-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Pulls Plug On SMCCF

EXECUTIVE SUMMARY

- BIDEN TO AMEND TRUMP'S CHINA BLACKLIST, TARGET KEY INDUSTRIES (BBG)

- FED PLANS TO BEGIN SELLING ITS CORPORATE BOND PURCHASES (MNI)

- MNI SOURCES: ECB INFLATION TARGET DEBATE FOCUSSES ON SYMMETRY

- ECB'S LAGARDE: ECB TO HELP EURO ZONE 'WELL INTO' RECOVERY (RTRS)

- ECB'S WEIDMANN DROPS OPPOSITION TO MAKING BOND PURCHASES GREENER (RTRS)

- PBOC EXPECTED TO BOOST LIQUIDITY INJECTION IN JUNE (CSJ)

Fig. 1: USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson said on Wednesday he remained upbeat about easing remaining coronavirus lockdown measures in England on June 21, but ministers are discussing a fallback plan of delaying the easing by two weeks if data show a surge in hospitalisations and deaths. Senior members of Johnson's government said they expected the prime minister to hold to the June 21 date unless the data present a compelling case for a delay. "He'll move heaven and earth for June 21," said one senior minister. (FT)

CORONAVIRUS: Boris Johnson has warned that the Government "will not hesitate" to axe countries from the green list for travel amid growing concern that Portugal could be removed. Ministers and their medical advisers will meet on Thursday to decide whether Portugal should be dropped from the green list and instead rated amber, requiring holidaymakers to quarantine for 10 days on their return and pay for two PCR tests. (Telegraph)

CORONAVIRUS: The UK government has begun negotiations with AstraZeneca to secure a "variant vaccine" that can tackle the South African variant, Health Secretary Matt Hancock has said. Also known as the Beta variant and the B.1.351 variant, a study published in March found two doses of the current AstraZeneca COVID-19 vaccine only had a 10.4% efficacy against mild to moderate infections caused by the variant. The strain shares similar mutations to other variants, which has caused concern that those inoculated with the AstraZeneca vaccine could be exposed to multiple variants. (Sky)

ECONOMY: The reopening of indoor hospitality in England has failed to boost footfall to retail destinations such as high streets and shopping centres, according to new data. In the four weeks to May 29, visitor numbers across UK retail destinations were 27 per cent below 2019 levels, according to the consultancy Springboard. English pubs, bars and restaurants were permitted to serve indoors from May 17, but footfall was actually lower relative to 2019 in the final week of May than in the first. The pattern of retail parks outperforming other retail destinations continued with visitor numbers declining only 5.7 per cent compared with a 36 per cent drop in high street traffic over the same period. (FT)

BREXIT: The EU and Britain on Wednesday reached an agreement on fishing rights for 2021, the European Commission said. The accord was finalised in a phone call between the EU's Commissioner for Environment, Oceans and Fisheries Virginijus Sinkevicius and British Secretary of State for the Environment George Eustice. "This agreement provides predictability and continuity for our fleets with definitive TACs (trade and cooperation agreements) for the remainder of the year. "This is good for fishermen and women, our coastal communities and our ports, as well as for the sustainable use of our marine resources," Sinkevicius said in a statement. "This also proves that two partners on both sides of the Channel can find agreements and move forward if they work together." The agreement guarantees the rights of EU and UK fishing fleets in EU and British waters until the end of 2021. (AFP)

BREXIT: The UK is aiming to sign its first significant post-Brexit trade deal with Australia soon after the upcoming G7 summit, as a major Pacific trade bloc formally approved Britain's application to begin accession talks. Senior Whitehall officials said that talks between the UK and Australia were nearing their conclusion, with a tentative agreement "pencilled in" for the week commencing June 14 following the G7 summit in Cornwall. Scott Morrison, Australian prime minister, will join the gathering of western leaders from June 12 as a guest of his UK counterpart Boris Johnson. (FT)

NORTHERN IRELAND: The Ulster Unionist and Alliance parties have warned of potential political instability sparked by the appointment of a new first minister. UUP leader Doug Beattie said "dithering" would lead to more "factious cracks" in the executive. Justice Minister Naomi Long said instability within the DUP could be reflected in the political institutions. (BBC)

EUROPE

ECB: MNI SOURCES: ECB Inflation Target Debate Focusses On Symmetry

- The European Central Bank's strategy review has reached broad consensus about the need for a new symmetrical 2% price target, but officials are still arguing about whether to follow the Federal Reserve's inflation makeup strategy and some remain unsure how to incorporate climate goals into monetary policy, Eurosystem sources told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECB: The European Central Bank will support the euro zone "well into" its recovery from a pandemic-induced double dip recession, ECB chief Christine Lagarde said on Wednesday, just eight days before a crucial policy meeting. "Strong policy support will continue to provide a bridge over the pandemic and well into the economic recovery," Lagarde said in a speech. "The ECB is committed to preserving favourable financing conditions throughout this period." (RTRS)

