-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBA On Hold, No Yuan Dramatics

- RBA on hold, no substantial tweaks in rhetoric, focus remains on July meeting.

- PBoC doesn't deploy firmer hand in USD/CNY mid-point fixing.

- GBP/USD tags fresh multi-year highs in Asia.

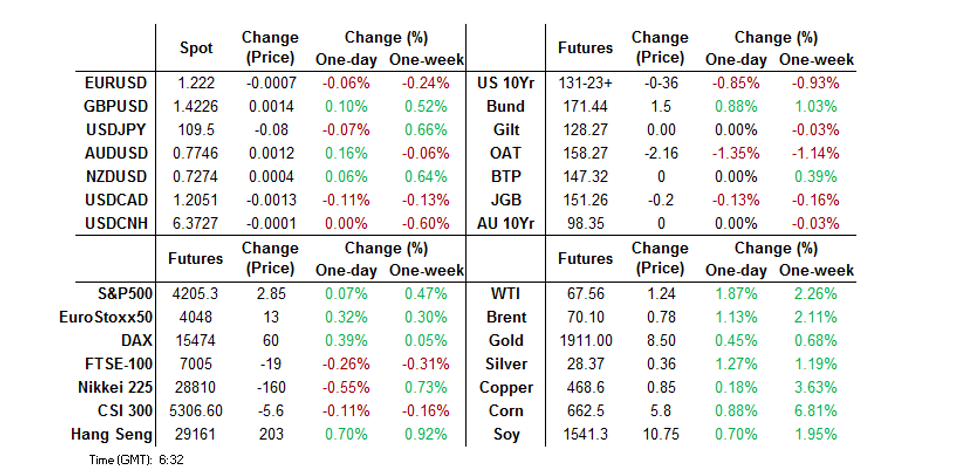

BOND SUMMARY: Core FI Mixed In Asia

10s led the way lower in U.S. cash Tsy trade during Asia-Pac hours as the space re-opened after the elongated weekend, with that benchmark last printing ~2.0bp cheaper vs. Friday's closing levels. T-Notes last -0-06 at 131-24, 0-02 off lows, after pockets of selling pressured the contract to worst levels of the day. Headline flow remains light, with no notable surprises in today's USD/CNY mid-point fixing. There was perhaps an element of the latest uptick in oil spilling over into Tsys, as Brent futures topped $70.00 Monday provided a very narrow, holiday-shortened session for futures after Friday's month-end driven movements. A mere ~150K T-notes changed hands during Monday's session, with weekend focus falling on verbal guidance from the Chinese policymaking sphere re: the recent CNY appreciation, before the PBoC stepped in, hiking the foreign exchange reserve requirement ratio by 2ppt (to 7% from 5%), effectively locking up ~$20bn of liquidity in the FX market, per estimates from an ex-SAFE official. The ISM m'fing survey headlines the local economic docket on Tuesday. Elsewhere, Fedspeak from Brainard & Quarles is due.

- A sedate session for JGBs, with the pressure in the U.S. Tsy space seemingly applying some modest weight here, leaving cash JGBs little changed to ~0.5bp cheaper across the curve, while futures print 3 ticks below yesterday's settlement level. There was little to note on the domestic front, outside of softer than expected Q1 CapEx data re: Japanese corporates & continued chatter surrounding the viability of the Tokyo Olympics. BoJ Rinban operations covering 1- to 5- & 25+-Year JGBs headline the local docket on Wednesday.

