-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI EUROPEAN OPEN: Familiar Stories Dominate Overnight

EXECUTIVE SUMMARY

- FED'S BOSTIC: LIFTOFF COULD OCCUR AS EARLY AS H2 2022 (MNI)

- FED'S BARKIN SEES STRONG SECOND HALF AFTER 'BUMPY' FEW MONTHS (BBG)

- FED'S KAPLAN HOPES TO BEGIN QE WEANING THIS YEAR (RTRS)

- TRUMP AND PENCE SIGNAL PRESIDENT WON'T RESIGN OR BE REMOVED (BBG)

- CHINA PLANS FURTHER HONG KONG CRACKDOWN AFTER MASS ARREST (RTRS SOURCES)

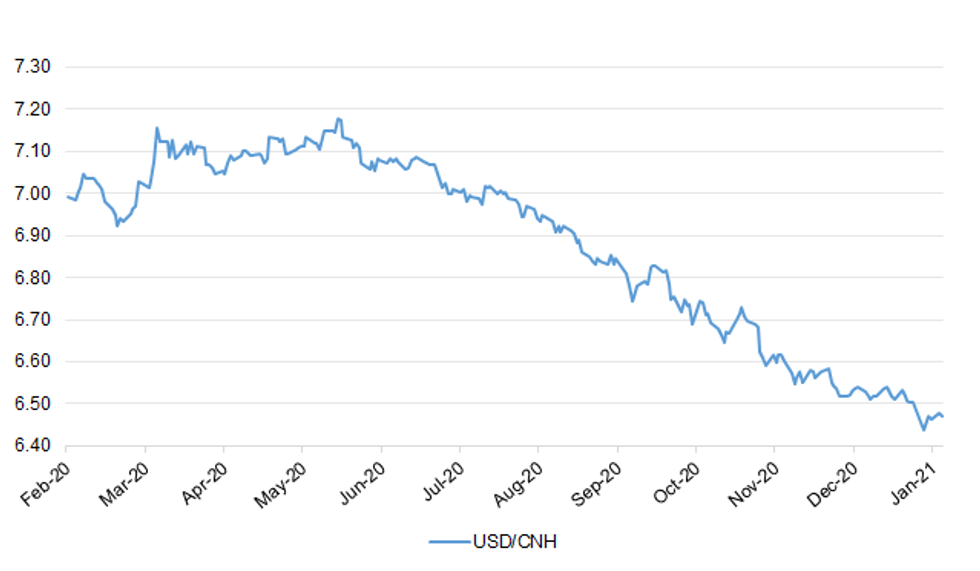

Fig. 1: USD/CNH

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Pre-departure Covid-19 testing will be required for everyone travelling to the UK from 04:00 GMT on Friday. People arriving by plane, train or boat, including UK nationals, will have to take a test up to 72 hours before leaving the country they are in. All those arriving from places not on the government's travel corridor list must still self-isolate for 10 days. There are issues with testing availability and capacity, so some countries will initially be exempt. (BBC)

CORONAVIRUS: Boris Johnson was on Monday urged by Conservative MPs to set a March 8 target for easing coronavirus restrictions after ministers insisted 15m of the most vulnerable people in the UK would be offered a vaccine by mid-February. The Department of Health said 2.3m people had been vaccinated since early December, and health secretary Matt Hancock said he was "confident" the government's goal of reaching 15m would be met by February 15. However, Tory MPs sceptical about England's lockdown seized on progress with vaccinating four priority groups of people — those over 70, health and social care workers and the clinically vulnerable — to demand a plan from the prime minister for lifting the restrictions. (FT)

CORONAVIRUS: The health secretary has suggested the prime minister was operating within the rules when he went cycling seven miles from Downing Street during lockdown. Boris Johnson was spotted at the Olympic Park in east London with members of his security detail on Sunday, according to the Evening Standard. (Sky)

