-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: PBoC Cuts 7-Day Repo Rate By 10bps

EXECUTIVE SUMMARY

- UK EMPLOYERS OFFER RECORD PAY AWARDS IN 3 MONTHS TO APRIL - IDR SURVEY - RTRS

- PBOC CUTS KEY POLICY RATE 10bp TO SHORE UP ECONOMY - MNI BRIEF

- AUSSIE HOUSING MARKET STRENGTHENS OVER MAR QUARTER - MNI BRIEF

- AUSTRALIA CONSUMER CONFIDENCE STABILIZES - BBG

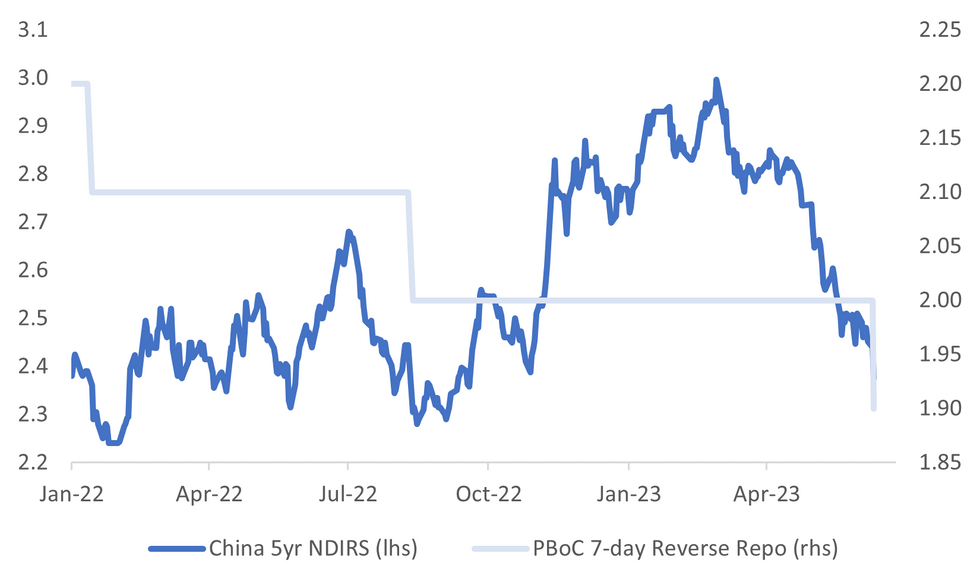

Fig. 1: PBoC 7-day Reverse Repo Versus 5yr NDIRS

Source: MNI - Market News/Bloomberg

U.K.

WAGES: British employers agreed pay increases averaging 5.6% in the three months to April, reflecting high consumer price inflation and a hefty rise in the minimum wage, putting further pressure on the Bank of England to keep raising interest rates. (RTRS)

STRIKES: England's hospitals face major disruption this week when junior doctors begin a three-day walkout in the latest row over pay and conditions. (BBG)

ENERGY: The UK will need batteries that last four times longer to balance supply and demand in a system that becoming more driven by swings in renewable power generation according to a report by Balance Power Group (BBG)

TECH: British chip designer Arm Ltd., backed by SoftBank Group Corp., is in talks with potential strategic investors including Intel Corp. to anchor what will be one of the largest initial public offerings of the year, according to people familiar with the matter. (BBG)

EUROPE

Tech: Google is set to be hit with a formal antitrust complaint from the European Union that could lead to massive new fines and strike at the heart of the advertising technology that drives most of the US firm’s revenue. (BBG)

Ukraine: Ukraine said on Monday its troops had recaptured seven villages from Russian forces along an approximately 100-km (60-mile) front in the southeast since starting its long-anticipated counteroffensive last week. (RTRS)

U.S.

Politics: Donald Trump’s stranglehold on the Republican Party showed some signs of weakening Monday as an influential GOP senator questioned the twice-indicted former president’s electability. Trump remains the front-runner for the 2024 Republican nomination even as he awaits arraignment Tuesday on 37 federal charges pertaining to his mishandling classified information. (BBG)

PROPERTY: Offices in New York City crossed the 50% occupancy threshold last week for the first time since the start of the Covid-19 pandemic hitting 50.5% of pre-pandemic levels in the week ending 7 June. (BBG)

OTHER

AUSTRALIA: The total value of residential dwellings in Australia rose by AUD140.0 billion to AUD9.9 trillion over the March quarter, snapping the downward trend in prices recorded since the Reserve Bank of Australia began hiking rates in May 2022, according to the Australian Bureau of Statistics. (MNI)

