-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN OPEN: Japanese Fiscal Taps To Open Further Than Expected?

EXECUTIVE SUMMARY

- FED'S EVANS: TAPER TO TAKE UNTIL MID-2022 TO COMPLETE (RTRS)

- WHITE HOUSE: BIDEN LIKELY TO MAKE DECISION ON FED CHAIR BEFORE THANKSGIVING

- EU BACKS DOWN ON THREATS TO RETALIATE IF ARTICLE 16 TRIGGERED (TELEGRAPH)

- JAPAN FISCAL STIMULUS TO TOTAL 55.7TN IN SPENDING (NIKKEI)

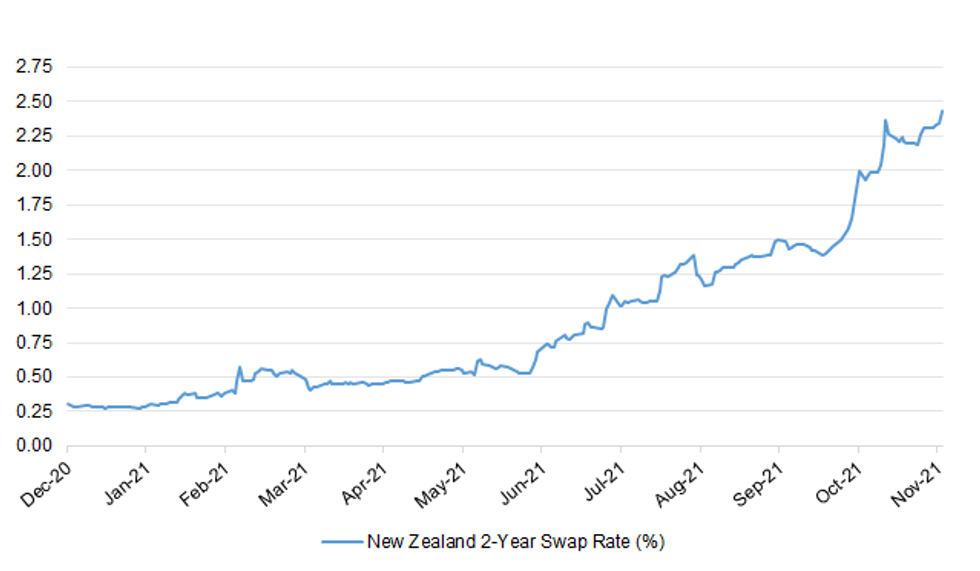

- NEW ZEALAND 2-YEAR INFLATION EXPECTATIONS HIT HIGHEST SINCE '11

- CHINA RESERVE BUREAU WORKING ON CRUDE OIL RELEASE (RTRS)

Fig. 1: New Zealand 2-Year Swap Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Brussels has rowed back from threats of retaliating against Britain over Article 16, as the UK and EU near their first deal to break the deadlock in talks over the Northern Ireland Protocol. European Commission officials signalled a possible compromise and, in a private briefing with senior EU diplomats, said they were closing in on an agreement to protect medicine supplies to the province. Ahead of face-to-face talks between Lord Frost, the Brexit minister, and Maros Sefcovic, his European counterpart, in Brussels on Friday, EU governments were told "on medicines, we're nearly there", according to a source close to the discussions. (Telegraph)

BREXIT: The chairman of M&S has written to Brexit minister Lord Frost to warn that EU plans to end its stand-off with the UK over Northern Ireland threaten to add to, not ease, red tape. Archie Norman said the Brussels offer "could result in worsening friction and cost and a high level of ambiguity and scope for dispute", according to the letter first reported by the Financial Times. Britain is seeking to rewrite the deal which left Northern Ireland within the EU single market for goods even after Brexit. (Sky)

FISCAL: Boris Johnson's government has significantly scaled back the social care support it plans to offer poorer households in a move that will hit pensioners with lower-value homes. On Wednesday, the government published details of its social care cap, introducing technical changes that mean those with total assets below £185,000 will pay more than initially thought for social care when the new rules are introduced in 2023. Under the new plans, lower-asset households will have to pay a proportion of their care costs for longer before they hit a cap of £86,000, after which state support kicks in. The change is the result of removing means-tested support from the government's calculation of the cap. (FT)

FISCAL: Boris Johnson will on Thursday unveil £96bn of investment in rail links to boost northern England but the watered down plans risk inciting the wrath of MPs in the region. When he announces a new Integrated Rail Plan, the prime minister will confirm cuts to the north-south High Speed 2 and the High Speed 3 line from Leeds to Manchester. Jake Berry, chair of the Northern Research Group of Conservative MPs, reminded Johnson during prime minister's questions on Wednesday that he had committed to building an entirely new line between Manchester and Leeds. (FT)

