-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Divide Becomes Evident In ECB Speak

EXECUTIVE SUMMARY

- FED’S MESTER WANTS MORE PROGRESS ON INFLATION BEFORE ENDING INTEREST RATE HIKES (CNBC)

- FED MUST BE MINDFUL OF OVERDOING RATE HIKES, DALY SAYS (MNI)

- ECB'S VILLEROY: INFLATION IN FRANCE AND EUROPE WILL PEAK IN FIRST HALF OF 2023 (RTRS)

- ECB’S CENTENO SEES CONDITIONS TO SLOW RATE HIKES IN DECEMBER (BBG)

- ECB’S HOLZMANN: FAVOR 75 BP HIKE NEXT MONTH IF THINGS STAY SAME (BBG)

- ITALY TO RAISE ENERGY WINDFALL TAX TO FINANCE €35 BILLION BUDGET (BBG)

- SAUDIS DENY REPORT OF TALKS ON OPEC+ OIL-PRODUCTION INCREASE (BBG)

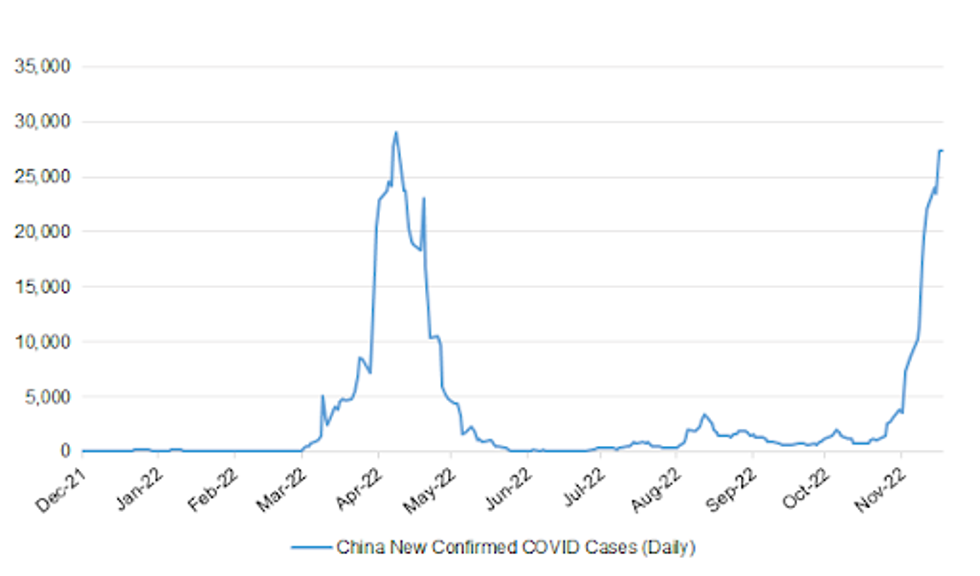

Fig. 1: China New Confirmed COVID Cases (Daily)

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Business leaders have called on Rishi Sunak to move faster to outline plans to help stimulate investment and economic growth, with Shell suggesting that its ambitions to invest £25 billion in the UK were under review unless changes were made to the windfall tax. (The Times)

EUROPE

ECB: Inflation should reach its peak in France and in Europe by the first half of next year, French ECB policymaker Francois Villeroy de Galhau said on Monday. (RTRS)

ECB: The European Central Bank can afford to reduce the pace of interest-rate hiking after two 75 basis-point increases, according to Governing Council member Mario Centeno. (BBG)

ECB: European Central Bank Governing Council member Robert Holzmann says he would favor a 50 basis-point hike only if inflation data show a “major reduction” for this month, according to an interview with Econostream Media. (BBG)

ITALY: Italy has approved a €35 billion ($36 billion) budget law for next year which plans to raise a windfall tax on additional profits made by companies selling energy in order to expand energy aid relief to families and businesses. (BBG)

SPAIN: The Spanish government will approve on Tuesday mortgage relief measures such as extending loan repayments for up to seven years for more than one million vulnerable households and middle-class families, the economy ministry said on Monday. (RTRS)

U.S.