BREXIT: The British finance industry will have to be patient as the European Union decides what sort of market access it will allow, according to an official from the 27-nation bloc. U.K. firms' ability to serve clients on the continent will largely depend on how British regulations evolve, something that still has to be assessed in detail, said Almoro Rubin de Cervin, who's in charge of international relations at the European Commission's department for financial services. (BBG)

ECONOMY: The UK economy will "get worse before it gets better" as the country battles the pandemic, Chancellor Rishi Sunak has warned. The chancellor told MPs the new national restrictions were necessary to control the spread of coronavirus. However, he said they would have a further significant economic impact, "Even with the significant economic support we've provided, over 800,000 people have lost their job since February," he said. "Sadly, we have not and will not be able to save every job and every business. "But I am confident that our economic plan is supporting the finances of millions of people and businesses." The chancellor said "the road ahead will be tough", but maintained that the government was "taking the difficult but right long-term decisions for our country". (BBC)

ECONOMY: British consumer spending fell in December at the fastest rate in six months, with pubs and restaurants especially hard hit by a resurgence of coronavirus cases, a survey showed on Tuesday. Payment card provider Barclaycard said consumer spending contracted 2.3% in year-on-year terms last month, the biggest drop since June when most of the economy was still in lockdown. (RTRS)

EUROPE

CORONAVIRUS: France and other EU nations are racing to isolate cases of the highly infectious variant of Covid-19 dominant in parts of England while preparing for a possible tightening of restrictions on movement if the mutation threatens to spread widely. Jean Castex, French prime minister, told parliamentarians at a meeting on Monday that it was impossible to rule out a third lockdown for the country, according to officials. (FT)

ITALY: A junior partner in Italy's ruling coalition is considering ditching the alliance as early as Tuesday, threatening to bring down Premier Giuseppe Conte's government just as the country is battered by a resurgence of the coronavirus pandemic, according to officials. (BBG)

ITALY/BTPS: Italy to offer BTPs with maturity of 3, 7 and 30 years on Jan. 14 , Finance ministry says in a statement on Monday. The maximum amount will be EU9.25B, according to the statement. (BBG)

PORTUGAL: Portuguese President Marcelo Rebelo de Sousa tested positive for Covid-19 late on Monday but has no symptoms of the virus. Rebelo de Sousa, 72, will remain in self isolation and has canceled his agenda for the coming days, according to a statement posted on the presidency's website. Portugal on Monday reported the biggest daily increase in deaths from the coronavirus since the start of the outbreak. (BBG)

U.S.

FED: MNI BRIEF: Bostic: Liftoff Could Occur As Early As H2 2022

- Atlanta Fed President Raphael Bostic said Monday that he could see liftoff of its benchmark interest rate in as early as late 2022, assuming the economy performs better than expected currently Latest MNI interview on Chinese consumption published - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of Richmond President Thomas Barkin says the U.S. could face a bumpy first six months but will be well supported by the rollout of Covid-19 vaccines and fiscal stimulus later in the year. "I do think you're looking at a second half that is going to be very strong and the question I think is how do we get through where we are today to that second half," Barkin, who votes on monetary policy this year, told CNBC in an interview Monday. "While it might be bumpy, I think there are backstops here, and in particular, fiscal would be a backstop, I think elevated savings are a backstop," he said. "We've given outcome guidance not date guidance so I couldn't tell you the day. I do think this notion of 'substantial further progress' is the right way to think about it," he said. "So there are scenarios certainly where we see strong recovery in unemployment and inflation but there are lots of scenarios where we don't."

FED: Dallas Federal Reserve President Robert Kaplan on Monday said he expects broad vaccine distribution to unleash strong economic growth later this year, allowing the U.S. central bank to begin to pull back on some of its extraordinary monetary support. "We should be as aggressive as we can be while we are in the teeth of this pandemic, until we are convinced that we have weathered this pandemic," Kaplan said in a virtual town hall event. But "later this year, my own view is, we should at least be having an earnest discussion about when it's appropriate to taper" the Fed's asset purchase program. (RTRS)

