-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Nov RBA Hike Odds Surge Post Q3 CPI Upside Surprise

EXECUTIVE SUMMARY

- AUSSIE CPI MEASURES HIGHER THAN EXPECTED - MNI BRIEF

- TRUMP ALLY MIKE JOHNSON BECOMES LATEST GOP HOUSE SPEAK NOMINEE - BBG

- ISRAEL RATING OUTLOOK CUT TO NEGATIVE BY S&P ON RISK WAR SPREADS - BBG

- CHINA WILLING TO COOPERATE WITH US, MANAGE DIFFERENCES - XI - RTRS

- HONG KONG LOWERS STOCK-TRADING TAX TO REVIVE ROLE AS HUB - BBG

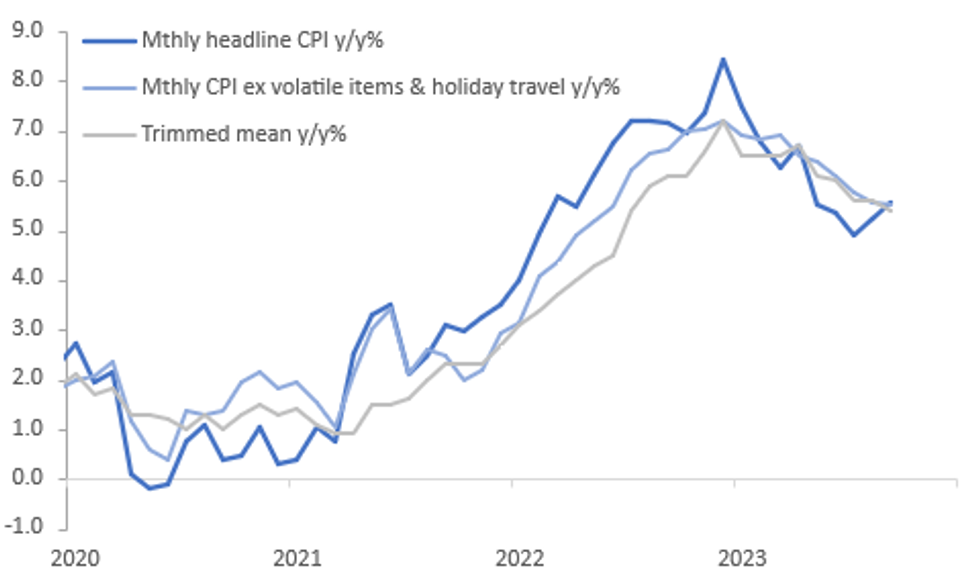

Fig. 1: Australia CPI Y/Y, Moderation In Inflation Slowdown

Source: MNI - Market News/Bloomberg

U.K.

BANKS (BBG): Barclays Plc lost as much as $2.7 billion in market value on Tuesday after inaugurating the reporting season for UK banks by lowering its forecast for lending profitability.

EUROPE

SPAIN (RTRS): Spain's Socialist Party and the hard-left Sumar on Tuesday agreed policies that included expanding a windfall tax for banks and energy firms as they try to form the basis of a coalition government three months after an inconclusive election.

FINLAND (BBC): Finnish police have said that the rupture of a gas pipeline under the Baltic Sea was probably caused by an anchor dragging along the seabed.

EU/UKRAINE (POLITICO): European Parliament President Roberta Metsola suggested that Ukrainian and Moldovan lawmakers could join the assembly as “observer” members while the two countries await formal accession into the European Union.

FRANCE/ISRAEL (EURO OBSERVER): French president Emmanuel Macron has offered Israel to help fight Hamas in future, amid EU efforts to get more aid into Gaza.

GEOPOLITICS (BBG): A series of flubs is laying bare the European Union’s inner tensions and casting a shadow over its geopolitical ambitions.

U.S.

POLITICS (BBG): House Republicans nominated Representative Mike Johnson of Louisiana as their latest choice for speaker, selecting one of Donald Trump’s most outspoken allies in his efforts to overturn the 2020 presidential election.

FED (BBG): The Federal Reserve’s top bank watchdog for most of the Trump administration fired back at critics who have said the central bank’s stance during his tenure left regulators less prepared.

OTHER

ISRAEL (BBG): Israel’s credit outlook was cut to negative by S&P Global Ratings, which cited risks that the war with Hamas could spread more widely and have a more pronounced impact on the country’s economy than expected.

ISRAEL (BBG): The Israeli ambassador to the United Nations demanded that Secretary-General Antonio Guterres resign for saying Hamas’s Oct. 7 attack on Israel didn’t happen in a vacuum, capping a day of heated exchanges at the Security Council over violence that threatens to spark a regional war.

