-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fiscal Matters Still Headline Into Year-End

EXECUTIVE SUMMARY

- BIG DIFFERENCES STILL EVIDENT IN BREXIT TALKS AS JOHNSON PROVIDES WARNING

- U.S. TO BLACKLIST DOZENS OF CHINESE FIRMS INCLUDING SMIC (RTRS SOURCES)

- REPUBLICAN BID TO END VIRUS LENDING SLOWS RELIEF DEAL (BBG)

- U.S. TREASURY SEEKS TO WATER DOWN TRUMP'S CHINESE SECURITIES BAN (FT)

- BOJ TWEAKS CORPORATE LIQUIDITY PROVISIONS, BROADER POLICY SETTINGS UNCHANGED

- EU AGREES 'IN PRINCIPLE' TO AN INVESTMENT AGREEMENT WITH CHINA (SCMP)

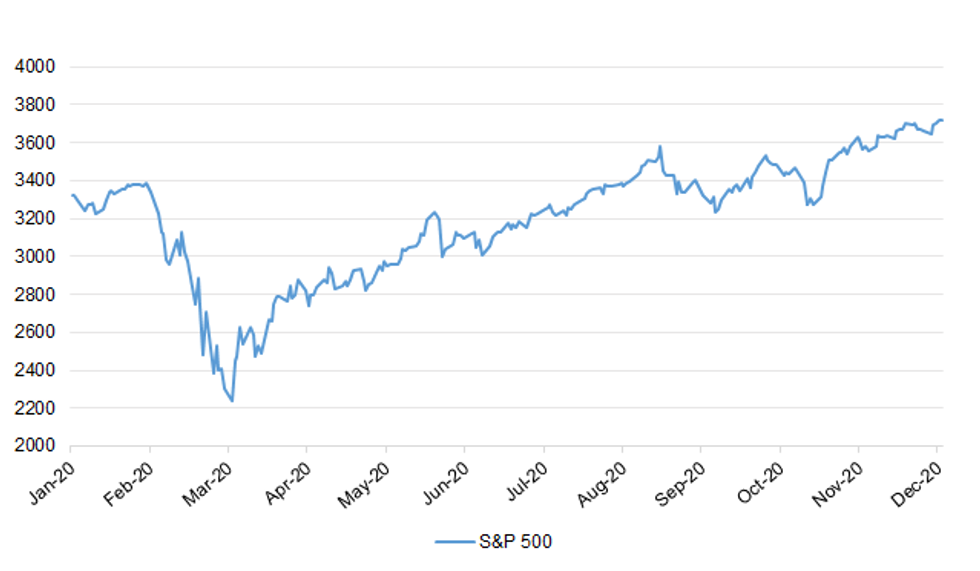

Fig. 1: S&P 500

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Boris Johnson has told EU chief Ursula von der Leyen that Brexit trade talks are now in "a serious situation" and that a no-deal outcome is "very likely" unless the EU changes its stance "substantially". The prime minister spoke to the European Commission president by phone on Thursday evening, in which the two leaders took stock of the current state of EU-UK negotiations. It comes ahead of the end of the Brexit transition period in two weeks' time. (Sky)

BREXIT: European Commission President Ursula von der Leyen said after a call with British Prime Minister Boris Johnson on Thursday that "substantial progress" was made in their trade talks but that bridging the "big differences" on fisheries would still be hard. "We welcomed substantial progress on many issues. Yet big differences remain to be bridged, in particular on fisheries. Bridging them will be very challenging," she said on Twitter, adding that trade negotiations would continue on Friday. (RTRS)

BREXIT: UK chief Brexit negotiator Frost tweeted the following on Thursday: "The situation in our talks with the EU is very serious tonight. Progress seems blocked and time is running out. The Prime Minister @BorisJohnson set out his concerns about the state of play to Commission President @vonderleyen this evening." (MNI)

BREXIT: A row over Brussels' €750bn Covid recovery package has become a sticking point as UK trade talks go to the wire, after Boris Johnson warned that EU-level spending should not be exempt from state-aid restrictions in a post-Brexit agreement. (FT)

