-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Jobs On The Mind

EXECUTIVE SUMMARY

- FED'S WILLIAMS: US ECONOMY 'QUITE A WAY OFF' FROM TAPERING ASSET PURCHASES (YAHOO)

- WHITE HOUSE: NO MONDAY DEADLINE ON INFRASTRUCTURE PLAN

- UK'S WORK FROM HOME ADVICE COULD CONTINUE BEYOND JUNE 21 (TELEGRAPH)

- EU COULD RETALIATE AGAINST BRITAIN OVER NI PROTOCOL, COVENEY WARNS (IRISH TIMES)

- ANALYSTS SAY EXPECTATION OF YUAN APPRECIATION HAS ABATED (CSJ)

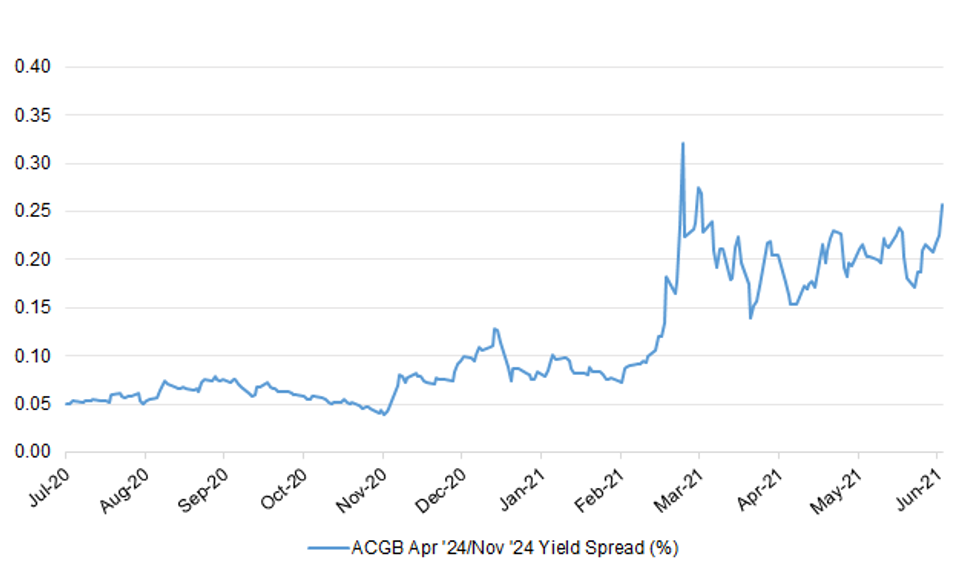

Fig. 1: ACGB Apr '24/Nov '24 Yield Spread (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The Delta variant of coronavirus that was first identified in India is now the dominant variant in the U.K., according to Public Health England. Early evidence suggests there "may be an increased risk of hospitalization" for Delta, although "more data is needed for us to have more confidence in that finding," PHE said in an emailed statement. (BBG)

CORONAVIRUS: The coronavirus variant of concern first discovered in India, known as Delta, is more likely to lead to hospitalisations that the Alpha variant first detected in Kent, data suggests, raising further concerns about its spread across the UK. (Guardian)

CORONAVIRUS: Advice to work from home could continue beyond June 21 as the price of lifting other coronavirus restrictions, under plans being discussed in Whitehall. Government sources on Thursday confirmed that officials were examining whether to retain the "work from home" guidance as a mitigating measure, in the event that Covid hospitalisations and deaths surge in coming weeks. Boris Johnson has pencilled in June 21 for the final step in his roadmap out of legal restrictions, which would see all constraints on social contact lifted and the cap removed on the numbers allowed to attend large events. (Telegraph)

CORONAVIRUS: The U.K. removed Portugal from its so-called green list of countries that Britons can visit without having to quarantine after returning home. The setback for summer tourism sent airline shares lower. "It feels like the summer for U.K. airlines is fast ebbing away," said Rob Morris, who heads consultancy at aviation tracker Ascend by Cirium. (BBG)

ECONOMY: British employers took on permanent staff last month at the fastest rate since records started being kept in the late 1990s, a survey showed on Friday in another sign that the economy is rebounding swiftly from the COVID-19 pandemic. Growth in temporary staff placements also hit a six-year high, according to the Recruitment and Employment Confederation (REC) trade body and accountants KPMG. "We now have a consistent picture over the past few months to show that confidence is growing and hiring plans are in motion," Kate Shoesmith, REC deputy chief executive officer, said. Starting salaries rose last month at the fastest rate since September 2018 as the availability of staff declined sharply, which REC linked to pandemic uncertainty and fewer EU candidates. (RTRS)

