-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRiEF: Riksbank Puts Neutral Rate In 1.5 To 3.0% Range

MNI: Japan Govt Keeps Economic Assessment, Ups Imports

MNI EUROPEAN OPEN: CAD, MXN Weaken On Tariff Threat, JPY Firms

MNI EUROPEAN OPEN: FDIC Reviewing First Republic Bids

EXECUTIVE SUMMARY

- The U.S. government has asked JPMorgan, PNC and several other financial groups, including a handful of non-bank investment firms, to bid for all or part of First Republic (BBG)

- Democratic Representative Khanna said FDIC should be seeking the “lowest-cost alternative” to rescue First Republic Bank (BBG)

- UK nurses warned there will be no quick conclusion to strikes as health-care workers prepare for a new walkout beginning tonight. (BBG)

- China's manufacturing activity unexpectedly shrank in April, official data showed on Sunday (RTRS)

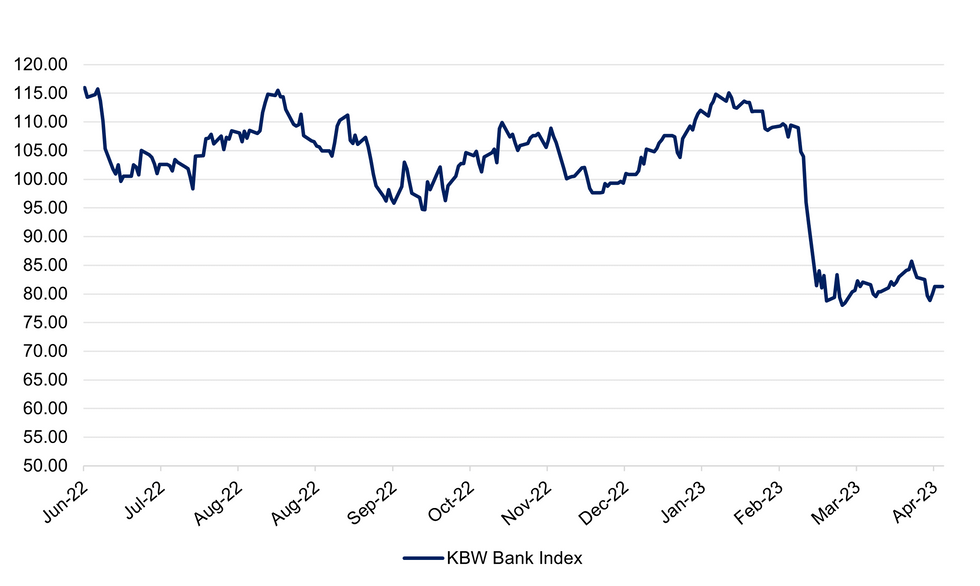

Fig. 1: KBW Bank Index

Source: MNI - Market News/Bloomberg

UK

STRIKES: UK nurses warned there will be no quick conclusion to strikes as health-care workers prepare for a new walkout beginning tonight. (BBG)

POLITICS: The most senior civil servants in the UK Business Department intervened to protect their staff after officials raised concerns about a former ministers behavior. (BBG)

CHIPS: UK chip start up Paragraf ltd has bought a California-based competitor, acquiring manufacturing capabilities as well as technological expertise. (BBG)

EUROPE

INFLATION: French food price increases should start to ease by September the country’s minister for small and medium enterprises, trade and tourism said. (BBG)

U.S.