BREXIT: Mr Johnson told Ms von der Leyen that he would not accept a Brussels demand for EU fishing boats to be given guaranteed access to UK waters for eight years, according to officials. The UK has offered a transition that would ensure that EU boats could continue to fish in the country's waters for three years, with pre-agreed quota rights, after Britain leaves the EU's Common Fisheries Policy on January 1. Britain's stance has been that, after that period, access should depend on successful annual negotiations. But EU leaders, including France's Emmanuel Macron, who on Thursday tested positive for Covid-19, have said this would not provide enough medium-term certainty for their national fleets. (FT)

BREXIT: AFP tweeted the following on Thursday: "Germany sees 'signs Britain moving' on Brexit talks: ministry source." (MNI)

BREXIT: The UK has already drafted legislation to put any Brexit deal it strikes with the EU into law, HuffPost UK has learnt. A 50-page "draft future relationship bill" is in existence with time running out until the end of the transition period on December 31. HuffPost UK understands that the current text forms a skeleton to which the details of any last-minute UK-EU trade agreement can be added. (Huffington Post)

BREXIT: One of Prime Minister Boris Johnson's senior ministers said on Thursday that Britain hoped to reach a trade deal with the European Union but that talks might go on until after Christmas. "When we think about the real deadline, I hope that we can conclude an agreement as quickly as possible but talks may go on until after Christmas," Michael Gove told a parliamentary committee. (RTRS)

BREXIT: There's often an element of theater at the end of negotiations, Irish Deputy Prime Minister Leo Varadkar told RTE on Thursday. He said he was on the "optimistic" side of a 50:50 chance of a deal. The discussions continue Friday. (BBG)

BREXIT: Britain's biggest business lobby group called on the European Union to delay introducing new customs checks after Brexit because firms haven't had enough time to prepare amid the coronavirus pandemic. The Confederation of British Industry, which represents 190,000 businesses, is also asking for companies to be given a grace period to comply with new paperwork that will be required at the end of the year whether or not the U.K. and EU reach a trade deal. With less than 14 days to go before Britain leaves the EU's single market, firms are still in the dark as to what the future trading relationship with the bloc will look like -- raising the threat of widespread disruption on Jan. 1. (BBG)

CORONAVIRUS: Northern Ireland will enter a six-week lockdown starting Dec. 26 in a bid to contain a surge in COVID-19 cases, Deputy First Minister Michelle O'Neill announced on Thursday. The British region has been in and out of some form of lockdown since mid-October when it was one of Europe's worst COVID-19 hotbeds. The most recent curbs were lifted last week, when all shops, restaurants and pubs serving food reopened. All non-essential shops, pubs, bars and restaurants will close on Dec. 26 with the exception of takeaway food services, O'Neill told journalists. (RTRS)

ECONOMY: MNI REALITY CHECK: UK Nov Sales Lower, But Not All Bad News

- Widespread lockdowns in the UK dampened non-essential retail sales in November, but early Christmas shopping and buoyant food sales may have prevented some of the nosedive in sales predicted by City forecasters, leading industry sources tell MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

EUROPE

FRANCE: France's coronavirus situation is worrying as the number of new cases is rising again after a November decline and the year- end holiday period will increase infection risk, the country's director general of health said. "We know we have a two-week risk period ahead of us, this being the festive period," Jerome Salomon said in a briefing on Thursday. (BBG)

ITALY: Banca Monte dei Paschi di Siena SpA plans to raise fresh funds to cover capital needs of as much as 2.5 billion euros ($3.1 billion), in a move that could help pave the way for the Italian government to sell the troubled Italian lender. (BBG)

PORTUGAL: Portugal will limit movement from 11 p.m. on Dec. 31 as it tries to contain the spread of the coronavirus pandemic. On Jan. 1-3, movement will be banned in public spaces from 1 p.m., Prime Minister Antonio Costa said on Thursday. No new restrictions will be added for the long Christmas weekend, he said. (BBG)

IRELAND: Government ministers are likely to look at bringing forward the tightening of Covid-19 restrictions to 28, 29 or 30 December. Sources indicate that restrictions for the hospitality sector and inter-county travel will be considered by ministers at a meeting next Tuesday. They will also discuss limiting the existing ceiling on household visits. It is understood that a key concern is that the authorities do not want the hospitality sector entirely open on New Year's Eve. (RTE)