AUSTRALIA: Australia’s business confidence slipped into negative territory and conditions slumped in May in a result that augers poorly for the nation’s already weakening economy amid rising interest rates. (BBG)

AUSTRALIA: Australia’s consumer confidence stabilized at “near recession lows” as a significant rise in the minimum wage offset the Reserve Bank unexpectedly raising interest rates for a second straight month. (BBG)

NZ: The New Zealand central bank’s aggressive hiking of the cash rate likely pushed the country into a technical recession in the first quarter, a Reuters poll found, giving traction to the idea the cash rate may have peaked. (RTRS)

NZ: New Zealand net immigration surged further in April amid a record inflow of foreigners. Net immigration rose to 72,330 in the year ended April 30, the biggest annual gain since July 2020 and up from a revised 65,755 in the 12 months through March, Statistics New Zealand said Tuesday in Wellington. The gain comprised the arrival of a record 98,391 non-New Zealand citizens, offset by citizen departures of 26,061. (BBG)

JAPAN: Japan will flexibly decide when to begin raising taxes to cover a major increase in defense spending, the finance minister said, in comments that could take on extra weight if the premier calls for an early election. (BBG)

JAPAN: Japanese Prime Minister Fumio Kishida’s approval rating fell 3 ppts to 43%, according to poll results published by broadcaster NHK on Mon. Disapproval rating rose 6 ppts to 37%. Asked when they think is the appropriate timing for a general election, 11% of respondents said “soon,” 19% said “by year-end,” 19% said “next year” and 40% said “sometime before the lower house term ends in Oct. 2025”. (BBG)

CHINA

POLICY: The People’s Bank of China cut the 7-day repo rate by 10bps on Tuesday due to increasing economic headwinds. The key policy rate was reduced to 1.9% from 2%, the first cut since last August. MNI reported the possible cut last week, citing advisors and analysts. Market speculation over a reduction to the medium-term lending facility’s rate, due this Thursday, has also risen after the cut (see: MNI: PBOC Rate Cut Expectations Build After Deposit Cuts).(MNI)

POLICY: China’s central bank unexpectedly cut its short-term policy interest rate, easing its monetary stance to help aid the economy’s recovery. The People’s Bank of China lowered the seven-day reverse repurchase rate by 10 basis points to 1.9%, according to a statement Tuesday. It was the first reduction in the rate since August 2022. (BBG)

FISCAL: China should speed up the issuance of local government special bonds in Q3 and Q4 to stabilise the macro economy, according to experts interviewed by Yicai. The news agency said the economy has began to show weakness and experts advised fiscal policy should be stepped up to improve efficiency and increase overall workload. Local governments will issue all CNY3.8 trillion of special bonds by the end of Q3, with major projects to receive funding, including municipal administration, industrial parks, transportation, and shantytown renovation, experts said. (Yicai)

FISCAL: Policymakers should maintain a proactive fiscal-policy stance in H2 to boost the economy, which currently operates at 73% of utilisation capacity, according to Guan Tao, a former director at the State Administration of Foreign Exchange. Guan said leaders in Beijing should focus on repairing household balance sheets, in particular for lower income groups who had suffered the most from Covid-19 disruption. Guan noted household’s had not translated their Covid-era savings pool into consumption as hoped, because lower income families had depleted their savings during the pandemic era and higher income households had directed a large portion of "revenge" spending abroad. Banks saw an increase in deposit savings in Q1 as lower income groups re-establish their firewall savings. (MNI)

CHINA MARKETS

PBOC Cuts Key Policy Rate10bp To Shore Up Economy

The People’s Bank of China cut the 7-day repo rate by 10bps on Tuesday due to increasing economic headwinds.

The key policy rate was reduced to 1.9% from 2%, the first cut since last August. MNI reported the possible cut last week, citing advisors and analysts. Market speculation over a reduction to the medium-term lending facility’s rate, due this Thursday, has also risen after the cut (see: MNI: PBOC Rate Cut Expectations Build After Deposit Cuts).

- The PBOC conducted CNY2 billion via 7-day reverse repos on Tuesday, and the operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- CNH dropped fast after the cut to 7.1687 against U.S dollar, while yield of 10-year CGB fell 3bps to 2.6600.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9571% at 09:33 am local time from the close of 1.8000% on Monday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1498 TUES VS 7.1212 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1498 on Tuesday, compared with 7.1212 set on Monday.

