-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: NZD/NZ Yields Slump As RBNZ Signals Peak OCR Hit

EXECUTIVE SUMMARY

- McCARTHY, GRAVES SINGAL IMPASSE IN WHITE HOUSE DEBT TALKS - BBG

- CHIP WARS WITH CHINA RISK ‘ENORMOUS DAMAGE’ TO US TECH, SAYS NVIDIA CHIEF - FT

- COPPER FALLS BELOW $8,000 A TON FOR FIRST TIME SINCE NOVEMBER - BBG

- RBNZ HIKES OCR TO 5.5% “PEAK”, RATES RESTRICTIVE - MNI

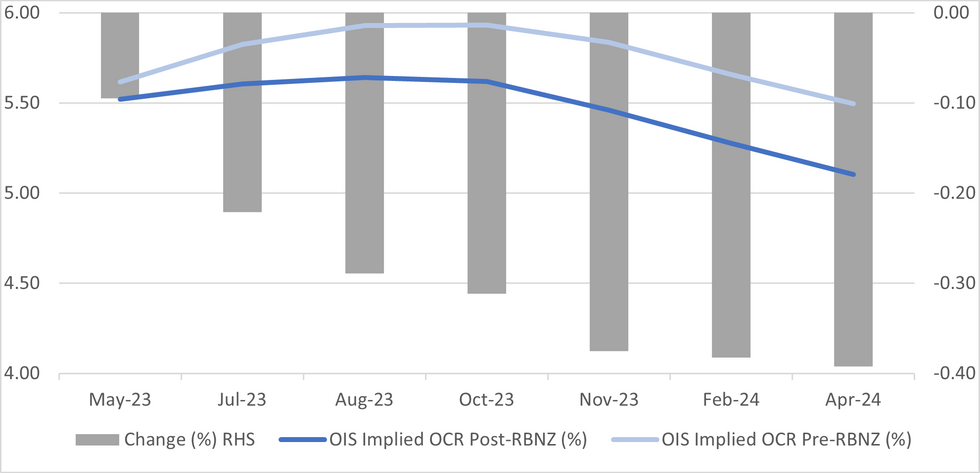

Fig. 1: RBNZ Peak Expectations Slump Post RBNZ

Source: MNI - Market News/Bloomberg

EUROPE

TECH: The European Union and the US are discussing working closely to address risks from investing in sensitive technologies in countries like China as they develop new tools to cope with an increasingly hostile economic environment. Both partners will seek to align their approaches for outbound investment screening “to prevent our companies’ capital, expertise, and knowledge from supporting the technological advances of strategic rivals in ways that threaten our national security,” according to the latest draft statement for a high-level meeting next week in Lulea, Sweden. (BBG)

U.S.

DEBT: Speaker Kevin McCarthy left the US Capitol late Tuesday afternoon saying the two parties had yet to reach a deal to avert a first-ever US default, and a top lieutenant said there are no more meetings planned. Republican Representative Garret Graves, one of McCarthy’s chief negotiators, suggested just hours after a two-hour meeting in the Capitol with his White House counterparts that the two sides were at a standoff. (BBG)

TECH: The U.S. Commerce Department should put trade curbs on Chinese memory chip maker Changxin Memory Technologies (CXMT) after Beijing earlier this week banned the sale of some chips by U.S.-based Micron Technology Inc (MU.O), the chair of the U.S. House of Representatives' committee on China said on Tuesday. The restrictions by China's cyberspace regulator against Micron are the latest in a widening trade dispute between the world's two largest economies. The move by China sparked tough language from key lawmakers and the White House. (RTRS)

OTHER

JAPAN: Japan's government is expected to fund part of its spending for childcare measures by issuing additional bonds over a period of roughly two years, the Yomiuri newspaper reported, raising concerns about an already high public debt burden.(RTRS).