FED: Cleveland Federal Reserve President Loretta Mester said Monday inflation will need to show more signs of progress before she’s ready to stop advocating for interest rate increases. (CNBC)

FED: The Federal Reserve needs to continue with rate hikes to bring down inflation while being careful not to ignore the drag from past tightening and signs price gains are moderating, San Francisco President Mary Daly said Monday. (MNI)

OTHER

U.S./CHINA: US Secretary of Defense Lloyd Austin urged China to avoid “destabilizing actions” toward Taiwan in his first face-to-face meeting with Defense Minister Wei Fenghe since House Speaker Nancy Pelosi’s visit to Taipei in August. (BBG)

JAPAN: Japan is expected to curb pension payment rises at rates below that of inflation, according to Nippon Life Insurance's research arm. (Nikkei)

JAPAN: Tokyo Electric Power says it has no plans to seek government approval this month to raise household electricity bills, denying a Sankei report that it’s among Japanese utilities planning to do so. (BBG)

SOUTH KOREA: South Korea’s government is closely monitoring the country’s short-term money market and is ready to introduce additional measures to ease financial strains if necessary, according to a senior official at the Finance Ministry. (BBG)

BOK: The Bank of Korea is expected to downshift to a 25bp hike at Thursday's meeting as policymakers consider the impact of slower growth and moderating inflation after October's decision to tighten by 50bp triggered dissent among some board members. (MNI)

BOK: South Korea's central bank will scale back its tightening pace on Thursday and hike rates by a modest 25 basis points amid signs of slowing domestic growth, despite high inflation and an aggressive U.S. Federal Reserve, a Reuters poll found. (RTRS)

BOC: Canada's central bank should be allowed to create a "deferred asset" covering losses on quantitative easing, according to former advisers at the C.D. Howe Institute. (MNI)

BRAZIL: President-elect Luiz Inacio Lula da Silva’s party wants Bolsa Familia social aid out of Brazil‘s spending cap for unlimited time in a yet-to-be-proposed transition amendment bill, party leader at lower house Reginaldo Lopes told reporters in Brasilia. (BBG)

TURKEY/RUSSIA: Russia has called on Turkey to show restraint in its use of "excessive" military force in Syria and to keep tensions from escalating, Russian news agencies cited a Russian envoy to Syria envoy as saying on Tuesday. (RTRS)

RUSSIA: Ukraine narrowly escaped disaster during fighting at the weekend that rocked Europe's largest atomic power plant with a barrage of shells, some falling near reactors and damaging a radioactive waste storage building, the U.N. nuclear watchdog said. (RTRS)

RUSSIA: Russian companies reduced their foreign currency loans by $7.4 billion last month and have also cut forex holdings on the accounts by $11.1 billion, the central bank said on Monday. Since the start of this year, forex holdings by Russian companies are down by $28 billion, the central bank added. (RTRS)

SOUTH AFRICA: South Africa, having secured $8.5 billion in climate finance from some of the world’s richest countries, is in talks with additional nations to help it cut reliance on coal, Environment Minister Barbara Creecy said. (BBG)

IRAN: Iran could soon “toy” with enriching uranium to the level of 90%, which can be used to build a nuclear weapon, the head of the Israeli military intelligence General Aharon Haliva said Monday. (Axios)

GOLD: Central banks are snapping up gold this year, but it is uncertain which ones are behind most of that shopping spree, fueling speculation that China is a big player. (Nikkei)

ENERGY: According to a draft proposal, seen by the Financial Times, the European Commission is planning to set a cap for the most widely-used gas futures contract in an effort to calm markets and avoid a return to the “abnormal” prices of more than €300 per megawatt hour that the bloc briefly experienced in August — a price equivalent to more than $500 a barrel for oil. (FT)