FISCAL: MNI BRIEF: US CBO Projects December Budget Deficit Of $143B

- The nonpartisan U.S. Congressional Budget Office on Monday projected the December federal budget deficit will be USD143 billion, up USD129 billion compared to the deficit in December 2019 Latest MNI interview on Chinese consumption published - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CORONAVIRUS: US coronavirus cases and deaths had their smallest daily increases in a week, while hospitalisations remained below a record high for the fifth day running. (FT)

CORONAVIRUS: Senate Democrats on Monday demanded the Trump administration make changes to its Covid-19 vaccine rollout strategy, saying it has "failed" states by not providing detailed guidance on how to effectively distribute the potentially lifesaving doses to Americans across the country. (CNBC)

CORONAVIRUS: New York governor Andrew Cuomo pleaded for patience and also suggested the federal government was to blame as the state struggles to ramp up what has been a plodding vaccination roll-out programme. (FT)

POLITICS: Vice President Mike Pence signaled he'll spurn demands to immediately oust Donald Trump over a deadly riot by the president's supporters as the two met and agreed to work together for the remainder of the term, according to a senior administration official. The discussion adds to indications that Trump has no plans to resign before Joe Biden's Jan. 20 inauguration. It was the first time Trump and Pence have spoken since the president's supporters stormed the Capitol while Pence was presiding over formal affirmation of his re-election defeat, according to two people familiar with the matter. (BBG)

POLITICS: President-elect Joseph R. Biden Jr. said he was exploring ways for Democrats in Congress to advance his agenda while pursuing a second impeachment of President Trump. Asked about the impeachment proceeding now underway against Mr. Trump in Congress, where House Democrats introduced an article of impeachment today, Mr. Biden noted that his top priority is the passage of a new economic stimulus plan and repairing the U.S. economy. But Mr. Biden added that he had spoken to House and Senate Democrats about whether it would be possible to "bifurcate" Congressional business, splitting days between impeachment and confirming his nominees and passing his agenda. (New York Times)

POLITICS: House Democrats Monday introduced a resolution to impeach President Donald Trump for a second time, setting up a vote this week unless Vice President Mike Pence uses his constitutional authority to remove the president. A majority of the Democratic-controlled House has signed on to the resolution led by Representatives David Cicilline, Jamie Raskin and Ted Lieu charging Trump with inciting the insurrection at the Capitol on Jan. 6th. It seeks to both remove him from the presidency and prevent him from ever holding office again. Majority Leader Steny Hoyer told Democrats on a conference call that the House will take up the resolution Wednesday. (BBG)

POLITICS: Senate Minority Leader Chuck Schumer (D-N.Y.) is exploring a way to force the Senate back into session before Jan. 20 to consider articles of impeachment against President Donald Trump for the second time, according to a senior Democratic aide. Reconvening the chamber ― which effectively adjourned after a mob stormed into and ransacked the U.S. Capitol last week, resulting in the deaths of at least five people ― would require agreement from Senate Majority Leader Mitch McConnell (R-Ky.), the aide noted. (Huffington Post)

POLITICS: The expectation House Republicans will reject a plan to use the 25th Amendment to oust President Trump on Tuesday is shuffling Democrats and Republicans on the impeachment vote to follow. House Democrats are split between those who want to deliver an impeachment resolution immediately and those who want to withhold it to allow other Senate business to proceed. A sizable number of Republicans may also vote to impeach after last week's pro-Trump assault on the Capitol. (Axios)

POLITICS: The leader of the Republican caucus in the House of Representatives told colleagues Monday that President Donald Trump bears some responsibility for the riot at the Capitol last week, two sources told NBC News. Minority Leader Kevin McCarthy of California also did not rule out supporting a motion to censure Trump for his actions, according to the report. (CNBC)

POLITICS: The FBI has also issued a bulletin warning of plans for armed protests at all 50 state capitals and in Washington, D.C., in the days leading up to Biden's inauguration. (Associated Press)

POLITICS: The head of the National Guard says at least 10,000 troops will be deployed in Washington, D.C., by Saturday, and an additional 5,000 could be requested from other states. There are currently 6,200 Guard members in the city from D.C. and five nearby states. The increase in requests for Guard members on Monday comes as officials brace for more, possibly violent protests surrounding the inauguration of President-elect Joe Biden. (NBC Washington)