HONG KONG (BBG): Hong Kong is reversing an emergency increase in the stamp duty on stock trades as officials seek to revive the city’s status as a hub for finance and initial public offerings.

AUSTRALIA (MNI BRIEF): Australia’s Consumer Price Index rose 1.2% in the September quarter and 5.4% y/y, while the monthly read – also released today – increased 5.6% y/y, data from the Australian Bureau of Statistics showed Tuesday. Both measures printed higher than market expectations, which had Q3 CPI at 1.1% q/q, or 5.3% y/y, and monthly inflation at 5.3% y/y. Q3 trimmed mean inflation was 1.2% q/q and 5.2% y/y, also higher than expectations.

AUSTRALIA (RTRS): Australian inflation was surprisingly strong in the third quarter amid broad-based and stubborn cost pressures, a headache for policymakers that added greatly to the risk of a rise in interest rates as early as next month.

CHINA

CHINA/US (RTRS): Chinese President Xi Jinping said on Wednesday that China is willing to cooperate with the United States as both sides manage their differences and work together to respond to global challenges, according to Chinese state media.

MONETARY POLICY (SECURITIES TIMES/BBG): China’s liquidity conditions need to be kept moderately loose as the task to boost confidence in the economy remains at a crucial stage, and the central bank should inject more money or even cut banks’ reserve requirement ratio again, the Securities Times said in a front-page commentary.

FISCAL (CSJ/BBG): China’s plan to issue an additional 1 trillion yuan worth of sovereign bonds this year can boost investor confidence and help stabilize economic growth, official newspapers reported, citing analysts and economists.

GROWTH (PEOPLE’S DAILY/BBG): The overall recovery trend of China’s economy has become more apparent after the release of 3Q economic data, showing great resilience and momentum, People’s Daily said in a front-page editorial Wednesday.

CHINA MARKETS

MNI: PBOC Injects Net CNY395 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY500 billion via 7-day reverse repo on Wednesday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY395 billion after offsetting the maturity of CNY105 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9893% at 10:00 am local time from the close of 2.0867% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 39 on Tuesday, compared with the close of 60 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1785 Wednesday vs 7.1786 Tuesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1785 on Wednesday, compared with 7.1786 set on Tuesday. The fixing was estimated at 7.3167 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA OCT CONSUMER CONFIDENCE 98.1; PRIOR 99.7

AUSTRALIA Q3 CPI Q/Q 1.2%; MEDIAN 1.1%; PRIOR 0.8%

AUSTRALIA Q3 CPI Y/Y 5.4%; MEDIAN 5.3%; PRIOR 6.0%

AUSTRALIA Q3 CPI TRIMMED MEAN Q/Q 1.2%; MEDIAN 1.0%; PRIOR 1.0%

AUSTRALIA Q3 CPI TRIMMED MEAN Y/Y 5.2%; MEDIAN 5.0%; PRIOR 5.9%

AUSTRALIA Q3 CPI WEIGHTED MEDIAN Q/Q 1.3%; MEDIAN 1.0%; PRIOR 1.0%

AUSTRALIA Q3 CPI WEIGHTED MEDIAN Y/Y 5.2%; MEDIAN 5.0%; PRIOR 5.4%

AUSTRALIA SEP CPI Y/Y 5.6%; MEDIAN 5.3%; PRIOR 5.2%

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 106-11+, unchanged from Tuesday's settlement level, a 0-07+ range has been observed on volume of ~100k

- Cash Tsys sit 2bps richer to 2bps cheaper across the major benchmarks, the curve has twist steepened pivoting on 5s.

- Tsys firmed in early trade, ticking higher alongside US Equity Futures paring early losses and marginal pressure on the USD. The space looked through the firmer than forecast CPI print from Australia.

- The move higher didn't follow through and Tsys ticked lower in narrow ranges for the remainder of the session.

- Flow wise the highlight was a block seller (two clips of 3k) in TY.

- The docket is thin in Europe today, further out we have New Home Sales and Fed Chair Powell provides welcome remarks at 2023 Moynihan Prize. We also have the latest 5-Year Supply.

JGBS: Futures Mid-Range, Belly Of Curve Underperforming

In the Tokyo afternoon session, JGB futures are sitting mid-range, -13 compared to the settlement levels.

- The local calendar has been light today, with Leading and Coincident Indices for August (final) due soon.

- Today’s weakness has been unexpected given it flew in the face of lower US tsy yields during Tuesday’s NY session. That said, afternoon weakness is consistent with the cheapening in longer-dated cash US tsys, which are dealing 1-2bps cheaper across benchmarks beyond the 5-year in Asia-Pac trade.