JAPAN: Business sentiment at big Japanese manufacturers turned positive for the first time this year and service-sector morale hit a five-month high, the Reuters Tankan poll showed, as the economy continued to improve from a COVID-led recession. Wednesday's monthly poll, which tracks the Bank of Japan's closely watched quarterly tankan survey, found that manufacturers are also upbeat about the coming three months, while service-sector morale was seen down a tad. (RTRS)

SOUTH KOREA: South Korea has asked Washington to review its criteria for new semiconductor subsidies, concerned over the impact of rules to limit chip investment in countries such as China, a U.S. public filing showed. In March, the U.S. commerce department proposed rules to prevent China and other countries it deems to be of concern from tapping funds of $52 billion earmarked for semiconductor manufacturing and research under the so-called CHIPS Act. (RTRS)

NZ: The Reserve Bank of New Zealand has raised the Official Cash Rate 25bp to its forecasted 5.5%, warning rates will stay higher “for the foreseeable future” as it aims to pull inflation back down to its 1-3% target. The RBNZ noted in its quarterly Monetary Policy Statement published alongside the decision that the OCR had likely reached its peak and forecasted a slightly faster pace of cuts. (MNI)

BRAZIL: Brazil's Finance Minister Fernando Haddad on Tuesday said that the government's new fiscal rules and a tax reform should calm investors and the central bank and that there is consensus on the urgency of approving both. After a closed-door meeting with government officials, top lawmakers and business leaders, Haddad told reporters he expects both houses of Congress to approve the new fiscal rules before the year's second half, while only the lower house will likely vote on the tax reform in that time frame. (RTRS)

BRAZIL: There are few, if any, leaders in the world who are publicly lashing out at central bankers more than Brazil’s Luiz Inacio Lula da Silva. The reasons are increasingly evident as Brazilians feel the pinch of a weakening economy. Nine months after policymakers pinned benchmark interest rates at 13.75%, capping off a dozen rapid-fire hikes, household debt is lingering at a record, banks are gutting lending and corporate bankruptcies are rising. (BBG)

CZECH: The current level of Czech interest rates is “adequate” for taming inflation and the central bank may be able to start lowering them in the fourth quarter or early next year, board member Jan Kubicek says in an interview with E15 newspaper. Declining consumption, rising household savings and a cooling mortgage market aren’t suggesting high inflation expectations, says Kubicek. (BBG)

CHILE: The board of Chile's central bank on Tuesday activated a counter-cyclical capital buffer, setting the measure at 0.5% of risk-weighted assets for one year. The measure, which requires Chilean banks to set aside a cushion to absorb any potential losses, is meant to boost the economy's resilience in the face of severe stress scenarios, the central bank said in a statement. (RTRS)

COMMODITIES: Copper fell below $8,000 a ton for the first time this year as the market grapples with a disappointing post-lockdown demand recovery in China, the biggest consumer. The industrial metal has been under pressure this month as a raft of data showed China’s rebound was stuttering. The absence of major spending by Beijing on infrastructure or property has hit sentiment, with copper down around 11% this quarter. The demand weakness is evident in rising inventories held by the London Metal Exchange. (BBG)

CHINA

FISCAL: China no longer needs to implement “unconventional” fiscal policy as the society has fully resumed normal operation and the economy is seeing better-than-expected growth, Securities Times says in a front-page commentary. The nation should instead make good use of the limited new local government debt quota to drive more effective investment (BBG)

ECONOMY: Sales of passenger vehicles in China are forecasted to reach 1.7 million units in May, up 6.6% m/m and 27.7% y/y, according to a note from the China Car Passenger Federation. Analysts noted attendance at auto shows was strong and manufacturers had continued to offer large discounts throughout the month. The government’s decision to postpone the ban on selling high emission cars to the end of the year had taken pressure off distributors and allowed the market to stabilise, the federation said. Analysts noted customer demand cooled down towards the end of the month, following a strong start. (MNI)

TECH: China’s move to ban Micron Technology Inc.’s products marked its most meaningful retaliation yet against US export controls. Now the question is whether President Xi Jinping will go after even bigger targets, risking blowback to his own economy. Until this week, Beijing hadn’t responded in kind to US moves to kneecap China’s access to advanced chips and other technology, which President Joe Biden has said could be used for military modernization. China has repeatedly blasted the actions as the “long-arm” of US hegemony, while taking few meaningful actions against American companies. (BBG)

