-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: No Deviation From The Focus On Inflation

EXECUTIVE SUMMARY

- FED’S JEFFERSON: UNDER 'NO ILLUSION' INFLATION FIGHT WILL BE QUICK (RTRS)

- ECB HAS STARTED TO WIN INFLATION FIGHT, LANE SAYS (RTRS)

- ECB MUST PERSEVERE WHILE INFLATION PERSISTS, VUJCIC SAYS (BBG)

- DUP GIVES GUARDED RESPONSE TO SUNAK’S NORTHERN IRELAND DEAL (FT)

- INCOMING BOJ DEPUTY HEAD BRUSHES ASIDE NEAR-TERM TWEAK TO EASY POLICY (RTRS)

- WHITE HOUSE SCALES BACK PLANS TO REGULATE U.S. INVESTMENTS IN CHINA (POLITICO)

- RUSSIA WILL NOT RESUME START NUCLEAR TALKS UNTIL WASHINGTON LISTENS TO MOSCOW (RTRS)

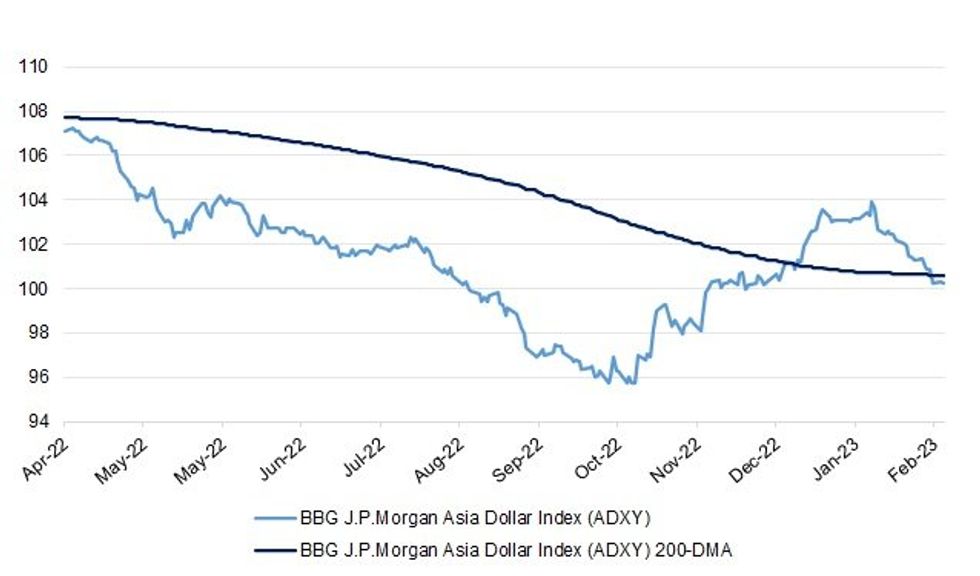

Fig. 1: BBG J.P.Morgan Asia Dollar Index (ADXY) Vs. 200-DMA

Source: MNI - Market News/Bloomberg

UK

BREXIT: If the deal is accepted, the new changes would be phased in over the next few years. A parliamentary vote will take place once all parties have had time to study it. (RTRS)

BREXIT: David Davis, a former Brexit minister, said Sunak had pulled off a "formidable negotiating success", although there has been speculation in Westminster that Boris Johnson could oppose the deal. A source close to the former prime minister said he was studying and reflecting on the proposal. (RTRS)

BREXIT: Northern Ireland’s biggest unionist party on Monday gave a guarded initial response to the Brexit deal struck by Rishi Sunak with the EU on revised trading arrangements for the region, saying “key issues of concern” remained. (FT)

BREXIT: Downing Street is pleased with how the new Brexit deal for Northern Ireland has gone down so far. In the House of Commons on Monday evening, there was a blanket of warm words from most MPs. From a former Prime Minister, Theresa May. From a former Brexit Secretary, David Davis. From Labour. From the Scottish National Party. But those around the prime minister attach particular significance to two words from the leader of the Democratic Unionist Party (DUP). (BBC)

BREXIT: Businesses groups in Northern Ireland have expressed hope over the announcement of a new deal on post-Brexit trade. (BBC)

