-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI EUROPEAN OPEN: Harris Deemed Winner Of Presidential Debate

EXECUTIVE SUMMARY

- HARRIS PUTS TRUMP ON DEFENSIVE IN FIERY DEBATE; TAYLOR SWIFT BACKS HARRIS - RTRS

- CAUTIOUS POLICY ADJUSTMENTS EYED - BOJ’S NAKAGAWA - MNI BRIEF

- RBA ‘SURPRISED’ BY LIMITED EASING IN JOB GAUGES, HUNTER SAYS - BBG

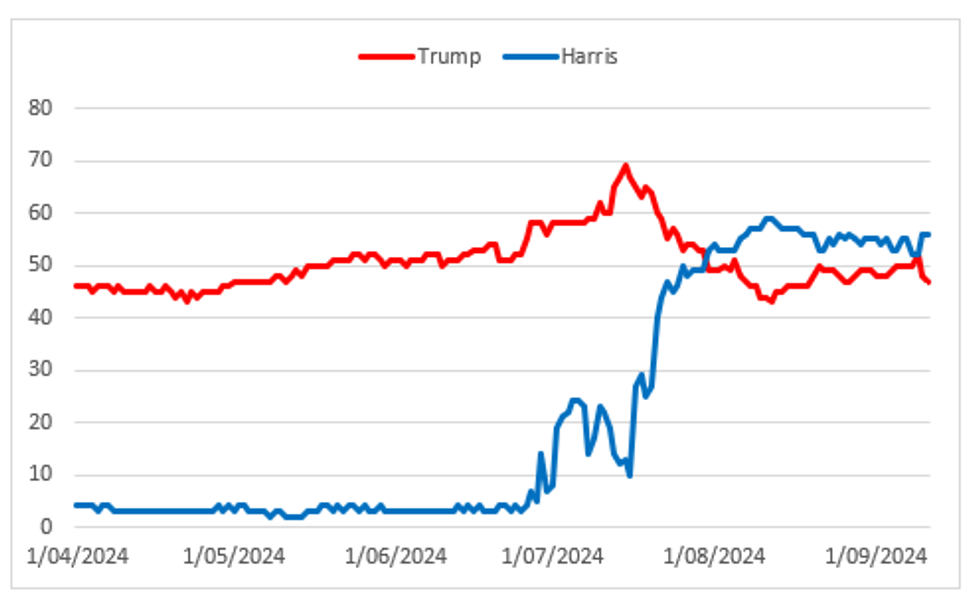

Fig. 1: US Election Odds Move in Harris's Favor Post Debate Per PredictIT

Source: PredictIT/MNI - Market News/Bloomberg

UK

INVESTMENT (BBG): “Amazon.com Inc. said it would spend £8 billion ($10.5 billion) in the UK to grow its cloud business, adding to a string of recent expansion moves in Europe and giving Britain’s new Labour government a welcome investment boost.”

POLITICS (BBC): “The Conservative leadership contest has been whittled down to four candidates after former cabinet minister Mel Stride was knocked out in a vote of Tory MPs. The former immigration minister Robert Jenrick finished top with 33 votes, with Kemi Badenoch second on 28 votes.”

EU

GEOPOLITICS (BBC): “The US, UK, France and Germany have imposed fresh sanctions on Iran for supplying Russia with ballistic missiles for use in Ukraine. The measures include restrictions on national carrier Iran Air's ability to fly to the UK and Europe, and travel bans and asset freezes on a number of Iranians accused of facilitating military support for Russia.”

UKRAINE/RUSSIA (RTRS): “Ukraine targeted the Russian capital on Tuesday in its biggest drone attack so far, killing at least one and wrecking dozens of homes in the Moscow region and forcing around 50 flights to be diverted from airports around Moscow.”

UKRAINE/US (RTRS): “ U.S. President Joe Biden said on Tuesday that his administration was "working that out now" when asked if the U.S. would lift restrictions on Ukraine's use of long range weapons in its war against Russia.”

GERMANY (BBG): “German carmakers are sinking deeper into a crisis undermining the future of the country’s most important industry, with BMW AG warning that profits will get hit by a costly brake problem and Volkswagen AG scrapping job protections that workers have enjoyed for three decades.”

GERMANY (BBC): “Polish Prime Minister Donald Tusk has denounced as "unacceptable" Germany's decision to extend temporary controls to all its land borders as part of its response to irregular migration. He is one of several figures from neighbouring countries to criticise the move.”

US

POLITICS (RTRS): “Democratic Vice President Kamala Harris put Republican Donald Trump on the defensive at a combative presidential debate on Tuesday with a stream of attacks on abortion limits, his fitness for office and his myriad legal woes, as both candidates sought a campaign-altering moment in their closely fought election.”