BOE: Bank of England Governor Andrew Bailey said that the central bank's Monetary Policy Committee recently discussed the economics of climate change for the first time, underscoring the U.K. commitment to slashing emissions. "When it comes to climate change, we cannot stand still," Bailey said in a speech to a Bank of International Settlements conference on the issue on Thursday. "We need to continue to be bold and learn from our work so far to deepen our understanding and inform future actions." (BBG)

BREXIT: Britain's lack of co-operation in implementing the Northern Ireland protocol is driving European capitals to push for a tougher response from the European Commission, Minister for Foreign Affairs Simon Coveney has warned. Speaking in London ahead of a meeting on Friday morning with Brexit minister David Frost, Mr Coveney said Ireland wished to avoid a situation where the EU would take retaliatory action against Britain. "I don't think that the status quo is sustainable for much longer. And what I mean by that is where the EU is constantly trying to push ideas and proposals on the table around flexibility and how it might work and where that is not resulting in any agreement or any traction in terms of moving the process forward," he told The Irish Times. "I think there is a sense within the EU and within EU capitals that the frustration has got to result in the EU perhaps changing the approach. And instead of constantly trying to offer solutions and flexibility, remind the UK that there are consequences to not implementing agreements that have a basis in international law. From an Irish perspective, the last thing we want here is a legal standoff between the two sides or retaliation on the back of non-compliance with international agreements." (Irish Times)

BREXIT: Irish Prime Minister Micheal Martin and Edwin Poots, leader of Northern Ireland's Democratic Unionist Party, had an "open exchange of views" across issues including North-South cooperation and the implementation of the so-called Northern Irish Protocol. Martin highlighted the critical importance of the stability and good functioning of the NI Executive and Institutions of the Good Friday Agreement, the government said in a statement, following the meeting in Dublin late Thursday. Agreement between the EU and U.K. on a temporary (SPS) veterinary agreement – which would do away with 80% of checks at NI ports - would be "an obvious way" to resolve some issues surrounding the protocol. Need to use the window available in EU-U.K. engagement to agree roadmap on outstanding issues. (BBG)

BREXIT: The UK is on the cusp of signing a trade deal with Norway and other members of the European Economic Area, with a formal announcement expected as soon as Friday. Norway, whose biggest trading partner is the UK, thanks to sales of North Sea gas, has been particularly worried about protecting its small but politically vital agriculture sector from the threat of cheap British beef and cheese in an election year. (FT)

EUROPE

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Italy (current rating: BBB-; Outlook Stable), Malta (current rating: A+; Outlook Stable) & Sweden (current rating: AAA, Outlook Stable)

- DBRS Morningstar on Germany (current rating: AAA, Stable Trend)

U.S.

FED: Federal Reserve Bank of New York President John Williams said Thursday that he would like to see the U.S. economy make more progress before the central bank pulls back on its aggressive monetary stimulus. "We're still quite a ways off from maintaining the substantial further progress we're really looking for in terms of adjustments to our asset purchase program," Williams told Yahoo Finance in an exclusive interview. But Williams added that the Fed should begin to be mindful of how the data looks in coming months. "We have to be thinking ahead, planning ahead, so I do think it makes sense for us to be thinking through the various options we may have in the future," Williams said. (Yahoo Finance)

FED: MNI BRIEF: Stickier Inflation Justifies Taper Talk - Kaplan

- Dallas Fed President Robert Kaplan Thursday suggested one reason he wants to start the debate around tapering asset purchases soon is because part of the recent inflation run-up may reflect secular trends that could keep prices higher than in years past. Kaplan said it is "my job to adapt to the current reality and to the future," suggesting that some labor trends and the economy's supply issues may be more secular. "From that point of view, it will be wiser sooner rather than later to begin discussions about adjusting our purchases, and with a view to taking the foot off the accelerator gently," he said. Part of that would also be reconsidering the Fed's MBS purchases - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: San Francisco Fed President Daly tweeted the following on Thursday: "As we await the next labor market report, remember, the next few months will likely be volatile. Let's remain steady in the boat. We have work to do to get to full employment and price stability." (MNI)

FED: "Declining economic mobility is one of the defining challenges of our time," Philadelphia Fed President Patrick Harker says. "Far too many of people's paths to success have been blocked. Intergenerational mobility has fallen in recent decades. Income inequality has remained stubbornly high," Harker says Thursday in remarks prepared for a virtual event on workforce development." (BBG)

FED: MNI BRIEF: Fed's Quarles Rejects Call For CCyB

- Federal Reserve Vice Chair for Supervision Randal Quarles Thursday rejected calls to reconsider activating a countercyclical capital buffer, a tool that other Fed officials have argued should have been put in place before the coronavirus hit the banking system last year. "There were many calls from outside the Fed for us to activate the CCyB in the years before the COVID event," said Quarles. "It is clear now that those calls were mistaken." The Fed official said "by any measure" the bank regulatory system did "quite well" in the face of Covid, while still singling out runs on prime money funds and commercial paper as "particularly concerning," and adding that policymakers will also focus attention on non-banks - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI: Fed's New Framework Tested By Inflation Surge