FISCAL/ECONOMY/POLITICS: The UK government has been accused of engaging in “distraction” tactics by claiming that raising public-sector pay would add to inflation. (BBG)

EUROPE

ECB: Euro zone inflation pressures have begun to ease, including for all-important core prices, but the European Central Bank will not end rate hikes until it is confident price growth is heading back towards 2%, ECB Chief Economist Philip Lane said. (RTRS)

ECB: The European Central Bank must push on with monetary-policy tightening while price pressures endure, according to Governing Council member Boris Vujcic. (BBG)

EUROPE: German Defense Minister Boris Pistorius will only get at most half the extra cash he wants in his budget for next year, according to people involved in the government’s financial planning for 2024. (BBG)

U.S.

FED: U.S. Federal Reserve governor Philip Jefferson said he had "no illusion" that inflation would quickly fall back to target and was committed to keeping restrictive monetary policy in place for as long as needed to make sure price stability is restored. (RTRS)

FED: Former Kansas City Fed President Thomas Hoenig told MNI the U.S. central bank might need to raise interest rates more than investors expect because demand remains strong and monetary policy is still loose compared with the rate of inflation. (MNI)

ECONOMY: Treasury Secretary Janet Yellen said Monday she believes US inflation remains too high but that a soft landing is on the radar. (CNN)

EQUITIES: Companies that receive federal subsidies from a $39 billion program to support semiconductor manufacturing will be required to meet strict financial conditions, including in some cases sharing unforeseen profits with the government, according to a document viewed by The New York Times. (New York Times)

OTHER

CENTRAL BANKS: A new era of global shortages including of commodities and productive workers will require permanently higher central bank interest rates, former top BIS and OECD official Bill White told MNI. (MNI)

GLOBAL TRADE: The European Investment Bank urged EU member states to support an expansion of its green financing as the continent considers how to respond to US President Joe Biden’s green subsidy program. (BBG)

U.S./CHINA: Despite fraying relations with Beijing, President Joe Biden is expected to forego expansive new restrictions on American investment in China, denying a push by some hawks in his administration and in Congress. (POLITICO)

U.S./CHINA: The White House on Monday gave government agencies 30 days to ensure they do not have Chinese-owned app TikTok on federal devices and systems. (RTRS)

GEOPOLITICS: Foreign ministry officials from China and Russia held a discussion Monday on Asian affairs in Beijing, according to a MOFA statement. The two sides exchanged views on topics including regional cooperation and situation in Asia, and agreed to enhance communication and coordination regarding Asian affairs. (BBG)

BOJ: Incoming Bank of Japan (BOJ) Deputy Governor Shinichi Uchida on Tuesday brushed aside the chance of an immediate overhaul of ultra-loose monetary policy, suggesting that any review of its policy framework could take about a year. (RTRS)

BOJ: Incoming Bank of Japan (BOJ) Deputy Governor Ryozo Himino said on Tuesday the central bank must focus on supporting the economy with ultra-loose monetary policy, despite the pain prolonged low interest rates inflict on financial institutions' profits. (RTRS)

BOJ: Bank of Japan Deputy Governor Masazumi Wakatabe reiterated policymakers’ assessment that the 2% inflation target hasn’t yet been achieved. (BBG)

BOJ: Bank of Japan officials are vigilant against weaker industrial production in the first quarter of 2023 as both exports and production are under pressure due to the slowing global economy and the shortage of semiconductors. (MNI)

JAPAN: Japan’s trimmed mean measure of underlying inflation rose 3.1% y/y in January, unchanged from December's 3.1% rise and steady at a record high pace as the pass-through of cost increases continued, data released by the Bank of Japan on Tuesday showed. (MNI)

AUSTRALIA: Australia’s government plans to double the tax on large pension balances to 30% from 2025-26, a change it says will impact less than 0.5% of account holders and make the system more sustainable. (BBG)

SOUTH KOREA: South Korea’s finance ministry, Bank of Korea, Financial Services Commission and Financial Supervisory Service agreed to closely monitor FX demand and supply situation to prevent herd behavior, according to emailed statement on Tuesday. (BBG)

HONG KONG: Hongkongers and tourists can go mask-free from Wednesday as the city finally lifts its last major Covid-19 restriction after almost three years. (SCMP)