BANKS: The U.S. government has asked JPMorgan, PNC and several other financial groups, including a handful of non-bank investment firms, to bid for all or part of First Republic, as U.S. regulators try to determine how much it would cost taxpayers to take over the embattled California lender. (BBG)

BANKS: A deal on First Republic is getting close (MNI)

BANKS: Democratic Representative Khanna said FDIC should be seeking the “lowest-cost alternative” to rescue First Republic Bank (BBG)

STOCKS: SoftBank Group Corp's chip maker Arm Ltd has filed with regulators confidentially for a U.S. stock market listing, Arm said on Saturday, setting the stage for this year's largest initial public offering. (RTRS)

OTHER

BOJ: The BoJ left its major monetary policy levers unchanged at the end of Governor Ueda’s first meeting atop the central bank, as was widely expected, although made a more forceful tweak to its forward guidance than many expected. (MNI)

JAPAN: Rising inflation and an intensifying labour crunch are prodding smaller local Japanese firms to follow their big counterparts in raising pay, a move that can generate broader wage hikes and encourage the central bank to phase out its massive stimulus. (RTRS)

JAPAN: Japan's economy is expected to expand 0.2% in Q1 for the second straight quarter following solid private consumption and public investment (MNI)

UKRAINE: Ukraine had protested to key allies the European Union and Poland over restrictions on its grain supplies on Friday, before the European Commission announced later in the day that a deal had been reached in principle to resolve the matter. (RTRS)

UKRAINE: Wagners Prigozhin warns he is ready to withdraw from Bakhmut (BBG)

SOUTH KOREA: South Korea's exports fell for a seventh straight month in April for their longest losing streak in three years, driven by an extended slump in sales to China and suggesting persistent pressure on the economy from frail global demand. (RTRS)

BRAZIL: Brazilian President Luiz Inacio Lula da Silva pledged on Sunday to introduce a new policy of real increases in the minimum wage and announced plans to raise the income tax exemption for lower-income earners. (RTRS)

COLOMBIA: Colombia's central bank board raised the benchmark interest rate by 25 basis points to 13.25% on Friday, continuing a long tightening cycle amid persistent inflation and significant stability risks to the global financial system, it said. (RTRS)

SHIPPING: Ship traffic in Turkey's Bosphorus Strait is set to resume for southbound vessels as of 1840 GMT on Sunday, after a suspension due to an engine failure on one ship, the Tribeca shipping agency said. (RTRS)

COMMODITIES: Australia Pacific Coalis on track to restart a thermal coal mine in New South Wales state in the fourth quarter after it secured a supply agreement with a global coal buyer, it said on Monday. (RTRS)

OIL: Oil prices slide on Fed rate hike expectations, weaker China manufacturing data (RTRS)

OIL: The U.S. will not block a court auction of shares in oil refiner Citgo Petroleum Corp's parent, Justice Department officials told a federal court, paving the way for a potential seizure by creditors of Venezuela's most-prized foreign asset. (RTRS)

CHINA

ECONOMY: China's manufacturing activity unexpectedly shrank in April, official data showed on Sunday, raising pressure on policymakers seeking to boost an economy struggling for a post-COVID lift-off amid subdued global demand and persistent property weakness. (RTRS)

ECONOMY: China’s manufacturing activity unexpectedly contracted in April, a sign the economic recovery remains patchy and may be struggling to sustain momentum. (BBG)

ECONOMY: China’s economic recovery remains patchy with the latest indicators pointing to a contraction in manufacturing. (BBG)

HOUSING: China’s home sales rose for a third month in April, adding to signs of a recovery after policymakers expanded support for the beleaguered sector. (BBG)

TRAVEL: China’s tourism and consumer activities rose sharply on the first day of the five-day Labor Day holiday, as residents rushed to travel and spend after three years of Covid restrictions finally ended. (BBG)

OVERNIGHT DATA

AUSTRALIA APR, F JUDO BANK MFG PMI 48.0; PRIOR 48.1

SOUTH KOREA APR TRADE BALANCE -$2,620mn; MAR -$4,632mn

JAPAN APR, F JIBUN BANK MFG PMI 49.5; PRIOR 49.5

JAPAN APR CONSUMER CONFIDENCE INDEX 35.4; MAR 33.9

AUSTRALIA APR MELBOURNE INSTITUTE INFLATION M/M 0.2%; PRIOR 0.3%

AUSTRALIA APR ANZ-INDEED JOB ADVERTISEMENTS; -0.3%

MARKETS

US TSYS: Early Cheapening Holds In Asia

TYM3 deals at 115-07+, +0-01, a touch off the base of the 0-07 range on volume of ~58k.