POLITICS: The District of Columbia's attorney general said Monday that he is looking at whether to charge Donald Trump Jr., Rudy Giuliani and U.S. Rep. Mo Brooks with inciting the violent invasion of the U.S. Capitol last week by a horde of President Donald Trump's supporters. Karl Racine also left open the door to prosecuting President Trump himself for the same conduct once he leaves office later this month. (CNBC)

POLITICS: Acting Homeland Security Secretary Chad Wolf resigned Monday, becoming the third Cabinet-level official to quit on the heels of the riot at the U.S. Capitol by a mob of President Donald Trump's supporters. (CNBC)

OTHER

CHINA/HONG KONG: The arrest of more than 50 democrats in Hong Kong last week intensifies a drive by Beijing to stifle any return of a populist challenge to Chinese rule and more measures are likely, according to two individuals with direct knowledge of China's plans. While stressing that plans haven't been finalised, the individuals said it was possible that Hong Kong elections - already postponed until September on coronavirus grounds - could face reforms that one person said were aimed at reducing the influence of democrats. (RTRS)

U.S./EU: U.S. Customs and Border Protection said in a notice issued late on Monday that it will begin collections of new duties on aircraft parts and other products from France and Germany at 12:01 a.m. ET (0501 GMT) on Tuesday as part of the long-running Boeing-Airbus subsidy battle. The notice follows an announcement by the U.S. Trade Representative's office that it would impose an additional 15% tariff on aircraft parts, including fuselage and wing assemblies, and a 25% duties on certain wines. (RTRS)

UK/CHINA: Britain is to tighten the law on importing goods linked to alleged human rights abuses in China as ministers take a tougher stance on Beijing. Dominic Raab, the Foreign Secretary, will on Tuesday make a statement in the Commons on the Government's response to forced labour in Xinjiang, the northwest Chinese region that is home to around 12 million Uighur Muslims. (Telegraph)

CORONAVIRUS: New, more contagious mutated variants of the coronavirus are "highly problematic" and could cause more cases and hospitalizations if the virus' spread isn't immediately suppressed, the head of the World Health Organization said on Monday. (CNBC)

CORONAVIRUS: World Health Organization (WHO) chief scientist Soumya Swaminathan said Monday that herd immunity to the coronavirus would not be achieved in 2021, despite the growing availability of vaccines. Mitigating factors to herd immunity include limited access to vaccines in developing countries, skepticism about vaccination and the potential for virus mutations, according to health experts. (Deutsche Welle)

CORONAVIRUS: Moderna doesn't expect to have clinical trial data on its coronavirus vaccine in young children until 2022, CEO Stephane Bancel said Monday. (CNBC)

CORONAVIRUS: The general efficacy of the vaccine developed by China's Sinovac Biotech Ltd. against coronavirus was between 50% and 60% in Brazil trials, website UOL reported citing unnamed people. Brazil's Butantan Institute, which has partnered with the Chinese firm to produce the shot, said ny information on the matter that isn't presented by the institute "is purely speculative." In a press conference last week, officials said the vaccine was 78% effective in preventing mild cases of Covid-19 and 100% effective against severe and moderate infections. It wasn't apparent how the Brazilian researchers calculated that efficacy rate. (BBG)

JAPAN: The Japanese government will declare a state of emergency for Osaka, Kyoto and Hyogo prefectures as soon as Wednesday in an effort to contain the spread of coronavirus, public broadcaster NHK reports, without attribution. Aichi and Gifu governments will also ask the central government as soon as today to declare emergencies in the prefectures, according to the report. (BBG)

JAPAN: Osaka to expand shorter hour request. (Nikkei)

JAPAN: Japan's government will maintain its existing budgets for now, despite new measures to fight the spread of the coronavirus, finance minister Taro Aso tells reporters Tuesday in Tokyo. (BBG)