ECB: European Central Bank policymaker Jens Weidmann opened the door on Wednesday to buying fewer bonds from polluting companies under the ECB's stimulus programmes, dropping his opposition to taking such an active role in the fight against climate change. With Weidmann softening his stance, the ECB now looked more likely to adopt some form of green tilt in its multi-billion bond-buying schemes, as advocated by President Christine Lagarde. (RTRS)

PORTUGAL: Portugal will no longer require people to work remotely as it continues to ease confinement measures after the number of new Covid-19 cases eased and the vaccination campaign advances. While working from home will no longer be mandatory from June 14, it will still be recommended, Prime Minister Antonio Costa said at a press conference in Lisbon on Wednesday. Restrictions on opening hours for shops will be lifted and restaurants can remain open until 1 a.m. Bars and nightclubs will remain closed, he said. (BBG)

SNB: Swiss National Bank President Thomas Jordan says the pickup in consumer prices seen around the world is probably temporary and not a "big concern," according to comments made at a World Economic Forum online conference. Still, it's a development policy makers must be very attentive to, especially as output gaps narrow. (BBG)

U.S.

FED: MNI BRIEF: Inflation Picking Up, Fed's Beige Book Says

- U.S. price pressures increased further since the April FOMC meeting, with firms anticipating additional cost increases and charging higher prices in coming months, according to the Fed's anecdotal report on current economic conditions, released Wednesday ahead of the June policymaking meeting. "Input costs have continued to increase across the board," especially in raw materials, freight, packaging, and petrochemicals, as a result of supply chain disruptions, the Beige Book said. "Strengthening demand, however, allowed some businesses, particularly manufacturers, builders, and transportation companies, to pass through much of the cost increases to their customers." Overall business activity expanded at a moderate pace, according to information collected through May 25. Supply disruptions have propelled some firms' short-run inflation expectations to a record high last month and may start feeding longer run views - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI: Fed's Harker: Time to Think About Tapering QE

- Federal Reserve Bank of Philadelphia President Patrick Harker on Wednesday said it's time to start discussing pulling back the Fed's asset purchases in light of a strong recovery from Covid, the latest U.S. central banker to do so in recent weeks. "We're planning to keep the federal funds rate low for long, but it may be time to at least think about thinking about tapering our USD120 billion in monthly Treasury bond and mortgage-backed securities purchases," he said in remarks prepared for a finance forum in Washington - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI: Fed Plans to Begin Selling Its Corporate Bond Purchases

- The Federal Reserve Board on Wednesday announced plans to begin winding down its USD13.8 billion portfolio of corporate bond and ETF purchases made last year after setting up its Secondary Market Corporate Credit Facility to support businesses under the threat of Covid. Expectations are for the Fed will begin winding down its ETF holdings before beginning to sell individual corporate bonds later this summer. The last time the Fed directly sold assets was with Maiden Lane assets in the early 2010s. The central bank's entire Secondary Market Corporate Credit Facility portfolio will be off the balance sheet by the end of the year, a Fed official said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Republican U.S. Senator Shelley Moore Capito said after a meeting with U.S. President Joe Biden that she was encouraged that negotiations on a bill to revitalize U.S. infrastructure had continued, her office said. Capito would brief other members of the Republican negotiating team and talk to Biden on Friday, her office said. (RTRS)

CORONAVIRUS: The number of new cases is dropping in Minnesota, but an estimated 85% of have been traced to emerging variants of the virus, which have also sent a higher percentage of people to hospitals, said Kris Ehresmann, Minnesota Department of Health infectious disease director. (BBG)

CORONAVIRUS: New Jersey will close all six of its vaccine mega-sites by July 23 as demand wanes and the state nears its goal of immunizing 70% of residents. "We're localizing and this is yet another step in that direction," Governor Phil Murphy said at a streaming virus update. Health officials now will encourage vaccine seekers to make arrangements at any of almost 1,800 sites, including pharmacies, retailers and community medical centers. (BBG)

CORONAVIRUS: Free child care will be available during vaccine appointments as part of new incentives to reach President Joe Biden's target of getting 70% of U.S. adults at least partially vaccinated by July 4, according to a statement from the White House. Other new initiatives include offering shots at Black-owned barber shops and beauty salons as well as private-sector incentives such as free beer from Anheuser-Busch. Biden is calling for a national month of action to get more people vaccinated. (BBG)

OTHER

U.S./CHINA: President Joe Biden plans to amend a U.S. ban on investments in companies linked to China's military this week, after the Trump-era policy was challenged in court and left investors confused about the extent of its reach to subsidiary firms, people familiar with the matter said. Under Biden's amended order, the Treasury Department will create a list of companies that could face financial penalties for their connection to China's defense and surveillance technology sectors, the people said. Until now, the financial sanctions and selection of targeted companies were tied to a congressionally-mandated Defense Department report. The amended order, which Biden is expected to sign later this week, will change the criteria for blacklisting entities to capture those that operate in the defense or surveillance technology sectors. The Trump order targeted companies owned, controlled or otherwise affiliated with the Chinese military. (BBG)

