-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: FX Intervention Risks Rise Amid USD Strength

EXECUTIVE SUMMARY

- RBA NEEDS PRUDENTIAL TOOLS, MORE FISCAL SIGHT - MNI

- AUSSIE GDP GROWS 0.4% Q/Q, BEATS EXPECTATIONS - MNI BRIEF

- JAPAN WARNS ON YEN AFTER CURRENCY HITS FRESH 10-MONTH LOW - BBG

- BOJ’S 2% TARGET FAR, EASING NEEDED - TAKATA - MNI BRIEF

- CHINA DEVELOPERS JUMP ON EXPECTATIONS OF MORE STIMULUS MEASURES - BBG

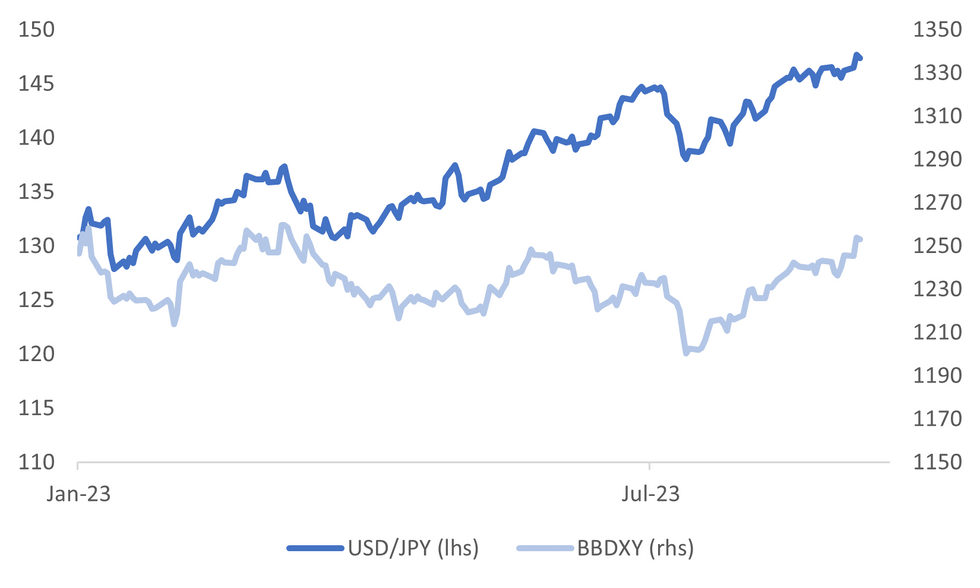

Fig. 1: USD/JPY & BBDXY Index

Source: MNI - Market News/Bloomberg

EUROPE

UKRAINE: Ukraine's military on Tuesday reported advances and robust defence along the front lines of its 18-month old war with Russia, with Moscow acknowledging "tension" in the southern sector but dismissing Kyiv's campaign as unsuccessful. Ukraine launched a counter offensive in June to reclaim territory seized by Russia, but has struggled to break through entrenched Russian lines and has faced growing criticism in Western media of concentrating forces in the wrong places. (RTRS)

U.S.

FED: The U.S. Senate on Tuesday voted overwhelmingly to clear the way for the confirmation this week of Federal Reserve Governor Philip Jefferson to be vice chair of the U.S. central bank. The 83-10 cloture vote, which limits debate on his nomination, marks the next-to-last step in a process that would install Jefferson with solid bipartisan backing in the No. 2 post at the Fed, which is chaired by Jerome Powell. (RTRS)

IPO: SoftBank Group Corp.’s Arm Holdings Ltd. is planning to raise as much as $4.87 billion in the chip designer’s long-anticipated initial public offering, marking lowered ambitions for an IPO that was once expected to generate roughly twice that amount. Arm will offer 95.5 million American depositary shares for $47 to $51 each, the company said in a filing Tuesday with the US Securities and Exchange Commission. The deal will value Arm at as much as $54.5 billion at the top end of the range, according to Bloomberg News calculations. Underwriters have the option of buying as many as 7 million additional shares. (BBG)

