-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Central Bank Debates Dominate

EXECUTIVE SUMMARY

- FED’S WALLER: FED MUST DO MORE, TIGHTEN FINANCIAL CONDITIONS (MNI)

- FED’S KASHKARI: MUST HIKE MORE TO 'BALANCE' JOBS (MNI)

- BIDEN SAYS HE SEES NO RECESSION IN 2023 OR 2024 (PBS)

- ECB RATES MUST HIT SIGNIFICANTLY RESTRICTIVE LEVELS, KAZAKS SAYS (BBG)

- BIDEN DENIES US-CHINA TIES MORE STRAINED AFTER BALLOON SPAT (BBG)

- G-7 MULLS SANCTIONING CHINESE FIRMS FOR AIDING RUSSIA’S MILITARY (BBG)

- TOP CHINA ECONOMIST SEES POSSIBLE INTEREST RATE CUT NEXT QUARTER (BBG)

- JAPAN’S LDP SAID TO BE DIVIDED IF KISHIDA SEEKS BOJ PIVOT (BBG)

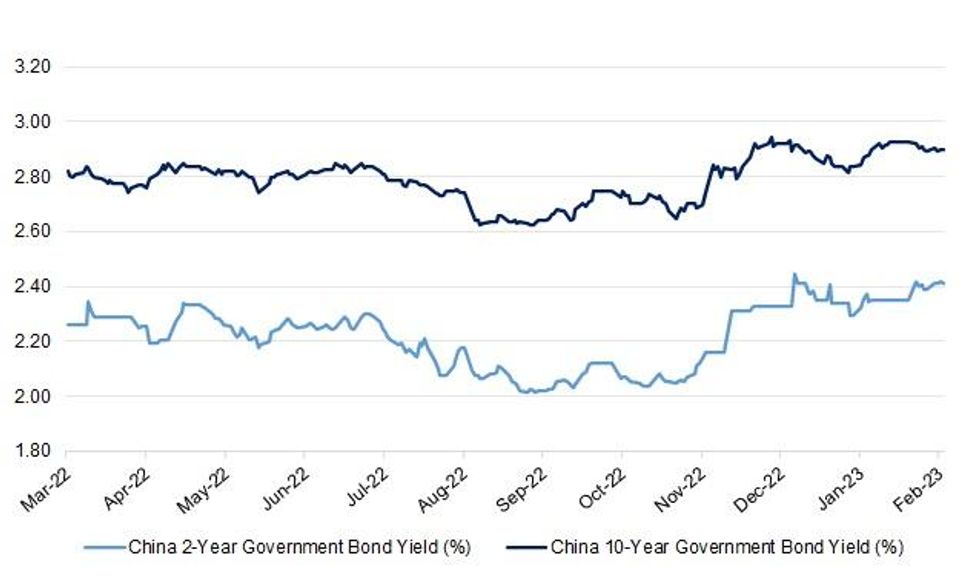

Fig. 1: China 2- & 10-Year Government Bond Yields

Source: MNI - Market News/Bloomberg

UK

FISCAL: Jeremy Hunt has come under pressure from the CBI to announce tax breaks for businesses at the budget as a “last chance” to help the economy avoid a recession this year. (The Times)

POLITICS: The Conservatives would be relegated to Westminster’s third party behind the Scottish National Party in a snap election, new polling for the Telegraph has found. (Telegraph)

EUROPE

ECB: The European Central Bank must lift interest rates to levels that “significantly” restrict the economy, according to Governing Council member Martins Kazaks, who argued that hikes may need to persist beyond the next meeting in March. (BBG)

FISCAL: Poland cleared further hurdles on the way to unlock more than €35 billion ($38 billion) of the European Union’s post-pandemic aid, putting fresh financing within the ruling party’s reach just eight months before a general election. (BBG)

FISCAL: European Union officials are doubtful that the “broad consensus” over reform of the bloc’s fiscal rules will be reached by March in line with a call by Economy Commissioner Paolo Gentiloni, several told MNI. (MNI)

FRANCE: The Bank of France ruled out a recession this winter as its monthly survey showed stronger-than-expected growth despite a succession of external shocks. (BBG)

FRANCE: French trade unions are planning a new day of strikes and demonstrations on Thursday, Feb. 16 against planned pension changes, trade union sources said on Wednesday. (RTRS)

ITALY: Italy is preparing a new package of measures to help businesses and families cope with costly energy bills and hopes to unveil it in March, the economy minister said on Wednesday. (RTRS)

U.S.