TECH: CEO Jensen Huang says the US tech industry is at risk of “enormous damage” from the battle over chips between Washington DC and Beijing, Financial Times reports, citing an interview with Huang. US export controls introduced by the Biden administration to slow Chinese semiconductor manufacturing has Nvidia with “our hands tied behind our back,” Huang tells the FT. (BBG)

US/CHINA: China’s new ambassador to the US said the relationship between the world’s two biggest economies is facing “serious difficulties and challenges.” “We hope the United States will work together with China to increase dialogue, to manage differences and also to expand our cooperation,” Xie Feng said after his arrival at John F. Kennedy International Airport in New York on Tuesday. (BBG)

CHINA MARKETS

PBOC Injects CNY2 Bln Via OMOs Weds, Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to an unchanged liquidity after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9412% at 09:24 am local time from the close of 1.7712% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 50 on Tuesday, compared with the close of 51 on Monday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.0560 WED VS 7.00326 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.0560 on Wednesday, compared with 7.0326 set on Tuesday.

OVERNIGHT DATA

SOUTH KOREA JUN BUSINESS SURVEY NON-MANUFACTURING 78; PRIOR 76

SOUTH KOREA JUN BUSINESS SURVEY MANUFACTURING 73; PRIOR 72

SOUTH KOREA Q1 SHORT-TERM EXTERNAL DEBT $173.7bn; PRIOR $166.5bn

NZ Q1 RETAIL SALES Ex INFLATION Q/Q -1.4%; MEDIAN 0.2%; PRIOR -1.0%

AU APR WESTPAC LEADING INDEX M/M -0.03%, PRIOR 0.01%

MARKETS

US TSYS: Marginally Firmer In Asia

TYM3 deals at 115-01+, +0-04, a touch off the top of the observed 0-06 range on volume of ~62k

- Cash tsys sit 1-2bps richer across the major benchmarks, some light bull steepening is apparent.

- Tsys firmed after Asia participants digested this morning's Fedspeak, Goolsbee and Bostic think that the Fed should pause at its June 14 meeting to allow time to assess the impact of previous tightening but also the effect of higher banking funding costs on the economy.

- Spillover from a rally in JGBs, after a strong 20 Year auction, added a layer of support.

- Tsys held marginally richer for the remainder of the session with little follow through on moves dealing in narrow ranges.

- President Biden has cut short his scheduled trip to Asia this week as discussions over the US debt ceiling remain ongoing. Biden noted that the latest round of talk was productive.

- In Europe today we have the final print of Eurozone CPI, further out US Housing Starts crosses. We also have the latest 20-Year supply.

JGBS: Futures Little Changed, Narrow Range, Awaits FOMC Minutes

JGB futures are unchanged versus settlement levels in afternoon Tokyo trade.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined news from the Yomiuri newspaper that the government plans to issue bridge bonds for about 2 years to finance childcare policies.

- In the absence of other domestic catalysts, market participants have likely been on headlines and US tsys watch ahead of the release of FOMC Minutes later today. US tsys have witnessed a bull steepening in Asia-Pac trade, with the 2-year yield decreasing by 7bp while the 10-year yield by 1bp.

- Cash JGBs are little changed with yield changes ranging from +0.8bp (1-year) to -0.4bp (5-year). The benchmark 10-year yield is 0.1bp higher at 0.405%, below the BoJ's YCC limit of 0.50%.

- The 40-year zone sees its yield 0.1bp higher ahead of the scheduled supply on tomorrow.

- Swap curve bull flattens out to the 10-year zone with rates 0.1 to 0.6bp lower. Rates for the 20-year zone and beyond are flat to 0.4bp lower. Swap spreads tighter across the curve.

- Later today sees the release of Machine Tool Orders (April final) ahead of Weekly Security Investment Flow data and 40-year JGB supply tomorrow.

