-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - New EUR Highs on German Concessions

MNI EUROPEAN OPEN: No Fireworks

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* FINAL TRUMP-BIDEN DEBATE REVEALS LITTLE NEW

* KUDLOW: POLICY DIFFERENCES AMID COVID-19 TALKS APPEAR UNLIKELY TO GET RESOLVED (RTRS)

* FDA APPROVES GILEAD'S REMDESIVIR AS CORONAVIRUS TREATMENT (CNBC)

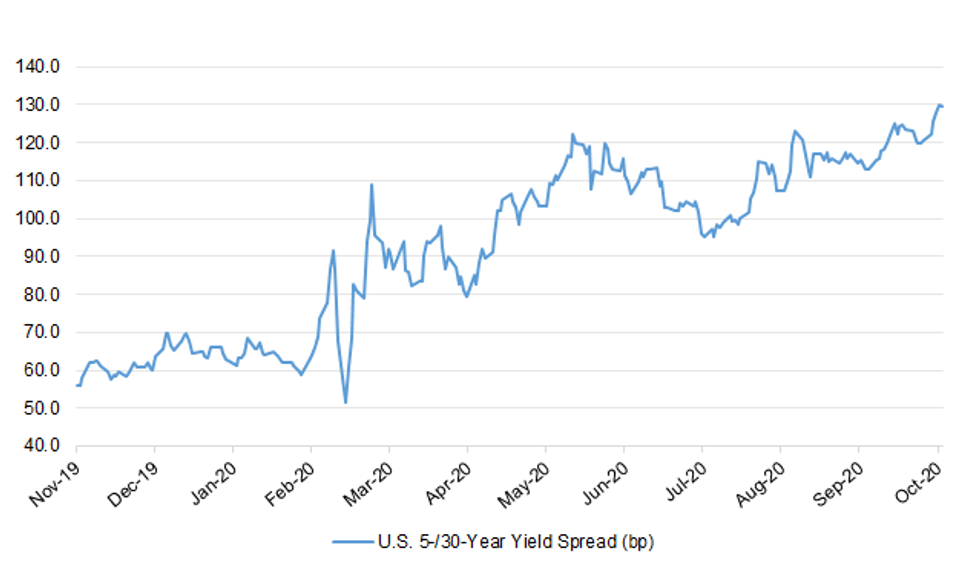

Fig. 1: U.S. 5-/30-Year Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Sir Patrick Vallance says he wont speculate on how successful a vaccine will be, but once that becomes clear then a plan can be made. "Clearly the aim of vaccination is to take most of the load of infection spread onto the vaccine in order to release other measures," he says, noting the speed of development so far is "remarkable". Boris Johnson says he really hopes there is progress on vaccines and it is "wonderful" that Sir Patrick is so confident. "But we can't just count on that which is why we have to do all the other things," he says. But another lockdown would be economically and psychologically damaging, he adds. (Telegraph)

FISCAL: More than £3bn might have been stolen in furlough money by criminal gangs and fraudulent employers, according to estimates used by parliament's spending watchdog in a report into the government's flagship jobs protection scheme. (FT)

FISCAL: Rishi Sunak's £13bn rescue plan will help protect 500,000 hospitality jobs but cannot prevent a winter crisis in the battered industry, bosses have said. (Telegraph)

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- S&P on the UK (current rating: AA; Outlook Stable).

EUROPE

ECB: Surging coronavirus infections and renewed lockdowns will prompt the European Central Bank to step up monetary stimulus later this year, according to economists surveyed by Bloomberg. Respondents predict 500 billion euros ($590 billion) will be added to the 1.35 trillion-euro pandemic bond-buying program, with most anticipating action in December. The Governing Council is seen keeping policy unchanged when it meets on Thursday to discuss the economic damage, though some analysts expect President Christine Lagarde to signal that more support is on the way. (BBG)

GERMANY: Germany faces a "tedious" recovery from the economic slump caused by the coronavirus that could take anywhere between 5 and 10 years, Marcel Fratzscher, who heads the Deutsches Institut fuer Wirtschaftsforschung economic institute, tells Sueddeutsche Zeitung. (BBG)

