-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI EUROPEAN OPEN: Hunt To Lay Out Plan To Balance Books

EXECUTIVE SUMMARY

- FED'S WALLER 'MORE COMFORTABLE' WITH 50 BPS IN DECEMBER (MNI)

- ECB OFFICIALS WEIGH SLOWER RATE-HIKE TEMPO WITH HALF-POINT MOVE (BBG)

- UK C’LLR HUNT TO UNVEIL SPENDING CUTS AND TAX RISES (BBC)

- CHINA IS ABLE TO ACHIEVE COVID ZERO (PEOPLE’S DAILY)

- CHINA COVID CASES TOP 23,000 AS OUTBREAKS ENDURE IN MAJOR CITIES (BBG)

- CHINA ASKS BANKS TO REPORT ON LIQUIDITY AFTER SUDDEN BOND SLUMP (BBG)

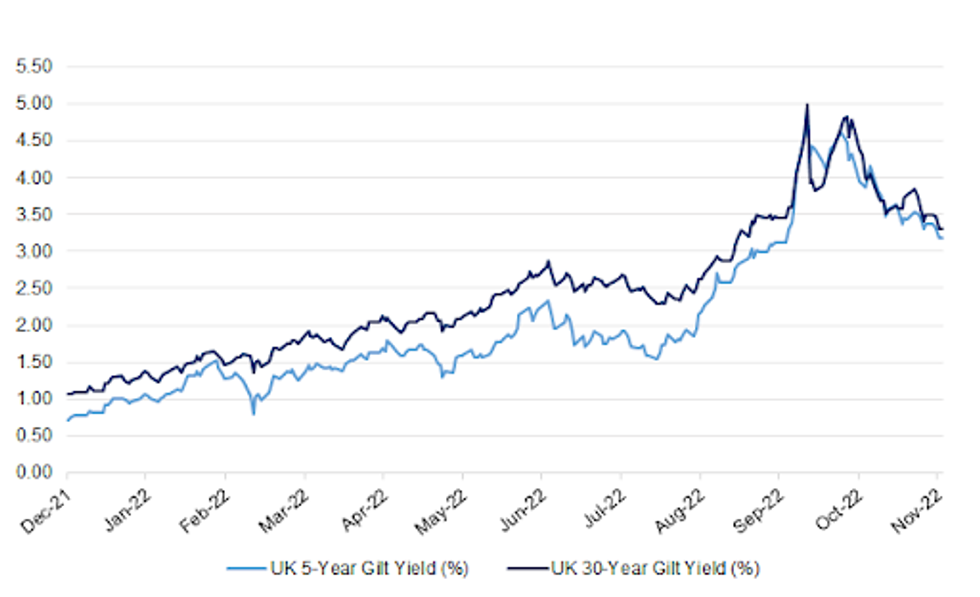

Fig. 1: UK 5- & 30-Year Gilt Yields

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Chancellor Jeremy Hunt will pledge to face into the economic "storm", as he is expected to confirm widespread spending cuts and tax rises. He will say "difficult decisions" are needed to tackle soaring prices and limit mortgage costs. But he faces a potential backlash from some Tory MPs who oppose big tax hikes. The BBC understands the state pension and benefits will rise with prices. Energy support is likely to continue beyond April but will be less generous. (BBC)

FISCAL/ENERGY: The UK government is set to spend billions of pounds to insulate homes and upgrade boilers in a drive to cut Britain’s overall energy demand by at least 13% this decade. (BBG)

FISCAL: Re-including the Bank of England’s net assets in public debt figures would bump up total public sector liabilities but make it easier for the UK government to show debt-to-GDP on a declining path within its five-year forecast horizon, external adviser on public finances to the Institute of Chartered Accountants In England and Wales Martin Wheatcroft told MNI. (MNI)

PROPERTY: Social housing tenants in England will face a 7 per cent rise in their rents next year under plans set to be announced by chancellor Jeremy Hunt in Thursday’s Autumn Statement, adding further pressure to their straitened finances. (FT)

EUROPE

ECB: European Central Bank policy makers may slow down interest-rate hiking with only a 50 basis-point increase next month, according to people with knowledge of the matter. (BBG)

FISCAL: The European Union is running out of time to approve Hungary’s recovery funds ahead of a key deadline in a rule-of-law dispute that’s threatening to hold up other urgent priorities, including aid to Ukraine. (BBG)

NETHERLANDS: The Netherlands has raised the prospect of one day building out its debt issuance to include bonds that link interest payments to ESG targets, in what would be a first for a European government. (BBG)

U.S.

