-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI EUROPEAN OPEN: How Much Hiking Is Needed?

EXECUTIVE SUMMARY

- GOLDMAN LIFTS FORECAST FOR ECB’S TERMINAL DEPOSIT RATE TO 3.50% (BBG)

- EU PLANS TO FINANCE WEAPONS FOR UKRAINE VIA ITS OWN BUDGET (FT)

- NI BREXIT DEAL MAY TRIGGER RESIGNATIONS, SUNAK TOLD (THE TIMES)

- RBA CONSIDERED 50BP AND 25BP HIKE AT FEB MEETING (MNI)

- NZ TREASURY SAYS CYCLONE REBUILD WILL ADD TO INFLATION PRESSURE (BBG)

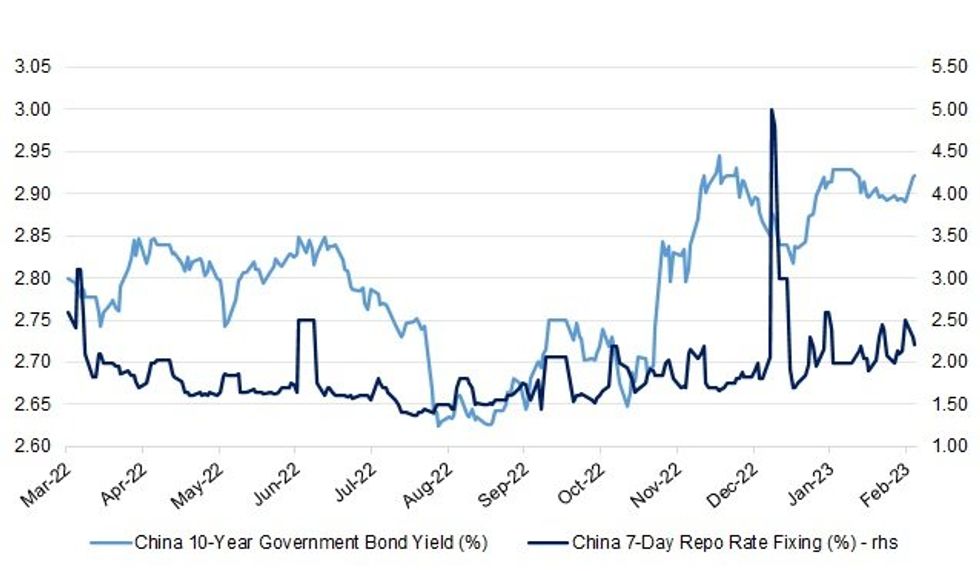

- ANALYSTS STILL LOOK FOR MOVE LOWER IN CHINESE BENCHMARK INTEREST RATES

- STAR BANKER’S DISAPPEARANCE SURPRISES EVEN CHINA’S STATE LENDERS (BBG)

Fig. 1: China 10-Year Government Bond Yield Vs. China 7-Day Repo Rate Fixing

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Bosses of small companies are increasingly upbeat about their prospects, according to a survey, adding to evidence that the outlook for the British economy may not be as bad as has been feared. (The Times)

BREXIT: Rishi Sunak on Monday urged Eurosceptic Tory MPs to back him in his bid to end the bitter dispute with Brussels over post-Brexit trade rules for Northern Ireland, but opposition to a deal was hardening. (FT)

BREXIT: Ministers are prepared to resign over Rishi Sunak’s Brexit deal if it risks Northern Ireland’s place within the UK, The Times has been told. There is a mounting backlash among Eurosceptic Conservative MPs to the deal. (The Times)

BREXIT: Foreign Secretary James Cleverly has said intensive work continues on getting a deal on the Northern Ireland Protocol. (BBC)

BREXIT: The Home Secretary has fired a warning shot at Rishi Sunak, praising a piece of Brexit legislation he may ditch as “one of the biggest tools” to end the Northern Irish impasse. (Telegraph)

BOE/INSURERS: The Bank of England said on Monday that Britain's insurers will know before year-end what a long-trailed reform of their capital rules will look like, and the Bank would not seek to use new powers to water down the changes government has called for. (RTRS)

EUROPE

ECB: Goldman Sachs economists led by Jari Stehn raised their forecast for the European Central Bank’s deposit rate to 3.5%, citing a more hawkish stance from policy makers including Executive Board member Isabel Schnabel. (BBG)