EQUITIES: Microsoft was hacked as part of the suspected Russian campaign that has hit multiple U.S. government agencies by taking advantage of the widespread use of software from SolarWinds Corp, according to people familiar with the matter. As with networking management software by SolarWinds, Microsoft's own products were then used to further the attacks on others, the people said. It was not immediately clear how many Microsoft users were affected by the tainted products. The Department of Homeland Security, which said earlier Thursday that the hackers used multiple methods of entry, is continuing to investigate. Microsoft did not immediately respond to a request for comment. (RTRS)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Slovenia (current rating: A; Outlook Stable)

- Moody's on Cyprus (current rating: Ba2; Outlook Positive)

U.S.

FED: MNI BRIEF: Fed Balance Sheet Sets New Record, as Lending Jumps

- The Federal Reserve's balance sheet jumped to a record USD7.363 trillion this week on increased holdings of MBS and Treasuries, data released Thursday showed, and as some of the Fed's 13(3) facilities showed their largest weekly jump - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Senate Majority Leader McConnell tweeted the following on Thursday: "Productive conversations remain underway on COVID-19 relief. But Congress must not slide into treating these talks like routine negotiations at our routine pace. This could not be more urgent. The Senate's going to keep working right through the weekend until we get an outcome." (MNI)

FISCAL: Two leading Senate Republicans say that language terminating the Federal Reserve's pandemic lending facilities should be in the economic relief bill -- a demand that could slow negotiations as lawmakers look to make a deal. Senator Pat Toomey of Pennsylvania said Thursday that ending the facilities is a top issue for him to include in the bill. Senator Mike Crapo of Idaho said including language to explicitly wind down the emergency lending programs by the end of the year is becoming a red-line issue for Republicans. (BBG)

FISCAL: White House aides intervened Thursday to prevent President Trump from issuing a statement calling for substantially larger stimulus payments for millions of Americans, according to two people granted anonymity to share details of the private exchange. On a phone call Thursday afternoon, Trump told allies that he believes stimulus payments in next relief package should be "at least" $1,200 per person and possibly as big as $2,000 per person, the officials said. Congressional leadership is currently preparing a stimulus package that would provide checksof $600 per person. (Washington Post)

FISCAL: Republican Senator John Thune says it's possible there will be a brief, partial government shutdown over the weekend as negotiations continue on a longer-term spending bill and a Covid-relief package. (BBG)

CORONAVIRUS: The US set a daily record with more than 241,000 new infections on Thursday as the nation continues to battle an autumn resurgence of coronavirus. (FT)

CORONAVIRUS: Pfizer Inc. said it has shipped all 2.9 million doses of the Covid-19 vaccine that the U.S. government ordered this week and that it has millions more doses sitting in warehouses awaiting instructions for where to ship. Officials from Operation Warp Speed have said that the second shots of the two-dose vaccines are being withheld until they are due in three weeks. (BBG)

CORONAVIRUS: A spokesperson for the Department of Health and Human Services said vaccine allocations for next week have not been reduced, despite several governors' public remarks that their allocations have been slashed nearly in half. "Reports that jurisdictions' allocations are being reduced are incorrect," the spokesperson said in a statement to CNBC, adding that shipments will arrive over several days. "This same process was successfully used for the initial distribution of Pfizer's vaccine, and we are simply applying lessons learned." (CNBC)

CORONAVIRUS: San Francisco health officials ordered a mandatory quarantine of 10 days for anyone traveling, moving or returning from anywhere outside the San Francisco Bay Area. The quarantine order begins on Friday and will remain in effect until Jan. 4. The travel quarantine order strongly discourages non-essential travel, including from one place to another within the Bay Area. (CNBC)

POLITICS: Navarro: Special prosecutor should be named to look at election (BBG)

POLITICS: President-elect Joe Biden defended his son Hunter Biden amid an ongoing investigation into the younger Biden's taxes. During an interview with Stephen Colbert that is scheduled to air on Thursday night, the president-elect sat alongside Dr. Jill Biden and expressed "confidence" in his son. "I think it's kind of foul play, but look, it is what it is and he's a grown man, he is the smartest man I know – I mean from a pure intellectual capacity – and as long as he's good, we're good," Joe Biden said. (Fox)