POLITICS: After two weeks of trying to dodge responsibility for the furor over his Conservative Party's ethics, Boris Johnson finally took it on the chin. In a private meeting on Wednesday evening, the prime minister told rank-and-file Tories that after their successful party conference in October he'd taken his eye off the road and effectively driven the car into a ditch, according to two members of Parliament present who asked not to be named. "He got a very good reception," said Geoffrey Clifton-Brown, another Tory MP who was in the meeting. (BBG)

POLITICS: MPs have backed government plans to prevent them taking on certain jobs in addition to their work in Parliament. Boris Johnson made a surprise announcement on the proposals on Tuesday amid sleaze allegations about Conservative MPs. Labour has been calling for a ban for sometime and tried to get MPs to back its plan which it said was tougher. But the government ordered its MPs to vote against the party's motion, defeating it by 51 votes. Under the government's plan any outside role, paid or unpaid, should be "within reasonable limits" and not stop MPs fully serving their constituents. This is yet to be defined, but International Trade Secretary Anne-Marie Trevelyan has suggested 15 hours a week as a reasonable limit. (BBC)

EUROPE

ITALY: Italy is weighing a capital increase of as much as 3.5 billion euros ($4 billion) to prop up Banca Monte dei Paschi di Siena SpA after rescue talks with UniCredit SpA fell apart, people with knowledge of the matter said. Treasury officials have been sounding out possible investors to share the risk of a capital increase, according to the people, who asked not to be identified as the matter is private. (BBG)

SPAIN: Spain said it would roll out booster shots to health workers and people older than 60 and will discuss the initiative with authorities in autonomous regions. Prime Minister Pedro Sanchez said the country's vaccination rate of about 80% had shielded the former hot spot from the worst of the latest wave of the pandemic. Spain's 14-day average infection rate climbed 67% in two weeks to 82 cases per 100,000 inhabitants, but remained well below that of countries including Germany and Austria, where less than 70% of the population is vaccinated. (BBG)

BELGIUM: Belgium reinstated a requirement for people to work from home four days a week into mid-December, despite opposition from business groups. The country also extended mandatory mask wearing to 10-year-olds and will mandate indoor mask wearing even in venues where access is regulated by a Covid pass. With an average number of daily cases above 10,000, Belgium has one of the highest per-capita case rates in Western Europe. The government and regions resisted calls from experts to shut down nightlife. Belgium's high vaccination rate, 75% of the population, is the main reason the government was able to avoid imposing a new lockdown, Prime Minister Alexander De Croo said. (BBG)

SWITZERLAND: The majority of Swiss favor Covid-19 certificates for access to indoor spaces and events as Europe battles a winter surge in infections. Some 61% of voters back a law that would permit the mandatory use of the certificates, according to a poll for broadcaster SRG. About 38% were against it, while 1% remained undecided. The vote on the referendum, which also covers financial pandemic relief, takes place Nov. 28. (BBG)

U.S.

FED: Chicago Federal Reserve President Charles Evans on Wednesday reiterated that it will take until the middle of next year to complete the Fed's wind-down of its bond-buying program even as the central bank checks to see if high inflation recedes as he expects. (RTRS)

FED: "This Treasury market is a crucial global financial market, so improving its structural resiliency is a top priority," and all reforms need to be "carefully evaluated," Federal Reserve Bank of Cleveland President Loretta Mester says. (BBG)

FED: President Joe Biden will likely decide on who he will nominate to head the U.S. Federal Reserve before Thanksgiving, a White House spokesperson said on Wednesday, a day after Biden said he would come to a decision in about four days. (RTRS)

FED: A FOX Business reporter tweeted the following on Wednesday: "Wall Street execs now say they think Powell has edge in @federalreserve chairman's race and progressives will get a say in another position possible Brainard as vice chair." (MNI)

CORONAVIRUS: Nine states in the U.S. are now offering booster shots to all adults, contradicting federal guidance and reigniting the national debate on eligibility for supplemental vaccine doses. (BBG)

CORONAVIRUS: Moderna refiled its application to the Food and Drug Administration on Wednesday to approve vaccine booster doses for all adults ages 18 and older. (CNBC)