OTHER

JAPAN: Japan issued its strongest warning over sharp currency movements in weeks after the yen set a fresh 10-month low against the dollar overnight. The nation’s top currency official said speculative moves could be seen in the foreign exchange market and warned that Tokyo was prepared to take action if needed. (BBG)

JAPAN: Bank of Japan Board Member Hajime Takata said on Wednesday that the BOJ must continue patiently with easy policy as the economy remains far from achieving the Bank's 2% inflation target in a sustainable and stable manner. The performance of overseas economies also poses a downside risk, Takata told business leaders in Shimonoseki City. “If overseas economies decelerate sharply as a result of the rate hikes in the U.S. and Eurozone, downward pressure on Japan’s economy will strengthen,” he added. (MNI)

AUSTRALIA: The Reserve Bank of Australia should regain control of macroprudential regulatory tools, while Treasury should have greater representation on the yet-to-be created monetary policy board to streamline monetary policy coordination, a former RBA board member told MNI. Adrian Pagan, professor of economics in the School of Economics at the University of Sydney, and RBA board member between 1995-2000, noted the central bank's recent Review, which published its findings earlier in the year, may have missed an opportunity to boost coordination between three key elements of the economy. (MNI)

AUSTRALIA: Australia’s economy grew 0.4% over Q2, compared with 0.2% noted in Q1, beating market expectations of a 0.3% rise, data from the Australian Bureau of Statistics showed Wednesday. GDP grew 2.1% on an annual basis, higher than the 1.8% expected, but down from Q1’s 2.3%. (MNI)

AUSTRALIA: Australia’s economy maintained its momentum in the three months through June, with the expansion underpinned by exports and sectors less impacted by the Reserve Bank’s 12 interest-rate increases. Gross domestic product advanced 0.4%, the same pace as the prior quarter and in line with economists’ estimates, official data showed Wednesday. From a year earlier, the economy grew 2.1% from an upwardly revised 2.4%. (BBG)

LNG: Chevron and a union alliance will hold a final round of talks on Wednesday ahead of planned strike actions at two major liquefied natural gas (LNG) facilities in Australia as ongoing disputes over pay and conditions remained unresolved. Workers are set to begin brief work stoppages and ban certain tasks from Thursday at Chevron's Gorgon and Wheatstone facilities and plan to escalate to a total strike for two weeks from Sept. 14 if their terms are not met. (RTRS)

IRON ORE: Iron ore climbed for a third day to near the highest since April after a major miner said the outlook for China’s steel-intensive property sector was looking “more encouraging.” Vale SA, the world’s No 2 iron ore producer, still sees reasons to be positive about the steel demand outlook despite challenges facing its top customer China, according to an investor presentation from Marcello Spinelli, vice president of iron ore. He referred to high operating rates at mills and low inventories of both iron ore and steel in the country. (BBG)

NEW ZEALAND: New Zealand Prime Minister Chris Hipkins has outlined five economic priorities for his government if he is reelected at next month’s election. His list includes positioning New Zealand as a global leader in sustainable agriculture and renewable energy, as well as doing more to leverage the nation’s digital creativity. It also includes growing an export-led economy and offering more premium tourism. (BBG)

NORTH KOREA: Arms negotiations between Russia and North Korea are actively advancing, a U.S. official said on Tuesday and warned leader Kim Jong Un that his country would pay a price for supplying Russia with weapons to use in Ukraine. Providing weapons to Russia "is not going to reflect well on North Korea and they will pay a price for this in the international community," U.S. national security adviser Jake Sullivan told reporters at the White House. (RTRS)

INDONESIA: China wants to work with Indonesia to expand cooperation in various areas including green energy, the digital economy, biomedicine, and artificial intelligence, China's foreign ministry reported on Wednesday, citing Premier Li Qiang. Li, in Indonesia for a regional summit, told a late Tuesday dinner with business leaders that they should be confident in cooperation, after weak economic data indicating a slowdown in China had raised doubts in other markets about China's rise. (RTRS)