U.S./CHINA: Chinese Vice Premier Liu He's talks with two top-level U.S. officials within the last week marked the full recovery of communications, giving the impression that the current bilateral cooperation in trade and economy is calmer and more rational than in other areas and can serve as a new stable framework for relations, the Global Times said in an editorial. The trade war against China has been a terrible failure and the U.S. is more fragile than it was three or four years ago while losing its resources to engage in an economic confrontation with China, the newspaper said. None of the U.S. allies are seriously willing to reduce their trade ties with China, and if U.S. companies decouple from China, they will lose the opportunity to become global top firms, the newspaper said. (MNI)

U.S./CHINA: Hackers with suspected ties to China penetrated the New York transit agency's computer systems in April, an M.T.A. document shows. Transit officials say the intrusion did not pose a risk to riders. A hacking group believed to have links to the Chinese government penetrated the Metropolitan Transportation Authority's computer systems in April, exposing vulnerabilities in a vast transportation network that carries millions of people every day, according to an M.T.A. document that outlined the breach. (New York Times)

GLOBAL TRADE: Global negotiators attempting to rewrite tax rules for the digital era are tussling over a threshold for corporate revenue as one of the criteria to resolve the thorny issue of how to tax globe-trotting U.S. tech giants like Amazon.com Inc. and Facebook Inc. European officials are considering a proposal from Joe Biden's administration to make companies with at least $20 billion in annual revenue pay more of their tax bill in places they operate, while being less enthused that the U.S. offer would limit levies to just 100 firms, according to people familiar with the discussions. Negotiators also continue to haggle over a profitability threshold for companies to fall in the tax net, particularly a level that would ensure low-margin Amazon pays up, the people said, speaking on condition of anonymity to describe private talks. (BBG)

GLOBAL TRADE: The European Union is planning to make importers of steel, cement and aluminum pay for greenhouse gas emissions in a mechanism that will link new levies to the costs domestic producers already face. In a move no other country in the world has so far taken in the fight against climate change, the European Commission wants to introduce a system imposing a penalty for bringing into the bloc emissions embeded in goods that also include fertilizers and electricity, according to a person familiar with the proposals due to be unveiled next month. Importers will have to buy special certificates at a price linked to the EU Emissions Trading System, the person said, asking not to be named commenting on private discussions. (BBG)

CORONAVIRUS: The Covid-19 variant first detected in India in October has now spread to at least 62 countries as outbreaks surge across Asia and Africa — despite a 15% week-over-week drop in cases across the globe, according to the World Health Organization. "We continue to observe significantly increased transmissibility and a growing number of countries reporting outbreaks associated with this variant," the WHO said of the Delta strain, noting that further study was a high priority. (CNBC)

CORONAVIRUS: The Biden administration is poised to announce which countries will receive the first shipments of vaccines donated from the U.S. stockpile, amid the risk that more coronavirus variants will arise in countries lacking access to the shots, people familiar with the matter said. The White House, which has faced pressure from a range of countries to share its vaccines, has settled on its plan and an announcement is imminent, according to the people, who discussed the matter on condition of anonymity. The planned recipients weren't immediately disclosed. The U.S. has said it will send at least some of its donated doses to the Covax initiative, the World Health Organization-backed effort to buy and distribute vaccines to low- and middle-income nations. The U.S. has been consulting with Covax on its plan, one official said. (BBG)

JAPAN: Japanese Prime Minister Yoshihide Suga is likely to call a snap election after the Tokyo Olympic and Paralympic Games, a media report said, showing his resolve to push ahead with the Games despite the country's struggle to contain the COVID-19 pandemic. The government is considering crafting a new economic stimulus package before the expected snap election, the Asahi newspaper said on Thursday, citing several anonymous ruling party executives. Suga agreed on Wednesday with the head of his ruling coalition partner not to extend the current parliament session when it closes on June 16, according to media reports. That means Japan will forgo compiling a supplementary budget for now and tap nearly 4 trillion yen ($36.50 billion) left in reserves to pay for immediate spending to combat the pandemic, the Asahi said. (RTRS)

AUSTRALIA: Prime Minister Scott Morrison has announced a national plan to give Commonwealth money to people who are caught in coronavirus hotspots. It's called a "temporary COVID disaster payment" and will only kick in if a lockdown lasts longer than a week and coincides with a federally-designated hotspot. The new payment will be $500 a week for people who normally work more than 20 hours a week and $325 a week for people who normally do less than 20 hours. It will only kick in where people can't work and have less than $10,000 in liquid assets. It cannot be combined with other welfare or coronavirus support payments from the federal government, excluding people on JobSeeker, Youth Allowance and the aged pension. (Sydney Morning Herald)