US TSYS: MNI BRIEF: US Treasury Says Central Clearing Appears Promising

- Treasury Department undersecretary for domestic finance Nellie Liang Wednesday said reforms in the Treasury market to expand central clearing appear promising in terms of potential improvements in efficiencies from netting across all counterparties, but cautioned it could concentrate risk - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

OTHER

GLOBAL TRADE: Plans by Korea's SK Hynix to overhaul a huge facility in China so it can make memory chips more efficiently are in jeopardy, sources familiar with the matter told Reuters, because U.S. officials do not want advanced equipment used in the process to enter into China. (RTRS)

GLOBAL TRADE: EU lawmakers have reached a breakthrough on how to target tech companies, including Apple and Google, as part of moves by Brussels to curb anti-competitive practices in the digital economy. The European Parliament's main political parties agreed on Wednesday to a deal that would apply to companies with a market capitalisation of at least €80bn and offering at least one internet service, such as online search, according to four people with direct knowledge of the discussions. It means the rules would draw more companies than previously thought into the EU's planned Digital Markets Act (DMA), a wide-ranging effort to rein in Big Tech. Brussels hopes to implement the act next year. Companies including Google, Amazon, Apple, Facebook and Microsoft would fall under its scope, alongside Netherlands' Booking and China's Alibaba. (FT)

USMCA: Mexico will likely decide by December on whether to go to arbitration with the U.S. over interpretations of the U.S.-Mexico-Canada trade deal's rules dealing with the origins of car parts, a top trade official said. The conflict, which isn't on the agenda of this week's meetings between leaders from the three countries in Washington, focuses on how to calculate the percentage of a vehicle that comes collectively from North America. There's a "50-50" chance that Mexico will go to the dispute panel, Luz Maria de la Mora, undersecretary of economy for foreign trade, said in an interview Wednesday while traveling to the summit. "We are still doing the analysis." (BBG)

USMCA: American and Canadian companies are "deeply concerned" about Mexico's efforts to reduce the private sector's ability to compete in the state-dominated energy industry and asked the nations' leaders to address the issue at a summit Thursday. Mexican President Andres Manuel Lopez Obrador has been working to undo changes implemented by his predecessor that started to expose state-owned oil producer Petroleos Mexicanos, known as Pemex, and electric utility CFE to more competition. (BBG)

U.S./CHINA: The virtual meeting between Presidents Xi Jinping and Joe Biden on Nov. 16 was "frank, constructive, substantive and fruitful," and increased the world's positive expectations for China-U.S. relations development, the Communist Party's People' Daily said in an official editorial. The two countries must stick to a bottom line of avoiding conflict and opposition, the newspaper said. The U.S. should clearly implement its promise of not supporting Taiwan's independence, the newspaper said. (MNI)

U.S./CHINA: Democrats said the Senate will no longer attach the nearly $250 billion bill seeking to bolster U.S. competitiveness against China to the annual defense measure amid Republican opposition. The move could delay passage of the China-related measure. "We have reached an agreement for the House and Senate to go to conference on the United States Innovation and Competition Act," Senate Majority Leader Chuck Schumer and House Speaker Nancy Pelosi say in a statement, referring to the China bill. "Therefore, the House and Senate will immediately begin a bipartisan process of reconciling the two chambers' legislative proposals so that we can deliver a final piece of legislation to the President's desk as soon as possible." (BBG)

JAPAN: Japan's economic stimulus package will be 55.7t yen in terms of fiscal spending, Nikkei reports, without attribution. Cabinet to approve Friday. Including private sector spending, the size of stimulus to reach ~78.9t yen Costs have swollen for measures in the plan such as distributing funds to households and businesses. Issuance of deficit bonds inevitable as source of funding, but details undetermined. Spending by central govt ~43.7t yen. Extra budget of 31.9t yen planned to back the measures; 5t yen reserves will be earmarked in fiscal 2022 initial budget. (BBG)

JAPAN: Japan's ruling party executive Toshimitsu Motegi said on Thursday an extra budget of more than 30 trillion yen ($263 billion) would send a "big message" to markets, Kyodo news agency reported. The remark by Motegi, secretary general of the Liberal Democratic Party (LDP), comes ahead of the government's expected announcement of a new pandemic-relief stimulus package on Friday. (RTRS)

JAPAN: Japan looks to secure 500 billion yen ($4.4 billion) to help develop and apply key technologies, such as artificial intelligence, as it aims to strengthen its economic security, government sources said Thursday. The government intends to include the policy in its economic package to be formally adopted Friday along with its plans to help create production bases for semiconductors and vaccines, they said. (Kyodo)