BOJ: BOJ financial market dept to have market op. meeting Feb. 19. (BBG)

NEW ZEALAND: New Zealand's borders controls are getting even stricter, with arrivals from virtually all countries soon needing a negative Covid test before boarding a plane here. (Stuff NZ)

SOUTH KOREA: South Korea's prime minister Chung Sye-kyun said on Tuesday that the government is trying to purchase more coronavirus vaccines from different companies to address uncertainties over the safe inoculation of the public. "The government has been working to purchase an additional quantity of vaccines of another platform and has seen substantial progress," Mr Chung told government officials. (FT)

SOUTH KOREA: South Korea's stock market regulators are sticking with their plan to lift the short-selling ban they imposed in the early days of the pandemic to tamp down on volatility despite a potential backlash from retail investors. The Financial Services Commission said in a text message Monday evening that it plans to lift the ban on March 16. It imposed the ban in March, one of the longest such prohibitions globally. Korea's stock market is the world's best performing market in the past year. (BBG)

NORTH KOREA: Officials and other guests have been invited to "celebrations" arranged to mark the ongoing party congress, Pyongyang's media reported Tuesday, raising the possibility that Pyongyang might be preparing to hold a military parade. On Monday, Seoul's military officials said signs were detected that the North carried out a military parade in central Pyongyang Sunday night in time for the eighth congress of the ruling Workers' Party, which has been under way since its opening last week. (RTRS)

ASIA: The widespread fallout from the pandemic and the measures adopted by governments to contain it have created an economic, fiscal and social shock that will last into 2021, underpinning Moody's Investors Service's negative outlook for APAC sovereign creditworthiness in 2021. Sovereigns' recovery from the shock will be shaped by policy effectiveness in containing the pandemic, with varying governance strengths driving an uneven recovery across the region. (Moody's)

CANADA: Canadian Prime Minister Justin Trudeau is planning to replace a handful of ministers, CBC News says in a tweet, citing people with knowledge of the shuffle. Industry Minister Navdeep Bains doesn't plan to run in the next election and will leave the cabinet, CBC says. Bains to be replaced by Foreign Affairs Minister Francois-Philippe Champagne, CBC says. Marc Garneau to become the new foreign minister; Omar Alghabra will replace Garneau in the transport ministry. Change expected to occur Tuesday ahead of virtual cabinet retreat. (BBG)

CANADA: MNI POLICY: Canada Q4 Consumer Sentiment Up on Spending, Homes

- Canadian consumer confidence rose in the fourth quarter after setting a record low during the first wave of Covid, led by spending gains and signs a resilient housing market is lifting prices. The MNI summary measure of the Bank of Canada's household survey data was +60 compared with +40 in the third quarter and -96 in the second quarter. Nine of 13 components in the summary measure showed improvement this time, up one from the previous analysis - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

TURKEY: Greece and Turkey will resume talks later this month aimed at resolving their differences over energy exploration and maritime borders. "The 61st round of exploratory talks will take place in Istanbul on January 25," the Greek Foreign Ministry said in a statement late Monday. Earlier in the day, Turkish Foreign Minister Mevlüt Çavuşoğlu said Ankara had made an official invitation to Athens to resume talks. (Politico)

MEXICO: Lawmakers will start meetings on Thursday to listen "unheard voices" in a debate about a bill that would make the Mexican central bank a dollar buyer of last resort for local financial institutions, a top ruling party senator said on Monday. (BBG)

BRAZIL: The candidate backed by President Jair Bolsonaro in the race for the lower house speakership pledged to protect Brazil's spending cap rule, seen by investors as an anchor to the nation's fiscal austerity drive. (BBG)

SOUTH AFRICA: South African President Cyril Ramaphosa extended a prohibition on alcohol sales, restricted cross-border travel and announced plans to buy millions of additional vaccines as hospitals struggle to cope with a surge in coronavirus cases. The country will remain on virus alert level 3, and the alcohol ban that was introduced on Dec. 28 and was due to end on Jan. 15 will remain in place, Ramaphosa said in a nationally televised address. All land-border posts will be closed to most travelers until Feb. 15, public gatherings other than funerals won't be allowed, and a nationwide curfew will be enforced from 9 p.m. to 5 a.m., he said. (BBG)