INDONESIA: Indonesia expects to reach an agreement with the US on the Inflation Reduction Act, which grants tax breaks for some green products produced in the US. The Southeast Asian country is confident of reaching a conclusion in November, said Coordinating Investment and Maritime Affairs Minister Luhut Panjaitan during a Bloomberg CEO forum in Jakarta on Wednesday, declining to give more detail on what the agreement comprises. (BBG)

CHINA

HOUSING: China should drop home-buying restrictions in regions other than top-tier cities with the hottest markets, the Securities Times says in a front-page commentary on Wednesday. (BBG)

TECH: China should take more steps to prevent online gaming addiction among minors after achieving initial results by limiting playing time two years ago, People’s Daily said in a commentary. The time and money children spend on games has declined significantly since authorities introduced the curbs, the commentary cites an industry association report as saying (BBG)

PROPERTY: Chinese property developers jump, with Sunac China up as much as 34%, after Securities Times said in a front-page commentary calling more cities to drop home-buying restrictions to boost property sales and amid investors expectation on more policy support. (BBG)

YUAN: The yuan will likely not significantly depreciate further with policies to stabilise the currency kicking in and economic expectations improving, wrote Ming Ming, chief economist at CITIC Securities in a commentary. The central bank has abundant policy reserves including the introduction of countercyclical factors, increasing FX risk reserve ratio for forward FX sales and using FX reserves to intervene. ( 21st Century Business Herald)

ECONOMY: The Yicai chief economist survey index rose to 50.69 in August as the government implemented economic support policies following July’s politburo meeting. Economists forecasted August’s CPI rate at 0.05% y/y and retail sales of consumer goods up 3.95% y/y. (Yicai)

CHINA MARKETS

MNI: PBOC Net Drains CNY356 Bln Wednesday via OMO

The People's Bank of China (PBOC) conducted CNY26 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 1.80%. The operation has led to a net drain of CNY356 billion after offsetting the maturity of CNY382 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8000% at 09:25 am local time from the close of 1.7411% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 48 on Tuesday, the same as the close on Monday.

PBOC Yuan Parity Higher At 7.1969 Wednesday Vs 7.1783 Tuesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1969 on Wednesday, compared with 7.1783 set on Tuesday. The fixing was estimated at 7.3108 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND: Q2 VOLUME OF ALL BUILDINGS SA Q/Q -0.1%; MEDIAN 0.2%; PRIOR -1.7%

AUSTRALIA Q2 GDP Q/Q 0.4%; MEDIAN 0.4%; PRIOR 0.4%

AUSTRALIA Q2 GDP Y/Y 2.1%; MEDIAN 1.8%; PRIOR 2.4%

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 110-03+, +0-05, a 0-05+ range has been observed on volume of ~60k.

- Cash tsys sit 2bps richer to flat across the major benchmarks, light bull steepening is apparent.

- Tsys were pressured in early dealing, the move came alongside the USD extending recent gains despite the lack of an overt headline driver.

- TY was supported ahead of 109-28+, the low from Aug 29.

- The move didn't follow through and tsys ticked higher through the session.

- On the wires today we have Trade Balance and ISM Services Index, the Fed's Beige Book is also released and the latest monetary policy decision from the Bank of Canada is due. Fedspeak from Boston Fed President Collins and Dallas Fed President Logan crosses.

JGBS: Futures Are Stronger And At Session Highs, 30Y Supply Tomorrow

JGB futures are close to session highs, +5 compared to settlement levels, after spending most of the morning session in slightly negative territory.

- With the local data calendar empty today, local participants were likely focused on a speech by BoJ Board Member Takata. In the speech, he said that large-scale monetary easing must be kept in place amid extremely high uncertainties. Adding that it’s also necessary to take action nimbly to prepare for uncertainties by considering inflation and economic conditions. (See linkICYMI)

- Outside the speech, local participants have likely been guided by US tsys. US tsys are dealing at Asia-Pac session bests, 1-2bp richer.

- Cash JGBs are mixed across the curve, with yields 0.5bp higher (1-year) to 1.6bp lower (40-year). The benchmark 10-year yield is 0.1bp lower at 0.657%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- The swaps curve has bull flattened, with rates 0.1bp to 1.5bp lower. Swap spreads are tighter, out to the 30-year.

