-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessKey Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN OPEN: Poor Japan Debt Sale Adds To Yield Pressure

EXECUTIVE SUMMARY

- CHINA IS HEADWIND FOR US, GLOBAL ECONOMY, TREASURY OFFICIAL SAYS - BBG

- CHINA’S MAJOR STATE BANKS SELL DOLLARS FOR YUAN IN LONDON, NY HOURS - RTRS

- JAPAN 20-YEAR DEBT SALE HAS LONGEST TAIL SINCE 1987 - BBG

- RBNZ’S ORR SAYS RECESSION IS BARE MINIMUM TO TAME INFLATION - BBG

- AUSTRALIA UNEMPLOYMENT RISES TO 3.7% AS RATE HIKES TAKE TOLL - BBG

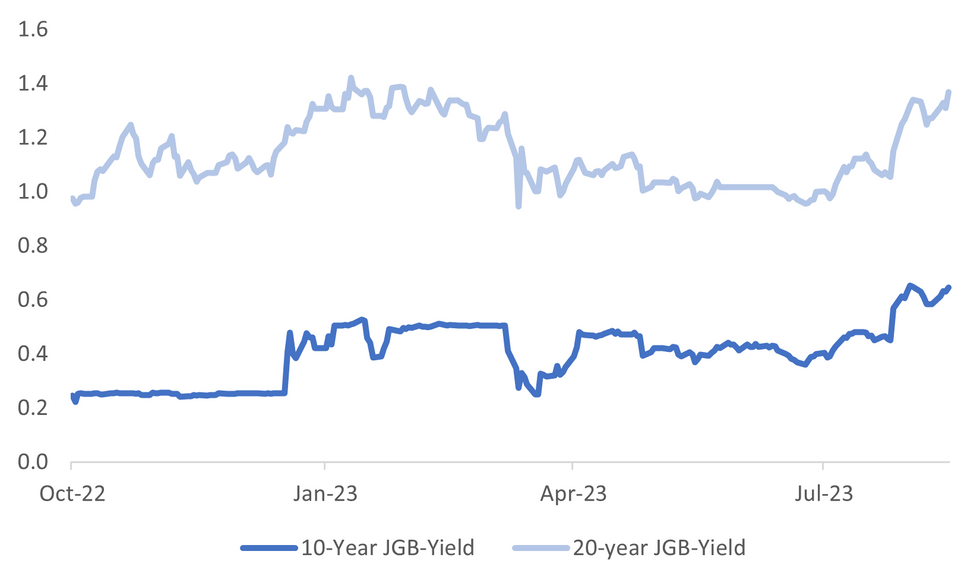

Fig. 1: Japan 10-year and 20-year JGB Yields

Source: MNI - Market News/Bloomberg

U.K.

HOUSING: Britain’s intensifying mortgage crunch is now forcing London’s wealthiest home sellers to agree to discounts or risk deals falling through. The number of price reductions for deals worth £5 million ($6.4 million) or more almost doubled in the year through July, compared with the same period in 2022, according to a report by researcher LonRes. The data also showed transaction volumes in London’s prime property market — which includes the capital’s most affluent postcodes — dropped by more than a quarter in July, compared with the same month a year earlier. (BBG)

U.S.

ECONOMY: US Deputy Treasury Secretary Wally Adeyemo said China’s economic issues are proving to be a headwind for the US and global economies and that the Asian nation’s fortunes are a result of its own policy choices. “The United States economy is the engine of growth for the global economy, not by mistake,” Ademeyo said in an interview with Annmarie Hordern and Joe Mathieu on Bloomberg Television’s Balance of Power Wednesday. The expansion is due to “policy choices we’ve made — like the inflation Reduction Act, which is leading to a manufacturing boom here.” (BBG)

ECONOMY: Excess savings US households built up during the pandemic will probably be exhausted in the current quarter, according to research from the Federal Reserve Bank of San Francisco, removing a key support for consumer spending that has boosted the US economy this year. “Our updated estimates suggest that households held less than $190 billion of aggregate excess savings by June,” San Francisco Fed researchers Hamza Abdelrahman and Luiz Oliveira said in a blog post published Wednesday on the bank’s website. (BBG)