- The Federal Reserve is facing tough questions about the viability of its new outcome-based approach to monetary policy less than a year after announcing the shift -- and before the new framework gets properly implemented, top former policymakers told MNI. "Over the last six months to a year the strategy looks less and less credible, " said Charles Plosser, ex-president of the Philadelphia Fed. "It looks and less and less believable that they're not going to change their minds" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI REALITY CHECK: US Labor Shortage Still Hampering Job Gains

- The pace of U.S. job growth improved in May, partially bouncing back from a weaker-than-expected April as the economy continued to recover and businesses opened closer to full capacity, although a shortage of available workers is still capping job gains, recruiters and industry experts told MNI. Demand for workers was elevated throughout the month, said Nick Bunker, a labor economist at online job marketplace Indeed, with available jobs posted to the site through May 21 up 26% over February of last year, suggesting employment gains have been "fairly broad-based across a wide range of job types" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI INTERVIEW: Job Market Progress May Be Rocky - Fed Economist

- The U.S. economy is more likely than not to have seen robust hiring in May, but another disappointing payrolls number Friday could indicate structural changes facing the labor market could pose a bigger challenge than thought, Richmond Fed senior adviser Thomas Lubik told MNI. At the moment Lubik remains "cautiously optimistic" of new jobs in the 600,000 to 700,000 range in May and that April's shockingly low 266,000 payrolls figure will be revised upward - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI BRIEF: Half of Small U.S. Firms Unable to Fill Jobs - NFIB

- A record number of small businesses said they could not fill open jobs in May, with 93% of owners saying hiring or trying to hire reported few or no "qualified" applications for the positions they were trying to fill, according to the National Federation of Independent Business - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI INTERVIEW: 'Jailbreak' Spending Lifts US Service Prices - ISM

- U.S. service activity and price gains will remain around record highs in coming months with households eager to spend while firms experience shortages of products and workers, ISM survey chair Anthony Nieves told MNI Thursday. "The pent up demand is real," he said, with consumers in a "jailbreak" mentality after more than a year of on-and-off Covid lockdowns and limitations on in-person activities - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The White House said Thursday that there is no deadline next week for a breakthrough on infrastructure plan negotiations with Republicans, as President Joe Biden plans more talks with a key GOP lawmaker. On Sunday, Transportation Secretary Pete Buttigieg said on CNN that there needed to be a "clear direction" on infrastructure by June 7, when Congress returns to Washington after a Memorial Day break. (MarketWatch)

FISCAL: U.S. President Joe Biden offered to scrap his proposed corporate tax hike during negotiations with Republicans, two sources familiar with the matter said on Thursday, in what would be a major concession by the Democratic president as he works to hammer out an infrastructure deal. Biden offered to drop plans to raise corporate tax rates as high as 28% and instead set a minimum 15% tax rate aimed at ensuring all companies pay taxes, sources said. In return, Republicans would have to agree to at least $1 trillion in new infrastructure spending, one source said. And Biden has not given up on seeking as much as $1.7 trillion. (RTRS)

FISCAL: Biden's initial plan called for $2.25 trillion in infrastructure spending and new revenue, including $857.8 billion from the prior proposal to raise corporate income tax from 21% to 28%. "He is personally leaning in, willing to compromise, spending time with senators - Democrat and Republican - to find out what is the art of the possible," Commerce Secretary Gina Raimondo told CNN in an interview on Thursday. "The only thing he won't accept is inaction," she said. "It has to be big and bold, $1 trillion or more." (RTRS)

FISCAL: According to the Republican source, GOP lawmakers see Biden's rejiggered proposal, which includes several other tax modifications along with the 15% minimum rate, as nothing more than a corporate tax hike by another name. (ABC)

FISCAL: U.S. Senator Mitch McConnell said on Thursday that Republicans are still hoping to reach a bipartisan agreement with President Joe Biden on an infrastructure package of "maybe $1 trillion" that would be fully paid for. "I don't know whether we're going to reach an agreement or not," McConnell said during an appearance in Paducah, Kentucky. (RTRS)

FISCAL: Psaki on Thursday said discussions between the administration and Republicans are continuing in "good faith" and refused to set a deadline for talks, but the Monday deadline for progress set by Transportation Secretary Pete Buttigieg this past Sunday is drawing near. (ABC)