FRANCE: France reported more than 40,000 new cases for the first time, as the government prepares to expand curfews beyond Paris and some other big cities as the virus gained momentum. (BBG)

ITALY/BTPS: Italy plans to sell up to 2.5 billion euros ($3 billion) of zero bonds due Sep 28, 2022 in an auction on Oct 27. The sale is a reopening of previously issued securities with 3.827 billion euros outstanding. Currently the securities are being quoted at a price to yield of -0.216 percent. (BBG)

ITALY/BTPS: Treasury announces the results of syndicated exchange transaction, according to statement. Bought back EU2b of BTP 01/08/2021, EU2b BTP 01/05/2023, EU2b of BTP 01/08/2023, EU1.97b of BTP 01/10/2023, EU2b of CCTeu 15/01/2025. The settlement date of the transaction is set on Oct. 29. (BBG)

GREECE: Greece has announced a night-time curfew in 17 regions including Athens and Thessaloniki, the two largest cities, following another record daily increase in Covid-19 cases. (FT)

SNB: The Swiss National Bank could be forced to sell a chunk of its more than $100 billion U.S. stock portfolio as part of a campaign to ban it from investing in defense companies. A poll by gfs.bern for public broadcaster SRG on Friday showed 54% of voters in favor of the proposal, which goes to a national vote on Nov. 29. Such an outcome would forbid the central bank or pension funds from providing financing for a company that derives more than 5% of revenue from arms sales. The SNB estimates it'd have to sell stakes in 300 companies, which together are worth 11% of the value of its portfolio of global stocks. (BBG)

RISKBANK: The Riksbank governor, Stefan Ingves, fears the economic outlook is deteriorating amid signs the coronavirus pandemic is tightening its grip across Europe, and ensnaring Sweden again too. "If you look at our forecasts, it will take a few years before GDP is back" at pre-crisis levels, Ingves said in an interview in Stockholm. "And those forecasts were done before the rather bleak situation that we are seeing in Europe today, so there's reason to believe that the risks at the moment are skewed more to the downside." (BBG)

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- Fitch on the Netherlands (current rating: AAA; Outlook Stable).

- S&P on the EFSF (current rating: AA; Outlook Stable), Greece (current rating: BB-; Outlook Stable) & Italy (current rating: BBB; Outlook Negative).

- DBRS Morningstar on Greece (current rating: BB (Low); Stable Trend).

U.S.

FED: MNI POLICY: Fed Balance Sheet Grows to Record USD7.18 Trillion

- The Federal Reserve's balance sheet increased to a record USD7.177 trillion this week, just surpassing the previous mark set in June on holdings of Treasuries, data released Thursday showed - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: MNI INTERVIEW: US Slump Worsens On No Fiscal Aid: Ex-BLS Head

- The U.S. economy faces an even deeper downturn with a lack of fiscal stimulus cutting into consumer and business sentiment, ex-BLS Commissioner Erica Groshen told MNI. "The recessionary dynamic is now taking hold--the business cycle is actually getting worse right now," Groshen, who is also a former New York Fed staffer, said in an interview - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: White House economic adviser Larry Kudlow on Thursday said talks were continuing on a possible COVID-19 aid deal but that larger policy differences with Democrats were unlikely to be resolved with the Nov. 3 election less than two weeks away. "There are still significant policy differences," Kudlow told reporters at the White House. "Since they don't directly affect COVID safety or economic growth, why do we have to do that now? We're going to have an election..." to address policy issues, he said, adding that if there's agreement on aid for the unemployed, small businesses, airlines and schools, "let's just get that done." (RTRS)

FISCAL: Shelby, the appropriations committee chairman, said he had yet to see any details of the proposals that Pelosi and Mnuchin had been batting around. He said White House Chief of Staff Mark Meadows had tried to call him, but they had not connected, and Meadows had been in touch with some of his staff. "It's about three or four minutes to midnight on the clock here. I don't see much doing. It could always be a miracle, but not very many around here," he said. (RTRS)

