-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Kuroda Signs Off With No Changes, SVB Fear Dominates Asia

EXECUTIVE SUMMARY

- BOJ KEEPS YCC, MAINTAINS FORWARD GUIDANCE ON RATES (MNI)

- SVB TROUBLES REVERBERATE THROUGH ASIA

- ECB DEPOSIT RATE TO PEAK AT 3.75% OR HIGHER AS INFLATION STAYS STICKY (RTRS POLL)

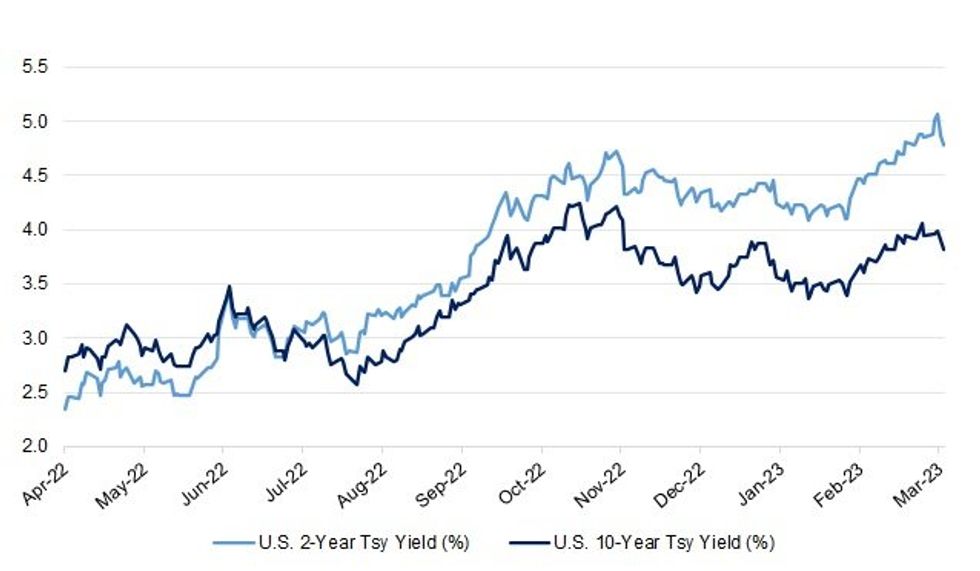

Fig. 1: U.S. 2-& 10-Year Tsy Yields

Source: MNI - Market News/Bloomberg

UK

FISCAL: Jeremy Hunt will have £166bn of headroom to cut taxes and invest in next week's Budget, according to one of Britain's leading economic think tanks. (Telegraph)

EUROPE

ECB: The peak for European Central Bank interest rates will be much higher than thought only a month ago, according to economists polled by Reuters, and they added that stubbornly high inflation would push policymakers to be more aggressive. (RTRS)

FRANCE: Opposition to French President Emmanuel Macron’s plan to reform the pension system has risen to its highest level yet, according to the latest survey by pollster BVA for RTL radio published on Thursday. (BBG)

RATINGS: Sovereign credit rating reviews of note scheduled for after hours on Friday include:

- Fitch on Belgium (current rating: AA-; Outlook Stable) & Cyprus (current rating: BBB-; Outlook Stable)

- S&P on Norway (current rating: AAA; Outlook Stable) & Portugal (current rating: BBB+; Outlook Stable)

- DBRS Morningstar on Greece (current rating: BB (high), Stable Trend)

U.S.

FED: The Federal Reserve should keep open the option to revert to a 50-basis-point rate increase in March if upcoming data on jobs and inflation corroborate a burst of strength early this year, former Fed Vice Chair Donald Kohn told MNI. (MNI)

ECONOMY: President Joe Biden’s proposed budget expects inflation to cool further, but it predicts that the historically low US unemployment rate — which the administration has put at the heart of its economic appeal — will start to climb. (BBG)

ECONOMY: U.S. household wealth rose in the final three months of last year to snap two straight quarterly declines in net worth as consumer balance sheets were strengthened by a late-year recovery in the stock market. (RTRS)

FISCAL: President Biden’s third budget proposal released Thursday touts nearly USD3 trillion in new deficit reduction over the next ten years on tax increases, but still manages to average a 5.2% deficit to GDP thru 2033, above the prepandemic path. (MNI)

FISCAL: President Biden on Thursday said he was ready to meet again with Speaker Kevin McCarthy (R-Calif.) as soon as he makes public GOP priorities for the budget after Biden released his proposal for next fiscal year. (The Hill)