FED: Federal Reserve Governor Chris Waller said Wednesday the central bank has "farther to go" and he is preparing for a longer fight to bring inflation down to its 2%, and part of that process will be to tighten financial conditions. (MNI)

FED: The Federal Reserve needs to raise interest rates further in order to cool an overheated labor market and booming services sector and keep inflation declining, Minneapolis Fed President Neel Kashkari said Wednesday. (MNI)

ECONOMY: President Joe Biden said on Wednesday he did not believe the U.S. economy will fall into recession either this year or next year, his most confident prediction on the fate of an economy that is still rattled by fears of a downturn. (RTRS)

ECONOMY: U.S. Treasury Secretary Janet Yellen said on Wednesday that while inflation remained elevated, there were encouraging signs that supply-demand mismatches were easing in many sectors of the economy. (RTRS)

EQUITIES: Money managers have cut $300 billion of bearish bets and are now positioned more in line with historic norms — robbing the market of pent-up demand just as the Federal Reserve warns its inflation-fighting battle is far from over. (BBG)

OTHER

GLOBAL TRADE: US Treasury Secretary Janet Yellen on Wednesday encouraged the idea of green subsidies by the European Union to offset feared harm from a vast US climate plan -- arguing there is enough business for all to benefit from the clean energy transition. (France 24)

GLOBAL TRADE: India is considering extending a ban on wheat exports as the world's second-biggest producer seeks to replenish state reserves and bring down domestic prices, government sources said. (RTRS)

U.S./CHINA: President Joe Biden denied that relations with Beijing have suffered a serious blow after the US downed an alleged Chinese spy balloon that flew across the continental US. (BBG)

U.S./CHINA: U.S Secretary of State Antony Blinken said on Wednesday the United States has shared information it has obtained about China's spy balloon with dozens of countries around the world. Blinken also told a news conference with NATO Secretary General Jens Stoltenberg that he had discussed with him the systemic and tactical challenges China presents to alliance. (RTRS)

U.S./CHINA: U.S. Treasury Secretary Janet Yellen said on Wednesday that she still hoped to be able to visit China but offered no details on plans or timing. (RTRS)

JAPAN/CHINA: Japan is considering easing COVID-19 border controls on travelers arriving from China by the end of this month, a government source said Thursday. (Kyodo News)

AUSTRALIA/CHINA: The first Australian coal shipment to China in more than two years is on the verge of docking, signaling hard evidence of a major thaw in trade relations between the two countries following months of diplomatic talks. (BBG)

GEOPOLITICS: Group of Seven member states are discussing whether to sanction companies in China, Iran and North Korea they believe are providing Russia with parts and technology that have military purposes, according to people familiar with the matter. (BBG)

GEOPOLITICS: The Chinese spy balloon that drifted across the United States last week presents security challenges for NATO’s 30-member alliance as well as other countries around the globe, NATO Secretary General Jens Stoltenberg said on Wednesday. (CNBC)

BOJ: Japan’s ruling party members see the possibility of division within the party if Prime Minister Fumio Kishida’s choice for the new Bank of Japan chief is someone who is unlikely to follow the current path of monetary easing. (BBG)

BOJ: The Bank of Japan's new governor must change the timeframe of the 2% inflation target as a key step towards reviewing its yield curve control policy that has produced negative side-effects like impaired bond market functioning, former BOJ executive director Kenzo Yamamoto told MNI. (MNI)

JAPAN: The Japanese government plans to target a spending level of 200,000 yen per foreign tourist in 2025, a 25% increase from pre-pandemic levels, public broadcaster NHK reports, without attribution. (BBG)

JAPAN: The Japanese government is planning to ease its mask-wearing guidelines against Covid-19 in the first half of March, leaving whether to wear one both indoors and outdoors up to individuals, public broadcaster NHK reports without attribution. (BBG)