IRAN: U.S. Secretary of State Mike Pompeo plans to use newly declassified U.S. intelligence on Tuesday to publicly accuse Iran of ties to al Qaeda, two people familiar with the matter said, as part of his last-minute offensive against Tehran before handing over to the incoming Biden administration. (RTRS)

MIDDLE EAST: The U.S. military has not halted a U.S. troop withdrawal from Afghanistan, the Department of Defense told Reuters on Monday, despite a new law prohibiting further reductions without the Pentagon sending Congress an assessment of the risks. (RTRS)

OIL: The Trump administration is expected to grant waivers to some oil refiners that would exempt them from requirements to blend biofuels into their fuel mix for the 2019 compliance year, according to two sources familiar with the matter. (RTRS)

CHINA

CORONAVIRUS: China's coronavirus outbreak in the northern province of Hebei appeared to slow, as nationwide cases on Monday dropped by half to 55, the National Health Commission reported on Tuesday morning. China reported 103 locally-transmitted cases of Covid-19 on Monday, the highest one-day tally since July. (FT)

CORONAVIRUS: China has set up a high-level government working group to oversee emergency planning as it tries to discourage large crowds from travelling during the Spring Festival, amid its highest daily Covid-19 case numbers since July. Authorities have stressed the importance of passenger flow analysis during the festival and encouraged schools and companies to stagger holidays. The ministry of transport said it had set up a pandemic prevention working group under the State Council, China's cabinet, and held its first meeting on Sunday. Mass migration across China normally occurs during Lunar New Year, as people travel to join family gatherings. The holiday this year falls on February 12, and about 407 million train journeys are expected to be taken between January 28 and March 8, according to China's railway authority. (SCMP)

POLICY: China faces unprecedented opportunities for development and has "time on its side," but must accelerate building the new dual-circulation model through further supply-side reform, Communist Party General Secretary Xi Jinping said at a conference of top central and provincial party leaders. According to a readout of the meeting from the Xinhua News Agency, Xi also said that China must increase its ability to innovate and compete, and steadily build a "super-sized" domestic market to ensure a high level of self sufficiency. Xi reportedly reminded his cadres to be prepared for risks as the global balance of power shifts, and ensure that political stability, people's safety and national interests are tied together. (MNI)

INFLATION: China's CPI is forecast at a moderate 1.5% this year, leaving more room for monetary policies, the China Securities Journal reported citing analysts. A rebound in global demand later in the year and the rollout of vaccines against the Covid-19 virus will drive prices of energy and other commodities, although rising pork output will limit food inflation, the newspaper reported citing Zhou Maohua, an analyst from China Everbright Bank. (MNI)

ECONOMY: MNI INTERVIEW: China Can Tap Low-Income Grp For Demand: Advisor

- China can lift consumption immediately by tapping the purchasing power of its lower-income population with more affordable, customised products as demand-side reforms aimed at improving wages and enlarging the middle class will take years to make a difference, a State Counsellor told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

OVERNIGHT DATA

JAPAN NOV BOP CURRENT A/C BALANCE +Y1.8784TN; MEDIAN +Y1.5520TN; OCT +Y2.1447TN

JAPAN NOV BOP CURRENT A/C BALANCE ADJ. +Y2.3393TN; MEDIAN +Y1.9978TN; OCT +Y1.9833TN

JAPAN NOV BOP TRADE BALANCE +Y616.1BN; MEDIAN +Y474.6BN; OCT +Y971.1BN

JAPAN DEC ECO WATCHERS SURVEY CURRENT 35.5; MEDIAN 36.8; NOV 45.6

JAPAN DEC ECO WATCHERS SURVEY OUTLOOK 37.1; MEDIAN 30.5; NOV 36.5

JAPAN DEC BANK LENDING INCL. TRUSTS +6.2 Y/Y; NOV +6.2%

JAPAN DEC BANK LENDING EXCL. TRUSTS +5.9 Y/Y; NOV +5.9%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 108.9; PREV 109.0