JAPAN: Japan's ruling Liberal Democratic Party is looking to expand tax benefits to companies raising base wages, Nikkei reports, citing the party's tax panel chief Yoichi Miyazawa. Plans to expand the 15% tax exemption rate currently in place, but didn't elaborate further. Miyazawa says he wants to create an environment where base wages will rise 1% annually. (BBG)

JAPAN: The Japanese government is planning to cut the tax deduction it gives on home loans to 0.7% from the current 1% in its fiscal 2022 tax reform, Jiji reports, citing an unidentified person. (BBG)

JAPAN: Japan's Financial Services Agency and the Bank of Japan begin a joint survey of foreign currency funding at the country's three biggest banks, Nikkei reports, without attribution. (BBG)

AUSTRALIA: There will be another easing of restrictions in Victoria with 88 per cent of residents being fully vaccinated. Visitor caps and density limits are set to be scrapped as of midnight tonight. Crowds will also be back at full capacity at the MCG and events such as the Australian Open. However, masks will be required in high-risk settings, such as retail, as well as for primary school students in years three to six. Close contacts of positive COVID cases, if outside of the home, will no longer need to quarantine but will need to get a test and isolate until a negative result is returned. For those inside the home, the quarantine period has been slashed down to seven days or 14 days if unvaccinated. (Sky)

MEXICO: Mexico President Andres Manuel Lopez Obrador's proposed electricity reform could derail more than $22 billion of solar, wind and other renewable-energy installations owned by major foreign companies such as Iberdrola SA and Sempra Energy. (BBG)

MEXICO: Mexico wants the U.S. to relax its Covid-19 vaccination and testing requirements at the shared borders in order to improve commerce and Transit. Mexico's Deputy Health Minister Hugo Lopez-Gatell, who is also the virus czar, said officials will discuss the topic during Thursday's so-called Three Amigos summit in Washington with Mexican President Andres Manuel Lopez Obrador, Canadian Prime Minister Justin Trudeau and U.S. President Joseph Biden. (BBG)

MEXICO/RATINGS: Fitch affirmed Mexico at BBB-; Outlook Stable. (MNI)

BRAZIL: If Brazil's Congress does not approve original precatorios bill proposal, Brazil's Economy Minister Paulo Guedes says he will be concerned about the country's GDP growth, during a virtual event held by Bradesco. Guedes said that govt is committed to fiscal responsibility. He disagrees with banks' forecasts about Brazil's GDP. The average drop of the world economy was higher than Brazil's. Inflation will probably be a little above what banks are forecasting in 2022. Best solution for food and fuel inflation doesn't involve freezing prices, Guedes said. (BBG)

RUSSIA: American officials are unsure why Russian President Vladimir Putin is building up military forces near the border with eastern Ukraine but view it as another example of troubling military moves that demand Moscow's explanation, Defense Secretary Lloyd Austin said Wednesday. "We'll continue to call on Russia to act responsibly and be more transparent on the buildup of the forces around on the border of Ukraine," Austin told a Pentagon news conference, adding, "We're not sure exactly what Mr. Putin is up to." He said the troop buildup has the Pentagon's attention and that the Russians should be "more transparent about what they're up to." Austin also criticized Russia for using a missile to shoot down one of its old satellites on Monday, an action that created hundreds of pieces of space debris that U.S. officials have said will be a long-term hazard to space operations. (AP)

SOUTH AFRICA: South Africa's energy department has said it will start preparing for the end of coal-for-power use in the country but cautioned that a retreat from the dirtiest fossil fuel must take account of the impact on the economy and the people who depend on it for a living. In a presentation to a small group of business, government and research representatives on Nov. 15, the department said it plans to set up a Just Energy Transition unit to help deliver an outcome "which delivers social justice," according to a copy of it seen by Bloomberg. While the department declined to immediately comment on the presentation, four people with knowledge of it confirmed its veracity. (BBG)

IRAN: National security adviser Jake Sullivan raised with his Israeli counterpart the idea of an interim agreement with Iran to buy more time for nuclear negotiations, three Israeli and U.S. sources tell me. (Axios)

OIL: The Biden administration has asked some of the world's largest oil consuming nations to consider releasing some of their crude reserves in a coordinated effort to lower prices and stimulate the economic recovery, according to several people familiar with the matter. (RTRS)