RBNZ: New Zealand's central bank said on Thursday it was seeking feedback on the second stage of its liquidity policy review. The bank said in a statement that this stage of the policy review contains proposals on some of the significant policy issues, including eligibility criteria for liquid assets, the potential adoption of international standards, and how liquidity requirements could be applied across deposit takers in a proportionate manner. (RTRS)

BOK: The Bank of Korea will cut its benchmark interest rate earlier than previously expected, a Bloomberg survey shows, reflecting growing concerns over the outlook for economic growth. (BBG)

BOK: Bank of Korea reschedules April rate decision meeting to April 11 from April 13 due to G20 finance ministers and central bank governors meeting which will be held in US on April 12-15, BOK says in a statement. (BBG)

NORTH KOREA: Nuclear-armed North Korea unveiled what could be a new, solid-fuel intercontinental ballistic missile (ICBM) during a nighttime parade, analysts said on Thursday, citing commercial satellite imagery. (RTRS)

BOC: The Bank of Canada's first-ever meeting minutes published Wednesday showed Governor Tiff Macklem and his deputies debated keeping interest rates unchanged ahead of the Jan. 25 decision to hike for an eighth consecutive time. (MNI)

BRAZIL: Brazil’s central bank Monetary Policy Director Bruno Serra said on Wednesday the country will have monetary easing “at some point in the future, when conditions allow.” At an event hosted by municipal business movement Repensar Macae, he said the benchmark interest rate Selic is at 13.75% because it is technically adequate, amid intense criticism from President Luiz Inacio Lula da Silva that it should be lower. (RTRS)

BRAZIL: Brazil’s real rose and swap rates fell after one of Luiz Inacio Lula da Silva’s cabinet members said the administration will respect a law that gives autonomy to the central bank despite the president’s growing attacks against the monetary authority. (BBG)

BRAZIL: New administrative probes were initiated based on the work of the task force set up to investigate a billionaire gap in the retailer’s balance sheet, says the Brazilian segurities regulator CVM in a statement. (BBG)

RUSSIA: The US government continues to resist calls to provide Ukraine with fighter jets, but Secretary of State Antony Blinken stopped short of categorically ruling out such assistance down the road. (BBG)

RUSSIA: Russia's embassy to Britain on Wednesday warned London against sending fighter jets to Ukraine, saying such a move would have "military and political consequences for the European continent and the entire world", the TASS news agency reported. (RTRS)

RUSSIA: France and Germany have the opportunity to be "game changers" in the war against Russia by not hesitating in delivering heavy weapons and modern fighter jets to Ukraine, President Volodymyr Zelenskiy said during a visit to Paris on Wednesday. (RTRS)

RUSSIA: Ahead of Thursday's meeting in Belgium, Scholz sought to stress Kyiv's position in Europe. "I am taking a clear message to Brussels: Ukraine belongs to the European family," Scholz said. (RTRS)

INDIA: Adani Group stocks slipped in early trading, ending a two-day reprieve, after MSCI Inc. said it was reviewing the amount of shares linked to the group that were freely tradable in public markets. (BBG)

INDIA: Gautam Adani, whose Indian business empire is under pressure over fraud allegations, repaid a $1.1bn share-backed loan last week after facing a margin call of more than $500mn, according to four people with direct knowledge of the matter. (FT)

CHINA

PBOC: China’s central bank may have more room to cut interest rates in the second quarter as the risk of another Covid wave looms in coming months and the US Federal Reserve ends its interest rate hikes, according to a prominent Chinese economist. (BBG)

ECONOMY: Leading economists predict China’s GDP growth target for 2023 will be set at 5.28%, as the weakening impact of the pandemic and the promotion of growth policies help stabilise the economy and expand domestic demand, according to a survey by Yicai.com. (MNI)

ECONOMY: Demand expectations in the automotive market remain optimistic despite a fall in car sales during January, according to the China Automobile Dealers Association (CADA). (MNI)

MARKETS: China’s capital markets can support high quality development by providing financing and improving governance standards for SME’s, according to experts interviewed by the China Economic Network. (MNI)

MONEY MARKETS: China’s short-term borrowing costs eased for the first time in four days as the central bank continued its net cash injection via open market operations to boost interbank liquidity. (BBG)

EQUITIES: Chinese stock investors should not blindly join domestic stock speculation linked to ChatGPT, Securities Times says in a front-page commentary. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY387 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY453 billion via 7-day reverse repos with the rates unchanged at 2.00% on Thursday. The operation has led to a net injection of CNY387 billion after offsetting the maturity of CNY66 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1374% at 9:30 am local time from the close of 2.2446% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 60 on Wednesday, compared with the close of 55 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7905 THURS VS 6.7752 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7905 on Thursday, compared with 6.7752 set on Wednesday.