FED (MNI INTERVIEW): Fed Should Cut Rates 150BPS This Year-Benigno

FED (MNI INTERVIEW): US Inflation Resurgence Still Possible- Koenig

BANKING (MNI): The Federal Reserve's top banking regulator Michael Barr on Tuesday said the biggest U.S. banks would face a 9% increase in capital requirements in a re-proposal of Basel endgame and G-SIB surcharge rules.

OTHER

MIDEAST (BBG): “Israel proposed giving Hamas leader Yahya Sinwar safe passage out of Gaza in exchange for the group freeing the hostages it holds and giving up control of the strip, a senior official said, even as doubts deepen about the two sides’ ability to reach any cease-fire accord.”

JAPAN (MNI BRIEF): Bank of Japan board member Junko Nakagawa said on Wednesday that the BOJ will adjust the degree of easy policy if the economy realises the bank’s forecast for economy and prices as real interest rates remain at considerably low levels.

CANADA (MNI BRIEF): Governor Tiff Macklem told reporters Tuesday the Bank of Canada has been able to lower interest rates before the Federal Reserve because its hikes gained "traction" with more consumers refinancing at higher mortgage rates.

MEXICO (BBG): “An opposition senator said he will support President Andres Manuel Lopez Obrador’s judicial reform proposal, likely handing the ruling coalition the deciding vote to approve the plan in the Senate.”

AUSTRALIA (BBG): “Australia’s central bank has been surprised by the “limited” easing this year in some key employment indicators, Assistant Governor Sarah Hunter said, reinforcing its view that the labor market is still operating above full capacity.”

CHINA

MORTGAGES (SHANGHAI SECURITIES): “The mooted cut to existing mortgage interest rates will be constrained by banks’ narrowing interest margin and any reduction would be limited, Shanghai Securities News reported citing analysts. The current mortgage interest rate is 3.4% for first-time buyers in Shanghai, compared with the 4.55% level of existing loans.”

EVS (SECURITIES DAILY): “China’s electric vehicle production and consumption grew by about 30% y/y in August to reach over one million units, as local governments’ trade-in subsidies have stimulated demand for new cars, Securities Daily reported.

CHINA MARKETS

MNI: PBOC Net Injects CNY209.3 Bln via OMO Wednesday

The People's Bank of China (PBOC) conducted CNY210 billion via 7-day reverse repos, with the rate unchanged at 1.70%. The operation led to a net injection of CNY209.3 billion after offsetting maturities of CNY0.7 billion, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7000% at 09:36 am local time from the close of 1.8612% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 43 on Tuesday, compared with the close of 50 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1182 on Wednesday, compared with 7.1136 set on Tuesday. The fixing was estimated at 7.1201 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND JULY NET MIGRATION ESTIMATE +3,030; PRIOR +2,880

SOUTH KOREA AUG. ADJUSTED JOBLESS RATE 2.4%; EST. 2.6%; PRIOR 2.5%

SOUTH KOREA AUG. HOUSEHOLD LENDING RISES TO KRW1,130T; PRIOR KRW1,120.7T

MARKETS

US TSYS: Tsys Futures Make New Highs Ahead Of US CPI

- Tsys futures continue to edge higher today, and now trade at session best levels. TUZ4 is + 02¼ at 104-14⅝ and TYZ4 is + 05+ at 115-20.

- Initial moves higher came about 30 minutes into the Trump v Harris debate, although there wasn't anything new really spoke about. Betting odds have Harris winning the debate and up about 5pts from prior.

- Cash tsys have seen better buying through the belly of the curve, with the 3yr outperforming -3.1bps at 3.427%, while the 30yr has declined to it's lowest since July 2023.

- Volumes have increased ahead of US CPI today, there was earlier a block TU/FV/TY fly seller of the belly, and a block seller of UXY.

- Projected rate cuts through year end have regained some ground after receding Monday into early Tuesday (*): Sep'24 cumulative -33.5bp (-32.7bp), Nov'24 cumulative -73.3bp (-71.8bp), Dec'24 -115.4bp (-112.0bp).

- Later today we have MBA Mortgage Applications, followed by CPI.

JGBS: Belly Leads Rally, 20Y Supply & BoJ Tamura Speech Tomorrow

JGB futures are stronger and at session highs, +42 compared to the settlement levels.

- MNI BoJ board member Junko Nakagawa said today that the BoJ will adjust the degree of easy policy if the economy realises the bank’s forecast for theeconomy and prices as real interest rates remain at considerably low levels.

- However, Nakagawa added the BoJ needs to assess and judge rate hikes cautiously, taking the impact of volatile markets on economy and prices into consideration.

- The yen has gained 0.9% since the comments, reaching the strongest level versus the dollar since January.