MEXICO:The United States asked Mexico's government to extradite Ovidio Guzman, son of jailed drug boss Joaquin "El Chapo" Guzman, so that he can face criminal charges in a U.S. court, two Mexican government sources told Reuters on Monday. (RTRS)

BRAZIL: Brazil’s Central Bank President Roberto Campos Neto and Institutional Relations Minister Alexandre Padilha met this Monday to discuss central bank’s bills in Congress, the minister said in an audio released by his press-office. (BBG)

BRAZIL: Luiz Inacio Lula da Silva’s administration wants former President Jair Bolsonaro to appear before Brazilian courts in the next few months and is considering options to force him to return to the country if he doesn’t voluntarily come back by the end of March, according to a high-ranking adviser to the leftist leader. (BBG)

BRAZIL: Brazil's Treasury Secretary Rogerio Ceron said on Monday the government is carefully monitoring the credit market to ensure liquidity, adding possible measures for specific sectors and small and medium-sized companies are under preliminary discussion. Speaking at a news conference, he said the recomposition of the tax burden is important for discussions on fuels in the context of improving public accounts. (RTRS)

BRAZIL: The Brazilian government is set to resume the collection of federal taxes on fuels, but with different rates for fossil and biofuels, according to a column from local newspaper Folha de Sao Paulo citing a source. The taxes on fossil fuels will be higher than those levied on biofuels, said the report. (RTRS)

BRAZIL: Brazil finance ministry nominated Viviane Aparecida da Silva Varga and Otavio Ladeira de Medeiros to be head and back-up member of Petrobras’s Fiscal Council, respectively, the company said in a filing. (BBG)

RUSSIA: Ukrainian President Volodymyr Zelenskiy said in a nightly speech on Monday that his country can only defend its skies if an "aviation taboo" is ended. U.S. President Joe Biden said on Monday the new deal between British Prime Minister Rishi Sunak and the European Union on post-Brexit trade rules for Northern Ireland is an "essential step" to ensuring peace from the Good Friday Agreement is preserved. (RTRS)

RUSSIA: Kremlin spokesman Dmitry Peskov said in remarks published on Tuesday that Russia will not resume participation in the START nuclear arms treaty until Washington listens to Moscow's position. Speaking to the daily Izvestia, Peskov said also that NATO, "acts as a single bloc no longer as our conditional opponents, but as enemies." (RTRS)

RUSSIA: The US has every intention of supporting Ukraine in order for it to achieve victory over Russia even though the Biden administration has resisted demands to provide it with F-16 fighter jets, National Security Council spokesman John Kirby said Monday. (BBG)

RUSSIA: China has been "anything but an honest broker" in efforts to bring peace to Ukraine, and "very clearly" has taken a side, U.S. State Department spokesman Ned Price said on Monday. (RTRS)

IRAN: Two Iranian warships docked in Rio de Janeiro on Sunday after Brazilian President Luiz Inacio Lula da Silva's government granted permission despite pressure from the United States to bar them. (RTRS)

COLOMBIA: Colombia’s education minister left the government in the first cabinet shakeup since President Gustavo Petro took office in August, as the leftist leader’s radical plans to reform the pension and health systems alienate key allies. (BBG)

METALS: Commodity trader Trafigura Group is in talks to buy aluminum from United Co. Rusal International PJSC, highlighting its willingness to strike new deals with Russian companies even as its biggest rival balks. (BBG)

METALS: Grasberg mines and mill are operating again after a disruption caused by a landslide at the Indonesian copper and gold complex, Richard Adkerson, CEO of operator Freeport-McMoRan, says at an industry conference. (BBG)

CHINA

ECONOMY: Income per capita in China grew by just 2.9% in real terms over 2022, after increasing by 8.1% a year earlier, returning to a growth rate similar to that of 2020 when China was battling COVID and introducing sweeping lockdowns and other restrictions. Per capita spending also decreased by 0.2% in real terms, according to data published by the National Bureau of Statistics (NBS) in its annual statistical communique on Tuesday. (RTRS)

ECONOMY: Shanghai’s economy will grow 5.3% in 2023, with consumption and investment playing an important role in driving high-quality development, according to a report by the Economic Research Institute of the Shanghai Academy of Social Sciences. (MNI)

ECONOMY: China will promote digital sector’s integration with the real economy to bolster economic growth, Xinhua reports, citing guideline released by the central committee of the Communist Party and the State Council. (BBG)