FISCAL: A POLITICO reporter tweeted the following on Thursday: "On a leadership call today, @SpeakerPelosi said Dem lawmakers are telling her they DONT want a pre-election vote on a potential covid relief bill unless the Senate is going to take it up before the election…Senate seems very unlikely to take up a bill before the elex. And comments indicate that dems don't want to come back to DC for a vote unless they have guarantees from McConnnell." (MNI)

CORONAVIRUS: Some Chicago businesses will have to close by 10 p.m. and residents are asked to limit gatherings to six people as the number of newly confirmed coronavirus cases among residents continues to rise, the city's mayor announced Thursday. (ABC)

CORONAVIRUS: New Jersey Gov. Phil Muphy issued a travel advisory for the state, asking people to "avoid any unnecessary interstate travel," citing rising coronavirus numbers in the region. (CNBC)

POLITICS: After their first debate was dominated by rancour and interruptions, this time Joe Biden and Donald Trump were far more focused and restrained. They were deftly assisted by a moderator who asked considered but thoughtful questions, who was firm without being rude and who respectfully followed up with fact checks when they were needed. But the debate wasn't short on attack lines and we saw two candidates deliver starkly different closing arguments on reshaping the immigration system, two divergent prognoses on coronavirus and polar opposite views on climate change. (Sky)

EQUITIES: A federal antitrust probe targeting Facebook appears to have entered its late stages, according to three people familiar with the matter, as Republican and Democratic leaders on the Federal Trade Commission huddled privately Thursday to discuss their next steps in the case. (Washington Post)

OTHER

GLOBAL TRADE: Huawei Technologies Co. quietly spent months racing to stockpile critical radio chips ahead of Trump administration sanctions, ensuring it can keep supplying Chinese carriers in their $170 billion rollout of 5G technology through at least 2021. Partner Taiwan Semiconductor Manufacturing Co. began ramping up output in late 2019 of Huawei's 7-nanometer Tiangang communications chips, the most crucial element in 5G base stations, people familiar with the matter said. (BBG)

GLOBAL TRADE: Huawei Technologies Co.'s quarterly revenue expanded at a slower pace after the Trump administration's curbs took a toll on its consumer business during the Covid-19 pandemic. Sales climbed by 3.7% to 217.3 billion yuan ($32.5 billion) from a year earlier, versus 23% for the second quarter, according to Bloomberg calculations based on January-September figures reported by Huawei. Nine-month revenue was up 9.9% year-on-year and its net profit margin for the period was 8%, compared with 9.2% for the first half. (BBG)

GLOBAL TRADE: China will collect deposits at a ratio between 12.5%-222% on ethylene-propylene-non-conjugated diene rubber produced from U.S., South Korea and EU, according to a statement from Ministry of Commerce. (BBG)

GLOBAL TRADE: The European Union threatens to impose tariffs on aluminium converter foil from China after producers in the bloc requested protection against alleged unfair trade. (BBG)

GEOPOLITICS: United States National Security Advisor O'Brien tells Fox that the U.S. is watching 2-3 other nations (in addition to Russia & Iran) re: interference in the upcoming election. (MNI)

GEOPOLITICS: Russia and Turkey disagree on the Nagorno-Karabakh conflict and they need to find compromises, Russian President Vladimir Putin said Thursday. "Erdoğan may seem tough but he is a flexible politician and a reliable partner for Russia," he added. Putin added that he hopes the U.S. will help Russia broker a solution to the tensions in the Caucasus. (Daily Sabah)

CORONAVIRUS: The Food and Drug Administration on Thursday approved Gilead Sciences' antiviral drug remdesivir as a treatment for the coronavirus. In May, the FDA granted the drug an emergency use authorization, allowing hospitals and doctors to use the drug on patients hospitalized with the disease even though the drug has not been formally approved by the agency. The intravenous drug has helped shorten the recovery time of some hospitalized Covid-19 patients. It was one of the drugs used to treat President Donald Trump, who tested positive for the virus earlier this month. (CNBC)