• Cash tsys sit 2-4bps cheaper across the major benchmarks, the curve bear flattened.

• Tsys were pressured in early dealing as local participants digested weaker-than-expected Chinese PMI data published yesterday as well as Fridays US data.

• An expected deal for First Republic did not eventuate as Reuters reported that regulators have had to ask for bids to be revised although a decision is said to be getting closer.

• Ranges were narrow with little follow through on moves for the remainder of the session.

• FOMC data OIS price a ~22bp hike for this weeks FOMC meeting which headlines the week's calendar, with a terminal rate of ~5.10% in June. There are ~60bps of cuts priced for 2023.

• There is a thin docket in Europe today with the UK and several European countries closed for the observance of national holidays. Further out we have the latest ISM Survey which headlines an otherwise thin calendar.JGBS: Futures Dip Into Negative Territory, Swaps Curve Bear Steepens

JGB futures sit at Tokyo session lows, -3 compared to settlement levels, after local participants faded strength seen in overnight trade ahead of the weekend. Assisting the move lower over the Tokyo session has been a cheapening in US tsys in Asia-Pac trade.

• Consumer Confidence for April, just released, surprised on the upside with a print of 35.4 versus expectations of 34.5 and 33.9 in March. The data however failed to generate a significant immediate market reaction.

• JBM3 currently sits at 148.57, sandwiched between the April trading range's top at 147.92 and the March 22 high at 149.53. Technical analysis from MNI suggests that breaking the March 22 high would signal the continuation of the uptrend.

• Cash JGBs are trading mixed across the curve, with the 4-5-year zone outperforming. Benchmark yields are 0.4bp lower to 4.2bp higher, with the 30-40-year zone experiencing the weakest performance. The benchmark 10-year yield is 0.3bp higher at 0.397%, well below BoJ's YCC limit of 0.50%.

• The swaps curve has bear steepened with rates 0.2-5.6bp higher. Swap spreads are wider across the curve.

AUSSIE BONDS: Cheapen with US Tsys Ahead of RBA Decision Tomorrow

ACGBs sit slightly weaker (YM -1.0 & XM -1.0) after early gains inspired by US tsys strength ahead of the weekend are more than reversed over the Sydney session. With little meaningful macro news flow, the local market has traded with US tsys, which have cheapened in Asia-Pac trade, ahead of tomorrow’s RBA policy decision.

• The RBA is expected to remain on hold at its policy decision meeting tomorrow, taking advantage of the Q1 core CPI undershoot to assess the impact of the 350bp of tightening that has been delivered.

• RBA dated OIS is currently attaching a 12% chance of a 25bp hike versus 36% ahead of Q1 CPI data. Terminal rate expectations, which have centred on the August meeting, have also been scaled back with current pricing at 3.70%, 13bp of cumulative tightening.

• Cash ACGBs are flat to 1bp cheaper with the AU/US 10-year yield differential +3bp at -11bp.

• Swap rates are 1-2bp higher with EFPs slightly wider.

• Bills strip pricing is -2 to +1 with mid-reds the strongest.

• RBA Governor Lowe is scheduled to deliver a speech (1220 BST) after tomorrow’s decision.

NZGBS: Twist Flattens As Short-End Unwinds Gains

NZGBs closed stronger but off session bests, particularly for the short end. 2/10 NZGB cash curve steepened 6bp on the day with 2-year and 10-year benchmark yields respectively flat and 6bp lower. The 2-year yield was down as much as 8bp early. Without a domestic catalyst, NZGBs moved away from bests as US tsys cheapened in Asia-Pac trade.

• 2s10s swap curve twist flattens with rates 1bp higher to 3bp lower and implied long-end swap spreads wider.

• RBNZ dated OIS closed flat to 3bp firmer across meetings. May meeting pricing remained at 22bp of tightening.