FISCAL: Local government bond issuance was CNY643.5 billion in January, according to the Ministry of Finance. China Securities News said data for February was also high, with CNY576.1 billion issued so far, including CNY335.753 billion yuan of new special bonds. (MNI)

INFLATION: China’s CPI may rise about 2% in February with food price gains narrowing and PPI deflating, Securities Daily reports, citing analysts. (BBG)

CREDIT: New loans in China may fall to 1.6t yuan in Feb. from record-high 4.9t yuan in Jan., according to a Securities Daily report citing two analysts. (BBG)

PROPERTY: China Evergrande Group, the developer at the epicenter of the country’s real estate crisis, has yet to reach an agreement with major creditors on a debt restructuring framework crucial to avoiding potential court- ordered asset liquidation, people familiar with the matter said. (BBG)

PROPERTY: Second hand property transactions in Shenzhen last week were up 24.4% y/y, indicating upward momentum in the local property market, according to the Securities Times.(MNI)

FUNDS: China’s banks and asset managers are turning to an old yet potentially risky accounting maneuver to attract buyers for their investment funds after a rout in the bond market triggered waves of redemptions last year. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY331 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) conducted CNY481 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY331 billion after offsetting the maturity of CNY150 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable towards the end of month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2058% at 9:48 am local time from the close of 2.2946% on Monday.

- The CFETS-NEX money-market sentiment index closed at 49 on Monday, compared with the close of 47 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9519 TUES VS 6.9572 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9519 on Tuesday, compared with 6.9572 set on Monday.

OVERNIGHT DATA

JAPAN JAN, P INDUSTRIAL PRODUCTION -4.6% M/M; MEDIAN -2.9%; DEC +0.3%

JAPAN JAN, P INDUSTRIAL PRODUCTION -2.3% Y/Y; MEDIAN -0.7%; DEC -2.4%

JAPAN JAN RETAIL SALES +1.9% M/M; MEDIAN +0.4%; DEC +1.1%

JAPAN JAN RETAIL SALES +6.3% Y/Y; MEDIAN +4.0%; DEC +3.8%

JAPAN JAN DEPARTMENT STORE & SUPERMARKET SALES +5.3% Y/Y; DEC +3.6%

JAPAN JAN HOUSING STARTS +6.6% Y/Y; MEDIAN +1.1%; DEC -1.7%

JAPAN JAN ANNUALISED HOUSING STARTS 0.893MN; MEDIAN 0.850MN; DEC 0.846MN

AUSTRALIA Q4 BOP CURRENT ACCOUNT BALANCE +A$14.1BN; MEDIAN +A$5.5BN; Q3 +A$0.8BN

AUSTRALIA Q4 NET EXPORTS OF GDP +1.1%; MEDIAN +1.3%; Q3 +0.2%

AUSTRALIA JAN RETAIL SALES +1.9% M/M; MEDIAN +1.5%; DEC -4.0%

AUSTRALIA JAN PRIVATE SECTOR CREDIT +0.4% M/M; MEDIAN +0.3%; DEC +0.3%

AUSTRALIA JAN PRIVATE SECTOR CREDIT +8.0% Y/Y; DEC +8.3%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 80.0; PREV 80.4

Consumer confidence remained virtually unchanged last week with a slight fall from the week before. This is the third consecutive week with confidence among the worst ten results since the COVID outbreak in Australia. Among those paying off their mortgage, confidence dropped sharply (-4.4pts), to its lowest level since early April 2020 and to 11pts below the average for all housing cohorts. Confidence about current and future economic conditions are at their lowest level since November 2022, while current financial conditions was at its worst level since December 2022. Future financial conditions rose 0.9pts in the week. (ANZ)

NEW ZEALAND FEB ANZ BUSINESS CONFIDENCE -43.3; JAN -52.0

NEW ZEALAND FEB ANZ BUSINESS ACTIVITY OUTLOOK -9.2; JAN -15.8

February saw a further lift in all activity indicators in the ANZ Business Outlook survey, though many remain at very subdued levels compared to historical averages. (ANZ)

UK FEB LLOYDS BUSINESS BAROMETER 21; JAN 22

MARKETS

US TSYS: Marginally Cheaper In Asia

TYM3 deals at 111-17+, -0-02, a touch off the base of a narrow 0-04+ range on volume of ~56K.