FED: Federal Reserve Governor Chris Waller on Wednesday said he was warming up to the idea of slowing the pace of rate interest rate hikes to 50 basis poins at the FOMC's next meeting in December, citing signs of dampening demand that will help bend the steep trajectory of inflation. (MNI)

FISCAL: Student loan default rates could dramatically spike if the Biden administration’s loan forgiveness plan is blocked, a top official at the U.S. Department of Education said in a new court filing. (CNBC)

POLITICS: Republicans were projected to win a majority in the U.S. House of Representatives on Wednesday, setting the stage for two years of divided government as President Joe Biden's Democratic Party held control of the Senate.(RTRS)

POLITICS: Senate GOP Leader Mitch McConnell won a secret-ballot leadership election after days of finger-pointing over the Republican midterm losses, putting him on pace to become the longest-serving Senate party leader in US history. (CNN)

OTHER

GLOBAL TRADE: A United Nations source on Wednesday said they have reasons to be “cautiously optimistic” on the renewal of the Black Sea grains initiative, which is set to roll over on Saturday unless there are objections. (RTRS)

GLOBAL TRADE: The Taiwanese parliament is likely to review the process of technology transfers to mainland China amid fears that leaked advancements and know-how could threaten the island’s critically important tech sector, according to a senior legislator in Taipei. (SCMP)

BOJ: Two Bank of Japan veterans lead the field to replace Governor Haruhiko Kuroda next spring in a change of leadership at the central bank that risks upsetting global financial markets and spawning a renewed surge of speculation over possible policy change. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda reiterated on Thursday that the central bank needs to continue with its monetary easing programme in order to support a fragile economy. (RTRS)

BOJ: The Bank of Japan won’t rule out raising interest rates before adjusting the size of its balance sheet when the time comes to exit from monetary easing, executive director Shinichi Uchida says. (BBG)

NORTH KOREA: North Korea fired a ballistic missile on Thursday as it warned of "fiercer military responses" to U.S. efforts to boost its security presence in the region with its allies, saying Washington is taking a "gamble it will regret". (RTRS)

BOC: Signs that inflation will slow toward the Bank of Canada's target range over the next year weaken the case for another 50bp interest-rate hike, former BOC adviser Steve Ambler told MNI. (MNI)

BRAZIL: Leftist former Sao Paulo Mayor Fernando Haddad is emerging as the front-runner to be Brazilian President-elect Luiz Inacio Lula da Silva's finance minister, three sources said, although they added no decision has yet been made. A Haddad appointment would likely be seen by investors as the latest sign that Lula appears to be elevating leftist allies over centrists in formulating his government-in-waiting's economic policy. (RTRS)

BRAZIL: Brazil President-elect Luiz Inacio Lula da Silva will ask congress to circumvent a key fiscal safeguard by excluding the country’s most important social program from a public spending cap to pay for his campaign pledges. (BBG)

COLOMBIA: Colombia’s latest tax reform does not affect the agency’s near-term fiscal forecasts as the additional revenues will be used to fund higher social spending in line with the policies of President Gustavo Petro, Fitch Ratings says. We forecast deficits to narrow and debt/GDP to stabilize in 2023-2024, but risks to our forecasts remain significant. (Fitch)

MARKETS: Chinese regulators asked banks to report on their ability to meet short-term obligations after a rapid selloff in bonds triggered a flood of investor withdrawals from fixed-income products, according to people familiar with the matter. The unscheduled regulatory queries coincided with the biggest slump in China’s short-term government debt since mid-2020. The rout -- spurred by a shift toward riskier assets including stocks -- prompted retail investors to pull money from wealth-management products, fueling a spiral of price declines and accelerating withdrawals. Losses also spread to top-rated corporate bonds, stoking a record surge in yields this week. (BBG)