CORONAVIRUS: The Biden administration is stepping up efforts to enlist colleges to help community members, including faculty and staff, get shots. The administration will host regular training sessions for college and student leaders to organize their colleges, peers, and communities in what's being billed as a COVID Community Corps. It will also promote partnerships between retail pharmacies and high-enrollment community colleges to provide on- site clinics. Colleges themselves, including Purdue University, and state governments are also offering incentives, such as free tuition in New York and Ohio. (BBG)

CORONAVIRUS: Evidence of severe cases among adolescents and young adults leading up to the CDC's recommendation of a vaccine for that age group underscore the urgency getting them vaccinated, Centers for Disease Control and Prevention director Rochelle Walensky said. "I strongly encourage parents to get their teens vaccinated, as I did mine," Walensky said at a White House briefing on Thursday. (BBG)

CORONAVIRUS: Experimental drug Tempol "may be a promising oral antiviral treatment for Covid-19," the National Institutes of Health said, citing findings from a study of cell cultures by its researchers. Tempol can limit Covid-19 infection by impairing the activity of a viral enzyme called RNA replicase, NIH said in a statement. (BBG)

CORONAVIRUS: Chicago will fully reopen in Phase 5 on June 11 with the rest of Illinois, Mayor Lori Lightfoot announced Thursday. "Because you've masked up, socially distanced and got vaccinated, we're now moving to Phase 5 on Friday, June 11 in alignment with the state. This means Chicago is scheduled to fully reopen," Lightfoot tweeted. (NBC)

OTHER

GLOBAL TRADE: Japan's Ministry of Economy, Trade and Industry will, in its new digital industry strategy, note the importance of semiconductor, data center and cloud service businesses to the nation and back the industries as a "national project," Nikkei reports, without saying who provided the information. The ministry will view the industries as important as food and energy, and will consider taking measures that go beyond those taken for normal industries. The ministry will seek budget needed for the measures. (BBG)

GLOBAL TRADE: Chancellor Rishi Sunak says he is "confident" of reaching a global agreement on digital taxation ahead of a meeting of world finance leaders. Tax on big tech companies has been a source of friction between the US and countries including the UK. The US announced sanctions on Wednesday but then suspended them to give more time for talks. Finance minsters will also discuss climate change at the two day meeting which starts in London on Friday. (BBC)

U.S./CHINA: President Joe Biden signed an order Thursday amending a ban on U.S. investment in Chinese companies begun under his predecessor, naming 59 firms with ties to China's military or in the surveillance industry, including Huawei Technologies Co. and the country's three biggest telecommunications companies. The ban on new investments will take effect Aug. 2 at 12:01 a.m. in New York, according to administration officials who briefed reporters on condition of anonymity. Investors will have one year to fully divest. (BBG)

U.S./CHINA: Pentagon releases list of Chinese military companies operating directly or indirectly in the U.S. (BBG)

U.S./CHINA: Joe Biden's chief medical adviser has called on China to release the medical records of nine people whose illnesses might provide vital clues into whether Covid-19 first emerged as the result of a lab leak. Dr Anthony Fauci, the head of the National Institute of Allergy and Infectious Diseases, or NIAID, told the Financial Times that the records could help resolve the debate over the origins of a disease that has killed more than 3.5m people worldwide. The records in question U.S./CHINA: concern three researchers at the Wuhan Institute of Virology who reportedly became sick in November 2019, and six miners who fell ill after entering a bat cave in 2012. Scientists from the Wuhan Institute of Virology subsequently visited the cave to take samples from the bats. Three of the miners died. (FT)

U.S./CHINA: China for the first time formally stated its views on issues with the U.S. when the Commerce Ministry said the two sides have begun "normal communication" in economic and trade areas, wrote Taoran Notes, an influential blog which some said is linked to the official newspaper Economic Daily. This is not something that came abruptly but resulted from gradual change with "cool and rational manners," the blog said. China still needs to carefully think about what its fundamental interests are and calmly deal with the U.S. with an extremely pragmatic attitude, as both sides have been emotional in the past when bilateral relations encountered difficulties, said the blog. (MNI)

GEOPOLITICS: The U.S. Department of Justice is elevating investigations of ransomware attacks to a similar priority as terrorism in the wake of the Colonial Pipeline hack and mounting damage caused by cyber criminals, a senior department official told Reuters. Internal guidance sent on Thursday to U.S. attorney's offices across the country said information about ransomware investigations in the field should be centrally coordinated with a recently created task force in Washington. (RTRS)

GEOPOLITICS: A group of lawmakers in Japan's ruling party on Thursday recommended that Japan and the U.S. revise their defense guidelines to focus on potential flashpoints involving China, particularly Taiwan and the South China Sea. (Nikkei)

JAPAN: Japan's government will say the country must "aim to" achieve its fiscal target bearing in mind that its fiscal state is in dire straits from spending to combat the coronavirus pandemic, a draft of a fiscal blueprint obtained by Nippon TV showed. The government must lay the groundwork towards fiscal restoration before baby boomers reach 75, the broadcaster reported on Friday, citing the blueprint. (RTRS)