For the third year in a row, consumer confidence has begun the year on a flat/downbeat note compared to the pre-Christmas level. Given the Brisbane lockdown and the widespread border closures, the effectively flat result for confidence might be seen as a reasonably good outcome. But confidence usually rises over the holiday period. Between 2009 and 2018, consumer confidence rose 3.3% on average between the last survey of December and the first of January. In this context, the result for this survey should be viewed as soft. Interestingly, notwithstanding the short lockdown, confidence in Brisbane and rest of Queensland was up on the pre-Christmas week. On the other hand, confidence in New South Wales and Victoria declined, as borders closed. (ANZ)

UK DEC BRC RETAIL TOTAL SALES +1.8% Y/Y; NOV +0.9%

UK DEC BRC RETAIL LIKEFL SALES +4.8% Y/Y; NOV +7.7%

CHINA MARKETS

PBOC Net Drained CNY5 Billion Via OMOs Tuesday

The People's Bank of China (PBOC) injected CNY5 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net drain of CNY5 billion given the maturity of CNY10 billion of reverse repos today, according to Wind Information.

PBOC Sets Yuan Parity Higher At 6.4823 Tues; +7.01% Y/Y

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a fourth trading day at 6.4823 on Tuesday. This compares with the 6.4764 set on Monday.

MARKETS

SNAPSHOT: Familiar Stories Dominate Overnight

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 29.53 points at 28168.56

- ASX 200 down 18.06 points at 6679.1

- Shanghai Comp. up 28.646 points at 3560.015

- JGB 10-Yr future up 5 ticks at 151.83, yield down 0bp at 0.035%

- Aussie 10-Yr future down 4.0 ticks at 98.840, yield up 4.3bp at 1.148%

- U.S. 10-Yr future down 0-04+ at 136-09, yield up 0.18bp at 1.1478%

- WTI crude down $0.09 at $52.16, Gold up $7.99 at $1851.73

- USDJPY up 4 pips at 104.30

- FED'S BOSTIC: LIFTOFF COULD OCCUR AS EARLY AS H2 2022 (MNI)

- FED'S BARKIN SEES STRONG SECOND HALF AFTER 'BUMPY' FEW MONTHS (BBG)

- FED'S KAPLAN HOPES TO BEGIN QE WEANING THIS YEAR (RTRS)

- TRUMP AND PENCE SIGNAL PRESIDENT WON'T RESIGN OR BE REMOVED (BBG)

- CHINA PLANS FURTHER HONG KONG CRACKDOWN AFTER MASS ARREST (RTRS SOURCES)

BOND SUMMARY: Core FI Mixed After Early Pressure In Asia

T-Notes recovered from worst levels of the Asia-Pac session after early trade saw Monday's low breached, with some profit taking on low vol TY downside plays (both on screen and via block) noted. Macro headline flow was generally light, with Fed's Kaplan (a non-voter in '21) pointing to the potential for QE tapering later this year and a sign from Messrs Trump & Pence that the President plans to see out the short remainder of his term headlining overnight. RTRS source reports pointing to the potential for a deeper Chinese crackdown re: the HK political sphere may have provided some light support. T-Notes last -0-03 at 136-10+, while cash Tsys trade little changed across the curve.

- JGB futures firmed in afternoon trading, aided by a moderation in offer to cover ratios in the BoJ's latest round of 3-25 Year Rinban ops, while FinMin Aso noted that the government will maintain its existing budget outlines for now. Early morning trade saw some light pressure on the back of the broader impetus seen in core global FI in recent sessions, with Tokyo returning from an elongated weekend. Futures last +8, with modest twist steepening of the cash curve in play after the aforementioned Rinban ops allowed the shorter end of the curve to unwind its early, modest underperformance.

- Aussie bonds traded in a lacklustre fashion, with little in the way of notable headline flow seen. YM -0.5, XM -3.5, following the broader themes seen in core FI during Asia-Pac hours after the latter printed at the lowest levels seen since the March vol in early Sydney trade.