EU/FISCAL: Brussels is drawing up a proposal to use the EU budget to pre-finance purchases of weapons and ammunition, in what would be an unprecedented foray into the defence industry designed to speed up arms supplies to Ukraine. (FT)

EU/FISCAL: Hungary's European Union funds negotiator on Monday flagged a further possible delay in access to billions of euros of recovery money, saying ironing out remaining issues with Brussels over democratic reforms could last until the summer. (RTRS)

GERMANY: Tax revenues of Germany's federal and regional state governments increased by 0.8% in January compared with the previous year, driven by higher sales taxes and wage taxes, the finance ministry said on Tuesday. (RTRS)

FRANCE: French President Emmanuel Macron has vowed to boost investment in the nation’s startups in an effort to counter some of the slowdown in venture funding affecting other tech hubs. (BBG)

SNB: Swiss National Bank Vice Chairman Martin Schlegel said on Tuesday it was too early to sound the 'all-clear' on inflation in Switzerland, despite an expected decline in the rate of price rises. (RTRS)

SNB: The Swiss National Bank is "still willing" to be active on the foreign currency markets in pursuing its goal of price stability, Vice Chairman Martin Schlegel said on Monday. (RTRS)

BANKS: Swiss financial regulator Finma is reviewing remarks made by Credit Suisse Group Chairman Axel Lehmann about outflows from the lender having stabilized in early December, two people with knowledge of the matter told Reuters. (RTRS)

OTHER

U.S./CHINA/TAIWAN: A delegation of United States lawmakers met with Taiwan's president on Tuesday as part of an ongoing visit to the island that comes at a tense moment between the U.S. and China, who have spent weeks trading accusations over a suspected spy balloon. (AP)

GEOPOLITICS: German Foreign Minister Annalena Baerbock told Chinese diplomats last week that China is responsible for ensuring world peace and must not ship any weapons or so-called dual-use goods to Russia, she said on Monday. (RTRS)

GEOPOLITICS: The Philippines and the United States are discussing conducting joint coastguard patrols, including in the South China Sea, a Manila official said on Monday. (SCMP)

GEOPOLITICS: British foreign minister James Cleverly said on Monday he had spoken to his Chinese counterpart Qin Gang and raised alleged human rights abuses in China’s western region of Xinjiang. (SCMP)

GEOPOLITICS: China issued a Global Security Initiative Concept Paper on Tuesday, elaborating on innovative core concept and principles, firmly supporting a UN-led governance structure and the UN's role in preventing war and forming peace. (Global Times)

GEOPOLITICS: China urged the world to stop drawing parallels between Ukraine and Taiwan, part of Beijing’s efforts to distance itself from Russia and portray itself as a neutral force for peace. (BBG)

GEOPOLITICS: China’s State Councilor Wang Yi is expected to arrive in Moscow on Tuesday afternoon, Tass reports, citing an unidentified official close to the organization of the visit. (BBG)

G20: Japan will host a meeting of finance chiefs from the Group of Seven nations on Thursday to discuss their response to Russia's war in Ukraine, including sanctions, on the fringes of a broader Group of 20 gathering in India, Finance Minister Shunichi Suzuki said Tuesday. (Kyodo News)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Tuesday wage growth will likely accelerate as companies increase pay to compensate households for the higher cost of living, and cope with an intensifying labour shortage. Speaking in parliament, Kuroda also said the central bank will continue to scrutinise currency market moves and their impact on Japan's economy in guiding monetary policy. (RTRS)

BOJ: BOJ governor nominee Kazuo Ueda is likely to try and change policy to some extent, but won’t do it in a hasty manner, former BOJ Executive Director Hideo Hayakawa says on Bloomberg TV speaking to Annabelle Droulers. (BBG)

BOJ: Bank of Japan Governor nominee Kazuo Ueda has more scope to end the central bank’s control of yields because he isn’t tied to a specific agenda unlike outgoing chief Haruhiko Kuroda, according to Koichi Hamada, a close adviser to former Prime Minister Shinzo Abe. (BBG)

AUSTRALIA/CHINA: Ties between Australia and China have improved faster than many expected since Prime Minister Anthony Albanese took power last year. Beijing’s reaction to Canberra’s plans for a new submarine may show whether the goodwill can last. (BBG)

