets reinforced expectations that the central bank will stick with its ultra-loose monetary policy settings tomorrow. The contract for December delivery climbed to a session high of 148.75, before easing off into the Tokyo lunch break and extending its pullback thereafter. It last operates at 148.59, up 27 ticks versus prior settlement.

- Fresh pressure to JGB futures likely came from other core FI markets, with U.S. Tsy yields pausing recent declines. Resilience in e-mini futures and several major equity markets (albeit not in Japan) may have helped sap strength from core FI.

- Cash JGB yields are lower across the curve, save for 10s, which remain in the vicinity of the BoJ's 0.25% ceiling. 20s comfortably outperform, while 2s are strongest in the short end, aided by an auction of Nov '24 Notes today.

- 2-Year JGBs advanced after an auction of that tenor. The tail remained unchanged from the previous offering and the bid/cover ratio fell to 4.16x (prev. 4.78x), but the low price was higher than forecast in a BBG dealer poll. The yield on 2-Year JGBs remains under scrutiny after if flirted with positive territory last Friday.

- The widely watched Japan 10-Year swap rates extended the retreat from cyclical highs printed a few days back, reducing their premium to 10-Year JGB yield.

JGBS AUCTION: 2-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.2704tn 2-Year JGBs:

- Average Yield -0.031% (prev. -0.046%)

- Average Price 100.074 (prev. 100.103)

- High Yield: -0.027% (prev. -0.042%)

- Low Price 100.065 (prev. 100.095)

- % Allotted At High Yield: 41.4205% (prev. 3.2510%)

- Bid/Cover: 4.155x (prev. 4.779x)

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.8643tn 3-Month Bills:

- Average Yield -0.1381% (prev. -0.1492%)

- Average Price 100.0371 (prev. 100.0401)

- High Yield: -0.1265% (prev. -0.1358%)

- Low Price 100.0340 (prev. 100.0365)

- % Allotted At High Yield: 53.2362% (prev. 33.2481%)

- Bid/Cover: 2.576x (prev. 3.036x)

AUSSIE BONDS: ACGBs Pare Initial Gains, Tweak To Westpac RBA Call Provokes Knee-Jerk Reaction

Aussie bonds trimmed their initial gains, as the broader core FI space came under pressure, while hawkish RBA expectations sharpened at the margin.

- U.S. e-minis operated in the green, while Asia-Pac equity benchmarks outside of China and Japan firmed. The combination of the BoC's unexpected shift to a slower pace of rate hikes, weaker-than-forecast U.S. data outturns from earlier this week and underwhelming earnings reports from some U.S. tech giants lent credence to the narrative suggesting that the Fed could soon pivot to less aggressive tightening.

- ACGBs briefly ticked lower in a knee-jerk reaction to Westpac's updated RBA call. The bank now sees a 50bp cash rate target hike next week and a terminal rate of 3.85%. The tweak to his forecast came after a number of sell-side desks lifted their peak rate estimates in reaction to expectation-beating CPI report Wednesday, though the dominant view remains that we will see a 25bp move next week.

- Overhang impetus helped push Aussie bond futures to session highs in morning trade, before they slowly unwound gains; YM last sits +7.0 & XM +5.0. Bills run unch. to +11 ticks through the reds. Cash ACGB curve runs steeper and sits lower, albeit off early session lows.

EQUITIES: China Rebound Stalls, Mixed Performances Elsewhere

Asia Pac equities have been mixed, with the onshore China market rebound stalling, while HK stocks continue to recover. US futures have stayed in positive territory for much of the session (0.30-0.60% ranges), following cash losses overnight, particularly in the tech sector.

- Mainland China indices are modestly lower at this stage, the CSI 300 off 0.1%. September industrial profits fell YTD y/y by 2.3%, with weakness fairly broad based. Wuhan has also locked down parts of the city amid fresh covid cases. It's expected the lockdown will last until Sunday. President Xi did state that China is willing to find ways to get along with the US.

- In contrast, the HSI is up around 1.7%, with tech related companies gaining 3.00%. Note the China Golden Dragon index gained a further 7.19% overnight, recouping more of Monday's 14.43% dip.