- Tomorrow the local calendar sees International Investment Flows, along with a speech from BoJ Board Member Nakagawa.

- Tomorrow the MoF plans to sell Y900mn of 30-year JGBs.

AUSSIE BONDS: Little Changed, At Session Bests, RBA Gov. Lowe’s Final Speech Tomorrow

ACGBs (YM -1.0 & XM -1.0) sit at or near session highs, although the ranges have been narrow today.

- Q2 GDP printed in line with expectations at +0.4% q/q after an upwardly revised +0.4% in Q1. Due to revisions, Q2 grew at a faster-than-expected +2.1% y/y. This is above trend and well above the RBA’s forecast of +1.6% y/y. To achieve its year-end projection of +0.9%, H2 needs to average 0.1% q/q.

- Q2 saw another very weak productivity reading driven by a strong pick-up in hours worked, which rose 2.5% q/q. Productivity fell 2% q/q, the third straight quarterly drop, to be down 3.5% y/y after -4.6% y/y in Q1. As a result, unit labour costs remained elevated rising to 7.5% y/y, which is likely to continue concerning the RBA.

- Cash ACGBs are flat to 1bp cheaper, with the AU-US 10-year yield differential at -10bp.

- Swap rates are flat, with EFPs tighter.

- The bills strip is mixed, with pricing flat to +1.

- RBA-dated OIS pricing is flat to 3bp firmer for meetings beyond Mar'24.

- Tomorrow the local calendar sees the release of July trade balance data, along with a speech from outgoing RBA Governor Phil Lowe.

NZGBS: Cheaper, Narrow Range, PM Wants Trade Diversification

NZGBs closed 1-3bp cheaper in the middle of the local session range. Construction work done fell in Q2 by 0.1% q/q versus the consensus estimate of +0.2%. Nevertheless, the data had minimal impact on the market, with the session’s range relatively narrow.

- 10-year NZGB underperformed its $-bloc counterparts, with the NZ-US and NZ-AU yield differentials respectively 1bp and 3bp wider at respectively +77bp and +88bp.

- Swap rates are -1bp lower to 2bp higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is flat to 1bp firmer across meetings out to Jul’24.

- NZ’s government plans to focus on trade diversification to help insulate its economy from the slowdown in key trading partner China, Prime Minister Chris Hipkins said. “The slower-than-expected recovery in the Chinese economy has had an impact on New Zealand,” Hipkins told Bloomberg Television in Auckland Wednesday. “That is one of the reasons our government has been very focused on trade diversification.” (See link)

- Tomorrow the local data calendar is empty.

- Tomorrow the NZ Treasury plans to sell NZ$225mn of the 4.50% May-30 bond, NZ$175mn of the 2.00% May-32 bond and NZ$100mn of the 2.75% Apr-37 bond.

EQUITIES: Further Property Stimulus Hopes Aid China Developers, But Not Aggregate Indices

Regional equities have been mixed, despite a modestly negative lead from US/EU markets in Tuesday trade. HK and China stocks are down in terms of aggregate indices, despite hopes of more property stimulus. Japan shares have bucked the weaker trend at this stage. US equity futures are down a touch. Eminis last near 4498, off 0.10%, Nasdaq futures were just under 15504, down -0.20%.

- China property developers have surged. The Hang Seng Mainland Properties Index has rebounded 3%, while the CSI 300 real estate sub index is actually down slightly, off by 0.31%. Earlier onshore media reported that policies restricting house purchases should be scrapped. Easier restrictions should not just be for the tier-one cities. (See this link for more details).

- Still, these moves couldn't drag the HSI aggregate index higher. This index sits down 0.82% at the break. Softness in terms of the earnings backdrop was a factor citied as weighing on overall HSI trends.

- In China, the headline CSI 300 is off by 0.65% at the break, the index back sub the 3800 level.

- Japan's Topix is +0.70% higher, with Toyota gains helping to drive broader sentiment. A slightly stronger yen, fueled by increased intervention threats from the authorities, hasn't impacted sentiment.

