-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Japanese Equities Recover From Lows On Rumours Of Large Fiscal Stimulus

- Reports pointing to a larger than expected round of fiscal stimulus out of Japan weighed on the JPY and allowed Japanese equities to pare a chunk of their early losses.

- New Zealand 2-Year inflation expectations surged to the highest levels seen since '11.

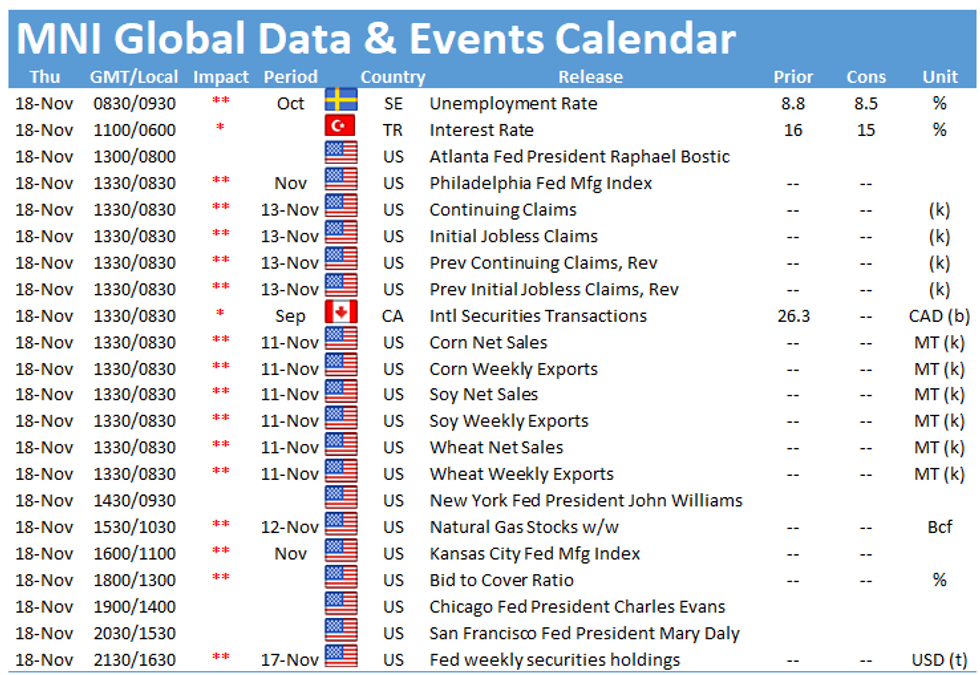

- U.S. weekly jobless claims headlines the global data docket during the remainder of the day. There's plenty of central bank rhetoric coming up, with PBOC, Fed & ECB members due to speak. There will also be a raft of EM central bank decisions.

BOND SUMMARY: Sizeable Japanese Fiscal Stimulus Seemingly Inbound

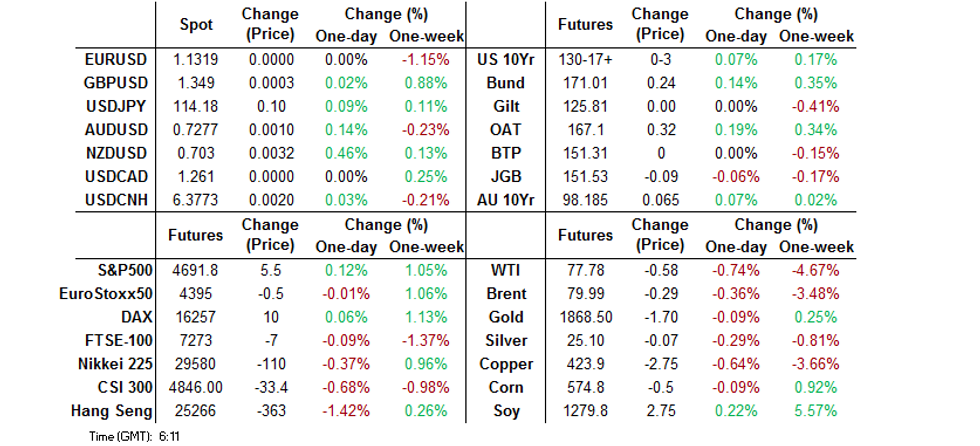

TYZ1 in a narrow 0-05 range overnight, last +0-03 at 130-17+, after a limited look above Wednesday's best level. The curve has seen some very modest twist flattening, with benchmark yields last -/+0.5bp on the day. Reports re: Japanese fiscal matters have helped the space away from best levels, but broader macro headline flow was light overnight. Thursday's U.S. docket will be headlined by weekly jobless claims & regional Fed economic activity indicators, in addition to Fedspeak from Williams, Bostic, Evans & Daly. On the supply front, we will see a 10-Year TIPS auction and the end of month supply announcement from the Tsy.