OIL: President Joe Biden and his Chinese counterpart Xi Jinping discussed the merits of releasing oil from their strategic petroleum reserves to ensure stability in global energy markets. Monday's virtual summit didn't make any decisions on the issue and both sides put forward their own views on the subject, according to officials familiar with the discussions, asking not be named because they aren't authorized to speak publicly on the matter. But the fact the world's two largest oil consumers are even considering unprecedented joint action shows the level of concern that the rally in oil prices will stunt the global economy and further stoke inflation. China has already tapped its strategic petroleum reserve at least twice this year in an effort to bring domestic crude oil prices down. Beijing has also released gasoline and diesel from a separate reserve. The two sides agreed to keeping talking about oil markets and a possible coordinated response, the officials said. (BBG)

OIL: China's state reserve bureau on Wednesday told Reuters that it was working on a release of crude oil reserves and will disclose the details of the move on its website. The National Food and Strategic Reserves Administration declined to comment if the release is related to Washington's request to the world's top consuming nations on tapping oil reserves to cool global energy prices. (RTRS)

OIL: A Japanese industry ministry official said the United States has requested Tokyo's cooperation in dealing with higher oil prices, but he could not confirm whether the request included coordinated releases of stockpiles. By law, Japan cannot use reserve releases to lower prices, the official said. A senior cabinet official declined to comment. (RTRS)

OIL: A South Korean official confirmed the United States had asked Seoul to release some oil reserves."We are thoroughly reviewing the U.S. request, however, we do not release oil reserve because of rising oil prices. We could release oil reserve in case of supply imbalance, but not to respond to rising oil prices," the official said. (RTRS)

OIL: Some U.S. lawmakers are seizing on the energy price surge to revive long-standing legislation that would subject the OPEC oil cartel to the same antitrust laws used more than century ago to break up Standard Oil's monopoly. The "No Oil Producing and Exporting Cartels Act" -- known as NOPEC -- would allow the U.S. government to sue members of the Organization of Petroleum Exporting Countries for manipulating the energy market, potentially seeking billions of dollars in reparations. The legislation faces difficult odds amid concerns about diplomatic fallout that has led the State Department to oppose it in the past. But the House Judiciary Committee did approve the latest iteration by a voice vote in April. (BBG)

OIL: Oil companies spent $191.7 million buying drilling rights in the Gulf of Mexico on Wednesday, during a robust government auction that underscored the industry's appetite for new crude as the White House seeks to shifts the U.S. away from fossil fuels. Analysts said bidding was driven by interest in lower-carbon crude from the Gulf of Mexico as well as uncertainty about the timing and conditions of future sales, which are expected to come with higher fees and stringent requirements. (BBG)

CHINA

YUAN: The Chinese yuan will continue to strengthen in the longer run, and the U.S.'s possible move to lower some tariffs will help to further expand China's exports to the U.S. and promote the appreciation of yuan against the dollar, wrote Peng Bo, a deputy researcher at CAITEC, a think tank affiliated with the Ministry of Commerce in a commentary run by the 21st Century Busines Herald. China will allow a stronger yuan as it can help offset the pressure of imported inflation, Peng wrote. On Wednesday, the onshore yuan strengthened above 6.37 against the U.S. to the highest level since Jun1, even amid a rising dollar index, due to China's strong exports and increased demand for foreign exchange settlement, Peng said. (MNI)

PBOC: China's move on Wednesday to set up a CNY200 billion special relending facility to support the clean and efficient use of coal will add to in total CNY2 trillion of capital support from commercial banks toward clean energy projects, the Global Times reported citing experts. The relending facility, in addition to previous financial lending tools to support carbon emissions cuts, will focus on supporting clean coal, including green and smart exploitation as well as efficient usage, the newspaper said citing the State Council executive meeting chaired by Premier Li Keqiang. National banks will issue preferential loans to such projects, while the central bank will provide relending based on the size of the principal, the newspaper said. (MNI)

EVERGRANDE: China Evergrande Group is planning to sell its entire stake in a Hong Kong-listed film and television programmes production company for 2.13 billion Hong Kong dollars ($273.5 million), the latest move by debt-strapped conglomerate to generate cash. The Shenzhen-based company is selling its entire 18% stake in HengTen Networks Group Ltd., for HK$1.28 per shares, which is a 24.3% discount to the last traded price, Evergrande Group said Thursday. The company will incur a loss of about HK$8.5 billion from the transaction, calculated based on the difference between the consideration and the book value for the sale shares as at end-June. (Dow Jones)

EVERGRANDE: China Evergrande Group Chairman Hui Ka Yan, known as Xu Jiayin in Mandarin, pledged two more luxury houses in Hong Kong as collateral to borrow $105 million to help pay the developer's debts. (Caixin)