OIL: Saudi Arabia denied a report that it is discussing an oil-production increase for the OPEC+ meeting next month, and said it stands ready to make further cuts if needed. (BBG)

OIL: United Arab Emirates' energy minister said on Monday that the Gulf state denied that it is engaging in any discussion with other OPEC+ members to change their latest agreement, adding that it is valid until the end of 2023. (RTRS)

OIL: Russia doesn’t plan to supply crude or oil products to nations that implement a price cap, according to Deputy Prime Minister Alexander Novak. Instead, Russia will redirect its oil supply to “market-oriented partners” or will reduce production, Novak said in a statement. (BBG)

OIL: Yemen's Houthis attacked al-Dhabba oil terminal in Hadhramaut province on Monday, the group and Yemen's internationally recognised government said. (RTRS)

CHINA

CORONAVIRUS: Covid control restrictions now weigh on a fifth of China’s economy as infections continue their upward march, defying the central government’s call for more targeted, less disruptive Covid Zero measures. (BBG)

CORONAVIRUS: The Chinese capital city’s Communist Party chief Yin Li urged local officials to stick to Covid zero and curb surge in infections, according to a government statement on a meeting Monday. (BBG)

CORONAVIRUS: China’s Vice Premier Sun Chunlan urged southwestern municipality of Chongqing to adopt “decisive” measures to curb Covid outbreak and minimize the pandemic’s impact on economy and people’s daily life, Xinhua reported Monday. (BBG)

PBOC: The reference rate used to price Chinese mortgages is expected to be cut next month after being held steady in November, with banks to lend support to the property market recovery despite rising interbank funding costs, advisers and analysts said. (MNI)

ECONOMY: China should set its 2023 growth target at around 5%, which would match the country’s potential growth level, support employment, prevent risks and boost market confidence, 21st Century Business Herald reported citing Zhu Baoliang, chief economist of the State Information Center. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY170 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) on Tuesday injected CNY2 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY170 billion after offsetting the maturity of CNY172 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9773% at 9:27 am local time from the close of 1.6416% on Monday.

- The CFETS-NEX money-market sentiment index closed at 46 on Monday, flat from the close of Friday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1667 TUES VS 7.1256 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1667 on Tuesday, compared with 7.1256 set on Monday.

OVERNIGHT DATA

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 81.6; PREV 80.8

Consumer confidence increased 1% last week, likely boosted by solid employment growth in October and a further easing in inflation expectations. (ANZ)

NEW ZEALAND OCT TRADE BALANCE -NZ$2.129BN; SEP -NZ$1.696BN

NEW ZEALAND OCT EXPORTS NZ$6.14BN; SEP NZ$5.94BN

NEW ZEALAND OCT IMPORTS NZ$8.27BN; SEP NZ$7.63BN

NEW ZEALAND OCT 12-MONTH YTD TRADE BALANCE -NZ$12.880BN; SEP -NZ$12.033BN

SOUTH KOREA NOV CONSUMER CONFIDENCE 86.5; SEP 88.8

SOUTH KOREA Q3 HOUSEHOLD CREDIT KRW1,870.6TN; Q2 KRW1,868.4TN

MARKETS

SNAPSHOT: Familiar Divide Becomes Evident In ECB Speak

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 200.05 points at 28143.64

- ASX 200 up 42.048 points at 7181.3

- Shanghai Comp. up 25.144 points at 3109.626

- JGB 10-Yr future down 9 ticks at 149.32, yield up 0.4bp at 0.251%

- 10-Yr future down 0.5 tick at 96.405, yield up 1.3bp at 3.599%

- U.S. 10-Yr future up 0-00+ at 112-10+, yield down 0.94bp at 3.8175%

- WTI crude up $0.28 at $80.31, Gold up $5.35 at $1743.41

- USD/JPY down 31 pips at Y141.82

- FED’S MESTER WANTS MORE PROGRESS ON INFLATION BEFORE ENDING INTEREST RATE HIKES (CNBC)

- FED MUST BE MINDFUL OF OVERDOING RATE HIKES, DALY SAYS (MNI)