EQUITIES: Google now faces its third government antitrust lawsuit in less than two months, this time from a bipartisan coalition of state attorneys general. A group of 38 states and territories took part in the lawsuit, which claims Google illegally maintained a monopoly in general search and search advertising through anticompetitive conduct and contracts. Members of the executive committee leading the states included Arizona, Colorado Iowa, Nebraska, New York, North Carolina, Tennessee and Utah. (CNBC)

OTHER

U.S./CHINA: The United States is set to add dozens of Chinese companies, including the country's top chipmaker SMIC, to a trade blacklist on Friday, two people familiar with the matter told Reuters on Thursday. (RTRS)

U.S./CHINA: The US Treasury department is attempting to water down an executive order from Donald Trump that bars Americans from investing in Chinese companies with suspected ties to Beijing's military. The effort has been met with furious opposition from the Pentagon and state department, opening up a heated dispute over one of the last big anti-Beijing policies of the Trump era. (FT)

U.S./CHINA: The US energy secretary on Thursday signed an order prohibiting electric utilities that supply critical defence facilities from importing certain power system items from China, in an effort to protect US security from cyber and other attacks. The Department of Energy said in a release the order prohibits utilities that supply the defence facilities at a service voltage of 69kV or above from acquiring, importing, transferring, or installing bulk power system electric equipment. It was not immediately clear which defence sites were considered critical and the Energy Department did not immediately respond to a request for comment. Bulk power equipment consists of items used in substations, control rooms, or power plants, including nuclear reactors, capacitors, transformers, large generators and backup generators and other equipment. (SCMP)

EU/CHINA: The European Union has agreed "in principle" to an investment agreement with China, a high-level diplomatic source in Brussels told the South China Morning Post on Thursday, in what would be a big win for Beijing in the face of tattered relations with the US. The EU's two most influential leaders, German Chancellor Angela Merkel and French President Emmanuel Macron, are understood to be in agreement for the deal to go ahead, a second source briefed on the negotiation said. (SCMP)

CORONAVIRUS: The US drugs regulator will grant emergency approval to a second coronavirus vaccine in the coming days, a decision that will make it the first country to have authorised two inoculations against the virus. The US Food and Drug Administration decided on Thursday night to approve Moderna's vaccine on an emergency basis, according to people close to the process, following the recommendation to do so by a panel of outside experts. (FT)

CORONAVIRUS: U.S. drugmaker Pfizer on Friday applied to Japan's Ministry of Health for approval of its coronavirus vaccine, the company announced. The pharmaceutical giant is the first supplier to seek formal approval in Japan and has already agreed to supply the country with 120 million doses, enough for 60 million people. (Nikkei)

CORONAVIRUS: Regeneron Pharmaceuticals says New England Journal of Medicine has published initial clinical data from an ongoing phase 1/2/3 trial of the antibody cocktail casirivimab and imdevimab in non-hospitalized patients with covid-19. Data showed that casirivimab and imdevimab effectively reduced viral load and the need for medically-attended visits. (BBG)

BOJ: MNI REVIEW: BOJ On Hold; To Examine Policy; Results In March

- The Bank of Japan on Friday left monetary policy unchanged citing the modest economic recovery and extended its lending facilities to help companies but said it was ready to take additional easing measures depending on the impact of the resurgent virus - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN: MNI POLICY: Japan Govt Sees Strong Growth Recovery In FY21

- Japan's government has raised its real GDP forecast for fiscal 2021 to 4% from the previous 3.4%, as the added stimulus from the latest round of stimulus measures will help ease the impact of Covid-19 on the economy, the Cabinet Office said on Friday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN: The Japanese government plans to issue ~43.6t yen of government bonds next fiscal year to fund its planned 106.6t yen budget, Yomiuri reports, without attribution. The budget will be approved by the cabinet as soon as Monday. (BBG)

JAPAN: Japan to issue 37.26t yen deficit-covering bonds in FY21. (JiJi)

JAPAN: Tokyo prosecutors questioned former Prime Minister Shinzo Abe on Thursday or earlierover the expenses of dinner parties his political group held for his supporters, TV Asahi reports, citing several unidentified ruling Liberal Democratic Party officials. (BBG)

JAPAN: Japan ruling LDP plans to summon former PM Abe to Diet. (Kyodo)