- The RBA left its broader monetary policy settings unchanged at its June meeting, with no change in its forward guidance, and nothing in the way of fresh, meaningful information provided. The updates surrounding the economy were more of a mark to market exercise for the Bank, with no change in its underlying view surrounding inflation. July's gathering will prove to be much more interesting, given the key decisions that will take place at that meeting re: the Bank's yield curve targeting scheme and the next tranche of QE. Aussie bonds were underpinned ahead of the decision, even with local data generally on the firmer side of expectations, while there was another uptick in cases within the Melbourne COVID cluster. YM & XM now sit at unchanged levels after limited blips lower as the RBA decision hit. 10s see some marginal outperformance on the cash ACGB curve. 3-Year EFPs have established themselves on the 16bp handle. There was also the potential for some trans-Tasman impetus in early Sydney trade, with RBNZ chief economist Ha telling Interest NZ that "there might not be an abrupt end to the RBNZ's bond buying when its Large-Scale Asset Purchase (LSAP) programme ends in June 2022." The last couple of days have seen various RBNZ policymakers look to re-assert the notion of optionality into the broader narrative after markets deemed last week's decision (and the OCR track within the MPS) to be hawkish. NZGB have firmed as a result. Q1 GDP data headlines tomorrow's local docket. Elsewhere, comments from Bradley Jones, the RBA's Head of Economic Analysis, are due.

FOREX: Greenback Struggles

The greenback continued its move lower with liquidity still thinner than usual, UK and US participants are expected to return today after a long weekend.

- AUD is top of the G10 pile, AUD/USD up 31 pips at 0.7765. The RBA rate announcement is still to come. Final May manufacturing PMI came in at 60.4 from 59.9 previously, while ANZ Roy Morgan weekly consumer confidence printed 111.4 down from 114.2 last week. CoreLogic house prices rose 2.3% M/M in May from 1.8% in April

- NZD is up 14 pips at 0.7283, data showed New Zealand April home building approvals rose 4.8% M/M from a revised 19.2% rise in March.

- Yen is firmer, USD/JPY is down 14 pips having moved in a narrow range through the session. There are reports that organisers are preparing to hold the Olympics with spectators. Data showed Q1 capital spending fell more than expected at -7.8% Y/Y, consensus -6.8%, capital spending ex-software came in at -9.9% Y/Y against estimates of -7.6%. Companies sales print -3.0% Y/Y, profits rose 26.0% after falling 0.7% in Q4.

- Yuan is firmer, USD/CNH down 31 pips after the pair jumped on Monday following an increase in the RRR by the PBOC to 7% from 5% by the PBOC. The PBOC once again fixed USD/CNY above sell side estimates indicating a preference for a weaker yuan. Caixin manufacturing PMI at 52.0 in May was in-line with April.

- GBP/USD pushed higher, registering a fresh multi-year high in the process. Bulls now eye 1.4315 as the next resistance point, which represents the April 18 2018 high.

ASIA FX: Greenback Struggles Again; Sees Asia FX Rise

Broad greenback weakness saw Asia EM FX gain despite a touch of negative risk sentiment in the region.

- CNH: Yuan is firmer after dropping on Monday following an increase in the RRR by the PBOC to 7% from 5% by the PBOC. The PBOC once again fixed USD/CNY above sell side estimates indicating a preference for a weaker yuan. Caixin manufacturing PMI at 52.0 in May was in-line with April.

- SGD: Singapore dollar is stronger, USD/SGD is now approaching its 2021 lows at 1.3157. PMI data for Singapore is due tomorrow.

- TWD: Taiwan dollar is stronger, but off best levels. Having fallen at the open USD/TWD hit support at 27.50 and has ground higher through the session. IHS Markit Taiwan May Manufacturing PMI 62 vs 62.4 in April.

- KRW: Won is stronger, data showed the trade balance widened to $2.925bn, lower than the expected $3.751bn. The gain was driven by exports rising 45.6% in May, lower than estimates of a 48.9% rise but still a robust print and the biggest gain since 1988.

- MYR: Ringgit is stronger as the government announced the latest support package for the economy worth MYR 40bn. IHS Markit Malaysia May Manufacturing PMI 51.3 vs 53.9 in April

- PHP: Peso is stronger, hovering around its strongest level since 2016. There were reports on the wires earlier that Manila would remain under general quarantine until June 15.