OVERNIGHT DATA

JAPAN JAN M2 MONEY STOCK +2.7% Y/Y; DEC +2.9%

JAPAN JAN M3 MONEY STOCK +2.3% Y/Y; DEC +2.5%

JAPAN JAN, P MACHINE TOOL ORDERS -9.7% Y/Y; DEC +0.9%

NEW ZEALAND JAN ANZ TRUCKOMETER HEAVY +0.8% M/M; DEC -1.5%

The Heavy Traffic Index lifted 0.8% in January, while the Light Traffic Index fell 0.7% (figures 1 and 2). Both have dropped back to trend after a period of outperformance last year. (ANZ)

SOUTH KOREA JAN TOTAL BANK LENDING TO HOUSEHOLDS KRW1053.4TN; DEC KRW1058.0TN

UK JAN RICS HOUSE PRICE BALANCE -47%; MEDIAN -45%; DEC -42%

MARKETS

US TSYS: Early Cheapening Holds In Asia

TYH3 deals at 113-14, +0-01, a touch off the base of its 0-07+ range on volume of ~106K.

- Cash Tsys sit 1-2bps cheaper across the major benchmarks.

- Asia-Pac participants faded yesterday's late NY bid, with the latter aided by a report noting the G7 is mulling sanctions for Chinese firms aiding the Russian military, as well as more attractive entry points after a pullback from previous highs which were registered after the latest 10-Year Tsy auction stopped through.

- The early cheapening held through the session.

- A block buy of TU futures (+5.5K) did little to generate wider demand in the space.

- Pressure briefly extended late in the session as JGBs spiked lower on headlines from Japan noting that the ruling LDP would be divided if Kishida seeks a BOJ pivot.

- National CPI from Germany and an appearance by BoE figures at a Treasury committee provide the highlights in Europe today. Further out, Initial Jobless Claims headlines a thin NY docket, we also have the latest 30-Year Tsy Supply.

JGBS: BoJ Chatter-Induced Vol. Jolts Previously Sedate Session

JGB trade had been fairly sedate until a burst of volatility ahead of the Tokyo close, with futures now -10 and the major cash benchmarks running 0.5bp cheaper to 2bp richer. 5s are the only major benchmark sitting cheaper on the day, while the 20- to 30-Year zone outperforms in the curve. The swap curve has twist flattened, although the moves in those benchmark rates was even more limited than that seen in JGBs.

- The source of late vol. seemed to centre on some misinterpretation surrounding the latest BoJ leadership race source report from BBG, with the hawkish knee-jerk quickly unwound.

- The report noted that “Japan’s ruling party members see the possibility of division within the party if Prime Minister Fumio Kishida’s choice for the new Bank of Japan chief is someone who is unlikely to follow the current path of monetary easing.” Elsewhere, it suggested that there would be at least some opposition if PM Kishida selects former BoJ Deputy Governor Hirohide Yamaguchi (the most hawkish major candidate) as outgoing BoJ Governor Kuroda’s successor.

- Futures now sit marginally below pre-story levels, comfortably off session cheaps.

- Looking ahead, Friday will see the release of Japanese PPI data.

JGBS AUCTION: 10-Year JGBi Auction Results

The Japanese Ministry of Finance (MOF) sells Y250bn 10-Year JGBis:

- High Yield: -0.173% (prev. -0.733%)

- Low Price: 101.65 (prev. 107.40)

- % Allotted At High Yield: 72.0000% (prev. 78.1818%)

- Bid/Cover: 3.057x (prev. 3.283x)

JGBS AUCTION: 6-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y3.69146tn 6-month Bills:

- Average Yield: -0.1330% (prev. -0.1007%)

- Average Price: 100.066 (prev. 100.050)

- High Yield: -0.1148% (prev. -0.0685%)

- Low Price: 100.057 (prev. 100.034)

- % Allotted At High Yield: 21.4375% (prev. 2.3376%)

- Bid/Cover: 4.171x (prev. 4.031x)

AUSSIE BONDS: Weaker As RBA Repricing Continues

Aussie bonds weakened more than their U.S. Tsy counterparts, leaving the AU/U.S. 10-Year yield spread near the +5bp mark. Cash ACGBs were 5-8bp cheaper, with the 7- to 12-Year zone lagging the broader weakness on the curve. YM finished -7.0, XM was -5.5.