US/CHINA: Bipartisan majorities of Americans favor more tariffs on Chinese goods and believe that the United States needs to step up preparations for military threats from the country, according to a new Reuters/Ipsos survey. The two-day poll, which concluded on Tuesday, revealed deep worries among Americans about China's global influence at a time when U.S.-China relations have fallen to their lowest point in decades. (RTRS)

US/JAPAN/SOUTH KOREA: The US, Japan and South Korea are aiming to establish a three-way hot line following a summit among the countries’ leaders this week, a senior White House official said. “We’re going to invest in technology to have a three-way hotline,” Kurt Campbell, deputy assistant to President Joe Biden and coordinator for Indo-Pacific Affairs said in Washington ahead of the summit. Japanese Prime Minister Fumio Kishida and South Korean President Yoon Suk Yeol are set to depart Thursday for the meeting at the Camp David presidential retreat in rural Maryland on Friday. (BBG)

OTHER

NEW ZEALAND: New Zealand’s central bank Governor Adrian Orr said the nation’s economy needs a mild recession at the very least to slow activity before policymakers could consider reducing interest rates. “It’s the bare minimum we need to see because without doubt demand has been well outstripping the pace of the supply capacity” of the economy, Orr said in an interview with Bloomberg Television on Thursday in Wellington. “We need to see subdued consumer spending, business investment and government constraints on spending, these are a critical part of the inflation process.” (BBG)

AUSTRALIA: Australia’s unemployment rate rose more than expected in July as the economy surprisingly shed jobs, signaling the labor market may be approaching a turning point and sending the currency lower. The jobless rate climbed to 3.7% from 3.5% a month earlier, having hovered in a range of 3.4%-3.7% since June last year, Australian Bureau of Statistics data showed Thursday. The economy lost 14,600 roles, confounding estimates for a 15,000 gain. (BBG)

JAPAN: Japan's exports fell in July for the first time in nearly 2-1/2 years, dragged down by faltering demand for light oil and chip-making equipment, underlining concerns about a global recession as key markets like China weakened. Ministry of Finance (MOF) data out Thursday showed Japanese exports fell 0.3% in July year-on-year, compared with a 0.8% decrease expected by economists in a Reuters poll. It followed a 1.5% rise in the previous month. (RTRS)

JAPAN: Japan’s auction of 20-year govt bonds saw tail, or the difference between average and cut-off prices, widen to 0.96 from 0.04 at previous sale. It was the longest tail since 1987. The lowest bid-to-cover ratio in almost a year, indicating weak demand. Bid-to-cover ratio falls to 2.8, the lowest level since September last year, from 3.38 at prior offering on July 13. (BBG)

CHINA

GROWTH: China should focus on boosting domestic demand and continue expanding policy space for consumption and investment, which includes spending on big-ticket items and mobilizing enthusiasm for private investment, said Premier Li Qiang in a State Council meeting on Wednesday. (Gov.cn)

YUAN: China's major state-owned banks were seen busy selling U.S. dollars to buy yuan in both onshore and offshore spot foreign exchange markets this week, people with direct knowledge of the matter said, in an attempt to arrest the yuan's rapid losses. State banks usually act on behalf of China's central bank in the country's foreign exchange market, but they could also trade on their own behalf or execute their clients' orders. (RTRS)

HOUSING: Judging by China’s official statistics, the nation’s housing market has been remarkably resilient in the face of tepid economic growth and record defaults by developers. New-home prices have slipped just 2.4% from a high in August 2021, government figures show, while those for existing homes have dropped 6%. But the picture emerging from property agents and private data providers is far more dire. (BBG)

CREDIT: Chinese local corporate bond defaults are running at the highest levels since the beginning of the year, adding to strains in the world's second-biggest debt market as an unprecedented property market crisis deepens. (BBG)