OVERNIGHT DATA

NZ APR NET MIGRATION SA 5785; PRIOR 13176

JAPAN 2Q BSI LARGE ALL INDUSTRY Q/Q 2.7; PRIOR -3.0

JAPAN 2Q LARGE MANUFACTURING Q/Q -0.4; PRIOR -10.5

AU MAY CBA HOUSEHOLD SPENDING M/M 3.1%; PRIOR -4.2%

AU MAY CBA HOUSEHOLD SPENDING Y/Y 4.7%; PRIOR 3.8%

AU JUN WESTPAC CONSUMER CONFIDENCE M/M 0.2%; PRIOR -7.9%

AU JUN WESTPAC CONSUMER CONFIDENCE INDEX 79.2; PRIOR 79.0

AU MAY NAB BUSINESS CONFIDENCE -4; PRIOR 0

AU MAY NAB BUSINESS CONDITIONS 8; PRIOR 15

MARKETS

US TSYS: Marginally Richer In Asia, CPI In View

TYU3 deals at 113-20, +0-08+, with a 0-08+ range observed on volume of ~47k.

- Cash tsys sit 1-3bps richer across the major benchmarks, the curve has bull steepened.

- Tsys firmed to session highs on spillover from the PBOC cutting the 7-Day Repo Rate 10bps to 1.90%.

- Gains were marginally pared as there was no follow through on the move higher and tsys dealt in narrow ranges for the remainder of the Asian session. Perhaps the proximity to today's CPI print limited activity.

- FOMC dated OIS remain stable, ~6bps of hikes are priced in for Wednesday's meeting with a terminal rate of ~5.30% in July.

- Today's docket is headlined by May CPI print, the MNI preview is here. We also have the latest 30-Year supply.

JGBS: Futures Sit Slightly Off Session Highs

JBU3 sits slightly below session highs, last 148.29, +.20. Session highs came in at 148.35, which is just below mid-May highs for the Sep futures contract at 148.41. We have seen positive spill over post China's PBoC 7-day repo cut. This has also been evident in terms of US futures, with TYU3 last at 113-19, +07. US cash Tsys yields are lower across the board.

- For Japan Cash bonds we have seen a decent move lower in yield at the back end, 40yr off 3.5bps, 30yr nearly 2.5bps. The 10yr yield has ticked sub 0.42% in yield terms.

- Swap rates are lower across the board, the 10yr down nearly 2bps to 0.5775%.

- Earlier data on Q2 BSI industry activity showed a bounce from Q1 weakness, but this, along with an appearance in parliament by BoJ Governor Ueda hasn't shifted the sentiment needle today.

- Japan accepted ¥496.6bn for enhanced liquidity bonds (bids were ¥1426.5bn), leaving the bid to cover ratio at 2.87, down slightly from the prior result (3.10).

AUSSIE BONDS: Curve Flattens On Tuesday

ACGB's sit 1bp cheaper to 6bps richer across the major benchmarks, the curve has twist flattened piboting on 5s.

- XM (+0.03) and YM (+0.01) are a touch firmer, early gains extended as spillover from PBOC's cut to the 7-Day Repo Rate to 1.90%. The move didnt follow through and narrow ranges were observed for the remainder of the session.

- RBA dated OIS have been stable today, a terminal rate of 4.47% is seen in November.

- NAB has lifted their RBA terminal rate forecast to 4.6% from 4.35%, the bank now sees 25bp hikes in July and August.

- The CBA household spending intentions (HSI) rose 3.1% m/m and 4.7% y/y. Westpac Consumer Confidence rose 0.2% to 79.2. NAB Business Confidence fell to -4 from 0 in May and Business Conditions fell to 8 from 14.

- The local data docket is empty tomorrow.

NZGBs: Marginally Firmer On Tuesday

NZGBs have finished dealing on Tuesday 1-3bps richer across the major benchmarks, the curve has bull flattened.

- Global FI richened on spillover from the PBOC cutting the 7-day repo cut 10bps to 1.90%. NZGBs firmed off session lows on the move but remained within daily ranges.

- RBNZ dated OIS pricing has eased a touch today, a terminal rate of 5.62% is now seen in October.

- Apr Estimated Net Migration rose 5785, the prior read was a touch higher to 13,176.

- On the wires early tomorrow we have Q1 Balance of Payments and May Food Prices.

FOREX: USD Tracking Lower Ahead Of CPI Print

The USD index hits high not long after the PBoC announced a 10bps cut to its 7-day repo rate. We got to 1235.35, but we now sit back near 1233.40, a little over 0.10% below NY closing levels. In the cross asset space, we have seen weaker US yields post the PBoC announcement (2yr yield back to 4.55%, off 2.5bps), while US equity futures have firmed, as have regional equities. These trends have weighed on the USD.