- Cash Tsys sit 1-2bp cheaper across the major benchmarks, mild bear flattening has been observed.

- Tsys pulled back from best levels seen in early Asia cash dealing as a similar move in ACGBs spilled over. There was no headline driver for the move.

- Narrow ranges were observed for the remainder of the session as Tsys struggled to recover from session lows.

- Flow-wise a block seller (-3,812) in TU headlined.

- CPI and PPI data from France, and several BOE speakers headline in Europe. Further out we have Wholesale Inventories, and MNI Chicago PMI. Fedspeak from Chicago Fed President Goolsbee will also cross.

JGBS: Super-Long End Drives The Bid As Curve Flattens

The morning bid in JGBs extends through the afternoon.

- Early gains were inspired by comfortably larger than average estimates of month-end index extensions and spill over from the light bid seen in U.S. Tsys on Monday.

- That leaves JGB futures +20 ahead of the close, just shy of best levels.

- Wider cash JGBs run 1-9bp richer as the curve bull flattens, with desks still pointing to super-long demand from life insurers and pension funds ahead of the turn of the Japanese FY.

- Swap spreads were mixed across the curve, with the most pronounced moves coming in the form of widening in the super-long end.

- Comments from BoJ Deputy Governors in waiting, Himino & Uchida, failed to move the needle as they took part in their nomination hearings in front of the upper house of parliament. Ultimately, they didn’t stray too far from what they delivered to the lower house last week. The comments are moderate to slightly dovish when compared to the pre-hearing expectations that were in place last week (pushing back against an imminent need for policy tweaks, while being cognisant of side effects of policy settings). Ultimately, the new stewards of the BoJ should be a little more pragmatic, tipping its hat to the need to alter policy again at some point (when the inflation goal is reached), while supporting the deployment of current policy settings.

- 2-Year JGB supply was delayed by technical issues but cleared smoothly.

- The latest round of BoJ pooled collateral funding operations generated a cover of just over 3.00x.

- The BoJ will release its March Rinban schedule after market.

- Final manufacturing PMI data and an address from BoJ’s Nakagawa will cross on Wednesday.

JGBS AUCTION: 2-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.3338tn 2-Year JGBs:

- Average Yield -0.0270% (prev. -0.009%)

- Average Price 100.0650 (prev. 100.029)

- High Yield: -0.0240% (prev. -0.007%)

- Low Price 100.0600 (prev. 100.025)

- % Allotted At High Yield: 93.1818% (prev. 88.9171%)

- Bid/Cover: 4.112x (prev. 3.727x)

AUSSIE BONDS: Market Looks Through Upside Data Surprises To Slowing Trends

Despite stronger than expected prints for January retail sales, private sector credit and Q4 current account data (although a modest miss for net exports contribution to GDP), ACGBs deliver a post-data reversal to close nearer to Sydney session highs with YM +4.0 and XM +2.5. Cash benchmarks run 2-4bp richer with the 3/10 curve steepening 3bp.

- The AU/US cash 10-year yield differential closes -3bp at -8bp.

- 3s10s swaps curve bull steepens with rates 2-4bp lower.

- Bills were 1 cheaper to 4bp firmer through the reds, with only IRH3 finishing softer.

- RBA dated OIS gives back 2-5bp of yesterday’s +7-12bp firming for meetings beyond June, with terminal rate pricing back at 4.30% versus last week’s high of 4.35%.

- The market chose to look through today’s upside data surprises, instead focusing on the slowing underlying trends. Despite today’s beat, the volatile Nov-Jan period for retail sales leaves the average monthly change (+0.1% M/M) significantly slower than the average monthly change for the period Aug-Oct (+0.7% M/M). On the private credit front as well, today’s upside surprise did little to arrest the appreciable slowing in the monthly pace of credit growth from +0.9% in April last year to +0.4% in January.

- Tomorrow sees the release of Q4 GDP (BBG consensus forecast is +0.8% Q/Q) and the relatively new, but increasingly important, monthly read on the CPI. We will also hear from RBA's Jones.