FLOWS: Foreign investors have dumped Chinese stocks and bonds after losing confidence in Beijing’s promises of more help to shore up the country’s wobbling economy. Financial Times calculations based on data from Hong Kong’s Stock Connect trading scheme show that investors have almost completely reversed Rmb54bn ($7.4bn) in net purchases of Chinese equities that followed a July 24 pledge from the politburo of top Communist party leaders to increase policy support. (FT)

MARKETS: Investors are expecting a reduction or even cancellation of A-share stamp duty as top policymakers seek to activate the capital market. Lower investment costs will promote active trading, as stamp duty accounted for about 55% of IPOs in H1, totalling CNY110.8 billion, said Lu Zhe, chief economist of Topsperity Securities. (The Paper)

LIQUIDITY: Analysts believe PBOC will continue to ensure reasonably ample liquidity in the banking system via various tools after the central bank increased reverse repo injections to offset impact from tax payments and government bond sales, according to an article on China Securities Journal. (CSJ)

CHINA MARKETS

MNI: PBOC Injects Net CNY163 Bln Thursday

The People's Bank of China (PBOC) conducted CNY168 billion via 7-day reverse repos on Thursday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY163 billion after offsetting the maturity of CNY5 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8273% at 09:28 am local time from the close of 1.8533% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Wednesday, compared with the close of 45 on Tuesday.

PBOC Yuan Parity Higher At 7.2076 Thursday Vs 7.1986 Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2076 on Thursday, compared with 7.1986 set on Wednesday. The fixing was estimated at 7.2994 by BBG survey today.

MARKET DATA

SOUTH KOREA JULY IMPORT PRICE M/M 0.4%; PRIOR -3.9%

SOUTH KOREA JULY IMPORT PRICE Y/Y -13.5%; -16.1%

SOUTH KOREA JULY EXPORT PRICE M/M 0.1%; -3.2%

SOUTH KOREA JULY EXPORT PRICE Y/Y -12.8%; -15.0%

NEW ZEALAND 2Q PPI OUTPUT Q/Q 0.2%; PRIOR 0.3%

NEW ZEALAND 2Q PPI INPUT Q/Q -0.2%; PRIOR 0.2%

JAPAN JULY TRADE BALANCE -¥78.7bn; MEDIAN ¥47.9bn; PRIOR ¥43.1bn

JAPAN JULY TRADE BALANCE ADJUSTED -¥557.2bn; MEDIAN ¥460.9bn; PRIOR ¥540.2bn

JAPAN JULY EXPORTS Y/Y -0.3%; MEDIAN -0.2%; PRIOR 1.5%

JAPAN JULY IMPORTS Y/Y -13.5%; MEDIAN -15.2%; PRIOR -12.9%

JAPAN JUNE CORE MACHINE ORDERS M/M 2.7%; MEDIAN 3.5%; PRIOR -7.6%

JAPAN JUNE CORE MACHINE ORDERS Y/Y -5.8%; MEDIAN -5.8%; PRIOR -8.7%

JAPAN JUNE TERTIARY INDUSTRY INDEX M/M -0.4%; MEDIAN -0.2%; PRIOR 1.2%

AUSTRALIA JULY EMPLOYMENT -14.6k; MEDIAN 15k; PRIOR 31.6k

AUSTRALIA JULY FULL-TIME EMPLOYMENT -24.2k; PRIOR 38k

AUSTRALIA JULY PART-TIME EMPLOYMENT 9.6k; PRIOR -6.4k

AUSTRALIA JULY UNEMPLOYMENT 3.7%; MEDIAN 3.6%; PRIOR 3.5%

AUSTRALIA JULY PARTICIPATION 66.7%; MEDIAN 66.8%; PRIOR 66.8%

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 109-10+, -0-07+, a range of 0-12+ has been observed on volume of 146k.

- Cash tsys sit ~3bps cheaper across the major benchmarks.

- TY extended contact lows in early dealing as weaker regional equities and US equity futures weighed on risk sentiment as concerns over the Chinese economy continued to escalate.

- Tsys held cheaper through the session dealing in narrow ranges for the most part, despite a recovery from session lows in regional & US equities and the USD ticking away from best levels.