AUSTRALIA: A cluster of coronavirus cases in Sydney's Northern Beaches area has ballooned to 28 confirmed infections as state and territory leaders move to impose travel restrictions a week before Christmas. Health authorities said genomic testing had confirmed the virus entered Australia from overseas, but health authorities had so far been unable to determine how it spread to the community. The spike in cases prompted federal Chief Medical Officer Paul Kelly to declare the Northern Beaches Local Government Area a hotspot on Friday, on the basis that more infections are expected, Health Minister Greg Hunt said. (SBS)

AUSTRALIA: Victoria, the state that's so far been hardest hit by Australia's Covid-19 pandemic, is advising all residents not to travel to Sydney after case numbers in a cluster on the city's northern beaches rose again Friday. (BBG)

AUSTRALIA: Australian Prime Minister Scott Morrison announced a reshuffle of his cabinet on Friday, charging Dan Tehan with front-line repair work with China in the vital trade portfolio. Tehan, a former diplomat from Victoria state with 10 years' experience as a lawmaker, will relinquish the education portfolio to take on the role. He replaces Simon Birmingham, who this year became Finance Minister. (BBG)

SOUTH KOREA: South Korea has reported more than 1,000 new coronavirus cases for the third straight day, piling pressure on health authorities to raise distancing restrictions to maximum levels. (FT)

TURKEY: Secretary of State Mike Pompeo spoke this week with his Turkish counterpart surrounding the decision by President Trump to impose sanctions on Turkey over its purchase last year of a Russian missile defense system, the secretary said Thursday. President Trump on Monday announced that the U.S. would impose sanctions on Turkey over its purchase last year of the Russian S-400 missile defense system as required under the Countering America's Adversaries Through Sanctions Act (CAATSA), which became law in August 2017. Pompeo wrote on Twitter Thursday that he spoke with Turkish Foreign Minister Mevlut Cavusoglu this week and said that the imposing of sanctions demonstrates that "the U.S. will fully implement [CAATSA] and prevent Russia from receiving revenue, access, and influence." (The Hill)

MEXICO: Mexico's central bank kept its benchmark interest rate unchanged at 4.25% on Thursday, as expected, but two of its five-member board wanted to lower rates and the bank hinted it may reduce borrowing costs in the coming months. "This pause provides the necessary room to confirm that the trajectory of inflation converges to the target," the central bank said in a statement, the second month in a row it had used the word "pause" after leaving rates on hold. Still, two board members voted to cut rates to 4.00%. (RTRS)

MEXICO: Mexico's public sector financing needs for 2021 seen at 14% of GDP, -2 ppts from 2020, according to a plan released by the Finance Ministry. (BBG)

BRAZIL: All Brazilians are required to be vaccinated against Covid-19 under the penalty of being banned from certain public activities and spaces, the country's top court has decided. Ten justices of the 11-member court backed the mandatory inoculation with only one vote against in a virtual session held Thursday. The ruling is a blow to President Jair Bolsonaro, who has said he won't get a vaccine and nobody should be forced to. (BBG)

RUSSIA: The massive hacking campaign disclosed by U.S. officials this week and tentatively attributed to the Russian government extended beyond users of pervasive network software that had been compromised. The Department of Homeland Security said in a bulletin on Thursday that the spies had used other techniques besides corrupting updates of network management software by SolarWinds, which is used by hundreds of thousands of companies and government agencies. (RTRS)

RUSSIA: At least three states were hacked as part of a suspected Russian cyber-attack that breached several U.S. government agencies. Two people familiar with the ongoing investigation said three states were breached in the attack, though they wouldn't identify the states. A third person familiar with the probe confirmed that states were hacked but didn't provide a number. (BBG)

RUSSIA: The Energy Department and National Nuclear Security Administration, which maintains the U.S. nuclear weapons stockpile, have evidence that hackers accessed their networks as part of an extensive espionage operation that has affected at least half a dozen federal agencies, officials directly familiar with the matter said. (POLITICO)