- ECB'S VILLEROY: INFLATION IN FRANCE AND EUROPE WILL PEAK IN FIRST HALF OF 2023 (RTRS)

- ECB’S CENTENO SEES CONDITIONS TO SLOW RATE HIKES IN DECEMBER (BBG)

- ECB’S HOLZMANN: FAVOR 75 BP HIKE NEXT MONTH IF THINGS STAY SAME (BBG)

- ITALY TO RAISE ENERGY WINDFALL TAX TO FINANCE €35 BILLION BUDGET (BBG)

- SAUDIS DENY REPORT OF TALKS ON OPEC+ OIL-PRODUCTION INCREASE (BBG)

US TSYS: Firmer Into London

Tsys have firmed a touch into London hours, with comments from the Chinese Defence Minister crossing the wires after a meeting with his U.S. counterpart. The Minister has stressed that no outside force has the right to interfere with Taiwan, while noting that the Chinese military has the ability to maintain unification. Similar things have been said before, with markets perhaps a bit jittery after the meeting.

- TYZ2 is +0-06 at 112-16, 0-01 off its fresh session high, operating in a 0-10+ range on volume of 147K (boosted by roll activity). Cash Tsys are 2.0-4.5bp richer, with the belly of the curve leading.

- A light bid was apparent in earlier rounds of Asia-Pac trade. There was little in the way of overt catalysts noted as cross-market flows aided the bid, with the broad USD ticking lower in FX trade.

- A block buy of FV futures (+2,030) and quarterly roll activity headlined on the flow side.

- Markets looked through the latest Chinese COVID case update, with the country recording another 2 COVID-linked deaths after recording 3 over the weekend (the first such deaths observed in nearly 6 months, albeit within the elderly community, with 2 of the initial 3 instances also exhibiting complex medical conditional pre-COVID).

- NY hours will see the release of the Richmond Fed m’fing survey, 7-Year Tsy & 2-Year FRN supply, as well as Fedspeak from Bullard, George & Mester.

JGBS: A Little Steeper Ahead Of Mid-Week Break

JGB futures meandered through Tokyo trade, with a lack of meaningful headline flow apparent, leaving the contract -10 into the bell, consolidating most of its overnight losses.

- Cash JGBs sit little changed to 2bp cheaper, with the long end edging away from worst levels. The steepening impulse may have been a product of some jitters ahead of Friday’s 40-Year JGB supply, with tomorrow’s holiday not aiding liquidity.

- Local news flow was light, with Chief Cabinet Secretary Matsuno playing down news reports which pointed to the likelihood of a fairly imminent cabinet reshuffle from PM Kishida, given the recent headwinds for his approval ratings/loss of 3 ministers.

- Elsewhere, Kishida provided familiar tones re: the BoJ & FX markets, while noting that pay rises shouldn’t be outstripped by inflation.

- Spreads tightened and the cover ratio jumped at the latest liquidity auction covering off-the-run 1- to 5-Year JGBs. Offshore participants perhaps took advantage of x-ccy basis swap related yield pickups, while domestic names may have looked to the BoJ’s on hold stance and relative stability of this area of the curve to park any excess cash, given continued market volatility and elevated FX-hedging costs, which renders many offshore bond investments unviable.

- As mentioned above, tomorrow is a national holiday in Japan, which will result in the closure of the country’s financial markets.

JGBS AUCTION: Liquidity Enhancement Auction For OTR 1- To 5-Year JGBs Results

The Japanese Ministry of Finance (MOF) sells Y499.5 bn of 1- to 5-Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.005% (prev. +0.008%)

- High Spread: -0.003% (prev. +0.010%)

- % Allotted At High Spread: 99.1150% (prev. 73.6035%)

- Bid/Cover: 5.391x (prev. 3.147x)

AUSSIE BONDS: Flattening, Lowe Eyed

Tuesday provided a muted round of trade for ACGBs as participants look ahead to the impending Antipodean risk events, namely this evening’s dinner address from RBA Governor Lowe (on the topic of “Price Stability, the Supply Side and Prosperity”) and tomorrow’s monetary policy decision from the RBNZ.