- There is a thin docket in Europe today, further out we have US initial jobless claims and US Conf. Board leading index.

JGBS: Futures Pressured By A Very Poor 20Y Auction, National CPI Tomorrow

JGB futures pushed to a new Tokyo session low of 146.26 in afternoon trade. The catalyst for the move was very poor digestion of today's 20-year supply.

- The highest outright yield since February and the steepest 10/20 curve since March were unable to facilitate a successful takedown of this month's 20-year supply. The low price fell well below dealer expectations (95.55 versus 96.75 est.), the cover ratio tumbled to 2.795x from 3.382x last month and the tail lengthened to its longest since 1987.

- Currently, JBU3 is 146.39, -24 compared to settlement levels.

- The cash JGB curve has bear steepened in the afternoon session, with yields 0.1bp to 4.8bp higher. The benchmark 10-year yield is 1.4bp higher at 0.645%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- The 20-year JGB yield is currently 4.8bp higher on the day at 1.357%, after hitting a session high of 1.381% in the aftermath of the 20-year auction result.

- The swaps curve has bear steepened, with rates 0.8bp to 5.0bp higher. Swap spreads are generally wider across the curve.

- Tomorrow the local calendar sees National CPI.

AUSSIE BONDS: Post-Jobs Data Gains Pared, Pressured By US Tsys & JGBs

ACGBs (YM -5.0 & XM -9.0) sit weaker, well off session bests, despite the July employment report printing significantly weaker than expected. Employment fell 14,644 versus the +15,000 estimate. The unemployment rate unexpectedly rose to 3.7% versus expectations of 3.6% and 3.5% prior.

- ACGBs had richened 3-5bp immediately after the data, but subsequently unwound those gains, particularly at the long end as the local market got caught in spillover selling after the 20-year JGB auction saw a very poor outcome. The cover ratio declined sharply, and the auction tail lengthened to its longest since 1987.

- Cash ACGBs are 4-9bp cheaper on the day, but flat to 2bp richer after the data. The AU-US 10-year yield differential is 3bp tighter at flat.

- Longer-end ACGBs have been relatively pressured by US tsys, which sit ~3bp weaker and at Asia-Pac lows.

- Swap rates are 4-8bp higher on the day, with the 3s10s curve steeper.

- The bill strip has bear steepened with pricing flat to -6.

- RBA-dated OIS pricing is 1-2bp firmer for meetings beyond Feb’24.

- Tomorrow the local calendar is empty.

- There is a thin docket in Europe today, further out we have US initial jobless claims and US Conf. Board leading index.

NZGBS: Closed Sharply Cheaper, Pressured By US Tsys & JGBs

NZGBs closed sharply cheaper, resulting in benchmark yields surging by 9bp. This downward trend was attributed to the local market being affected by the upward movement of global bond yields. Initially, despite the weakness observed in US tsys overnight, NZGBs commenced the day with only a slight cheapening. However, as weakness in US tsys persisted throughout the Asia-Pac session, NZGBs progressively weakened.

- A temporary pause in the selling occurred when ACGBs saw an uptick in response to unexpectedly weak employment data. Nonetheless, the selling pressure resumed after global bonds were negatively impacted by a subpar 20-year JGB auction.

- US tsys sit ~3bps cheaper across the major benchmarks in Asia-Pac trade.

- The situation was exacerbated by lacklustre demand witnessed at the weekly NZGB auction, where cover ratios ranged from 2.11x to 2.93x.

- Swap rates closed 9-12bp higher with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 2-6bp firmer across meetings.

- Tomorrow the local calendar is empty tomorrow.

- There is a thin docket in Europe today, further out we have US initial jobless claims and US Conf. Board leading index.

FOREX: AUD Extends Losses After July Jobs Report

The AUD is the weakest performer in the G10 space, AUD/USD sits ~0.7% lower. The Unemployment Rate ticked higher in July to 3.7%, higher than the expected rise to 3.6%, and there was a net loss of 14.6k jobs.

- AUD/USD prints at $0.6380/85, a touch off the lowest level since November 2022. Support now comes in at $0.6285, low from 4 Nov 2022.