AUSSIE BONDS: Richer, Spillover Bid From NZGBs

ACGBs are richer (YM +6.0 & XM +2.5) with the curve steeper as the local market enjoyed spillover from the bid in NZGBs following the RBNZ indicating that the current OCR level would be the peak.

- Cash ACGBs are 3-6bp richer with the 3/10 curve 3bp steeper and the AU/US 10-year yield differential +1bp at -6bp.

- The first round of ACGB Dec-34 supply, following its syndicated opening on April 19, showed solid demand with the average yield printing through prevailing mids and a cover ratio of 3.6250x. The outcome aligned with the recent trend of robust pricing observed at ACGB auctions.

- Swap rates are 3-6bp lower with EFPs little changed.

- The bill strip bull flattens with pricing +2 to +7.

- RBA dated OIS is 1-7bp softer across meetings with a 17% chance of a 25bp rate hike in June priced.

- The local calendar is light ahead of April Sales on Friday. While the official ABS retail estimates account for regular seasonal fluctuations, they can encounter challenges during the Easter period. This is primarily due to the variable timing of the holiday and its proximity to other holidays, which can disrupt the accuracy of the adjustments.

NZGBS: Yields Sharply Lower, RBNZ Signals OCR At Peak

NZGB yields have closed 11-33bp lower after the RBNZ Decision proved to be a dovish hike.

- The RBNZ hiked 25bp to 5.5%, which aligned with its previous projection for the OCR peak. 5 members opted for the hike while 2 advocated for a pause.

- The statement released by the RBNZ primarily focused on the impact of restrictive policies and acknowledged the presence of transmission lags. Notably, the Committee appeared unconcerned about the near-term fiscal expansion and the rise in immigration.

- Based on the current scenario, it appears increasingly likely that the RBNZ will keep rates unchanged at its upcoming meeting on July 12.

- Ahead of the RBNZ Decision, the market had been pricing 37bp of tightening for today's meeting and a terminal rate of 5.93%. Post-Decision, the terminal rate has softened to 5.60%.

- Swap rates are 11-34bp lower with the 2s10s curve 23bp steeper.

- Q1 retail sales volumes fell a larger-than-expected 1.4% q/q in Q1 to be down 4.1% y/y, as significant tightening and cost-of-living pressures weighed on spending.

- The local calendar is light tomorrow.

- The NZ Treasury announced that they plan to sell NZ$200mn of the May-28 bond, NZ$150mn of the Apr-33 bond and NZ$50mn of the May-51 bond tomorrow.

FOREX: Kiwi Pressured As RBNZ Signal Rates Peak After 25bp Hike

Kiwi is pressured in Asia today as the RBNZ hiked rates 25bps to 5.50%. The bank stated the cash rate is now likely at its peak (5.50% post today's outcome), the market was expecting a peak of close to 6% before the meeting.

- NZD/USD prints at $0.6170/80 and is down ~1.2%. Support at $0.6182 (low from May 11) has been broken, on the downside the next support level is low from 26 April at $0.6112. AUD/NZD is ~1% firmer, the cross has broken the 20-Day EMA ($1.0668). The next upside target for bulls is the 200-Day EMA.

- AUD was pressured on spillover from the move in NZD however support was seen below $0.6590 and losses were pared. AUD/USD sits a touch above $0.66. Early in the session the Westpac Leading Index for April fell -0.03%.

- Yen is a touch firmer, USD/JPY is down ~0.1%. Ranges have been narrow with little follow through on moves.

- Elsewhere in G-10 EUR and GBP are a touch firmer.

- Cross asset wise; BBDXY is down ~0.1% and e-minis are ~0.1% firmer. 2 Year US Treasury Yields are ~2bps lower.

- On the docket today we have UK CPI & PPI and the minutes from the May FOMC meeting.