- Short end flow aided the move, with terminal rate pricing on the RBA-dated OIS strip back above 4.00% as participants continued to adjust to Tuesday’s hawkish tweaks in the post-meeting statement. Bills finished 1-10bp cheaper through the reds as that strip steepened.

- Local headline flow was limited, outside of a BBG report which noted that “the first Australian coal shipment to China in more than two years is on the verge of docking.”

- Hedging surrounding the pricing of A$1bn of new SAFA-38 paper would have applied some pressure. Elsewhere, there may have been some background pressure on reports that Virgin Australia is considering taking on new debt ahead of its potential IPO. In addition, pricing of A$1.5bn of EIB’s 5.5-Year climate awareness bond would have added further pressure, while Westpac mandated for 3- & 5-Year senior unsecured paper. Weakness in NZGBs will also have weighed.

- Looking ahead, the release of the RBA’s SoMP (with focus on the underlying inflation forecasts) & A$500mn of ACGB May-28 supply headline on Friday.

NZGBS: Curve Bear Flattens, Uncovered Auction & Trans-Tasman Dynamic Weighs

The NZGB curve bear flattened, with the major benchmarks running 3-8bp cheaper at the close.

- NZGBs were already on the defensive ahead of today’s auctions, with global core FI markets coming under modest cheapening pressure, allowing the space to unwind the early, modest richening which had represented catch up to NY Tsy trade.

- That was before an uncovered NZGB-27 auction applied further pressure to the front end of the curve, while solid enough demand in the NZGB-34 auction (1.64x cover) and strong demand at the NZGB-51 auction (2.96x cover) promoted curve flattening.

- Swap rates were ~8bp higher across the curve, leaving swap spreads flat to wider.

- That came alongside RBNZ-dated OIS showing ~60bp of tightening for this month’s meeting, while terminal OCR pricing ticked back above 5.30%, aided by another uptick in RBA-dated OIS. That seemingly aided payside swap flows (with higher for longer central bank worry probably contributing to the weakness in the aforementioned NZGB-27 auction).

- Local headline flow was fairly limited.

- Corporate issuance saw NZ$500mn of Feb-28 paper from ANZ priced.

- The latest manufacturing PMI print and card spending data headline the domestic docket on Friday.

EQUITIES: China/HK Markets Outperform As Northbound Flows Return

Outside of gains for China and Hong Kong equities, most regional markets are down. This is line with a weaker tone from Wall St on Wednesday, although higher US futures today (Eminis +0.20%, Nasdaq +0.25%), has likely helped curb losses.

- China and Hong Kong indices started off lower, but have pushed higher as the session progressed. The HSI is +0.34% at this stage, with the tech sub-index +0.55% after opening lower.

- The CSI 300 is +0.75%, pushing the index back above 4100. The authorities warned of speculation around the tech sector, particularly in relation ChatGPT.

- Potential for easier policy settings in Q2, as touted by top China economist, is also likely to have helped sentiment at the margins. Northbound stock connect flows have returned, with +7.43bn yuan coming back so far today. The first positive flows in 5 days.

- Elsewhere, the Nikkei 225 is -0.25%, while the Kospi (-0.10%) and Taiex (-0.15% are down slightly. Both indices are outperforming the tech sell-offs from Wednesday trade in the major markets.

- SEA markets are mostly lower, with JCI the exception.

GOLD: Bullion Higher Again Today After Fed Comments Wiped Wednesday’s Gains

Bullion is up today after giving up its gains on Wednesday in the wake of Fed comments affirming that rates will need to go up further to get inflation back to target. Gold prices are 0.2% higher during APAC trading reaching a high of $1880.33/oz and are now trading around $1879.00. The USD is slightly lower.