CORONAVIRUS: Infusing hospitalized Covid-19 patients with blood plasma from people who recovered from the disease had no effect on whether patients got sicker or died, according to the first completed randomized trial of the treatments. The study, published Thursday in BMJ, could re-energize the debate over whether blood plasma is an effective treatment for the disease. An earlier study, run by the Mayo Clinic, showed blood plasma did yield some benefit, leading the Food and Drug Administration to grant emergency access to the therapy in August. That trial, however, did not have a control arm. (STAT News)

NEW ZEALAND: The New Zealand Activity Index rises 1.0% y/y, Treasury says in weekly update. Traffic movements, grid demand, and the performance of manufacturing index were above year-earlier levels. Business confidence and job advertisements were still below year ago. (BBG)

RBNZ: New Zealand banks have experienced high demand for home loans, the RBNZ says Friday in statement on website, citing results of its credit conditions survey. (BBG)

MEXICO: Mexico's economy could return 2019 levels in 2 to 3 years if current trends hold, Deputy Finance Minister Gabriel Yorio said in an interview with Latin Finance. (BBG)

MEXICO: Banxico Deputy Governor Irene Espinosa says there are real questions about Pemex's long-term viability. Pemex problems may mean more risks to public finances, Espinosa says at conference hosted by Mexico's Biva stock exchange. (BBG)

RUSSIA: U.S. President Donald Trump and his intelligence chief have pushed for quick declassification of a document disputing the 2017 intelligence community finding that Russia acted to help Trump get elected in 2016, three U.S. government officials familiar with the matter told Reuters on Thursday. (RTRS)

RUSSIA: The discovery of the hacks came as American intelligence agencies, infiltrating Russian networks themselves, have pieced together details of what they believe are Russia's plans to interfere in the presidential race in its final days or immediately after the election on Nov. 3. Officials did not make clear what Russia planned to do, but they said its operations would be intended to help President Trump, potentially by exacerbating disputes around the results, especially if the race is too close to call. (New York Times)

RUSSIA: Energetic Bear, a Russian state-sponsored hacking group, has stolen data from two servers after targeting state and federal government networks in the U.S. since at least September, the FBI and Cybersecurity and Infrastructure Security Agency said on Thursday. (Axios)

RUSSIA: Russian President Vladimir Putin urged his U.S. counterpart Donald Trump to agree to his proposal for a one-year extension of the New START arms-control treaty as talks enter a vital phase less than two weeks before the American presidential election. Putin said Russia is willing to include its new-generation hypersonic nuclear weapons in the arsenal that his country has proposed freezing during the extension of the pact. (BBG)

RUSSIA: The European Union imposed sanctions Thursday on two Russian intelligence officers and a unit of the military intelligence service GRU over their involvement in hacking the German parliament in 2015. (POLITICO)

OIL: Russia doesn't rule out delaying scheduled production hikes by the OPEC+ alliance, President Vladimir Putin said, the latest sign the cartel could restrain crude output for longer as the pandemic crimps demand again. Oil rose after Putin said he didn't rule out a change of plan. Production cuts are due to be eased -- as part of a gradual tapering -- from January but the cartel has hinted it may change tack as demand falters. Putin's preference was to adhere to the current plan. "We think there is no need to change anything now," Putin said in his address to the Kremlin-backed Valdai Club. Yet "we don't rule out that we may keep the current restrictions on output, that we don't lift them as soon as we have planned earlier." "If necessary, we can take a decision on further cuts," he said. "But so far we simply see no such need." (BBG)

OIL: Iraq's Oil Ministry has ordered more than 250,000 barrels per day (bpd) in production hikes this month, according to officials at eight fields that have received instructions to raise output. The new increases reverse a recent set of cuts that brought Iraq's September production down by 200,000 bpd to its lowest monthly average in five years, as the ministry sought to compensate for previously exceeding its OPEC quota. (Iraq Oil Report)