CHINA

ECONOMY: China's economic recovery is unstable and unbalanced due to uncertainties around the pandemic, weak demand, rising financial risks, trade frictions and unemployment, YiCai.com reported citing analysts. While some have projected growth as high as 9% next year this is mainly driven by a low comparison base and policy support, the newspaper said citing Shen Jianguang, chief economist of JD Finance. China should continue to encourage technological innovation, improve industrial efficiency amid an aging population in an economy with a declining cheap labor force and widening income gaps, the newspaper said citing analysts. (MNI)

ECONOMY: China must set its sights on expanding the job market next year, especially for university graduates and migrant workers, experts at a labour ministry conference have said, as the country's top leaders gather in Beijing to set future economic policies. Hundreds of officials are in the capital for the annual Central Economic Work Conference this week, where job growth will be high on the agenda for 2021, the same year the Communist Party celebrates its 100th anniversary and the start of the next five-year plan. With China's economic rebound from the coronavirus pandemic set to continue next year, employment will be a key concern for the government, along with improving basic living standards, reducing financial vulnerability and ensuring grain and energy security. (SCMP)

POLICY: China launched a fifth state-owned asset management company (AMC), China Galaxy Asset Management Co., on Dec. 11 to deal with non-performing assets in the securities sector, the Financial News reported citing the China Banking and Insurance Regulatory Commission. The four other AMCs, set up 20 years ago, primarily deal with non-performing loans at state banks. China also allowed the first foreign-owned AMC, Oaktree (Beijing) Investment Management Co. to register on Feb. 18, according to the report. (MNI)

POWER: Chinese provinces including Zhejiang and Hunan are restricting power usage due to a lack of coal as yearend production safety protocols, environmental restrictions and slowing imports crimped demand, the Securities Daily reported citing businesses interviewed. MNI noted that thermal coal prices are surging in China after authorities began to restrict imports from Australia, the world's largest supplier, as bilateral tensions continue to rise this year. (MNI)

OVERNIGHT DATA

JAPAN NOV CPI -0.9% Y/Y; MEDIAN -0.8%; OCT -0.4%

JAPAN NOV CPI EX-FRESH FOOD -0.9% Y/Y; MEDIAN -0.9%; OCT -0.7%

JAPAN NOV CPI EX-FRESH FOOD & ENERGY -0.3% Y/Y; MEDIAN -0.3%; OCT -0.2%

NEW ZEALAND DEC, F ANZ BUSINESS CONFIDENCE INDEX 9.4; NOV -6.9

NEW ZEALAND DEC, F ANZ BUSINESS ACTIVITY OUTLOOK INDEX 21.7; NOV 9.1

The December ANZ Business Outlook survey was full of Christmas cheer. Both business confidence and own activity lifted strongly to multi-year highs. All other activity indicators rose solidly too. (ANZ)

NEW ZEALAND DEC ANZ CONSUMER CONFIDENCE INDEX AT 112.0; NOV 106.9

The ANZ-Roy Morgan Consumer Confidence Index lifted 5 points in December. It remains well short of 2017-19 levels, unlike business sentiment. (ANZ)

NEW ZEALAND NOV TRADE BALANCE +NZ$252MN; MEDIAN +NZ$255MN; OCT -NZ$472MN

NEW ZEALAND NOV EXPORTS NZ$5.20BN; MEDIAN NZ$5.21BN; OCT NZ$4.80BN

NEW ZEALAND NOV IMPORTS NZ$4.95BN; MEDIAN NZ$4.95BN; OCT NZ$5.27BN

UK DEC GFK CONSUMER CONFIDENCE -26; MEDIAN -31; NOV -33

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with rates unchanged at 2.2% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

PBOC SETS YUAN CENTRAL PARITY AT 6.5315 FRI VS 6.5362 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate slightly lower at 6.5315 on Friday, compared with the 6.5362 set on Thursday.

MARKETS

BOND SUMMARY: Rebalancing, When & How Much?

Cash Tsys are a touch flatter, with yields unchanged to 1.1bp richer across the curve, as end-of-year focus remains zoomed in on fiscal developments in DC. T-Notes unch. at 137-27+, sticking to a narrow 0-03+ range thus far, with macro headlines light during early Asia dealing. There has also been some interest in rebalancing flows into year-end (which are seen as equity -ve, bond +ve).