- One possible explanation for today’s move comes from Cranfield at Bloomberg. He believes the fact that JGBs are still biased lower despite an unscheduled buying operation and support for the belly of the curve via 5-year loans could be adding to bets for abandoning yield curve control at next week’s policy meeting. (See linkICYMI)

- Cash JGBs are dealing mixed, with the belly underperforming. Yield movements 1.6bps lower to 0.7bp higher. The benchmark 10-year yield is at 0.858% versus the cycle high of 0.882% set on Monday.

- The swap curve is also trading mixed, with rates 2bp lower to 0.6bp higher. Swap spreads are mixed.

- Tomorrow, the local calendar sees PPI Services, International Investment Flows and Machine Tool Orders data.

- The MOF will conduct a Liquidity Enhancement Auction for 15.5-39-year JGBs at 1700 JT.

AUSSIE BONDS: Sharply Cheaper After Q3 & September CPI Data Increases Chances Of A Nov Hike

ACGBs (YM -12.0 & XM -5.0) are 5-8bps cheaper after Q3 and September CPI printed higher than expected. Consequently, these outcomes have amplified concerns regarding the possibility of another interest rate hike in November, as it appears that inflation may be slowing less than the desired rate.

- RBA Governor Bullock said the board will hike again “if there is a material upward revision to the outlook for inflation”. This data is likely to result in an upward revision to near-term RBA CPI forecasts, but the key will be the outlook further out. Q2 2025 already stands at 3.1%, marginally above the top of the band.

- Cash ACGBs are 5-9bps cheaper after the data, with the AU-US 10-year yield differential 6bps higher on the day at -10bps.

- Swap rates are 4-8bps higher after the data and 4-12bps higher on the day. The 3s10s curve is flatter on the day.

- The bills strip is sharply weaker, with pricing -8 to -16.

- RBA-dated OIS pricing has shunted 10-15bps firmer on the day across meetings.

- A 78% chance of a 25bp rate is priced for the November meeting. Terminal rate expectations firm to 4.47% (+40bps) from 4.34% pre-data.

- Tomorrow, the local calendar sees an appearance by RBA Governor Bullock before the Senate Economics Legislation Committee, along with Terms of Trade data.

NZGBS: Closed Richer Despite Post-CPI ACGB Cheapening

NZGBs closed at the session's best levels, 1-5bps richer, despite a sharp cheapening in ACGBs following the release of higher-than-expected Q3 CPI data. NZGB yields were 2-3bps lower in post-AU CPI dealings. In contrast, ACGBs are 4-9bps cheaper.

- Notably, the Australian CPI release stands out as it bucks the recent trend observed in the peripheral regions of the $-bloc, specifically New Zealand and Canada, where inflation prints have fallen below expectations. Additionally, the Australian monthly CPI data for September revealed a significant uptick in inflation, suggesting that it carries strong momentum into the fourth quarter. This newfound momentum is expected to play a role in the likely revision of the RBA's Q4 CPI forecasts, potentially pushing them upward.

- The NZ-AU 10-year yield differential closed a massive 9bps tighter at +68bps versus its mid-October high of +99bps.

- Swap rates closed 2-4bps lower, with the 2s10s curve unchanged.

- RBNZ dated OIS pricing closed 1-4bps softer across meetings, with terminal rate expectations at 5.60%.

- Tomorrow, the local calendar is empty again, ahead of ANZ Consumer Confidence on Friday.

- Tomorrow, the NZ Treasury plans to sell NZ$200mn of the 4.5% Apr-27 bond, NZ$200mn of the 3.5% Apr-33 bond and NZ$100mn of the 2.75% May-51 bond.

FOREX: AUD Firms After Q3 CPI Print

AUD is the strongest performer in the G-10 space at the margins. The move higher was seen after the Q3 CPI print which was firmer than expected with the headline rate at 1.2% Q/Q, RBA terminal rate expectations now sit at 4.47% and another 25bp rate hike is 78% priced in for the November meeting.

- AUD/USD sits ~0.4% firmer at $0.6375/80. Resistance is at $0.6393, high from Oct 18, the next level for bulls is $0.6445, high from Oct 11.

- Kiwi is a touch firmer, NZD/USD is up ~0.1%. The pair was up ~0.3% firmer after the bid in AUD spilled over however it has ticked away from session highs through the session.

- Yen is little changed and sits beneath the ¥150 handle. Technically bulls remain in the driver's seat, resistance is at ¥150.16, high from Oct 3 and bull trigger. Support comes in at ¥149.21, 20-Day EMA.