JAPAN: Sanofi said on Thurs. it would start a final phase of clinical trial for its Covid-19 vaccine in Japan, without providing a date, Nikkei reports. If approved in Japan, it plans to outsource production to a bio-pharmaceutical company Unigen based in Gifu prefecture. (BBG)

JAPAN: A Japanese Olympic Committee board member on Friday blasted organisers of the Tokyo Games for ignoring public concerns about holding the global sporting showpiece amid a pandemic, but said it was too late to cancel. (RTRS)

AUSTRALIA/CHINA: China will handle disputes regarding anti-dumping and countervailing duties on barley imported from Australia in line with settlement procedures of the World Trade Organization, the state news agency Xinhua reported, citing the commerce ministry. (RTRS)

NEW ZEALAND: New Zealand government is scaling back three key roading projects in its NZ Upgrade Program as construction cost pressures mount, Finance Minister Grant Robertson says in emailed statement. In January 2020 the government announced 32 infrastructure projects aimed at supporting the economic recovery. (BBG)

SOUTH KOREA: South Korea will consider another extra budget to shore up businesses and jobs battered by the pandemic, Finance Minister Hong Nam-ki said Friday, which would mark the sixth such spending since the onset of the Covid crisis. The proposal would be funded by excess tax revenue, Hong said in a meeting with economists. The comments came as President Moon Jae-in called for expansionary spending through 2022 to bridge wealth gaps that have worsened amid the pandemic. Korea's spending spree has helped lessen the economic damage so far, but has also pushed debt levels well beyond 40% of gross domestic product, which previous administrations saw as a ceiling. The Bank of Korea said last week the economy may grow more than its 4% projection this year if the government adds stimulus. (BBG)

CANADA: MNI DATA BRIEF: Canada Jobs Seen Falling For 2nd Month in May

- Canada's May's Labour Force Survey on Friday will likely show a 23K job loss following April's 207K decline reflecting a drag from the pandemic's third wave, a weak note in the last top line data before the central bank's rate decision next Wednesday. The unemployment rate is expected to remain at 8.1% according to the economist consensus. Joblessness had dropped from a modern era record high of 13.7% during the first Covid wave to 7.5% in March as firms adapted to social distancing rules and vaccines emerged - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: Toronto's housing market recorded its second consecutive month of slowing sales in May, as reduced supply and a lingering lockdown to contain the coronavirus helped to cool off the market. The number of homes that traded hands in Canada's largest city fell 8.9% in May from the month before, according to data released Thursday from the Toronto Regional Real Estate Board. The seasonally-adjusted average selling price for a home in the Toronto region still rose 1.1% from April, to C$1,061,987 ($882,300). (BBG)

TURKEY/RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody's on Turkey (current rating: B2; Outlook Negative)

RUSSIA/RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody's on Russia (current rating: Baa3; Outlook Stable)

SOUTH AFRICA: Eskom Holdings SOC Ltd.'s fired Chief Procurement Officer Solly Tshitangano endangered the company finances by making racism allegations against the chief executive officer that he later retracted, an official investigation has found. (BBG)

SOUTH AFRICA: South African Mineral and Energy Resources Minister Gwede Mantashe and the two most senior officials in his department denied corruption in court papers responding to allegations by a losing bidder in a power tender. Director-General Thabo Mokoena confirmed that he and his deputy met Aldworth Mbalati, executive director of DNG Energy Ltd., at Kream Restaurant in Pretoria in November, but denied they tried to secure a bribe. Mantashe denied allegations by Mbalati that a business associate and a relative of the minister tried to interfere in the process of awarding contracts. (BBG)

IRAN: The United States expects to have a sixth round of indirect talks on reviving the Iran nuclear deal and would predict for negotiations to extend into further subsequent rounds, State Department spokesman Ned Price said on Thursday. Speaking at a briefing, Price said hurdles remained even after five rounds of talks. The European Union envoy coordinating talks on reviving the Iran nuclear deal on Wednesday he believed a deal would be struck at the next round of talks starting next week, but other senior diplomats said "the most difficult decisions lie ahead." (RTRS)

ISRAEL: Defense Minister Benny Gantz met Thursday with Biden administration officials in a flash 24-hour visit. Gantz and U.S. Secretary of State Antony Blinken delivered short statements to the press before their meeting. Blinken noted that the State Department is "very happy" to have the opportunity to continue the conversation with Gantz that began in Israel last week, regarding the United States' "enduring commitment to Israel's security," and "some of the needs that Israel has in that regard." (Haaretz)

