-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Firmer Asia PMIs Give Hope To Global Trade Outlook

EXECUTIVE SUMMARY

- CAIXIN MAY MANUFACTURING PMI HITS OVER TWO-YEAR HIGH - MNI BRIEF

- JAPAN Q1 CAPEX DOWN Q/Q; GDP SEEN REVISED LOWER - MNI BRIEF

- HOW THE RBA IS RESPONDING TO RECENT DATA - MNI POLICY

- MODI SET FOR LANDSLIDE ELECTION WIN IN INDIA, EXIT POLLS SHOW - BBG.

- SHEINBAUM IS SET TO BECOME MEXICO’S FIRST FEMALE PRESIDENT - BBG

- OPEC+ EXTENDS DEEP OIL PRODUCTION CUTS INTO 2025 - RTRS

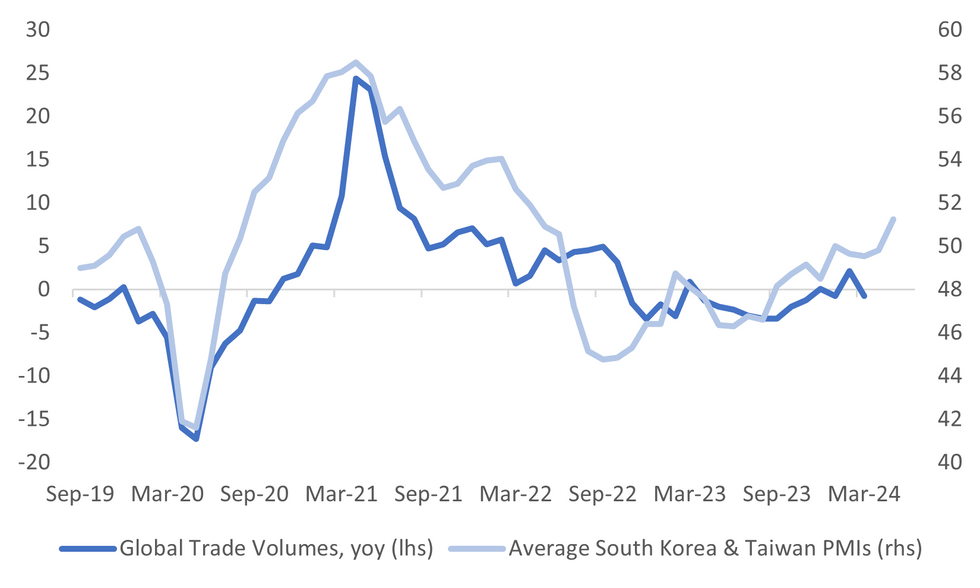

Fig. 1: Average South Korea & Taiwan PMIs Versus Global Trade Volumes Y/Y

Source: MNI - Market News/Bloomberg

UK

POLITICS (BBG): Keir Starmer will pitch Labour as the “party of national security” in a bid to squeeze Rishi Sunak’s Conservatives on traditional Tory turf as the rivals prepare to face off in a UK election debate on Tuesday.

EUROPE

EU/CHINA (MNI): The European Commission is likely to impose tariffs on Chinese electrical vehicle imports when it announces findings of an anti-subsidy investigation in coming weeks, but European Union member states continue to be worried by the prospect of retaliation from Beijing if Brussels follows the U.S. in taking a tough stance, diplomatic and other official sources told MNI.

EU/CHINA (BBG): China accused the European Union of working to “suppress” Chinese companies and said Beijing will take action to safeguard its interests, as the bloc moves closer to imposing tariffs on Chinese electric vehicles.

FRANCE (BBG): S&P Global Ratings downgraded France, tarnishing President Emmanuel Macron’s record for debt management and plunging him deeper into political difficulties a week before European elections.

TRADE (BBC): European retailers are rushing to place their Christmas orders early as soaring shipping costs and trade route disruption threaten holiday deliveries, experts say. Container prices, which peaked in January and briefly declined, have rebounded sharply in recent weeks.

BANKING (BBC): Hackers are attempting to sell what they say is confidential information belonging to millions of Santander staff and customers. They belong to the same gang which this week claimed to have hacked Ticketmaster.

EU (POLITICO): Belgium, current holder of the rotating Council of the EU presidency, is taking the extraordinary step of urging EU governments to consider moving ahead with the procedure to deprive Hungary — which takes over the presidency next month — of voting rights.