- JGBs were on the defensive ahead of the close on the back of the latest Nikkei report surrounding the size of the impending fiscal stimulus package, with futures -9 last, while the cash JGB curve twist steepened as issuance worry weighs on the longer end. 20s are still a touch firmer than yesterday's closing levels on the back of the strong 20-Year JGB auction witnessed earlier today. In terms of the details, the Nikkei noted that the Japanese fiscal support package will total Y55.7tn, that is above any expectations that we had seen in circulation, and is much higher than the previously touted ~Y40tn.

- There was little in the way of idiosyncratic matters to really point to re: the latest leg of strength in the ACGB space, with futures registering fresh incremental session highs before backing off from best levels, leaving YM +3.0 & XM +6.5 at the close. A post-auction rally in NZGBs likely provided some trans-Tasman impetus (before firm NZ inflation expectation data unwound the bid in the shorter end of the NZ curve), while the movements in U.S. Tsys (which also sit off of best levels but operate within the confines of a narrow range) and JGBs also provided some input re: ACGB pricing. A quick reminder that we are on the lookout for the pricing of TASCORP's new benchmark sized Jan '33 bond, which is expected later today. Hedging around pricing may weigh on XM futures.

JAPAN: Bond Flows Dominate Weekly International Security Flow Data

As usual, bond flows headlined within the breakdown of the weekly Japanese international security flow data. Japanese net investment into foreign bonds moderated, pulling back below the Y500bn marker after the previous week saw the largest round of net purchases of foreign purchases on the part of Japanese investors since September. Elsewhere, foreigners bought a net Y1.266tn of Japanese bonds, in what was the largest round of weekly net purchases seen since August.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 456.3 | 1290.6 | 617.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -492.7 | -227.6 | -810.6 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1266.4 | 445.7 | 871.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 164.9 | 146.3 | 953.2 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Firmer Inflation Expectations Support Kiwi

Hawkish RBNZ repricing lent support to the kiwi dollar, after the Reserve Bank released their Q4 Survey of Expectations. The data showed that benchmark 2-year inflation expectations jumped to a level not seen in a decade. The proximity of the Reserve Bank's monetary policy meeting put a spotlight on the report. The OIS strip still prices ~35bp worth of OCR hikes come the end of next week's MPC gathering. However, the implied tightening path runs steeper, amid growing expectation that the RBNZ will need to act more aggressively to tame inflation.

- Demand for the kiwi sapped strength from AUD/NZD, which bottomed out just above Nov 9 multi-week low of NZ$1.0331. Trans-Tasman spillover likely sheltered AUD from greater losses against other G10 currencies, as softer crude oil prices dented high-beta FX. Oil-tied CAD and NOK were among the worst performers in the G10 basket.

- USD and JPY struggled for momentum. Japan's Chief Cabinet Sec Matsuno pointed to the importance of currency stability after USD/JPY staged a failed run at Y115.00 on Wednesday. USD/JPY implied vols remain elevated across the curve.

- In EM FX space, the yuan ignored a softer than expected PBOC fix, while USD/TRY surged towards the untouched TRY11 figure ahead of today's CBRT MonPol decision.

- U.S. weekly jobless claims headlines the global data docket during the remainder of the day. There's plenty of central bank rhetoric coming up, with PBOC, Fed & ECB members due to speak.

FOREX OPTIONS: Expiries for Nov18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1290(E552mln), $1.1330-50(E646mln), $1.1450-60(E941mln)

- USD/JPY: Y113.90-05($1.4bln), Y114.20-25($1.3bln), Y114.50-55($521mln), Y115.00($510mln)

- GBP/USD: $1.3400(Gbp896mln)

- EUR/GBP: Gbp0.8400(E1.1bln), Gbp0.8450-60(E1.1bln)

- USD/CAD: C$1.2330($1.3bln), C$1.2380($770mln), C$1.2500($1.0bln)

- USD/CNY: Cny6.3830($1bln)

JPY: Chief Cabinet Sec Notes Importance Of FX Stability, TWI Breathing Room?

Japanese Chief Cabinet Secretary Hirokazu Matsuno has noted that "currency stability is very important for Japan," stressing that policymakers are watching FX movements. The Japanese policymaking sphere was relatively quiet re: such matters during the latest run higher in USD/JPY (which challenged Y115.00 on Wednesday), with the JPY actually finding itself atop the G10 FX table in the period since October 20 (given USD/JPY's retracement to Y114.00). This has allowed the JPY trade weighted index (TWI) to recover from the multi-year lows registered on October 20, which in turn likely meant that the Japanese powers that be could remain relatively muted even as USD/JPY briefly threatened to break above Y115.00 for the first time since early '17. Matsuno is looking to reinforce the message of alertness when it comes to FX matters, after PM Kishida noted that the government will scrutinise the economic impact of any further declines in the JPY, which could damage corporate profits, back on October 12. Matsuno's rhetoric remains relatively timid when judged on the broader Japanese "traffic light" scale re: policymaker language surrounding FX movements.