RBA: Reserve Bank of Australia Deputy Governor Guy Debelle acknowledged that a hot property market fueled by emergency-low interest rates has "distributional consequences," while reiterating that monetary policy isn't the right tool to address the issue. "We recognize that rising house prices heighten concerns in part of the community," Debelle said in a Podcast released Thursday, in which the RBA's senior leadership team recounted the bank's responses to the pandemic. "There are a number of tools that can be used to address the issue, but I don't think that monetary policy is one of those tools." Sydney house prices posted their largest quarterly gain in almost 33 years as cashed-up buyers snapped up high-end properties amid low borrowing costs and a lack of supply. The RBA's cash rate is at 0.1% and the same level is applied to its three-year bond yield target, which doubles as forward guidance that rates are unlikely to rise before 2024. (BBG)

SOUTH KOREA: South Korea's government ministries and state agencies have requested a 6.3 percent hike in their budgets for next year as they seek to cope with post-pandemic economic recovery and implement key policy projects, the finance ministry said Thursday. Their budget proposals amount to a combined 593.2 trillion won (US$533.7 billion), up 35.2 trillion won from the previous year, according to the Ministry of Economy and Finance. Requests for budget spending in the health, social welfare and environment sectors were high as the country seeks to handle the COVID-19 pandemic and reduce deepening income gaps. (Yonhap)

BOC: The Bank of Canada will taper its asset purchase programme again next quarter and raise interest rates earlier than previously predicted amid expectations for a robust economic recovery after a recent downturn, a Reuters poll showed. In April the BoC became the first among Group of Seven central banks to reduce the scope of its pandemic support although preliminary data showed the Canadian economy likely contracted 0.8% that month, its first decline in a year, largely due to coronavirus lockdown restrictions. Canadian policymakers were forecast to keep monetary policy unchanged at the June 9 meeting, according to all 31 economists in the May 28-June 2 poll. Sixteen of 17 economists who responded to an additional question said the central bank would taper its asset purchase programme again next quarter, to C$2 billion ($1.7 billion) per week from C$3 billion per week currently. One predicted it for October. (RTRS)

MEXICO: Mexico's central bank sees inflation ending the year well above its target ceiling, but expects it to fall sharply in 2022 once short-term pressures ease. The bank expects inflation to finish 2021 at 4.8%, down from its current high of 6.1%, but far above its target ceiling of 4% and last quarter's estimate of 3.6%, the central bank, known as Banxico, said in a quarterly report released Wednesday. Inflation should slow to 3.1% by the end of 2022, the report said. The above-target expectations have been propelled by the so-called base effect of being compared against last year's very low prices as demand sunk during the pandemic, Governor Alejandro Diaz de Leon said in a press conference. Once those base effects are passed, inflation will slow quickly toward the bank's 3% target next year, he said. (BBG)

MEXICO: Mexican President Andres Manuel Lopez Obrador drew flak on Wednesday from one of his appointees to the central bank for his criticism of Bank of Mexico Governor Alejandro Diaz de Leon and the announcement that he would replace him at the end of 2021. Deputy Governor Gerardo Esquivel, a left-leaning economist whom Lopez Obrador had initially tapped as deputy finance minister before he nominated him to the bank's five-member board, called the treatment of Diaz de Leon "unfortunate." "It seems to me it adds unnecessary uncertainty to the economic and financial stability of the country," Esquivel said during a news conference on the bank's latest forecasts. After questioning the pedigree for the job of Diaz de Leon, who was made governor under the previous government, Lopez Obrador said last month he would not renew his term when it expires on Dec. 31. Asked about the president's swipes, Diaz de Leon said there had been "no interference" in his decisions at the bank's helm. (RTRS)

RUSSIA: Joe Biden will rebuke Vladimir Putin over the cyber attack on JBS, the world's biggest meat processor, when the two presidents meet later this month, and the US does not rule out retaliating against the perpetrator it suspects is a Russian criminal gang, the White House said on Wednesday. The São Paulo-headquartered meat company suffered a ransomware attack that forced the closure of much of its North American and Australian operations and halted work for thousands of employees this week. The incident raised fears about the security of the US's food supply. According to information passed to White House officials by the company, the attack was launched from a known criminal organisation that is probably based in Russia. (FT)

BRAZIL: Brazil's Health Ministry said it expects to receive 39.8 million doses of vaccines in June, 3.9 million fewer than it had forecast, O Globo reported, without saying how it got the information. Until last week, the federal government expected to receive about 43.8 million vaccines in June. (BBG)

BRAZIL/RATINGS: S&P affirmed Brazil at BB-; Outlook Stable

RUSSIA: German airline Lufthansa said late Wednesday that it has received the green light from Russia to resume flights there, after being briefly denied permission, which resulted in a reciprocal blocking of flights by Germany. (AP)

SOUTH AFRICA: South Africa's Department of Health said the positivity rate of Covid-19 tests has risen to 12.7% and the country had 5,782 new confirmed infections over the last 24 hours. "We will be monitoring this increase in positivity rate to see if it sustains," the department said in a statement on Wednesday, adding that the surge in cases was highest in Gauteng province, the country's commercial hub. South Africa has vaccinated just over 1.1 million of its 60 million people. (BBG)