- JGB futures shrugged off the latest BoJ decision, with the upcoming assessment of the Bank's QQE with YCC scheme on the back of the sustained deviation from its inflation target flagged ahead of time by the Nikkei. There is little scope for major policy tweaks stemming from the assessment given the Bank's comments re: QQE with YCC i.e. there is no need to change the framework. The corporate liquidity provision extension was in line with broader expectations, at least in terms of time horizon (through the end of Sep '21), with the scheme made a little more generous overall (see earlier bullet for further details). Futures are now -3 on the day, with yields little changed across the JGB curve.

- The Aussie bond space continues to operate within narrow ranges, with YM -0.5 & XM -1.0. Focus remains on the domestic COVID-19 situation and guidance from the NSW government which advised residents in one of Sydney's suburbs to stay at home as much as possible over the next three days to fight the cluster that has emerged. The cash ACGB curve has seen some light twist steepening.

EQUITIES: Headlines Light, Rebalancing Flows Eyed

A lack of headline flow and continued focus on the fiscal situation in DC made for a limited round of Asia-Pac trading on Friday, with the major regional indices unchanged to a touch lower.

- The ASX 200 underperformed vs. its major regional benchmarks as the financial and energy sectors struggled.

- E-minis also nudged lower against the headline-light backdrop.

- Month-, quarter- and year-end portfolio rebalancing flows are also be eyed and are seen as equity negative/bond positive. Note that these flows may be even more sporadic than normal, given the upcoming holiday schedule.

- Nikkei 225 -0.1%, Hang Seng -0.7%, CSI 300 unch., ASX 200 -0.9%.

- S&P 500 futures -6, DJIA futures -69, NASDAQ 100 futures -24.

GOLD: Looking To $1,900/oz

Gold is marginally softer on the day, last trading a touch above $1,880/oz.

- The DXY has edged away from its newly minted cycle lows during Asia-Pac hours, which has applied very modest pressure to bullion after spot failed to challenge $1,900/oz on Thursday. A reminder that the pullback from intraday lows for U.S. real yields allowed gold to move off best levels of the day on Thursday. A softer USD and lower U.S. real yields had provided support for bullion in early U.S. trade.

- Bulls now look to clear psychological resistance in the form of the $1,900/oz mark to open the way higher.

OIL: Little Changed In Asia

WTI & Brent sit a few cents below their respective settlement levels after a softer USD supported crude on Thursday.

- It has been a quiet 24 hours or so for crude-specific news flow, although Thursday saw Saudi Arabia point to continued close management of the supply/demand mix for crude, as the country's Energy Minister looked to reassure markets.

FOREX: DXY Off Lows Amid Year End Flows; Thin Volumes Exacerbate Moves

A stronger US dollar was the main driver of price action in Asia, moves exacerbated by thin volumes heading into year end. The DXY has edged away from its newly minted cycle lows during Asia-Pac hours, which has applied some pressure to USD crosses. A pullback from intraday lows for U.S. real yields has allowed DXY to rise in Asia.

- AUD/USD down 25 pips at 0.7596 and dropping below the 0.76 handle. There is some concern in Australia around a mini resurgence of COVID-19 cases. Sydney reported 7 new cases in the past two days, which bought to an end around 5-weeks of virtually no cases and limited transmission in Australia's largest city.

- NZD/USD saw a similar move, down 23 pips at 0.7126. The December final ANZ Business Confidence rose to 9.4 from -6.9 previously, while the Activity Outlook rose to 21.7 from 9.1. The headline figure is at a 3-year high at these levels. The release had no effect on NZD.

- JPY saw some weakness heading into the BoJ decision. The bank kept rates on hold as expected, but tweaked its scheme focused on corporate liquidity provisions, extending its duration by 6 months, out to the end of September 2021 (meeting expectations), while noting that further extension will be considered if necessary. USD/JPY up 36 pips at 103.46, benefitting from a stronger greenback.

- GBP/USD fell, last down 60 pips at 1.3526. There has been no significant news flow, some of the weakness can be attributed to money coming off the table ahead of year end. There is still hope from some a Brexit deal can be reached, Ireland's Deputy Prime Minister Varadkar was the latest to weigh in saying both sides are edging towards a Brexit trade deal and he thinks both sides will want to get a deal by Christmas. However comments from UK Prime Minister Johnson were not so optimistic. He said the EU needs to substantially soften its stance on fisheries to secure a deal. European Commission President Ursula von der Leyen said there was progress big differences remain and noted fisheries as a sticking point. EU Chief Negotiator Barnier has proposed extending the deadline to Sunday.