EQUITIES: An explosion in trading in a type of equity derivative security in recent months has prompted Wall Street players and a major clearing house to examine the potential risks it poses, according to two sources familiar with the matter. (RTRS)

BANKS: Peter Thiel’s Founders Fund and several other high-profile venture capital firms advised their portfolio companies to pull money from Silicon Valley Bank on Thursday, responding to panic about the bank’s financial situation in tech startup circles. (BBG)

BANKS: The US government should consider a “highly dilutive” bailout of SVB Financial Group if a private capital solution can’t be provided, according to Pershing Square founder Bill Ackman. (BBG)

OTHER

GLOBAL TRADE:The European Union stands ready to coordinate a bloc-wide approach to export controls on advanced chips, following a decision by the Netherlands to restrict some of its supplies, according to a senior official. (BBG)

GLOBAL TRADE: Brussels has cleared the way for a subsidy race with the US over crucial technologies, allowing EU member states to “match” multi-billion dollar incentives as they fight to keep projects in Europe. (FT)

U.S./CHINA: The US is working to close a loophole in restrictions imposed on Inspur Group that leaves American companies such as Intel Corp. free to keep supplying the Chinese server maker’s affiliates. (BBG)

U.S./CHINA: The Biden administration’s proposed budget for the fiscal year beginning Oct. 1 asks for billions more dollars to boost its Indo-Pacific military command, enhance missile defense and strengthen regional economies, as part of a broader push to counter China’s more assertive role in the region. (BBG)

BOJ: Japan’s Upper House of the Diet on Friday approved economist and former Bank of Japan board member Kazuo Ueda as the BOJ’s next governor to replace Haruhiko Kuroda, whose term ends on April 8. (MNI)

BOJ: The Bank of Japan board left monetary policy settings unchanged at its last meeting under Governor Haruhiko Kuroda on Friday, stating the economy continued moving in line with its baseline scenario despite lingering downside risks and high uncertainties. (MNI)

BOJ: Japan must discuss the handling of the 2013 joint statement between the government and the Bank of Japan with the new central bank governor, Tokyo's top spokesperson said on Friday. (RTRS)

JAPAN: Japan plans to add nine new fields, including semiconductors and storage batteries, to the list of "core" business sectors that require tougher pre-screening for foreign investors. (Nikkei)

NORTH KOREA: North Korea said on Friday its military unit conducted a "fire assault drill" on Thursday which proved its capability to counter "an actual war," its state media reported, after South Korea said North Korea fired a missile off its west coast the previous day. (RTRS)

BOC: The Bank of Canada signaled Thursday that policymakers are willing to diverge from more hawkish G7 peers with a plan to stop raising interest rates, saying domestic inflation is lower and on track to return to target, while making no reference to any potential weakness in Canada's dollar as a result. (MNI)

BRAZIL: Mounting concerns about a possible credit crunch and slowing economic activity in Brazil are prompting traders to bet the central bank will be forced to cut interest rates faster than initially thought, even as inflation expectations remain above target. (BBG)

BRAZIL: Brazilian state development bank BNDES will never be negligent or passive regarding the multibillion-dollar accounting scandal of retailer Americanas case, its chief executive Aloizio Mercadante said on Thursday. (RTRS)

RUSSIA: German Chancellor Olaf Scholz can detect no willingness on the part of Russian President Vladimir Putin to negotiate an end to the war in Ukraine, he told the NBR group of German newspapers. (RTRS)

PERU: Peru's central bank maintained its benchmark interest rate steady at 7.75% on Thursday, as monetary policymakers in the copper-producing Andean nation battle the highest inflation in a quarter of a century. (RTRS)

PERU: Recently ousted former Peruvian President Pedro Castillo was given three years of pre-trial detention on Thursday for allegedly working to rig public works contracts while in office. (BBG)

ARGENTINA/RATINGS: S&P lowered Argentina’s local currency rating to 'SD' on another distressed exchange; CCC+ foreign currency rating affirmed

IRAN: The United States on Thursday imposed sanctions on 39 entities, including many based in the United Arab Emirates and Hong Kong, that Washington said facilitate Iran's access to the global financial system, describing them as a "shadow banking" network that moves billions of dollars. (RTRS)

OIL: The US has privately urged some of the world’s largest commodity traders to shed concerns over shipping price-capped Russian oil, in a bid to keep supplies stable and regain some oversight of Moscow’s exports. (FT)