METALS: The London Metal Exchange is stepping up surveillance of trading in the nickel market after sharp price swings revived memories of the extreme volatility seen during a runaway short squeeze. (BBG)

ENERGY: The European Commission plans to propose a cap on natural gas prices after Nov. 24, as it seeks to contain an energy crisis stemming from Russia's invasion of Ukraine, the EU's energy policy chief told Reuters on Wednesday. (RTRS)

OIL: Saudi Arabia is leading the way in reducing oil shipments so far this month, Geneva-based tanker-tracker Petro-Logistics says. (BBG)

OIL: Iraq plans to increase its oil production capacity to around 7 million barrels per day in 2027, head of state-owned oil marketer SOMO Alaa Alyasri told Reuters on Wednesday. (RTRS)

OIL: Germany can’t rule out temporary supply bottlenecks and price increases when a ban on imports of Russian crude starts next month. (BBG)

CHINA

CORONAVIRUS: China’s daily Covid cases surged again as top cities struggle to get persistent outbreaks under control without deploying the one-size-fits-all Covid Zero restrictions that Beijing has said must be avoided. (BBG)

CORONAVIRUS: China is capable of achieving “dynamic Covid zero” and winning its fight against the pandemic, according to a commentary in People’s Daily. (BBG)

POLICY: China’s government needs to reduce risks in the property sector and adjust its Covid policy to alleviate disruptions to the economy, according to a senior International Monetary Fund official. (BBG)

BANKS: Chinese regulators asked banks to report on their ability to meet short-term obligations after a rapid selloff in bonds triggered a flood of investor withdrawals from fixed-income products, according to people familiar with the matter. (BBG)

EQUITIES: There has been a large net inflow of northbound funds for several consecutive days, with foreign investment banks including Goldman Sachs and JPMorgan Chase suggesting clients increase their allocation to Chinese assets, China Securities Journal reported. (MNI)

PROPERTY: The prices of new and second-hand houses in first-, second- and third-tier cities all suffered a month-on-month decline in October, the first comprehensive decline in the past eight years, Caixin reported. (MNI)

PROPERTY: Chinese property developers are at risk of defaulting on higher cost U.S. dollar bonds despite Beijing’s rescue package that includes easier funding to support the ailing property market, with debt restructuring plans needed to minimise losses for creditors, advisers told MNI. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY123 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) on Thursday injected CNY132 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY123 billion after offsetting the maturity of CNY9 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8640% at 9:44 am local time from the close of 2.0150% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Wednesday vs 52 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 7.0655 THURS VS 7.0363 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.0655 on Thursday, compared with 7.0363 set on Wednesday.