Fig. 1: Deutsche Bank JPY TWI

Source: MNI – Market News/Deutsche Bank/Bloomberg

Source: MNI – Market News/Deutsche Bank/Bloomberg

ASIA FX: Most Regional EM FX Outperform Greenback, Yuan Ignores Softer PBOC Fix

Overnight greenback weakness weighed on most USD/Asia crosses, while the yuan was unfazed by a soft yuan fixing delivered by the PBOC. Monetary policy decisions from Indonesia and the Philippines were eyed.

- CNH: Offshore yuan held a tight range, ignoring a softer than expected yuan fixing. The PBOC set their central USD/CNY mid-point at CNY6.3803, 17 pips above sell-side estimate.

- KRW: Spot USD/KRW went offered, even as South Korea's daily Covid-19 case count hit a fresh record. Local markets opened an hour later owing to national college entrance exams.

- IDR: The rupiah was marginally stronger, with focus on the upcoming monetary policy decision from Bank Indonesia.

- MYR: Spot USD/MYR advanced towards its 100-DMA, which has been intact since Oct 12. An uptick in Malaysia's Covid-19 cases provided a source of concern, while the Dewan Rakyat discussed Budget 2022.

- PHP: The peso garnered some strength ahead of the announcement of Bangko Sentral ng Pilipinas' monetary policy decision. Sino-Philippine geopolitical tension resurfaced, as Chinese Coast Guard blocked Philippine vessels carrying food supplies for troops stationed on a contested shoal.

- THB: Spot USD/THB fell to a new 10-week low. BoT Gov Sethaput delivered a speech, but refrained from comments on monetary policy. The official called for restructuring domestic economy, as the tourism sector will take longer to recover.

EQUITIES: Asia Generally Lower, E-Minis Marginally Higher

The major regional equity indices were generally lower in Asia-Pac trade, after Wall St. provided a slightly negative lead.

- Chinese tech names struggled in the wake of soft quarterly earnings reports from Baidu & Bilibili, with those companies subjected to the burden of the well-documented policymaker crackdown in China. The inflationary spectre provided a further source of pressure for the space, while the fall in oil prices evident over the last 24 hours also weighed. The Hang Seng shed over 1% as a result.

- The Nikkei 225 pared its early losses on the back of a Nikkei report which noted that the heavily awaited Japanese fiscal support package will total Y55.7tn. That level of spending is above any expectations that we had seen in circulation and is much higher than the previously touted ~Y40tn.

- The ASX was the exception to the broader rule, adding 0.1% on the day.

- U.S. e-mini futures sit marginally above settlement levels, aided by the previously outlined story re: Japanese fiscal spending.

GOLD: Holding In The Recent Range, ETFs Still Not Interested

Spot gold is little changed on the day, dealing just shy of $1,870/oz. Our weighted U.S. real yield monitor slipped on Wednesday, operating a touch above the recently recorded all-time lows, while the DXY finished a little lower on the day after a spike to fresh YtD highs during Asia-Pac hours. These 2 factors combined to support bullion, although spot continues to operate within the recent range, leaving a familiar technical overlay in place. ETF holdings continue to hover around the lowest levels witnessed since May '20, showing no sign of participation (actually recording a liquidation in holdings) during the recent rally

OIL: Crude A Touch Lower

Crude oil futures are a touch lower than settlement levels, albeit off worst levels of the session. WTI has shed ~$0.70, while Brent is ~$0.30 softer on the day.

- A RTRS story garnered most of the focus during Asia-Pac hours, noting that "China's state reserve bureau on Wednesday told Reuters that it was working on a release of crude oil reserves and will disclose the details of the move on its website." Although, "the National Food and Strategic Reserves Administration declined to comment if the release is related to Washington's request to the world's top consuming nations on tapping oil reserves to cool global energy prices." Japanese & South Korean officials also confirmed similar lines of communication with the U.S., but the same officials pushed back against a coordinated response to the well-documented rise in oil prices, with supply imbalances at the centre of their policy/local law.

- A reminder that both of the benchmarks closed over $2.00 lower on Wednesday, shaking off what appeared to be a relatively bullish weekly DoE inventory report, as focus continued to fall on the potential for coordinated oil stock releases from some of the major oil consuming nations (see follow up to that above) and U.S. President Biden's request that the U.S. FTC look into price gouging in the energy markets.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.