SOUTH AFRICA: South Africa must expand public employment services to help match work seekers with available jobs in a country where a third of the labor force is unemployed, according to the central bank. Data on Tuesday showed joblessness in Africa's most industrialized economy rose to a record 32.6% in the first quarter, with unemployment concentrated among school leavers who don't move on to tertiary studies. The official jobless rate for people aged 15 to 24, is 63%. "Most urgent, and feasible in the short term, is improving the transition from school to jobs, by widening the volume and quality of the currently minimal public employment service to improve matching in the labor market," researchers led by Chris Loewald, a member of the South African Reserve Bank's monetary policy committee, said in a working paper published online. (BBG)

IRAN: World powers adjourned talks in Vienna with plans to return next week, as differences between Iran and the U.S. over how to revive a landmark nuclear deal continue to delay the Islamic Republic's return to oil markets. Both the U.S. and Iran will need to make "hard decisions" that could ruffle domestic political constituencies, Enrique Mora, the European Union's deputy foreign policy chief, said after Wednesday's talks concluded. Envoys were departing Vienna to return to their capitals, where leaders will have to decide whether the landmark agreement capping Iran's nuclear work in exchange for sanctions relief is worth reviving. (BBG)

IRAN: Indirect talks between Iran and the United States on both countries fully returning to the 2015 nuclear deal between Tehran and major powers are expected to resume on Thursday of next week, two diplomats said on Wednesday. (RTRS)

ISRAEL: Israeli opposition leader Yair Lapid has notified President Reuven Rivlin that he managed to form a power-sharing government that will oust Prime Minister Benjamin Netanyahu if it survives a confidence vote in the Knesset. We are on the verge of a seismic event in Israeli politics, with Israel's longest-serving prime minister and the man who has dominated the country's politics and relations with the world for over a decade on the verge of being replaced. But he's not out quite yet. Right-winger Naftali Bennett would serve first as prime minister for two years with the centrist Lapid then rotating into the job. (Axios)

OIL: Iran's Tehran Oil Refinery has suspended all operations, the semi-official Tasnim news agency reported, after a gas leak caused a massive fire sending black plumes of smoke across the city's skyline. There were no initial reports of deaths or injuries at the refinery in southern Tehran and firefighters had managed to control the blaze by late Wednesday evening, the state-run Islamic Republic News Agency reported, adding that around 20,000 barrels of diesel were burned in the fire. (BBG)

CHINA

PBOC: The Chinese central bank is expected to inject more liquidity into the market this month to meet institutions' reasonable demand, China Securities Journal reports, without citing anyone. The report didn't specify the measures PBOC will use to add liquidity. The market may see more fluctuations in liquidity level as overall liquidity in the banking system is not high and impact from bond sales and corporate tax payments may emerge. PBOC may have to boost liquidity injections in early or mid-June to offset the above impact, report cites Liu Yu, a researcher with GF Securities, as saying. (BBG)

YUAN: The Chinese yuan faces depreciation pressure as most Chinese companies listed overseas will purchase foreign exchange to pay dividends generally in June and July, while the PBOC's latest move to hike FX reserve requirement ratio also indicates its intention of not allowing a rapid appreciation, the Shanghai Securities News reported citing analysts. Judging from the announced dividend plans, Chinese companies listed in the Hong Kong stock market may need to purchase as much as USD70 billion during June to August, the newspaper said citing Lu Zhengwei, chief economist of Industrial Bank. The yuan weakened for the second day yesterday, closing at 6.3872, with a total loss of 265 basis points over the last two days, the newspaper said. (MNI)

QDII: The State Administration of Foreign Exchange's move to grant USD10.3 billion qualified domestic institutional investor (QDII) quota signaled China's resolution to facilitate the two-way capital market opening-up, the China Securities Journal reported citing analysts. Also, there are obvious signs that the yuan's recent appreciation has been excessive that had been partly driven by a short-term influx of international "hot money", the newspaper said. The timely release of the new QDII quota can promote the orderly flow of cross-border funds in two ways, the newspaper said. (MNI)

OVERNIGHT DATA

CHINA MAY CAIXIN SERVICES PMI 55.1; MEDIAN 56.2; APR 56.3

CHINA MAY CAIXIN COMPOSITE PMI 53.8; APR 54.7

The Caixin China General Services Business Activity Index fell to 55.1 in May from 56.3 the previous month. The reading stayed in expansionary territory for 13 straight months, indicating solid growth in the sector. Services supply and demand continued their upward trends for the 13th consecutive month, though both expanded at a slower pace than in the previous month. After expanding in April, overseas demand shrank as the measure for new export business slipped into contractionary territory. Surveyed enterprises blamed the dip on the adverse effects of the pandemic overseas. The job market continued to improve along with the economic recovery. The gauge for employment stayed in positive territory in May, though down slightly from the previous month. Services employment continued to recover in the post-epidemic era, expanding in nine out of past 10 months. However, the expansion in employment was insufficient to meet the increasing demand for services. The measure for outstanding business returned to expansionary territory in May. Inflationary pressure was enormous as price gauges continued to rise. Both the measures for input costs and the prices service providers charged rose to their highest points of the year. Surveyed enterprises attributed the rise in input costs to growth in raw material, energy, labor and transportation costs. The increased costs and strong demand pushed up the prices service companies charged. The sector remained optimistic. Entrepreneurs remained confident about the economic recovery going forward as the gauge for business expectations stayed high in expansionary territory. But some respondents worried about the overseas pandemic. (Caixin)