OIL: President Donald Trump seized on Joe Biden's pledge Thursday to eventually replace fossil fuels with renewable energy, turning the Democratic nominee's remarks into a warning for swing state voters that oil and gas jobs could be at risk. Biden's comment came in response to a question from Trump during Thursday's debate in Nashville about whether he would shut down the oil industry. The former vice president, in one of his starkest comments of the campaign on the issue, said "I would transition from the oil industry, yes." (BBG)

CHINA

POLICY: Chinese President Xi Jinping said on Friday (Oct 23) that China will never allow its sovereignty, security and development interests to be undermined, adding that the Chinese people are not to be trifled with. Any act of unilateralism, monopolism and bullying would not work, and would only lead to a dead end, Mr Xi said in a speech delivered at the Great Hall of the People in Beijing. Mr Xi also called for moves to expedite the modernisation of the country's defence and armed forces. (RTRS)

POLICY: China will focus on high quality development and follow the economic development pattern of Chairman Xi Jinping's dual circulation strategy during the 2021-25 Five Year Plan, the People's Daily said citing a meeting of the Standing Committee of the CPC Politburo. Chairman Xi Jinping told the meeting that China would strive for the alleviation of poverty, the mitigation of major risks, and progress in pollution control. Under the dual circulation strategy, the domestic market is the mainstay while the internal and external markets promote each other. (MNI)

PBOC: The PBOC is not likely to cut required deposit-reserve ratios to help banks deal with deposit shortages but may use OMOs and MLFs to help when bond issuances or loans are high, the 21st Century Business Herald reported citing an unnamed chief analyst with a securities house. To lower financing costs for non-financial firms, the PBOC required commercial banks to step back from offering high-interest-rate deposit products, resulting in money flowing out of banks, particularly small-and-middle sized banks. The interest rates of interbank deposits issued by those banks have risen to 3.49% from 2%, the lowest point reached in May, the source said adding that monetary policy was likely to maintain the current "tight balance". (MNI)

YUAN: China mulls further easing limits on cross-border investment by domestic institutions and individuals, with QDII as one of the approaches, State Administration of Foreign Exchange Spokeswoman Wang Chunying says at a briefing. China should better meet domestic investors' needs to invest globally. (BBG)

WEALTH MANAGEMENT: China's wealth management products continue to drop in terms of issuance and earning yields after the introduction of new asset management regulations, the Securities Daily reported citing Xu Chengyuan, an analyst from Golden Credit Rating. The regulations have resulted in banks pulling away from expanding the scale of their products, while the stock market rallies have also drawn capital away from the wealth sector. WMPs have long been one of main channels of off-balance-sheet financing for banks. Future wealth management products will follow the Net Asset Value (NAV) standard and become the mainstream, reported the Daily. (MNI)

OVERNIGHT DATA

CHINA SEP FX NET SETTLEMENT - CLIENTS CNY 67.5BN; AUG -16.7BN

JAPAN SEP CPI 0.0% Y/Y; MEDIAN 0.0%; AUG +0.2%

JAPAN SEP CORE CPI -0.3% Y/Y; MEDIAN -0.4%; AUG -0.4%

JAPAN SEP CORE-CORE CPI 0.0% Y/Y; MEDIAN -0.1%; AUG -0.1%

JAPAN OCT, P JIBUN BANK M'FING PMI 48.0; SEP 47.7

JAPAN OCT, P JIBUN BANK SERVICES PMI 46.6; SEP 46.9

JAPAN OCT, P JIBUN BANK COMPOSITE PMI 46.7; SEP 46.6

The Japanese private sector started the fourth quarter on a weak footing, with business activity shrinking further in October, according to flash PMI survey data. New business inflows continued to fall in October, though the rate of decline was the slowest in the current sequence of contraction. External demand continued to weaken. The survey also revealed some bright spots. The labour market stabilised in October, with employment broadly unchanged from September. Business sentiment also improved to the strongest for over two years as firms highlighted expectations of economic recovery as well as planned business investment. Anecdotal evidence showed that the government's "Go to Campaign" provided a boost to tourism services. That said, the recovery is slow-going and could remain so in the coming months as a global resurgence of COVID-19 cases could weigh on Japanese economic activity, particularly in the external-facing sectors. (IHS Markit)