RBA: The Reserve Bank of Australia discussed a 50bp hike at its February 7 meeting, but stuck with its recent stance of 25bp rises given the uncertain outlook and the ability to adjust policy due to the frequency of its meetings, according to the minutes released on Tuesday. (MNI)

RBNZ: Treasury Dept. comments on impact of Cyclone Gabrielle and other recent weather events, in Fortnightly Economic Update published Tuesday. “Additional demand in the economy will add to general, nationwide inflation pressure. Consequently, Cyclone Gabrielle could result in the Reserve Bank keeping interest rates higher for longer than otherwise, displacing some activity that otherwise would have taken place.” (BBG)

NEW ZEALAND: New Zealand Prime Minister Chris Hipkins comments in Statement to Parliament Tuesday in Wellington, which marks the start of the parliamentary year. “We’ve got to build back better; we’ve got to build back safer and we’ve got to build back smarter.” (BBG)

TURKEY: Rescuers are once again searching for people trapped under rubble in Turkey after two new earthquakes hit the country, killing at least three people. (BBC)

RUSSIA: A world order based on rules and humanity depends on how events play out in Ukraine, President Volodymyr Zelenskiy said on Monday. (RTRS)

RUSSIA: EU members should approve the 10th package of sanctions against Russia this week, EU's foreign policy chief Josep Borrell told reporters on Monday (RTRS)

RUSSIA: Russian banks' profits totalled 258 billion roubles ($3.38 billion) in January, 1.5 times higher than in the same month of 2022, Russia's central bank said on Monday. (RTRS)

INDIA: The combined equity market value of Adani Group’s 10 companies slipped below $100 billion on Tuesday, a reflection that attempts to reassure investors following a scathing report by a US short seller are falling short. (BBG)

METALS: Global miner BHP Group reported a steeper-than-expected 32% fall in first-half profit owing to a drop in iron ore prices, sending its shares down, although it flagged a brightening outlook in China, its biggest customer. (RTRS)

OIL: China doubled its purchases of Urals oil in the first half of February compared to the same period of January amid more attractive pricing and as Chinese demand rebounds after COVID-related lockdowns, according to traders and Refinitiv Eikon data. (RTRS)

OIL: Chinese hired at least 10 supertankers to transport crude from the US Gulf Coast to the Asian nation next month, according to people with knowledge of the matter. (BBG)

EQUITIES: HSBC on Tuesday reported fourth-quarter earnings for 2022 that beat analyst expectations. The bank’s reported profit before tax for the three months ended in December was $5.2 billion, 108% higher than $2.5 billion a year ago. Analyst estimates compiled by the bank had expected a jump of 87% to $4.97 billion. For the full year, reported revenue was $51.73 billion, up from $49.55 billion in 2021. (CNBC)

CHINA

PBOC: Authorities in China will likely lower the over-five-year loan prime rate later in H1 2023 by around 0.1 to 0.15 percentage points, according to the 21st Century Herald. (MNI)

PBOC: China’s five-year loan prime rate has further downside this year as there is little need to cut reserve-ratio requirements or interest rates in the short term, the Shanghai Securities News reported, citing economists and analysts. (BBG)

PBOC: China’s central bank should avoid overly expansionary monetary easing and make only temporary use of its targeted tools given the economy could grow at up to 6% this year as pent-up demand fuels a recovery, a former People’s Bank of China adviser told MNI. (MNI)

FISCAL: China’s macro leverage ratio still has room to increase this year, but the growth rate is expected to slow down, according to a front-page commentary published in the Economic Daily Tuesday. (BBG)

POLICY: China Banking and Insurance Regulatory Commission will guide banks to improve mechanism to monitor big companies’ debt financing in the eastern province of Shandong, and expedite work on any debt extension and restructuring plan. (BBG)

BANKS: The disappearance of Chinese banker Bao Fan has come as a surprise to even some of his state-owned lenders, several of which are asking his firm for more information as they assess their exposure, according to people familiar with the matter. (BBG)

PROPERTY: Yangzhou City in Jiangsu province has introduced new measures to stimulate demand in the real estate market, according to the Securities Daily Network. (MNI)

PROPERTY: The China Securities Regulatory Commission (CSRC) is launching a pilot project to increase participation of private equity in the real estate sector, according to a notice on the CSRC website. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY59 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) conducted CNY150 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY59 billion after offsetting the maturity of CNY91 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0480% at 9:27 am local time from the close of 2.1354% on Monday.