OIL: Oil flows on TC Energy's Keystone pipeline will not change after the U.S. pipeline regulator said it would require the company to reduce pressure following a 13,000-barrel oil spill in Kansas in December, Chief Executive François Poirier told Reuters on Thursday. (RTRS)

CHINA

POLITICS: Chinese leader Xi Jinping gained an unprecedented third term as president of the country on Friday. (CNBC)

PBOC: The incoming People’s Bank of China governor’s immediate task will be to support a recovery amid sluggish domestic demand, while coordinating longer term with a new regulator to manage risks in a financial system burdened with debt after a decade of expansion, policy advisers told MN. (MNI)

INFLATION: February's 1.0% y/y increase in the Consumer Price Index should be the lowest result this year, as the economy recovers and prices of housing and services increase, according to the Securities Daily. (MNI)

POLICY: Beijing’s plans to establish a new National Data Bureau to oversee regulation on data collection and sharing will lead to enhanced public services, more digitalisation, and speed up construction of smart cities, according to Xinhua. (MNI)

FOREX: The premium to borrow the dollar in China has jumped to the highest since the pandemic due to demand for higher-yielding US assets, and a decline in the nation’s export earnings. (BBG)

BANKS: Small and medium sized banks in China are facing pressure to ensure asset quality and control risks, according to a financial expert interviewed by Shanghai Securities News on the sidelines of the National People’s Congress. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY3 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) conducted CNY15 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY3 billion after offsetting the maturity of CNY18 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 09:25 am local time from the close of 1.9330% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 59 on Thursday, compared with the close of 44 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9655 FRI VS 6.9666 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9655 on Friday, compared with 6.9666 set on Thursday.

OVERNIGHT DATA

JAPAN FEB PPI +8.2% Y/Y; MEDIAN +8.4%; JAN +9.5%

JAPAN FEB PPI -0.4% M/M; MEDIAN -0.3%; JAN 0.0%

JAPAN JAN HOUSEHOLD SPENDING -0.3% Y/Y; MEDIAN -0.1%; DEC -1.3%

NEW ZEALAND Q4 MANUFACTURING ACTIVITY -0.4% Q/Q; Q3 +5.0%

NEW ZEALAND Q4 MANUFACTURING ACTIVITY VOLUME -4.7% Q/Q; Q3 +2.6%

NEW ZEALAND FEB BUSINESSNZ MANUFACTURING PMI 52.0; JAN 51.2

New Zealand’s manufacturing sector experienced a further increase in expansion, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI). (BusinessNZ)

SOUTH KOREA JAN BOP GOODS BALANCE -US$7.4613BN; DEC -US$475.0MN

SOUTH KOREA JAN BOP CURRENT ACCOUNT BALANCE -US$4.5167BN; +US$2.6772BN

MARKETS

US TSYS: Firmer In Asia As SVB Worry Takes Hold, NFP In Focus

TYM3 deals at 112-09+, +0-26, a touch off the top of the observed 0-24+ range on very heavy volume of ~389K.

- Cash Tsys sit 6-10bps richer across the major benchmarks, the curve has bull steepened, building on Thursday's move.

- Continued weakness in U.S. equity futures, with that move centred on concerns re: the U.S. bank sector, has aided the bid in Tsys, with pre-NFP positioning also in play (given the focus on fresh short setting in the wake of Fed Chair Powell's comments earlier this week).

- The BOJ's decision to leave policy settings unchanged provided a further leg of support (this was the consensus view, but the unwind of hedging against a hawkish step added legs to a rally in JGBs that was already underway pre-decision).

- TYM3 took out resistance levels at 20 day EMA (111-31+) and 112-03 (24 Feb high). Initial resistance moves up to the Feb 17 high (112-18).

- S&P500 e-minis breached the 2 March low and bear trigger at 3,925.00 the break confirmed a resumption of the bear leg which started on Feb 2.

- UK GDP headlines in Europe. February's NFP print provides today's highlight, our preview is here.

JGBS: 10s Lead Post-BoJ Rally As Kuroda Leaves Policy Unchanged At Final Meeting

JGBs were notably richer on Friday, with the initial bid derived from the wider risk-off feel evident since NY hours developing further as the BoJ left its monetary policy settings unchanged.

- While the clear consensus looked for no change in the Bank’s monetary policy settings, the degree of conviction displayed in that view was highly variable as this was BoJ Governor Kuroda’s final monetary policy meeting, with the spectre of December’s surprise YCC tweak adding an extra layer of uncertainty.

- Post-BoJ decision moves looked very much like an unwind of hawkish plays, with futures over 100 ticks higher on the day (albeit not anywhere near meaningful resistance after the recent re-establishment of a technical downtrend).