AUSTRALIA OCT, P CBA M'FING PMI 54.2; SEP 55.4

AUSTRALIA OCT, P CBA SERVICES PMI 53.8; SEP 50.8

AUSTRALIA OCT, P CBA COMPOSITE PMI 53.6; SEP 51.1

Further easing of virus containment measures provided a further boost to Australia's private sector business conditions in October, according to the latest PMI data. The service sector particularly benefited from loosening restrictions. Consequently, business confidence also strengthened to the strongest for just over two years as firms expect the eventual return of normal market conditions to underpin output growth over the coming year. "An area of concern, however, was the subdued growth in new business, casting doubt on the durability of the current upturn in private sector activity. Furthermore, lacklustre sales meant that firms continued to be saddled with unused capacity. In response to rising costs and a further development of spare capacity, companies reduced their workforce numbers again in October, with lower employment seen in both the manufacturing and service sectors. (IHS Markit)

NEW ZEALAND Q3 CPI +1.4% Y/Y; MEDIAN +1.7%; Q2 +1.5%

NEW ZEALAND Q3 CPI +0.7% Q/Q; MEDIAN +0.9%; Q2 -0.5%

UK OCT GFK CONSUMER CONFIDENCE -31; MEDIAN -28; SEP -2

CHINA MARKETS

PBOC NET INJECTS CNY20BN VIA OMOS FRI

The People's Bank of China (PBOC) injected CNY70 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This resulted in a net injection of CNY20 billion as CNY50 reverse repos matured today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:27 am local time from the close of 2.1643% on Thursday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 35 on Thursday, flat from the close for Wednesday . A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.6703 FRI VS 6.6556

MARKETS

SNAPSHOT: No Fireworks

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 83.22 points at 23557.93

- ASX 200 down 1.254 points at 6172.5

- Shanghai Comp. up 4.374 points at 3316.874

- JGB 10-Yr future down 16 ticks at 151.82, yield up 0.5bp at 0.040%

- Aussie 10-Yr future down 3.5 ticks at 99.150, yield up 3.7bp at 0.848%

- U.S. 10-Yr future +0-00+ at 138-11, yield down 0.84bp at 0.848%

- WTI crude down $0.06 at $40.58, Gold up $1.03 at $1905.15

- USD/JPY down 15 pips at Y104.71

- FINAL TRUMP-BIDEN DEBATE REVEALS LITTLE NEW

- KUDLOW: POLICY DIFFERENCES AMID COVID-19 TALKS APPEAR UNLIKELY TO GET RESOLVED (RTRS)

- FDA APPROVES GILEAD'S REMDESIVIR AS CORONAVIRUS TREATMENT (CNBC)

BOND SUMMARY: ACGBs Underperform In Asia

T-Notes struggled for a clear sense of direction in Asia-Pac trade, with no real game changing moments identified in the final Trump-Biden debate. Still, volume in the contract was still above average overnight, with the contract last +0-00+ at 138-11 after the contract managed to recover from worst levels. Cash Tsy trade has seen light bear flattening creep in.

- JGB futures sit 14 ticks below settlement, after edging away from worst levels, after bears failed to force a challenge of trend support at 151.75. 7s and 40s were the weak points on the cash curve, with the former likely linked to weakness in futures, while the longer end weakness would fall in line with the steepening pressure witnessed in U.S. Tsys on Thursday. The Japanese swaps curve also steepened. There was nothing of local note to drive the space.

- Aussie bonds steepened with XM trading as much as 6.0 ticks lower vs. settlement before edging away from worst levels, having unwound all of the gains it saw in the wake of RBA Governor Lowe's October 15 address. The latest ACGB '26 auction was solid, although the cover ratio wasn't particularly standout by recent standards (~4.50x), but the pricing was strong, with average yields stopping ~0.9bp through prevailing mids at the time of supply (per BBG prices).