• The Antipodean calendar sees the RBA Policy Decision tomorrow, with no change expected, ahead of the release of the Q1 Labour Market Report on Wednesday. BBG consensus expects some cooling in tight labour market conditions. Q1 wage growth is however expected to remain at Q4’s strong pace.

• Ahead of the release of the 2023 Financial Stability Report (Wed), the RBNZ noted in an article that NZ lending is generally at variable or short-term fixed rates, which means the potential losses for banks from interest rate movements are smaller.

• Ahead of the RBA decision, the local market will be guided by US tsys through the release of US ISM Manufacturing PMI later today.FOREX: Yen Pressured In Asia

The yen is under pressure in Asia today continuing its move lower seen on Friday after the latest BoJ monetary policy decision. USD/JPY is at its highest level since mid-March.

• USD/JPY has extended gains through the session, the pair now sits a touch under the ¥137 handle and is ~0.5% higher today. Bulls target a break of ¥136.99 high from Mar 10 opening up ¥137.91 high from Mar 8 and key resistance.

• Kiwi is little changed, NZD/USD has observed a narrow 20 pip range for the most part of today's session with little follow through on moves.

• AUD is the strongest performer in the G-10 space at the margins. AUD/USD is ~0.3% firmer as is AUD/NZD which has recovered to deal above the $1.07 handle.

• Elsewhere in G-10 there has been little follow through on moves with narrow ranges observed.

• Cross asset wise; US Equity futures have pared early losses and sit a touch firmer. BBDXY is ~0.1% firmer and 2 Year US Treasury Yields are ~4bps firmer.

• There is a thin docket in Europe today with the UK and several European countries observing national holidays. Further out we have the latest ISM Survey which headlines an otherwise thin calendar.GOLD: Bullion Down On Fed Hike Expectations

Gold prices are down 0.2% today to around $1985.50/oz after rising only 0.1% on Friday. They have softened from a peak of $1990.40 earlier in the session on the back of expectations that the Fed will hike rates again on Wednesday. The USD index is up 0.1% so far today and 10-year Treasury yields are higher.

• Bullion remains well above support at $1969.30, the April 19 low, but well below resistance at $2015.10, the April 17 high. Gold has struggled to hold gains above $2000 recently.

• The FDIC was expected to announce the results of an auction for the troubled First Republic Bank on Sunday night. A Reuters source has said that a decision is close (see A Deal On First Republic Is Apparently Getting Closer).

https://marketnews.com/a-deal-on-first-republic-is...

OIL: Crude Weighed Down By Weak China PMI & Expected Fed Hike

Oil prices are down today on the back of China’s manufacturing PMI falling below 50 and in anticipation of another Fed hike but have been trading in a range of less than a dollar. WTI is down 0.7% to $76.13/bbl close to the intraday low of $76.03 and now below the 50-day moving average. Brent is down 0.5% to $79.74 following a $79.63 low. The USD index is 0.1% higher.

• Crude markets have been soft as demand fears have taken prominence. These came to the fore again after China reported a drop in the April manufacturing PMI to 49.2, below the breakeven 50-level, from 51.9, suggesting that fuel demand from China may not be as robust as expected following reopening.

• The FDIC was expected to announce the results of an auction for the troubled First Republic Bank on Sunday night. A Reuters source has said that a decision is close (see A Deal On First Republic Is Apparently Getting Closer).

https://marketnews.com/a-deal-on-first-republic-is...

• Later today there are the US manufacturing ISM and PMI for April and construction data. Europe and the UK will also be shut.UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/05/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/05/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/05/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/05/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/05/2023 | 1400/1000 | * |  | US | Construction Spending |

| 01/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 01/05/2023 | 1900/1500 |  | US | Treasury Borrowing Estimates | |

| 02/05/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 02/05/2023 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 02/05/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 02/05/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 02/05/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0800/1000 | ** |  | EU | M3 |

| 02/05/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 02/05/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 02/05/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 02/05/2023 | 1000/1200 | ** |  | IT | PPI |

| 02/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 02/05/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 02/05/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 02/05/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 02/05/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 02/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 03/05/2023 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

| 03/05/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.