- Cash JGBs are 1-11bp richer, with 10s now leading the move, sitting around the 0.39% mark after operating around the BoJ’s 0.50% YCC cap pre-decision. No change in tone of the BoJ’s post-meeting statement was key, with Kuroda playing a straight bat as he prepares to hand control over to Ueda (as opposed to tweaking policy to facilitate a ‘smoother’ handover and less pressure on Ueda).

- Swap spreads are now tighter out to 5s but wider beyond that, after swaps initially outperformed bonds into the BoJ decision.

- Kuroda’s final post-meeting press conference will get underway shortly.

AUSSIE BONDS: Strong Rally Ahead Of U.S. Payrolls

ACGB's close at highs (YM +10.8 & XM 12.6) with the wider risk-averse tone (centred on worry in the U.S. banking sector) setting the stall out for the space. Cash ACGBs close 10-12bp richer with the 3/10 curve 2bp flatter and AU/US 10-year yield differential +4bp at -24bp versus its cyclical low of -32bp intraday yesterday.

- Swap rates fell 12-17bp, although the move faded from extremes, particularly at the short-end.

- Similarly, Bills were stronger but off session bests with closes +4-10bp.

- RBA dated OIS softens 6-13bp for meetings beyond June with terminal rate expectations holding below 4.0% level at 3.98%. Notably, pricing for April declined to less than a 50% chance of a 25bp hike.

- With February Non-Farm Payrolls due in the overnight session, the market will stay tuned to developments in U.S. Tsys through the release. With data dependency the flavour of the week for the Fed, the market-moving potential of the data should not be underestimated.

- Beyond that, next week delivers February U.S. CPI (Tue), and February NAB Business Confidence (Tue) and Employment (Thu) in Australia. Attention to these releases will be amped up given the RBA's explicit focus on these data prints.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 14 March it plans to sell A$100mn of the 1.25% August 2040 Indexed Bond.

- On Thursday 16 March it plans to sell A$1.0bn of the 26 May 2023 Note, A$1.0bn of the 21 July 2023 Note & A$500mn of the 8 September 2023 Note.

- On Friday 17 March it plans to sell A$1.0bn of the 3.75% 21 May 2034 Bond.

NZGBS: Rally But Lag Tsys

NZGBs close at best levels with yields 9bp lower across the curve in line with a strong extension rally in U.S. Tsys in Asia-Pac trade as the market eyes softer equities (on the back of worries surrounding the U.S. banking sector) ahead of U.S. Non-Farm Payrolls tonight. On a relative basis, NZGBs underperform U.S. Tsys but tread water against ACGBs with the NZ/US 10-year yield differential +5bp and the NZ/AU at +84bp versus its 8-year high (+90bp) struck yesterday intraday.

- Swaps close at the richest levels with rates 11-12bp lower, implying tighter swap spreads, with the 2s10s curve unchanged.

- RBNZ dated OIS soften 5-6bp for meetings beyond July. Terminal OCR expectations pull back to 5.58% but remain above RBNZ’s projected OCR peak of 5.50%.

- On the local data front, expansion in the February Business NZ Manufacturing PMI quickened, as the headline index its highest reading in 5 months, but Q4 Manufacturing Volumes declined 4.7% Q/Q after a revised +2.6% in Q3.

- Next week sees a raft of releases locally with Q4 Current Account (Wed) and Q4 GDP (Thu) the highlights. BBG consensus for Q4 GDP is currently -0.2% Q/Q and +3.3% Y/Y.

- In the interim, the market will surely stay focused on U.S. Tsys through Non-Farm Payrolls tonight while eyeing global equity moves.

EQUITIES: A Sea Of Red

Thursday’s risk negative-tone surrounding the troubles of Silcon Valley Bank reverberated through the Asia-Pac session, weighing on equities.

- E-minis extended on Thursday’s declines, with the S&P 500 contract below the 3,900 level after it breached a technical bear trigger. The contract operates a touch above its Asia-Pac base, last -0.7%, with any fresh extension lower set to turn focus towards the early January lows.

- The major Asia-Pac equity indices are comfortably in the red.

- The Hang Seng is the weakest, running 2.5% softer ahead of the weekend, while the Nikkei 225 (on the BoJ’s decision to stand pat) and CSI 300 were quick to unwind some relief rallies, before pushing onto fresh session lows thereafter.

- Japanese financials were particularly pressured in lieu of the BoJ decision, after the recent run of outperformance surrounding monetary normalisation hopes.