JGBS AUCTION: Japanese MOF sells Y6.1574tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y6.1574tn 3-Month Bills:- Average Yield -0.0793% (prev. -0.0834%)

- Average Price 100.0213 (prev. 100.0224)

- High Yield: -0.0744% (prev. -0.0781%)

- Low Price 100.0200 (prev. 100.0210)

- % Allotted At High Yield: 54.9827% (prev. 26.7333%)

- Bid/Cover: 3.228x (prev. 3.229x)

AUSSIE BONDS: The AOFM sells A$1.5bn of the 0.50% 21 Sep '26 Bond, issue #TB164:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 0.50% 21 September 2026 Bond, issue #TB164:- Average Yield: 0.3937%

- High Yield: 0.3950%

- Bid/Cover: 4.5220x

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 64.0%

- bidders 49, successful 16, allocated in full 7

AUSSIE BONDS: Nothing Of Note On Next Week's AOFM Issuance Schedule

The AOFM has released its weekly issuance schedule:

- On Monday 26 October it plans to sell A$1.5bn of the 2.75% 21 November 2028 Bond.

- On Thursday 29 October it plans to sell A$1.0bn of the 26 February 2021 Note & A$1.0bn of the 23 April 2021 Note.

- On Friday 30 October it plans to sell A$2.0bn of the 1.50% 21 June 2031 Bond.

EQUITIES: Limited Into The Weekend

Equities lacked any real impetus during Friday's Asia-Pac session, with the final Trump-Biden debate providing nothing in the way of flashpoints/catalysts for a meaningful momentum shift in favour of the incumbent.

- The space also failed to show any meaningful reaction to headlines from U.S. National Security Advisor O'Brien, as he told Fox that the U.S. is watching 2-3 other nations (in addition to Russia & Iran) re: interference in the upcoming election.

- Nikkei 225 +0.2%, Hang Seng +0.3%, CSI 300 +0.2%, ASX 200 -0.2%.

- S&P 500 futures +1, DJIA futures +11, NASDAQ 100 futures +15.

OIL: Putin Not Completely Against Modification To OPEC+ Pact

WTI & Brent sit $0.15 above settlement levels at typing, with a lack of flash points in the final Trump-Biden debate noted.

- A reminder that the benchmarks added $0.60-0.75 on Thursday, with most of the focus falling on rhetoric from Russian President Putin as he weighed in on the OPEC+ pact. Putin noted that "we think there is no need to change anything now… We don't rule out that we may keep the current restrictions on output, that we don't lift them as soon as we have planned earlier…If necessary, we can take a decision on further cuts."

- The global COVID-19 situation continues to be the driving issue on the demand side, with global mitigation measures in focus on that front.

GOLD: Holding The Range

The uptick in the DXY and U.S. real yields evident over the last 24 hours or so has kept gold bulls in check, as familiar fundamental drivers and technical lines remain in play. Spot last deals little changed, just above $1,900/oz.

FOREX: USD & JPY Firm Up, Trump-Biden Debate Fails To Impress

USD & JPY went bid in a relatively slow Asia-Pac session, which saw little in the way of market-moving catalysts. The final Trump-Biden debate was less chaotic than their earlier face-off, but provided nothing to alter the trajectory of the ongoing campaign. BBG trader sources flagged that USD & JPY were bought against EUR & GBP on above average turnover. EUR/JPY had a look under its 100-DMA, but failed to consolidate below the level.

- NZD was sold in reaction to a miss in New Zealand's CPI vs. both market & RBNZ expectations. That being said, price reaction was relatively limited, with participants already expecting further easing from the RBNZ.

- USD/CNH continued to tick away from cycle lows, with State Administration of Foreign Exchange (SAFE) confirming earlier reports that it wants to implement a phased increase in QDII quotas. SAFE also judged that the yuan has been more stable than exp. & its appreciation this year was driven by fundamentals.