- AUD/USD fell in sympathy with weaker CNH levels post the PBoC announcement, but support was evident sub 0.6740, the pair back above 0.6760 now, +0.15% for the session. NAB raised its terminal rate forecast to 4.60% for the RBA, but we saw generally depressed consumer confidence prints, along with weaker NAB business confidence and conditions reads. Commodity prices are firmer, but haven't seen much positive follow post the China rate news.

- NZD/USD is a touch higher, but is lagging the A$ at the margins, the pair last just above 0.6125.

- USD/JPY is down slightly versus NY closing levels, last under 139.45. Better Q2 business conditions and Ueda comments not shifting sentiment much.

- EUR/USD is around 0.20% firmer, last near 1.0780, although this pair has been able to sustain breaches above the 1.0780 handle in recent sessions.

- Looking ahead, we have the UK labor market survey and German ZEW, but the main focus will be on US CPI out later.

EQUITIES: Tech Plays Still Outperforming, PBoC Rate Cuts Helps At The Margins

Regional equities are mostly tracking higher. The China PBoC 7-day cut providing some support, but other themes have been evident. Japan stocks once again leading the move higher. Tech related indices have also risen, following strong gains in Monday US trade. US futures are firmer, Eminis last near 4400, +0.20%, while Nasdaq futures continue to outperform (+0.40%).

- Japan bourses have benefited from positive tech spill over from Monday US trade, while SoftBank rose as much as 7.7% on reports that its Arm chip unit could receive investment from Intel.

- At the break, the HSI is up 0.40%, just below session highs, the tech sub index is +2.10%. China's CSI 300 is only +0.12% higher, with little aggregate benefit from the 7-day repo cut by the PBoC. Still, the real estate sub index is slightly firmer at +0.43%.

- The Taiex is up +1.60%, following the strong +3.3% rally in the US SOX on Monday. The Kospi is +0.40%, but the Kosdaq is doing better at +1.35%.

- In SEA trends are more mixed, Malaysia stocks off by 0.45%, while Indonesia stocks are struggling to stay in positive territory. Some carry over from weaker energy/crude palm oil prices may be weighing.

OIL: Crude Consolidates Ahead Of US CPI Data

Oil prices have stopped their slide during the APAC session ahead of the US CPI May data later, helped by lower US yields, USD index and the surprise cut in the PBoC’s 7-day repo rate. Brent is 0.7% higher to $72.31/bbl, close to the intraday high of $72.39, and WTI +0.5% to $67.45, following a high of $67.53.

- Crude markets continue to worry about the demand outlook but today seem to be hoping that US inflation will moderate and that the Fed will pause (see MNI’s Fed Preview here). Continued robust Russian supply and futures spreads signalling plentiful output have also weighed on prices. The market has looked through Saudi Arabia’s latest production cut scheduled for July.

- Later today the focus is on US May CPI (see MNI’s US CPI Preview here), which could impact the Fed outcome, and the headline is expected to ease to 4.1% and core to 5.2%. There is also API crude and product inventory data. NFIB small business optimism and real earnings for May are released. In the UK, labour market/wages data print.

GOLD: Bullion Higher Ahead Of US CPI

Gold has unwound Monday’s 0.2% loss during APAC trading today and is currently around $1961.27 helped by the lower US yields and USD index. It hasn’t traded above $2000/oz since mid-May, as sticky inflation outcomes have increased risks of further policy tightening. Today’s US CPI and Wednesday’s FOMC meeting will be key to bullion movements.

- Bullion reached an intraday high today of $1962.22 after a low of $1956.02. It remains clear of support at $1932.20, the May 31 low. Hopes of a pause in Fed tightening have put a floor under prices. Economists expect the FOMC to hold rates on June 14 (see MNI’s Fed Preview here).

- Later today the focus is on US May CPI (see MNI’s US CPI Preview here), which could impact the Fed outcome, and the headline is expected to ease to 4.1% and core to 5.2%. There is also NFIB small business optimism and real earnings for May. In the UK, labour market/wages data print.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/06/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 13/06/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/06/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 13/06/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/06/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/06/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/06/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/06/2023 | 1230/0830 | *** |  | US | CPI |

| 13/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/06/2023 | 1400/1500 |  | UK | BOE Bailey Lords Economic Affairs Committee Hearing | |

| 13/06/2023 | 1400/1000 |  | US | Treasury Secretary Janet Yellen | |

| 13/06/2023 | 1500/1600 |  | UK | BOE Dhingra Speech at Manchester Metropolitan University | |

| 13/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 13/06/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 13/06/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.