HUARONG: China Huarong Asset Management (HKG:2799) is set to raise 42 billion yuan ($6.59 billion) from the sale of shares to a group of state-owned investors, the Chinese bad debt manager said in a filing late Thursday. Huarong will issue up to 39.22 billion shares in the domestic market at 1.02 yuan apiece, and 1.96 billion shares in Hong Kong priced at the amount of Hong Kong dollar equivalent to 1.02 yuan. (WSJ)

OVERNIGHT DATA

CHINA OCT SWIFT GLOBAL PAYMENTS CNY 1.85%; SEP 2.19%

JAPAN OCT TOKYO CONDOMINIUMS FOR SALE -38.8% Y/Y; SEP -6.7%

AUSTRALIA OCT RBA FX TRANSACTIONS GOV'T -A$757MN; SEP -A$1.505BN

AUSTRALIA OCT RBA FX TRANSACTIONS MARKET +A$723MN; SEP +A$1.518BN

AUSTRALIA OCT RBA FX TRANSACTIONS OTHER -A$2.750BN; SEP +A$1.759BN

NEW ZEALAND Q4 2-YEAR INFLATION EXPECTATION +2.96%; Q3 +2.27%

SOUTH KOREA Q3 SHORT-TERM EXTERNAL DEBT $164.6BN; Q2 $178.0BN

CHINA MARKETS

PBOC NET DRAINS CNY50BN VIA OMOS THURS

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rates unchanged at 2.2% on Thursday. The operation has led to a net drain of CNY50 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1917% at 09:30 am local time from the close of 2.1785% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Wednesday vs 57 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3803 THURS VS 6.3935

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3803 on Thursday, compared with the 6.3935 set on Wednesday.

MARKETS

SNAPSHOT: Japanese Fiscal Taps To Open Further Than Expected?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 89.51 points at 29602.46

- ASX 200 up 9.266 points at 7379.2

- Shanghai Comp. down 5.396 points at 3532.066

- JGB 10-Yr future down 11 ticks at 151.5, yield up 0.3bp at 0.082%

- Aussie 10-Yr future up 6.5 ticks at 98.185, yield down 6.5bp at 1.795%

- U.S. 10-Yr future +0-03+ at 130-18, yield down 0.52bp at 1.584%

- WTI crude down $0.66 at $77.70, Gold down $1.01 at $1866.56

- USD/JPY up 10 pips at Y114.18

- FED'S EVANS: TAPER TO TAKE UNTIL MID-2022 TO COMPLETE (RTRS)

- WHITE HOUSE: BIDEN LIKELY TO MAKE DECISION ON FED CHAIR BEFORE THANKSGIVING

- EU BACKS DOWN ON THREATS TO RETALIATE IF ARTICLE 16 TRIGGERED (TELEGRAPH)

- JAPAN FISCAL STIMULUS TO TOTAL 55.7TN IN SPENDING (NIKKEI)

- NEW ZEALAND 2-YEAR INFLATION EXPECTATIONS HIT HIGHEST SINCE '11

- CHINA RESERVE BUREAU WORKING ON CRUDE OIL RELEASE (RTRS)

BOND SUMMARY: Sizeable Japanese Fiscal Stimulus Seemingly Inbound

TYZ1 in a narrow 0-05 range overnight, last +0-03 at 130-17+, after a limited look above Wednesday's best level. The curve has seen some very modest twist flattening, with benchmark yields last -/+0.5bp on the day. Reports re: Japanese fiscal matters have helped the space away from best levels, but broader macro headline flow was light overnight. Thursday's U.S. docket will be headlined by weekly jobless claims & regional Fed economic activity indicators, in addition to Fedspeak from Williams, Bostic, Evans & Daly. On the supply front, we will see a 10-Year TIPS auction and the end of month supply announcement from the Tsy.

- JGBs were on the defensive ahead of the close on the back of the latest Nikkei report surrounding the size of the impending fiscal stimulus package, with futures -9 last, while the cash JGB curve twist steepened as issuance worry weighs on the longer end. 20s are still a touch firmer than yesterday's closing levels on the back of the strong 20-Year JGB auction witnessed earlier today. In terms of the details, the Nikkei noted that the Japanese fiscal support package will total Y55.7tn, that is above any expectations that we had seen in circulation, and is much higher than the previously touted ~Y40tn.