EQUITIES: China Outperforms As E-Minis Fade Back From Overnight Highs

E-minis traded either side of unchanged in Asia-Pac hours, while the major regional equity markets were flat to higher, with little in the way of tier 1 macro headline flow noted in the timezone. This allowed participants to step back and assess multiple, well discussed risk matters in the wake of a modest dip on Wall St.

- Chinese equities were the largest mover, with President Xi re-affirming the nation's support for the policy of dual-circulation, as he noted that policymakers want to build a "super-sized" domestic market to ensure a high level of self-sufficiency, which in turn supported Chinese equities.

- Nikkei 225 unch., Hang Seng +0.5%, CSI 300 +1.1%, ASX 200 unch.

- S&P 500 futures -1, DJIA futures -13, NASDAQ 100 futures +7.

GOLD: Not Threatening Recent Lows

Yesterday's low of $1,817.5/oz now represents the initial area of support which bears will look to force a break of to extend the recent sell off. Spot last dealing marginally higher on the day around the $1,850/oz mark, even with the DXY and U.S. real yields moving higher over the last 24 hours or so.

- Elsewhere, ETF holdings of gold have flatlined over the last few days.

OIL: A Quiet Start To The Week

WTI and Brent sit a handful of cents below their respective settlement levels, with the benchmarks unchanged to a touch lower vs. Friday's closing levels after a limited round of early trade this week, with crude hovering just shy of recent cycle highs. API crude inventory data will hit later on Tuesday.

FOREX: Tight Ranges All Round

A quiet session, US dollar strength has taken a breather in Asia on Tuesday while risk sentiment in the region is mixed. DXY last at 90.576 after closing yesterday at 90.465, the index tread water throughout the session.

- AUD & NZD are flat. Both initially moved higher alongside equity indices in the region, before gradually giving back. AUD/USD hovers around the key 0.77 level, while NZD/USD has receded from 0.72. Headline flow from the region has been thin, New Zealand did announce plans to tighten coronavirus detection measures for travellers. Both head into the European time zone near session lows.

- JPY is broadly flat at 104.30. Trade data today from Japan showed November's surplus rose to JPY 616bn against JPY 474bn expected, but lower than the JPY 971 in October. Bank lending data was also released which showed bank lending excluding trusts rose 5.9% in December, in line with October.

- The PBOC drained a net CNY 5bn from the system today, and fixed USD/CNY at 6.4823 around 59 pips higher than yesterday. The PBOC has weakened the yuan 115 pips so far this week, but USD/CNY bucked the trend and rose against the greenback. President Xi reaffirmed the nation's support for the policy of dual-circulation, as he noted that policymakers want to build a "super-sized" domestic market to ensure a high level of self-sufficiency, which in term supported risk sentiment.

- EUR slightly lower from the NY close, some chatter of bids surrounding 1.2125 coming from leveraged names. Some sizable put option strikes due today are EUR 1.4bn at 1.2250; EUR 1.4bn at 1.2200 and EUR 1.1bn at 1.2150.

FOREX OPTIONS: Expiries for Jan12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2150(E1.1bln-EUR puts), $1.2200(E1.4bln-EUR puts), $1.2230(E632mln), $1.2250(E1.4bln-EUR puts), $1.2275(E618mln), $1.2300(E2.1bln-mainly EUR puts), $1.2370-75(E826mln-EUR puts), $1.2400(E865mln-EUR puts)

- USD/JPY: Y102.90-00($984mln), Y103.10-25($1.4bln), Y103.35-43($616mln),

Y103.85-00($1.7bln-USD puts), Y104.10-30($1.1bln) - GBP/USD: $1.3995-1.4000(Gbp986mln-GBP puts)

- EUR/GBP: Gbp0.9300(E766mln)

- AUD/USD: $0.7500(A$516mln), $0.7650(A$508mln), $0.7750(A$828mln)

- USD/CAD: C$1.2750($615mln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.