JAPAN MAY JIBUN BANK SERVICES PMI 46.5; PRELIM 45.7; APR 49.5

JAPAN MAY JIBUN BANK COMPOSITE PMI 48.8; PRELIM 48.1; APR 51.0

The Japanese services economy faced a sharper downturn in demand conditions in the middle of the second quarter. Latest PMI data signalled a quicker decline in both business activity and new orders, the fastest since February. Panel members highlighted that a surge in COVID-19 infections and the subsequent implementation of another state of emergency dampened output and demand further. Despite this, service providers continued to increase staffing levels for the fourth month in a row. Moreover, expectations regarding the year-ahead outlook for activity were positive for the ninth consecutive month. Overall private sector activity saw a renewed decline in May, driven by a sharper fall in the larger service sector. At the same time, manufacturing output rose at a softer pace. Businesses in the Japanese private sector remained optimistic regarding a rise in activity in the coming 12 months. Although the level of positive sentiment was strong overall, it fell for the second month running amid a renewed rise in COVID-19 cases. Firms highlighted concerns over the timing of the recovery given the introduction of stricter measures, which are currently due to ease shortly before the planned start of the Tokyo Olympic Games in July. Nonetheless, businesses were confident that the eventual end to the pandemic would occur within the coming year, and provide a broad-based boost to demand. As a result, IHS Markit expects the economy to grow 2.6% in 2021. (IHS Markit)

AUSTRALIA APR. RETAIL SALES RISE +1.1% M/M; MEDIAN +1.1%; MAR +1.3%

AUSTRALIA APR TRADE BALANCE +A$8.028 BLN; MEDIAN +A$8.250 BLN; MAR +A$5.794BN

AUSTRALIAN APR EXPORTS +3% M/M; MEDIAN +7%; MAR -1%

AUSTRALIAN APR IMPORTS -3% M/M; MEDIAN -3%; MAR +5%

AUSTRALIA MAY IHS MARKIT SERVICES PMI 58.0; PRELIM 58.2; APR 58.8

AUSTRALIA MAY IHS MARKIT COMPOSITE PMI 58.0; PRELIM 58.1; APR 58.9

Australia's service sector sustained a strong rate of expansion in May with both demand and business activity growing at a healthy pace. The improvement in economic conditions can be seen providing firms with better confidence to continue hiring at a record pace. Backlogs meanwhile continued to build despite the increase in operating capacity. Anecdotally, some service providers are looking to rebuild their headcount to pre COVID-19 levels but a few are citing difficulties in finding new employees. Business confidence remained strong in May, even as price inflation accelerated, with firms anticipating further recovery from the COVID-19 pandemic. The latest developments surrounding Melbourne's lockdown may however be one to keep a close eye on. (IHS Markit)

NEW ZEALAND MAY ANZ COMMODITY PRICE INDEX +1.3% M/M; APR +2.3%

The ANZ World Commodity Price Index lifted 1.3% m/m in May, its eighth consecutive lift. Prices for all major categories of commodities lifted, pushing the index to a record level. (ANZ)

NEW ZEALAND 10-MONTH BUDGET DEFICIT NZ$5.05BN

SOUTH KOREA MAY FOREIGN EXCHANGE RESERVES $456.46BN; APR $452.31BN

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS THU; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information. The operation aims to keep liquidity reasonable and ample, the PBOC said on its website. The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.1142% at 09:30 am local time from the close of 2.1269% on Wednesday. The CFETS-NEX money-market sentiment index closed at 33 on Wednesday vs 40 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3811 THURS VS 6.3773 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a second trading days at 6.3811 on Thursday, compared with the 6.3773 set on Wednesday.

MARKETS

SNAPSHOT: Fed Pulls Plug On SMCCF

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 125.83 points at 29070.96

- ASX 200 up 44.58 points at 7262.4

- Shanghai Comp. up 13.758 points at 3610.896

- JGB 10-Yr future up 3 ticks at 151.5, JGB 10-Yr yield up 0.2bp at 0.085%

- Aussie 10-Yr future up 1.5 ticks at 98.395, Aussie 10-Yr yield down 2bp at 1.663%

- U.S. 10-Yr future unch. at 131-30, US 10-Yr yield up 0.34bp at 1.5909%

- WTI crude up $0.36 at $69.19, Gold down $4.19 at $1904.19

- USD/JPY up 16 pips at Y109.72

- BIDEN TO AMEND TRUMP'S CHINA BLACKLIST, TARGET KEY INDUSTRIES (BBG)

- FED PLANS TO BEGIN SELLING ITS CORPORATE BOND PURCHASES (MNI)