- There was little in the way of idiosyncratic matters to really point to re: the latest leg of strength in the ACGB space, with futures registering fresh incremental session highs before backing off from best levels, leaving YM +3.0 & XM +6.5 at the close. A post-auction rally in NZGBs likely provided some trans-Tasman impetus (before firm NZ inflation expectation data unwound the bid in the shorter end of the NZ curve), while the movements in U.S. Tsys (which also sit off of best levels but operate within the confines of a narrow range) and JGBs also provided some input re: ACGB pricing. A quick reminder that we are on the lookout for the pricing of TASCORP's new benchmark sized Jan '33 bond, which is expected later today. Hedging around pricing may weigh on XM futures.

JGBS AUCTION: Japanese MOF sells Y960.0bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y960.0bn 20-Year JGBs:

- Average Yield 0.464% (prev. 0.471%)

- Average Price 100.64 (prev. 100.51)

- High Yield: 0.466% (prev. 0.475%)

- Low Price 100.60 (prev. 100.45)

- % Allotted At High Yield: 23.9612% (prev. 81.1162%)

- Bid/Cover: 3.781x (prev. 2.693x)

JGBS AUCTION: Japanese MOF sells Y2.8479tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8479tn 1-Year Bills:

- Average Yield -0.1261% (prev. -0.1098%)

- Average Price 100.126 (prev. 100.110)

- High Yield: -0.1241% (prev. -0.1088%)

- Low Price 100.124 (prev. 100.109)

- % Allotted At High Yield: 33.2848% (prev. 4.5388%)

- Bid/Cover: 3.774x (prev. 4.446x)

JAPAN: Bond Flows Dominate Weekly International Security Flow Data

As usual, bond flows headlined within the breakdown of the weekly Japanese international security flow data. Japanese net investment into foreign bonds moderated, pulling back below the Y500bn marker after the previous week saw the largest round of net purchases of foreign purchases on the part of Japanese investors since September. Elsewhere, foreigners bought a net Y1.266tn of Japanese bonds, in what was the largest round of weekly net purchases seen since August.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 456.3 | 1290.6 | 617.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -492.7 | -227.6 | -810.6 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1266.4 | 445.7 | 871.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 164.9 | 146.3 | 953.2 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Asia Generally Lower, E-Minis Marginally Higher

The major regional equity indices were generally lower in Asia-Pac trade, after Wall St. provided a slightly negative lead.

- Chinese tech names struggled in the wake of soft quarterly earnings reports from Baidu & Bilibili, with those companies subjected to the burden of the well-documented policymaker crackdown in China. The inflationary spectre provided a further source of pressure for the space, while the fall in oil prices evident over the last 24 hours also weighed. The Hang Seng shed over 1% as a result.

- The Nikkei 225 pared its early losses on the back of a Nikkei report which noted that the heavily awaited Japanese fiscal support package will total Y55.7tn. That level of spending is above any expectations that we had seen in circulation and is much higher than the previously touted ~Y40tn.

- The ASX was the exception to the broader rule, adding 0.1% on the day.

- U.S. e-mini futures sit marginally above settlement levels, aided by the previously outlined story re: Japanese fiscal spending.

OIL: Crude A Touch Lower

Crude oil futures are a touch lower than settlement levels, albeit off worst levels of the session. WTI has shed ~$0.70, while Brent is ~$0.30 softer on the day.

- A RTRS story garnered most of the focus during Asia-Pac hours, noting that "China's state reserve bureau on Wednesday told Reuters that it was working on a release of crude oil reserves and will disclose the details of the move on its website." Although, "the National Food and Strategic Reserves Administration declined to comment if the release is related to Washington's request to the world's top consuming nations on tapping oil reserves to cool global energy prices." Japanese & South Korean officials also confirmed similar lines of communication with the U.S., but the same officials pushed back against a coordinated response to the well-documented rise in oil prices, with supply imbalances at the centre of their policy/local law.

- A reminder that both of the benchmarks closed over $2.00 lower on Wednesday, shaking off what appeared to be a relatively bullish weekly DoE inventory report, as focus continued to fall on the potential for coordinated oil stock releases from some of the major oil consuming nations (see follow up to that above) and U.S. President Biden's request that the U.S. FTC look into price gouging in the energy markets.