OIL: Russian Deputy Prime Minister Alexander Novak on Thursday said the oil and gas-rich country may soon be tempted to move away from U.S. dollar-denominated crude contracts if President Joe Biden's administration continues to impose targeted economic sanctions. "Well, ideally we would prefer not to move away from the dollar as it is an international currency used for settlements," Novak told CNBC's Hadley Gamble at the St. Petersburg International Economic Forum, according to a translation. "But if our American partners create this type of situation we shall have no other choice but gradually do that," he added. (CNBC)

OIL: The bosses of two of Russia's main oil companies expect OPEC+ to raise output further this year as the market heats up, perhaps as soon as its July meeting. The group, of which Russia is joint leader with Saudi Arabia, is currently restoring about 2 million barrels a day of idle production in monthly installments that end in July. The alliance may need to keep ramping up in August or September to feed the demand recovery, said Gazprom Neft PJSC Chief Executive Officer Alexander Dyukov. (BBG)

CHINA

YUAN: MNI: PBOC Will Act Again If Needed To Curb Yuan, Advisors Say

- The People's Bank of China could take further steps to deter any speculation-driven yuan rally if necessary, Chinese policy advisors and foreign exchange experts told MNI, though one noted that recent moves to curb currency strength had been enacted only after considerable internal debate among policy makers - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

YUAN: Expectation of "one-way" yuan appreciation has abated following the currency's recent correction, China Securities Journal says in a front-page report, citing unnamed analysts. Yuan is under pressure from seasonal foreign exchange demand by overseas-listed Chinese enterprises for dividend payment and a likely rebound in U.S. dollar index. (BBG)

YUAN: Investors shouldn't bet on one-way yuan movement as the PBOC and FX regulators have new policy tools that control capital in and out of capital accounts and markets, the 21st Century Business Herald reported citing Guan Tao, chief economist of BOC International and a former official at SAFE, the forex regulator. SAFE's move to release new Qualified Domestic Institutional Investor quota on Wednesday will channel domestic funds to overseas assets and further ease the yuan's rapid appreciation pressure, the newspaper said citing analysts. Following the move, yuan lost for a fourth day, hovered around 6.3903 against the U.S. dollar as of 7 p.m. on Thursday, the newspaper said. (MNI)

ECONOMY: China's rebounding consumer spending and recovering investment in high-tech, manufacturing and infrastructure will help growth in the second half, said Xu Xianchun, a former deputy head of the National Bureau of Statistics and now a scholar at Tsinghua University. Xu projects over 6% GDP growth in Q3, before a higher base of comparison brings Q4 below 6%. The widening vaccination programs will boost close-contact consumption, hotels and dining and rental and commercial services, Xu said. Exports will maintain strength in Q2 while the prospect for H2 will depend on the global management of the pandemic, he said. Household disposable incomes are expected to improve, while companies' profits will slow given surging costs of raw material and labor, said Xu. (MNI)

LGFVS: Chinese local governments face greater supervision that discourages them from selling more debt, and net financing in May through local government financing vehicles (LGFVs) has fallen to a record low last month, the 21st Century Business Herald reported. LGFVs will face great pressure repaying their combined CNY1.6 trillion maturing bonds in H2 if bond financing continues to tighten, and they may turn to banks for more credit lines and moderately reduce new investment projects, the newspaper said citing sources. (MNI)

CORONAVIRUS: Panyu district in Guangzhou in southern China will suspend dine-in service at restaurants from June 4 to 17 to contain coronavirus risks, according to a statement from the local government. Guangzhou has suffered from new wave of Covid infections recently with 15 local confirmed cases reported in the city June 2, according to local health authorities. (BBG)

FISCAL: China's lawmakers plan to make amendments to the current draft of stamp duty law, including making appropriate reduction to the tax rates, further clarifying the scope of the tax and improving tax preferential policies, Zang Tiewei, spokesman for Legislative Affairs Commission of the standing committee, says at a briefing. The planned amendments are based on opinions from various sides. Zang dosen't specify the categories of stamp duties that China may Reduce. (BBG)

OVERNIGHT DATA

JAPAN APR HOUSEHOLD SPENDING +13.0% Y/Y; MEDIAN +8.7%; MAR +6.2%

AUSTRALIA APR HOME-LOAN VALUES +3.7% M/M; MEDIAN +5.4%; MAR +4.5%

AUSTRALIAN APR INVESTOR LOAN VALUES +2.1% M/M; MAR +14.3%

AUSTRALIAN APR OWNER-OCCUPIED HOME LOAN VALUES +4.3% M/M; MAR +1.4%

NEW ZEALAND Q1 CONSTRUCTION WORK +3.7% Q/Q; MEDIAN +3.0%; Q4 -0.5%

CHINA MARKETS

PBOC SETS YUAN CENTRAL PARITY AT 6.4072 FRI VS 6.3811 THU

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a third trading days at 6.4072 on Friday, compared with the 6.3811 set on Thursday.