- We don’t expect Lowe to offer much new when it comes to the outlook for monetary policy, after the RBA recently stepped down to 25bp increments re: cash rate hikes, while stressing that policy is not on a pre-set path.

- The flattening impulse from Monday’s U.S. Tsy trade held throughout the session, with a light bid in Tsys lending support, leaving YM -2.0 & +0.5 at the close, paring some of the losses observed in post-Sydney trade. Wider cash ACGB trade saw the major benchmarks running 3bp cheaper to 2bp richer late in the day, with the wings providing the extremes and a pivot observed around 12s.

- The 3-/10-Year EFP box was a little flatter, suggesting receiver side swap flows may have aided the bid in the longer end.

- Bills were +2 to -4 through the reds at the bell, as the strip twist steepened.

- Wednesday’s local docket will bring A$900mn of ACGB May-32 supply and flash PMI data from S&P Global.

AUSSIE BONDS: Sep-30 I/L Auction Results

The Australian Office of Financial Management (AOFM) sells A$150mn of the 2.50% 20 September 2030 Indexed Bond, issue #CAIN408:

- Average Yield: 1.1742% (prev. 1.4944%)

- High Yield: 1.1875% (prev. 1.5200%)

- Bid/Cover: 2.4533x (prev. 1.7600x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 50.0% (prev. 72.7%)

- Bidders 35 (prev. 42), successful 18 (prev. 22), allocated in full 16 (prev. 20)

NZGBS: Impending RBNZ Decision Front & Centre

A twist flattening move became apparent in NZGBs as the day wore on, with the impulse from Monday’s U.S. Tsy trade and a light bid in global core FI markets during the Asia-Pacific session providing some support as NZGBs recovered from early session cheaps.

- That left the major NZGB benchmarks running 5.5 cheaper to 4.0bp richer at the bell, pivoting around 7s.

- Swap spreads were mixed across the curve, tightening in the front end but widening a little further out the curve.

- The 2/10-Year swap curve moved deeper into inverted territory, printing fresh cycle extremes in the process, representing the most inverted level witnessed since ’08.

- Local headline flow was light ahead of tomorrow’s RBNZ decision. A reminder that the majority of analysts look for a 75bp rate hike ahead of the Bank’s three-month hiatus, with just under 70bp of tightening priced into RBNZ dated OIS for the event. Terminal OCR pricing prints just above 5.15% (see our full preview of that event here)

- Early Wednesday trade may see some adjustment to RBA Governor Lowe’s dinner time address, if there is anything in the way of notable trans-Tasman impetus generated.

EQUITIES: China Property Stocks Recover, Mixed Trends Elsewhere

Regional equities have enjoyed a better afternoon session relative to earlier in the session. Onshore China shares have recovered from earlier weakness, but trends are mixed elsewhere throughout the region. US futures have stayed in positive territory for most of the session, last around 0.10-0.20% firmer for the main indices.

- The CSI 300 is up 0.77% at this stage, likewise for the Shanghai Composite index. Early concerns around Covid trends dominated, with officials calling for the greater efforts to curb the virus spread in major cities.

- Support has come from the property sub-sector though, with the Shanghai sub-index up 1.80%. Late yesterday the China regulators stated that banks should step up lending support for property developers/construction companies.

- Japan stocks have outperformed for much of the session, the Topix +1.2%, as exporter related names have outperformed. The yen was the worst performer in the G10 FX space yesterday (-1.2%), and it has only retraced some losses today (+0.30%).

- The Kospi is off by 0.34%, but the Taiex is outperforming (+0.55%). The ASX 200 is up close to 0.70%, as resource companies led the move higher. Higher coal prices are helping, while iron ore is down slightly from recent highs.