GOLD: Holding In The Recent Range, ETFs Still Not Interested

Spot gold is little changed on the day, dealing just shy of $1,870/oz. Our weighted U.S. real yield monitor slipped on Wednesday, operating a touch above the recently recorded all-time lows, while the DXY finished a little lower on the day after a spike to fresh YtD highs during Asia-Pac hours. These 2 factors combined to support bullion, although spot continues to operate within the recent range, leaving a familiar technical overlay in place. ETF holdings continue to hover around the lowest levels witnessed since May '20, showing no sign of participation (actually recording a liquidation in holdings) during the recent rally

FOREX: Firmer Inflation Expectations Support Kiwi

Hawkish RBNZ repricing lent support to the kiwi dollar, after the Reserve Bank released their Q4 Survey of Expectations. The data showed that benchmark 2-year inflation expectations jumped to a level not seen in a decade. The proximity of the Reserve Bank's monetary policy meeting put a spotlight on the report. The OIS strip still prices ~35bp worth of OCR hikes come the end of next week's MPC gathering. However, the implied tightening path runs steeper, amid growing expectation that the RBNZ will need to act more aggressively to tame inflation.

- Demand for the kiwi sapped strength from AUD/NZD, which bottomed out just above Nov 9 multi-week low of NZ$1.0331. Trans-Tasman spillover likely sheltered AUD from greater losses against other G10 currencies, as softer crude oil prices dented high-beta FX. Oil-tied CAD and NOK were among the worst performers in the G10 basket.

- USD and JPY struggled for momentum. Japan's Chief Cabinet Sec Matsuno pointed to the importance of currency stability after USD/JPY staged a failed run at Y115.00 on Wednesday. USD/JPY implied vols remain elevated across the curve.

- In EM FX space, the yuan ignored a softer than expected PBOC fix, while USD/TRY surged towards the untouched TRY11 figure ahead of today's CBRT MonPol decision.

- U.S. weekly jobless claims headlines the global data docket during the remainder of the day. There's plenty of central bank rhetoric coming up, with PBOC, Fed & ECB members due to speak.

FOREX OPTIONS: Expiries for Nov18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1290(E552mln), $1.1330-50(E646mln), $1.1450-60(E941mln)

- USD/JPY: Y113.90-05($1.4bln), Y114.20-25($1.3bln), Y114.50-55($521mln), Y115.00($510mln)

- GBP/USD: $1.3400(Gbp896mln)

- EUR/GBP: Gbp0.8400(E1.1bln), Gbp0.8450-60(E1.1bln)

- USD/CAD: C$1.2330($1.3bln), C$1.2380($770mln), C$1.2500($1.0bln)

- USD/CNY: Cny6.3830($1bln)

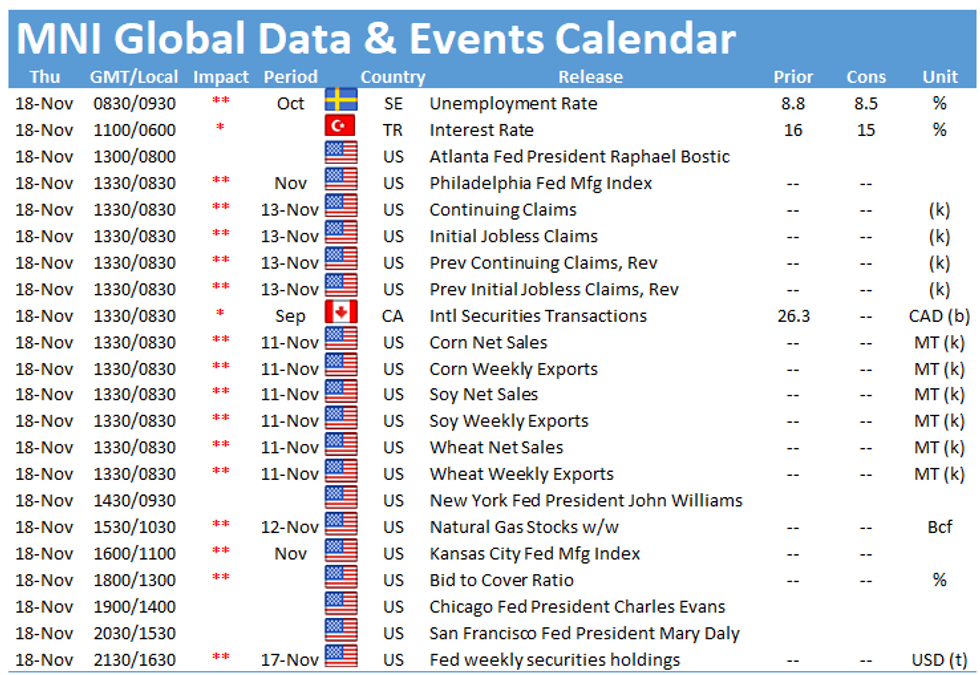

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.