UKRAINE (BBC): Ukrainian President Volodymyr Zelensky has accused Russia and China of attempting to undermine his upcoming global peace summit in Switzerland. He said Russia was trying to dissuade other states from attending the event, and that China was working to do this as well.

UKRAINE (POLITICO): Russia launched a large-scale missile and drone attack — the most extensive in more than three weeks — against Ukraine overnight, damaging the country's power system, Ukrainian officials said on Saturday.

BALTICS (BBC): Estonia once a part of the Soviet Union, is convinced that once the fighting stops in Ukraine, President Vladimir Putin will turn his attention to the Baltics, looking to bring countries like Estonia back under Moscow’s control. To help stave off that possibility, Estonia’s government has poured money and weapons into Ukraine’s war effort, donating more than 1% of its GDP to Kyiv.

US

FED (MNI POLICY): Federal Reserve policymakers are actively debating just how much restraint a 23-year high fed funds rate is exerting on the economy, with the FOMC's core leadership arguing policy is constraining the economy enough to bring inflation down to target but a number of officials worried monetary conditions might still be insufficiently restrictive.

FED (MNI BRIEF): Proposals calling for mandating regular use of the Federal Reserve's discount window might ensure readiness in times of crisis, but are unlikely enough to break the facility's long stigma, according to a New York Fed blog published Friday.

OTHER

JAPAN (MNI BRIEF): Combined capital investment by non-financial Japanese companies excluding software fell 0.5% q/q in Q1, decelerating from 8.2% in Q4 2023, a quarterly survey released by the Ministry of Finance showed on Monday.

AUSTRALIA (MNI POLICY): MNI Looks At The RBA’S Likely Reaction To Recent Data Outcomes.

AUSTRALIA (AFR): Australian central bank Deputy Governor Andrew Hauser said the “first and predominant challenge” for policymakers is to bring down inflation, according to an interview with the Australian Financial Review.

SOUTH KOREA (BBG): South Korean oil and gas shares surged in early trade on Monday after President Yoon Suk Yeol approved a plan to develop a deposit of the fossil fuels discovered off the country’s southeastern coast.

INDIA (BBG): Prime Minister Narendra Modi’s party is set to win a decisive majority in India’s election for the third time in a row, several exit polls showed, extending his decade in power atop the world’s fastest-growing major economy.

MEXICO (BBG): Claudia Sheinbaum is set to become Mexico’s first female leader in a landslide victory, capitalizing on outgoing President Andres Manuel Lopez Obrador’s popularity while also inheriting rampant criminal violence and a large fiscal deficit left by his government.

SOUTH AFRICA (RTRS): President Cyril Ramaphosa called on South Africa's political parties to work together for the good of the country as final results from last week's election confirmed his African National Congress had lost its majority for the first time.

OIL (RTRS): OPEC+ agreed on Sunday to extend most of its deep oil output cuts well into 2025 as the group seeks to shore up the market amid tepid demand growth, high interest rates and rising rival U.S. production.

CHINA

PROPERTY (SHANGHAI SECURITIES NEWS): Shanghai property market becomes more active after easing of home purchase rules, Shanghai Securities News reports, citing homebuyers and unnamed property agents.

MANUFACTURING (MNI BRIEF): China's Caixin manufacturing PMI registered 51.7 in May, up 0.3 points from April, staying in the expansionary zone above the breakeven 50 mark for a seventh month and hitting the highest level since July 2022, the financial publisher said on Monday.

INFLATION (SECURITIES DAILY): Industry insiders predict May’s CPI will reach 0.3%, unchanged from last month, according to the Securities Daily. However, Liu Peizhong, a researcher at the Bank of China expects a slight increase, noting pork CPI was trending higher and egg prices were up for the first time in six months.

CREDIT (SECURITIES DAILY): China’s new yuan loans in May are expected to reach CNY1.5 trillion compared to April’s CNY730 billion, mainly driven by abundant bank credit lines, Securities Daily reported citing Wang Qing, analyst at Golden Credit Rating.

BONDS (YICAI): Investors need to consider that China’s inflation rate could increase in the long term and drive up long-term interest rates, making recent appetite for low-yield long duration bonds potentially unprofitable, according to Guan Tao, a former senior official at State Administration of Foreign Exchange.