- THB: Baht is stronger, IHS Markit Thai May Manufacturing PMI 47.8 vs 50.7 in April. The government announced plans to delay a plan to ease restrictions on some businesses in Bangkok.

FOREX OPTIONS: Expiries for Jun01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2125-30(E775mln), $1.2150-51(E2.0bln-EUR puts), $1.2195-05(E587mln), $1.2225-40(E1.1bln-EUR puts), $1.2275(E1.7bln-EUR puts), $1.2300(E901mln)

- USD/CNY: Cny6.3900($501mln)

ASIA RATES: China Repo Rates Drop After Jump Higher

- INDIA: Yields mixed in early trade, bonds came under pressure yesterday after the announcement of additional borrowing. GDP data yesterday beat estimates, proving more resilient than expected in the face of the pandemic though consensus seems to be that challenges are on the horizon for Indian growth. Emkay Global lowered their growth estimates even further to 9% citing slow recovery from lockdowns and a sluggish vaccine programme. Participants look ahead to state bond sales today as well as PMI data.

- SOUTH KOREA: Futures lower, Vice FinMin Lee was on the wires earlier noting that there was a high possibility inflation would rise above 2% in Q1 due to base effects and commodity prices. He added the government will announce measures tomorrow to designed to stabilise prices, May CPI figures are released tomorrow. Data earlier showed the trade balance widened to $2.925bn, lower than the expected $3.751bn. The gain was driven by exports rising 45.6% in May, lower than estimates of a 48.9% rise but still a robust print and the biggest gain since 1988.

- CHINA: Repo rates have fallen today after a jump yesterday, the rates remain inverted though with the overnight rate just hove the 7-day rate. Overnight repo rate is down 9.7bps to 2.1823% while the 7-day repo rate is down 33bps to 2.1699%. Yesterday's reports that the PBOC may increase liquidity injection through daily reverse repos in June if market rates rise as local government special bond issuances peak and rising PPI fuel tightening expectation still fresh participants minds. Futures are higher with equity markets coming under pressure.

- INDONESIA: Markets closed for a holiday.

EQUITIES: Mixed As PMI's Slow

Another mixed session for equity markets in the Asia-Pac region. Markets in Japan are lower but off worst levels, liquidity was said to be thin which exacerbated the move lower. Markets in mainland China are also lower, the PBOC late yesterday raised RRR from 5% to 7% effective June 15, Caixin manufacturing PMI was in-line with last month at 52.0. The Hang Seng has managed to squeeze out some gains ahead of retail sales data later today. Manufacturing PMI figures in the region also negatively hit sentiment with many citing an uncertain outlook due to the latest wave of the pandemic. Markets in South Korea were boosted by another bumper set of exports in trade balance data. In the US future are marginally higher with liquidity still thin as participants are set to return from a long weekend.

GOLD: Bulls In The Driving Seat

Fresh USD downside has supported bullion over the last 24 hours or so, with spot last dealing $5/oz or so higher on the day at $1,912/oz. The impulse from a softer USD has outweighed an uptick in U.S. Tsy yields during Asia-Pac dealing. Bulls now look to the Jan 8 high at $1,917.6/oz, with any sustained break there opening up the path to the Jan 7 high at $1,927.7/oz.

OIL: Crude Futures Higher Ahead Of OPEC+ Meeting

Oil is higher again in Asia-Pac trade on Tuesday; WTI is up $1.25 from settlement while Brent is up $0.80. Markets are focusing on comments from the OPEC+ group who see tighter conditions in the oil market according to its latest communication. The group meets later today and ahead of the meeting has said that the stockpile glut built up during the pandemic has almost been used up and expects inventories to reduce in the second half of the year. The group is expected to confirm the supply increase due for July which would complete the return of 2m bpd since May. Elsewhere, there were reports that Nigeria's NNPC are looking to purchase stakes in six private refineries to meet requirements in a government directive.