PBOC INJECTS CNY10 BLN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information. The operation aims to keep liquidity reasonable and ample, the PBOC said on its website. The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1955% at 09:23 am local time from the close of 2.0618% on Thursday. The CFETS-NEX money-market sentiment index closed at 48 on Thursday vs 33 on Wednesday.

MARKETS

SNAPSHOT: Jobs On The Mind

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 105.42 points at 28950.71

- ASX 200 up 35.751 points at 7295.9

- Shanghai Comp. up 5.071 points at 3589.283

- JGB 10-Yr future down 7 ticks at 151.42, yield up 0.1bp at 0.085%

- Aussie 10-Yr future down 2.5 ticks at 98.365, yield up 2.9bp at 1.694%

- U.S. 10-Yr future up 0-00+ at 131-19+, yield down unch. at 1.625%

- WTI crude down $0.07 at $68.74, Gold down $1.84 at $1869.06

- USD/JPY down 6 pips at Y110.23

- FED'S WILLIAMS: US ECONOMY 'QUITE A WAY OFF' FROM TAPERING ASSET PURCHASES (YAHOO)

- WHITE HOUSE: NO MONDAY DEADLINE ON INFRASTRUCTURE PLAN

- UK'S WORK FROM HOME ADVICE COULD CONTINUE BEYOND JUNE 21 (TELEGRAPH)

- EU COULD RETALIATE AGAINST BRITAIN OVER NI PROTOCOL, COVENEY WARNS (IRISH TIMES)

- ANALYSTS SAY EXPECTATION OF YUAN APPRECIATION HAS ABATED (CSJ)

BOND SUMMARY: Westpac's RBA Watcher Steals The Headlines

T-Notes held to a 0-02 range overnight, sitting at the lower end of Thursday's range, last +0-01 at 131-20, on volume of ~60K. Cash Tsys sit unchanged to 0.5bp cheaper across the curve, with little in the way of tier 1 headlines crossing in Asia. Focus is squarely on Friday's NFP print, which comes in the wake of strong U.S. labour market data, although many continued to question the link between the ADP employment print and headline NFP reading.

- JGB futures drifted lower during the morning session, with participants looking to Thursday's cheapening in U.S. Tsys & the proximity to next Tuesday's 30-Year JGB supply. The contract last prints 7 ticks below settlement levels, with the major cash JGB benchmarks running little changed to ~1.0bp cheaper on the day (10s and 20s were the flat prints). The latest round of domestic household spending data was firmer than expected, but there has been little in the way of notable headline flow to trade off.

- Aussie bonds cheapened a little, aided by Westpac's Bill Evans tweaking his RBA call. Evans suggested that "the RBA Board is likely to decide that there will be no extension of the YCT to the November 2024 bond at the July Board meeting because such action would imply no tightening till 2025." He did stress that "Westpac disagrees with that interpretation but cannot dispute the resulting decision." He previously expected the YCT to be extended to ACGB November 2024 and was perhaps the last remaining major voice in that camp. On the broader bond buying scheme Evans suggested that "the QE program has now matured to allow the Board more flexibility going forward. We expect the Governor to announce an open-ended A$5 billion per week purchase program to be reviewed later in 2021 to be introduced following the completion of QE2. Given the confidence the RBA has in the QE program and Australia's low relative use of QE we continue to expect that the ultimate level of additional purchases will reach A$150 billion which we have advocated for some time." The move in futures was fairly limited, with contracts now off lows, YM -2.5 and XM -3.0. 3s cheapened by ~4.5bp in cash ACGB trade, providing the weak point on the curve. Elsewhere, the AOFM weekly issuance looks thin, while today's ACGB Nov '25 auction printed 0.76bp through prevailing mids at the time of supply, with the cover ratio printing at a comfortable ~3.5x.

EQUITIES: Mostly Lower After Negative Lead From US

Another mixed day in Asia-Pac equity markets after a negative lead from the US as strong data fueled concerns stimulus will be withdrawn. Markets in Japan are lower, data earlier showed household spending rose 13.0% Y/Y in April, above estimates of 8.7%. Markets in mainland China are modestly lower, US President Biden signed an order yesterday which amends a ban on US investment In Chinese companies with military links, extending a Trump era policy. Markets in Taiwan and South Korea are lower, weighed down by tech stocks after the Nasdaq lagged its peers on Thursday. US futures also slightly softer, markets await NFP data later in the session.