- USD/KRW pushed higher initially, amid lingering concerns over a continued increase in South Korea's daily Covid-19 case count, which rose further above 100. The rate gradually trimmed gains and still trades within touching distance from its 19-month low.

- A flurry of PMI data from across the globe, UK retail sales and a speech from BoE's Ramsden feature on today's economic docket.

FOREX OPTIONS: Expiries for Oct23 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1750-55(E1.3bln), $1.1800(E2.0bln), $1.1830-50(E2.0bln), $1.1975(E518mln), $1.2000(E1.4bln)

- USD/JPY: Y103.00($1.3bln), Y105.00($751mln), Y105.40-60($1.2bln), Y105.85($628mln)

- GBP/USD: $1.3090-1.3100(Gbp1.1bln-GBP calls)

- AUD/USD: $0.7180(A$827mln)

- USD/CAD: C$1.3080($936mln), C$1.3190-00($576mln)

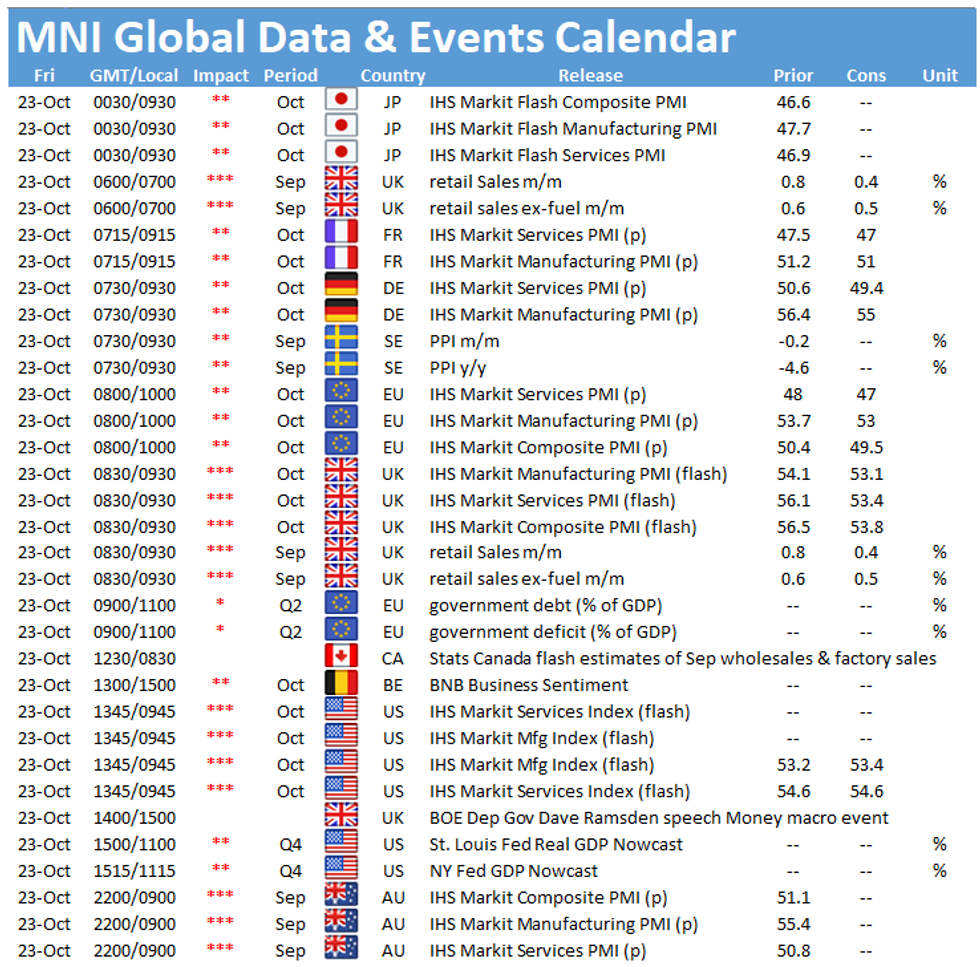

UP TODAY (Time GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.