AUSSIE BONDS: Nov-27 I/L Auction Results

The Australian Office of Financial Management (AOFM) sells A$100mn of the 0.75% 21 November 2027 Index Linked Bond, issue #CAIN414:

- Average Yield: 0.9175% (prev. 0.4782%)

- High Yield: 0.9200% (prev. 0.4850%)

- Bid/Cover: 5.8500x (prev. 3.4333x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 50.0% (prev. 9.1%)

- Bidders 47 (prev. 46), successful 7 (prev.16), allocated in full 5 (prev. 11)

NZGBS: Outperform Vs. $-Bloc Peers

NZGBs stage an across the curve strengthening with yields down 6-7bp at the close. With the local news light and U.S. Tsys flat in Asian trading, the cumulative rise in NZGB yields over the past week (+35-40bp) and the narrowing in the gap between market pricing and the RBNZ’s projected OCR path appear to be likely drivers of today’s rally, along with the lead from Monday's light richening in Tsys. NZGBs outperformed across the curve versus its $-bloc peers with the NZ/US cash yield differential narrowing 3bp in the 2-year and 5bp in the 10-year. Cash NZGB 10-year outperformed Australia by 4bp.

- Short to mid-curve swaps outperformed, with rates 5-7bp lower and the curve 5bp steeper.

- RBNZ dated OIS is 2-6bp lower across meetings with August leading as terminal rate pricing re-coiled from a level just shy of the RBNZ’s projected OCR peak of 5.50% to close at 5.43% (after touching the RBNZ's 5.50% projection yesterday). April meeting pricing is 2bp lower at 38bp of tightening.

- On the local docket, the ANZ Business Outlook Survey delivered an improvement but the underlying story of an economy with subdued confidence and high inflationary pressures remained. Moreover, the results are unlikely to fully reflect the impact of the recent cyclone.

- The local calendar delivers CoreLogic House Prices (Feb) and Building Permits (Jan) tomorrow. While the market is keen to get an update on the impact of RBNZ tightening, the data pre-dates much of the recent severe weather. Recent permit data had shown increasing caution from developers and purchasers.

EQUITIES: Early HK/China Strength Runs Out Of Steam

The early positive impulse to regional equities has given way to a more cautious stance as the session has progressed. The HSI is back to flat after being up by over 1% at one stage. Mainland indices are also back to slightly in the red. Trends are mixed elsewhere, although most indices are away from best levels. US futures are modestly positive, but only just.

- The early impetus was higher for China/HK stocks. An end to the mask mandate in HK aided sentiment early (although this was expected). Politico also reported that US President Biden won't ramp up investment restrictions into China, but instead focus on increased transparency. This is a positive, albeit at the margins.

- Gains ebbed as the session progressed. Tomorrow, we have important China PMI data for Feb, while this weekend the People's Congress begins. Hence this may be keeping some funds on the sidelines until we have greater clarity on the outlook.

- Elsewhere, the Kospi is +0.50% firmer, in line with better tech tone from Monday's session, but we are down from earlier session highs. The Nikkei is +0.12% higher at his stage.

- The ASX 200 is +0.46%, led by materials stocks, while better retail sales data, also helped staple stocks at the margin.

GOLD: Bullion Stabilising After A Weak Month Driven By Fed Hawkishness

Gold prices have stabilised this week rising 0.3% on Monday and are down 0.1% so far during APAC trading. Bullion has been in a narrow range and is currently around $1815.00/oz, close to the intraday low, after a reaching a high of $1819.43 earlier. The USD index is up 0.1% and US yields are marginally lower.

- Trend conditions for gold remain bearish and close to the 2023 lows as Fed talk remains hawkish. Bullion had been trending higher since November. Prices are now approaching the 100-day moving average after breaking through the 50-day earlier in February.

- Bloomberg is reporting that there were net outflows from gold-backed ETFs on every day in February except for three and that holdings are close to their lowest since April 2020.

- A number of second tier data releases are out in the US later today. There are the January trade balance and wholesale inventories, February consumer confidence, Chicago and Richmond indices, and December house prices. The Fed’s Goolsbee also speaks.

OIL: Another Disappointing Month As Fed Stays Hawkish & Russian Output Resilient

Oil has been trading in a very tight range today. WTI is currently up 0.3% after falling 0.7% on Monday. It is now around $75.90/bbl, close to its intraday high of $75.94 which followed a low of $75.55 earlier. Brent is trading around $82.60 and the USD index is up about 0.1%.