OVERNIGHT DATA

JAPAN OCT TRADE BALANCE -Y2.1623TN; MEDIAN -Y1.6200TN; -Y2.0943TN

JAPAN OCT EXPORTS +25.3% Y/Y; MEDIAN +29.3%; SEP +28.9%

JAPAN OCT IMPORTS +53.5% Y/Y; MEDIAN +50.0%; SEP +45.7%

JAPAN OCT ADJUSTED TRADE BALANCE -Y2.2992TN; MEDIAN -Y1.9512TN; SEP -Y2.0368BN

AUSTRALIA OCT EMPLOYMENT CHANGE +32.2K; MEDIAN +15.0K; SEP -3.8K

AUSTRALIA OCT FULL-TIME EMPLOYMENT CHANGE +47.1K; SEP +10.9K

AUSTRALIA OCT PART-TIME EMPLOYMENT CHANGE -14.9K; SEP -14.7K

AUSTRALIA OCT UNEMPLOYMENT RATE 3.4%; MEDIAN 3.5%; SEP 3.5%

AUSTRALIA OCT PARTICIPATION RATE 66.5%; MEDIAN 66.6%; SEP 66.5%

AUSTRALIA OCT RBA FX TRANSACTIONS GOVERNMENT -A$785MN; SEP -A$1.490BN

AUSTRALIA OCT RBA FX TRANSACTIONS MARKET +A$597MN; SEP +A$1.460BN

AUSTRALIA OCT RBA FX TRANSACTIONS OTHER +A$605M; SEP -A$262MN

NEW ZEALAND Q3 PPI OUTPUT +1.6% Q/Q; Q2 +2.4%

NEW ZEALAND Q3 PPI INPUT +0.8% Q/Q; Q2 +3.1%

MARKETS

SNAPSHOT: Hunt To Lay Out Plan To Balance Books

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 88.29 points at 27938.78

- ASX 200 up 13.459 points at 7135.7

- Shanghai Comp. down 28.755 points at 3091.225

- JGB 10-Yr future up 9 ticks at 149.45, JGB 10-Yr yield down 0.3bp at 0.245%

- Aussie 10-Yr future up 11.0 ticks at 96.380, yield down 10.7bp at 3.619%

- U.S. 10-Yr future down 0-06+ at 113-00, yield up 2.77bp at 3.7176%

- WTI crude down $1.19 at $84.40, Gold down $10.85 at $1762.97

- USD/JPY down 6 pips at Y139.45

- FED'S WALLER 'MORE COMFORTABLE' WITH 50 BPS IN DECEMBER (MNI)

- ECB OFFICIALS WEIGH SLOWER RATE-HIKE TEMPO WITH HALF-POINT MOVE (BBG)

- UK C’LLR HUNT TO UNVEIL SPENDING CUTS AND TAX RISES (BBC)

- CHINA IS ABLE TO ACHIEVE COVID ZERO (PEOPLE’S DAILY)

- CHINA COVID CASES TOP 23,000 AS OUTBREAKS ENDURE IN MAJOR CITIES (BBG)

- CHINA ASKS BANKS TO REPORT ON LIQUIDITY AFTER SUDDEN BOND SLUMP (BBG)

US TSYS: A Little Cheaper Overnight, Asia Not Willing To Extend The Bid

The major cash Tsy benchmarks run 1-2bp cheaper across the curve, with intermediates leading the weakness. TYZ2 sits -0-05 at 113-01+ into London hours, around the middle of its 0-10 Asia-Pac range, on volume of ~99K

- Tsys have pulled away from session lows, which were facilitated by a combination of a block sale in FV futures (-3K), spill over from a bid in the broader USD, as well as pockets of screen selling in TY futures.

- A bid in the super long end of the JGB curve and some weakness in Chinese & HK equities may have resulted in some spill over demand for U.S. Tsys, allowing the space to stabilise.

- There was little in the way of Asia-Pac enthusiasm to extend on Wednesday’s bull flattening dynamic, with yesterday’s price action seeing the 2-/10-Year yield spread register the deepest levels of inversion witnessed during the current cycle, while 10-Year Tsy yields moved below the lower boundary of the Fed Funds target range.

- On top of the previously covered flow we also saw some screen sales of the FVF3 107.75/108.50 call spread and a seller of FFF3 futures in the short-end.

- A deluge of Fedspeak headlines the NY docket on Thursday, with weekly jobless claims data, housing starts, building permits and regional Fed economic activity indicators also slated for release. Further afield, there will be plenty of interest in UK’s Autumn Fiscal Statement after the challenges surrounding that matter witnessed in recent weeks/months.

JGBS: Bull Flattening Dominates

The JGB curve has continued to flatten during the Tokyo afternoon, with a move away from session cheaps in U.S. Tsys and smooth enough digestion of the latest round of 20-Year JGB supply (crucially, the low price met wider dealer expectations, even with the remainder of the internal metrics presenting a more mixed picture) aiding the bid, after U.S. Tsy trade on Wednesday provided some early direction. The major JGB benchmarks are little changed to ~7bp richer across the curve, while JGB futures are +15 ahead of the bell, regaining some poise after initially ticking away from overnight highs.

- We have suggested that recent sessions have seen super-long demand from the domestic pension fund and life insurer cohort, given the lack of attractive offshore bond propositions noted at present (owing to elevated FX-hedging costs and ongoing market vol.).