CHINA MARKETS

MNI: PBOC conducts CNY2 bln via Omo Mon; liquidity unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Monday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting the CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8106% at 09:55 am local time from the close of 1.8675% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Friday, compared with the close of 40 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1086 on Monday, compared with 7.1088 set on Friday. The fixing was estimated at 7.2399 by Bloomberg survey today.

MARKET DATA

AUSTRALIA JUDO BANK MAY MANUFACTURING PMI 49.7; PRE 49.6; APRIL 49.6

AUSTRALIA MELBOURNE INSTITUTE INFLATION GAUGE MAY +3.1% Y/Y; PRIOR +3.7%

JAPAN 1Q CAPITAL SPENDING RISES 6.8% Y/Y; EST. 11.0%; PRIOR +16.4%

JAPAN 1Q CAPITAL SPENDING EX-SOFTWARE +6.8% Y/Y; EST. 8.4%; PRIOR +11.7%

JAPANESE COMPANIES 1Q PROFITS RISE 15.1% Y/Y; EST. +8.3%; PRIOR +13.0%

JAPANESE COMPANIES 1Q SALES RISE 2.3% Y/Y; EST. +2.4%; PRIOR +4.2%

JAPAN JIBUN BANK MAY MANUFACTURING PMI 50.4; PRE 50.5; APRIL 49.6

SOUTH KOREA S&P GLOBAL MAY MANUFACTURING PMI 51.6; APRIL 49.4

CHINA MAY CAIXIN MANUFACTURING PMI 51.7; EST. 51.6; APRIL 51.4

MARKETS

US TSYS: Treasury Futures Edge Higher Ahead Of ISM Later Today

- Treasury futures are higher today, the long-end is outperforming. TU opened the session at intraday highs of 101-29.25, we have edged lower since but still trade + 01 for the day at 101-28.25, while TY is trading near session's best and is up 05+ at 108-31.

- Volumes: TU40.5k, FV 78k TY 115k

- Tsys flows: Likely Block Seller 1.8k FV at 105-29.25

- Cash treasury curve has bull-flattened today, the 2Y is +0.4bp at 4.877%, the 10Y -1.4bps at 4.485% while the 2y10y was -1.799 at -39.420.

- APAC Rates: ACGB yields are 2-4bps lower, while JGB yields are +/- 1bp, the 10y trading at 1.054%, New Zealand markets are closed.

- Rate cut projections have gained slightly post data: June 2024 at -0% w/ cumulative rate cut 0.0bp at 5.328%, July'24 at -12% w/ cumulative at -3.5bp at 5.293%, Sep'24 cumulative -14.7bp (-13.9bp pre-data), Nov'24 cumulative -21.7bp (-20bp pre-data), Dec'24 -35.5bp (-32.9bp pre-data).

- Looking ahead; S&P Global US Manufacturing PMI, while the Fed is in blackout period until June 13

JGBS: Futures Richer But Off Best Levels, 10Y Supply Tomorrow

JGB futures are stronger but off session highs, +16 compared to the settlement levels.

- Outside of the previously outlined Capex, Company Profits and Jibun Bank PMI data, there hasn't been much in the way of domestic drivers to flag.

- BoJ Executive Director Takashi Kato said on Monday that “BoJ has no plan to immediately unload its exchange traded funds (ETF) holdings.” He added, “I hope to spend time examining how to unload BoJ’s ETF holdings in the future.”

- Cash US tsys have bull-flattened in today’s Asia-Pac session, with yield flat to 2bps lower, after Friday’s post-PCE-Deflator rally.

- Cash JGBs are dealing mixed, with yield movements bounded by +/- 1.5bp. The benchmark 10-year yield is 0.4bp lower at 1.065% versus the cycle high of 1.101% set late last week.

- Swaps are dealing slightly mixed, with the 3-20-year zone seeing slightly lower rates. Swap spreads are mixed.

- Tomorrow, the local calendar sees Monetary Base data alongside 10-year supply.

AUSSIE BONDS: Richer, Session Highs, Q1 GDP On Wednesday

ACGBs (YM +2.0 & XM +4.5) are holding stronger and at Sydney session highs.

- Outside of the previously outlined Fair Work Commission’s Minimum Wage Decision, Judo Bank PMI Mfg and MI Inflation Gauge, there hasn't been much in the way of domestic drivers to flag.