- MNI SOURCES: ECB INFLATION TARGET DEBATE FOCUSSES ON SYMMETRY

- ECB'S LAGARDE: ECB TO HELP EURO ZONE 'WELL INTO' RECOVERY (RTRS)

- ECB'S WEIDMANN DROPS OPPOSITION TO MAKING BOND PURCHASES GREENER (RTRS)

- PBOC EXPECTED TO BOOST LIQUIDITY INJECTION IN JUNE (CSJ)

BOND SUMMARY: Soft 10-Year JGB Supply, RBA Speculation Does The Rounds

T-Notes are unchanged at 131-30 at typing, holding to a narrow 0-02+ range overnight. Headline flow remains light. Cash Tsys are little changed to 0.5bp cheaper across the curve. Eurodollar futures trade -0.25 to +1.0 through the reds. Flow has been headlined by downside interest in EDZ3 via the options space, which saw 5.5K of the 2EZ1 99.000/98.875 put spread trade vs. the 2EZ1 99.250/99.375 call spread, with a market contact pointing to buying of the put spread vs. selling of the call spread.

- It seems that desks were a little complacent re: the prospects surrounding the smooth takedown of today's 10-Year JGB supply, with the average price only just matching the broader expectations for the low price (per the BBG dealer poll), as the cover ratio slid to the lowest witnessed at a 10-Year auction since '15. Elsewhere, the tail widened vs. the previous auction. Crimped 10-Year ranges since the BoJ's March decision, questions over market functioning and a lack out outright/relative value appeal likely hampered takedown today. Futures softened in the wake of the auction results, briefly printing below yesterday's settlement level, before recovering to last trade +3 on the day, while cash JGBs sit little changed to 0.5bp cheaper across the curve. Elsewhere, the Asahi suggested that PM Suga is likely to call a snap election in the Autumn, after the end of Paralympic games. The report also suggested that the government is considering compiling a new stimulus package ahead of the snap election.

- YM unch., XM +1.5 in Sydney. XM is back from best levels after running out of steam just ahead of the previously flagged resistance in the form of the May 27 high (98.430), peaking at 98.425 after shorts were squeezed in early Sydney dealing. Elsewhere, domestic data was solid to firm, but had no real impact on the space. There has been plenty of speculation doing the rounds after an appearance from RBA Governor Lowe was added to the docket for 6 July, the day of the Bank's key July decision (the addition came late on Wednesday). The title of the address is "Today's Monetary Policy Decision" and it will come 90 minutes after the decision & accompanying statement are released. It has become common practice for Lowe to conduct such addresses in the wake of key monetary policy decisions, and many have suggested that he could use the address to temper any hawkish reaction in the wake of the decisions surrounding QE & the Bank's yield targeting scheme. Still, this didn't impact the market.

EQUITIES: Broad Gains

A mostly positive day for equity markets in the Asia-Pac region. Markets in South Korea lead the way higher with gains of over 1% as government ministries and state agencies request a 6.3% hike in their budgets for next year. Markets in Japan are higher as the vaccination programme gathers pace. Gains in China are subdued after reports that US President Biden is planning on amending a US investment ban on companies linked to China's military. US futures are higher, late yesterday Fed's Harker said the central bank would seek to avoid a taper tantrum, markets have one eye on tomorrow's NFP data.

GOLD: U.S. Jobs Data Eyed

Steady U.S. real yields and a pullback from intraday best levels in the DXY have allowed spot gold to reclaim $1,900/oz over the last 24 hours, with little fresh to note from a technical perspective as bullion trades a few dollars above the round number at typing. U.S. labour market dynamics will likely be key for gold during the remainder of the week, with ADP employment and weekly initial jobless claims data due on Thursday, ahead of the release of the latest monthly employment report on Friday.

OIL: Crude Futures On Track For Third Straight Rise

Oil is higher again in Asia-Pac trade on Thursday, on track for a third day of gains. WTI is up $0.53 from settlement levels at $69.37/bbl while Brent is up $0.60 at $71.95/bbl. Delayed API data yesterday showed headline crude stocks fell 5.36m bbls, markets will look to official DOE inventory data later today to confirm this, which would be the biggest draw in a month. Meanwhile negotiations with Iran have been adjourned until next week. Markets expect little material outcome from the discussions, with Tehran's lack of compliance with nuclear curbs likely hindering any near-term oil supply deal.

FOREX: Greenback Rises From Yesterday's Lows

The greenback bounced which saw AUD and NZD come under pressure, Antipodean/USD crosses down around 13 pips. Australian PM Morrison announced support for hotspots impacted by COVID-19. Elsewhere The trade surplus widened less than expected as exports missed estimates, while retail sales rose 1.1%, in line with forecasts. RBNZ Deputy Gov Bascand spoke late on Wednesday and said that loose policy will not last forever and noted supply driven price pressures.

- Yen is softer, USD/JPY up 12 pips, final Jibun Bank services PMI fell to 46.5 for the sixteenth straight month of contraction, while composite slipped to 48.8 from 51.0. Meanwhile Asahi reports suggested that PM Suga is likely to call a snap election in the Autumn, after the end of Paralympic games. The report also suggested that the government is considering compiling a new stimulus package ahead of the snap election.