- Elsewhere in G-10 EUR and GBP are following the broader USD move and sit ~0.1% firmer.

- Cross asset wise; BBDXY is unchanged and the US Tsy curve is marginally steeper. The Hang Seng has pared an early gain of as much as 3% and now sits ~1.6% higher.

- On Wednesday the docket is thin in Europe with the IFO Survey from Germany providing the highlight.

EQUITIES: Hong Kong/China Markets Rise, But Are Away From Best Levels

Most regional equity markets are higher. Focus has been on gains in HK and China markets post additional fiscal stimulus measures. We are in positive territory, but indices are away from session highs. Elsewhere South Korean and Australian shares are lagging. US futures are down following mixed after late earning results from tech bellwethers. Eminis are off 0.2%, last tracking near 4262, which is just above the simple 200-day MA. Nasdaq futures are down by more, off 0.40% at this stage.

- In early trade Hong Kong's HSI was up comfortably over 2%. At the break though gains had been pared to +1.18%. We had a strong lead from the Golden Dragon Index in US trade on Tuesday, up nearly 4%, amid fiscal stimulus optimism (post the government's approval of an additional 1trln yuan in bond issuance).

- The properties sub index rose over 3% as Hong Kong Chief Executive John Lee delivered his annual address, which included cutting the home purchase tax on second homes to 7.5% from 15%. Again, though gains have been pared, the index last near +1%.

- Lee also stated that the stamp duty on stock trading would be cut to 0.1% (from 0.13%). This move may have a positive impetus post the lunchtime break.

- It has been a similar story for mainland shares, at the break, the CSI 300 is up 0.50%, we were +1.1% in earlier trade. Vice Finance Minister Zhu Zhongming stated that the extra fiscal stimulus will still leave the government's debt ratio manageable (see the Global Times link here).

- Japan stocks have posted healthy gains, up over 1% for the major benchmarks. South Korean shares are struggling though, the Kospi off 0.60%, foreign and institutional selling not helping.

- The ASX 200 is down slightly, the Q3 upside surprise on CPI weighing. Philippine stocks are around flat, as the market awaits whether an off-cycle hike is delivered tomorrow.

- Thailand and Indonesian indices are doing better though.

OIL: Crude Range Trading, Conflict Fears Ease & Hope China Increases Demand

Oil hasn’t made up any of Tuesday’s losses during APAC trading today. Yesterday crude fell around 2% driven by a stronger greenback from better PMIs and stabilisation in the Middle East. Brent has been range trading and is up slightly to $88.11/bbl but off the intraday low of $87.92. WTI is flat at $83.75 after an intraday low of $83.45. The USD index is also little changed.

- The war risk premium has been reduced following US diplomatic efforts to stabilise the situation in the Middle East and increasing pressure on Israel to abandon a ground offensive. Crude markets were also reassured that the US and Saudi Arabia have been talking to ensure the conflict doesn’t escalate.

- On the demand side, China has increased the deficit ratio and issued more government bonds in an effort to stimulate the economy. There is hope that this will increase demand for oil given that China is the world’s largest importer.

- Bloomberg reported that US crude inventories fell another 2.67mn barrels after -4.38mn the previous week, according to people familiar with the API data. There was a 4.17mn barrel drawdown of gasoline stocks and -2.31mn of distillate. The official EIA data is released later today.

- Later Fed Chair Powell gives welcoming remarks and ECB President Lagarde speaks. On the data front, US new home sales and the German Ifo for September print. The Bank of Canada meets and is expected to leave rates unchanged.

GOLD: Slightly Stronger After A Solid Intraday Recovery On Tuesday

Gold is 0.1% higher in the Asia-Pac session. This comes after it closed near unchanged at $1970.97 on Tuesday after a strong recovery off a low of $1953.71. The recovery moved bullion away from support at $1943 (Oct 19 low), according to MNI’s technical team.

- A stronger dollar driven by the higher-than-expected US S&P global October manufacturing PMI at 50 vs 49.8 prior failed to negatively impact the yellow metal.

- Lower longer-dated US Treasury yields possibly supported gold, although short-dated yields did move higher following the US PMI data release.

- Gold remains below the five-month high reached last week on the back of the conflict in the Middle East. Tensions have eased this week as ongoing diplomatic measures and the freeing of some hostages have delayed the much-feared Israeli ground assault on Gaza.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/10/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Survey |

| 25/10/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/10/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/10/2023 | 0800/1000 | ** |  | EU | M3 |

| 25/10/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/10/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/10/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/10/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 25/10/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 25/10/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 25/10/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 25/10/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 25/10/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 25/10/2023 | 2035/1635 |  | US | Fed Chair Jerome Powell |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.