- Macro headline flow has been limited across Friday’s Asia-Pac decision, excluding the BoJ, leaving focus on Thursday’s headwinds for risk appetite.

GOLD: Thursday’s Rally Consolidated In Asia

Gold has benefited from the pullback in Fed terminal rate pricing, which sits nearly 25bp off of the peak pricing witnessed on the OIS strip just over 24 hours ago, operating just below 5.50%. This came in lieu of softer than expected U.S. labour market data and worry surrounding the U.S. banking sector given the troubles of Silicon Valley Bank.

- Spot gold has largely consolidated the gains registered on Thursday, last dealing little changed around the $1,830/oz mark.

- Technically, trend conditions in gold remain bearish after Tuesday’s strong sell-off reinforced this theme. The yellow metal needs to breach $1,858.3/oz, the Mar 6 high, to signal scope for a stronger bullish reversal.

- Known ETF holdings of gold have registered a fresh cycle low.

- Friday’s NFP report and any developments in the banking sector will set the tone ahead of the weekend.

OIL: Broader Risk-Negative Impulse Continues To Weigh In Asia

The risk-negative tone surrounding the U.S. banking sector applied further pressure to crude oil futures in Asia-Pac dealing, with Brent & WTI trading ~$0.50 softer apiece as a result. This builds on the weakness that was inspired by signs of more meaningful Fed tightening earlier in the week.

- Elsewhere, Russian oil export matters continue to catch the eye, with the FT reporting that “the US has privately urged some of the world’s largest commodity traders to shed concerns over shipping price-capped Russian oil, in a bid to keep supplies stable and regain some oversight of Moscow’s exports.”

- Friday’s NFP report and any developments in the banking sector will set the broader risk tone ahead of the weekend.

FOREX: Yen Pressured In Asia, CHF Outperforming

JPY is the weakest performer in the G-10 space at the margins. The Yen was pressured as the BOJ held policy unchanged today.

- USD/JPY prints at ¥136.60/70, ~0.3% firmer today. The pair rose from a touch below ¥136 handle, meeting resistance ahead of ¥137.00 before paring gains in the aftermath of the BOJ decision. The spike higher may have been facilitated by downside protection that was in play. In the lead up to the decision the 1-week risk reversal was at the lowest level since the depth of the initial COVID outbreak.

- Kiwi is ~0.2% firmer, NZD/USD prints at $0.6105/10. Early in the Asian session Feb Business NZ Mfg PMI printed 52.0 with the prior revised higher to 51.2. Q4 Manufacturing Activity fell -0.4% with the prior read revised lower to 5.0%.

- AUD/USD is a touch firmer at $0.6595/0.6600. The pair was pressured in early trade, printing a fresh 2023 low, as the fall in US and regional equities and an offer in AUD/NZD are weighed. However support was seen at $0.6565 and the pair pared losses.

- CHF is the standout in the G-10 space, USD/CHF is down ~0.4%. The pair broke its 20-Day EMA (0.9328), and broke through $0.93 to last print 0.9290/95.

- EUR and GBP are both a touch firmer as softer US Treasury Yields marginally weigh on the USD.

- US Treasury Yields have ticked lower in Asia, 10 Year Yields is down ~9bps. S&P500 E-minis sit ~0.8% lower today, and the Hang Seng is ~2.5% lower.

- UK GDP headlines in Europe. Further out February's NFP print provides today's highlight, our preview is here

FX OPTIONS: Expiries for Mar10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.5bln), $1.0525-30(E1.4bln), $1.0550-65(E1.5bln), $1.0600-20(E1.2bln), $1.0660-65(E1.1bln), $1.0695-00(E616mln)

- USD/JPY: Y135.00($606mln), Y136.00($2.6bln)

- AUD/USD: $0.6750(A$746mln), $0.6800-20($1.0bln)

- AUD/NZD: N$1.0750(A$914mln)

- USD/CAD: C$1.3710($618mln)

- USD/CNY: Cny6.9500($573mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/03/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 10/03/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 10/03/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 10/03/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 10/03/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 10/03/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/03/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 10/03/2023 | 0745/0845 | * |  | FR | Foreign Trade |

| 10/03/2023 | 0900/1000 | ** |  | IT | PPI |

| 10/03/2023 | 0900/1000 |  | EU | ECB Panetta Presentation on Digital Euro | |

| 10/03/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 10/03/2023 | 1330/0830 | *** |  | US | Employment Report |

| 10/03/2023 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.