- The CFETS-NEX money-market sentiment index closed at 46 on Monday, compared with the close of 45 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8557 TUES VS 6.8643 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8557 on Tuesday, compared with 6.8643 set on Monday.

OVERNIGHT DATA

JAPAN FEB, P JBUN BANK MANUFACTURING PMI 47.4; JAN 48.9

JAPAN FEB, P JIBUN BANK SERVICES PMI 53.6; JAN 52.3

JAPAN FEB, P JIBUN BANK COMPOSITE PMI 50.7; JAN 50.7

The modest, stable growth signalled by the au Jibun Bank Flash Japan Composite PMI in February masked widely differing trends between the manufacturing and service sectors midway through the first quarter of the year. (S&P Global)

AUSTRALIA FEB, P JUDO BANK MANUFACTURING PMI 50.1; JAN 50.0

AUSTRALIA FEB, P JUDO BANK SERVICES PMI 49.2; JAN 48.6

AUSTRALIA FEB, P JUDO BANK COMPOSITE PMI 49.2; JAN 48.5

Australian business activity improved in February 2023 with a second consecutive small rise in the flash composite output index to 49.2. The economy has slowed from the strong rates of growth in 2022 to be on a more sustainable footing in early 2023. We still appear to be on the narrow path to achieve a soft landing for the economy in 2023. (Judo Bank)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 80.4; PREV 78.1

Consumer confidence increased last week but remained lower than before the February RBA cash rate hike. At 80.4, the Consumer Confidence Index was among the worst ten results in the 150 weeks since the initial COVID outbreak in Australia. (ANZ)

NEW ZEALAND Q4 PPI OUTPUT +0.9% Q/Q; Q3 +1.6%

NEW ZEALAND Q4 PPI INPUT +0.5% Q/Q; Q3 +0.8%

SOUTH KOREA Q4 HOUSEHOLD CREDIT KRW1,867.0TN; Q3 KRW1,871.1TN

SOUTH KOREA FEB CONSUMER CONFIDENCE 90.2; JAN 90.7

SOUTH KOREA 1-20 FEB TRADE BALANCE -US$5.987BN

SOUTH KOREA 1-20 FEB EXPORTS -2.3% Y/Y

SOUTH KOREA 1-20 FEB IMPORTS +9.3% Y/Y

MARKETS

US TSYS: Cheaper In Asia

TYH3 deals at 111-25, -0-07, a touch off the top of its 0-04+ range on volume of ~63K.

- Cash Tsys sit 2-4bps cheaper across the major benchmarks.

- Tsy yields firmed after the long weekend in early trade, catching up the moves seen in futures yesterday with recent hawkish repricing of the Feds tightening cycle still in focus.

- Losses extended as pressure in Antipodean rates spilled over. The weakness was fueled by NZ Treasury comments on RBNZ policy and RBA's Feb minutes showing that a pause in policy was not discussed.

- Weakness in the Hang Seng provided some marginal support, as did a bounce in ACGBs.

- Block sellers in FV futures (-3.5K & -1.9K) headlined flow wise, while selling in the FV & TY rolls kept broader volume ticking over.

- In Europe today flash PMI data cross, further out flash US PMIs, Philadelphia Fed Non-Manf Activity and existing home sales data is on the wires. We also have the latest round of 2-Year Tsy supply.

JGBS: Morning Moves Hold/Extend Into Close, Curve Twist Flattens, YCC Band Breached

Cross-market-driven flows observed across the wider core global FI space were in play in JGB futures, which extended on their marginal overnight cheapening during the Tokyo morning, before bouncing. The contract has come under light pressure into the bell and is -20, registering fresh session lows in the process.

- Cash JGBs are 1.5bp cheaper to 2bp richer, with 20s outperforming even with the presence of a tepidly received round of 20-Year JGB supply, as the curve twist flattens. 10-Year JGB yields are showing through the peak of the BoJ’s YCC cap at present.

- Domestic headline flow was fairly subdued, with Finance Minister Suzuki going over well-trodden rhetoric re: the FX market, while soon-to-be departing BoJ Governor Kuroda reaffirmed the Bank’s view on inflation.

- Services PPI data and a speech from BoJ’s Tamura headlines the local docket on Wednesday. Look out for off-schedule Rinban purchases if the upper end of the BoJ’s YCC parameters continues to be breached.