- Kiwi is also pressured after the negative lead from regional equities weighed in early trade before spillover from the AUD saw losses extended. NZD/USD sits at touch above the $0.59 handle, a break through here opens $0.5813, a Fibonacci projection.

- Yen is little changed and has dealt in narrow ranges for the most part.

- Elsewhere in G-10, the Scandies are pressured however liquidity is generally poor in Asia.

- Cross asset wise; US Tsy Yields are ~3bps firmer across the curve and BBDXY is up ~0.1%. The Hang Seng has recouped an early ~2.3% loss to sit little changed, however spillover into FX is limited at this stage.

- There is a thin docket in Europe today, further out Initial Jobless Claims headlines an otherwise thin calendar.

EQUITIES: HK/China Recoup Early Losses, Japan Bank Stocks Rise With Local Yields

Regional equities are mostly tracking lower, albeit away from session lows. Hong Kong and China equities opened sharply lower, but have recouped a large proportion of losses to the lunchtime break. Also helping has been a recovery in US equity futures from earlier session lows. Eminis last tracked near 4424, slightly firmer for the session, against earlier lows at 4409.5. Nasdaq futures have also firmed from intra-day lows.

- Japan shares are lower but like elsewhere have recovered from earlier lows. The Topix was last around 2244, down ~0.60% for the session. Some support has come from firmer bank stocks, which have risen with local yields (yields have been supported by a weak 20-yr debt sale).

- The HSI opened down around 2%, but sits back at the break close to flat. The HSTECH index is into positive territory, after being down 2.5% at one stage. Some support is evident around the simple 200-day MA for this index.

- China's CSI 300 saw demand sub 3800 level, with the index back to 3816 at the break. The HS China Enterprise Index is also back in positive territory reversing earlier losses.

- The Kospi is tracking down around 0.5% at this stage, while the Taiex in Taiwan is slightly firmer.

- In SEA, most markets are down, but losses are generally less than 0.50% at this stage.

OIL: Crude Off Intraday Lows As Correction Stalls During APAC Trading

Oil prices are off their intraday lows to be steady during the APAC session. US yields are higher and the USD index is up 0.1% to be +0.7% on the week.

- WTI fell just below $79/bbl earlier but found support there. It reached a low of $78.95 but is now trading around $79.31, just off the high of $79.49. Support is at $78.69, August 2 low. Brent has held above $83 with the intraday low at $83.05. It is now trading around $83.47, close to the high of $83.63.

- Risk appetite has been weakened by lacklustre growth in China and ongoing problems in the property sector, and a hawkish Fed. This is also impacting commodity markets. Equities are down across the region today.

- If the correction continues, Saudi Arabia is likely to step in again to try and support prices. A fall in US inventories to their lowest level since early January suggests that supply is tightening.

- Later US jobless claims and August Philly Fed print.

GOLD: Falls Below the 200-Day Moving Average

Gold is little changed in the Asia-Pac session, after closing 0.5% lower at 1891.81 on Wednesday. The close was below the June 29 low and the bear trigger identified by MNI’s technicals team. The precious metal also breached its 200-day moving average, a key support level. The next level on the downside is $1885.8, the March 15 low.

- Bullion was pressured by more hawkish than expected FOMC minutes for the July meeting. The minutes revealed that a majority of participants maintain a perspective of substantial upward risks to inflation, potentially necessitating additional measures to tighten monetary policy. Furthermore, the minutes highlighted that forthcoming data in the following months would offer insights into the ongoing trajectory of the disinflation process.

- US tsys finished 1-4bps cheaper across the major benchmarks on Wednesday, with the belly underperforming. Higher bond yields are typically negative for the precious metal, which doesn’t earn interest income.

- The continued rise in the USD also added downward pressure on the yellow metal.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/08/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 18/08/2023 | 0800/1000 |  | EU | ECB's Lane appears in ECB podcast | |

| 18/08/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/08/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 18/08/2023 | 0900/0500 | * |  | US | Business Inventories |

| 18/08/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/08/2023 | 1400/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.