- Cash US tsys are 2-3bps richer in today’s Asia-Pac session. The US presidential debate saw betting odds nudge in favour of Harris. The US market will now focus on tomorrow’s CPI and Thursday’s PPI inflation measures.

- Cash JGBs are richer across benchmarks, with the belly leading. Yields are 1bp higher (1-year) to 5bps lower (7-year).

- The swaps curve has bull-flattened, with rates flat to 3bps lower. Swap spreads are wider out to the 30-year.

- Tomorrow, the local calendar will see BSI Industry Confidence, PPI and weekly International Investment Flow data along with a speech from BoJ Board Member Tamura in Okayama.

- The MoF also plans to sell Y1.0trn 20-year JGBs.

AUSSIE BONDS: Richer & At Best Levels, AU-US 10Y Diff. Pushes Wider

In roll-impacted dealings, ACGBs (YM +4.4 & XM +5.4) are richer and sit at Sydney session highs.

- Outside of the previously outlined speech by Sarah Hunter, RBA's chief economist and Assistant Governor, there hasn't been much by way of domestic drivers to flag.

- Cash US tsys are 2-3bps richer in today’s Asia-Pac session after yesterday’s bull-steepener. The US presidential debate saw betting odds nudge in favour of Harris. The US market will now focus on tomorrow’s CPI and Thursday’s PPI inflation measures. Core non-housing service inflation is expected to see at least a repeat of the 0.21% M/M from July.

- Cash ACGBs are 5-6bps richer, with the AU-US 10-year yield differential at +24bps. At +24bps, the differential is approaching the upper bound of the +/-30bps range observed since November 2022.

- Swap rates are 5-6bps lower.

- The bills strip has twist-flattened, with pricing -2 to +8.

- RBA-dated OIS pricing is flat to 9bps softer, with late 2025 meetings leading. The market is pricing 17bps of easing by year-end, with an additional 42bps by March 2025.

- Tomorrow, the local calendar will see Consumer Inflation Expectation data.

NZGBS: Closed At Bests, US Tsys Rally After US Pres. Debate

NZGBs closed at session highs, with benchmark yields down 5-6 basis points.

- However, the NZ 10-year bond has underperformed relative to its US counterpart, pushing the NZ-US 10-year yield differential up by 3bps to +53bps. This marks the highest level since March and a 40bp increase from late July, when the differential hit its lowest point since mid-2021.

- Cash US tsys are 2-3bps richer in today’s Asia-Pac session after yesterday’s bull-steepener. The US presidential debate saw betting odds nudged in favour of Harris. The US market now focuses on tomorrow’s CPI and Thursday’s PPI inflation measures. Core non-housing service inflation is expected to see at least a repeat of the 0.21% M/M from July.

- Outside of the previously outlined Net Migration data, there wasn't much by way of domestic drivers to flag.

- Swap rates closed 6-7bps lower.

- RBNZ dated OIS pricing closed 1-6bps softer across meetings, with mid-2025 leading. A cumulative 80bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Food Prices and Card Spending data.

- The NZ Treasury also plans to sell NZ$300mn of the 3.00% Apr-29 bond, NZ$150mn of the 4.50% May-35 bond and NZ$50mn of the 2.75% Apr-37 bond.

FOREX: USD/JPY Through August 5 Lows As Harris Deemed Winner Of Debate

The reflation theme has taken a hit today, with US Vice President Harris deemed the winner of the Presidential debate versus former President Trump. Election odds have firmed in favor of Harris and moved lower for Trump. CNN also noted that 63% of voters (surveyed after the debate) believed Harris won the debate. Safe haven FX has outperformed, with yen rallying 1%, with USD/JPY breaking down through key support at 141.70.

- USD/JPY is tracking close to 141.00 in latest dealings, nearly 1.0% firmer for the session in yen terms. Session lows today rest at 140.91. Having broken down through 141.70, the Aug 5 low, focus will be on 140.82, the Jan 2 low. Note 140.25 is the Dec 28 low from last year and key support. US-JP yield differentials are lower at the front, the spread at +319bps, levels last seen in August last year.

- With Harris having appeared to have won the US Presidential debate we are seeing some modest downside pressure on US yields. Earlier comments from BoJ official Nakagawa also lent hawkish, so this is likely providing some positive yen impetus as well.

- US equity futures are lower, with Eminis down 0.50%, while Nasdaq futures are off 0.65%, with similar drivers at play. USD/CHF is off 0.45%, last near 0.8430.

- AUD/USD is relatively unchanged, the pair last near 0.6650. Comments from the RBA's Hunter didn't impact sentiment. NZD/USD is down slightly, last near 0.6140, off 0.15%.

- Later the focus will be on US August CPI, which is expected to show headline easing to 2.5% y/y with core stable at 3.2%. There are also US August real earnings and UK July trade/IP/GDP. The ECB’s McCaul and Buch speak too.