JGBS AUCTION: 20-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y982.9bn 20-Year JGBs:

- Average Yield: 1.306% (prev. 1.341%)

- Average Price: 101.48 (prev. 100.92)

- High Yield: 1.314% (prev. 1.342%)

- Low Price: 101.35 (prev. 100.90)

- % Allotted At High Yield: 88.9563% (prev. 92.3846%)

- Bid/Cover: 3.048x (prev. 3.365x)

AUSSIE BONDS: Short-End Yields Higher Ahead Of Wages Data

The RBA's Feb meeting minutes added little new to the policy debate (there was confirmation that a pause in tightening was not discussed earlier this month, while a 50bp hike was), NZGB short-end weakness, fueled by NZ Treasury comments on RBNZ policy, was the dominant driver. Aussie rate futures closed YM -2.0 and XM -0.5, comfortably off their respective session bases. YM registered fresh intraday lows for '23 in the process, representing a 60bp+ sell-off from pre-RBA meeting levels. Cash ACGBs closed 1-3bp higher in yield with the 3/10 curve 2bp flatter.

- AU/U.S. 10-year yield differential closed at -4bp, 1bp higher than Friday’s close of -5bp.

- Swap flows added to the weakness with EFPs wider, led by the 3-year.

- Bills closed 4-5bp softer across the strip, also off session lows.

- RBA-dated OIS nudged higher to a 95% chance of a 25bp hike in March and firmed 3-4bp for meetings out to November. Terminal rate expectations moved higher to ~4.30%.

- Looking ahead, the resumption of cash Tsy trading after yesterday's holiday may provide fresh impetus, but the Aussie market will likely trade tentatively ahead of tomorrow’s Q4 WPI. With Q4 CPI signalling a shift in inflationary pressures from goods to services and wages closely linked to services inflation, wage data has quickly become a headline event on the local calendar.

NZGBS: NZ Treasury Comments On RBNZ Spark Short-End Sell-Off

NZ Treasury comments on the RBNZ policy outlook sparked a short-end led sell-off in NZGBs. By the close, 2-year yields were 10bp higher with the 2/10 cash curve 6bp more inverted.

- Swaps also delivered a 4bp flattening of the curve with the 2-year rate 7bp higher.

- Comments from the NZ Government over the past 24 hours have (1) pushed back against a ‘no hike’ option for tomorrow and (2) suggested that the RBNZ may have to keep rates ‘higher for longer’ given that the inflationary impact of the post-Cyclone rebuild.

- RBNZ-dated OIS pricing for tomorrow’s meeting closed unchanged at ~46bp, after being firmer during the session. Pricing for later meetings however bore the brunt of today's paying. Terminal OCR expectations moved to just below 5.40% and November pricing moved as much as 17bp higher. At yesterday's close the market had priced in 20bp of cuts by November. That has now been scaled back to ~15bp.

Fig 1: RBNZ-Dated OIS – Pre and Post NZ Treasury’s ‘Higher For Longer’ Comments

Source: MNI - Market News/Bloomberg

- Elsewhere, Q4 PPI managed to print at a slower Q/Q rate.

- Looking ahead, the resumption of U.S. cash Tsy trading after yesterday's holiday may provide fresh impetus, but the Antipodean markets will remain focused on Wednesday’s release of Australia’s Q4 WPI and the RBNZ decision.

EQUITIES: Early Positive Impetus Not Sustained For China Markets

Early gains in China/HK equities have not been sustained as a more cautious tone has given way as the session progressed. US futures are generally lower (Eminis off by 0.40%, Nasdaq futures down by 0.34% at this stage), with US fixed income markets re-opening and yields mostly pressing higher (+2.9-4.7bps firmer across the curve), with some spill over from leads in AU/NZ bond markets.

- The CSI 300 is around flat currently, unwinding earlier gains, while the Shanghai index is +0.10%. The property sub-index is +0.44%, although away from earlier highs. Market sentiment was lifted by reports from late yesterday that the country is launching a private equity pilot program for the property sector. Weakness in consumer staples stocks has also provided an offset.

- The HSI is down around 1% at this stage, with tech sub index off by 2.50%. HSBC reported lower than expected net income for the full year.

- The Kospi and Taiex are close to flat, with range bound markets in play. Likewise for the Nikkei 225.

- NZ stocks are down a further 0.90%. This followed comments by the NZ Treasury around higher for longer interest rates post Cyclone Gabrielle. The RBNZ decision is due tomorrow.