- Yuan stuck to a fairly narrow range, the PBOC fixed above sell-side estimates indicating a preference for a weaker yuan after a brief hiatus yesterday. Elsewhere May Caixin services PMI printed 55.1 from 56.3 previously, composite PMI fell to 53.8 from 54.7. There were reports that US President Biden is planning on amending a US investment ban on companies linked to China's military.

FOREX OPTIONS: Expiries for Jun03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-15(E1.4bln), $1.2067-75(E587mln), $1.2100-15(E1.3bln-EUR puts), $1.2150-70(E532mln), $1.2300-05(E1.0bln-EUR puts)

- USD/JPY: Y109.00-10($1.7bln-USD puts), Y109.15-25($1.1bln), Y109.45-50($695mln), Y109.98-110.00($1.5bln)

- GBP/USD: $1.3990-00(Gbp653mln), $1.4100(Gbp721mln)

- AUD/USD: $0.7715-25(A$622mln), $0.7835-40(A$812mln)

- USD/CNY: Cny6.42($700mln)

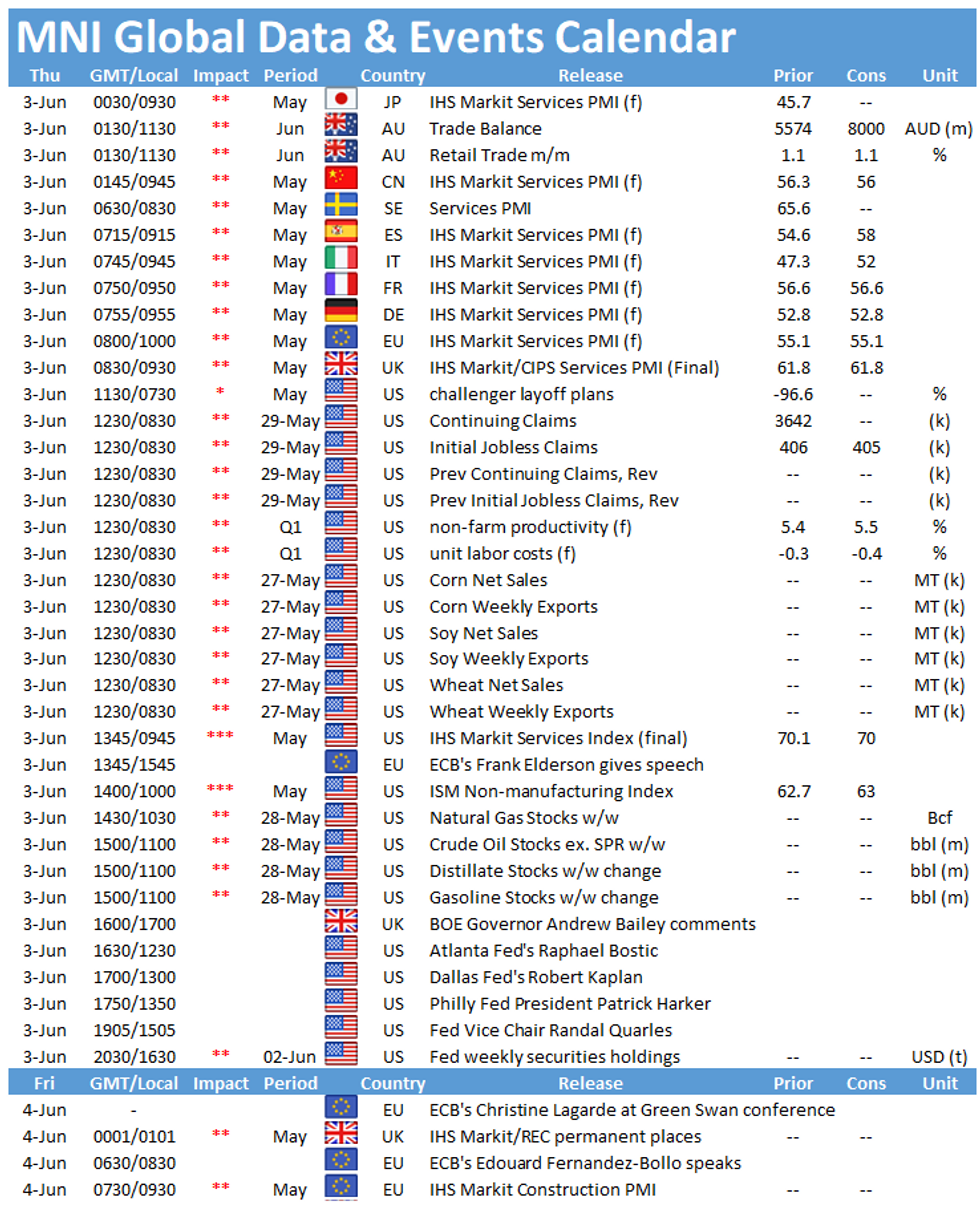

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.