- The Kospi is up a further 1.40%, despite an earnings miss from Samsung Electronics. BoK stepped up efforts to stabilise credit markets, by expanding the type of bonds it will accept as collateral. The Taiex is also higher, +1.3%. The government is planning to work with industry to support chip sector development amid US-China tensions in the sector.

- The Nikkei 225 has underperformed, -0.25%, with the banking sector weighing. Tomorrow's BoJ decision looms as the next major risk event for these markets.

OIL: Refined Product Shortages Provide Crude Price Support

Oil prices held onto their overnight gains from a lower USD and product market shortages. They have traded slightly higher today with WTI now just over $88 and Brent just under $96.

- While the EIA weekly data showed a build in inventories of crude, the details continued to report distillate stocks at record lows in the US and a drawdown of gasoline. Demand for crude is expected to rise globally to increase refined product supplies, especially of diesel, thus providing price support.

- Along the same theme, China increased export quotas to encourage more shipments of refined fuel products and to provide a boost to the struggling economy. Given excess capacity in the sector, refiners are likely to increase output and purchases of crude oil.

GOLD: Holding Overnight Gains

Gold is largely holding onto to gains from the overnight session. The precious metal was last close to $1665, near NY closing levels, after yesterday's +0.69% gain. This comes despite a slight recovery in USD sentiment, although mvoes amongst the majors have been modest

- An early attempt to push above $1670 met with resistance. Overnight, gains above this level couldn't be sustained either (highs were near $1675). On the downside, dips to the low $1660 level are being supported. Beyond that is earlier lows this week between $1638/$1643.

- More broadly, a sustained break above $1670 could pave the way for a test of the 50-day simple MA ($1687.26). ETF gold holdings rose for the first time in 5 sessions yesterday as well.

- Gold bulls may wish to see a further pull back in US real yields though before turning more constructive.

FOREX: USD Pullback Almost On Par With Previous 2022 Corrections

The USD was offered in early trade, particularly against both EUR and CNH. EUR/USD got close to 1.01, with the 100-day simple MA coming in at 1.0089, but we couldn't hold these levels, last back to 1.0070. USD/CNH got sub 7.1700, but has rebounded aggressively, back into a 7.2350/00 range, +0.70% above NY closing levels.

- This has helped the BBDXY stabilize, although we remain below the 50-day MA (1320.03), with the index last at 1318.45, see the chart below. Interestingly, the recent correction lower in this index, is getting close to the magnitude of other corrections, seen in recent months.

- In terms of cross-asset signals, equities have been mixed, with US futures higher, but the China equity rebound has stalled. US yields are slightly above NY closing levels (4.02% for the 10yr).

- AUD/USD has struggled to hold gains above 0.6500, even with calls from local banks for a 50bps move from the RBA next week. Futures pricing is slightly above 25bps priced in for next week.

- NZD has outperformed slightly, last near 0.5850, although unable to push above 0.5855 (50-day EMA). RBNZ Governor stated earlier that the RBNZ will fulfill its inflation mandate, even if the unemployment rate moves higher.

- Coming up, the main focus will be the ECB decision (+75bps expected). In the US, advance Q3 GDP data will provide another key input to the ongoing debate on Fed tightening trajectory.

Fig 1: BBDXY Correction Approach Previous 2022 Pullbacks In Terms Of Magnitude

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Oct27 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750-60(E953mln), $0.9800(E1.6bln), $0.9850(E2.1bln), $1.0000(E1.5bln), $1.0025-40(E1.1bln), $1.0050-60(E711mln)

- USD/JPY: Y145.00($714mln), Y147.50($580mln)

- GBP/USD: $1.1490-00(Gbp752mln)

- AUD/USD: $0.6430-35(A$674mln)

- USD/CAD: C$1.3470($710mln), C$1.3685-00($572mln)

- USD/CNY: Cny7.1800($600mln), Cny7.2000($907mln), Cny7.2500($1.7bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/10/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/10/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/10/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/10/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/10/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 27/10/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 27/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/10/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/10/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 27/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/10/2022 | 1245/1445 |  | EU | ECB post-policy decision press conference | |

| 27/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.