- Gold is trading above its 50-day simple MA but trend conditions remain bearish. It has been trading between its resistance at $1897.40, the 20-day EMA, and support at $1861.40, the February 3 low.

- Later today there is little in the US with no Fed officials scheduled to speak and only jobless claims on the data calendar.

OIL: Crude Range Trading Following Fed Comments Point To More Hikes

Commodity prices are generally stronger during APAC trading today but oil is down slightly after rallying on Wednesday following hawkish Fed comments. Oil prices continue to trade in a very narrow range with Brent currently at $85.05/bbl after a high of $85.27 and a low of $84.81. WTI is trading around $78.40 with a high of $78.62 following the $78.27 low. The USD is down slightly.

- WTI is still below its 100-day simple MA, while Brent has exceeded it. On Wednesday both WTI and Brent cleared the 50-day EMAs which has opened up $80.49 and $86.21 respectively.

- Optimism around demand from China drove the market yesterday, as Bloomberg reported that its largest refineries should reach peak levels in Q1 this year. Also oil shipments from Turkey remain disrupted following Monday’s tragic earthquake.

- The 2.423mn build in US crude stocks reported by the EIA on Wednesday didn’t dent the market’s optimism. This is the highest since July 2021. There was also a 5.01mn build in gasoline inventories.

- Later today there is little in the US with no Fed officials scheduled to speak and only jobless claims on the data calendar. The Riksbank is expected to hike 50bp and German preliminary January CPI is out.

FOREX: Antipodeans Outperforming, Greenback Pressured

The Antipodeans are outperforming today, there was no overt headline driver for the move although a Bloomberg piece from a top Chinese Economist noted potential for easier policy settings in Q2 aiding risk sentiment in the equity and commodity space.

- Kiwi is the strongest performer in the G-10 space at the margins, up ~0.6%. NZD/USD dealt through its 50-day EMA ($0.6337), and last prints at $0.6340/50.

- AUD/USD is ~0.4% firmer, last printing at $0.6950/60. Strength in copper (up ~0.6%) and iron ore (~1.2% firmer) are aiding the bid at the margins, along with the better tone in some equity markets.

- Yen is little changed from yesterday's closing levels. The pair was firmer in early trade, before meeting resistance at ¥131.80 before paring gains through the session.

- NOK and SEK are both ~0.3% firmer, benefiting from the improving risk sentiment.

- EUR and GBP are ~0.1% firmer vs USD.

- Cross asset flows show an improving equity picture; US equity futures are firmer (e-minis up ~0.3%) as are HK and Chinese Equities (CSI300 up ~0.7%, Hang Seng up ~0.4%). BBDXY is ~0.2% softer. 10 Year US Treasury Yields are marginally higher.

- National CPI from Germany and an appearance by BOE figures at a Treasury committee provide the highlight in Europe today. Further out Initial Jobless Claims highlight a thin NY docket.

FX OPTIONS: Expiries for Feb09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-06(E719mln), $1.0760-80(E2.2bln), $1.0800(E1.8bln), $1.0840-50(E1.7bln), $1.0885-00(E1.1bln)

- USD/JPY: Y128.00($1.3bln), Y129.00($645mln), Y130.45($500mln), Y131.25-30($727mln), Y131.45-55($821mln), Y133.00($718mln)

- GBP/USD: $1.1950(Gbp581mln), $1.2145-50(Gbp533mln)

- EUR/GBP: Gbp0.8835-50(E599mln), Gbp0.8925-50(E1.4bln)

- EUR/JPY: Y141.00(E519mln)

- AUD/USD: $0.6955(A$581mln), $0.7000($707mln), $0.7025-30(A$643mln)

- NZD/USD: $0.6375-90(N$510mln)

- USD/CAD: C$1.3350($647mln), C$1.3395($711mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/02/2023 | 0700/0800 | *** |  | DE | HICP (p) |

| 09/02/2023 | 0830/0930 | ** |  | SE | Riksbank Interest Rate |

| 09/02/2023 | 0945/0945 |  | UK | BOE Bailey, Pill, Tenreyro & Haskel at Treasury Select Committee Hearing | |

| 09/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 09/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 09/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/02/2023 | 1800/1900 |  | EU | ECB de Guindos Speech at Foro Economia y Humanismo | |

| 09/02/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 09/02/2023 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.