EQUITIES: Major Indices Tracking Lower, Post Wall St Losses

Regional equity markets have mostly tracked lower in Asia Pac today, in line with US and EU losses from Tuesday's session. The US debt impasse continues to hang over markets, with little fresh news late Tuesday evening in the US. US futures are a touch higher though, eminis last +0.15% near 4165, while Nasdaq futures were up by around the same amount.

- China stocks continue to weaken, the CSI 300 down a further 0.52% at this stage, albeit up from session lows. YTD gains for the index are just about wiped out, while we have seen a further 1.75bn yuan in stock outflows so far today (coming after yesterday's chunky ~8bn yuan in outflows). Tech headwinds amid clamps on investment in China from outside countries, coupled with economic woes continue to drive equity underperformance.

- The HSI is also weaker, down close to 1% at this stage. Similar drivers are at play, with the HS TECH index off by a little over 1%. The index is back close to 2023 lows. Alibaba is cutting staff following the recent earnings disappointment.

- Japan stocks are also giving back some of their recent gains, the Topix down a further 0.25% at this stage, following yesterday's 0.66% dip. Electronic related plays are the main drag on the index.

- The Kospi rally has stalled, although the index is only down a touch, while the Taiex is -0.60% at this stage.

- There are some better trends in SEA, but only at the margin. Thai's SET is +0.45%, recovering further from recent lows.

OIL: Saudi Comments Push Prices Higher During APAC Session

Oil prices are up around a percent during APAC trading today with WTI around $73.75/bbl and Brent $77.60, both close to intraday lows. They rose strongly on Tuesday following Saudi comments that it wouldn’t tolerate speculators. OPEC+ meets June 3-4. The USD index is slightly lower.

- The threat of OPEC+ taking more output action at its June meeting to push up prices is currently supporting crude. However, the market remains troubled by the unresolved US debt-ceiling issue, Fed tightening and lacklustre growth in China.

- The US EIA releases fuel inventory data later. Bloomberg reported that there was a large drawdown of crude stocks in the US of 6.8mn, according to people familiar with the API data. Gasoline inventories fell 6.4mn, as demand ramps up, and distillate -1.77mn.

- Later today the Fed’s Waller discusses the economic outlook and the May 3 minutes are published. There is also UK April CPI and the German IFO for May.

GOLD: Bounces Off Two-Month Lows

Gold is trading with minimal movement in the Asia-Pacific session following a slight uptick on Tuesday, closing at 1975.23 (+0.2%). The precious metal rebounded from its two-month lows as investors evaluated the developments in US debt-ceiling negotiations. While Republicans maintained their steadfast stance against any tax changes, rendering a potential deal elusive as emphasized by McCarthy, Democrats persistently pursued initiatives to enhance revenues and reduce spending.

- Amid the looming risk of a potential default, the demand for safe-haven assets surged, propelling gold to its highest price since March 2022 earlier this month. However, gold has experienced a decline of approximately 4% since reaching its peak on May 4th and is currently hovering around levels observed in late March.

- Rising bond yields, a stronger dollar and hawkish comments from Federal Reserve officials have recently put a lid on bullion prices.

- Bloomberg noted that a team of JPMorgan strategists led by Kolanovic trimmed their allocation to stocks and corporate bonds while boosting its stake in cash by 2%. Within the commodities portfolio, the firm also rotated out of energy and into gold on haven demand and as a debt-ceiling hedge. (link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/05/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 24/05/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 24/05/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/05/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 24/05/2023 | 0930/1030 |  | UK | BOE Bailey Keynote Speech at Mansion House Net Zero Summit | |

| 24/05/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/05/2023 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/05/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/05/2023 | 1300/1400 |  | UK | BOE Bailey Frieside Chat at WSJ CEO Council Summit | |

| 24/05/2023 | 1405/1005 |  | US | Treasury Secretary Janet Yellen | |

| 24/05/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 24/05/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/05/2023 | 1610/1210 |  | US | Fed Governor Christopher Waller | |

| 24/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 24/05/2023 | 1745/1945 |  | EU | ECB Lagarde Opens Anniversary of ECB Event | |

| 24/05/2023 | 1800/1400 | * |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.