GOLD: Bullion In A Tight Range As Market Waits For Wednesday’s Fed Minutes

Gold prices traded sideways on Monday given that the US was closed for the Presidents Holiday. During APAC trading they have also been in a tight range and are only 0.2% lower at $1838/oz, close to the intraday low of $1837.20. It reached a high of $1843.80 earlier. The market is waiting for Wednesday’s FOMC minutes and Fed speakers for direction.

- Bullion has moved further below its 50-day simple moving average. Initial support for the yellow metal is at $1819, the February 17 low, and resistance is at $1892.10, the 20-day EMA.

- There are no Fed speakers in today’s US calendar but in terms of data preliminary PMIs for February print and are expected to improve. A reading above 47.5 for the composite index could weigh on gold prices. There is also January existing home sales, which are projected to rise after declining the previous month.

OIL: Crude Eases On Concerns Fed Tightening Will Weigh On Demand

Oil prices rose on Monday due to demand optimism but have retreated during APAC trading but remain in a narrow range. The market is waiting for Wednesday’s Fed minutes to gauge how much tightening will weigh on demand. Brent is down 1.1% to $83.15/bbl, close to the intraday low of $83.12. It reached a high of $83.94 earlier in the session. WTI is around $76.40. The USD index is 0.2% higher.

- Brent is trading between resistance at $86.95, the February 14 high, and support at $75.06, the February 17 low. It has moved below its 50-day simple moving average again.

- Kazakhstan has created its own oil brand as an attempt to disentangle itself from Russia and sanctions. But since Kazakh oil is pumped through Russian pipelines, its price is still under pressure.

- API inventory data is scheduled, which are likely to be watched closely given recent large builds. There are no Fed speakers in today’s US calendar but in terms of data preliminary PMIs for February print and are expected to improve. There is also January existing home sales, which are projected to rise after declining the previous month. Canadian inflation is expected to ease slightly.

FOREX: Greenback Strengthens Amid Higher Yields, Weaker Equities

The USD is firmer in Asia as higher US Treasury Yields and Weaker Equities have weighed on risk sentiment.

- AUD/USD is pressured down ~0.2%. The pair is see-sawing around the $0.69 handle, despite a hawkish tilt in the RBA minutes which provided confirmation that the Board considered a 25bp or 50bp interest rate increase earlier this month, but not a pause. Support comes in at $0.6812, 16 Feb low.

- Yen is little changed from opening levels. USD/JPY has traded in a narrow ¥134.20/50 range today. Feb Jibun Bank Preliminary PMI prints crossed, the Composite read was 50.7, unchanged from the previous month. Manufacturing print remained in contractionary territory at 47.4 falling from last month's 48.9 read. Services printed 53.7 up from 52.3 prior.

- Kiwi is also softer, last printing at $0.6240/45. The NZ Treasury noted that the rebuild after Cyclone Gabrielle will support economic activity. They also noted that more demand will add to inflationary pressure and it may result in the RBNZ keeping rates higher for longer. Kiwi did firm in the aftermath of the comments however there was little follow through.

- The USD bid has weighed on EUR and GBP, both are down ~0.2%. NOK is down ~0.3%, Brent Crude futures fell by ~$1 in Asia.

- Cross asset wise: e-minis are ~0.4% softer, BBDXY is up ~0.2%. 10 Year US Treasury Yields are ~4bps firmer.

- In Europe today flash PMI data from cross as well as the latest ZEW Survey from Germany. Further out flash US PMIs and existing home sales data is on the wires.

FX OPTIONS: Expiries for Feb21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-90(E1.2bln), $1.0695-00(E577mln), $1.0800(E592mln), $1.0900(E1.2bln)

- USD/JPY: Y133.40-50($1.1bln), Y133.90-00($645mln)

- AUD/USD: $0.6730(A$1.1bln)

- USD/CNY: Cny6.7775($511mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/02/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/02/2023 | 0745/0845 | * |  | FR | Retail Sales |

| 21/02/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 21/02/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 21/02/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 21/02/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 21/02/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 21/02/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 21/02/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 21/02/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 21/02/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 21/02/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 21/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 21/02/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 21/02/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 21/02/2023 | 1330/0830 | *** |  | CA | CPI |

| 21/02/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/02/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/02/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 21/02/2023 | 1445/0945 | *** |  | US | S&P Global Services Index (flash) |

| 21/02/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 21/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.