GOLD: Back To Unchanged After Hitting Air Pocket In Asia

Spot has recovered to trade at nearly unchanged levels ($1,869/oz) after hitting a bit of an air pocket during Asia-Pac hours, as it broke through Thursday's low and then technical support in the form of the May 20 low, bottoming out at $1,856/oz. Gold has struggled over the last 24 hours, with the broader U.S. dollar pushing higher over that horizon, while U.S. real yields also ticked higher. This dynamic came about on the back of stronger than expected U.S. labour market data (initial jobless claims and ADP employment) ahead of today's NFP print. Some have questioned the link between the ADP & NFP releases, but the latter will no doubt shape broader price action on Friday.

OIL: Crude Futures Lower, But On Track For Second Weekly Gain

Oil is lower in Asia-Pac trade on Friday, WTI is down $0.28 from settlement levels at $68.53/bbl while Brent is up $0.35 at $70.96/bbl. Crude futures are under pressure from a stronger dollar but still on track for a second straight weekly gain as robust performance earlier in the week took the benchmarks to the highest since 2018. Prices are supported by a draw in headline DOE crude stocks, inventories fell 5.08m bbls, double the expected draw, downstream figures were less bullish.

FOREX: Rangey In Pre-NFP Lull

Limited movement with narrow ranges ahead of US NFP later today. AUD/USD and NZD/USD both hovered around neutral.

- In Australia notes from Westpac and NAB garnered some attention with Westpac predicting the RBA will change to a flexible QE regime and NAB forecasting the RBA will not roll its YCC forwards to Nov 2024.

- In New Zealand data earlier showed construction work done rose 3.7% in Q1 against estimates of 3.0%.

- JPY stronger, USD/JPY down 8 pips while EUR/JPY down 22 pips. Data earlier showed household spending rose 13.0% Y/Y in April, above estimates of 8.7%.

- Offshore yuan is slightly weaker, USD/CNH rising above 6.40 and breaking yesterday's high.There were reports in the China Securities Journal that analysts say expectations of yuan appreciation have abated, noting yuan is under pressure from seasonal FX demand from overseas-listed Chinese companies for dividend payments.

FOREX OPTIONS: Expiries for Jun04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E669mln), $1.2150(E603mln), $1.2185-1.2200(E1.2bln-EUR puts)

- USD/JPY: Y107.90-00($800mln), Y109.90-00($796mln)

- EUR/GBP: Gbp0.8550(E680mln)

- AUD/USD: $0.7730-50(A$1.4bln), $0.7780-0.7800(A$1.1bln-AUD puts)

- USD/CNY: Cny6.39($1.2bln), Cny6.40($1.0bln-USD puts), Cny6.41($630mln), Cny6.45($1.0bln-USD puts)

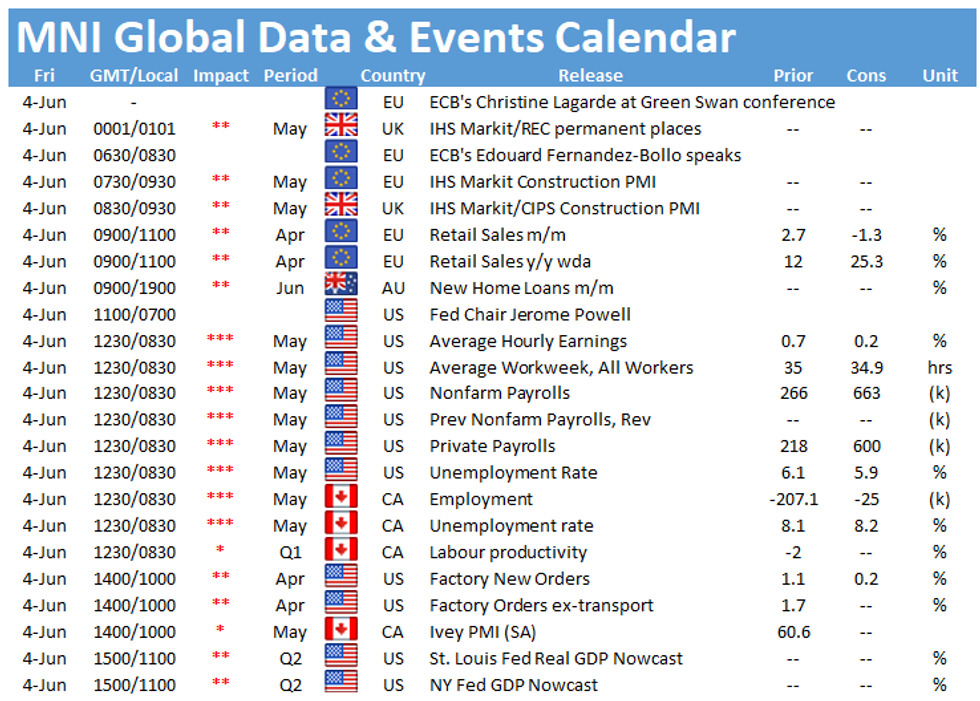

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.