ASIA STOCKS: Asian Equities Head Lower, Yen Hits New Highs, US CPI Later

Asian markets traded lower today, focus in the region today was on the Trump vs Harris debate betting markets have Harris winning with PredictIt showing a 5pt bounce in favor of Harris. There was little reaction from the equity markets during the debate, there has been some weakness post with crypto and tech slightly lower. Japanese & Hong Kong equities are the worst performing amid concerns over global growth and the upcoming U.S. inflation report, while the yen continues to strengthen hurting Japanese exporters. The MSCI Asia Pacific Index fell 0.4%, with key drags coming from Samsung Electronics, Toyota, and CBA. Meanwhile, South Korea’s Kospi dropped 0.2% despite a slight improvement in unemployment, and Australian shares also slipped, while Taiwan stocks are little changed as TSMC holds up well amid weakness in the sector.

- US Equity futures are making fresh session lows, led by the Nasdaq 100 which is down 0.70% while S&P 500 eminis are 0.50% lower.

- Hong Kong equities are the worst in the region today with Banking stocks the worst following overnight weakness in the sector, The HS Mainland Banking Index is -2.13%, while property indices continue to hit new all time lows with the Mainland Property Index down 1.75%.

- In line with weaker tech prices, foreign investors continue to sell South Korean equities with $606m of outflows so far today, with $426m of that coming from local tech stocks.

- Asian EM markets are mixed today, with Thailand SET 1.10% although flows into the region over the past week have been very strong.

OIL: Crude Moderately Higher, Waiting For US CPI Data

Crude is off its Tuesday lows but has barely begun to unwind the sharp decline which was driven by downward revisions to OPEC’s global demand growth forecasts and soft China imports. WTI is up 0.5% to $66.10/bbl after a low of $65.91 followed by a high of $66.41. Brent is 0.5% higher at $69.54 reaching $69.82 earlier after a low of $69.31. The weaker US dollar is providing support with the BBDXY down 0.2%.

- If the 14% drop in oil prices since the start of August is sustained, headline disinflation could pick up in the months ahead and with growth softening may feed through into core from second round effects, which would be good news for central banks but also for consumers. But the US’ EIA expects Brent to return to above $80/bbl in Q4 and average around $84/bbl in 2025.

- The narrowing of the Brent prompt spread is signalling an easing market, but Tuesday’s sharp fall has meant that the relative strength index is flashing oversold, according to Bloomberg.

- Hurricane Francine is due to make landfall today in Louisiana and may impact eight refining facilities along the coast which would reduce crude demand. But on the other hand some platforms in the Gulf have evacuated staff and stopped production. Officials said that about 25% of the Gulf’s crude output has been shut in.

- Bloomberg reported that US crude inventories fell 2.79mn barrels last week, according to people familiar with the API data. Gasoline fell 513k while distillate rose 191k. The official EIA data is out today.

- Later the focus will be on US August CPI, which is expected to show headline easing to 2.5% y/y with core stable at 3.2%. There are also US August real earnings and UK July trade/IP/GDP. The ECB’s McCaul and Buch speak too.

GOLD: Steady After A Two-Day Gain

Gold is slightly higher in today’s Asia-Pac session, after closing 0.4% higher at $2516.73 on Tuesday.

- There was no US economic data yesterday, with the markets awaiting tomorrow’s CPI and Thursday’s PPI inflation measures. Core non-housing service inflation is expected to see at least a repeat of the 0.21% M/M from July, with six analysts between 0.20-0.35% M/M.

- Nevertheless, US 2- and 10-year yields finished 6-7bps lower, with the curve steeper.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, sights remain on $2,536.4, a Fibonacci projection.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/09/2024 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 11/09/2024 | 0600/0700 | ** |  | UK | Trade Balance |

| 11/09/2024 | 0600/0700 | ** |  | UK | Index of Services |

| 11/09/2024 | 0600/0700 | *** |  | UK | Index of Production |

| 11/09/2024 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 11/09/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 11/09/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/09/2024 | - | *** |  | CN | Money Supply |

| 11/09/2024 | - | *** |  | CN | New Loans |

| 11/09/2024 | - | *** |  | CN | Social Financing |

| 11/09/2024 | 1230/0830 | *** |  | US | CPI |

| 11/09/2024 | 1230/0830 | * |  | CA | Intl Investment Position |

| 11/09/2024 | 1400/1000 | * |  | US | Services Revenues |

| 11/09/2024 | 1400/1000 |  | US | MNI Connect Video Conference on ‘Fed Balance Sheet – Comparison with Other Central Banks’ | |

| 11/09/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 11/09/2024 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/09/2024 | - |  | EU | European Central Bank Meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.