- Oil has been broadly range trading since December and that continued in February, although it is likely to be down again this month. The continued hawkish tone from the Fed and signs of persistent inflation pressures have weighed on crude, as the market remains concerned about the demand implications of further US tightening despite China’s reopening.

- Crude broke through both the 50-day and 100-day simple moving averages in February and it remains below them. The outlook is currently neutral.

- Bank of America is the latest to revise down its 2023 crude forecasts following a disappointing start to the year and resilient Russian output. It now expects Brent to reach $88 down from $100. (Bloomberg)

- A number of second tier data releases are out in the US later today. There are the January trade balance and wholesale inventories, February consumer confidence, Chicago and Richmond indices, and December house prices. The API data on US crude stocks also print. The Fed’s Goolsbee speaks and a number of BoE members later.

FOREX: USD Moderately Firmer In Asia

The USD has firmed through the Asian session as US Treasury Yields have marginally risen and US Equity futures and Regional Equities retreat from best levels.

- AUD/USD sits ~0.2% softer today, last printing at $0.6720/25. There was little follow through after the stronger than expected Jan Retail Sales print this morning, AUD initially firmed however couldn't hold its gains and deals a touch off session lows. There is a large option expiry, ~$800mn, at $0.6735 today.

- Kiwi is also pressured. NZD/USD prints at $0.6150/55, ~0.3% softer today. Feb ANZ Business Confidence continued to tick away from all time lows seen in December rising to -43.3 from -52.0. ANZ Activity Outlook rose to -9.2 from the prior read of-15.8.

- USD/JPY is a touch firmer, last printing at ¥136.30/40. The appearance of BoJ Deputy Governor-Nominees (Uchida & Himino) failed to move the needle as they reiterated comments given to the lower house last week. On the wires early in the session Jan Retail Sales printed 1.9% MoM vs 0.4% exp, preliminary read of Jan Industrial Production fell 4.6% vs exp -2.9%.

- EUR and GBP are moderately pressured as the Greenback advances. Both have given up some of the gains seen yesterday in the wake of the Brexit deal announcement.

- Cross asset flows are showing a mild risk-off tone. BBDXY is ~0.1% firmer and 10 Year US Treasury Yields are ~2bps higher. E-minis are flat, as they tick away from session highs, as is the Hang Seng.

- CPI and PPI data from France, and several BOE speakers headline in Europe. Further out we have Wholesale Inventories, and MNI Chicago PMI. Fedspeak from Chicago Fed President Goolsbee will also cross

FX OPTIONS: Expiries for Feb28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.3bln), $1.0520-30(E656mln), $1.0625-35(E559mln)

- USD/JPY: Y134.50-60($600mln), Y136.00($592mln), Y137.50($850mln)

- GBP/USD: $1.1850(Gbp854mln)

- AUD/USD: $0.7000-05(A$1.1bln)

- USD/CAD: C$1.3250($830mln), C$1.3415-25($650mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/02/2023 | 0700/0800 | ** |  | SE | PPI |

| 28/02/2023 | 0700/0800 | *** |  | SE | GDP |

| 28/02/2023 | 0745/0845 | ** |  | FR | Consumer Spending |

| 28/02/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 28/02/2023 | 0745/0845 | ** |  | FR | PPI |

| 28/02/2023 | 0745/0845 | *** |  | FR | GDP (f) |

| 28/02/2023 | 0800/0900 | *** |  | CH | GDP |

| 28/02/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 28/02/2023 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 28/02/2023 | 1015/1015 |  | UK | BOE Treasury Select Committee hearing: The crypto-asset industry | |

| 28/02/2023 | 1215/1215 |  | UK | BOE Pill Closes BEAR Research Conference | |

| 28/02/2023 | 1230/1230 |  | UK | BOE Mann Panellist at EIB Forum | |

| 28/02/2023 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 28/02/2023 | 1330/0830 | * |  | CA | Capital and repair expenditure survey |

| 28/02/2023 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/02/2023 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/02/2023 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 28/02/2023 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 28/02/2023 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 28/02/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/02/2023 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 28/02/2023 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 28/02/2023 | 1930/1430 |  | US | Chicago Fed's Austan Goolsbee | |

| 01/03/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.