- BoJ speak offered little tangible information for markets to trade off of, while Japanese Finance Minister Suzuki also went over old ground.

- Elsewhere, the latest BBG survey surrounding the BoJ questioned the analytical community on potential successors to BoJ Governor Kuroda when his current term ends in April ’23. It was no surprise to see BoJ veterans Masayoshi Amamiya & Hiroshi Nakaso at the top of the list, given their long-held status as front-runners in that race.

- Looking ahead, Friday’s local docket will be headlined by the latest round of national CPI data.

JGBS AUCTION: 20-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y961.6bn 20-Year JGBs:

- Average Yield: 1.029% (prev. 1.123%)

- Average Price: 101.16 (prev. 99.62)

- High Yield: 1.039% (prev. 1.133%)

- Low Price: 101.00 (prev. 99.45)

- % Allotted At High Yield: 22.0618% (prev. 57.5980%)

- Bid/Cover: 3.035x (prev. 3.263x)

JGBS AUCTION: 1-Year Note Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.87647tn 1-Year Notes:

- Average Yield: -0.1001% (prev. -0.1098%)

- Average Price: 100.100 (prev. 100.110)

- High Yield: -0.0971% (prev. -0.1018%)

- Low Price: 100.097 (prev. 100.102)

- % Allotted At High Yield: 60.0187% (prev. 29.3793%)

- Bid/Cover: 3.786x (prev. 2.612x)

AUSSIE BONDS: Closing Around Early Sydney Levels After Two-Way Trade

Aussie bonds gravitated back towards early Sydney levels after the pre-data bid waned in the wake of a strong labour market report and as U.S. Tsys softened, although a recovery from Sydney cheaps was seen into the close as U.S. Tsys ticked away from session lows.

- YM finished +7.0, with XM +11.0, while cash ACGBS were 6-11bp richer across the curve, with the 10- to 20-Year zone outperforming.

- The labour market continues to perform strongly, while wage growth has accelerated in recent times. Still, we doubt that this week’s labour market and wage data will trigger a move back to 50bp hikes for the RBA, given the proximity to the recent downshift to 25bp steps and the Bank’s clear focus on the lagged impact of the already deployed tightening, as well as the risks (both domestic & global) that are swirling around the Australian economy.

- Bills finished 1-15bp richer, with RBA dated OIS printing just over 20bp of tightening for next month’s RBA meeting and a terminal cash rate of just under 3.80%, with the latter softening a touch early in Sydney dealing.

- Looking ahead, A$700mn of ACGB Nov-29 supply and the release of the weekly AOFM issuance slate headline the domestic docket on Friday.

NZGBS: Off Best Levels, But Still Richer On The Day

NZGBs gave back some of their early gains as the major cash benchmarks finished the session 1-5bp richer vs. Wednesday’s closing levels, with the curve bull flattening. Swap spreads ran tighter, pointing to receiver side swap flow-based support for NZGBs.

- Local data failed to impact the space, with the PPi output metric softening in Q/Q terms, albeit running at still elevated levels when annualised.

- NZGBS found a base ahead of the local data, with the direction of travel for both U.S. Tsys and ACGBs (which saw a limited downtick in the wake of the latest labour market report) helping the space to nudge further away from best levels as the day wore on.

- RBNZ dated OIS is little changed on the day, with just under 65bp of tightening priced in for next week’s RBNZ decision, alongside a terminal OCR of ~5.05%.

- Friday’s domestic docket is empty.

OIL: China Growth Concerns Weigh On Oil Prices

Oil prices are weaker again today with WTI down 1.4% to around $84.40 and Brent -1.1% to $91.80/bbl respectively, as the demand outlook became the focus once more and risk appetite deteriorated with most equity markets in the region down.

- Concerns regarding crude demand from China came to the forefront, as Covid cases continue to rise reducing the hope of any further near-term easing of restrictions.

- The spread between the two nearest Brent contracts continues to be in backwardation pointing to a tight market, but it has eased since the start of the month. (Bloomberg)

- Overnight the US EIA reported that there had been a drawdown in crude inventories of 5.4mn barrels, more than last week’s 3.9mn build and the largest weekly drop since August.