- (AFR) Monday’s minimum wage decision by the Fair Work Commission – an increase of 3.75 per cent – isn’t going to trigger a wage-price spiral. But with productivity going backwards, it’s another meaningful factor in keeping inflation stuck higher for longer. (See link)

- Cash US tsys have bull-flattened in today’s Asia-Pac session, with yield flat to 2bps lower, after Friday’s post-PCE-Deflator rally.

- Swap rates are 2-4bps lower, with the 3s10s curve flatter

- The bills strip has bull-flattened, with pricing flat to +4.

- RBA-dated OIS pricing is 1-6bps softer across meetings. This comes after no upside surprise in the much-awaited US PCE deflator data on Friday prevented further erosion in the Fed outlook. The US market is still priced for at least one rate cut this year, though it is not fully priced until December. In Australia, 4bps of easing is priced by year-end from an expected terminal rate of 4.36%.

- Tomorrow, the local calendar will see Q1’s Current Account Balance, Company Operating Profit and Inventories ahead of Q1 GDP on Wednesday.

FOREX: USD Supported On Dips, But Tight Ranges Overall

The USD BBDXY index sits up from session lows sub 1250, last near 1250.50 (still down modestly for the session) but has traded tight ranges overall.

- In the G10 space, the A$ and JPY are the underperformers, although all majors are away from best levels against the USD.

- USD/JPY has nudged up to 157.40/45, currently around session highs. Earlier lows were at 157.00. We had weaker than expected Q1 capex figures earlier, but the yen didn't react to the print. Equity sentiment is mostly positive through the region, while US equity futures are also higher. US yields are slightly lower at the back end of the curve.

- AUD/USD probed above 0.6660, but sits back under 0.6650 in recent dealings. Some offset to the positive equity tone has come from further weakness in iron ore prices, down nearly 4% to the low $111/ton region. Higher iron ore inventories weighing on sentiment.

- May inflation expectations eased back to 3.1% y/y for Australia from 3.7%, although the m/m outcome was still higher than April's read. The better Caixin China manufacturing PMI hasn't shifted sentiment.

- NZD/USD is a touch higher, last near 0.6150 but away from session best levels.

- Looking ahead, US May manufacturing ISM/PMIs and European manufacturing PMIs print.

ASIA STOCKS: Hong Kong Equities Surge Higher, Property & Tech Lead The Way

Hong Kong & Chinese equities are mixed today, property names are the top performing sector after new home sales slump eased in in may and beat expectations, leading to belief that the recent government policies may be starting to have some positive effect. Hong Kong Markets are also benefitting from a softer reading of the Federal Reserve’s preferred inflation measure bolstered hopes for rate cuts. Earlier, we had Caixin China PMI Mfg which best estimates slightly.

- Hong Kong equities are higher today, with property names are the top performers today with the Mainland Property Index up 2.55%, the HS Property Index up 2.25%, elsewhere HSTech Index is up 2.70%, while the wider HSI is up 2.32%. In China onshore markets, the CSI300 is down 0.14%, the CSI 300 Real Estate Index is down 0.66%, small cap indices are the worst performing today with the CSI1000 & CSI2000 are down 01.35% and 1.90% respectively, while the ChiNext is up 0.25%

- (MNI): China Press Digest June 03: New Loans, CPI, Bonds (See link)

- In the property space, The Shanghai property market has become more active following the easing of home purchase rules, with increased on-site viewings and a boost in second-hand house sales, which in turn positively impacts the new home market, especially for houses priced below 3 million yuan. The PBoC is actively supporting the housing market by providing 300 billion yuan ($41 billion) in cheap credit to fund local-government purchases of unsold homes, alongside other lending programs aimed at easing cash flow for developers and revitalizing the market, though economists believe more central-bank credit is needed to achieve significant impact. The PBOC's scalable approach contrasts with slower fiscal spending methods, but the IMF suggests additional fiscal tools may be necessary to fully stabilize the market, per BBG.

- Looking ahead: China Caixin China PMI Composite & S&P Global Hong Kong PMI on Wednesday, while on Thursday we have China Trade Balance data.