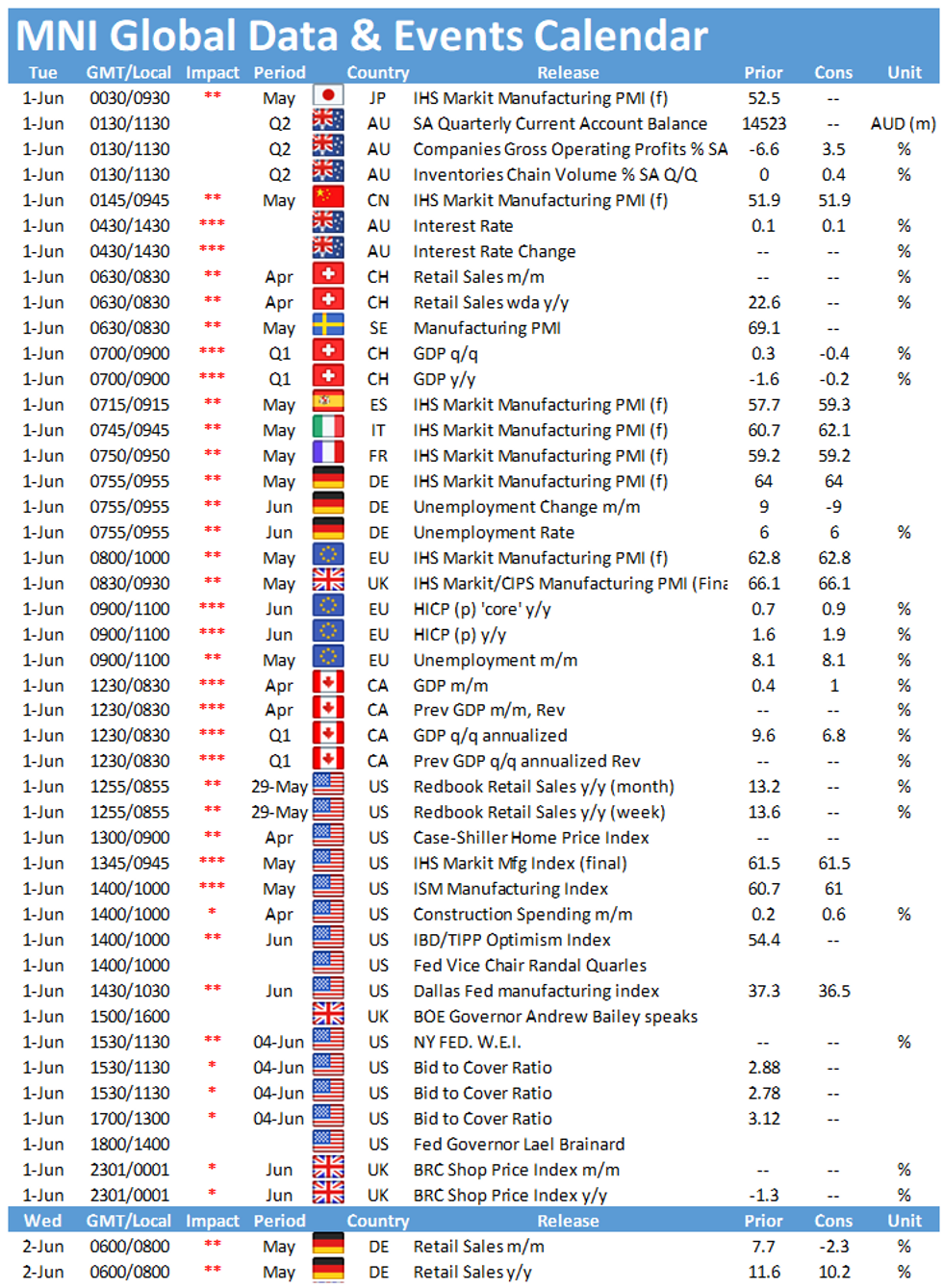

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.