- The Philippines bourse is up a further 0.90%. The country's finance minister stated the Philippines' may hit the top end of this year's GDP target (6.5-7.5%).

GOLD: Gold Price Advance As USD Softens

Gold prices are higher during APAC trading today after falling overnight. They are 0.4% higher than the NY close and are now around $1744.50/oz. After reaching a low of $1737.53 early in the session, prices rose to a high of $1745.08. Bullion has been helped by a slightly weaker USD with DXY down 0.25%.

- The short-term trend for gold remains bullish and any pullback in prices is considered corrective. $1786.50 is the bull trigger with $1800 the level to watch and key resistance at $1807.90, the August 10 high. Initial support is at $1702.30, the November 9 low.

- Central bank purchases of gold are at record highs and the IMF reported that Kazakhstan, the UAE, India and Cambodia all increased their gold reserves in October. (bbg)

- There is little economic data tonight but there is some Fed speak and any further hawkish comments or suggestions of a 75bp move at the December meeting would weigh on gold prices.

OIL: Oil Prices Range Trading As Supply And Demand Concerns Offset Each Other

Oil prices have been trading in a very tight range after OPEC+ denied any imminent output increases overnight. They also don’t seem to have been rattled by China Covid news today. They are again balancing an uncertain supply outlook and concerns regarding Chinese demand. WTI crude is up 0.3% from the NY close around $80.25/bbl, it has spent the day in a 50c range. Brent is up 0.4% around $87.80.

- WTI has been trading close to its initial resistance of $80.49. If it breaks this then the next level to watch is $85.60, the 50-day EMA. Initial support is $74.96, which is a key medium-term support level. WTI remains in a bearish trend and has been extending its reversal from $92.53, the November 7 high.

- The WTI spread between the two nearest contracts is still in backwardation but has narrowed over the week, suggesting an easing of supply pressures.

- The details of the G7 oil price cap on Russia could be announced as soon as Wednesday, according to Bloomberg. The plan bans companies from providing all shipping-related services to transport Russian oil if it is being sold above a certain price.

- There is US API weekly crude oil inventory data published tonight. There are also a number of Fed speakers and a bearish tone would weigh on oil prices.

FOREX: USD Stays On The Back Foot

The USD has stayed under pressure for much of the session, although overall losses have remained fairly modest. The BBDXY is off by around 0.20% (1289), the DXY by a similar amount. Headline flow has remained light, while slightly lower UST yields and a firmer equity backdrop have weighed on the USD from a cross asset standpoint.

- NZD has generally outperformed, despite a wider trade deficit posted for October. Focus likely rests on tomorrow's RBNZ meeting, where 75bps is the consensus, although not fully price by markets. NZD/USD is around +0.35% since the open, last at 0.6120/25.

- AUD has lagged but is still firmer for the session. The pair was last close to 0.6620. A firmer backdrop for China property stocks has helped at the margin and dragged the currency off earlier lows (close to 0.6600). The AUD/NZD cross got close to 1.0800, but is now back at 1.0815/20.

- JPY has firmed as the session has progressed, moving further away from overnight highs above 142.00. The pair last just under 141.70.

- Still to come is RBA's Lowe Speech, 7:30pm AEDT, 8:30am BST. UK public finances are on tap as well, along with some ECB speakers. In the US the Richmond Fed prints, while Fed speak is also due.

FX OPTIONS: Expiries for Nov22 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9835-50(E878mln)

- USD/CNY: Cny7.1000($525mln), Cny7.2500($810mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/11/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 22/11/2022 | 0900/1000 | ** |  | EU | EZ Current Account |

| 22/11/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 22/11/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/11/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/11/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 22/11/2022 | 1600/1100 |  | US | Cleveland Fed's Loretta Mester | |

| 22/11/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/11/2022 | 1645/1145 |  | CA | BOC's Sr Deputy Rogers talk on financial stability | |

| 22/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 22/11/2022 | 1915/1415 |  | US | Kansas City Fed's Esther George | |

| 22/11/2022 | 1945/1445 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.