- The PBOC strengthened the yuan by 47 pips at the fix, but this wasn't enough to stem the USD bid, USD/CNH up 90 pips at 6.5259 after brushing the 6.50 handle on Thursday.

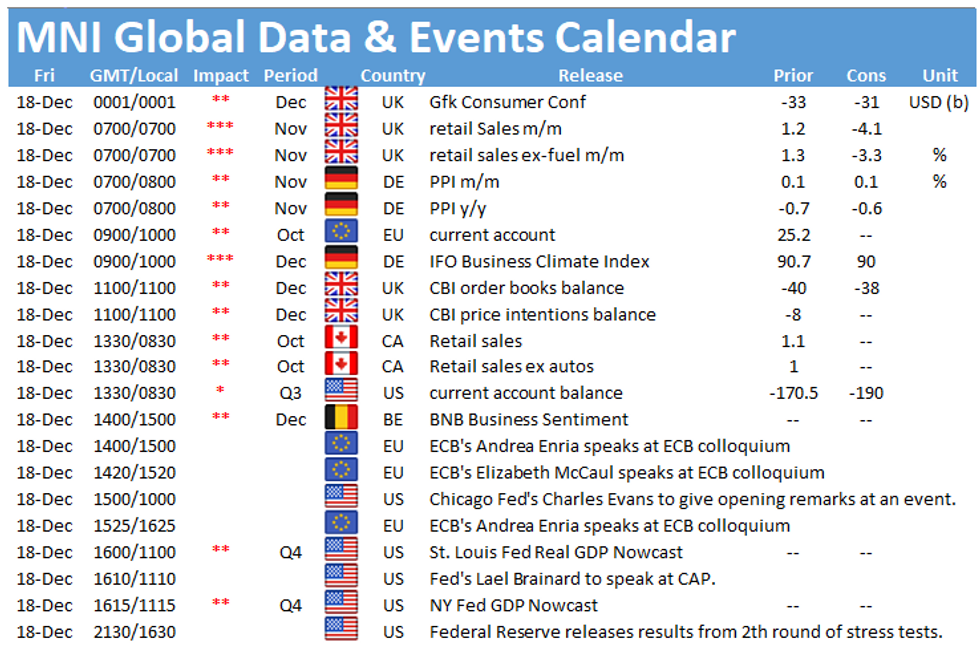

- A fairly thin economic docket to end the week. UK Retail Sales and German PPI are both at 0700GMT while ECB Current Account data and German IFO Survey at 0900GMT.

FOREX OPTIONS: Expiries for Dec18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1850(E765mln), $1.1950(E608mln), $1.2000(E2.6bln), $1.2025(E896mln), $1.2100-05(E1.3bln), $1.2115-25(E1.3bln), $1.2150(E1.6bln), $1.2170-80(E870mln), $1.2200(E875mln), $1.2225-30(E668mln), $1.2250(E2.2bln), $1.2300-10(E880mln)

- USD/JPY: Y101.00($550mln), Y101.75($500mln), Y101.90-05($1.0bln), Y103.50-60($655mln), Y104.00($614mln), Y104.15-25($882mln), Y104.50($835mln), Y105.10-15($631mln), Y106.65($1.8bln)GBP/USD: $1.3450-65(Gbp530mln)

- EUR/GBP: Gbp0.9300(E500mln)

- USD/NOK: Nok8.50($400mln), Nok8.75($550mln)

- AUD/USD: $0.7485(A$526mln), $0.7500(A$1.45bln), $0.7550-70(A$798mln)

- USD/CAD: C$1.2675($520mln), C$1.2750-55($1.4bln mixed, $1.35bln USD puts), C$1.2825($605mln), C$1.2950($905mln), C$1.3000($856mln), C$1.3050($648mln), C$1.3150($1.0bln)

- USD/CNY: Cny6.50($555mln), Cny6.55($635mln), Cny6.58($760mln)

- USD/MXN: Mxn19.50($1.95bln-USD puts), Mxn20.00($2.4bln-USD puts), Mxn20.50($1.3bln)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.