ASIA PAC STOCKS: Equities Rally On US Data, China Prop & Indian Election Results

Asian stocks are higher today, after softer reading of the Federal Reserve’s preferred inflation measure bolstered hopes for rate cuts. Equities in Australia, Japan, and Hong Kong advanced. Indian equities surged following election results indicating a victory for Prime Minister Narendra Modi’s party in a landslide while positive property numbers out of China have also helped boost stocks today. The recent decline of the US dollar, down 1.1% in May, also supported gains. On the data front we have had regional PMIs, AU MI Inflation and Indonesian CPI.

- Japanese equities are higher today. Japan's Topix is 0.95% higher and is now trading near a two-month highs, driven by renewed expectations for US interest-rate cuts, which boosted investor appetite for riskier assets. Sony Group has contributed the most to the Topix gain, with high domestic bond yields particularly benefited banking stocks such as Mitsubishi UFJ and Sumitomo Mitsui, the Topix Bank Index is up 1.46% while the Nikkei also advanced 1.15%. Earlier Capital spending for 1Q was 6.8% vs 11% est, while Jibun Bank PMI was 50.4 vs 50.5 prior.

- Taiwan equities have surged higher today, TSMC has contributed the most the index gain up 3.41% after Nvidia announced plans for new chips. Earlier, S&P PMI manufacturing was up in May to 50.9 from 50.2. The Taiex is up 1.76%.

- South Korean equities have surged higher today as chip and auto names lead the way. Earlier, S&P Manufacturing PMI increased in May to 51.6 vs 49.4 in Apr. The Kospi is up 1.87% and is now testing the 50-day EMA, while the Kosdaq lags moves however still trades up 0.51%.

- Australian equities are on track for their 2nd straight day of gains, led by Utilities and energy stocks. Earlier, we had Judo Bank PMI coming in at 49.7 vs 49.6 prior and MI Inflation for May was 0.3% vs 0.1% in April. The ASX200 is 0.79% higher.

- Elsewhere in SEA, Indian equities have surged on the back of the election results with the Nifity 50 up 2.90%, Indonesian equities are 1.36% higher, Singapore equities are 0.42% and Philippines equities are 0.60% higher.

OIL: Crude Has Recovered From Early Losses Following OPEC Decision

Oil prices started the APAC session lower following OPEC’s decision to reduce the amount output is cut from October. They then rose but are now off those highs to be moderately lower on the day. Brent is down 0.1% to $81.03/bbl after rising to $81.65 and a low of $80.55 early in trading. WTI is around $76.93/bbl after a high of $77.52 and a low of $76.39. The USD index is down 0.1%.

- OPEC cuts will be extended into 2025 but will then be reduced over the year from October, which was earlier than many expected. The June agreement seems a compromise as Saudi Arabia wants higher prices to fund its economic plans while other producers want to pump more as many have increased capacity. Bloomberg estimates that there could be an additional 750kbd by January.

- There has been a mixed response to the group’s decision with Goldman Sachs seeing an increase in stocks putting pressure on prices but RBC and UBS continuing to believe that OPEC will direct the market, according to Bloomberg. June’s deal is likely structured to keep the group united.

- Later US May manufacturing ISM/PMIs and European manufacturing PMIs print. US May payrolls on Friday are the next focus for oil markets.

GOLD: Lower Despite Friday’s Benign US PCE Deflator

Gold is 0.2% lower in the Asia-Pac session, after closing 0.7% lower at $2327.33 on Friday. The yellow metal was marginally lower on the week.

- In terms of fundamental drivers, the market has embraced the idea that the Federal Reserve will stick to recent signalling that it needs more evidence that inflation is cooling before it can pivot to rate cuts.

- On Friday, no upside surprise in the much-awaited PCE price data prevented further erosion in the Fed outlook. The market is still priced for at least one rate cut this year, though it is not fully priced until December.

- According to MNI’s technicals team, a short-term bear cycle in gold remains in play, for now, although the recent move down appears to be a correction that is allowing an overbought condition to unwind.

- A resumption of gains would open $2452.5 next, a Fibonacci projection. The 50-day EMA, at $2307.8, represents a key support.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/06/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/06/2024 | 0715/0915 | ** |  | ES | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0750/0950 | ** |  | FR | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0755/0955 | ** |  | DE | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 03/06/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/06/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (final) |

| 03/06/2024 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/06/2024 | 1400/1000 | * |  | US | Construction Spending |

| 03/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.