- The ASX 200 sits lower, last down 0.80%. Weakness in materials and financials have offset gains in energy stocks.

- in SEA, market trends are fairly muted. Thailand and Malaysia stocks are tracking modestly higher at this stage, but the Philippines are weaker.

FOREX: USD Erases Early Gains

The greenback has pared early gains in the Asian session to sit little changed from opening levels, BBDXY registered its highest level since mid-March in early trade marginally extending Tuesday's gains.

- Kiwi sits little changed from opening levels, NZD/USD was down as much as ~0.4% before finding support at Tuesday's lows and paring losses. The pair sits at $0.5880/85.

- AUD/USD was down ~0.3% before paring losses through the session. Q2 GDP was in line with estimates at 0.4% Q/Q, the Y/Y measure was firmer than expected at 2.1%. Technically the trend condition remains bearish; support comes in at yesterday's low ($0.6358) and 2.00 projection of the Jun 16-Jun 29-Jul 13 price swing ($0.6287). Resistance is at $0.6465, yesterday's high.

- Yen is marginally firmer, USD/JPY prints at ¥147.50/60, the pair was as low as ¥137.37 in early trade as Japanese Currency Chief Kanda noted that he wouldn't rule out any options if FX moves continue. Narrow ranges were observed for the remainder of the Asian session.

- Elsewhere in G-10 EUR and GBP are a touch higher.

- Cross asset wise; BBDXY pared a 0.1% gain to sit a touch lower and US Tsy Yields are little changed.

- German Factory Orders and UK Construction PMI provide the highlight in Europe before the Bank of Canada's rate decision crosses.

OIL: Crude Range Trading But Remains Elevated

Oil prices have held onto Tuesday’s gains and have been in a narrow range during APAC trading. WTI is unchanged at $86.70/bbl. It found round-number resistance at $87 where it reached the intraday high. Brent is also steady at $90.06 and has traded above $90 during the session with the low at $90.02. It made a high of $90.34 earlier. The USD index is off its intraday high but close to Tuesday’s close.

- On Tuesday Saudi Arabia and Russia announced their output cuts of 1mbd and 300kbd respectively would be extended to the end of the year whereas the market expected only until October. Prices rose sharply on the news. The WTI prompt spread is at its widest since mid-last year.

- OPEC+ output cuts plus stronger oil demand have resulted in prices rising around 20% in Q3 to date. The IEA estimates that consumption is at a record. Prices are likely to remain supported as these trends are expected to continue over the rest of 2023. Goldman Sachs sees upside risks to its crude forecasts, according to Bloomberg.

- Also on the supply side, the US has seen large crude inventory drawdowns and later today the API will release its latest stock data, which is likely to be monitored closely given last week’s huge 11.5mn drawdown.

- Later the Fed’s Collins speaks on the economy and policy making and Logan takes part in a listening session. The Beige Book is also published. In terms of data, the US July trade balance and August services PMI/ISM are out as well as euro area July retail sales. The Bank of Canada also meets.

GOLD: Steady After Largest Drop In A Month On Tuesday

Gold is unchanged in the Asia-Pac session, after closing 0.9% lower on Tuesday. A strong USD appreciation on higher US Treasury yields weighed heavily.

- Stronger-than-expected factory orders, heavy corporate issuance and higher oil prices were the key drivers for US Treasuries.

- Tuesday’s move in gold aligns with the observation that the USD Index looks to have resumed the primary uptrend off the mid-July low, potentially exerting downward pressure on precious metals.

- Bullion touched a low of $1925.41 but appears to have found some support at the 20-day EMA of $1926.1. A break of this level could see a more concerted push lower to potentially $1903.9 (Aug 25 low), according to MNI's technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/09/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/09/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/09/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/09/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/09/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/09/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/09/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/09/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 06/09/2023 | 1230/0830 |  | US | Boston Fed's Susan Collins | |

| 06/09/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/09/2023 | 1315/1415 |  | UK | BoE Reports Hearing (Financial Stability & MP) | |

| 06/09/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 06/09/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 06/09/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/09/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 06/09/2023 | 1900/1500 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.