- Later numerous central bank officials speak including the Fed’s Bullard, Bowman, Mester, Jefferson and Kashkari. Any comments that move the USD are also likely to move oil prices.

GOLD: Softening In Asia

An uptick in U.S. Tsy yields and a firmer USD have weighed on bullion in Asia-Pac hours. This comes after a relatively contained, two-way Wednesday session, in which bullion failed to capitalise on the twist flattening observed on the broader U.S. Tsy curve.

- Spot deals ~$10/oz cheaper at $1,763/oz, with the technical picture little changed from what we outlined earlier in the week.

- The Fed pivot/pause debate (at least on the part of market participants, as opposed to via Fedspeak) and USD dynamics will continue to dominate for gold in the immediate term, with elevated sensitivity to inflation readings and indicators set to remain evident.

FOREX: Safe-Haven FX In Demand, Cautious Risk Tone Dominates

The Asia-Pac session witnessed a flight to safety as Chinese tech shares dropped, while participants scrutinised the latest comments from U.S. central bankers/U.S. economic data for clues about Fed tightening outlook.

- The release of above-forecast retail sales data and signs of continued determination among Fed members to keep raising interest rates may have pushed U.S. Tsy yields higher in Asia hours, even as Fed Governor Waller said he feels "more comfortable" about slowing the pace of rate hikes.

- Higher U.S. Tsy yields generated greenback outperformance. The BBDXY index crept higher but the 1,280 level provided firm resistance.

- USD/JPY oscillated between gains and losses, holding a familiar range through the session. North Korea test-fired a ballistic missile in a reminder of the region's worrying geopolitical situation.

- A slightly softer commodity complex weighed on high-beta FX bloc, with the Antipodeans underperforming in the Asia-Pac timezone.

- The Aussie dollar showed a limited reaction to the domestic labour market report. Employment grew faster than forecast, which underpinned a surprise downtick in the unemployment rate, with participation steady versus its revised prior level.

- Data highlights today include U.S. jobless claims, housing starts, building permits & Philly Fed Survey, as well as final EZ CPI. Comments are due from Fed's Bullard, Bowman, Mester, Jefferson & Kashkari, BoE's Pill & Tenreyro, as well as ECB's Villeroy.

FX OPTIONS: Expiries for Nov17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0200(E978mln), $1.0300-05(E815mln), $1.0500(E590mln)

- USD/JPY: Y140.00-10($1.3bln)

- AUD/USD: $0.6300(A$1.4bln)

- USD/CAD: C$1.3300($1.0bln), C$1.3700($1.0bln)

- USD/CNY: Cny7.3000($2.0bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/11/2022 | 0720/0220 |  | ID | Bank of Indonesia Rate Decision | |

| 17/11/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 17/11/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 17/11/2022 | 1230/0730 |  | US | Atlanta Fed's Raphael Bostic | |

| 17/11/2022 | 1230/1230 |  | UK | BOE Pill Speech at the Bristol Festival of Economics | |

| 17/11/2022 | - |  | UK | Autumn Statement with New OBR forecasts / Updated DMO Remit | |

| 17/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 17/11/2022 | 1300/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 17/11/2022 | 1330/0830 | *** |  | US | Housing Starts |

| 17/11/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/11/2022 | 1415/0915 |  | US | Fed Governor Michelle Bowman | |

| 17/11/2022 | 1430/1430 |  | UK | BOE Tenreyro Speech at Asociacion Argentina de Economia Politica | |

| 17/11/2022 | 1440/0940 |  | US | Cleveland Fed's Loretta Mester | |

| 17/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 17/11/2022 | 1540/1040 |  | US | Minneapolis Fed's Neel Kashkari | |

| 17/11/2022 | 1540/1040 |  | US | Fed Governor Philip Jefferson | |

| 17/11/2022 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 17/11/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/11/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 17/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 17/11/2022 | 1830/1930 |  | EU | ECB Lagarde at F. v. Metzler Dinner | |

| 17/11/2022 | 1845/1345 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.